Open Free Demat & Trading Account

Under PNB Bank - SMC 3-in-1 Tie-Up

Freedom of Choice

Choose brokerage options to suit your requirements

| Feature | Full Service Brokerage | Discount Brokerage |

|---|---|---|

| Brokerage - Intraday | 0.015-0.04% | Flat ₹15 per Order |

| Brokerage - Delivery | 0.15-0.40% | ₹0 on Delivery |

| RM/Dealer | Dedicated RM | No Dedicated RM |

| Call & Trade | Free | ₹20 per call or Order |

| Trading AMC | Nil | ₹199 + GST (by SMC) from 2nd year |

| Local Support | Nearest Branch/Franchise Support | Not applicable |

| MTF | Available | Not available |

| Leverage | T+2/T+5 | Cash and Carry |

| Research support | Free | Paid |

| Personalised services | Yes | No |

| Educational Webinars | Yes | No |

| Nex-Gen Mobile app | Yes | Yes |

| Advanced Charting Facility | Yes | Yes |

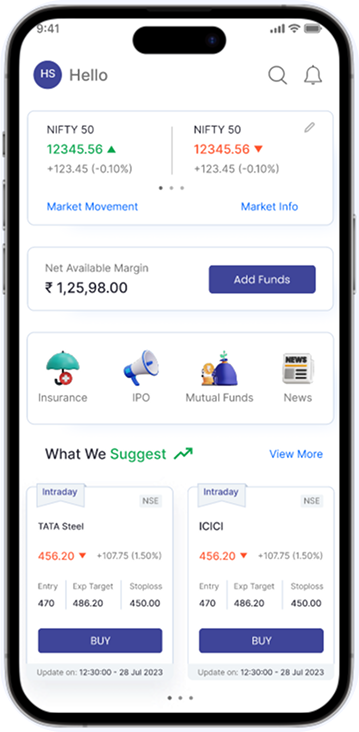

Next-Gen Mobile Trading App

A feature-rich trading app offering real-time data, expert research calls, and powerful tools to help traders and investors make informed short-term and long-term investment decisions.

Diverse Investment Options – Stocks, IPOs, Mutual Funds, SIPs, ETFs

Advanced Multiple Charting Tools

Option Chain Analysis

Free Research Calls

Script Overview with Technical & Fundamental Insights

Market Mojo Widget for Stocks Analysis

Efficient Order Slicing for Large Trades

Global Market View with Live Indices

Seamless & User-Friendly Trading Experience

Single-Click Basket Orders

Insta Options Trading

GTT Orders

Scan QR Code to Download the App Now

With SMC: Get a Defined Edge

SMC Global Securities offers a comprehensive suite of investment solutions designed to provide clients with a competitive edge in the financial markets.

Trusted Financial Partner

With over three decades of experience, SMC Global is a well-established name in the financial industry, offering integrated investment solutions tailored to meet diverse client needs.

Advanced Trading Platforms

Benefit from the feature-rich trading platform like Groot by SMC, designed to cater to both novice and experienced investors.

Comprehensive Research and Advisory

Receive free research calls and insights from a dedicated team of experts to guide your investment strategies.

Customer-Centric Services

Enjoy personalized services, including dedicated relationship managers, free webinars, and zero AMC for the first year, enhancing your overall trading experience.

Frequently Asked Questions

How can I get my eKYC done?

To start your eKYC process, follow these simple steps: 1. Online Submission: Visit https://www.smctradeonline.com/pnb-smc-online-trading 2. Select between ‘Full Service’ or ‘Discount Brokerage’ basis your requirement 3. Enter your Mobile number, Email Id, and verify them via OTP 4. Enter your PAN Card number 5. Upload: Your pic via live Selfie, e-Signature, and Aadhar card 6. Verification: Once the documents are submitted, our team will verify them. You may be asked for additional documents if necessary. 7. Completion: After successful verification, you will be notified, & your account will be started, allowing you to begin trading.

What are the documents required for KYC?

1. Proof of Identity: PAN CARD 2. Proof of Address: Aadhaar Card 3. Proof of Bank: For Linking Demat & Trading Account 4. Signature 5. Live Selfie 6. Derivative Proof: Optional

How do I fund the Account?

1. Login into SMC ACE 2.0: Access your account through trading platform (Website or Mobile App) 2. Go to the Fund Section: Navigate to the “Fund Transfer” Option. 3. Select Payment Method: • UPI: Use UPI payment for Quick & Secure Transactions. • Net Banking: Fund your account using registered Internet banking facilities.

What is a 3-in-1 account?

3-in-1 Account comprises PNB savings bank & demat account & online trading account with SMC

Contact Us:

011-6911-1000

smc.care@smcindia.online.com

Visit our nearest SMC Branch

Disclaimer: Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. This report is for informational purpose only and contains information, opinion, material obtained from reliable sources and every effort has been made to avoid errors and omissions and is not to be construed as an advice or an offer to act on views expressed therein or an offer to buy and/or sell any securities or related financial instruments, SMC, its employees and its group companies shall not be responsible and/or liable to anyone for any direct or consequential use of the contents thereof. Reproduction of the contents of this report in any form or by any means without prior written permission from the SMC is prohibited. Please note that we and our affiliates, officers, directors and employees, including person involved in the preparation or issuance of this material may; (a) from time to time, have long or short positions in, and buy or sell the securities thereof, of company (ies) mentioned herein or (b) may trade in this securities in ways different from those discussed in this report or (c) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instrument of the company (ies) discussed herein or may perform or seek to perform investment banking services for such Company (ies) or act as advisor or lender/borrower to such company (ies) or have other potential conflict of interest with respect of any recommendation and related information and opinions, All disputes shall be subject to the exclusive jurisdiction or Delhi High Court. By submitting your details to SMC, you are authorizing us to send promotional communication through Call/Email/SMS/WhatsApp even though you may be registered under DND. PNB Online Trading is an offering from PNB, which has been made possible by joining hands with SMC. This is a 3-in-1 account comprising PNB’s Savings and demat account and SMC’s online trading account.

To Know More

1800 11 0909

|

smc.care@smctradeonline.com