One account. Multiple benefits.

FreeAMC (for 1st Year)

FreeResearch advisory

for better decisions

Freeresearch webinars

for knowledge enhancement

Freededicated RM

for better money management

It’s time to get you going!

Open your Demat Account now through a seamless process

- Step 1

Sign up with SMC

- Step 2

Verify your contact details

- Step 3

Complete your KYC

- Step 4

Your trading account is ready

Financial Needs. Pick your Way.

Multiple financial avenues at your fingertips, the choice is yours!

Trust. Rock solid.

Legacy of 33 years in The Industry

Unique Customers

Authorized Person & Franchises

Lives Driving the Brand SMC

Cities Across India

Independent Distributors

Excellence. Awarded.

What is a Demat Account?

A Demat account (short form for the dematerialized account) is an electronic-based account to hold shares certificates. This account was introduced in India in 1996 providing a seamless and secure way to hold the equities certificates in online form which were previously held in paper certificates form. Earlier, there were the risks of theft, fraud, misinformation, or loss which are now eliminated by the use of an online demat account.

Open Demat account is a necessity to trade in the stock market because one has to hold the shares in a dematerialized mode only. This account helps with storing or transferring stocks, bonds, mutual funds, futures and options (F&Os), and ETFs (Exchange Traded Funds) without the use of any physical certificates.

There are two depositories in India that provide a demat account opening interface and that also hold your securities in a Demat account, namely,NSDL(National Securities Depository Limited) and CDSL (Central Depository Services Limited).

Steps to Open Demat Account

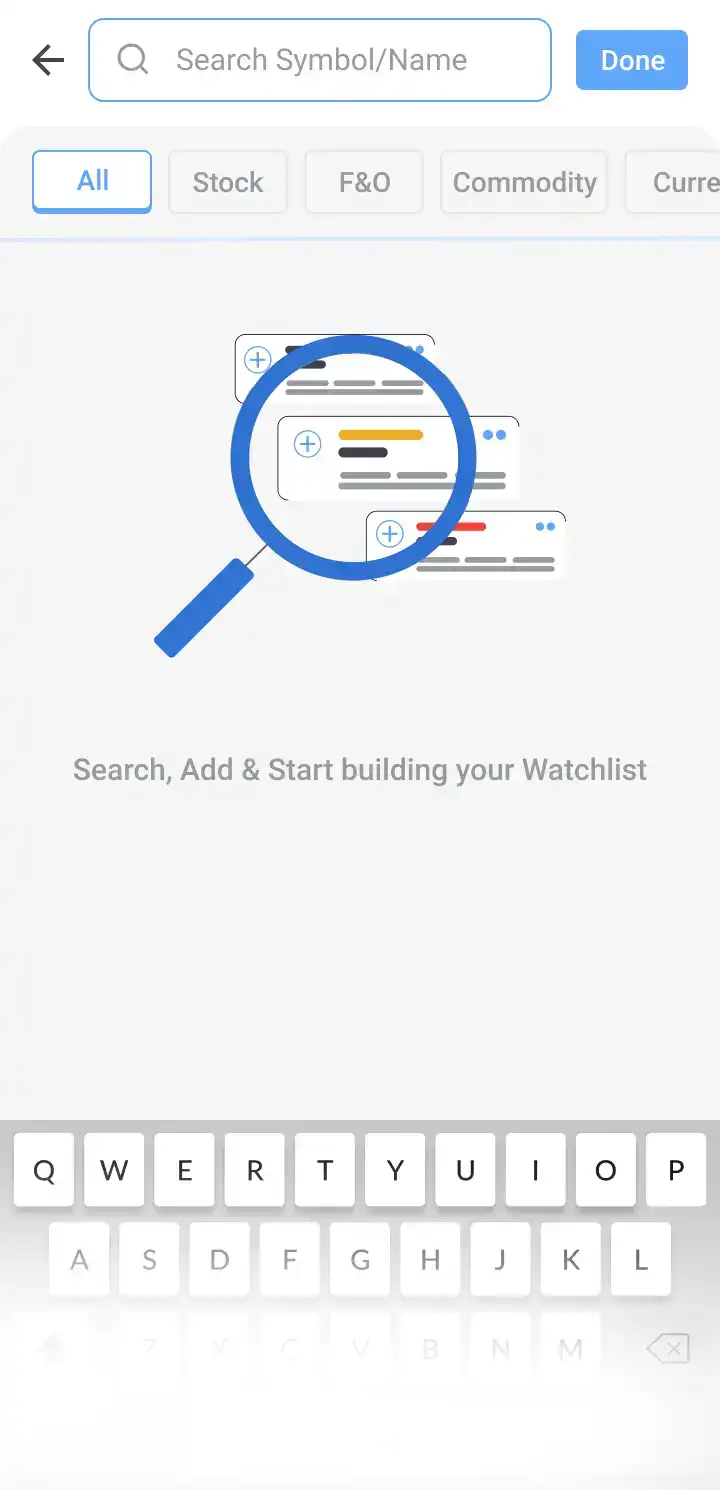

You can open free demat account within a few minutes with the SMC Global Securities or on the SMC ACE App

1

Enter your mobile number and click on the open free demat account tab.

2

Fill out the free demat account opening form by giving your details such as name, email ID, PAN card number, Aadhaar card number, etc.

3

For verification, enter the OTP sent to your mobile number and email address.

4

For ID proof, upload your PAN Card, or Aadhaar card. Do note that a PAN card is a necessity to open demat account.

5

For address proof, upload your Aadhaar card, or passport, or electricity bill.

6

For bank account details, give your bank statement or passbook image.

7

Upload the scanned image of your signature on white blank paper.

8

Review your details and do the E-sign.

9

Wait for the verification for a few minutes or hours.

10

Get your login credentials and start trading.

Proof of identity (POI)

- 1Adhar Card

- 2Passport

- 3Driving Licence

- 4Voter Id Card

- 5Pan Card

- 6Any other government-issued ID card having your photograph

Proof of address (POA)

- 1Electricity Bill

- 2Bank Account Statement/ Passbook

- 3Ration Card

- 4Any other document having your current address

- 5Income Proof (For F&O segment)

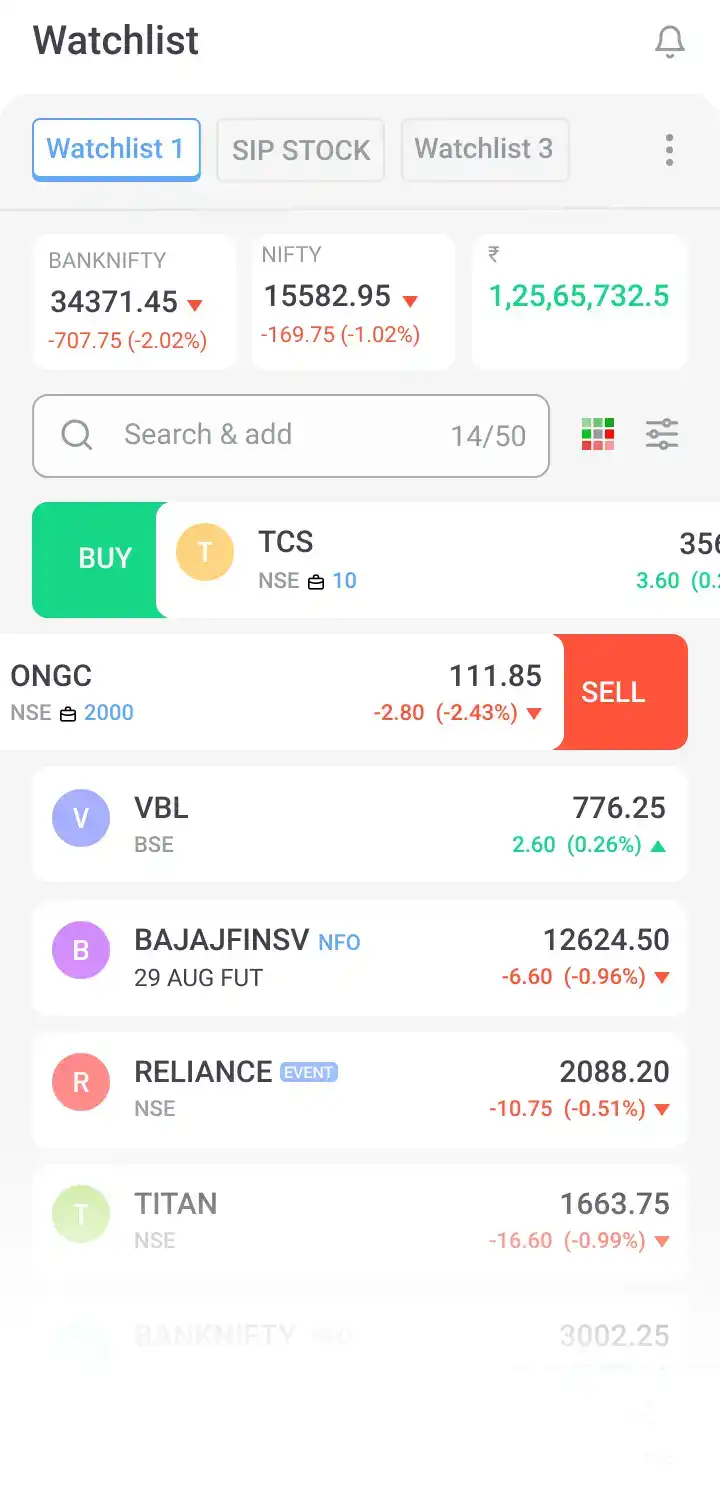

Trading Account: A Companion of Demat Account

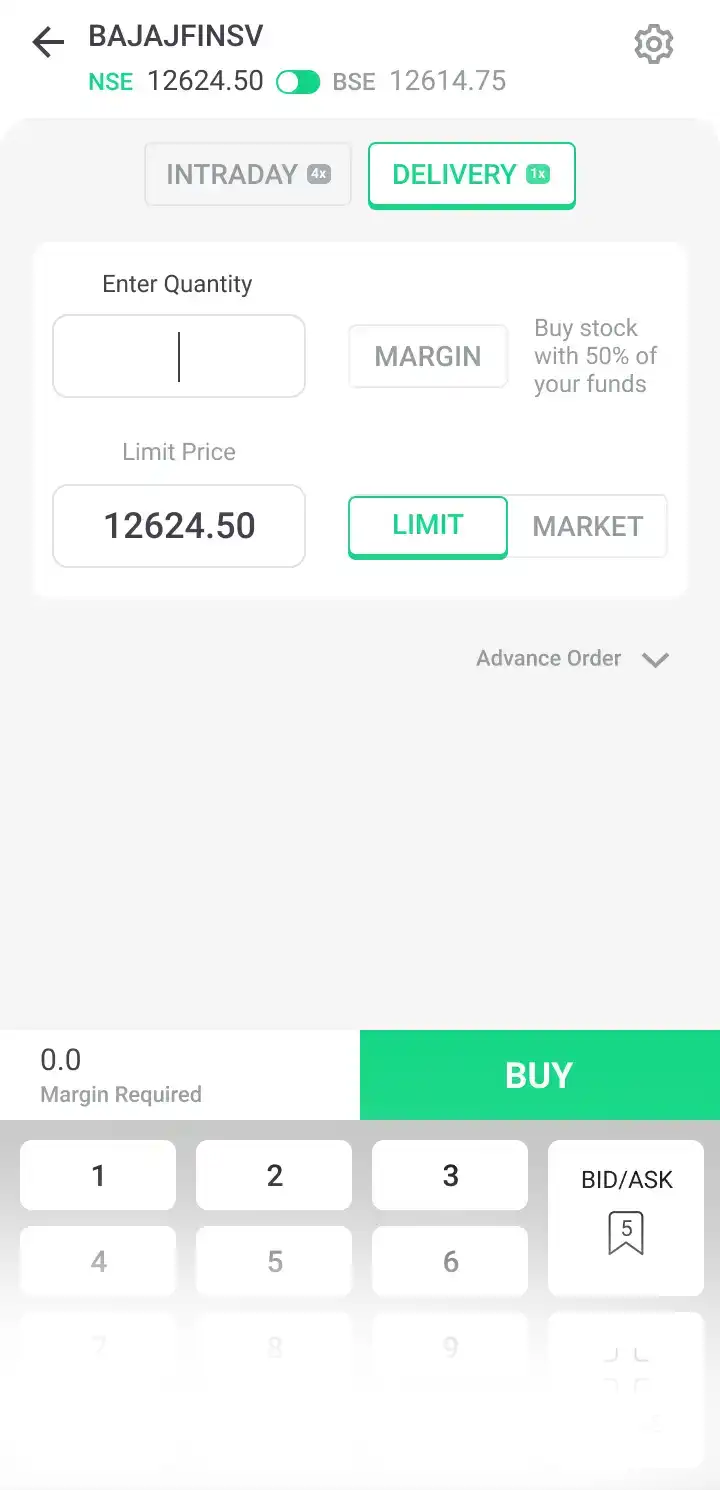

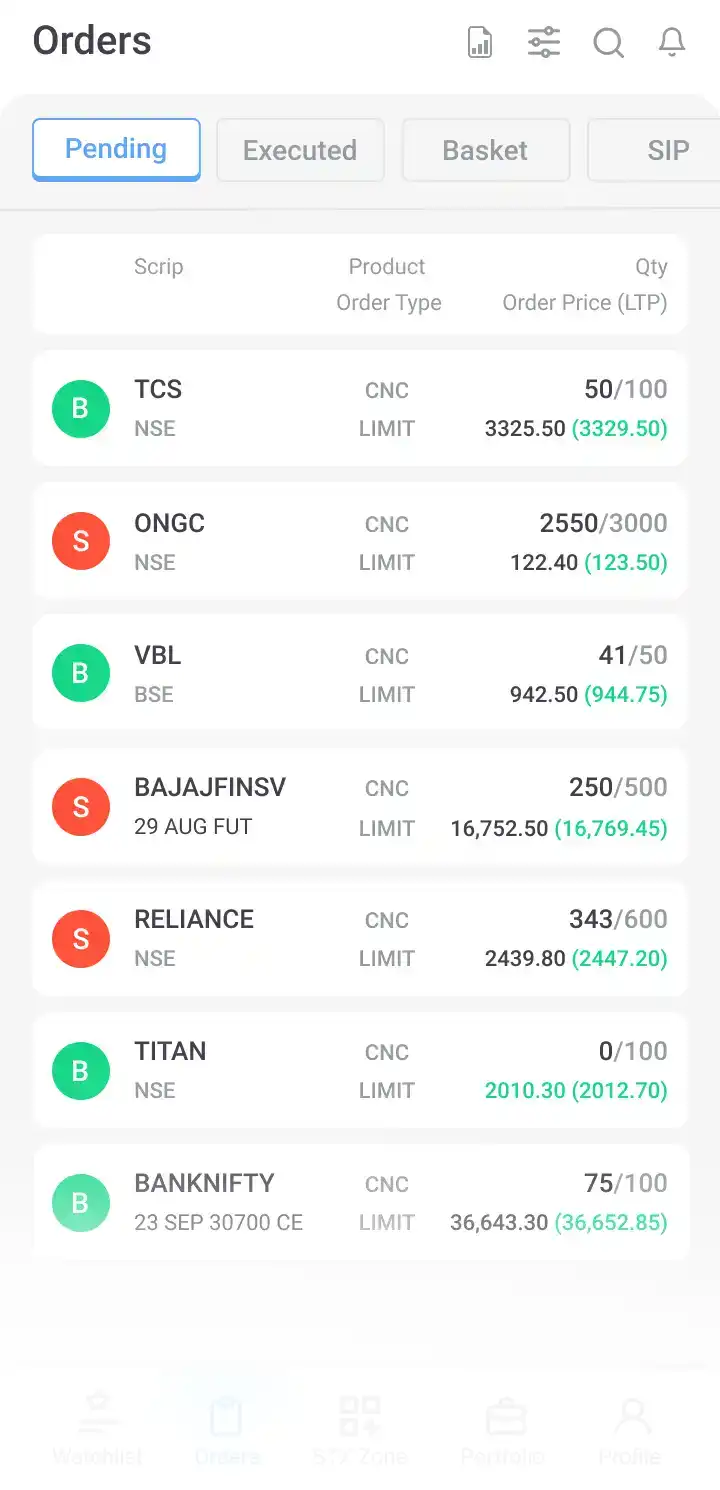

The Demat account is linked to the trading account for easy trading of securities. A trading account is a must to execute the order, while a demat account is just a way to hold the securities. Both trading and demat accounts have their unique numbers.

SMC Global Securities offers an all-in-one investment account to open demat account plus a trading account plus a mutual fund account.

How Order is Executed on a Demat Account?

Once a buy order is executed for any shares through a trading account, the depository participant will forward the order request to the stock exchange (NSE or BSE).

The selected exchange matches the buy order with a sell request from another trader. Once the buy and sell order is matched, the request goes to a clearing house for settling the trade.

At the end of the trading day, the shares will get credited to the buyer’s demat account, and at the same time, the seller’s demat account will get debited. So, both accounts work hand in hand for a smooth flow of transactions.

Frequently Asked Questions

Yes, you can open free demat account with SMC Global Securities or you can also download the SMC ACE App from the Play Store.

An Indian resident or an NRI (Non-Resident Indian) who wishes to trade in the Indian stock market will need a Demat account. The NRIs can open repatriable or non-repatriable Demat accounts.

The three types of Demat account offerings in India are:

- Regular Demat account for Indian residents.

- Repatriable Demat account for NRIs who also want to transfer the funds abroad.

- Non-Repatriable Demat account for NRIs who do not want to transfer the funds back to abroad.

A Demat account is used for holding stocks, mutual funds, bonds, ETFs, F&Os, etc. in electronic form.

Demat account is not a necessity to apply for an IPO but once you get the allotment of shares you can only hold them in a dematerialised form.

Demat charges include the account opening fees, account maintenance fees, transaction charges, STT, etc. This can vary for stocks and futures and options as well as for intraday and delivery trading.

- Fill out the account opening form

- Upload the KYC documents

- Verify and E-sign

DP (Depository Participant) is an intermediary that provides dematerialization or rematerialization services to investors.

All the sale proceeds from securities are directly credited to your linked bank account. So, there is no need to withdraw any amount from a Demat account.

Yes, a trading account is needed to place the order because the Demat account only holds the bought securities.

Yes, you can have more than one Demat account but one broker allows only one account opening.

Yes, you can hold mutual funds in a Demat account but it is not a compulsion as in the case of stocks.

Yes, the nominee can be added to a Demat account for easy transfer of securities in case of the beneficiary’s death. You can appoint more than one nominee.

The Demat account online opening process may take 15 minutes to an hour to complete.

Yes, the Demat account can be transferred to another DP by filling out the form.

A Demat account can be opened jointly like a bank account.

For starting a SIP in any mutual funds, Demat account is not mandatory.

Yes, you can link your Demat account with your trading account for smooth transactions of securities.