2020 : Issue 722, Week : 10th - 14th February

A Weekly Update from SMC (For private circulation only)

WISE M NEY

NEY

2020 : Issue 722, Week : 10th - 14th February

A Weekly Update from SMC (For private circulation only)

NEY

NEY

| Equity | 4-7 |

| Derivatives | 8-9 |

| Commodity | 10-13 |

| Currency | 14 |

| IPO | 15 |

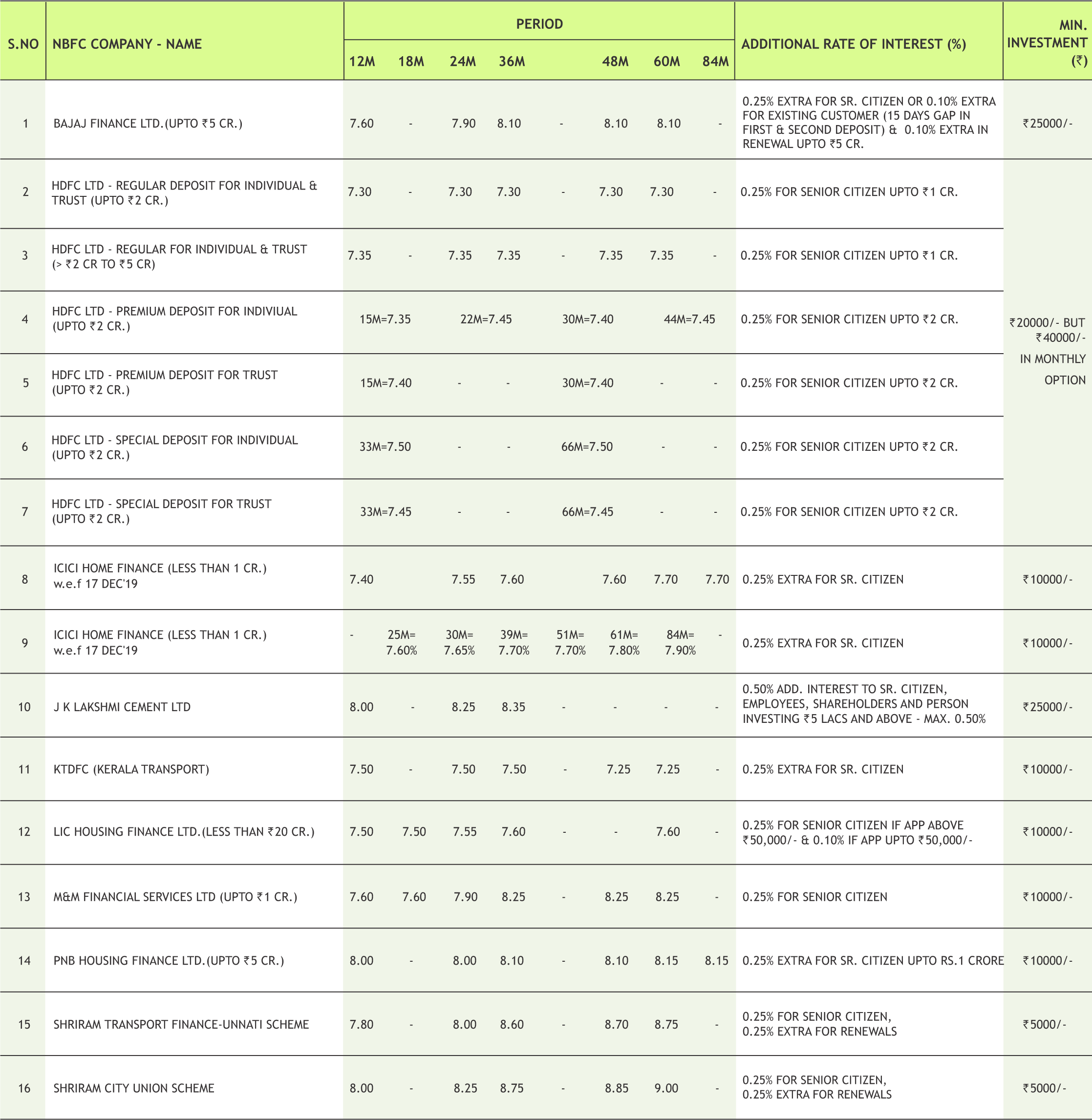

| FD Monitor | 16 |

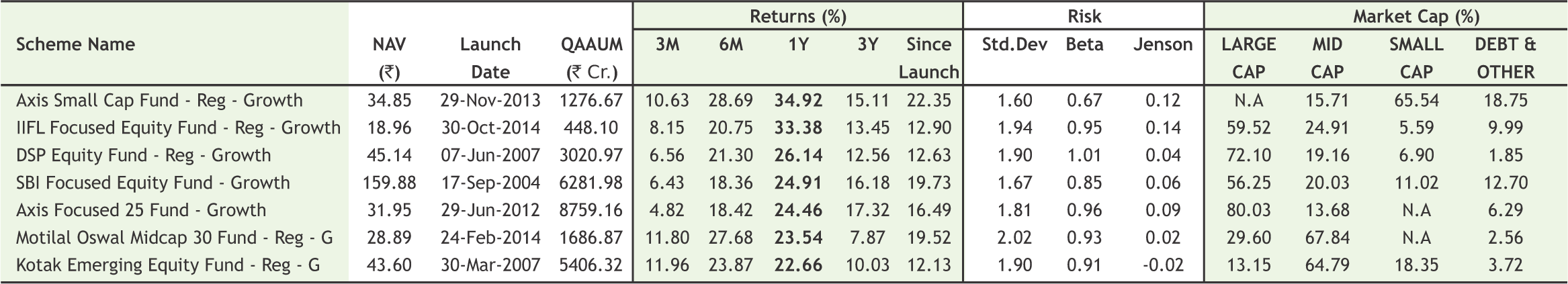

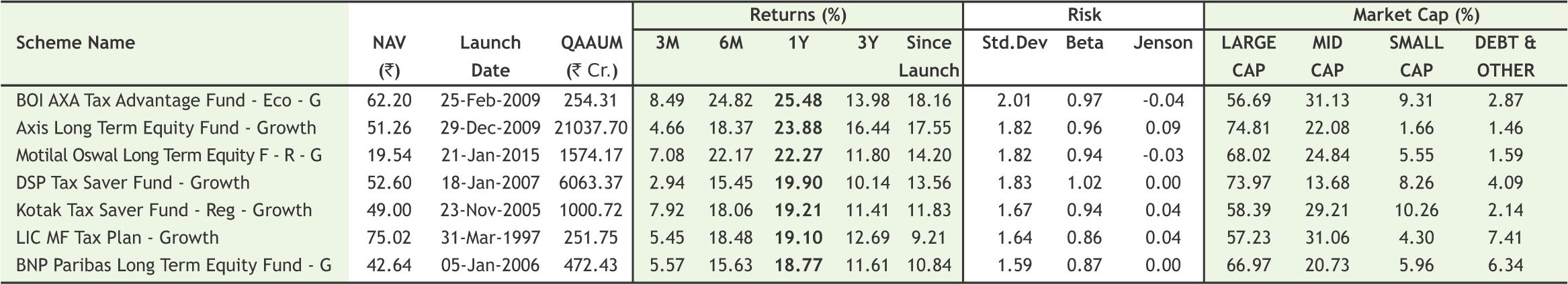

| Mutual Fund | 17-18 |

I

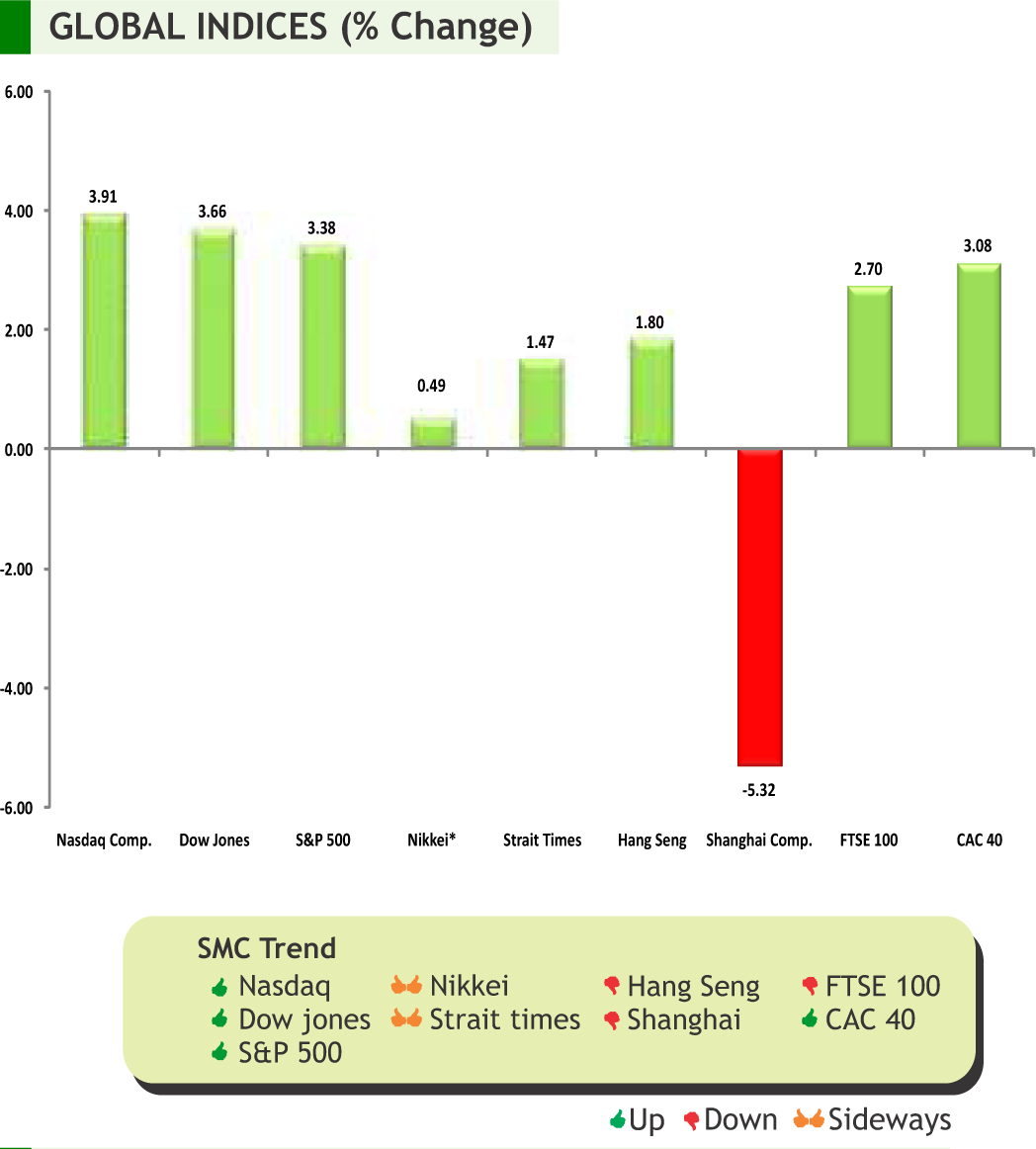

n the week gone by, global market rallied on encouraging US economic data and I waning fears of the financial fallout from the corona virus in China after the People’s Bank of China added a net 150 billion yuan ($21.4 billion) of funds using 7- day and 14-day reverse repurchase agreements. Actually, global markets have been buoyed by the growing expectations that central banks around the world will act should the outbreak of the Coronavirus intensify and threaten global growth. On the data front, a recent data showed that growth in China's services sector slowed for a second straight month in January, a traditionally busy sales season, hitting a threemonth low as companies cut prices and new orders dipped .

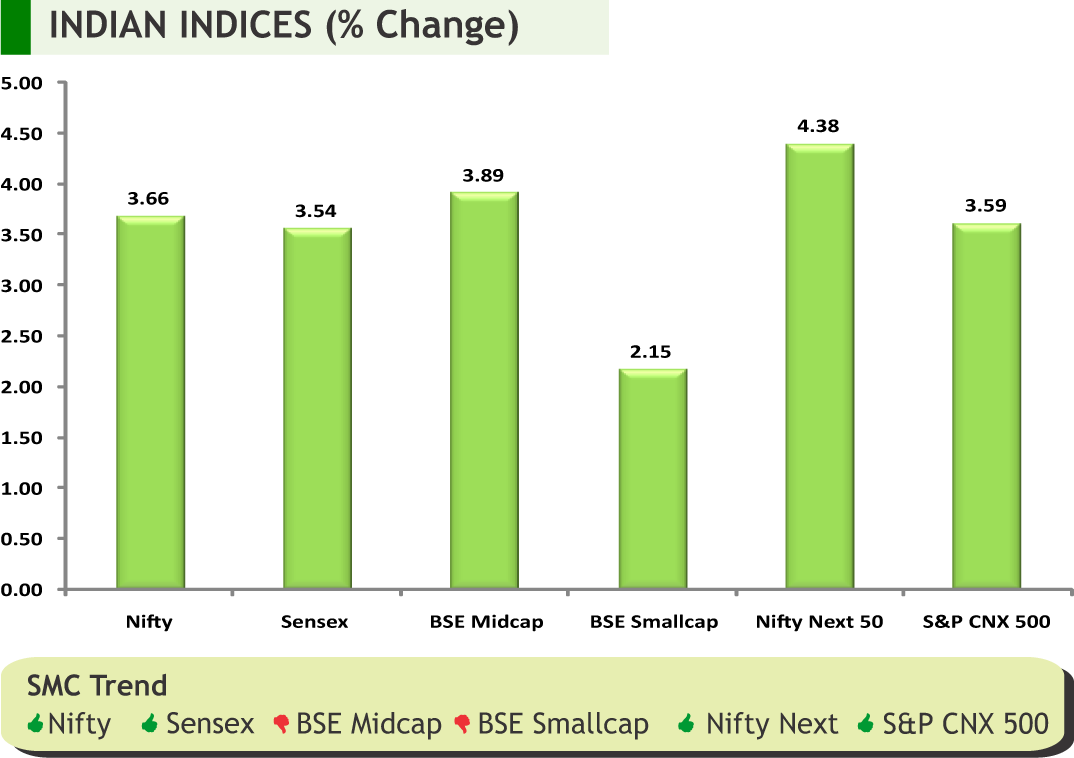

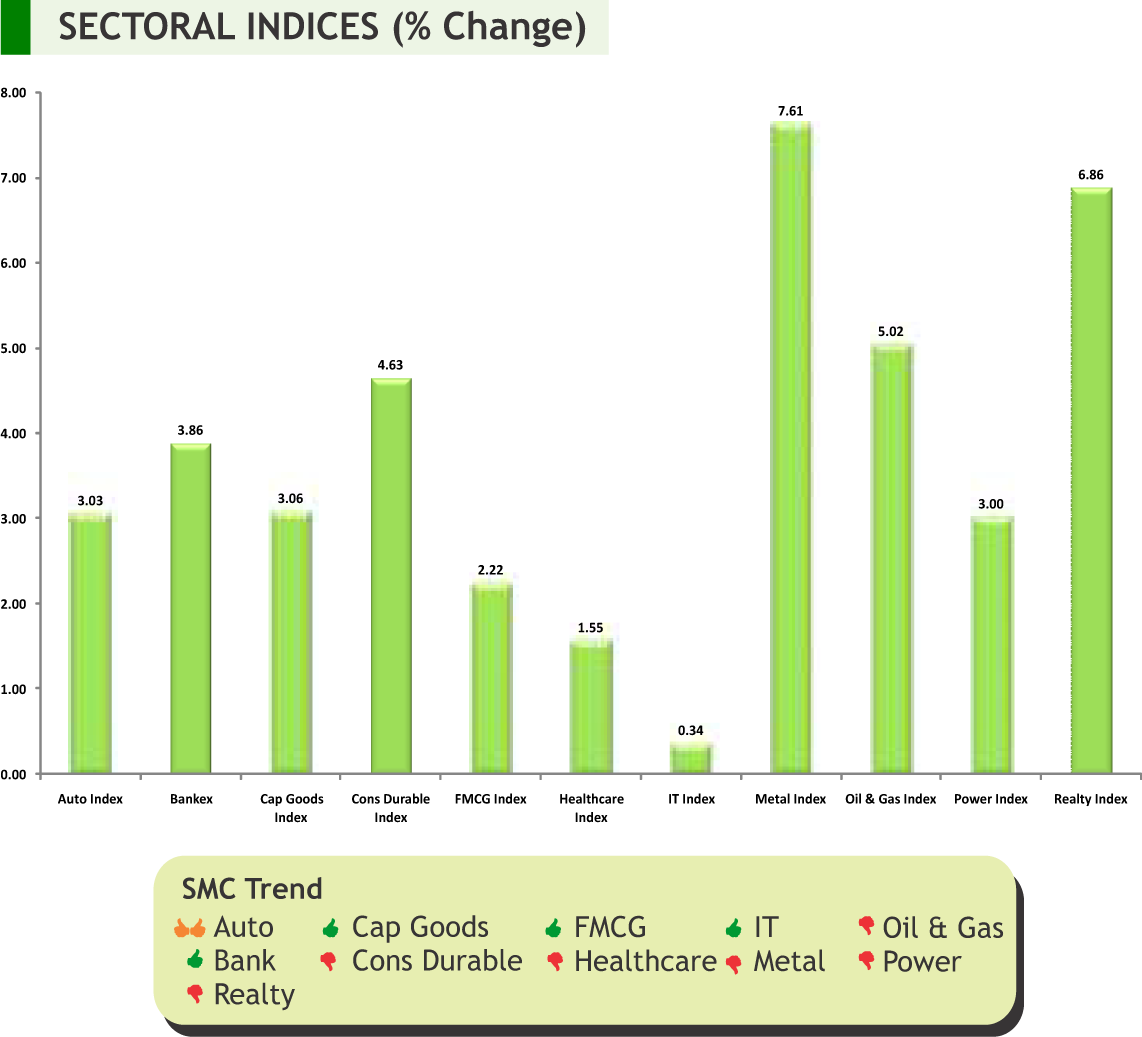

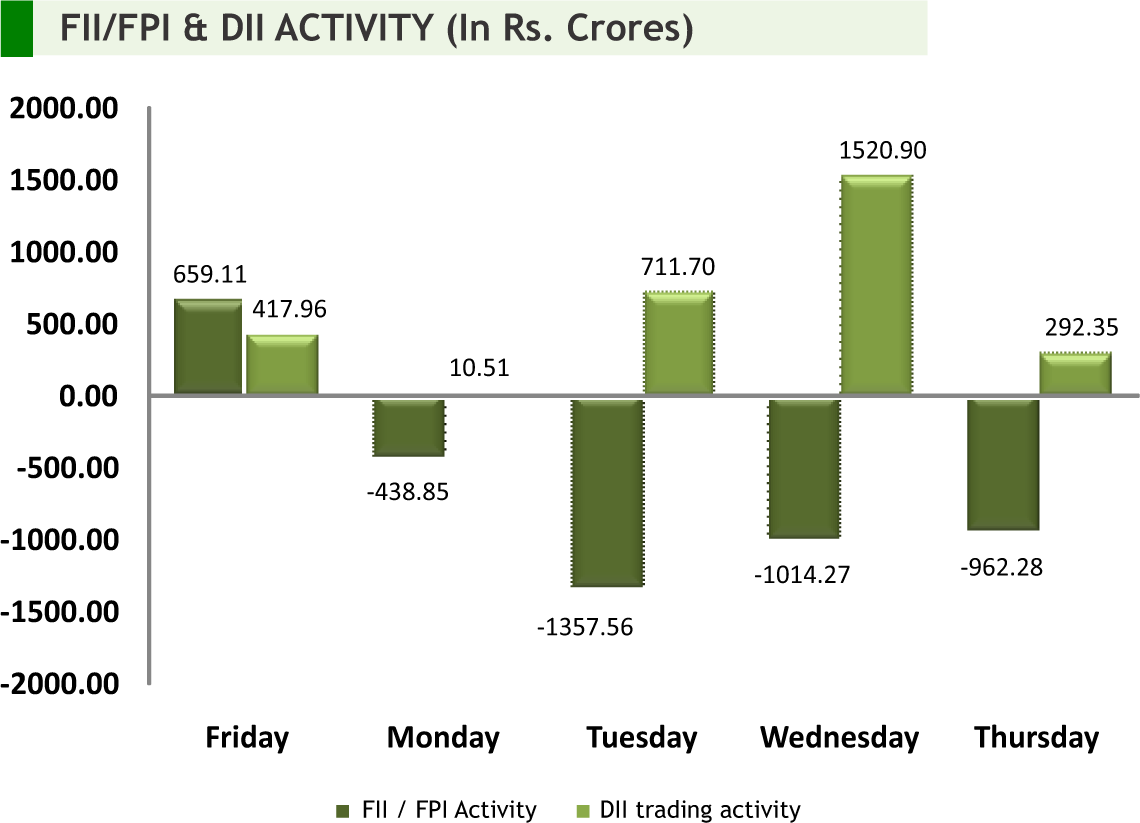

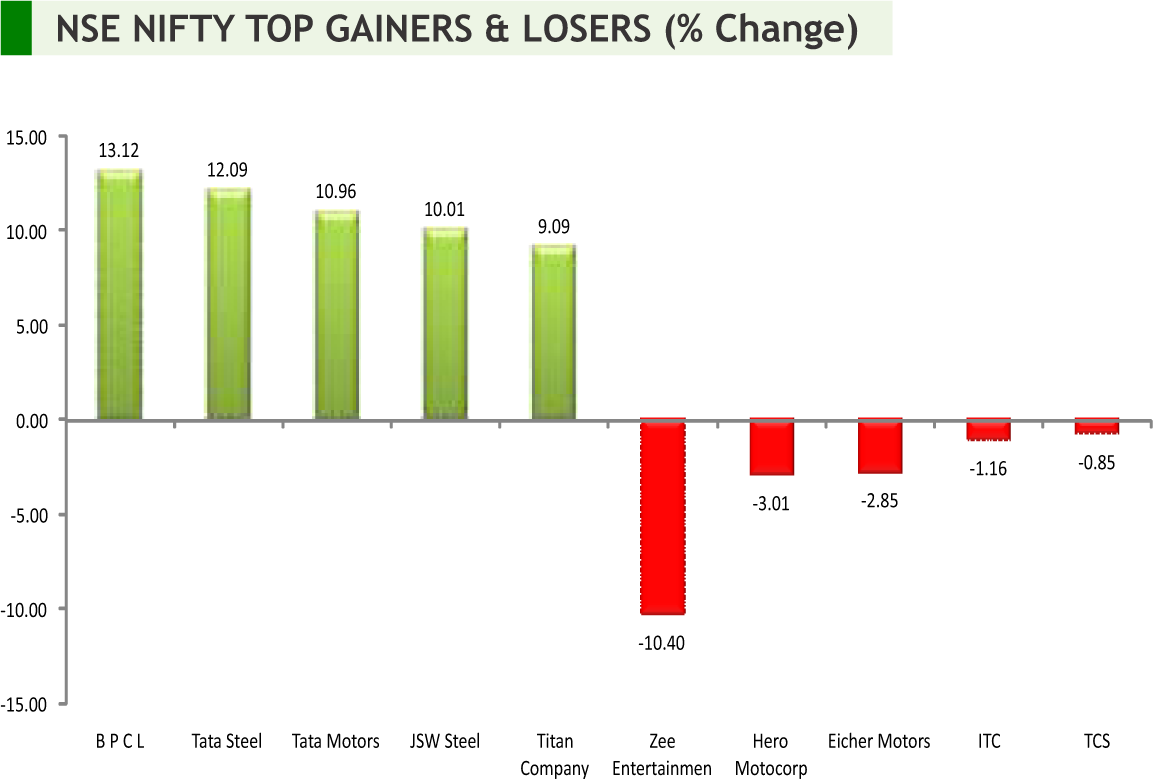

Back at home, domestic market continued to rally on positive global markets, softer oil prices and hopes of an economic recovery and better earnings growth. As expected the RBI has maintained status quo on rates as well as its monetary policy stance. In order to ensure better monetary policy transmission and to enable banks to reduce their lending rate, RBI has decided to conduct new one-year and three-year repos worth Rs 1 lakh crore . Besides, RBI has revised upward CPI inflation target for Q4 to 6.5%. In the recent budget, Government has focused on farmers, MSME and middle class - they're all finding favour, with the agricultural and infrastructure sector getting the biggest support. Besides, Finance minister focused on improving the ease of doing business, simplifying the tax structure, reduction in tax litigation, and stimulating growth in India. The much awaited tax rationalisation has given a ray of hope that the private investments will see sunshine and exports would revive. Going forward, with the overreaction on the Budget being mostly done, the market will keep its close eye on the each development in the global economy especially the outbreak of Corornavirus and the outcome of the remaining Q3 results.

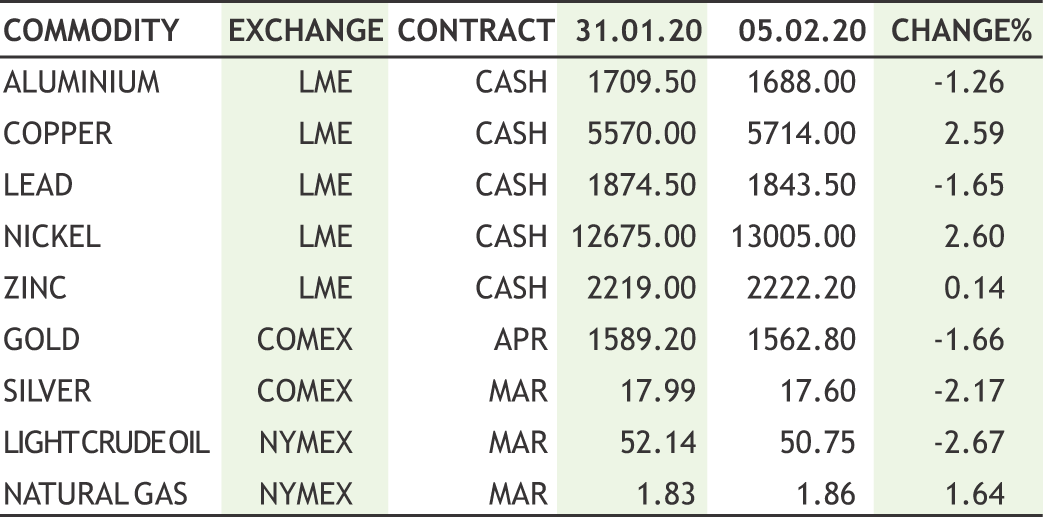

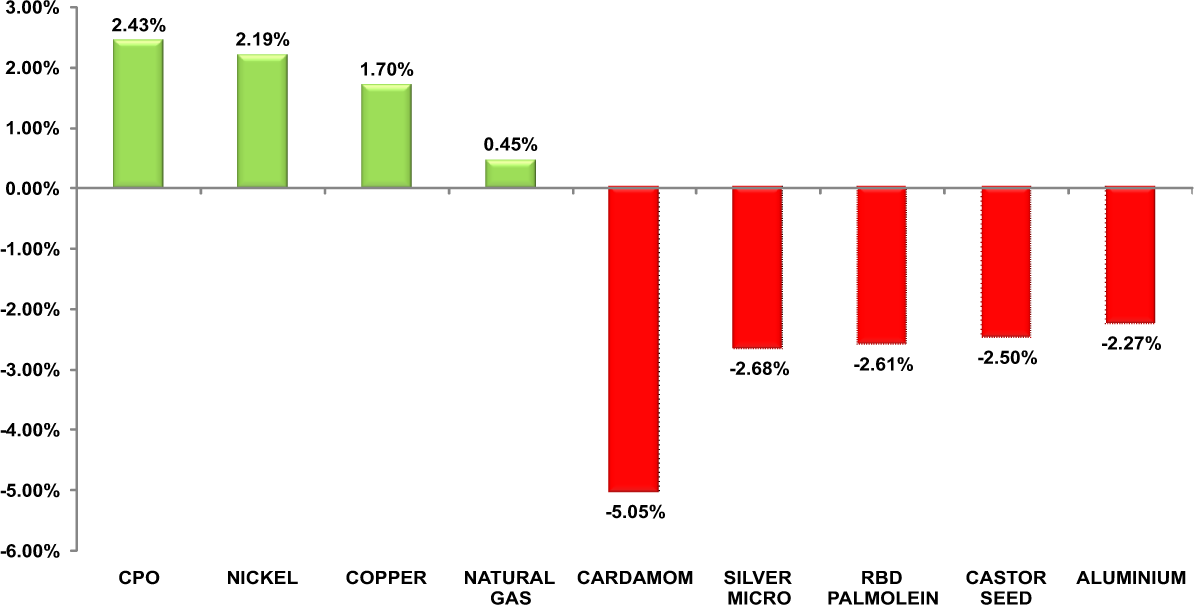

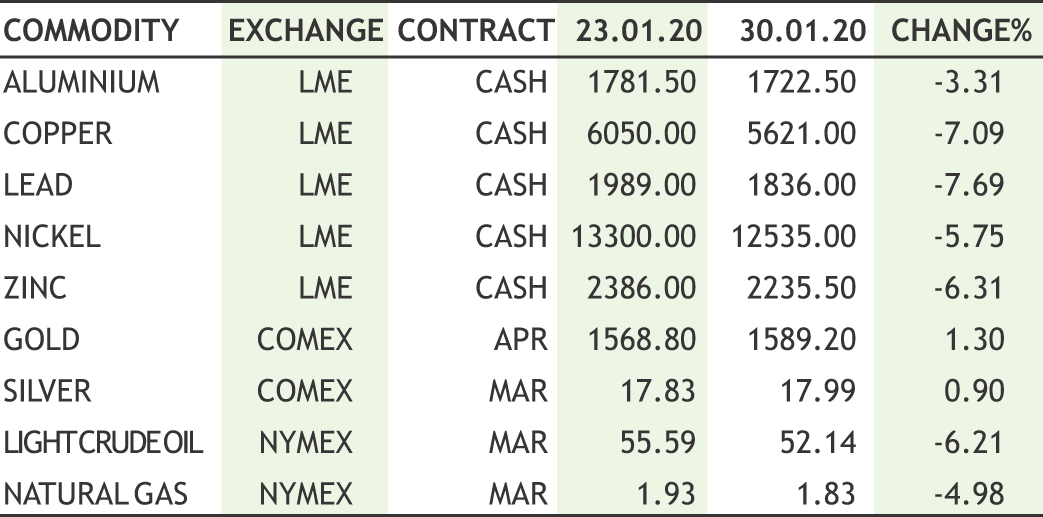

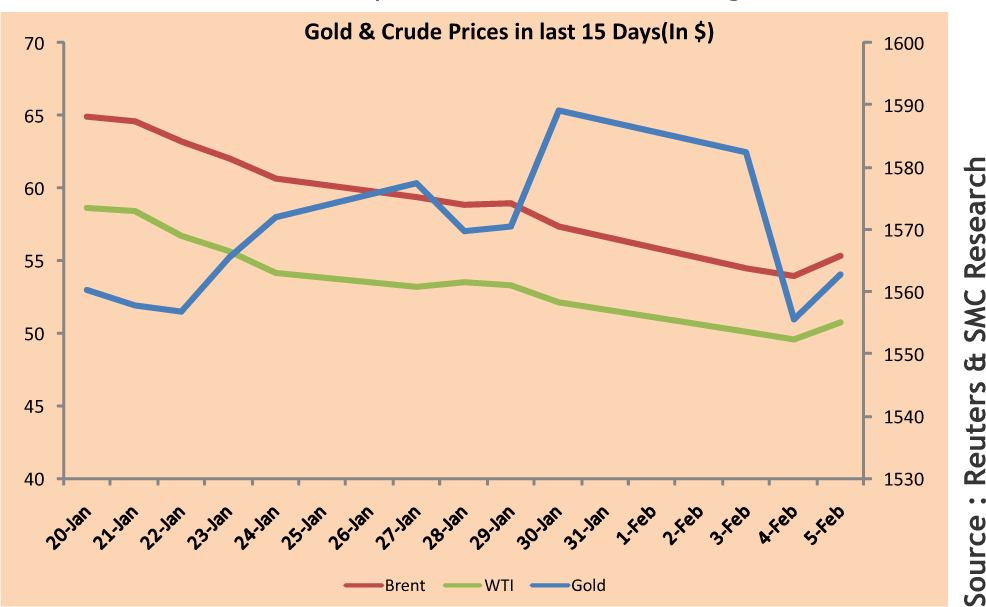

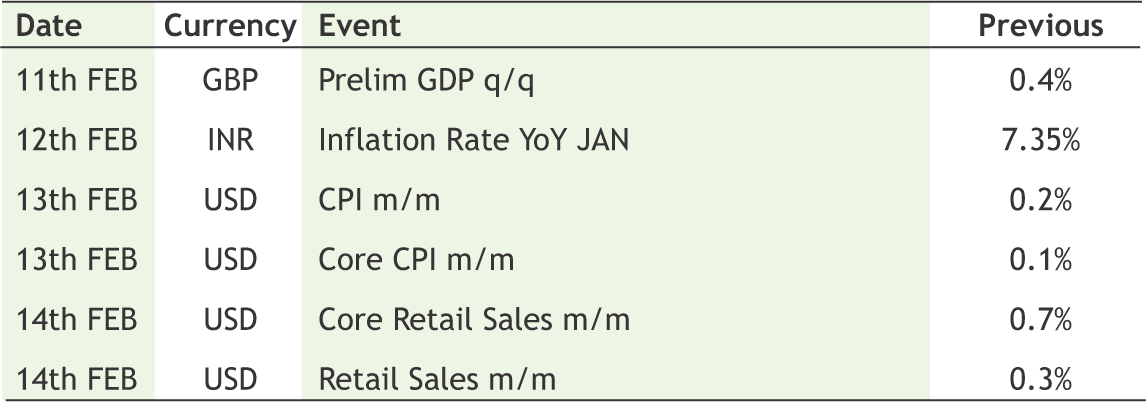

On the Commodity market front, CRB was six week down on increasing numbers of causalities in China due to Coronavirus amid sluggish trade activities. Bullion counter can trade on weaker path as infusion of stimulus measure from China into its economy and bounce back in global equity markets is keeping the upside capped. Gold may dip lower towards 39400 levels while facing resistance 40600 levels. Silver may test 45000 levels while facing resistance near 46800 levels. Crude oil prices may remain weak. Crude oil may dip lower towards 3500 levels while facing resistance near 4100 levels. According to an estimates China’s oil demand could grow at just 100,000 bpd this year due to the Coronavirus. That would make it the slowest expansion in consumption in nearly 20 years. New Yuan Loans and CPI of China, GDP of UK, RBNZ Official Cash Rate¸ CPI and Consumer Price Index Ex Food and Energy of US, etc are strong triggers for commodities market this week.

SMC Global Securities Ltd. (hereinafter referred to as “SMC”) is a registered Member of National Stock Exchange of India Limited, Bombay Stock Exchange Limited and its associate is member of MCX stock Exchange Limited. It is also registered as a Depository Participant with CDSL and NSDL. Its associates merchant banker and Portfolio Manager are registered with SEBI and NBFC registered with RBI. It also has registration with AMFI as a Mutual Fund Distributor.

SMC is a SEBI registered Research Analyst having registration number INH100001849. SMC or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities market.

SMC or its associates including its relatives/analyst do not hold any financial interest/beneficial ownership of more than 1% in the company covered by Analyst. SMC or its associates and relatives does not have any material conflict of interest. SMC or its associates/analyst has not received any compensation from the company covered by Analyst during the past twelve months. The subject company has not been a client of SMC during the past twelve months. SMC or its associates has not received any compensation or other benefits from the company covered by analyst or third party in connection with the research report. The Analyst has not served as an officer, director or employee of company covered by Analyst and SMC has not been engaged in market making activity of the company covered by Analyst.

The views expressed are based solely on information available publicly available/internal data/ other reliable sources believed to be true.

SMC does not represent/ provide any warranty express or implied to the accuracy, contents or views expressed herein and investors are advised to independently evaluate the market conditions/risks involved before making any investment decision.

DOMESTIC NEWS

Economy

• The Reserve Bank of India (RBI) kept the key repo rate unchanged 5.15 per cent in its first monetary policy review after Budget 2020-21. The six-member Monetary Policy Committee (MPC) maintained an accommodative stance in the sixth bi-monthly policy meet of 2019-20. It estimated a 6 per cent GDP growth rate for 2020-21 while projecting a 6.2 per cent growth rate for Q3FY21.

Oil & Gas

• Indian Oil Corporaion has signed a deal with Russia’s Rosneft for the annual purchase of 2 million metric tonnes of crude oil, the Oil Ministry said in a statement. This is the first ever annual oil purchase deal between the two countries.

The joint venture (JV) of Reliance Industries (RIL) and BP had completed the cessation of production at D1/D3 fields in the KG-D6 block. The fields were India’s first deepwater gas field, which started production inApril 2009. The fields were expected to cease production in 2015. Butthe company made specific investments to extend their lives.

Metal

• JSW Steel has bagged its third iron ore mine in Odisha at Ganua through an e-auction, with a reserve of 118 million tonnes (MT)on Wednesday, sources said. The company is committed to pay 132% of its sale value to the Odisha Government.

Infrastructure

• Adani Ports Ports and SEZ aims to spend Rs 4,000 crore as capital expenditure on its growth and expansion in FY21. Adani Ports last month announced the purchase of a 75% stake in Krishnapatnam Port for Rs 5,520 crore.

Pharmaceuticals

• Granules India Ltd foreign arm has received approval from the US health regulator for Valganciclovir hydrochloride oral solution, an antiviral medication.

• It is bioequivalent to the Reference Listed Drug product (RLD) -- Valcyte for oral solution, 50 mg/m, of Roche Palo Alto LLC.

• Cadila Healthcare said the inspection of its manufacturing facility at Ahmedabad by the US health regulator was completed with no observations.

Power

• Tata Power has joined hands with EV cab operator Prakriti E-Mobility to set up 50 charging stations for electric vehicles in a phased manner. Last month, three Tata Group companies had unveiled a mega plan for the electric mobility space along with group company Tata Motors.

• Adani Transmission Ltd raised $310 million in the US private placement market by placing 30-year paper last week. This was the first time in more than a decade an Indian company had managed to raise funds from the US private placement market.

Cement

• Shree Cement, second largest company in the segment, will be debuting in the West Indian market in the coming six months, with a 2.5 million tonne per annum (mtpa) grinding unit near Pune. Investment in the plant, spread across 65.7 acres, is Rs 625 crore. It doesn’t have linkages to limestone reserves and is getting this from a Shree unit near Kodla village in Karnataka.

Information Technology

• Tata Consultancy Services has bagged a $1.5 billion (about Rs 10,650 crore) contract from pharma company Walgreens Boots Alliance, spread over a period of 10 years. Under the contract, TCS will provide managed services including application maintenance and support, required infrastructure and security operations.

INTERNATIONAL NEWS

• US trade deficit widened to $48.9 billion in December from a revised $43.7 billion in November. Economists had expected the deficit to widen to $48.2 billion from the $43.1 billion originally reported for the previous month.

• US factory orders surged up by 1.8 percent in December after tumbling by a revised 1.2 percent in November. Economists had expected factory orders to jump by 1.2 percent compared to the 0.7 percent decrease originally reported for the previous month.

• US construction spending dipped by 0.2 percent to an annual rate of $1.328 trillion in December after climbing by 0.7 percent to a revised rate of $1.330 trillion in November.

• Eurozone Retail turnover declined 1.6 percent in December from November, when it was up 0.8 percent. Economists had forecast a 1.1 percent drop. Sales of food, drinks and tobacco fell 1.4 percent and that of non-food products decreased 1.6 percent in December. Automotive fuel sales were down 1.4 percent.

| Stocks | *Closing Price | Trend | Date Trend Changed | Rate Trend Changed | SUPPORT | RESISTANCE | Closing S/l |

|---|---|---|---|---|---|---|---|

| S&P BSE SENSEX | 41306 | UP | 08.02.19 | 36546 | 36300 | 35300 | |

| NIFTY50 | 12138 | UP | 08.02.19 | 10944 | 10900 | 10600 | |

| NIFTY IT | 16389 | UP | 21.07.17 | 10712 | 15200 | 14800 | |

| NIFTY BANK | 31287 | UP | 30.11.18 | 26863 | 27700 | 27000 | |

| ACC | 1490 | UP | 23.01.2020 1 | 1548 | 1500 | 1470 | |

| BHARTIAIRTEL | 547 | UP | 15.03.19 | 338 | 510 | 490 | |

| BPCL | 495 | UP | 30.08.19 | 355 | 470 | 450 | |

| CIPLA** | 440 | UP | 25.10.19 | 460 | - | 440 | |

| SBIN | 322 | UP | 01.11.19 | 314 | 315 | 305 | |

| HINDALCO | 194 | DOWN | 31.01.20 | 189 | 200 | 205 | |

| ICICI BANK | 542 | UP | 20.09.19 | 418 | 510 | 500 | INFOSYS | 771 | UP | 20.12.19 | 732 | 750 | 730 |

| ITC | 214 | DOWN | 31.05.19 | 279 | 235 | 245 | |

| L&T | 1318 | DOWN | 15.11.19 | 1378 | 1360 | 1380 | |

| MARUTI | 7022 | DOWN | 31.01.20 | 6913 | 7300 | 7400 | |

| NTPC | 112 | DOWN | 16.08.19 | 118 | 120 | 124 | |

| ONGC | 112 | DOWN | 06.12.19 | 127 | |||

| RELIANCE | 1458 | DOWN | 31.01.20 | 1412 | 1500 | 1530 | |

| TATASTEEL | 478 | DOWN | 31.01.20 | 439 | - | 485 | |

Closing as on 06-02-2020

NOTES:

1) These levels should not be confused with the daily trend sheet, which is sent every morning by e-mail in the name of "Morning Mantra ".

2) Sometimes you will find the stop loss to be too far but if we change the stop loss once, we will find more strength coming into the stock. At the moment, the stop loss will be far as we are seeing the graphs on weekly basis and taking a long-term view and not a short-term view.

| Meeting Date | Company name | Purpose |

|---|---|---|

| 10-Feb-20 | Bharat Forge | Financial Results |

| 10-Feb-20 | Petronet LNG | Financial Results |

| 10-Feb-20 | National Aluminium Co. | Financial Results/Dividend |

| 10-Feb-20 | Oil India | Financial Results |

| 4-Feb-20 | TVS Motor Company | Financial Results |

| 4-Feb-20 | Titan Company | Financial Results |

| 4-Feb-20 | Punjab National Bank | Financial Results |

| 4-Feb-20 | Exide Industries | Financial Results |

| 4-Feb-20 | Adani Ports and SEZ | Financial Results |

| 5-Feb-20 | HPCL | Financial Results |

| 5-Feb-20 | IndiabullsHousingFinan. | Financial Results/Dividend |

| 5-Feb-20 | DLF | Financial Results/Dividend |

| 5-Feb-20 | Divi's Laboratories | Financial Results |

| 5-Feb-20 | Adani Enterprises | Financial Results |

| 5-Feb-20 | Apollo Tyres | Financial Results |

| 6-Feb-20 | Aurobindo Pharma | Financial Results/Dividend |

| 6-Feb-20 | Sun Pharmaceutical Ind. | Financial Results |

| 6-Feb-20 | United Breweries | Financial Results |

| 6-Feb-20 | Lupin | Financial Results/Other business matters |

| 6-Feb-20 | Hero MotoCorp | Financial Results |

| 7-Feb-20 | Britannia Industries | Financial Results/Fund Raising |

| 7-Feb-20 | Voltas | Financial Results |

| 7-Feb-20 | Tata Steel | Financial Results |

| 7-Feb-20 | UPL | Financial Results |

| 7-Feb-20 | NCC | Financial Results |

| 7-Feb-20 | Container Corp. of India | Financial Results/Other business matters |

| 8-Feb-20 | Mahindra & Mahindra | Financial Results |

| 10-Feb-20 | MRF | Financial Results/Dividend |

| 10-Feb-20 | GAIL (India) | Financial Results |

4

5

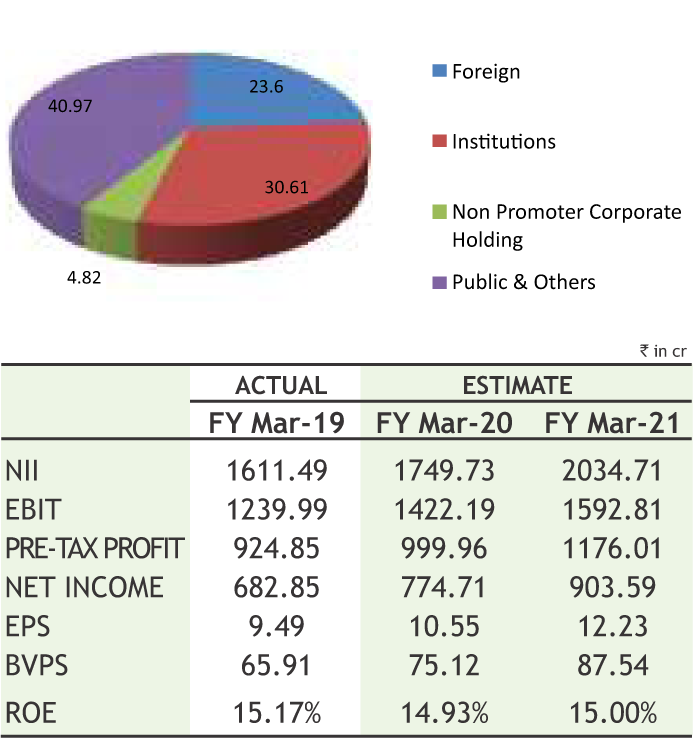

City Union Bank Limited

CMP: 229.80

Target Price: 263

Upside: 14%

| Face Value(Rs.) | 1.00 |

| 52 Week High/Low | 249.00/172.00 |

| M.Cap (Rs. in Cr.) | 16909.00 |

| EPS (Rs.) | 9.95 |

| P/E Ratio (times) | 23.10 |

| P/B Ratio (times) | 3.26 |

| Dividend Yield (%) | 0.59 |

| Stock Exchange | BSE |

Investment Rationale

• The business of the bank increased at steady pace of 15% to Rs.73730.60 crore at end of September 2019 with 17% surge in deposits to Rs. 40451.30 crore, while loan book of the bank moved up 12% to Rs. 33279.30 crore end of September 2019 over September 2018. The asset quality of the bank was stable in Q2FY2020. The CASA ratio of the bank improved on sequential basis 24.7% at end September 2019.

• Bank has recorded 12% increase in the interest earned at Rs 1036.82 crore, while interest expenses jumped 18% to Rs 625.28 crore in Q2FY2020. NII rose 3% to Rs 411.55 crore in the quarter ended September 2019. Further, the treasury income surged 270% to Rs 78.9 crore.

• The provision coverage ratio for NPAs was steady at 65% end September 2019. The Gross NPA and Net NPA of the Bank as at the end of the Quarter stood at Rs.1135.44 Cr and Rs. 624.08 Cr respectively. Gross NPA as a percentage stood at 3.41% and Net NPAas a percentage stood at 1.90%.

• The bank maintained the guidance for credit growth at 18-20% for FY2020 and ROA at 1.50- 1.60% as reduction in the corporate tax rate provides upside. The bank aims to improve RoA to in FY2021 and FY2022.

• The bank has network of 650 branches and 1724 ATM's with employee base at 5588 employees end September 2019.

• During the quarter 23 accounts were restructured amounting to Rs. 49 crs taking the total accounts

to 121 accounts with o/s balance of Rs.117 crs as at H1 FY 2020. The outstanding standard restructured accounts to Gross Advances stood at 0.35%. No account slipped to NPAduring Q2 FY 2020.

Risk

• Strict Regulatory guidelines

• Liquidity risk

Valuation

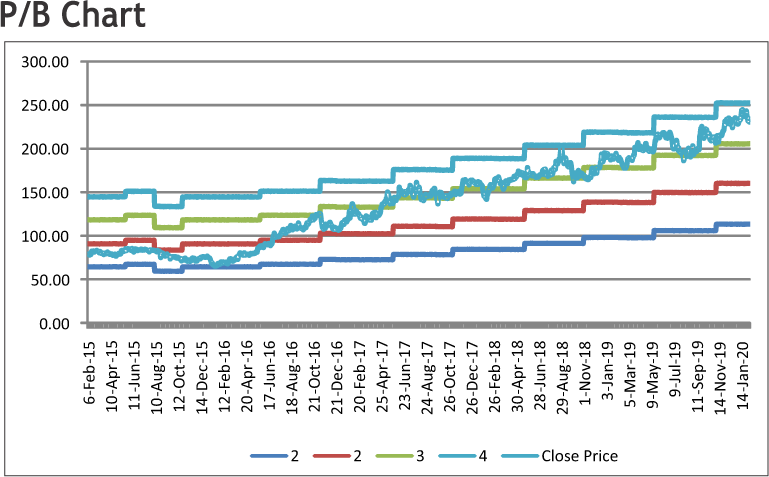

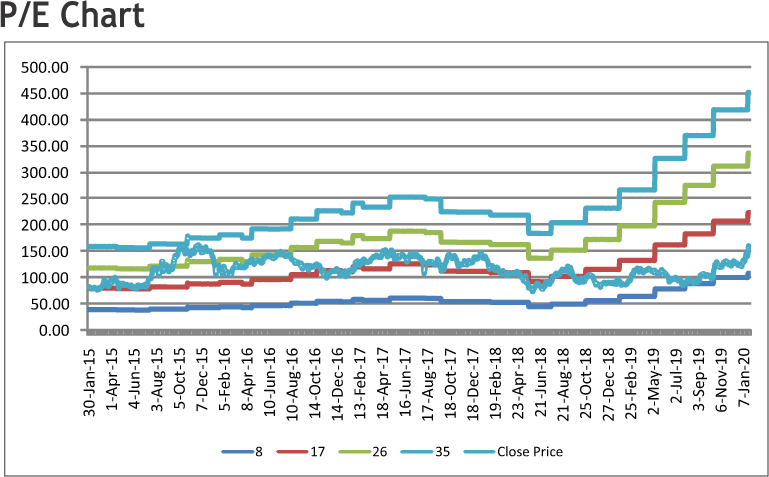

The business of the bank grew strongly and management has focused in retail banking which would continue to give strong, balanced credit growth, improvement in asset quality. New partnerships with Insurance and Mutual Funds distribution with companies like Star Health, Integrated Enterprises, BSE Star Mutual Funds, etc. would help to increase other income. Thus, it is expected that the stock will see a price target of Rs.263 in 8 to 10 months time frame on one year P/Bvx 3 and FY21 (BVPS) of Rs.87.54.

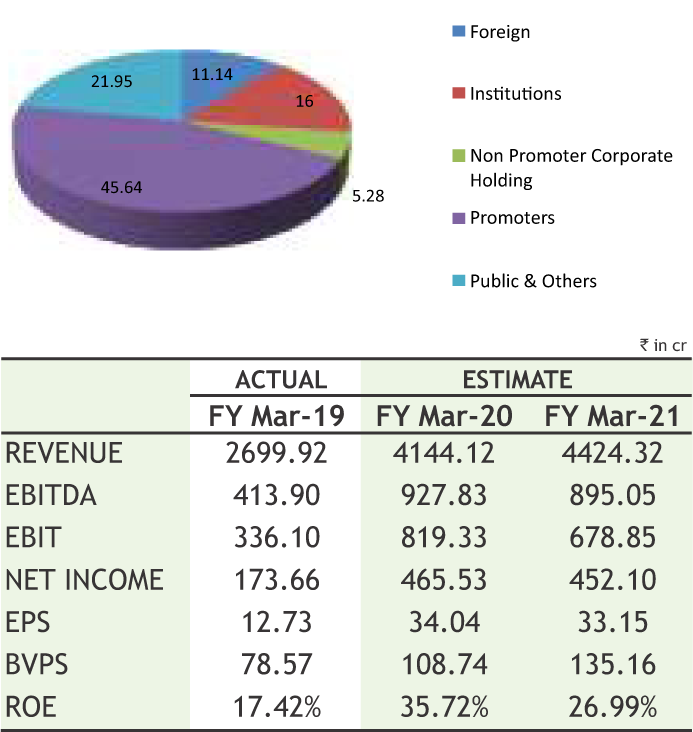

Deepak Nitrite Limited

CMP: 408.15

Target Price: 487

Upside: 19%

| Face Value (Rs.) | 2.00 |

| 52 Week High/Low | 423.85/211.00 |

| M.Cap (Rs. in Cr.) | 5566.88 |

| EPS (Rs.) | 38.87 |

| P/E Ratio (times) | 10.50 |

| P/B Ratio (times) | 4.22 |

| Dividend Yield (%) | 0.49 |

| Stock Exchange | BSE |

Investment Rationale

• During the December quarter, operating profit grew by 200% in Q3 FY20 to Rs 215 crore, as against Rs 72 crore in the same period last year. Robust operating performance was a result of operating leverage from higher volumes, realisation gains across most products and management efforts to optimise production schedules as well as focus on high-value high-margin products. Moreover, balanced growth across basic chemicals, fine & speciality chemicals and performance products segment resulted in robust topline performance which was supported by encouraging demand scenario of company's products in the export markets.

• Deepak Phenolics (DPL), a wholly-owned subsidiary of Deepak Nitrite, operates a Global Scale Plant to manufacture Phenol & Acetone, with a capacity of 200,000 MTPA and 120,000 MTPA respectively. This is supported by capacity to manufacture 260,000 MT of Cumene for captive consumption.

DPL registered revenue growth of 24% to Rs 550 crore in Q3 FY20, with operating profit of Rs 58 crore and has delivered its maiden profitable quarter with net profit of Rs 15 crore. Despite the challenges in the Phenol and Acetone market globally and slowing economic growth in the domestic market, the company has been able to increase sales volumes to sustain its leadership position in the domestic market. The capacity utilisation continued to remain high, at over 100%.

• The management of the company expects capex of Rs 400 crore in FY21 and has maintained its growth guidance for fine and speciality chemicals at 10- 15%.

Risk

• Volatility in Raw Material Prices

• Currency Fluctuations

Valuation

The company has strong track record on quarterly as well as yearly basis. It has a positive outlook towards the opportunities emerging across the chemicals industry landscape on the back of its diversified product portfolio across key product categories. Global customers are also seeking to establish operations in alternate markets other than China for which India is better placed. Furthermore, the company in filing said that uncertainties caused by the coronavirus are exacerbating the concerns around China. This is a tailwind for the speciality chemical industry and the company is well placed to continue to build upon its success in recent years. Thus, it is expected that the stock will see a price target of Rs.487 in 8 to 10 months time frame on a three year average P/BVx of 3.6x and FY21 BVPS of Rs.135.16.

Source: Company Website Reuters Capitaline

Above calls are recommended with a time horizon of 8 to 10 months.

6

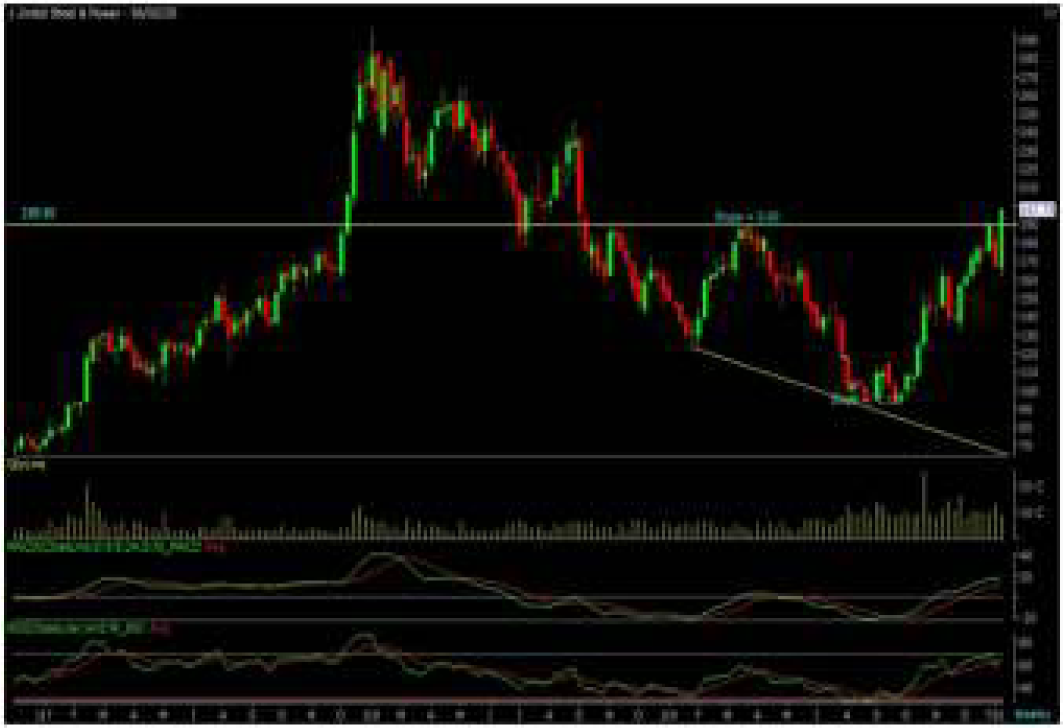

The stock closed at Rs 197.75 on 06th February 2020. It made a 52-week low of Rs 91.05 on 04th September 2019 and a 52-week high of Rs. 198.75 on 06th February 2020. The 200 days Exponential Moving Average (DEMA) of the stock on the daily chart is currently at Rs 149.63

As we can see on chart that stock is trading in higher highs and higher lows on charts which is bullish in nature. Apart from this, it was formed a “Broadening Bottom” on charts and also has given the breakout of same along with huge volumes. So buying momentum may continue in coming days in the stock. Therefore, one can buy in the range of 192-194 levels for the upside target of 220-225 levels with SL below 182.

The stock closed at Rs 128.05 on 06th February, 2020. It made a 52-week low at Rs 78.60 on 09th October 2019 and a 52-week high of Rs. 155.90 on 03rd April, 2019. The 200 days Exponential Moving Average (DEMA) of the stock on the daily chart is currently at Rs 114.38

Short term, Medium term bias are looking positive for the stock, it is forming an “Inverted Head and Shoulder” pattern on weekly charts and has closed on verge of breakout of same with decent buying interest. On the technical indicators front, RSI and MACD are suggest buying for the stock so one can initiate long in range of 123-125 levels for the upside target of 138-140 levels with SL below 114.

Disclaimer : The analyst and its affiliates companies make no representation or warranty in relation to the accuracy, completeness or reliability of the information contained in its research. The analysis contained in the analyst research is based on numerous assumptions. Different assumptions could result in materially different results.

The analyst not any of its affiliated companies not any of their, members, directors, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of the analysis research.

SOURCE: CAPITAL LINE

Charts by Spider Software India Ltd

Above calls are recommended with a time horizon of 1-2 months

7

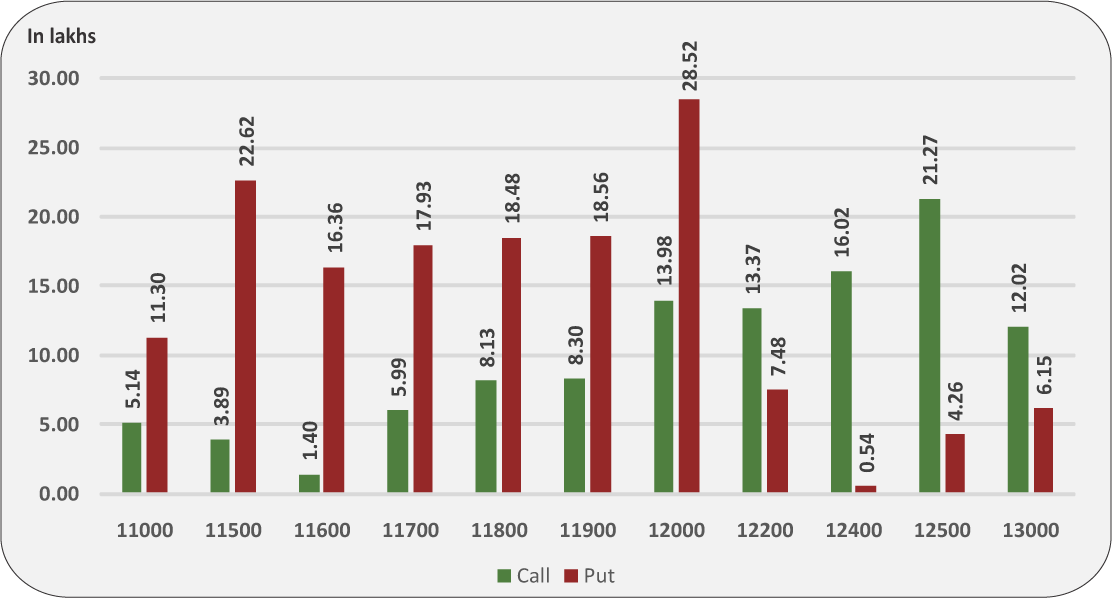

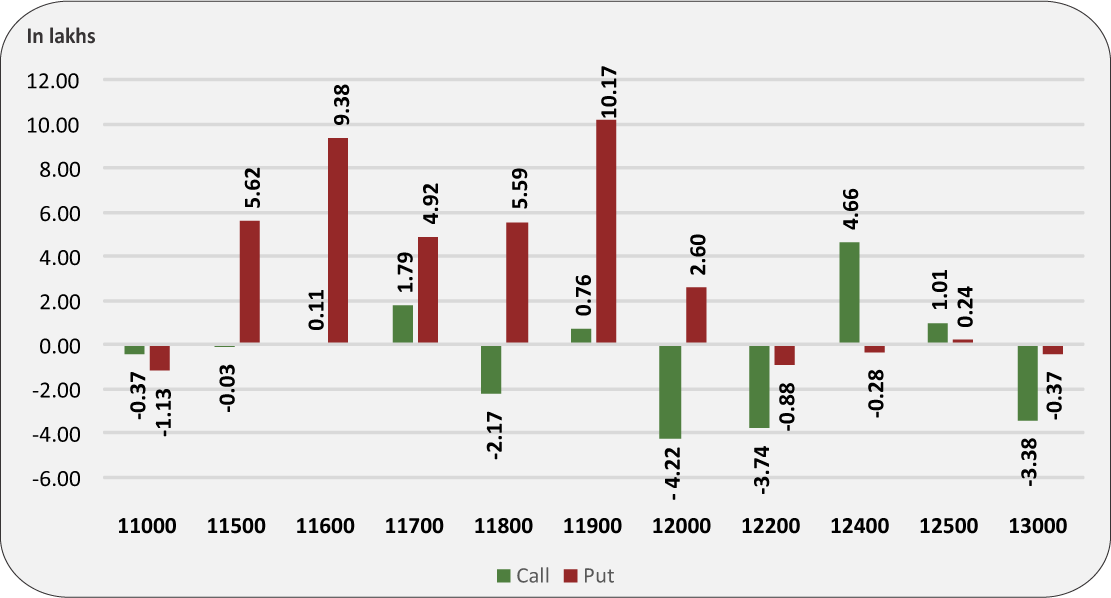

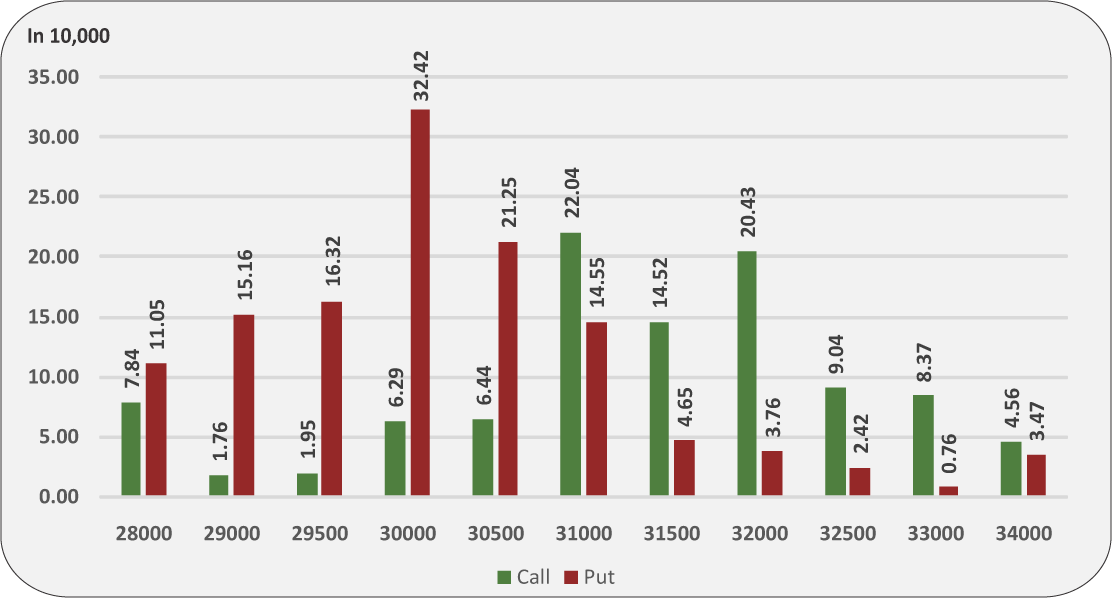

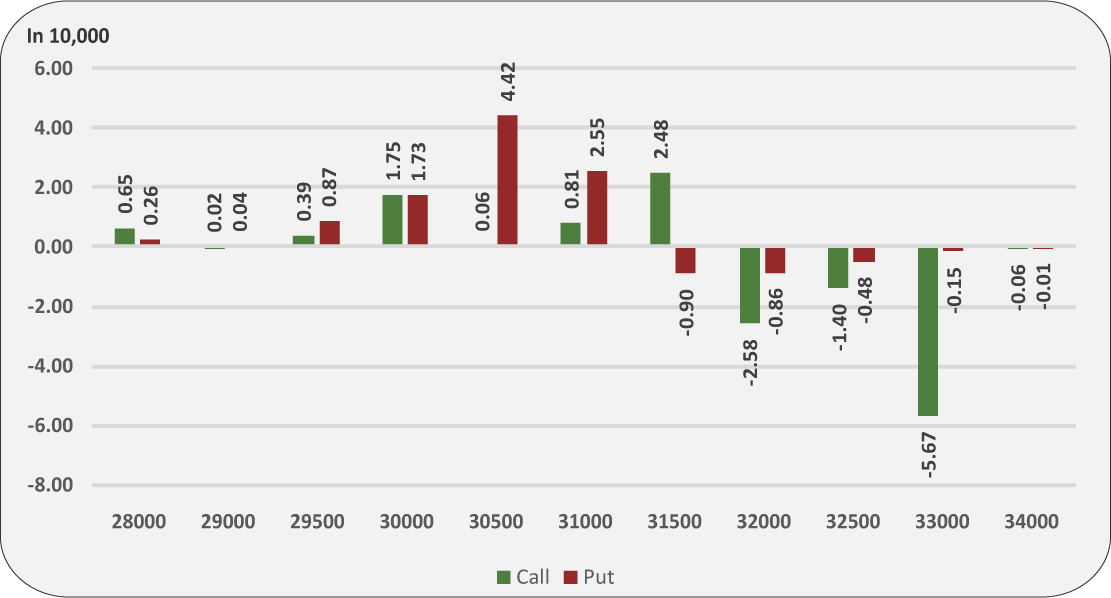

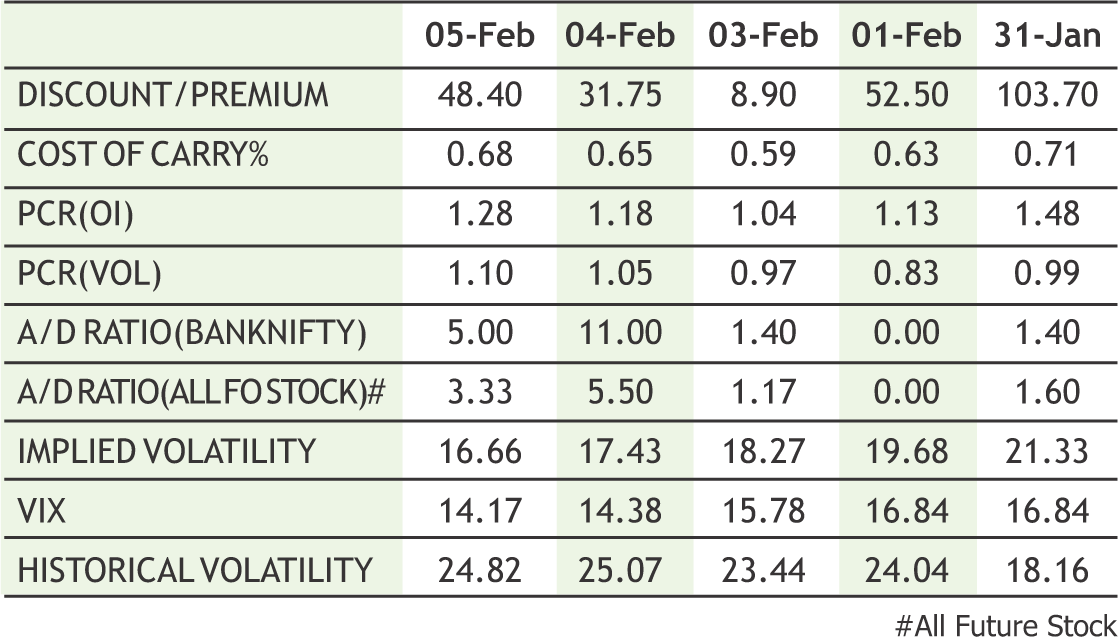

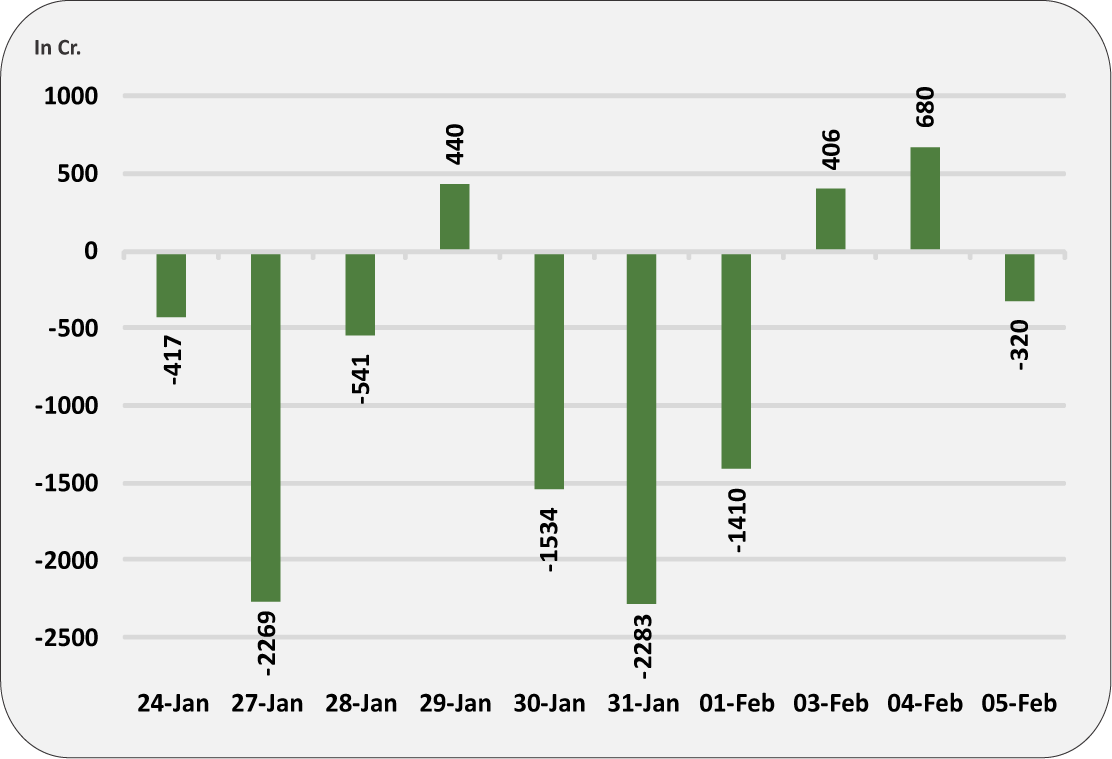

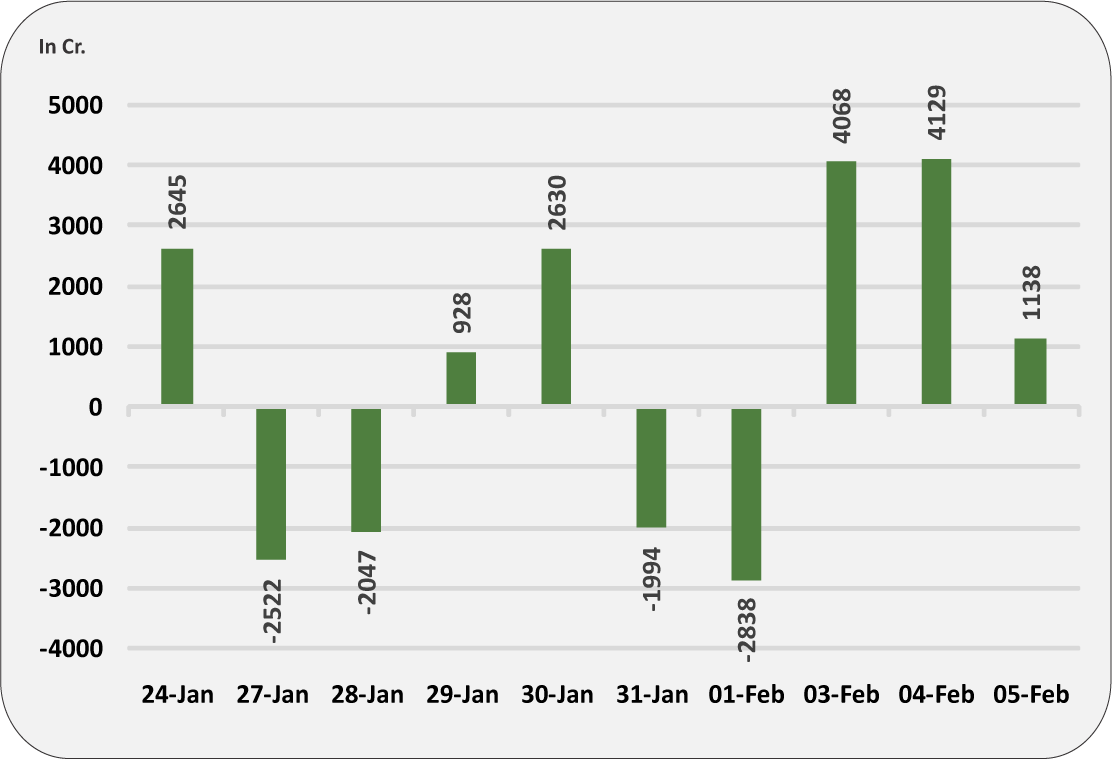

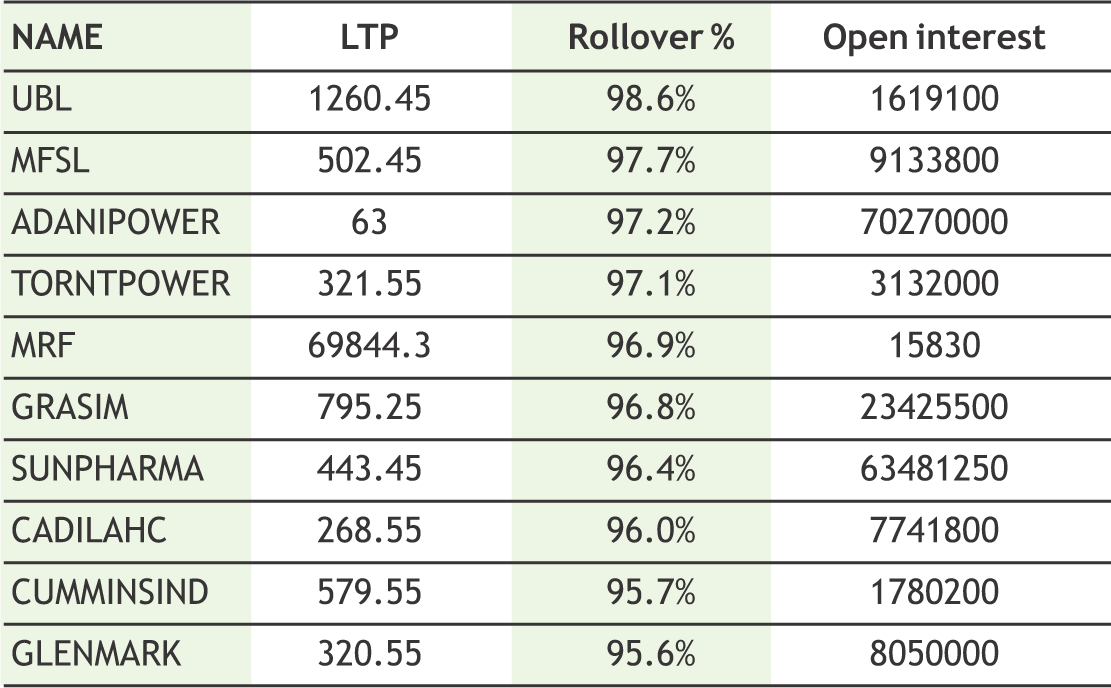

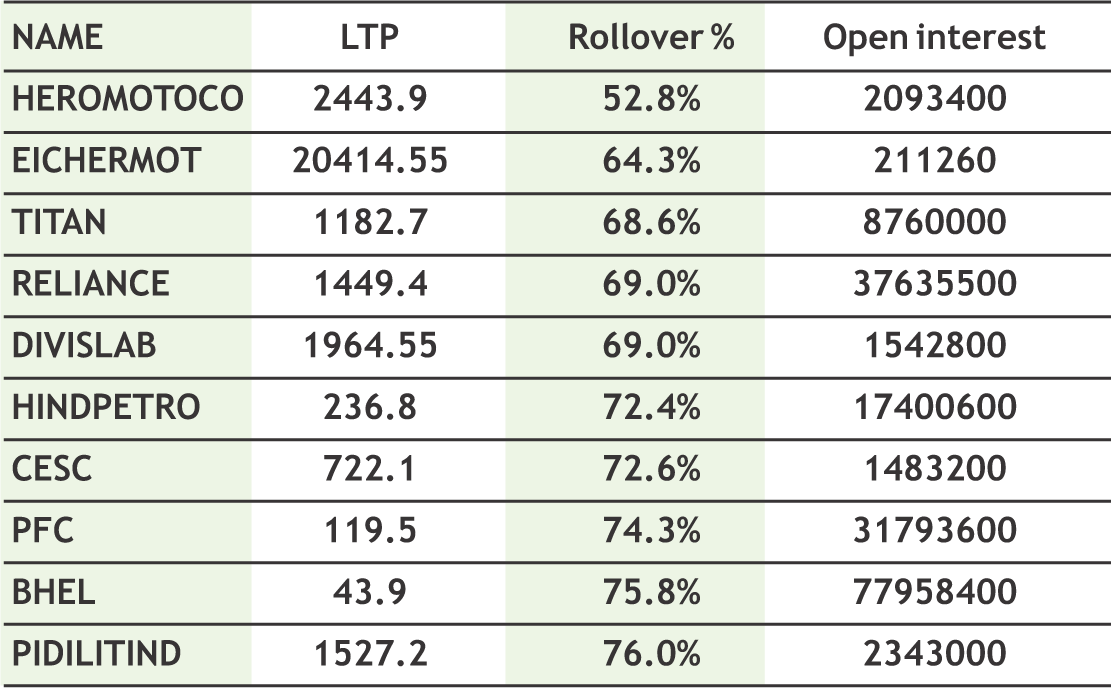

Indian markets rallied in the week gone by taking cues from firm global markets and RBI’s monetary policy outcome in which repo rates is kept unchanged at 5.15 percent. Reacting to it, banking and financial stocks surged higher along with some pharma names. From technical front, both the indices once again reclaimed their short and long term moving averages on daily charts after a steep fall witnessed last week. Both Nifty and Bank Nifty gave almost a V shape recovery after sliding well below 200 dema on daily charts. From derivative front, 12100 put strike witnessed heavy writing which could support the markets in coming week. The Implied Volatility (IV) of calls closed at 14.03% while that for put options closed at 15.10%. The Nifty VIX for the week closed at 14.17% and is expected to remain volatile. PCR OI for the week closed at 1.25. In coming week, it is expected that volatility is likely to grip the market and traders should keep stockspecific action on the radar on the back of ongoing result season. As far levels are concerned, now 12000-11950 zone would be a major support for Nifty while on higher side 12200-12250 would be immediate resistance.

8

|

|

|

|

**The highest call open interest acts as resistance and highest put open interest acts as support.

# Price rise with rise in open interest suggests long buildup | Price fall with rise in open interest suggests short buildup

# Price fall with fall in open interest suggests long unwinding | Price rise with fall in open interest suggests short covering

9

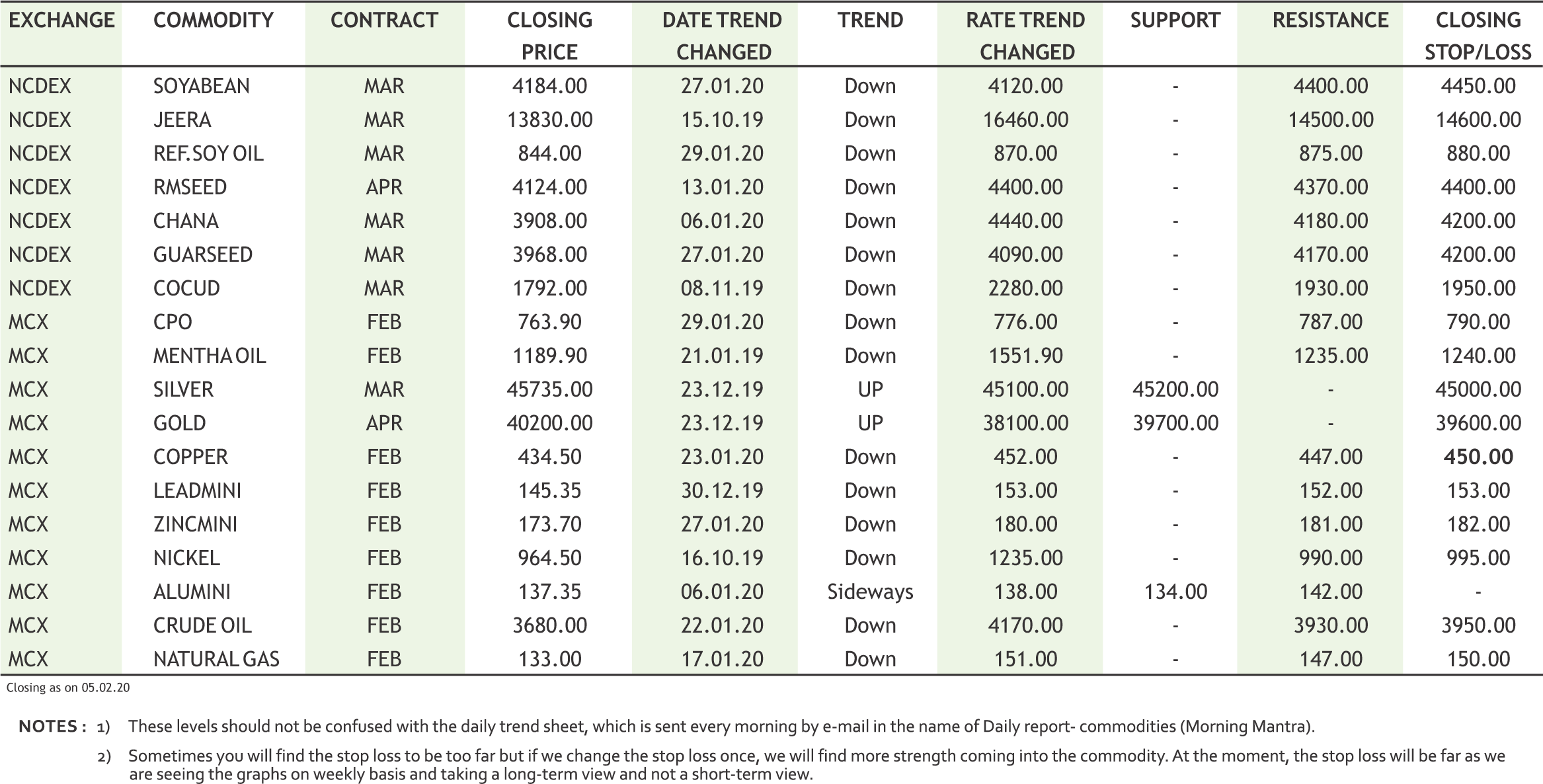

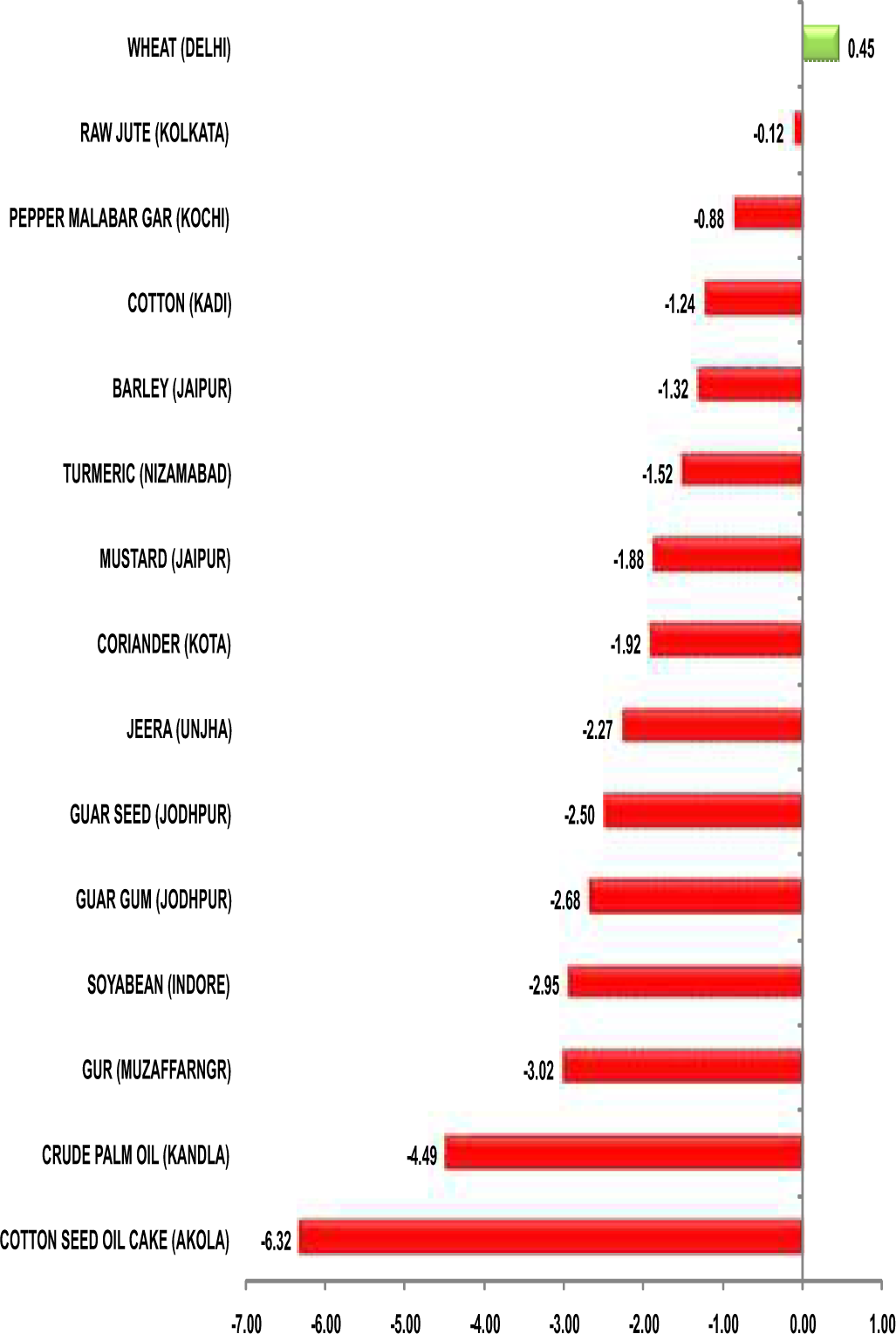

Turmeric futures (Mar) is expected to consolidate in the range of 5825-6150 levels & trade with a downside bias. This bearishness is likely to prevail for the rest of this month as higher output along with increased standard moisture content in the arrived crop has proved to be a double whammy for price. Furthermore, the quality of old turmeric is weak and there is sporadic arrival of Mysore turmeric in Erode. At Erode, new turmeric was sold at Rs.5,455- 6,522 a quintal of finger turmeric and root variety was sold at Rs.4,275-5,800. Jeera futures (Mar) may witness some recovery & move higher to test 14200- 14400 levels, taking support near 13700. Despite projected bumper crop of cumin, farmers are set to get encouraging prices for their yield as export prospects of the spice look up due to the lower cultivation of cumin seeds in Turkey and Syria. Local exporters are already getting orders at $2,000-2,500 per tonne from Gulf countries. It is expected that cumin exports from India would easily cross 1.70 lakh tonnes in the current season compared to last year’s around 160 lakh tonnes. Cardamom futures (Mar) is likely to descend towards 3300 taking negative cues from the spot markets. The availability of inferior quality capsules from the current harvest in the plantations following the end of the season has also escalated the bearish sentiments at the auctions. The market according to traders has been witnessing a very slow demand as there was no sales happening across the trade centers in upcountry markets. The high-priced inventory both at the primary trade centres and consuming markets, forcing buyers to abstain from the market.

Bullion counter can trade on weaker path as infusion of stimulus measure from China into its economy and bounce back in global equity markets globally is keeping the upside capped. Recently strong U.S. economic data was offset by fears over a rapidly spreading coronavirus outbreak and its impact on the global economy. Gold may dip lower towards 39400 while facing resistance 40600.Silver can test 45000 while facing resistance near 46800. China’s central bank huge liquidity injections through open market operations recently showed its determination to stabilize financial market expectations and restore market confidence. PBoC injected a total of 1.7 trillion Yuan ($242.74 billion) via reverse repos. With China’s efforts to support the economy jolted by the outbreak that is expected to have a devastating impact on first quarter growth, the economic data reported from US are also putting pressure on the metal prices. The China virus outbreak is adding to global economic uncertainty but its impact may be short term and temporary, limiting the need for policy action, top European Central Bank executives stated recently. Meanwhile U.S. factory activity rebounded in January after contracting for five straight months amid a surge in new orders .U.S. Mint gold coin sales saw a strong recovery in January after the weakest year on record in 2019. A total of 60,000 ounces of the gold American Eagle coins were sold in January, which is a staggering increase of 2,900% from the previous month that saw only 2,000 ounces sold, according to the U.S. Mint data.

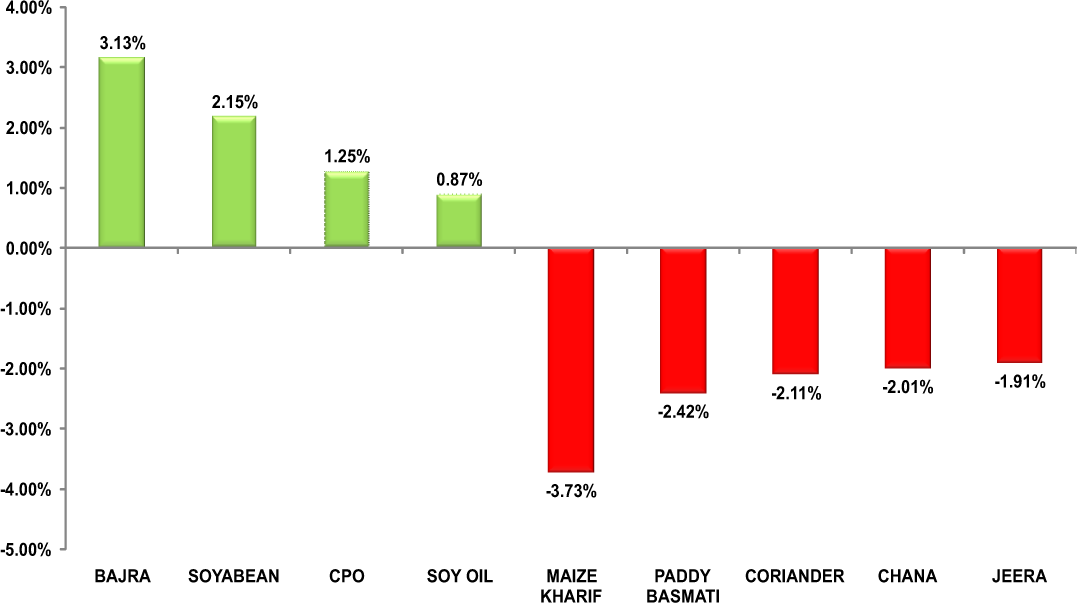

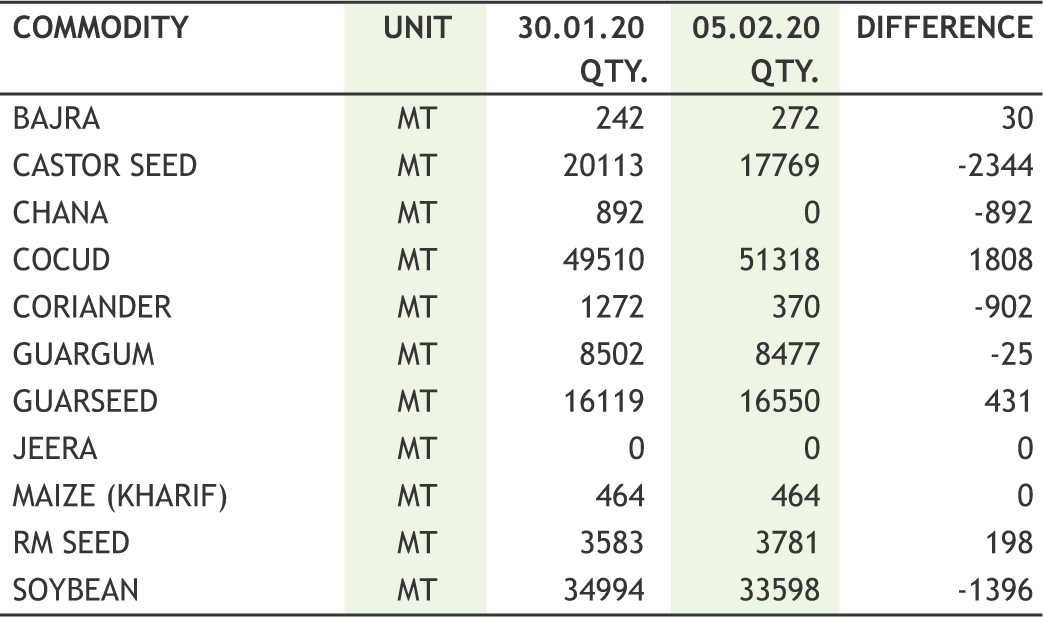

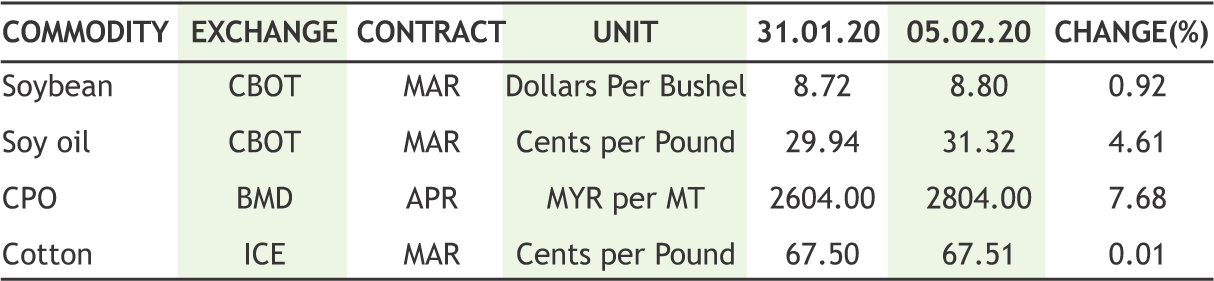

Soybean futures (Mar) is expected to trade higher towards 4250-4300 levels taking support near 4140-4100 levels on positive cues from the international markets. U.S soybean is on the recovery phase on expectation of fresh Chinese purchases. That agreement, signed on Jan. 15 and taking effect on Feb. 15, suspended a new round of U.S. tariffs in exchange for Chinese purchases of agricultural, energy and manufactured goods and services. The sentiments have got a boost aftermath of Beijing’s announcement that it will halve additional tariffs on some $75 billion of imports later this month. With the earlier retaliatory duty remaining place, it still means U.S. soybeans will be subject to a 27.5% tariff, down from 30% previously. The correction in mustard futures (Apr) may steepen further towards 4000-3930 levels. India's mustard output is seen at 8.0 mln tn in 2019-20 (Jul-Jun), 2.6% higher than last year's estimate of 7.8 mln tn, according to the market participants. A larger crop estimate is primarily due to likely higher yield and favourable weather conditions. Currently, the early-sown crop is in the pod filling stage and healthy. The overall output is likely to be higher due to rise in yield in Uttar Pradesh, Madhya Pradesh, and Haryana. CPO futures (Feb) has again resumed its uptrend & looking at the positive fundamentals of its counterparts on BMD & CBOT, it seems that in days to come it can test 780-790 levels. It is being estimated that Malaysian palm oil inventories likely tumbled to its lowest since June 2017, amid dry weather and lower fertiliser usage. Official palm oil data will be published by the Malaysian Palm Oil Board on Jan. 10. Similarly, soy oil may gain towards 865-875 levels.

Crude oil prices may remain on weaker path as energy demand globally would take long-term hit from growing coronavirus outbreak outweighing the efforts by OPEC to stabilize prices. Reports suggest OPEC+ considering cutting crude output by further 500,000 bpd. Uncertainty remains as producer group could face taxing battle to put more cuts in place so soon after existing pact was agreed to and uncertainty over how long the virus crisis will last. Crude oil may dip lower towards 3500 while facing resistance near 4100. According to an estimates China’s oil demand could grow at just 100,000 bpd this year due to the coronavirus. That would make it the slowest expansion in consumption in nearly 20 years. OPEC wants to extend current oil output cuts until at least June from March, with the possibility of deeper reductions on the table if oil demand in China is significantly impacted by the spread of a new coronavirus. Russia’s Energy Minister Alexander Novak said the OPEC+ ministers could discuss moving its meeting forward but said it needs several more days to monitor the situation. Natural gas can remain on weaker side as weather is expected to remain warmer than normal as it can further slip lower towards 120 by taking resistance near 150. U.S. natural gas futures slipped to near four-year low recently on forecasts for warmer-than-normal weather and low heating demand over the next two weeks, and a small decline in exports. The fact that winter has been relatively mild in the United States and 17 % excess gas production last year have resulted in huge glut of natural gas.

ICE cotton futures is likely to hold the support near 67 cents per pound & trade with a positive bias amid expectations of further stimulus measures to stem the impact of the new coronavirus and reports of a possible treatment for the epidemic.Cotton futures (Feb) may witness a rally till 19600 taking support near 19100. In the domestic market, despite a larger crop, the demand side is strong and this may outweigh the supply side. The month on month shipments significantly increased as new crop arrivals are being shipped primarily to Bangladesh, and small volumes to China and Indonesia, followed by Egypt. This is the second straight month of increasing cotton exports indicating signs of revival. Chana futures (Mar) may continue to slide further towards 3850- 3800 levels. Good crop and availability of new domestic Chana has dragged down price in the spot market below Rs 4,000 per quintal. The demand for chana dal and besan from consumption centres is also reported to be slow. It is also reported that NAFED has started liquidation of old procured stock at lower rates in Madhya Pradesh. Mentha oil futures (Feb) is likely to remain under selling pressure, hence may break the support near 1175 & move lower towards 1150-1130 levels. In the present scenario, the demand is tepid from the consuming industries and exporters. In the days to come, the sentiments are likely to become more bearish with waning of seasonal demand at the fagend of the winter season. In the major growing regions, the sowing of this mint is going on & weather will play a major role in deciding the crop’s fate.

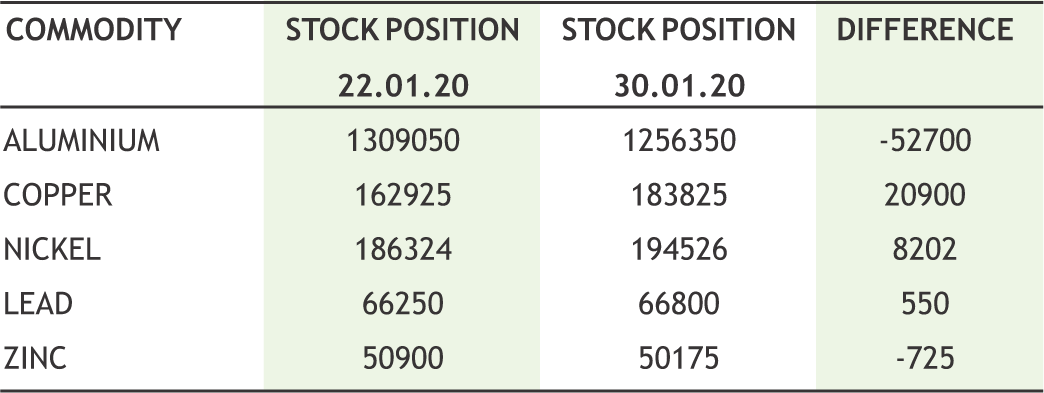

Base metal counter may remain on a positive path. Copper may recover towards 448 levels while taking support near 420 levels. Copper prices rebounded sharply higher recently as investors’ unwound bearish positions after the central bank in China, the world’s biggest metals consumer, pumped stimulus into its economy. China’s copper smelters will reduce output by more than 15% in February from last month due to the coronavirus outbreak. Meanwhile, lead may remain in green as it can test 150 levels while taking support near 135 levels. Imports of lead concentrates jumped by 37% last year and those of zinc were up by 7% after falling in the first half of the year. Zinc may witness some short covering towards 180 levels while taking support near 170. The premium of LME cash zinc over the three-month contract fell to $5.25 a tonne, the lowest since late December, from $23.75 two weeks ago, indicating there are more metal supplies in the LME system. Chinese zinc production, meanwhile, accelerated to a record high in December as smelters capitalized on high treatment charges and better concentrates availability. Nickel prices can recover towards 985 while taking support near 935. Manufacturing activities across nickel downstream sectors in China slowed from a month ago in January and stayed in contraction for the tenth consecutive month, but the decline was smaller than the previous estimates. China imports of nickel ore and concentrates leapt higher over the fourth quarter as shippers tried to beat the deadline. Aluminium prices can move in the range of 134-142 levels.

10

|

COTTON MCX (FEB) contract closed at Rs. 19300.00 on 05th Feb’2020. The contract made its high of Rs. 20440.00 on 10th Jan’2020 and a low of Rs. 18840.00 on 03rd Feb’2020. The 18-day Exponential Moving Average of the commodity is currently at Rs. 19562.59. On the daily chart,the commodity has Relative Strength Index (14-day) value of 38.606.

One can buy above Rs. 19450 for a target of Rs. 19850 with the stop loss of Rs. 19250

COPPER MCX (FEB) contract closed at Rs. 434.50 on 05th Feb’2020. The contract made its high of Rs. 457.50 on 16th Jan’2020 and a low of Rs. 420.60 on 03rd Feb’2020. The 18- day Exponential Moving Average of the commodity is currently at Rs. 437.22. On the daily chart, the commodity has Relative Strength Index (14-day) value of 48.221.

One can buy near Rs. 432 for a target of Rs. 448 with the stop loss of Rs. 424.

JEERA NCDEX (MAR) contract was closed at Rs. 13855.00 on 05th Feb’2020. The contract made its high of Rs. 16235.00 on 11th Nov’19 and a low of Rs. 13710.00 on 04th Feb’2020. The 18-day Exponential Moving Average of the commodity is currently at Rs. 14445.27. On the daily chart,the commodity has Relative Strength Index (14-day) value of 25.070.

One can buy above Rs. 14200 for a target of Rs. 15500 with the stop loss of Rs 13550

11

• The U.S. trade deficit fell for the first time in six years in 2019 as the White House's trade war with China curbed the import bill.

Glencore posted a 6% fall in fourth-quarter copper production and a 13% decline in cobalt as the miner and trader shut its Mutanda mine ahead of schedule.

• IHS Markit's final euro zone composite PMI rose to a fivemonth high of 51.3 in January from December's 50.9.

• India's gold imports in January plunged 48% from a year earlier to their lowest in 4 months.

• Total area sown under Rabi crops was at 662.13 lakh hectares as on January 31 in the current 2019-20 season, up 9.53 percent or 57.61 lakh hectares from 604.52 lakh hectares over the year-ago period.

• Acommodity transactiontax (CTT)willbeimposedontrading on commodity indices as well as options in goods with effect fromApril1,2020,accordingtoBudgetdocuments.

• In the Union Budget, agriculture credit target for the year 2020-21 has been set at Rs.15 lakh crore.

• Integration of electronic negotiable warehousing receipts (e-NWR) with the Electronic National Agriculture Market or eNAM, has been announced in the Union Budget.

• The Cotton Association of India (CAI) has retained its cotton crop estimate for 2019-20 season beginning October 1 at 354.50 lakh bales of 170 kg each as in the previous estimate.

Moscow Exchange will begin trading in a cash-settled futures contract on natural gas. The contract lot will be 100 MMBtu (or 100 million British Thermal Units). The contract will be quoted in US Dollars per MMBtu.

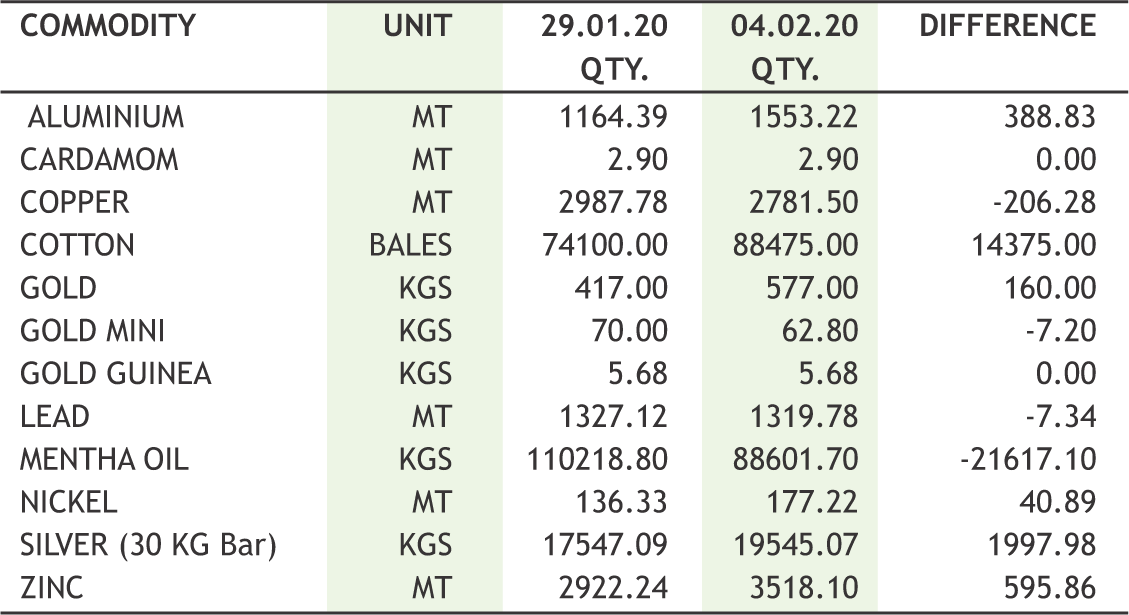

CRB was six week down on increasing numbers of causalities in China due to Coronavirus amid sluggish trade activities. Oil futures rose last week after a steep fall in previous four week amid investor optimism over unconfirmed reports of possible advances in combating the coronavirus outbreak in China as a sign fuel demand may rebound in the world's biggest oil importer. Death toll from coronavirus jumped by 73 to 563 on Thursday in mainland China. Oil prices have slumped more than 20% since reaching their highest this year on Jan. 8 on demand concerns caused by the virus outbreak and oversupply indications. Prices also gained after a government report on Wednesday showed U.S. gasoline and diesel inventories fell. In the U.S., gasoline stockpiles dropped last week, counter to analysts’ expectations for a gain, and diesel inventories fell more than expected, the Energy Information Administration reported. In base metals, copper and nickel saw good rebound buoyed by unconfirmed reports of a possible advance in producing treatment drugs for the coronavirus that has shut down transport and limited industrial activity in China. Prices moved up also as investors unwound bearish positions. Lead, zinc and aluminum remained weak. China’s exports and imports are likely to fell in January after a brief rebound at the end of 2019. China’s copper smelters will reduce output by more than 15% in February from last month due to the coronavirus outbreak. Bullion counter moved down on the news of some breakthrough in Coronavirus antidote amid positive data from the United States such as the rise in January private payrolls and services sector activity, suggested the economy could continue to grow moderately this year. Gold traded near 40000 levels whereas silver traded near 46000. Recovery witnessed in oil seeds and edible oil counter, except mustard seed. This season, production of mustard can be at a record high of 9.7 million tonnes in 2019-20 (Jul-Jun), up from 9.3 million tonnes. The yield could rise over 1.4 tons per hectare due to ample moisture content in the soil. Palm oil prices jumped, lifted by expectations of a steep drop in January production and strength in rival soyoil. Enthusiastic crop report and rise in selling pressure dragged chana prices. Mentha prices saw marginal bounce back in the prices. In spices, turmeric prices saw limited upside as there is sporadic arrival of new crops in Maharashtra as well. Currently, the new Mysore-8 turmeric is arriving for sale & traders are waiting for upcountry demand to pick up as at present, there is only a little local demand. Dhaniya was bearish as demand was weak and market participants are waiting for fresh arrivals, which are expected in the middle of February.

|

|

12

|

|

The coronavirus epidemic, started from China has created tremors across worldwide & caused more than 600 deaths as of till date and infected more than 20,000 people in two dozen countries. It has forced the Chinese cities to shut down and factories and could damage the world’s second-largest economy. By considering its widespread epidemic and its significant impact on global markets, World Health Organization has declared an international emergency.

How serious could the impact on the commodity sector be?

China is the world’s largest importer and exporter of commodities and slowdown is expected in its economy because of business disruptions resulting from widespread outbreak. Nevertheless the China authorities have taken measures to curb the disease’s spread but prolonged disruption in China will have significant impact on global markets.

As per analysts, the coronavirus epidemic’s impact on commodity prices is greater than during the Severe Acute Respiratory Syndrome (SARS) outbreak in 2002-2003, which also originated in China and led to nearly 800 deaths.

Impact on Base Metals

Although no health emergency is identical, but SARS provides us a reference that Chinese Gross Domestic Product and Industrial Production growth could fall 1% this year. Economic activity can also dip this quarter, but the extent of that fall will depend on how long coronavirus epidemic will last. For most of the commodities, the virus has created transport problems. Due to nationwide travel and transportation disruption closure of markets and shopping malls, different sectors including construction, automotive, manufacturing steelmaking, aluminium smelting, coal mining and phosphate production are at risk which reduce the demand for steel, copper, aluminium and other commodities. As a result, commodity supply chains have been disrupted; shipments canceled or delayed and stocks piling up.

China consumes approximately half of the world’s metals and mining resources. Now the consumption by China is almost double when the country was hit by the Severe Acute Respiratory Syndrome (Sars) outbreak in 2002. China accounts for around half of global copper demand, and the industrial metal was still down more than 7% year to date.

Crude oil Melting

Short-term sales of crude oil and liquefied natural gas into China almost ground to a halt this week as a coronavirus outbreak slowed economic activity and hurt demand. China is the world’s largestimporter of crude oil, having imported a record 506 million tonnes in 2019, or about 10 million barrels per day, and recently became the world’s largest importer of liquefied natural gas. Just a few weeks after the outbreak of the virus, daily Chinese oil demand has been already down by 20 percent because of dwindling air travel, road transportation and manufacturing. The brent crude prices dropped almost 18% in lasttwo weeks on fear of coronavirus.

Gold glitters

Globally much desired commodity, gold is benefitting as safe-haven demand was boosted by worries over a fast-spreading coronavirus outbreak in China. Although, Chinese steps by injecting 1.2 trillion yuan ($173.8 billion) of liquidity into markets to mitigate the economic impact from the coronavirus epidemic drove some investors away from safe havens and back into riskier assets but uncertainty still remains about the extent of the impact on the Chinese and global economies.

13

|

| 01st FEB | Union Budget set the fiscal deficit target at 3.5% of GDP for fiscal 2021. |

| 03rd FEB | Indian bond prices surged after the Union Budget avoided extra government borrowing for the current fiscal. |

| 04th FEB | U.S. finalizes rule to slap duties on countries that undervalue currencies. |

| 04th FEB | The People’s Bank of China added a net 150 billion yuan ($21.4 billion) of funds using 7-day and 14-day reverse repurchase agreements. |

| 06th FEB | The Reserve Bank of India’s monetary policy committee kept repo rate unchanged at 5.15% |

| 06th FEB | RBI revised upward CPI inflation target for Q4 to 6.5% |

Indian rupee warranted the recent slide after tracking the lower benchmark yield which kept the sentiment in-check both in rupee as well as government securities. Indian Finance Minister in Union Budget on 1st February set target on fiscal deficit of 3.5 per cent of gross domestic product for the financial year that starts on April 1, abandoning its commitment to pare the fiscal deficit to 3 per cent next year. The widening deficit target will require Centre to borrow an estimated $75bn to finance its operations in the financial year, up from around $70bn this year. Ms Sitharaman also admitted that India’s fiscal deficit for the current financial year would come in at 3.8 per cent of GDP, above the 3.3 per cent target. Indian rupee reacted negative on a modest note as the fiscal numbers was largely priced-in in the markets. Taking into account of all the measures to boost bond markets are likely to get wane soon as slowdown in the economy with uptick in core inflation will dent the positive sentiments. Meanwhile Pound plunged after recent rally as Boris Johnson tweaked the negotiations with EU in due course with a possible hint of hard deal under WTO terms. Going forward rupee move will be guided by RBI’s policy stance as the consensus are high that rate-setters will keep the repo on hold along with Job US job data will guide the major pairs.

USDINR is likely to stay above 71.00 and move higher towards 71.60 in the next week.

|

USD/INR (FEB) contract closed at 71.3700 on 05-Feb-2020. The contract made its high 71.8500 on 03-Feb-2020 and a low of 71.2925 on 05-Feb-2020 (Weekly Basis). The 14-day Exponential Moving Average of the USD/INR is currently at 71.50.

On the daily chart, the USD/INR has Relative Strength Index (14-day) value of 42.05. One can buy at 71.00 for the target of 71.60 with the stop loss of 70.70

EUR/INR (FEB) contract closed 78.7450 on 05-Feb-2020. The contract made its high of 79.7225 on 03-Feb-2020 and a low 78.7100 on 05-Feb-2020 (Weekly Basis). The 14-day Exponential Moving Average of the EUR/INR is currently at 79.10.

On the daily chart, EUR/INR has Relative Strength Index (14-day) value of 34.74. One can buy at 78.30 for a target of 79.20 with the stop loss of 79.95.

GBP/INR (FEB) contract closed at 93.1750 on 05-Feb-2020. The contract made its high of 94.6100 on 03-Feb-2020 and a low of 92.3550 on 04-Feb-2020 (Weekly Basis). The 14-day Exponential MovingAverage oftheGBP/INR is currently at 93.30.

On the daily chart, GBP/INR has Relative Strength Index (14-day) value of 42. One can sell at 93.00 for a target of 92.10 with the stop loss of 93.50.

JPY/INR (FEB) contract closed at 65.1400 on 05-Feb-2020. The contract made its high of 66.2900 on 03-Feb-2020 and a low of 65.0750 on 05-Feb-2020 (Weekly Basis). The 14-day Exponential MovingAverage ofthe JPY/INR is currently at 65.47.

On the daily chart, JPY/INR has Relative Strength Index (14-day) value of 39.60. One can buy at 64.80 for a target of 65.60 with the stop loss of 64.30

14

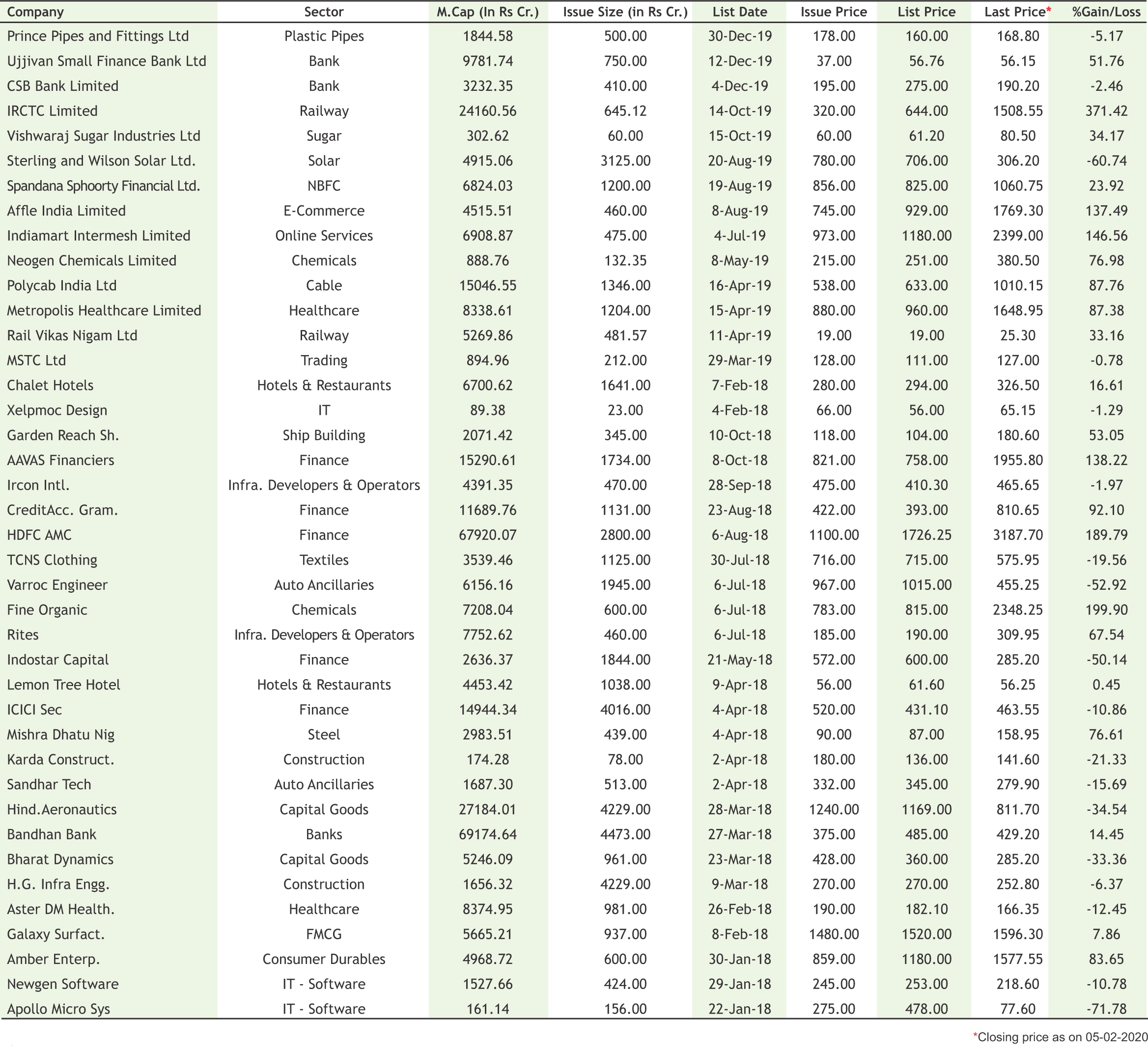

ITI withdraws Rs 1,400-cr FPO due to prevailing market condition

State-owned telecommunications technology company ITI Limited decided to withdraw its further public offering due to market conditions that prevailed on February 5, its last day of bidding. The Rs 1,400-crore public issue was subscribed 62 percent despite extending the subscription period twice since its opening, and reducing the price band to Rs 71-77, down from Rs 72-77 earlier. The issue was supposed to close on January 28, which then extended to January 31 and then to February 5. The company had filed the draft red herring prospectus on September 27, 2018 with the Securities and Exchange Board of India, and its red herring prospectus on January 17, with the Registrar of Companies.

Ujjivan Small Finance Bank utilises entire fund of Rs 746cr raised via IPO

Ujjivan Small Finance Bank (USFB) has said it has used the entire Rs 746 crore equity capital that it raised through an IPO in December. The lender had raised Rs 745.95 through an initial public offer (IPO) in December 2019. The company said the funds were raised to "augment to tier-1 capital base to meet future capital requirement of the bank.

|

15

|

* Interest Rate may be revised by company from time to time. Please confirm Interest rates before submitting the application.

* For Application of Rs.50 Lac & above, Contact to Head Office.

* Email us at fd@smcindiaonline.com

16

IDFC AMC launches open-ended equity fund for small-cap stocks

IDFC Asset Management Company (AMC) on February 3 announced the launch of an open-ended equity fund, predominantly investing in small-cap stocks. The new fund seeks to look at growth opportunities in the small-cap space alongside applying quality filters. The fund is mandated to invest at least 65 percent in the small-cap segment. It will contain buy and hold strategies as well as opportunistic picks in the cyclical space. The fund will also look to participate in new businesses via IPOs. The new fund offer opens February 3 through February 17, during which units will be offered at Rs 10 each and continuous offer for units at NAV-based price, the release said. The scheme will re-open for ongoing subscription and redemption within five business days from the date of allotment of units at NAV-based prices, it said.

Franklin Templeton Mutual Fund announced change in minimum application of some funds

Franklin Templeton Mutual Fund announced the change in minimum application amount of Franklin India Low Duration Fund (FILDF), Franklin India Income Opportunities Fund (FIIOF), Franklin India Dynamic Accrual Fund (FIDA), Franklin India Credit Risk Fund (FICRF), Franklin India Short-Term Income Plan (FISTIP) and Franklin India Ultra-Short Bond Fund (FIUBF) effective Jan 27, 2020. As per the revised provision, there is no upper limit to the investment amount. Fresh/additional purchase (including switch-in) by an investor on a single day in each plan will be accepted only up to Rs. 20 crore per application.

17

|

|

|

|

|

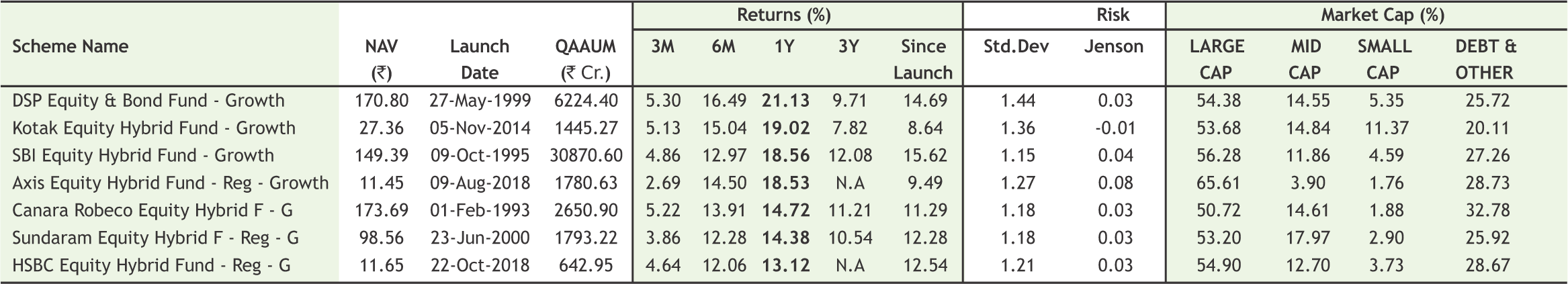

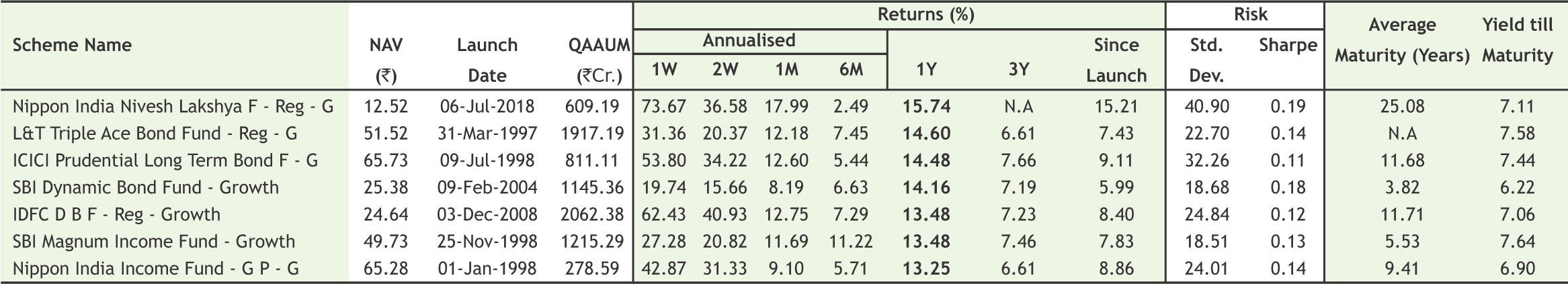

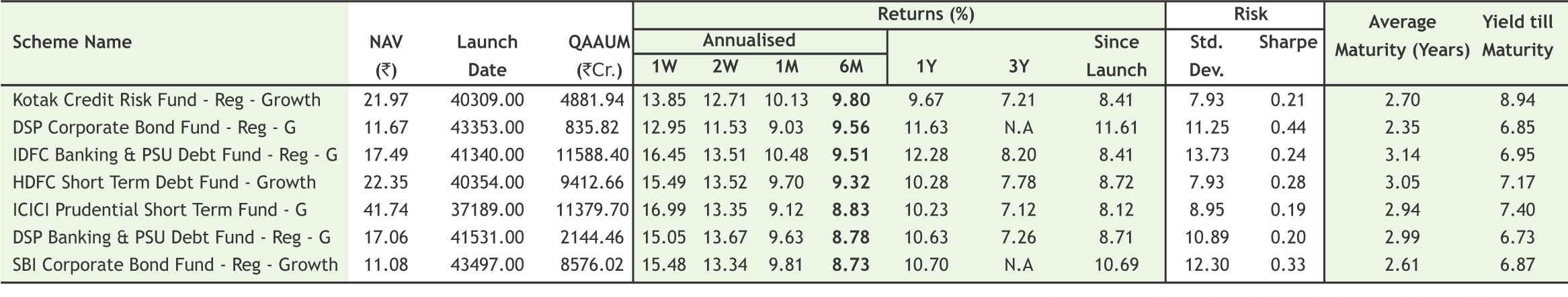

Note:Indicative corpus are including Growth & Dividend option . The above mentioned data is on the basis of 08/08/2019 Beta, Sharpe and Standard Deviation are calculated on the basis of period: 1 year, frequency: Weekly Friday, RF: 7%

*Mutual Fund investments are subject to market risks, read all scheme related documents carefully

18

Mr. S C Aggarwal (CMD, SMC Group) at the Assocham National Conference Gig Economy Aligning ConsumerPreferences: The Way Forward held on Friday, 24th January, 2020 at Hotel Le Meriden, New Delhi.

Mr. S C Aggarwal (CMD, SMC Group) along with Mr. Ashok Aggarwal (CMD, Global Capital) visitedSMC’s Kolkata regional office for branch manager's review meeting.

SMC organized an investor awareness program in association with MCX on Tuesday, 04th February, 2020at Hotel Bon Vivant, Nashik, Maharashtra.

![]() Customized Plans

Customized Plans

![]() Comprehensive Investment Solutions

Comprehensive Investment Solutions

![]() Long-term Focus

Long-term Focus

![]() Independent & Objective Advise

Independent & Objective Advise

![]() Financial Planning

Financial Planning

Call Toll-Free 180011 0909

Visit www.smcindiaonline.com

REGISTERED OFFICES:

11 / 6B, Shanti Chamber, Pusa Road, New Delhi 110005. Tel: 91-11-30111000, Fax: 91-11-25754365

MUMBAI OFFICE:

Lotus Corporate Park, A Wing 401 / 402 , 4th Floor , Graham Firth Steel Compound, Off Western Express Highway, Jay Coach Signal, Goreagon (East) Mumbai - 400063

Tel: 91-22-67341600, Fax: 91-22-67341697

KOLKATA OFFICE:

18, Rabindra Sarani, Poddar Court, Gate No-4,5th Floor, Kolkata-700001 Tel.: 033 6612 7000/033 4058 7000, Fax: 033 6612 7004/033 4058 7004

AHMEDABAD OFFICE :

10/A, 4th Floor, Kalapurnam Building, Near Municipal Market, C G Road, Ahmedabad-380009, Gujarat

Tel : 91-79-26424801 - 05, 40049801 - 03

CHENNAI OFFICE:

Salzburg Square, Flat No.1, III rd Floor, Door No.107, Harrington Road, Chetpet, Chennai - 600031.

Tel: 044-39109100, Fax -044- 39109111

SECUNDERABAD OFFICE:

315, 4th Floor Above CMR Exclusive, BhuvanaTower, S D Road, Secunderabad, Telangana-500003

Tel : 040-30031007/8/9

DUBAI OFFICE:

2404, 1 Lake Plaza Tower, Cluster T, Jumeriah Lake Towers, PO Box 117210, Dubai, UAE

Tel: 97145139780 Fax : 97145139781

Email ID : pankaj@smccomex.com

smcdmcc@gmail.com

Printed and Published on behalf of

Mr. Saurabh Jain @ Publication Address

11/6B, Shanti Chamber, Pusa Road, New Delhi-110005

Website: www.smcindiaonline.com

Investor Grievance : igc@smcindiaonline.com

Printed at: S&S MARKETING

102, Mahavirji Complex LSC-3, Rishabh Vihar, New Delhi - 110092 (India) Ph.: +91-11- 43035012, 43035014, Email: ss@sandsmarketing.in