2019: Issue 670, Week: 11th – 15th February

A Weekly Update from SMC (For private circulation only)

WISE M NEY

NEY

2019: Issue 670, Week: 11th – 15th February

A Weekly Update from SMC (For private circulation only)

NEY

NEY

www.smcindiaonline.com

| Equity | 4-7 |

| Derivatives | 8-9 |

| Commodity | 10-13 |

| Currency | 14 |

| IPO | 15 |

| FD Monitor | 16 |

| Mutual Fund | 17-18 |

G

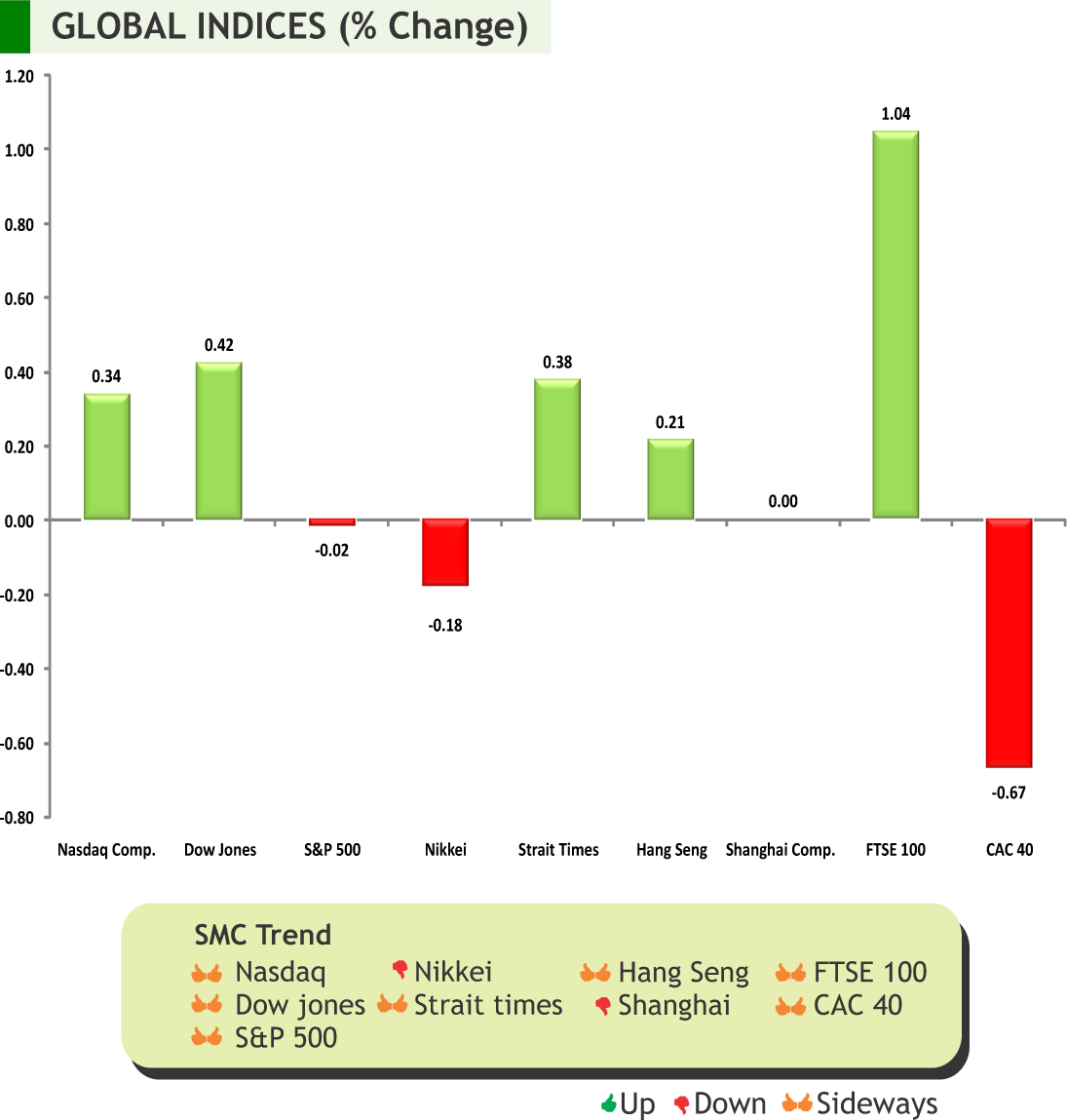

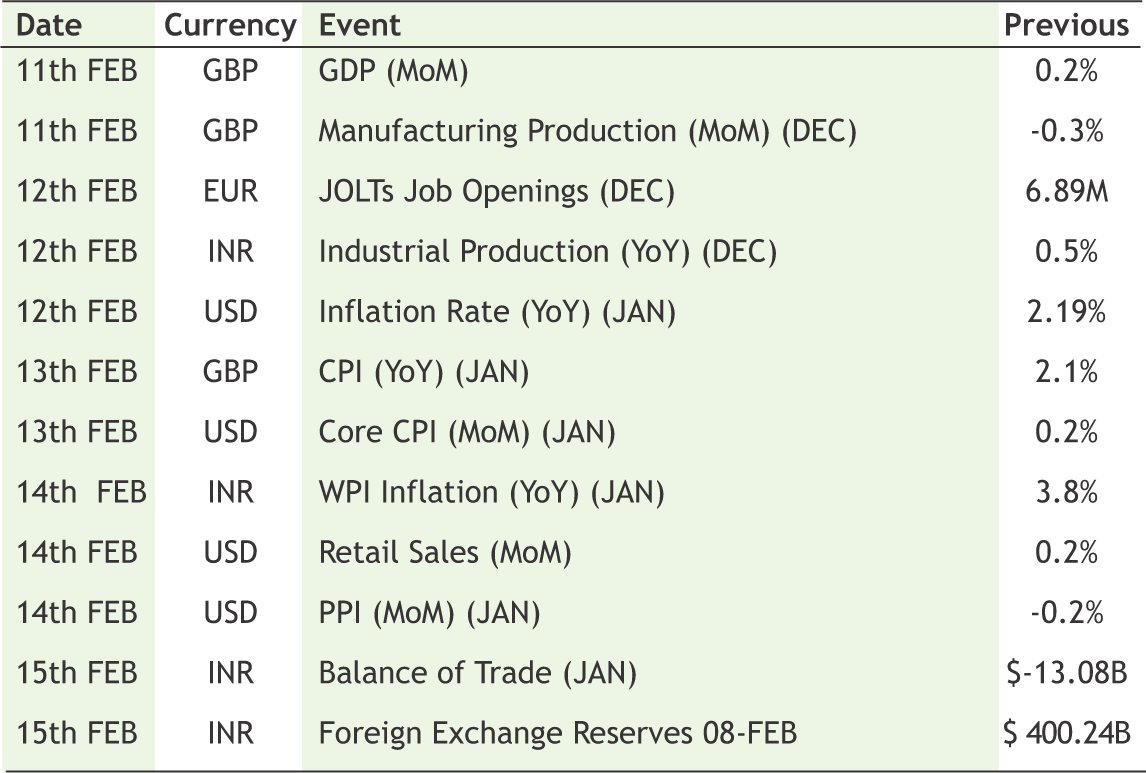

lobal markets slipped into red territory over fears of broadening global economic Gslowdown and absence of any positive signs for a resolution in the US-China trade row. U.S. president comments that he would not meet Chinese President Xi Jinping before a March 1 deadline to avert new U.S. tariffs on Chinese goods didn’t go well down among market participants. After the U.S. Fed meeting, markets are now pencilling only one more rate hike this year. Outlook of the Euro-area appears to be deteriorating with inflation in the region declining at the start of the year. Meanwhile, the European Commission slashed its growth outlook for the euro zone this year as it expects the bloc's largest economies to be held back by global trade tensions, among other issues. The Bank of England also cut its 2019 outlook and sees the UK economy growing at its slowest pace since 2009.

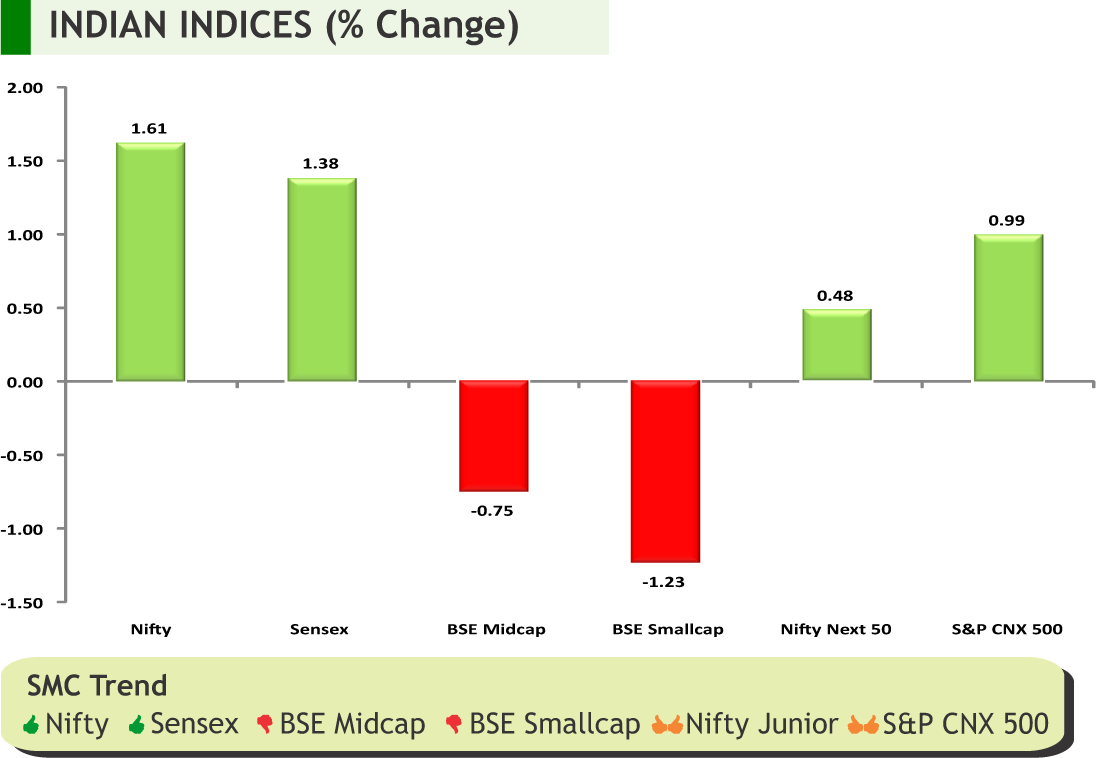

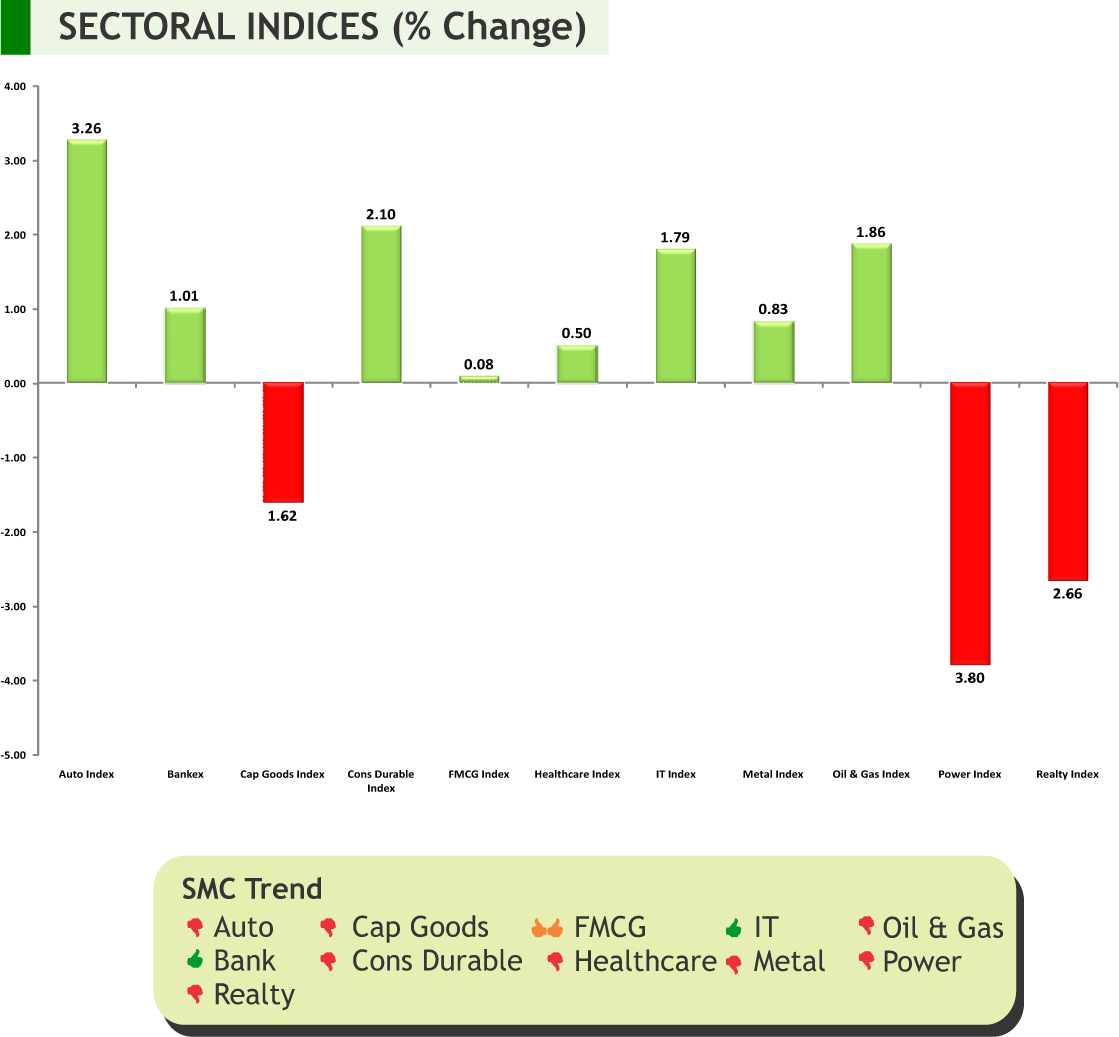

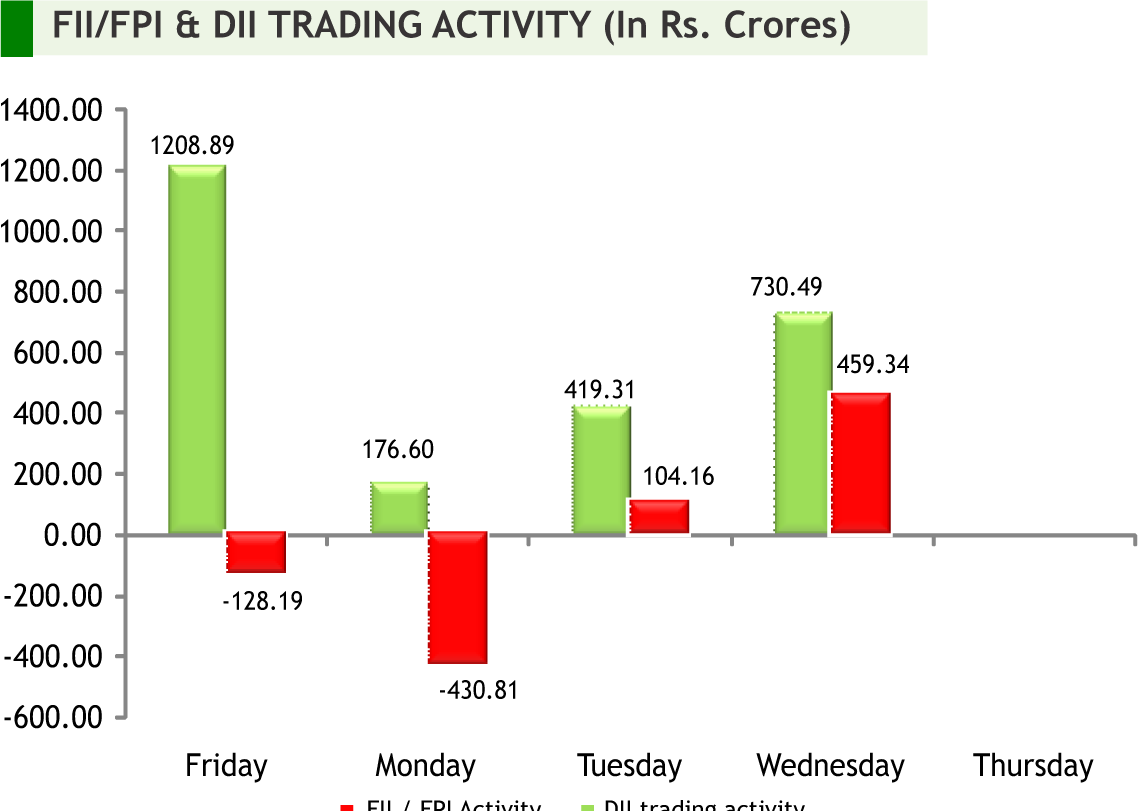

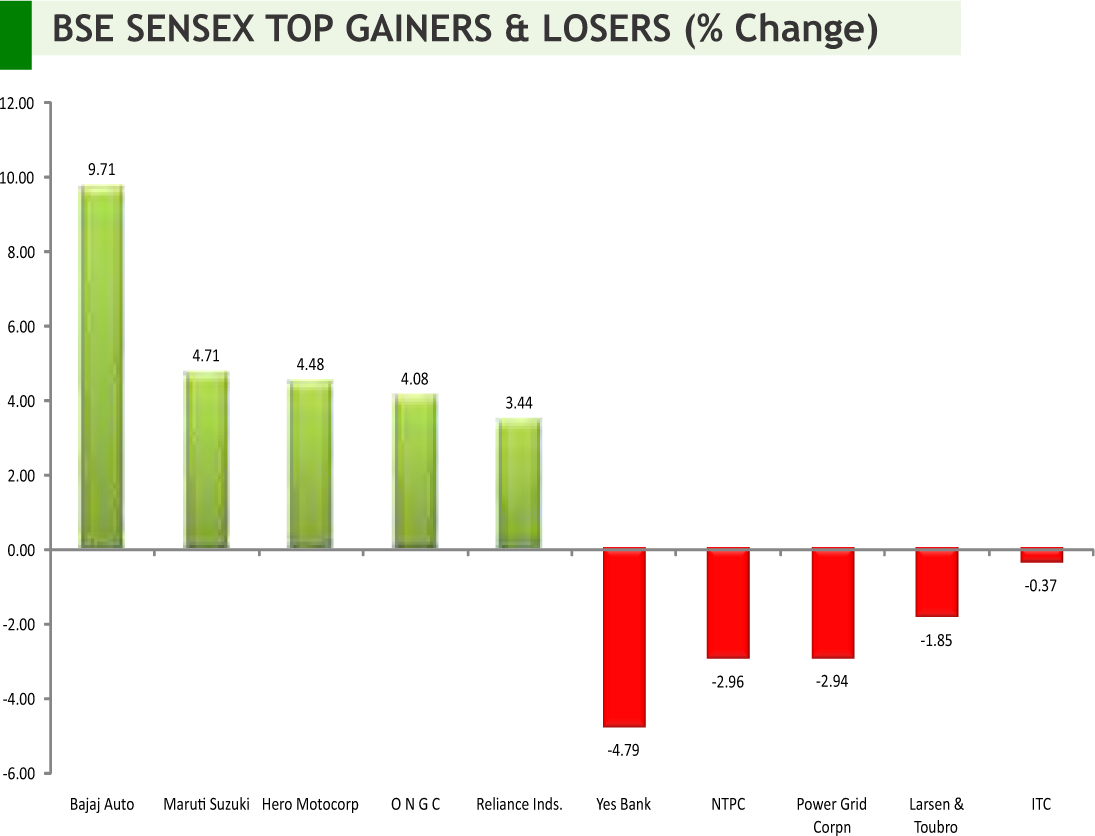

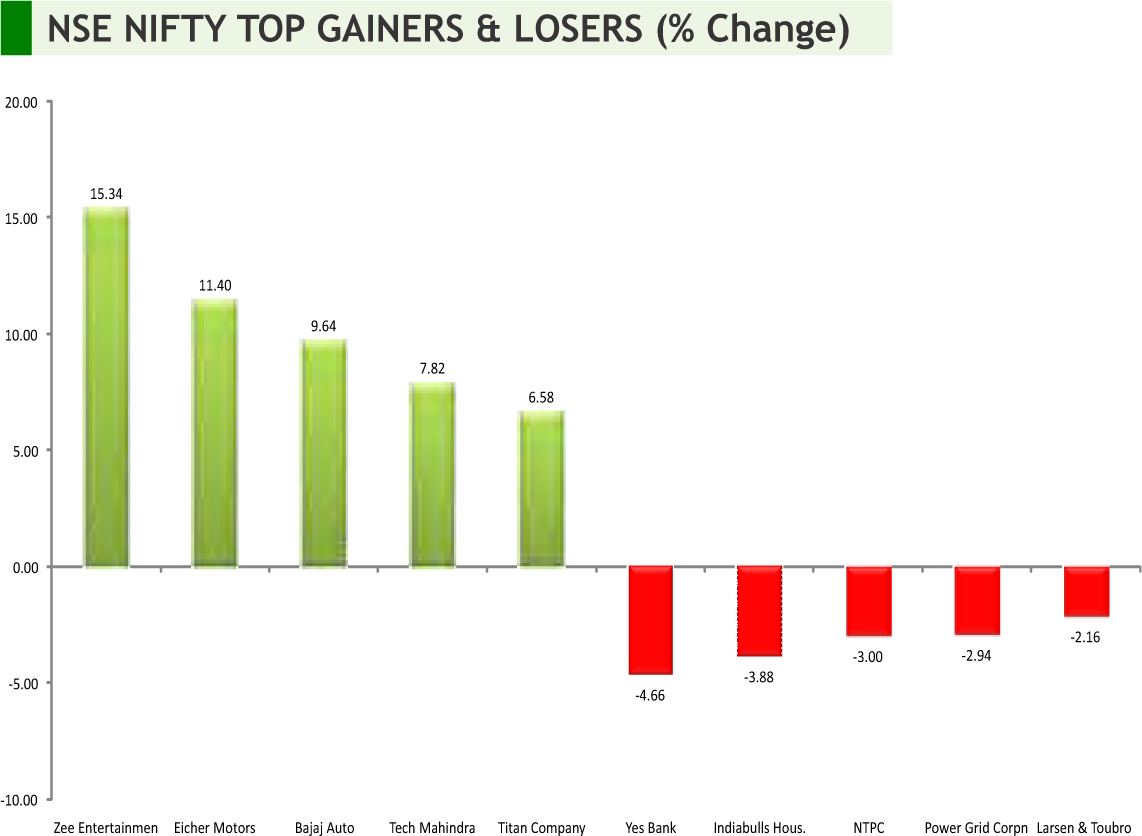

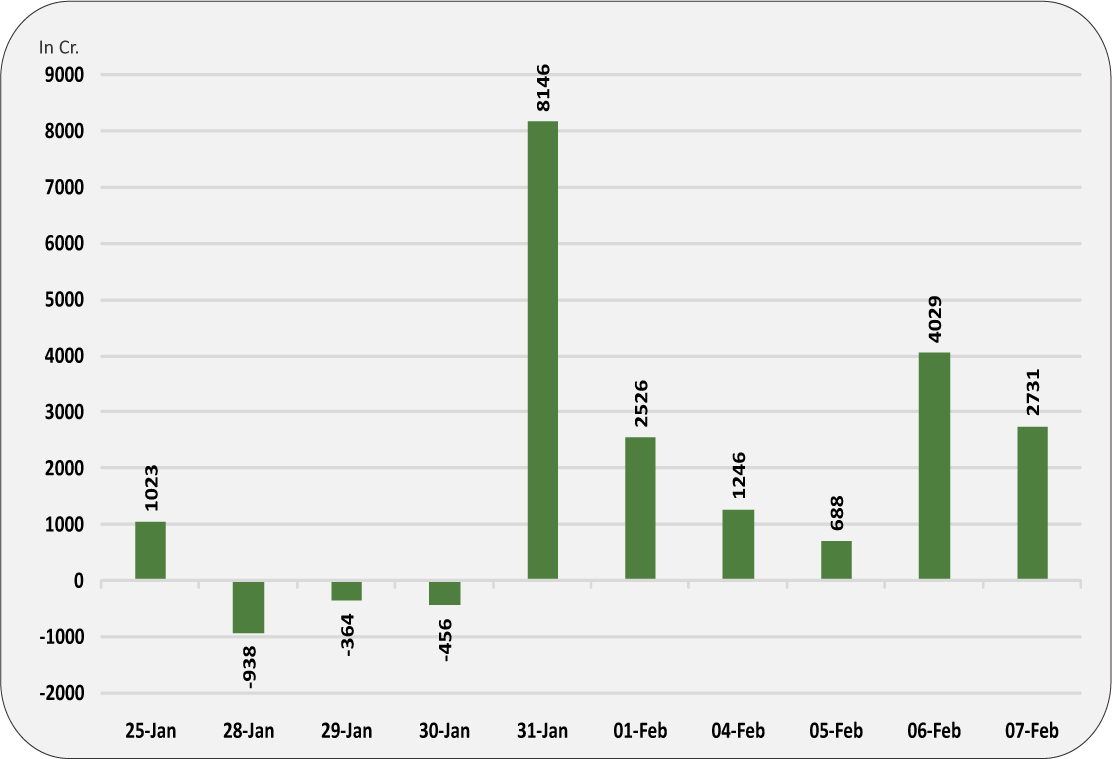

Back at home, Indian broader index Nifty reclaimed the 11,000 level but bulk of the stocks remained in negative territory. In the monetary policy review meeting, Reserve Bank of India decided to cut Repo rate by 25 bps to 6.25%, changing its policy stance to ‘neutral’ from ‘calibrated tightening’. RBI governor said that with inflation consistently contained below the desired level, the need has risen for policy action to support economy and strengthen investments. With the shift in policy stance and focus on growth, now markets are likely to price in another rate cut. Going forward, corporate earnings, domestic and global macroeconomic data, trend in global markets, the movement of rupee against the dollar and crude oil price movement will dictate the trend of the market in the near term. Investment by foreign portfolio investors (FPIs) and domestic institutional investors (DIIs) will also be monitored. On the macro front, India's industrial production data for December 2018 will be unveiled on 12 February 2019 and the inflation data based on wholesale price index (WPI) for January 2019, will be announced on 14 February 2019.

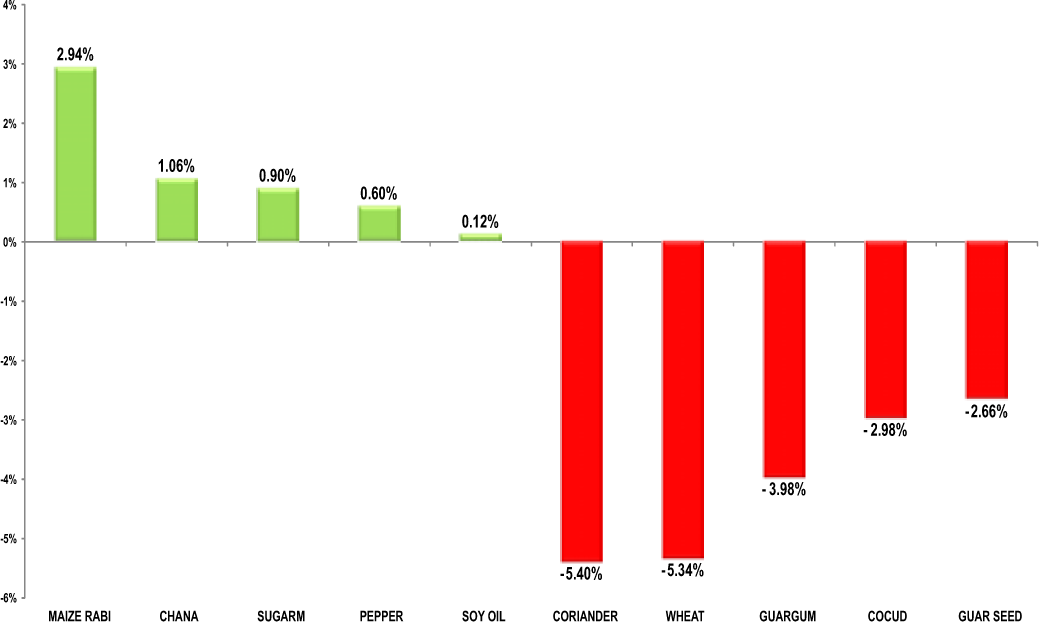

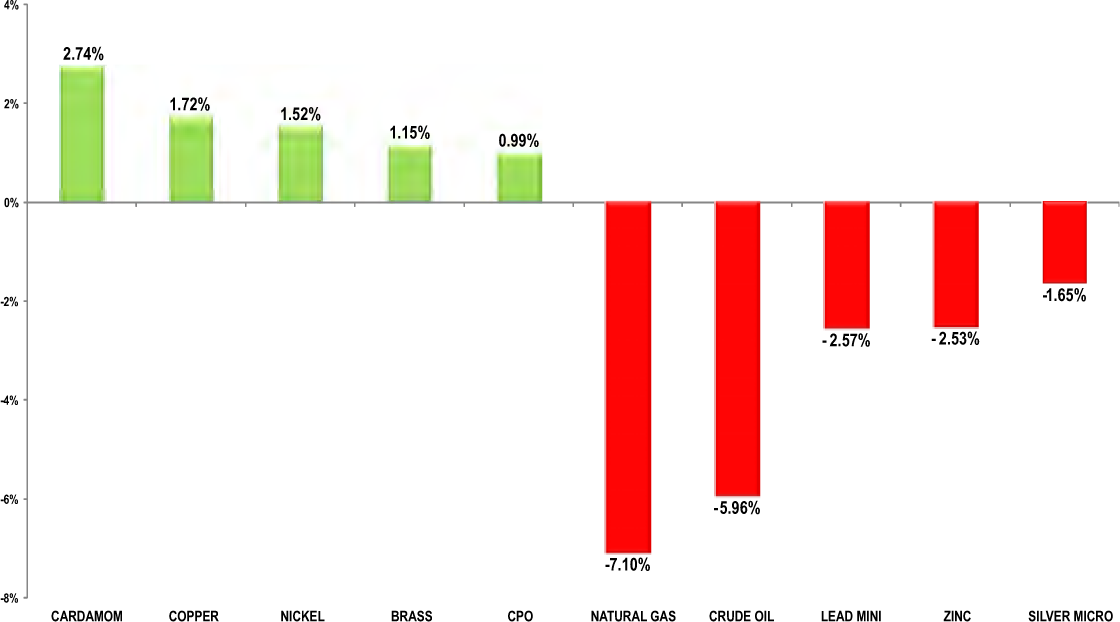

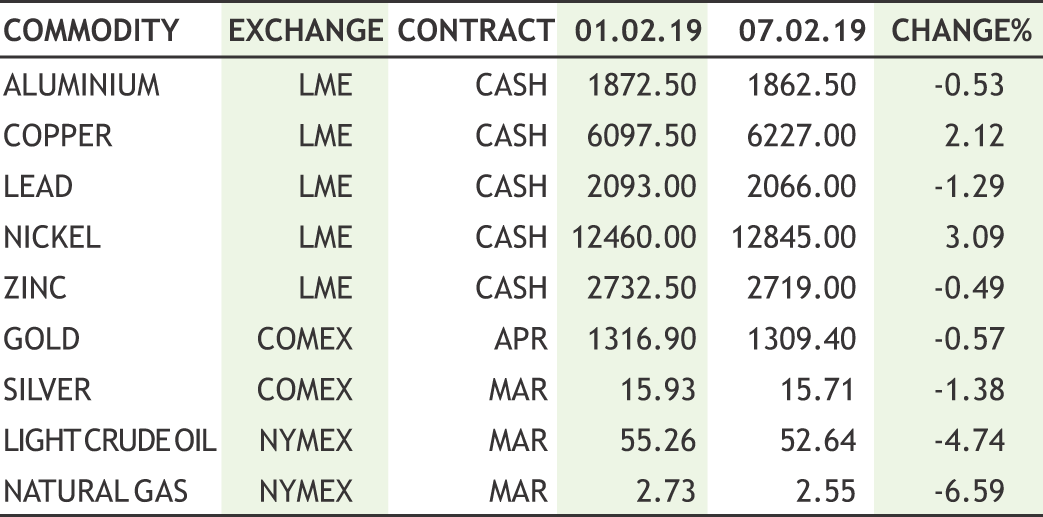

On the commodity market front, rally in commodities took a breather last week on profit booking from higher levels amid bounce back in the greenback. There were corrections almost everywhere, from bullion to energy to base metals and in some agri commodities. Bullion counter may witness range bound movement as stronger greenback is keeping the upside in check but dovish stance by Fed chairman along with US and China trade war concerns to keep downside capped. Natural gas counter may continue to plunge further as it can dip lower towards 175. In base metal counter, prices can witness some profit booking at higher levels as concerns over global economic growth and U.S.-China trade tensions weighing on the market. New Yuan Loans and CPI of China, CPI and GDP of UK, Retail Sales Advance, CPI and U. of Mich. Sentiment of US, GDP of Japan, Germany and EU etc are few data, which are scheduled this week.

SMC Global Securities Ltd. (hereinafter referred to as “SMC”) is a registered Member of National Stock Exchange of India Limited, Bombay Stock Exchange Limited and its associate is member of MCX stock Exchange Limited. It is also registered as a Depository Participant with CDSL and NSDL. Its associates merchant banker and Portfolio Manager are registered with SEBI and NBFC registered with RBI. It also has registration with AMFI as a Mutual Fund Distributor.

SMC is a SEBI registered Research Analyst having registration number INH100001849. SMC or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities market.

SMC or its associates including its relatives/analyst do not hold any financial interest/beneficial ownership of more than 1% in the company covered by Analyst. SMC or its associates and relatives does not have any material conflict of interest. SMC or its associates/analyst has not received any compensation from the company covered by Analyst during the past twelve months. The subject company has not been a client of SMC during the past twelve months. SMC or its associates has not received any compensation or other benefits from the company covered by analyst or third party in connection with the research report. The Analyst has not served as an officer, director or employee of company covered by Analyst and SMC has not been engaged in market making activity of the company covered by Analyst.

The views expressed are based solely on information available publicly available/internal data/ other reliable sources believed to be true.

SMC does not represent/ provide any warranty express or implied to the accuracy, contents or views expressed herein and investors are advised to independently evaluate the market conditions/risks involved before making any investment decision.

DOMESTIC NEWS

Economy

• The Reserve Bank of India (RBI) changed its monetary policy stance to "neutral" from "calibrated tightening in its February policy session. RBI has cut policy repo rate by 25 basis points in sixth bi-monthly monetary policy of FY19. With this, policy repo rate stands at 6.25% from previous 6.50%.

Pharmaceuticals

• Dr Reddy's Laboratories Ltd announced that it's wholly-owned subsidiary in USA is continuing its voluntary nation-wide recall of lot ABD807 of Levetiracetram in 0.54 per cent Sodium Chloride injection, 1,500 mg/100 mL (15 mg/mL) single-dose infusion bags to the hospital level in the North American country.

• Cipla ltd has received final nod from the US health regulator for its abbreviated new drug application (ANDA) for Tadalafil tablets 20 mg, used to treat pulmonary arterial hypertension. It is AB-rated generic therapeutic equivalent version of Eli Lilly & Co's Adcirca. Adcirca and its generic equivalents had US sales of approximately USD 490 million for the 12-month period ending November 2018.

Technology

• Tech Mahindra renewed its long term contract with KMD that is estimated over $50 million. It services to KMD will include Application Outsourcing - SAP, Microsoft, Testing, Application Development, Application Modernization, ERP implementation, amongst others in a comprehensive new age delivery portfolio.

Mining

• Coal India to invest Rs 7,000 crore to procure various types and sizes of high capacity heavy earth moving machinery (HEMM) to augment production in its open cast mines. Nine global tenders built on a common NIT at CIL level through a transparent e-procurement process with reverse auction have been issued.

Agrochemicals

• UPL Ltd has announced the completion of its $4.2 billion acquisition of Arysta LifeScience Inc, the global leader in bio solutions and seed treatment. Following this deal, the company’s combined sale would go up to $5 billion with EBITDA of $1 billion and EBITDA margins of 20 per cent.

Telecom

• Reliance Industries Ltd (RIL) will invest more than Rs 10,000 crore in West Bengal to expand operations of its telecom arm. The company has invested Rs 28,000 crore in West Bengal, which is one-tenth of the company’s total investments across India.

INTERNATIONAL NEWS

• U.S. initial jobless claims fell to 234,000, an decrease of 19000 from the previous week's upwardly revised level of 253,000. Economists had expected jobless claims to drop to 221,000.

• U.S. Consumer Credit increased in December, the Federal Reserve said consumer credit climbed by $16.6 billion in December after jumping by an upwardly revised $22.4 billion in November. Economists had expected credit to increase by $17.0 billion.

• U.S. Trade Deficit decreased in November, the Commerce Department said the trade deficit narrowed to $49.3 billion in November from a revised $55.7 billion in October.

• U.S. Factory Orders decreased in November, The Commerce Department said factory orders fell by 0.6 percent in November after jumping by 2.1 percent in October. The pullback surprised economists, who had expected orders to edge up by 0.2 percent.

• The European Commission slashed the euro area growth forecasts for this year and next, citing a high level of uncertainty and downside risks to the outlook. In its winter economic forecast, the executive arm of the EU cut the Eurozone growth forecast for this year to 1.3 percent from 1.9 percent.

• Japan posted a current account surplus of 452.8 billion yen in December, the Ministry of Finance said down 43.1 percent on year. That was shy of expectations for a surplus of 458.5 billion yen and down from 757.2 billion yen in November.

• Japan Overall bank lending was up 2.4 percent on year in January, the Bank of Japan said coming in at 535.350 trillion yen and roughly unchanged from December.

| Stocks | *Closing Price | Trend | Date Trend Changed | Rate Trend Changed | SUPPORT | RESISTANCE | Closing S/l |

|---|---|---|---|---|---|---|---|

| S&P BSE SENSEX | 36546 | DOWN | 05.10.18 | 34970 | 35400 | 34700 | |

| NIFTY50 | 10944 | DOWN | 05.10.18 | 10316 | 10600 | 10400 | |

| NIFTY IT* | 16020 | UP | 21.07.17 | 10712 | 15200 | 14800 | |

| NIFTY BANK | 27294 | UP | 30.11.18 | 26863 | 25900 | 25400 | |

| ACC | 1395 | DOWN | 24.01.19 | 1420 | 1480 | 1500 | |

| BHARTIAIRTEL | 313 | DOWN | 25.01.18 | 453 | 330 | 340 | |

| BPCL | 337 | UP | 16.11.18 | 322 | 345 | 330 | |

| CIPLA | 534 | DOWN | 26.10.18 | 604 | 535 | 545 | |

| SBIN** | 286 | UP | 02.11.18 | 286 | 270 | 260 | |

| HINDALCO | 206 | DOWN | 04.01.19 | 211 | 220 | 225 | |

| ICICI BANK | 355 | UP | 02.11.18 | 355 | 350 | 340 | INFOSYS | 761 | UP | 14.12.18 | 706 | 690 | 670 |

| ITC* | 276 | UP | 11.01.19 | 295 | - | 275 | |

| L&T | 1262 | DOWN | 18.01.19 | 1318 | 1330 | 1350 | |

| MARUTI | 7134 | DOWN | 14.09.18 | 8627 | 7600 | 7800 | |

| NTPC | 132 | DOWN | 26.10.18 | 159 | 143 | 147 | |

| ONGC | 144 | DOWN | 05.10.18 | 147 | 150 | 154 | |

| RELIANCE | 1278 | UP | 30.11.18 | 1168 | 1200 | 1170 | |

| TATASTEEL | 469 | DOWN | 26.10.18 | 552 | 490 | 510 | |

*ITC has broken the support of 280

Closing as on 08-02-2019

NOTES:

1) These levels should not be confused with the daily trend sheet, which is sent every morning by e-mail in the name of "Morning Mantra ".

2) Sometimes you will find the stop loss to be too far but if we change the stop loss once, we will find more strength coming into the stock. At the moment, the stop loss will be far as we are seeing the graphs on weekly basis and taking a long-term view and not a short-term view.

| Meeting Date | Company | Purpose |

|---|---|---|

| 11/2/2019 | Eicher Motors | Quarterly Results |

| 11/2/2019 | India Cements | Quarterly Results |

| 11/2/2019 | Amara Raja Batt. | Quarterly Results |

| 11/2/2019 | Motherson Sumi | Quarterly Results |

| 11/2/2019 | Power Fin.Corpn. | Quarterly Results |

| 12/2/2019 | Bata India | Quarterly Results |

| 12/2/2019 | Hindalco Inds. | Quarterly Results |

| 12/2/2019 | Jain Irrigation | Quarterly Results |

| 12/2/2019 | NCC | Quarterly Results |

| 12/2/2019 | Sun Pharma.Inds. | Quarterly Results |

| 12/2/2019 | Oil India | Quarterly Results, Interim Dividend |

| 12/2/2019 | Coal India | Quarterly Results |

| 12/2/2019 | Container Corpn. | Quarterly Results |

| 13/02/2019 | Godrej Inds. | Quarterly Results |

| 13/02/2019 | NBCC | Quarterly Results |

| 14/02/2019 | Ashok Leyland | Quarterly Results |

| 14/02/2019 | Nestle India | Quarterly Results, Final Dividend |

| 14/02/2019 | Voltas | Quarterly Results |

| 14/02/2019 | O N G C | Quarterly Results, Interim Dividend |

| Ex-Date | Company | Purpose |

|---|---|---|

| 11/2/2019 | Hero Motocorp | 2750% Interim Dividend |

| 11/2/2019 | SRF | 60% Second Interim Dividend |

| 11/2/2019 | Indiabulls Hous. | 500% Interim Dividend |

| 12/2/2019 | B H E L | 40% Interim Dividend |

| 12/2/2019 | GAIL (India) | 62.5% Interim Dividend |

| 12/2/2019 | Marico | 275% Second Interim Dividend |

| 14/02/2019 | CESC | 175% Interim Dividend |

| 14/02/2019 | H P C L | 65% Interim Dividend |

| 15/02/2019 | Cummins India | 350% Interim Dividend |

| 15/02/2019 | Manappuram Fin. | 27.5% Interim Dividend |

4

5

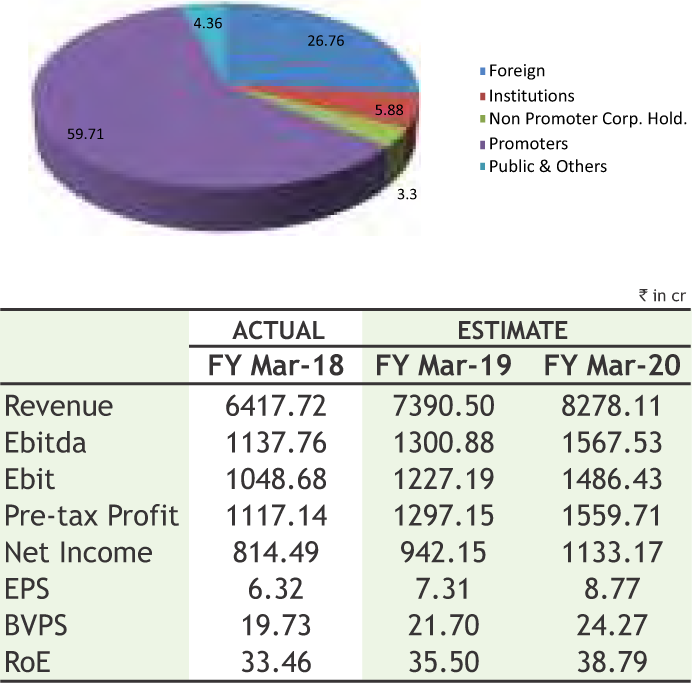

MARICO LIMITED

CMP: 369.00

Target Price: 435

Upside: 18%

| Face Value (Rs.) | 1.00 |

| 52 Week High/Low | 397.00/286.25 |

| M.Cap (Rs. in Cr.) | 47587.72 |

| EPS (Rs.) | 6.90 |

| P/E Ratio (times) | 53.43 |

| P/B Ratio (times) | 13.66 |

| Dividend Yield (%) | 1.15 |

| Stock Exchange | BSE |

Investment Rationale

• Marico is a leading Indian Group in consumer products operating in global beauty and wellness space. Marico markets well-known brands such as Parachute, Saffola, Hair & Care, Parachute Advanced, True Roots, Revive, Set Wet, Livon etc. The India business accounts for 78% of the consolidated revenues whereas the international business accounts for 22%

• The Company’s focus on innovation and premiumization landed some first-of-its-kind product into the market namely Hair & Care Dry Fruit Oil, during Q3 FY 19. The management has guided for aggressive investment for innovations and a visibly strong pipeline for the next 2-3 years. The company continues to maintain a healthy dividend payout.

•• The Company is focusing on Digital initiatives in a big way to improve consumer engagement, drive sales through E-commerce for internet-savvy consumers and build Data Analytics capabilities. Investment in Zed Lifestyle (which owns Beardo) is likely to enhance the capability in E-commerce and salons over the medium-term.

• In Q3 FY19, the company’s margins expanded sequentially owing to price hikes taken in the core portfolios and copra prices having eased during the quarter. Rural growth continued to outpace urban growth. Rural sales grew by 12% while urban sales grew by 1.1% in value terms. Its flagship product Parachute Coconut oil volumes grew 9% but the value growth was 19% owing to price hikes.

• In Q3 FY19, revenue from operations grew by 15% YoY to Rs. 1,861 crores, with an underlying volume

growth in the India business of 5%. The International business posted a broad-based constant currency growth of 11%. EBITDA margins came at a healthy 18.8%. Margin guidance for FY19 was retained at 17-18%.

Risk

• Currency Fluctuation

• Inflationary trend in commodity prices

Valuation

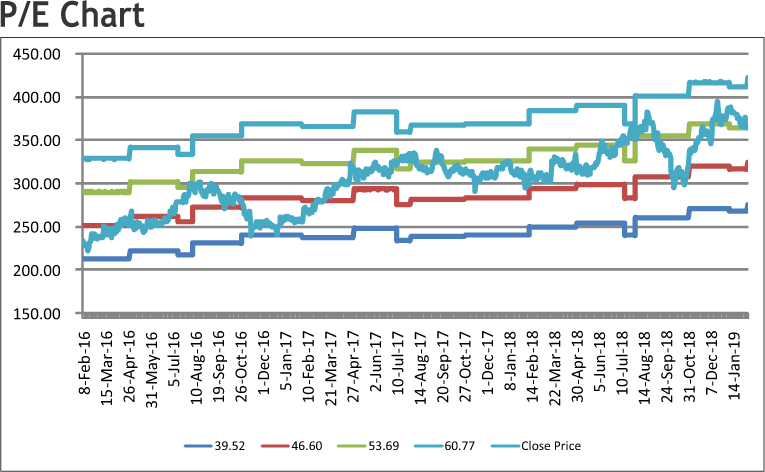

Over the last three years, the company has systematically invested in the core international markets to strengthen both the brands and the organizational capability to handle growth. The company is confident that each of these markets is well-poised to capitalize on the market opportunities. The company aims for a volume growth of 8-10% and a topline growth of 13-15%, going forward. The company has guided that it will focus on volume growth and market share gains to drive profitability. We expect the stock to see a price target of Rs. 435 in 8-10 months time frame on the PE of 49.57x and FY20E EPS of 8.77.

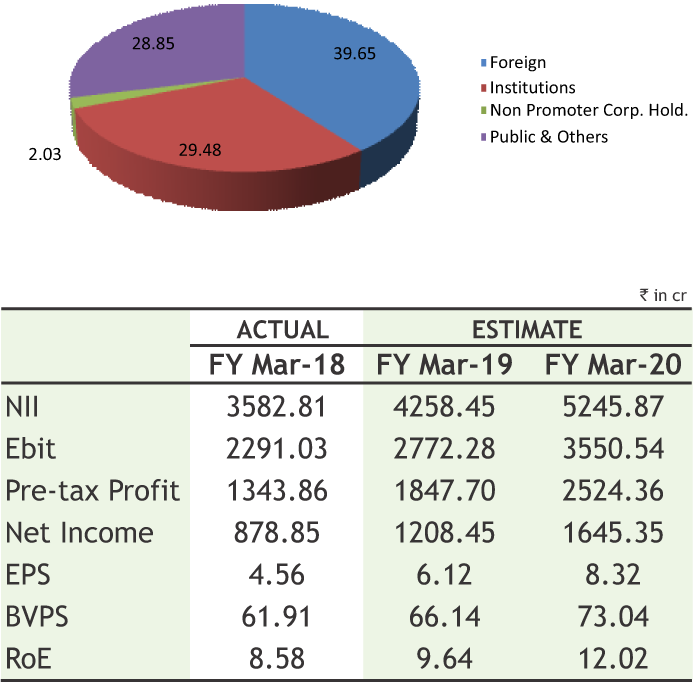

FEDERAL BANK LIMITED

CMP: 86.15

Target Price: 99

Upside: 15%

| Face Value (Rs.) | 2.00 |

| 52 Week High/Low | 105.00/67.05 |

| M.Cap (Rs. in Cr.) | 17094.40 |

| EPS (Rs.) | 5.08 |

| P/E Ratio (times) | 16.96 |

| P/B Ratio (times) | 1.36 |

| Stock Exchange | BSE |

Investment Rationale

• The total business of the bank grew 23.46 % Y-o-Y from Rs.185490.17 Cr as on 31st December 2017 to Rs. 229007.49 Cr as on 31st December 2018 while total Deposits reached Rs.123457.36 Cr from Rs.100537.10Cr, Net Advances grew 24.25% to reach Rs.105550.12 Cr. NRE deposits of the Bank grew by 21.55% to reach Rs.47930.07 Cr as on 31st Dec 2018. CASA increased to Rs. 41172.41 Cr from Rs.33304.30 Cr.

• It has registered 18% rise in Interest income to Rs 29541 crore in the quarter ended December 2018. 21% rise in interest expenses to Rs 1877.12 crore saw net interest income (NII) rise 13% to Rs 1077.29 crore.

• The Gross NPA and Net NPA of the Bank as at the end of the Quarter stood at Rs.3361.23 Cr and Rs. 1817.32Cr respectively. Gross NPA as a percentage stood at 3.14% and Net NPA as a percentage stood at 1.72%.The Provision Coverage Ratio (including technical write-offs) is 64.20%. It has no direct exposure to IL&FS; only IL&FS exposure is Rs 235 crore.

• The bank continued its thrust on new geographies. It has also penetrated new markets. New client acquisition continued with sharp focus on manufacturing entities. Exposure to NBFC is 10- 12% of total assets with largely top names. Rs 3000 crore is with top 4 NBFC companies.

• The bank entered into new partnerships in General Insurance with Tata AIG and HDFC Ergo to augment fee income.

• The management of the bank has guided 22-25% loan growth during the year. NIM guidance is 3.17- 3.20% for March 2019 quarter.

• The bank has 1251 branches and 1669 ATMs as on December 2018. It plans to add 40-50 branches each year.

Risk

• Strict Regulatory guidelines

• Liquidity risk

Valuation

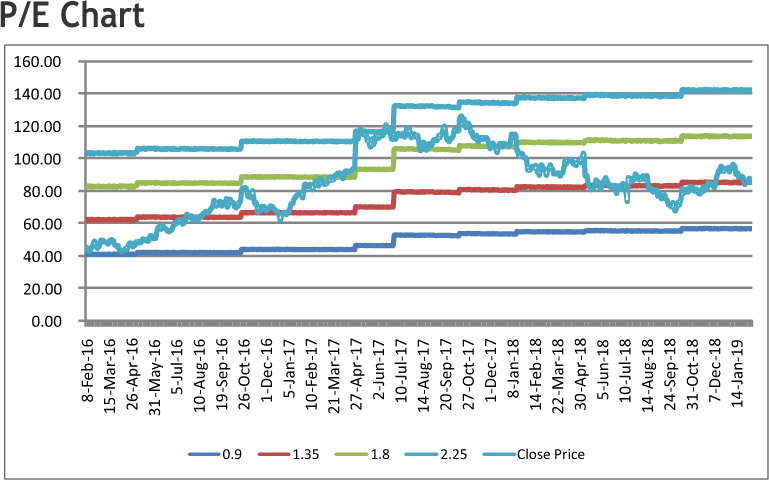

The bank of the business grew strongly and management of the bank has focused in wholesale banking which would continue to give strong, balanced credit growth and improvement in asset quality. The bank has empanelled in 15 states and catering 200 government entities. New partnerships in General Insurance with Tata AIG and HDFC Ergo to augment fee income and also has opened new Call Centre for Cross Selling products like Credit Card, Insurance and to extend exclusive support to Ultra HNI and NR Customers would help to increase other income. Thus, it is expected that the stock will see a price target of Rs.99 in 8 to 10 months time frame on a current P/Bvx 1.36 and FY20 (BVPS) of Rs.73.04.

Source: Company Website Reuters Capitaline

Above calls are recommended with a time horizon of 8 to 10 months.

6

The stock closed at Rs 207.15 on 08th February, 2019. It made a 52-week low at Rs 1576.45 on 22nd February 2018 and a 52-week high of Rs. 2994 on 29th August 2018. The 200 days Exponential Moving Average (DEMA) of the stock on the daily chart is currently at Rs 2365.09

As we can see on charts that stock has witnessed profit booking after registering all time high and 2000 levels in single downswing. Then after it started moving higher and formed an “Ascending Triangle” on weekly charts, which is bullish in nature. Last week, it has given the breakout of same and also has managed to close above the same so follow up buying may continue for coming days. Therefore, one can buy in the range of 2680-2690 levels for the upside target of 2900-2950 levels with SL below 2580.

The stock closed at Rs 2122.65 on 08th February, 2019. It made a 52-week low at Rs 1828.50 on 07th March 2018 and a 52-week high of Rs. 2220 on 18th July 2018. The 200 days Exponential Moving Average (DEMA) of the stock on the daily chart is currently at Rs 2030.07

Short term, medium term and long term bias are positive for the stock as it is continuously trading in uptrend. From past few weeks, it was consolidating in narrow range and formed an “Inverted Head and Shoulder” pattern on weekly charts which is bullish in nature. Although, stock hasn’t given the pattern breakout but its consolidation indicates, there is a strong spurt for near term. Therefore, one buy in the range of 2100-2110 levels for the upside target of 2300-2350 levels with SL below 2000.

Disclaimer : The analyst and its affiliates companies make no representation or warranty in relation to the accuracy, completeness or reliability of the information contained in its research. The analysis contained in the analyst research is based on numerous assumptions. Different assumptions could result in materially different results.

The analyst not any of its affiliated companies not any of their, members, directors, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of the analysis research.

SOURCE: CAPITAL LINE

Charts by Spider Software India Ltd

Above calls are recommended with a time horizon of 1-2 months

7

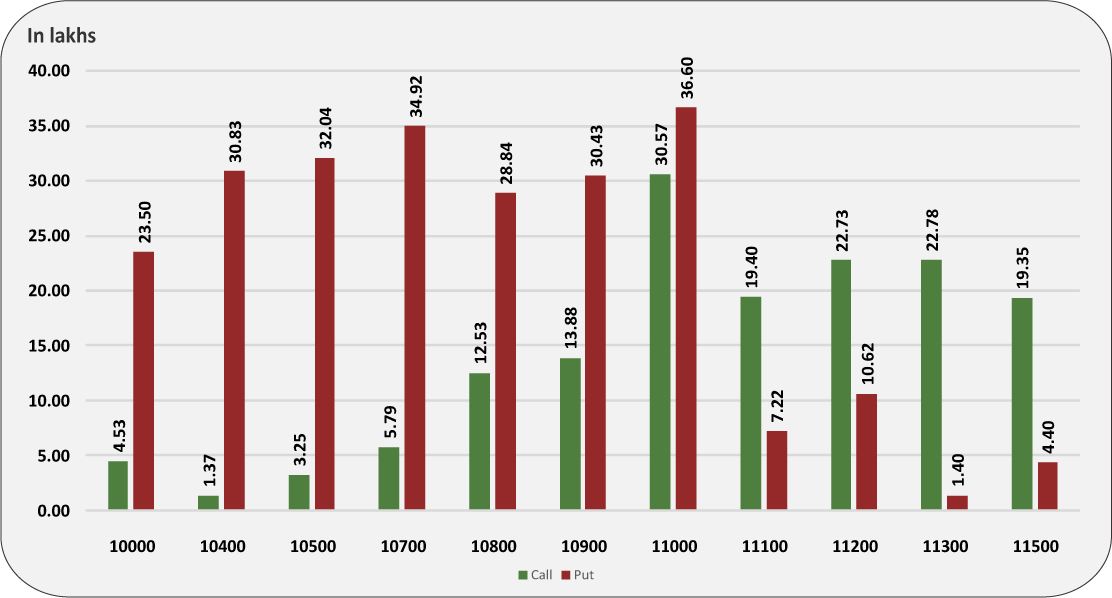

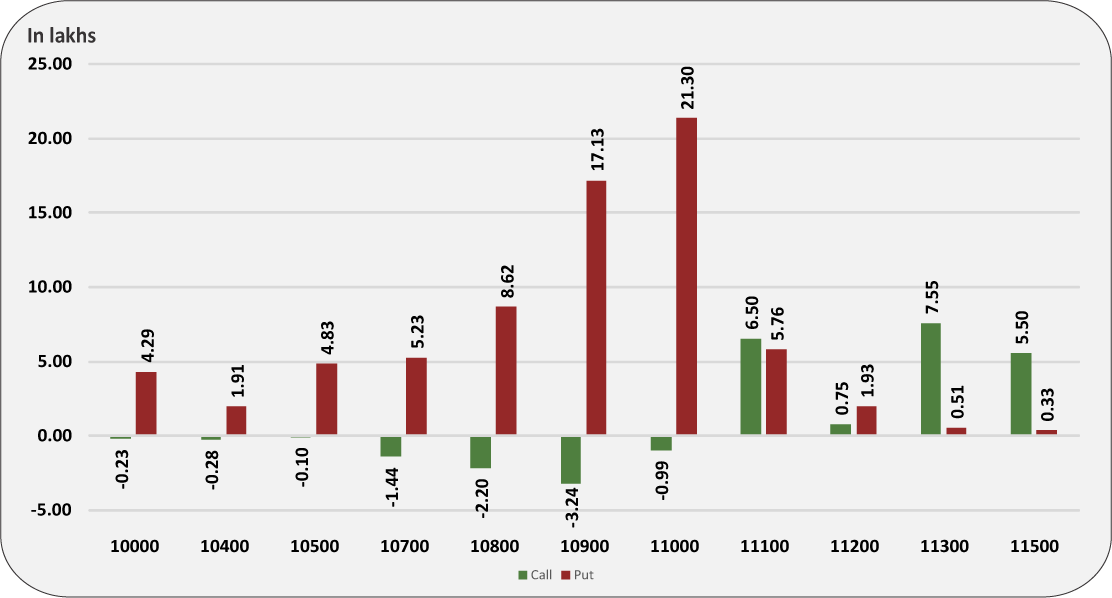

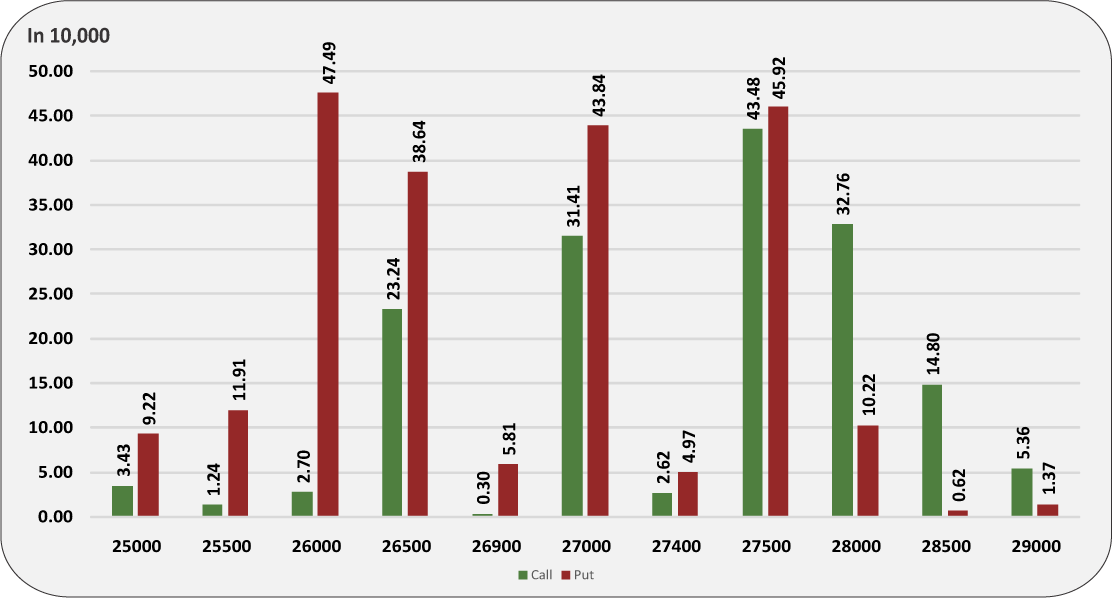

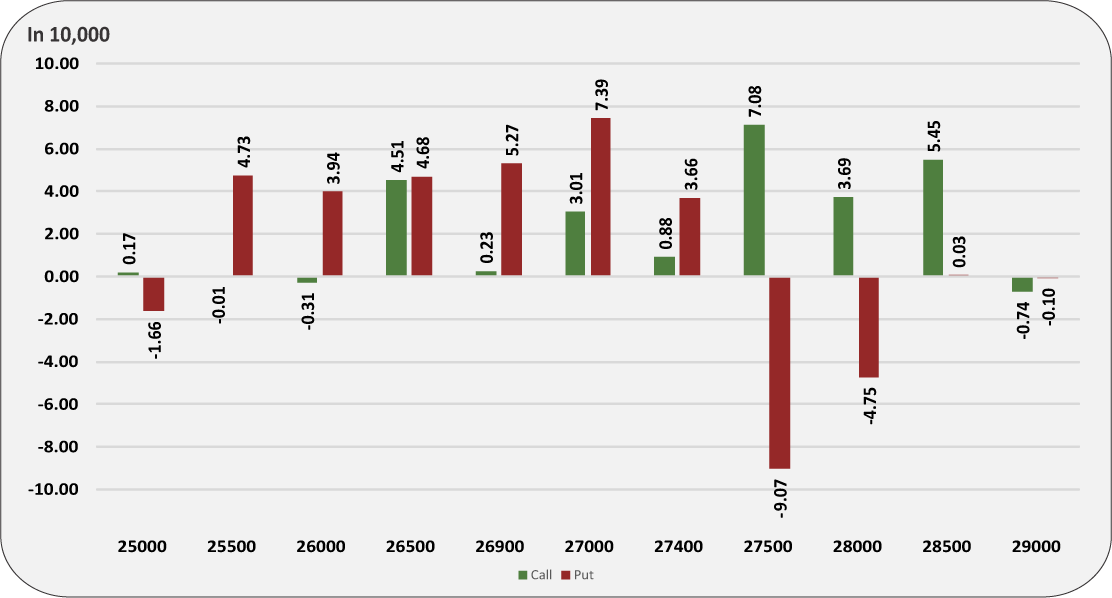

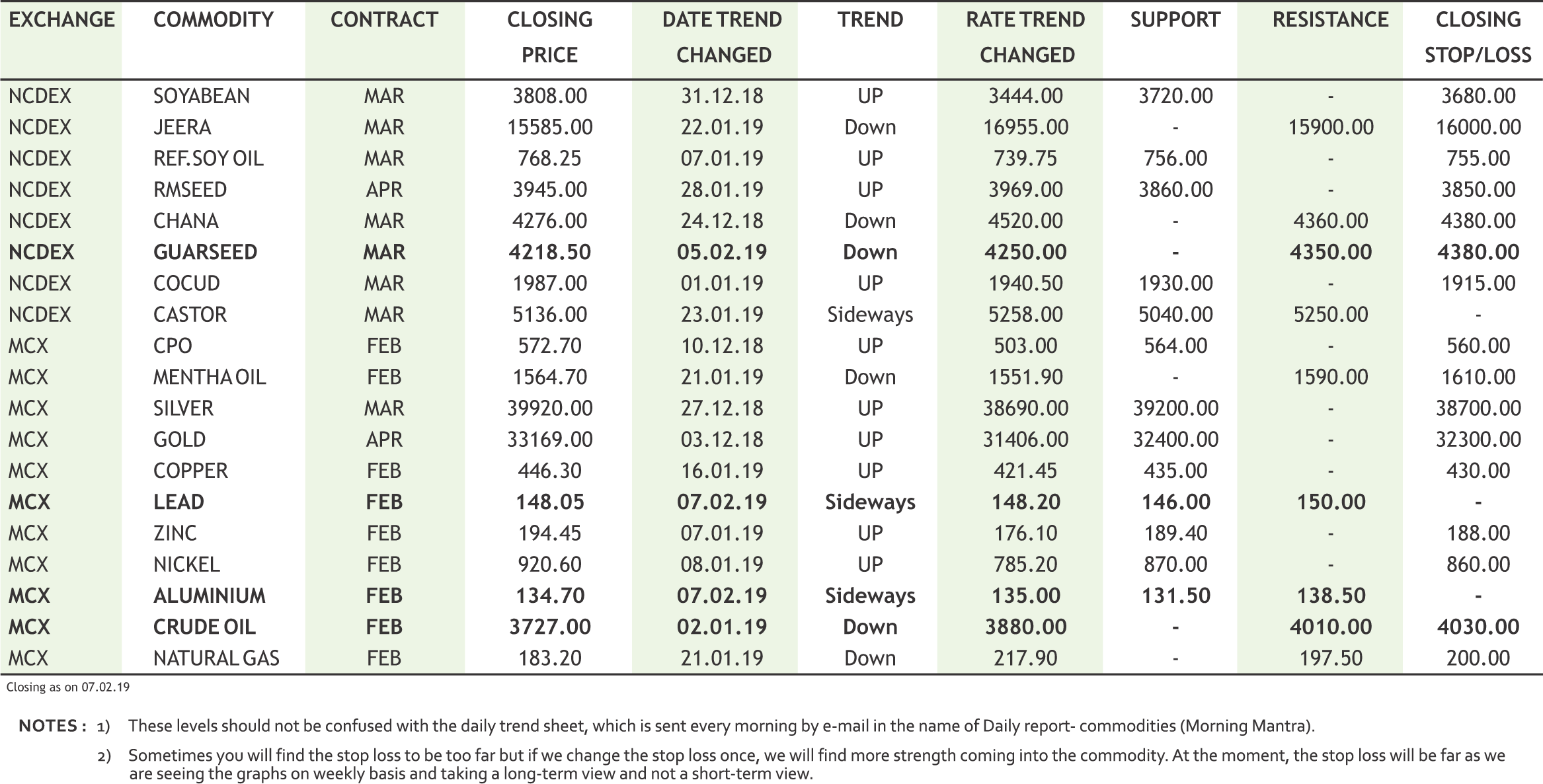

Nifty is trading between support and resistance. In recent sideways movement, call writers and puts writes were seen active in both calls and puts. Therefore Nifty is likely to trade sideways. Writers were seen active in 11000 and 11100 calls and simultaneously selling in 10900 and 10800 strikes puts. The Implied Volatility (IV) of calls closed at 13.21% while that for put options closed at 13.40%. The Nifty VIX for the week closed at 15.44% and is expected to remain sideways. Among Nifty Call options, the 11000-strike call has the highest open interest of more than 37 lakh shares and in put side 11000-strike put has the highest open interest of over 29 lakh shares in open interest respectively. The PCR OI for the week closed up at 1.61 which indicates put writing indicates support at lower levels. On the technical front, 10850 & 10900 spot levels are the support zone and Nifty is most likely to trade in the band of 10900 to 11100.

8

|

|

|

|

**The highest call open interest acts as resistance and highest put open interest acts as support.

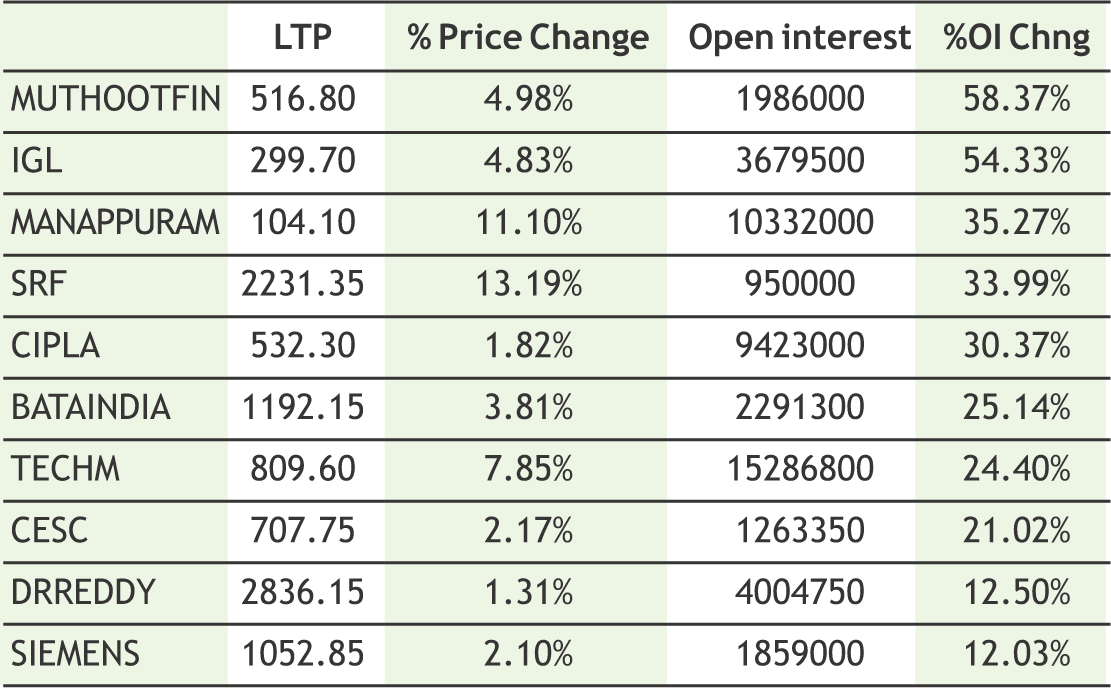

# Price rise with rise in open interest suggests long buildup | Price fall with rise in open interest suggests short buildup

# Price fall with fall in open interest suggests long unwinding | Price rise with fall in open interest suggests short covering

9

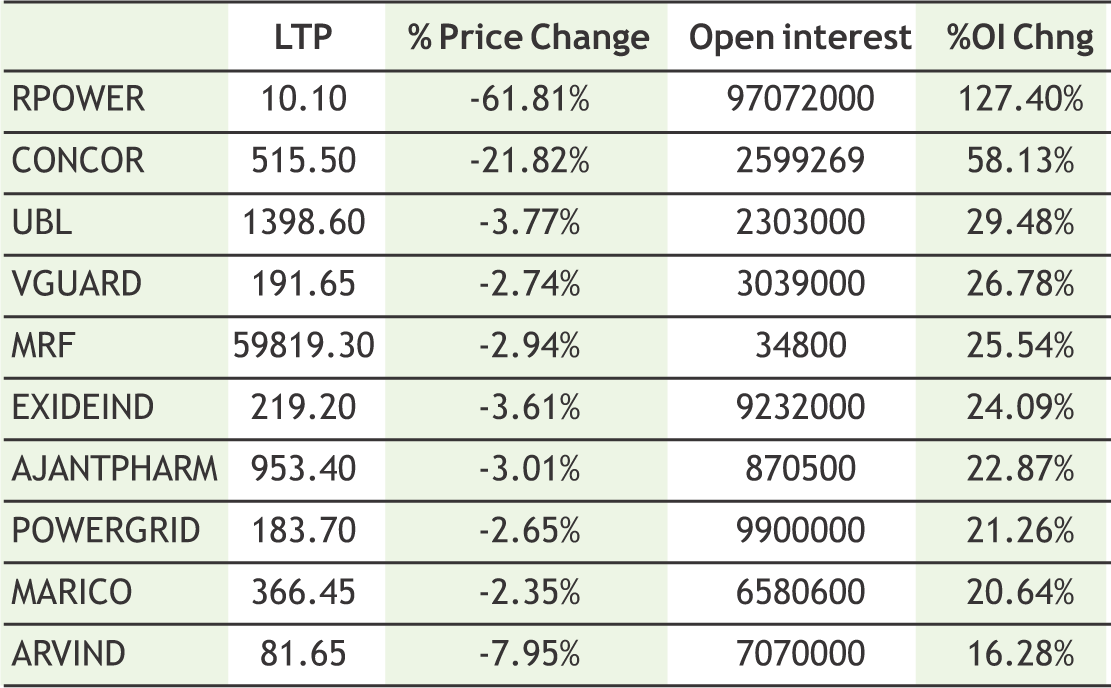

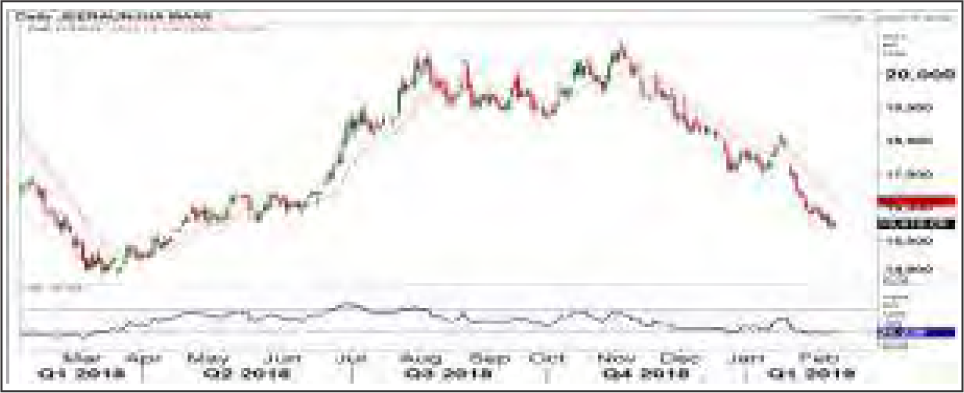

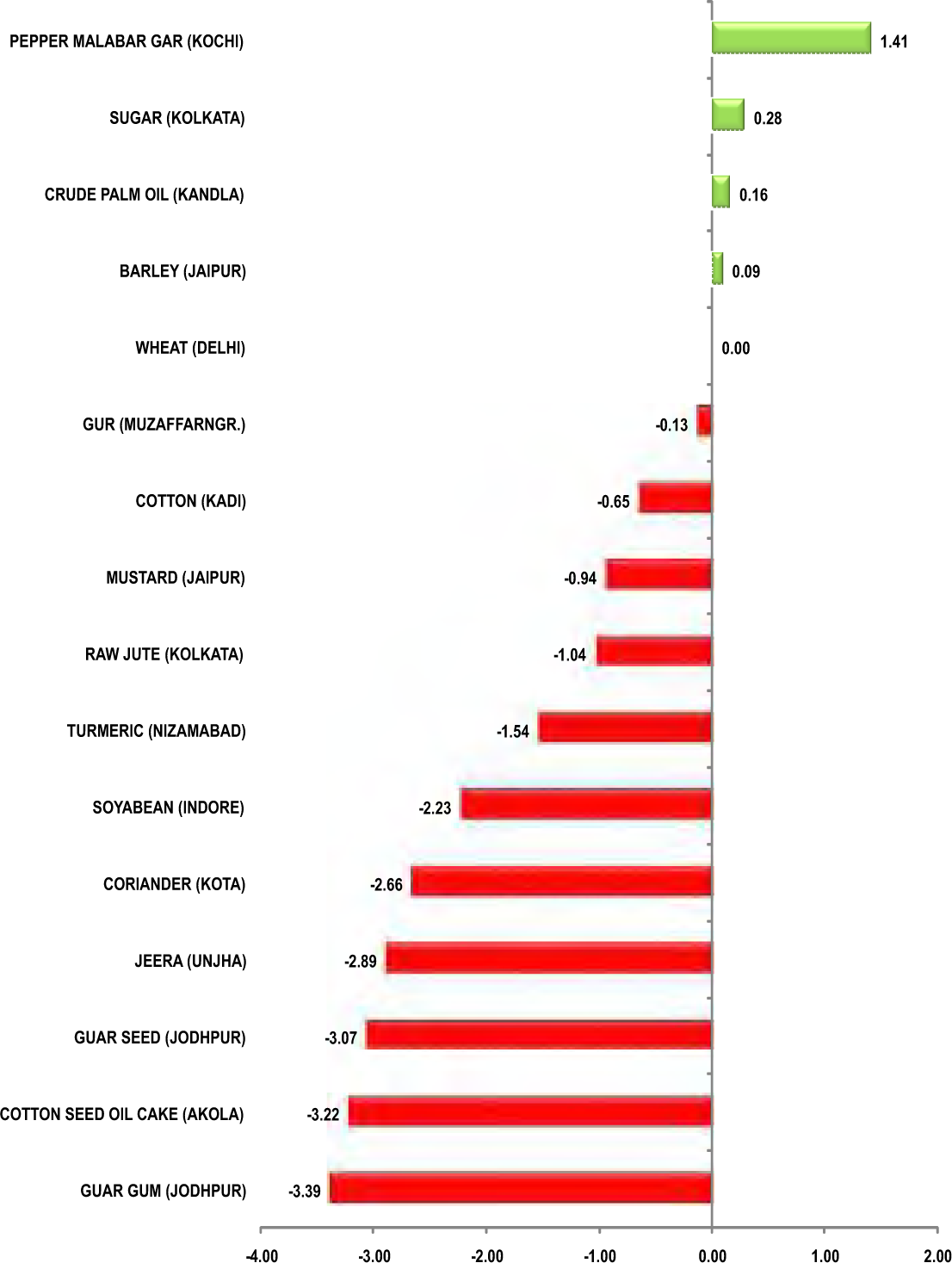

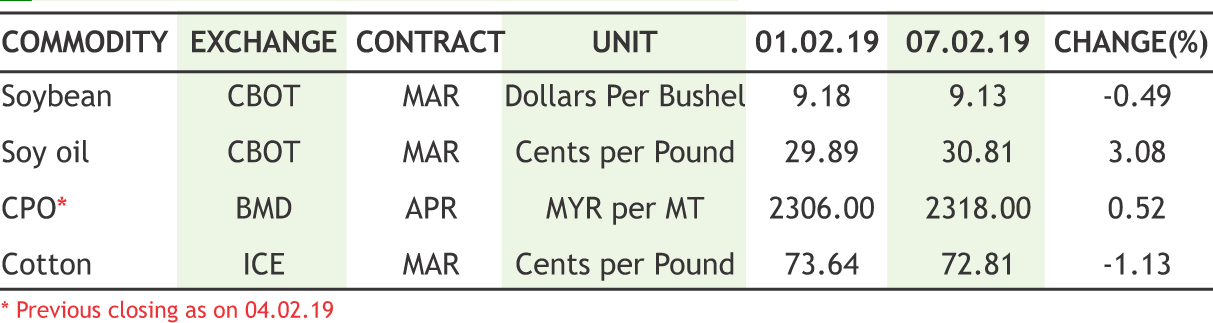

Turmeric futures (Apr) may see more downside of 6200-6100 levels owing to lack of sufficient cues from the demand side which are failing to pull up the prices. On the spot markets, poor quality of new turmeric is arriving for sale due to which the stockists are getting discouraged from fresh buying. The market participants are expecting upcountry demand but are getting very negligible numbers at present, hence getting the producers are not bringing their best quality produce. The production of Mysore turmeric at Karnataka area is in encouraging level, the farmers are bringing little quantity of the turmeric for sale every day. Jeera futures (Mar) has gone down to an extremely oversold zone & this week we may see some short covering with the counter expected to take support near 15300 levels. However, any sharp upside may not be seen as the fundamentals indicate that the current weather conditions over the major growing regions are conducive for the crop. This season, Gujarat has witnessed lower sowing, but due to cool weather persisting for a longer time, the yields are expected to get better. In Rajasthan, the climatic conditions are also proving to be beneficial for the standing crop & hence the production is likely to be higher. On the demand side, the exporters are almost inactive and waiting for the fresh crop to hit the markets. The increasing open interest week-on-week & decreasing trend of coriander futures (Apr) depict that we may witness more correction in the counter towards 6000 levels. Spot coriander prices are trading with a bearish bias at major markets in Gujarat, Madhya Pradesh and Rajasthan due to heavy arrivals from the ample old stocks.

Bullion counter may witness range bound movement as stronger greenback is keeping the upside in check but dovish stance by fed chairman along with US and China trade war concerns to keep downside capped. Market sentiments are also affected by the uncertainty Brexit concerns and possibility of another US government shutdown. U.S. President Donald Trump stated that he did not plan to meet with Chinese President Xi Jinping before a March 1 deadline set by the two countries to achieve a trade deal. The two countries had taken a 90-day hiatus in their trade war to work out a deal. Gold can face support near the level of 32500 while its upside will be capped near 33500 while silver can witness further profit booking towards 39200 while facing resistance near 40400. Dollar index can further improve towards 97.5 levels. The US dollar index has edged up against European currencies amid disappointing European economic data, concerns about Brexit and downbeat central bank outlook. U.S. President Donald Trump repeated his promise to build a border wall in his State of the Union address, raising the prospect of another U.S. government shutdown. The European Commission sharply cut its forecasts for euro zone economic growth this year and next on expectations the bloc's largest countries will be held back by global trade tensions and domestic challenges. Meanwhile Shanghai gold premium firmed in January, the volume traded on the Shanghai Gold Exchange was up 14% [year-on-year] and local prices have edged higher.

The correction in soybean futures (Mar) may witness a halt & take support in the range of 3750-3700 levels. The sentiments are turning optimistic after the export data highlighted a sharp jump in soybean meal exports to Iran during the period April 2018-January 2019 to 2.8 lakh tonnes from 23,000 tonnes last year. In the wake of economic sanctions by the US, Iran turned to India to meet its soybean meal requirements. To support this, Iran started accepting payments in Indian currency, used it to pay India for imports. The hopes of more exports are rising as Iran could use the opportunity to meet its soybean demand from India, because it does not produce enough of the protein-rich soymeal domestically. Mustard futures (Apr) is expected to trade with a downside bias & may even test 3825 levels. The prospects of rape meal exports to China amid US-China trade tensions are less likely to yield any fruit for Indian oilmeal exports & may not resume during current financial year as procedure for registration with MoA, China is too cumbersome, lengthy and time consuming to complete all formalities. CPO futures (Feb) is in the overbought region & correction may emerge due to profit booking & also facing resistance near 576 levels. Moreover, the India's January imports of palm oil, including crude and refined variants, are seen at around 900,000 tn, up 12.5% from December. Globally, the market participants are worried amid pessimism over trade and global growth after the breaking news that President Donald Trump won’t meet Chinese President Xi Jinping before a March 1 deadline to avert new U.S. tariffs on Chinese goods.

Crude oil prices may witness some profit booking at high levels as Russian Energy Minister Alexander Novak poured cold water over Saudi Arabia's hopes. Novak stated in December that it was highly unlikely that OPEC and other oil producers would set up a joint structure due to the additional red tape it would create, as well as the risk of U.S. sanctions against monopolies. On the flip side, Saudi Arabia cut its crude output in January by about 400,000 bpd, bring the total to 10.24 million bpd from 10.643 in December, representing a cut that was 70,000 bpd deeper than targeted under the OPEC-led pact to balance the market and support prices. Crude oil can test 3500 while facing resistance near 4000. The spare capacity in other oil producers and strategic reserves are likely to compensate for a loss of Venezuela's crude exports. U.S. refiners are eager to buy Canadian heavy crude to replace supplies they had been importing from Venezuela that are now blocked by Trump administration sanctions. But there’s not enough space on pipelines and trains to get it across the border due to pipeline constraints. Natural gas counter may continue to plunge further as it can dip lower towards 175. U.S. natural gas plunged to their lowest in almost 2.5 years after forecasts for warmer weather in February and a smaller-than-expected storage decline. EIA showed that inventories fell by 237 bcf compared to expectations for a 245 bcf drawdown.

Cotton futures (Feb) is likely to witness a bounce back amid lower level buying taking support near 20350. Moreover, the statistics of lower output this season may lend cushion to the prices. In its latest estimates, the Cotton Association of India has further trimmed the crop size by 5 lakh bales to 330 lakh bales of 170 kg each for season 2018-19. This estimated crop size is the lowest in a decade. Guar seed futures (Mar) may show more sign of weakness & may even break the strong support near 4185 to test 4030 levels, while guar gum futures (Mar) is expected to plunge further towards 7900 levels. The week-on-week declining ratio of guar seed to guar gum is depicting the fact that demand for these commodities are decreasing. Chana futures (Mar) is expected to show an upside momentum towards 4390. The counter is trading higher at major markets in the country following firm cues from fresh physical trade activity at lower rates. Flour millers are actively purchasing chana due to cheaper prices and easy availability compared to White Pea. Moreover, the cold waves and untimely rains may further damage the standing crop. Mentha oil (Feb) is likely to trade with a positive bias & may even rally up to test 1630-1660, if sustains above 1610 levels. Overall, sentiments are bullish as delayed sowing in the state is likely to affect the crop yield. As per reports, farmers are now worried as untimely rains and inclement weather conditions have delayed the sowing in key producing belts. The production is likely to be badly affected, if weather conditions don't improve in the next few days.

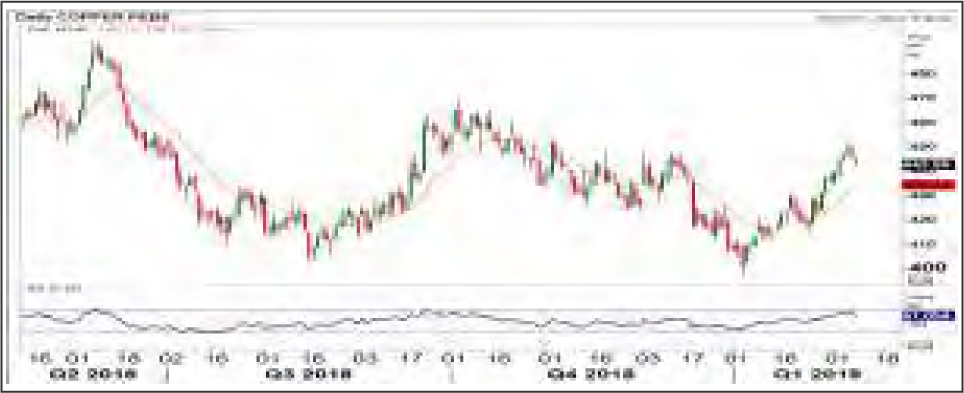

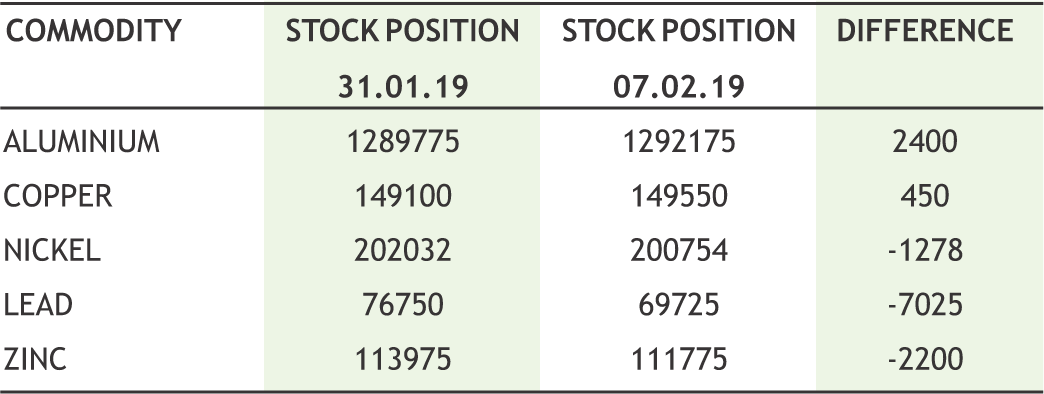

In base metal counter, prices can witness some profit booking at higher levels as concerns over global economic growth and U.S.-China trade tensions weighing on the market. Weak data in recent weeks in key global economies, including in top metals consumer China, has stoked fears of a recession. A private survey showed that China’s factory activity shrank by the most in almost three years in January as new orders slumped further and output fell. Copper may witness some profit booking at higher level, and may dip towards 435 while facing resistance near 453. Chilean state copper miner Codelco saw a 1.9 percent drop in its output in 2018, at 1.8 million tonnes, while production at the world’s largest copper mine, Escondida, shot up 34 percent in the same year. Meanwhile, Lead may also dip towards 144 while facing resistance near 152.Aluminium can trade with mixed bias in range of 131 -139. Rusal sees demand for aluminium growing in 2019 with potential for prices to rise. Alumina, an oxide key to aluminium smelting process, may be expected to be more balanced. Zinc may also dip towards 190 while facing resistance near 200. Concern about nearby zinc supplies has been fuelled by one company holding between 50 percent and 79 percent of LME zinc warrants and cash contracts. Nickel can also witness profit booking towards 880 while facing resistance near 945 levels. Nickel surged recently after a Brazilian state court ordered Vale to stop using eight tailings dams following a disaster last month that probably killed more than 300 people.

10

|

COPPER MCX (FEB) contract closed at Rs. 446.30 on 07th Feb’19. The contract made its high of Rs. 475.30 on 4th Oct’18 and a low of Rs. 397.4 on 3rd Jan’19. The 18-day Exponential Moving Average of the commodity is currently at Rs. 443.75. On the daily chart, the commodity has Relative Strength Index (14-day) value of 62.02.

One can buy at Rs. 437 for a target of Rs. 450 with the stop loss of Rs. 430.

CRUDE OIL MCX (FEB) contract closed at Rs. 3727 on 07th Feb’19. The contract made its high of Rs. 4100 on 14th Nov’18 and a low of Rs. 3037 on 26th Dec’18. The 18-day Exponential Moving Average of the commodity is currently at Rs. 3782. On the daily chart, the commodity has Relative Strength Index (14-day) value of 48.295.

One can sell at Rs. 3880 for a target of Rs. 3600 with the stop loss of Rs. 4010.

JEERA NCDEX (MAR) contract was closed at Rs. 15,585 on 7th Jan’19. The contract made its high of Rs. 19400 on 1st Nov’18 and a low of Rs. 15365 on 7th Jan’19. The 18-day Exponential Moving Average of the commodity is currently at Rs. 16102.0. On the daily chart, the commodity has Relative Strength Index (14-day) value of 25.448.

One can buy at Rs. 15300 for a target of Rs. 15900 with the stop loss of Rs 15000.

11

• Bank of England stated that Britain faced its weakest economic growth in 10 years in 2019, blaming mounting Brexit uncertainty.

• The Brazilian state of Minas Gerais canceled Vale SA's license to operate a dam at one of its largest mines.

• Eastern Libyan forces loyal to Libyan commander Khalifa Haftar captured the closed El Sharara oilfield last week.

• The U.S. trade deficit fell for the first time in six months in November last year amid declines in imports of cellphones and petroleum products.

• In the wake of the government announcing direct income support of Rs.6,000 per year for small and marginal farmers in the interim Budget on February 1, the Reserve Bank of India, on Thursday, raised the limit for collateralfree agriculture loans to Rs.1.6 lakh from Rs.1 lakh.

• India's cotton crop estimate is further reduced by 5 lakh bales to 330 lakh bales (each of 170 kg) for the season 2018-19. In its January 2019 estimate for India's cotton crop. - Cotton Association of India (CAI)

• BSE, in the commodity derivatives trading space, has launched futures trading in guarseed and guargum.

• The export of oilmeals during January 2019, provisionally reported at 283,850 tons compared to 269,668 tons in January 2018. The overall export during April 2018 to January 2019 is reported at 2,692,452 tons compared to 2,516,657 tons during the same period of last year i.e. up by 7%. - Solvent Extractors’ Association of India (SEA)

• The global food price index compiled by FAO started the year 2019 in a buoyant note and jumped by 1.8 per cent on sequential basis to 164.8 points in January.

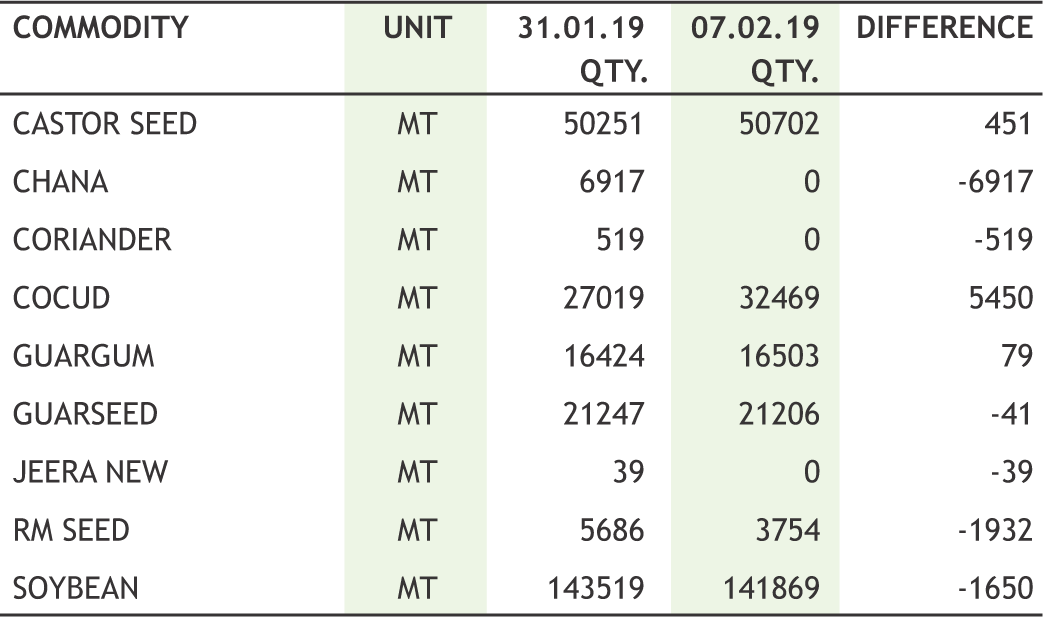

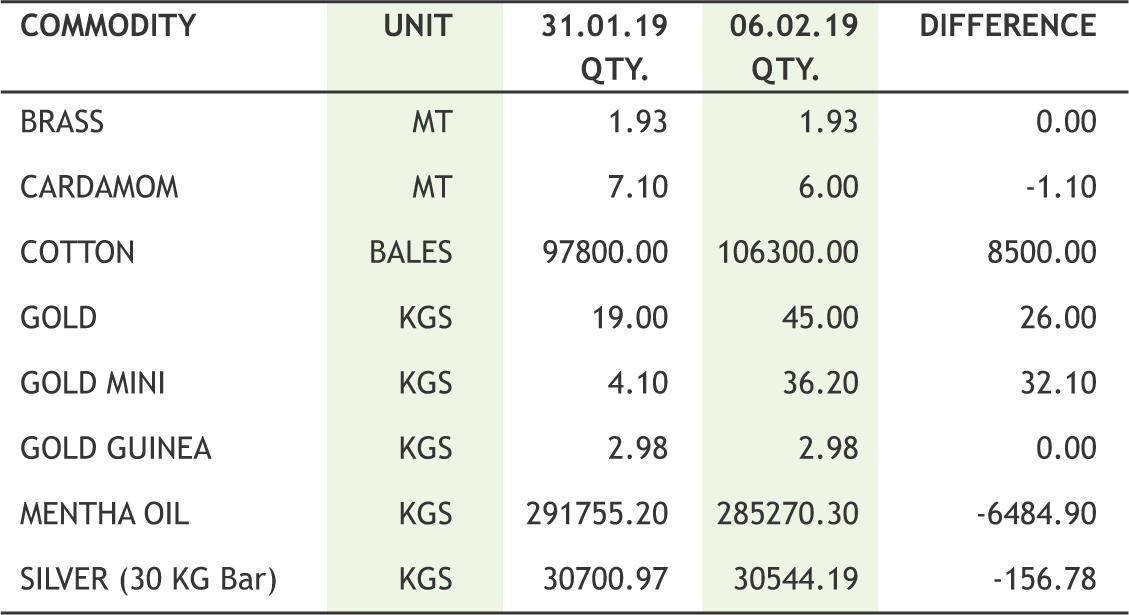

Rally in commodities took a breather last week on profit booking from higher levels amid bounce back in the greenback. Currency played important role; first INR weakened to the 71.83 levels; reacted on Repo rate cut by 25bps to 6.25%; then it appreciated and traded below 71.3 and this made Indian commodities more volatile. There were corrections almost everywhere, from bullion to energy to base metals and in some agri commodities. Gold and silver moved down after two week strong upside on the stronger dollar index. Holdings of SPDR Gold Trust, the world’s largest gold-backed exchange-traded fund, fell for a fifth straight session on Thursday. Overall, holdings of gold in the relevant exchange traded funds increased in January, according to new data from the World Gold Council (WGC). ETF holdings increased for the fourth straight month, this time by 71.9 tonnes to 2,512.8 tonnes. Base metals counter performed mix as market was full of mix news. U.S. President Donald Trump said on Thursday he did not plan to meet with Chinese President Xi Jinping before a March 1 deadline set by the two countries to strike a trade deal. If there is no agreement between the world's two biggest economies, Trump has threatened to increase U.S. tariffs on Chinese imports. Another round of talks is scheduled for next week in Beijing. On Thursday, the European Commission sharply cut its forecasts for euro zone economic growth as it expects global trade tension and an array of domestic challenges. The Commission said growth this year would slow to 1.3 percent from 1.9 percent in 2018, before rebounding in 2020 to 1.6 percent. It capped the upside of base metals and some of the saw correction viz; lead and zinc. In energy counter both natural gas and crude prices edged down. Extreme volatility returned to the U.S. natural gas market with futures plunging to their lowest in almost two and a half years after forecasts for warmer weather in February and a smaller-than-expected storage decline revived speculative selling.

Cotton counter traded in ambiguity amid ongoing meeting between China and US. Chana gradually moved up on fresh demand from spot market. Guarseed and guargum prices declined in line with crude prices amid dull physical demand. Mentha recovered from the lower levels on improved demand. Turmeric prices moved down on fresh arrivals issues. Jeera saw no respite on weak export demand amid ample supply. In oilseeds; both soyabean and mustard took correction on fresh arrivals issue.

|

|

12

|

|

Highlights of Monetary Policy Review

• RBI has decided the enhancement of collateral free agriculture loan from Rs 1 lakh to Rs 1.6 lakhs. This enhancement of Rs 60,000 has been taken in view of the overall rise in inflation, marginal agriculture input and benefit to small farmers.

• According to RBI, the headline inflation is expected to remain contained below or at its target of 4 percent. CPI inflation is revised downwards to 2.8% in Q4 of 2018-19. The inflation rate is estimated at 3.2-3.4% in the first half of the year 2019-20 and 3.9% in the third quarter of 2019-20.

• Inflation in the fuel and light group fell from 8.5 percent in October to 4.5 percent in December, pulled down by a sharp decline in the prices of liquefied petroleum gas (LPG), reflecting softening of international petroleum product prices.

• RBI expects GDP growth to go up to 7.4% in FY20, from the FY19 government estimate of 7.2%.

• Union budget proposals will boost demand by raising disposable incomes, may take time to play out.

• Export growth on a year-on-year basis was almost flat in November and December 2018, primarily due to a high base effect and weak global demand.

• RBI Governor has promised to ensure liquidity to all sectors. Impact of various budget proposals is factored into inflation projections.

• To enhance the operational freedom of banks in raising deposits, the RBI has revised the definition of bulk deposits as single rupee deposits of Rs. 2 crore and above. At present, deposits of Rs. 1 crore and above are treated as bulk deposits.

Impact of the rate cut

• With the apex bank lowering the repo rate, it is likely that banks will follow suit and reduce their marginal cost of funds based lending rates (MCLR). MCLR refers to the minimum interest rate that a bank will charge on the loan.

• The rate cut will pick up the consumer sentiment but more importantly it is an indication from the RBI that they want to improve the overall sentiment.

• The decision is positive for the market, as the decision provide more money in the hands of consumers. This would push the demand of commodities.

• Borrowers will benefit from lower rates as the banks can pass on the rate cut in a similar fashion.

• This would help growth all the sector of economy, especially manufacturing, auto & housing sector. Improved liquidity and demand will also catalyze industrial activity, which can again have cascading positive impact on vehicle demand and usage across passenger vehicles, commercial vehicles, farm and construction equipment.

• The decision will also boost in exports of petroleum products, gems and jewellery, engineering goods, meat and poultry.

13

|

| 4th FEB | ECB's combined stress test results show improved resilience. |

| 5th FEB | Government expects Rs 69,000-crore dividend from RBI in 2019-20. |

| 6th FEB | U.S. Fed chief to discuss economy before House panel on February 27 |

| 6th FEB | U.S.'s Mnuchin to visit China next week for trade talks. |

| 7th FEB | RBI cut the repo rate by 25 basis points (bps) to 6.25 per cent. |

| 7th FEB | RBI projects economic growth at 7.4% in 2019-20 |

| 7th FEB | BoE sees weakest UK outlook since 2009 on Brexit, global slowdown. |

| 7th FEB | Europe's economic outlook goes from bad to worse amid EU warning. |

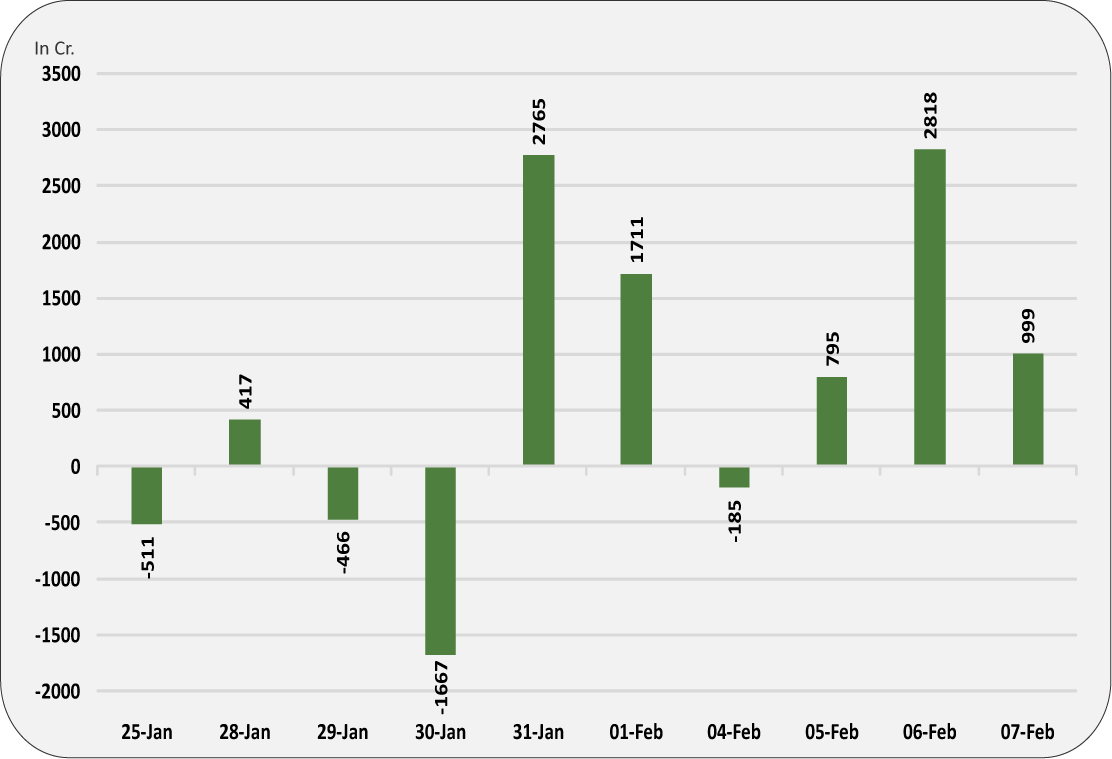

This week was predominantly centralized by RBI dovish monetary policy. With Indian Real Yield overshooting to four year high to 4.3% YoY – came from the benign inflation, pushed RBI newly appointed Governor to trim down repo and reverse repo by 25 bps to 6.25% and 6.00% respectively with a change in stance from Calibrated Tightening to Neutral. Going forward, inflation projection were trimmed down with headline projection was revised to 2.8% vs (2.7% -3.2% over 2HFY19) in the last quarter of FY19. Broadly FY20 non-core inflation now projected in 1HFY20 to 3.2- 3.4 and 2HCY20 to 3.9%. Additionally, growth projection was also forecasted to remain subdued to 7.4% in FY20. With expansionary fiscal policy, though Central Bank covered the spillover effect of the expansion in their inflation projection log, price pressure likely to recover moderately over the new fiscal year. Admittedly with base effect, FY20 inflation can range around 4%. Apart from the various projections and revisions steps by RBI, it has decided to place a task-force on offshore Rupee markets to limits the opening volatility on on-shore INR pair subsequently leads to wider participation domestically as one of the non-policy measures. Globally, Bank of England has further downgraded growth projection amid Brexit uncertainly – an obvious process which markets least bother to act. Its peer on the other side of Atlantic, Jay Powel – FED Chair ruled out any immediate slow-down due to hike pause hike pause rate paths in 2018. Politically Trump places more attention in Media after says “NO” to meet President Xi before important deadline of 1st March to combat tariff wars between INDO-SINO trade relationships. Expect USDINR to stay within 70.70 and 71.60.

|

USD/INR (FEB) contract closed at 71.2925 on 7th Feb’ 19. The contract made its high of 72.1450 on 5th Feb’19 and a low of 71.42 on 7th Feb’ 18 (Weekly Basis). The 14-day Exponential Moving Average of the USD/INR is currently at 71.49

On the daily chart, the USD/INR has Relative Strength Index (14-day) value of 50.96. One can buy above 71.45 for the target of 72.05 with the stop loss of 71.15.

EUR/INR (FEB) contract closed at 81.2575 on 7th Feb’ 19. The contract made its high of 82.9950 on 4th Feb’19 and a low of 81.1350 on 7th Feb’19 (Weekly Basis). The 14-day Exponential Moving Average of the EUR/INR is currently at 81.74

On the daily chart, EUR/INR has Relative Strength Index (14-day) value of 44.29. One can sell at 81.25 for a target of 80.65 with the stop loss of 81.55.

GBP/INR (FEB) contract closed at 93.2375 on 7th Feb’ 19. The contract made its high of 94.24 on 4th Feb’19 and a low of 92.2350 on 7th Feb’18 (Weekly Basis). The 14-day Exponential Moving Average of the GBP/INR is currently at 93.01

On the daily chart, GBP/INR has Relative Strength Index (14-day) value of 66.03. One can sell at 92.75 for a target of 92.15 with the stop loss of 93.05.

JPY/INR (FEB) contract closed at 65.44 on 7th Feb’ 19. The contract made its high of 65.68 on 4th Feb’19 and a low of 65.08 on 7th Feb’19 (Weekly Basis). The 14-day Exponential Moving Average of the JPY/INR is currently at 65.41

On the daily chart, JPY/INR has Relative Strength Index (14-day) value of 59.34. One can sell at 65.33 for a target of 64.73 with the stop loss of 65.63.

14

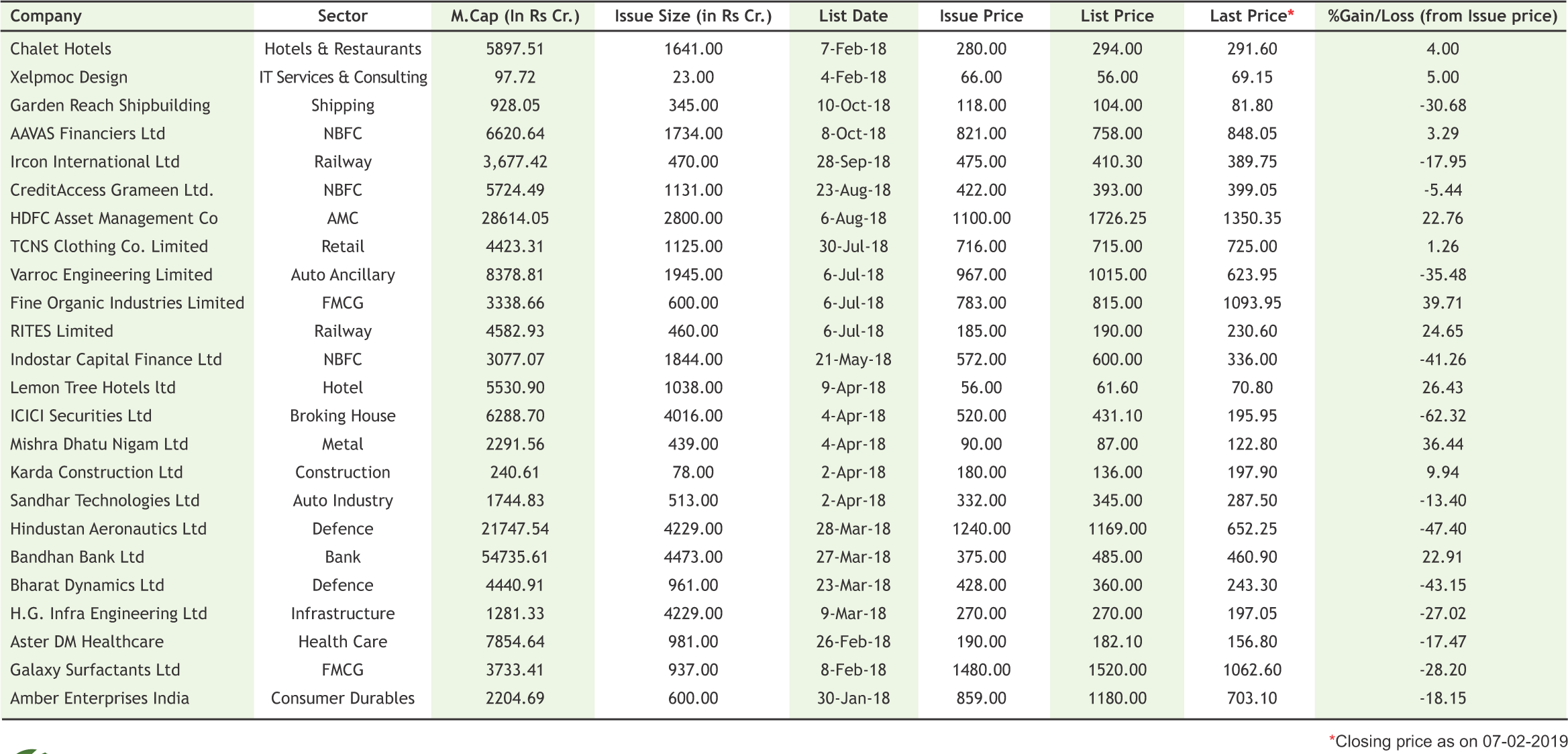

Chalet Hotels lists at a premium of 4% at Rs 291

Shares of Chalet Hotels listed at a premium of 4 percent on the exchanges at a price of Rs 291. The initial public offering of Chalet Hotels, which owns, develops and manages high-end hotels in key metro cities in India, was subscribed 1.57 times on the last day of bidding. The initial public offering (IPO) to raise about Rs 1,641 crore received bids for 6,49,07,563 shares against the total issue size of 4,13,26,672 shares. The category meant for qualified institutional buyers (QIBs) got subscribed 4.65 times, non-institutional investors 1.11 times and retail individual investors 3 percent, as per merchant banking sources. The offer comprises a fresh issue of Rs 950 crore and an offer for sale of up to 2,46,85,000 equity shares (including anchor portion of 1,75,84,071 equity shares). Its price range is at Rs 275-280 per equity share. JM Financial Limited, Axis Capital Limited and Morgan Stanley India Company are managing the offer.

Mazagon Dock to raise Rs 500-600 cr through IPO, plans to hit market by month-end

State-owned Mazagon Dock Shipbuilders is likely to raise Rs 500-600 crore through an initial public offer (IPO) by the end of this month. The public sector undertaking had in August last year received Sebi's go ahead to float the initial share sale. Mazagon, a leading shipyard of the country, would see sale of over 2.24 crore equity shares, amounting to 10 percent stake of the government. The offer will also have a portion for employees, which will not exceed 5 per cent of the post offer paid up equity share capital of the company. The IPO is part of the government's efforts to garner Rs 80,000 crore through stake sales in state-owned companies in 2018-19. Mazagon, which has an order book of Rs 52,000 crore, posted a turnover of Rs 4,500 crore in 2017-18. Yes Securities, Axis Capital, Edelweiss Financial Services, IDFC Bank and J M Financial will manage the issue.

Mini Ratna e-commerce firm MSTC files IPO papers with SEBI

MSTC Limited, a Mini Ratna works under Ministry of Steel, has filed the draft red herring prospectus with Securities and Exchange Board of India on January 31 for the public issue. The Government of India will dilute its stake in the company by selling 1.76 crore equity shares (representing 25 percent of total paid-up equity) through offer for sale. The company is engaged in providing e-commerce related services across diversified industry segment offering e-auction/e-sale, eprocurement services and development of customized software/solutions and also is a major player in trading of bulk raw material. Equirus Capital Private Limited is the sole book running lead manager to this offer and Alankit Assignments Limited is the registrar to this offer. Incorporated in 1964 as a trading company to regulate the export of scrap, the company has grown into a large diversified, multi-product services and trading company. It was a canalising agent for import of ferrous scrap until 1992. After de-canalisation, the company has established itself as one of the major players in trading of bulk industrial raw material and one of the leading e-commerce service providers in the country. The company entered into the recycling business through a 50:50 joint venture with Mahindra Intertrade Limited (MIL) for setting up a shredding plant and collection centers across the country. The company divided its business in three main verticals - e-commerce, trading, and recycling through the joint venture company (Mahindra MSTC Recycling Private Limited) with MIL.

|

15

|

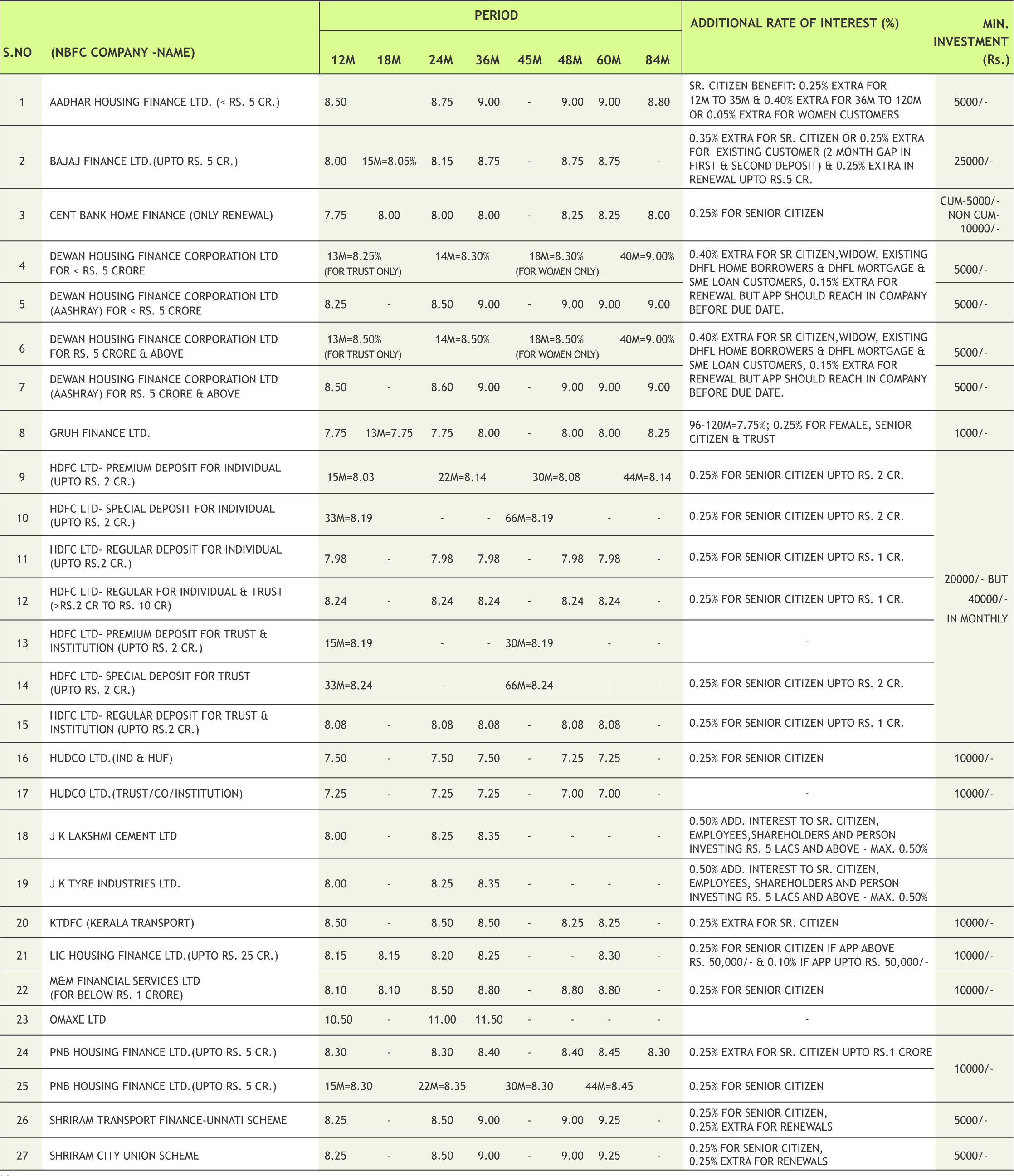

* Interest Rate may be revised by company from time to time. Please confirm Interest rates before submitting the application.

* For Application of Rs.50 Lac & above, Contact to Head Office.

* Email us at fd@smcindiaonline.com

16

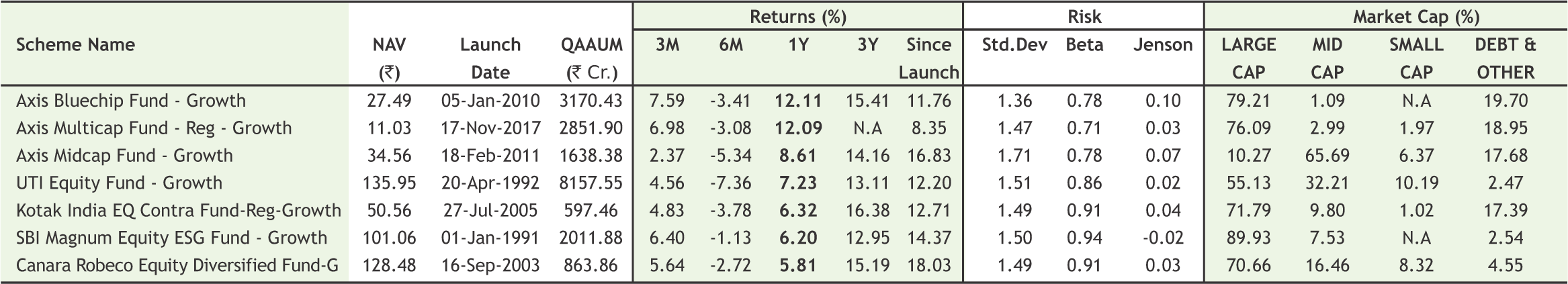

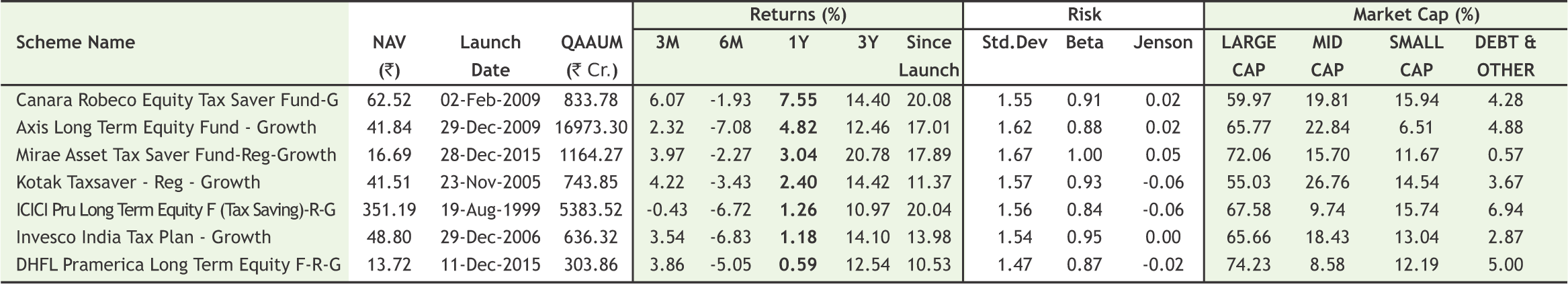

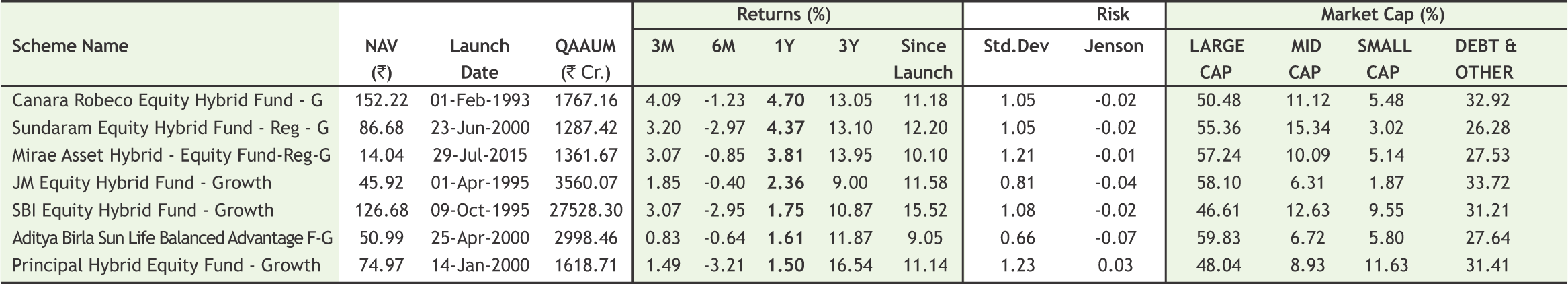

DSP Mutual Fund to launch two index funds on Feb 11; offers to close on February 15

DSP Mutual Fund will launch DSP Nifty 50 Index Fund and DSP Nifty Next 50 Index Fund on February 11, a release from the fund house stated. The openended index schemes, which seeks to replicate the performance of the Nifty and Nifty Next 50 respectively, will remain open for subscription until February 15. The Nifty tracks the performance of the top 50 companies in India by m-cap. The index invests in market leaders from different sectors and represents the economy through time. The Nifty Next 50 index tracks 51 to 100 stocks ranked by m-cap. This index tries to capture companies that may become the mega caps of tomorrow. Both indices operate in the largecap space as defined by the Securities Exchange Board of India (SEBI). DSP Nifty 50 Index Fund and DSP Nifty Next 50 Index Fund will be managed by Gauri Sekaria. The latter has been Vice President of ETFs and Passive Investments at DSP Investment Managers Pvt since January 2017 and serves as its Portfolio Manager.

Union Mutual Fund launches arbitrage fund; NFO to close February 13

Union Mutual Fund on January 30 launched Union Arbitrage Fund, an open-ended scheme which will close on February 13. The scheme will invest in arbitrage opportunities between spot and futures prices of exchange-traded equities and the arbitrage opportunities available within the derivative segment. In terms of asset allocation, the scheme will investment 65-90 percent of its corpus in equity and equity related instruments (as part of hedged/arbitrage exposure), while 10-25 percent will be deployed in debt money market Instruments including margin money deployed for derivatives transactions.

17

|

|

|

|

|

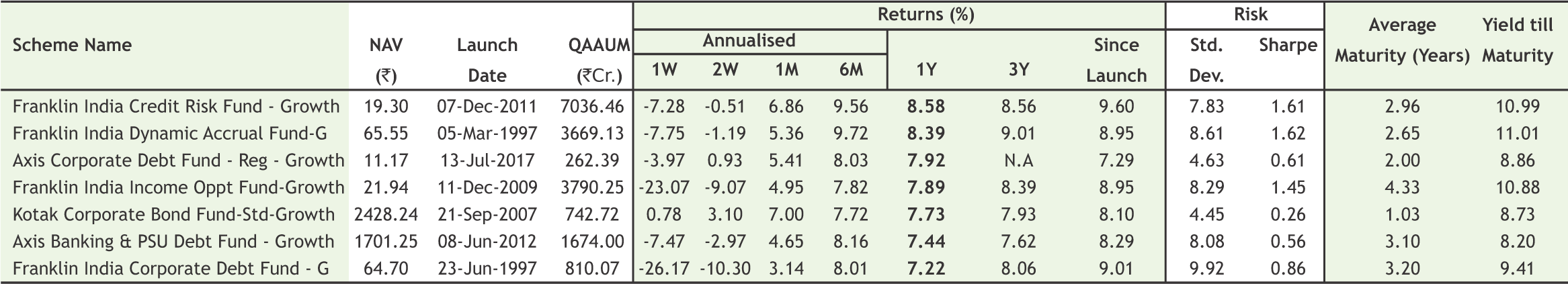

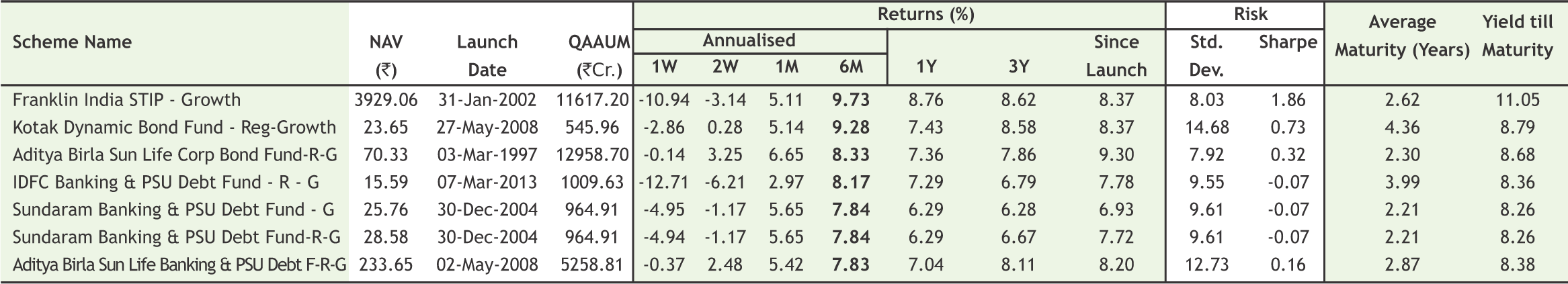

Note:Indicative corpus are including Growth & Dividend option . The above mentioned data is on the basis of 08/08/2019 Beta, Sharpe and Standard Deviation are calculated on the basis of period: 1 year, frequency: Weekly Friday, RF: 7%

*Mutual Fund investments are subject to market risks, read all scheme related documents carefully

17

Mr. Ajay Garg (CEO & Director, SMC Global Securities Ltd) during the ‘BTVI Money Mantra’ TV Show held on Tuesday, 29th January, 2019 at PHD House, New Delhi.

SMC organised a full day fun filled team outing for NBFC employees on Saturday, 19th January, 2019 at Pratapgarh Farms, Jhajjar, Haryana.

Mr. S C Aggarwal (CMD, SMC Group) and Mr. Mahesh C Gupta (Vice CMD, SMC Group) along with SMC employees during the January month birthday celebration held at SMC Head Office and Daryaganj Branch, New Delhi.

REGISTERED OFFICES:

11 / 6B, Shanti Chamber, Pusa Road, New Delhi 110005. Tel: 91-11-30111000, Fax: 91-11-25754365

MUMBAI OFFICE:

Lotus Corporate Park, A Wing 401 / 402 , 4th Floor , Graham Firth Steel Compound, Off Western Express Highway, Jay Coach Signal, Goreagon (East) Mumbai - 400063

Tel: 91-22-67341600, Fax: 91-22-67341697

KOLKATA OFFICE:

18, Rabindra Sarani, Poddar Court, Gate No-4,5th Floor, Kolkata-700001 Tel.: 033 6612 7000/033 4058 7000, Fax: 033 6612 7004/033 4058 7004

AHMEDABAD OFFICE :

10/A, 4th Floor, Kalapurnam Building, Near Municipal Market, C G Road, Ahmedabad-380009, Gujarat

Tel : 91-79-26424801 - 05, 40049801 - 03

CHENNAI OFFICE:

Salzburg Square, Flat No.1, III rd Floor, Door No.107, Harrington Road, Chetpet, Chennai - 600031.

Tel: 044-39109100, Fax -044- 39109111

SECUNDERABAD OFFICE:

315, 4th Floor Above CMR Exclusive, BhuvanaTower, S D Road, Secunderabad, Telangana-500003

Tel : 040-30031007/8/9

DUBAI OFFICE:

2404, 1 Lake Plaza Tower, Cluster T, Jumeriah Lake Towers, PO Box 117210, Dubai, UAE

Tel: 97145139780 Fax : 97145139781

Email ID : pankaj@smccomex.com

smcdmcc@gmail.com

Printed and Published on behalf of

Mr. Saurabh Jain @ Publication Address

11/6B, Shanti Chamber, Pusa Road, New Delhi-110005

Website: www.smcindiaonline.com

Investor Grievance : igc@smcindiaonline.com

Printed at: S&S MARKETING

102, Mahavirji Complex LSC-3, Rishabh Vihar, New Delhi - 110092 (India) Ph.: +91-11- 43035012, 43035014, Email: ss@sandsmarketing.in