NEWS

DOMESTIC NEWS

Economy

• India's manufacturing growth slowed slightly in December, but the

pace remained strong amid robust sales, data from IHS Markit. The

headline Nikkei manufacturing purchasing managers' index, or PMI,

fell to 53.2 in December from 54.0 in November. Any reading above 50

indicates an expansion in the sector.

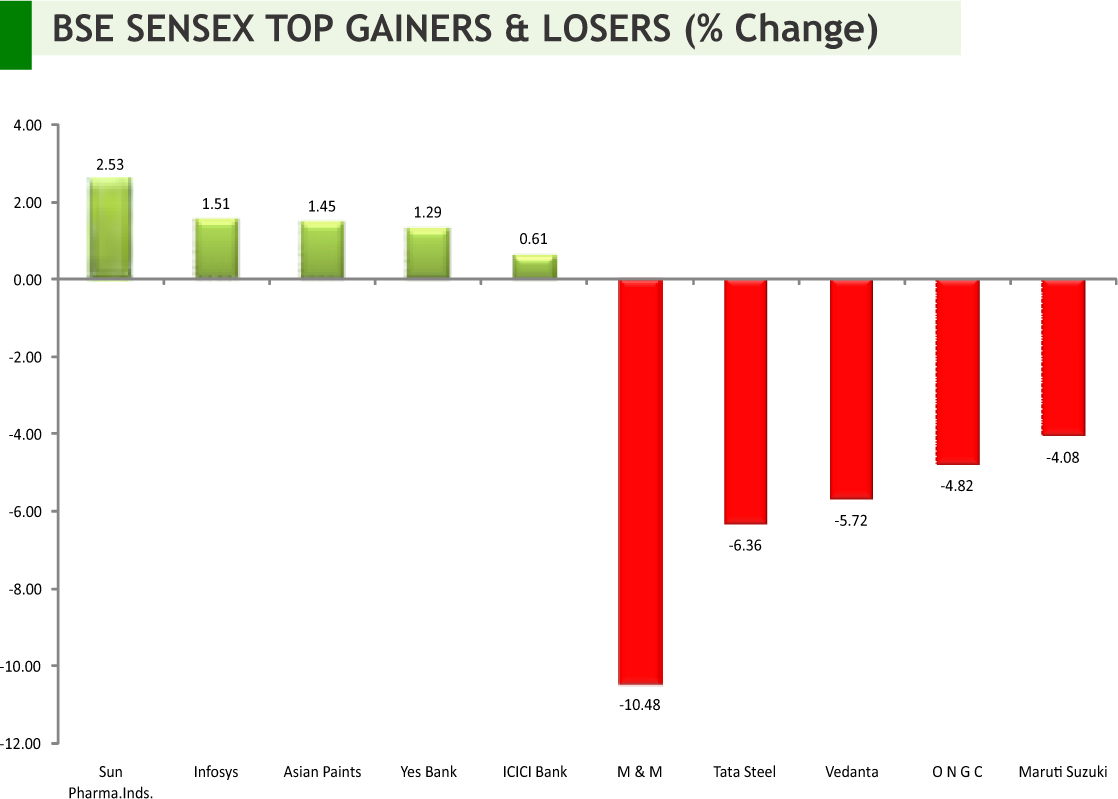

Pharmaceuticals

• Sun Pharma announced has completed acquisition of Japan-based Pola

Pharma to strengthen its presence in dermatology segment across the

globe. Pola Pharma’s portfolio mainly comprises dermatology

products. It has two manufacturing facilities in Saitama with

capabilities to manufacture topical products and injectables.

• Alembic Pharmaceutical received approval from the US health

regulator for Pramipexole Dihydrochloride extended-release tablets

used for the treatment of Parkinson’s disease. It has an estimated

market size of $38.6 million.

Realty/ Construction

• Capacite Infraprojects has bagged orders worth Rs 97.69 crore for

RCC, civil, high side MEP works for sub-structure and superstructure of

proposed research building of the Institute of Chemical Technology at

Matunga Mumbai.

Capital Goods

• BHEL has bagged an order worth Rs 3,500 crore for setting up a 660 MW

supercritical Sagardigh thermal power plant in West Bengal by West

Bengal Power Development Corporation (WBPDCL) at Manigram village

in Murshidabad district of West Bengal.

• L&T announced its construction arm has won orders worth Rs 1,060

crore in the domestic market. The smart world and communication

business has secured a major order from the Andhra Pradesh State

FiberNet Limited (APSFL) for Bharatnet Phase-II works to establish an

IP/MPLS Infrastructure covering the 13 districts of Andhra Pradesh.

Hotels

• Lemon Tree Hotels will soon be introducing its co-living prototype in

the country as early as March 2019. Hamstede Living, its joint venture

with global private equity major Warburg Pincus, will also launch a coliving brand that will tap into the sharing/ renting trend that's fast catching up with the millennial population in India.

Information Technology

• Tata Consultancy Services announced that Emirates NBD, the Middle

East's leading financial services group, has chosen TCS BaNCS for

Payments as its core processing platform to standardize and

streamline payments operations across multiple geographies,

including lndia, Egypt, Saudi Arabia, Singapore, UK and their home

market, the United Arab Emirates.

INTERNATIONAL NEWS

• U.S. Jobless claims rebounded in the week ended December 29th, The

Labor Department said initial jobless claims rose to 231,000, an

increase of 10,000 from the previous week's upwardly revised level of

221,000. Economists had expected jobless claims to climb to 220,000.

• US pending home sales index fell by 0.7 percent to 101.4 in November

after plunging by 2.6 percent to 102.1 in October. The continued

decline in pending home sales matched economist estimates.

• Eurozone manufacturing expanded at the weakest pace since early 2016

in December as new orders fell for a third month and business confidence

eroded to a six-year low, results of the survey by IHS Markit showed. The

final Eurozone Manufacturing Purchasing Managers' Index, or PMI, was

51.4, unchanged from the flash, but lower than November's 51.8.

• U.K. construction sector growth was the weakest in three months in

December amid a slower rise in commercial work, survey data from IHS

Markit. The CIPS Purchasing Managers' Index, or PMI, fell to 52.8 from 53.4 in

November. The latest reading was in line with economists' expectations.

• China's manufacturing activity fell in December, due to a decline in

new orders, for the first time since May 2017, survey data from IHS

Markit showed. The headline seasonally adjusted Caixin Factory

Purchasing Managers' Index, or PMI, fell to 49.7 from 50.2 in November.

• Hong Kong retail sales growth slowed far more-than-expected in November,

figures from the Census and Statistics Department showed. The retail sales

volume grew 1.2 percent year-on-year, following a 5.3 percent increase in

October. Economists had expected sales growth of 4.2 percent.

NEY

NEY