2019: Issue 709, Week: 11th - 15th November

A Weekly Update from SMC (For private circulation only)

WISE M NEY

NEY

2019: Issue 709, Week: 11th - 15th November

A Weekly Update from SMC (For private circulation only)

NEY

NEY

www.smcindiaonline.com

| Equity | 4-7 |

| Derivatives | 8-9 |

| Commodity | 10-13 |

| Currency | 14 |

| IPO | 15 |

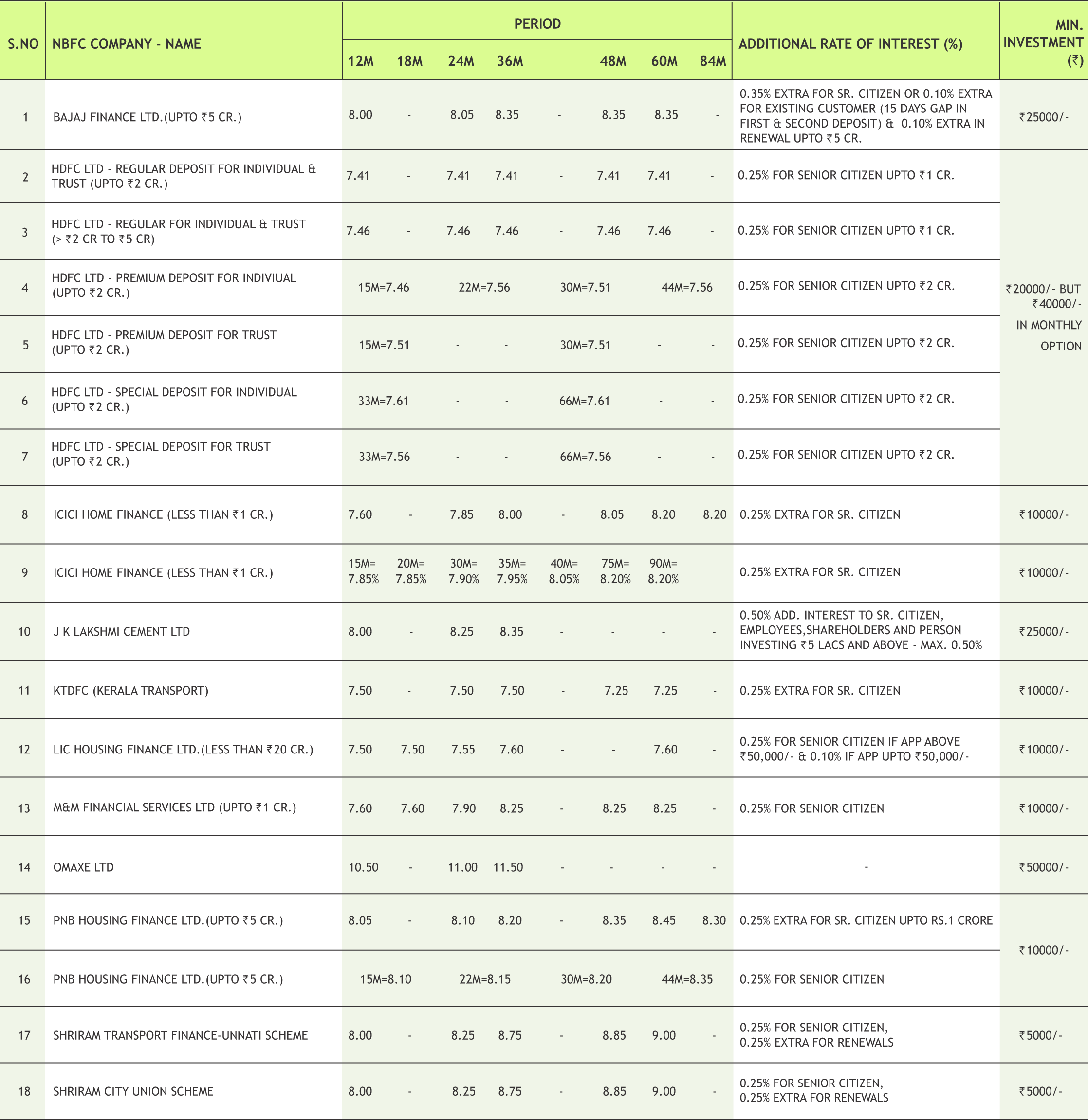

| FD Monitor | 16 |

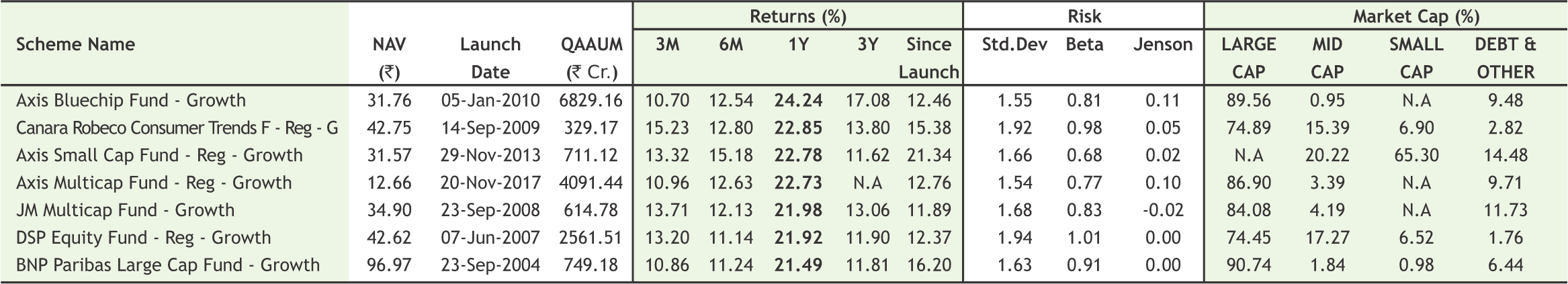

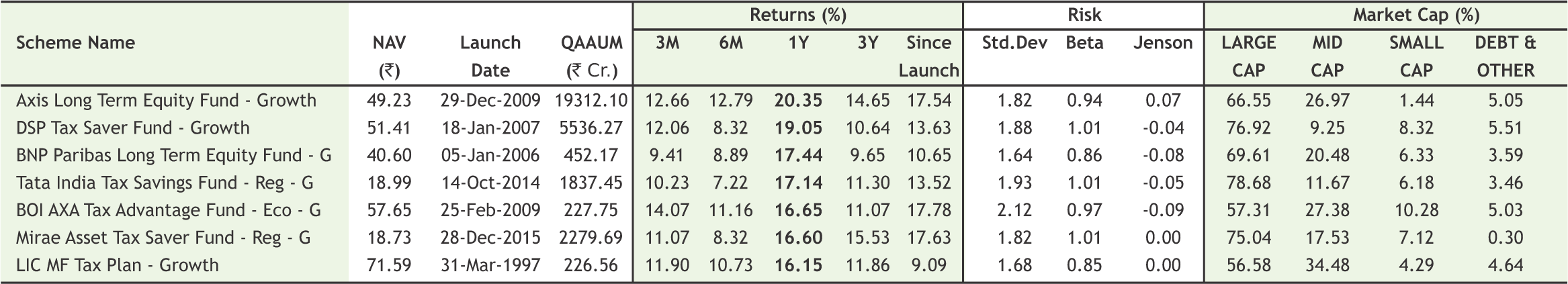

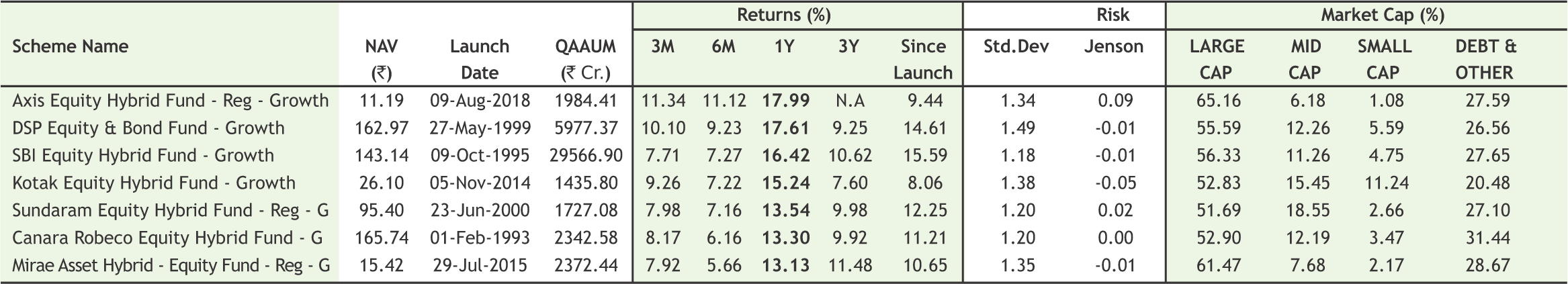

| Mutual Fund | 17-18 |

I

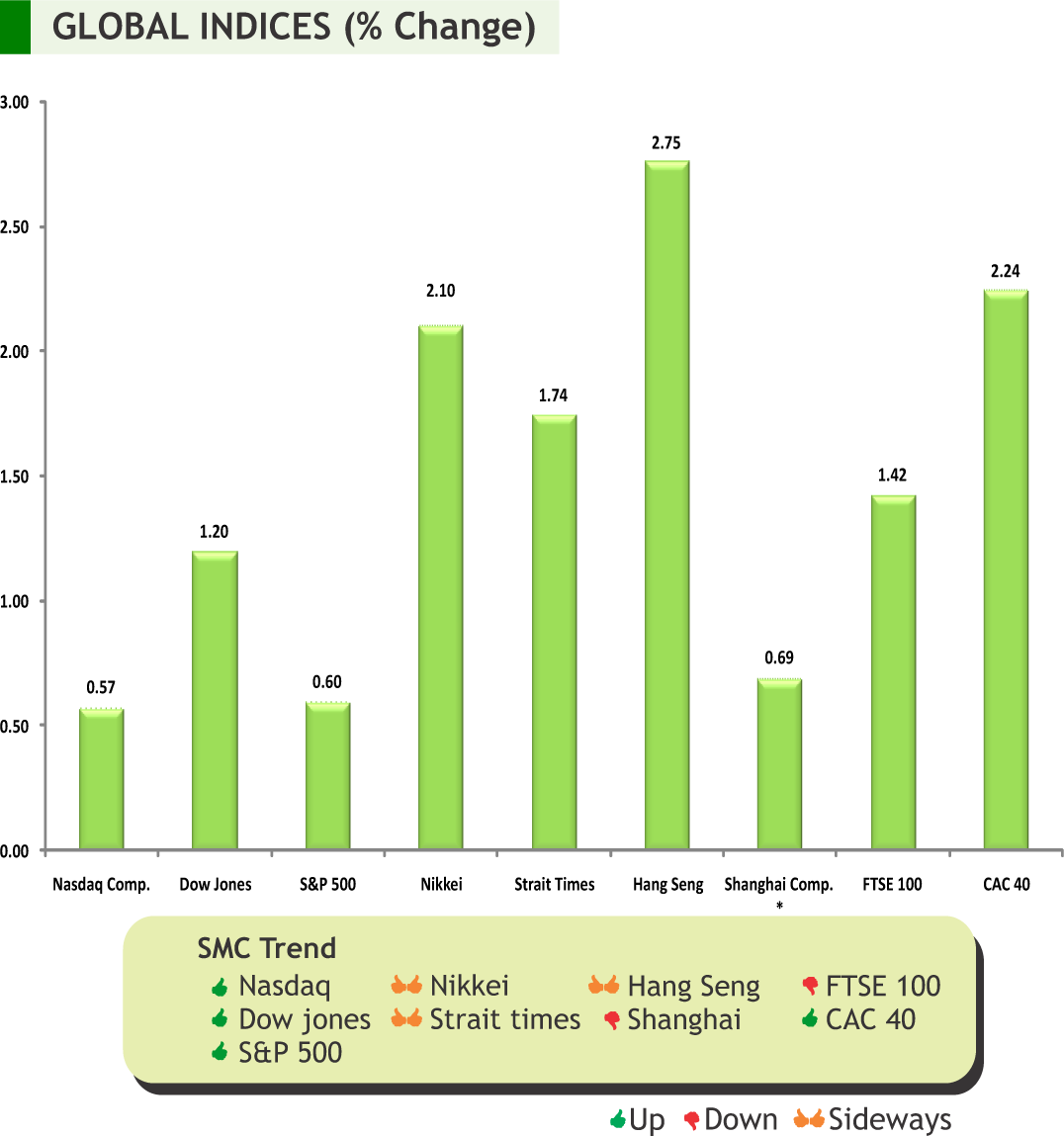

I n the week gone by, markets across the globe cheered after China and U.S. agreed to “phased rollback” of extra trade war tariffs once their leaders sign an interim deal towards ending a costly trade war, with both sides still working to wrap up the agreement. Undoubtedly, this development would provide relief to businesses and consumers as well in both the countries. Meanwhile, Euro zone business activity expanded slightly faster than expected last month but remained close to stagnation. German industrial orders rose more than expected in September, offering some hope for manufacturers in Europe's biggest economy after a tough spell. According to IMF, global debt has surged to a new all-time record equivalent to more than double the world's economic output i. e to $188 trillion.

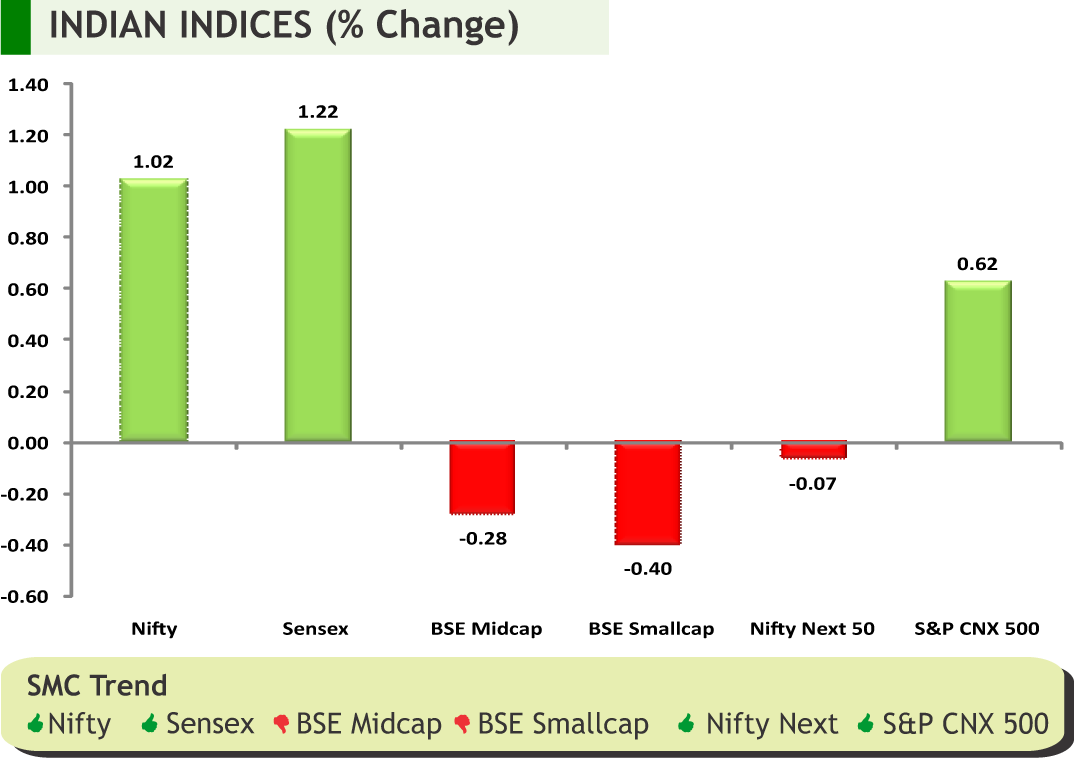

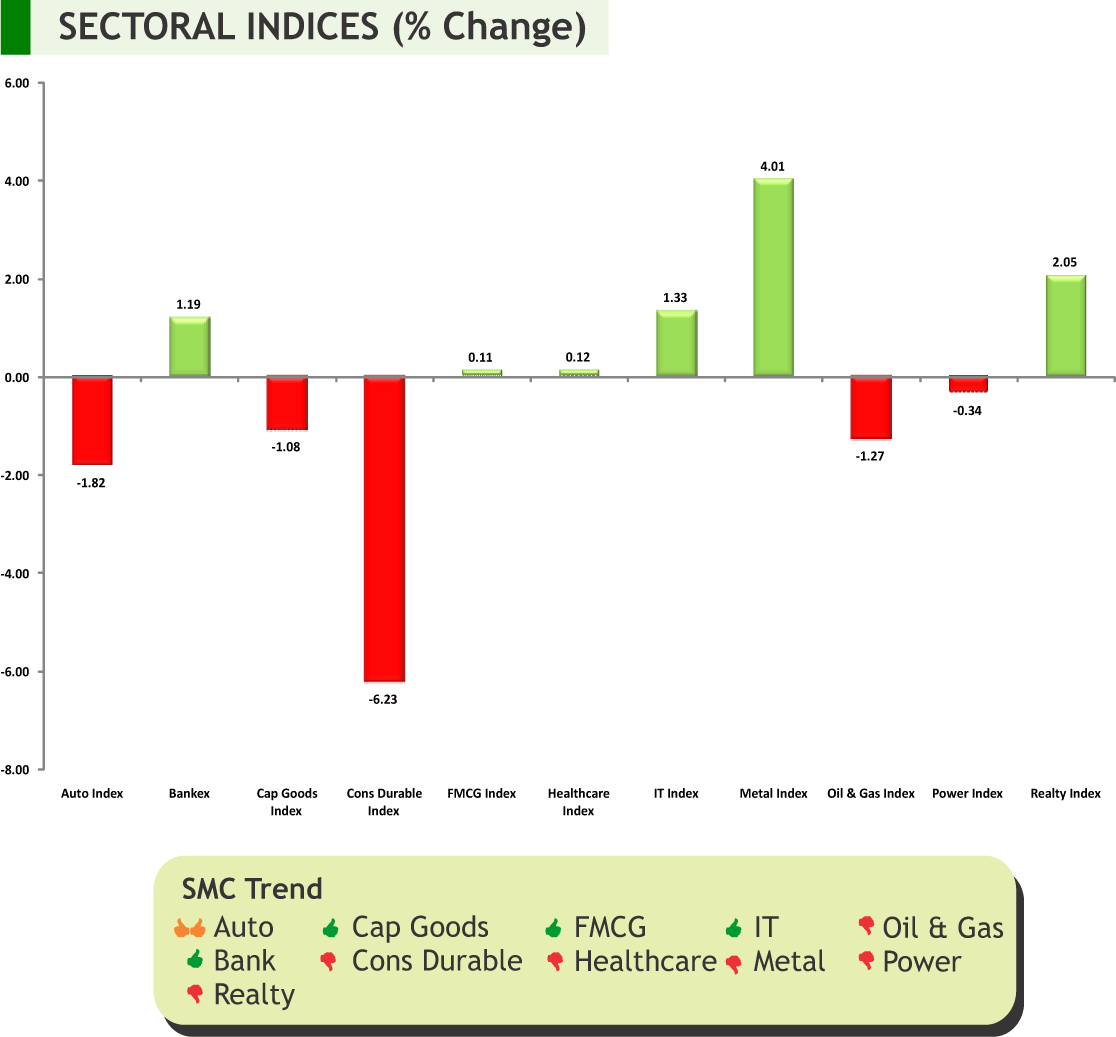

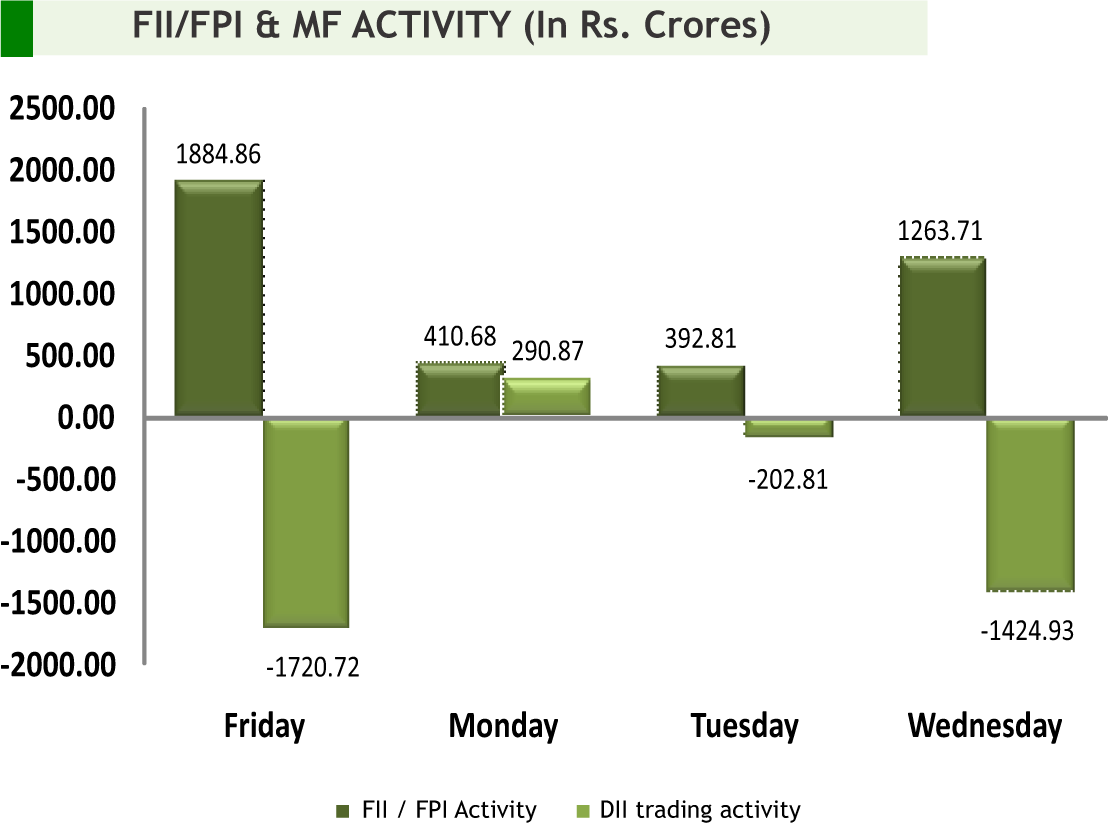

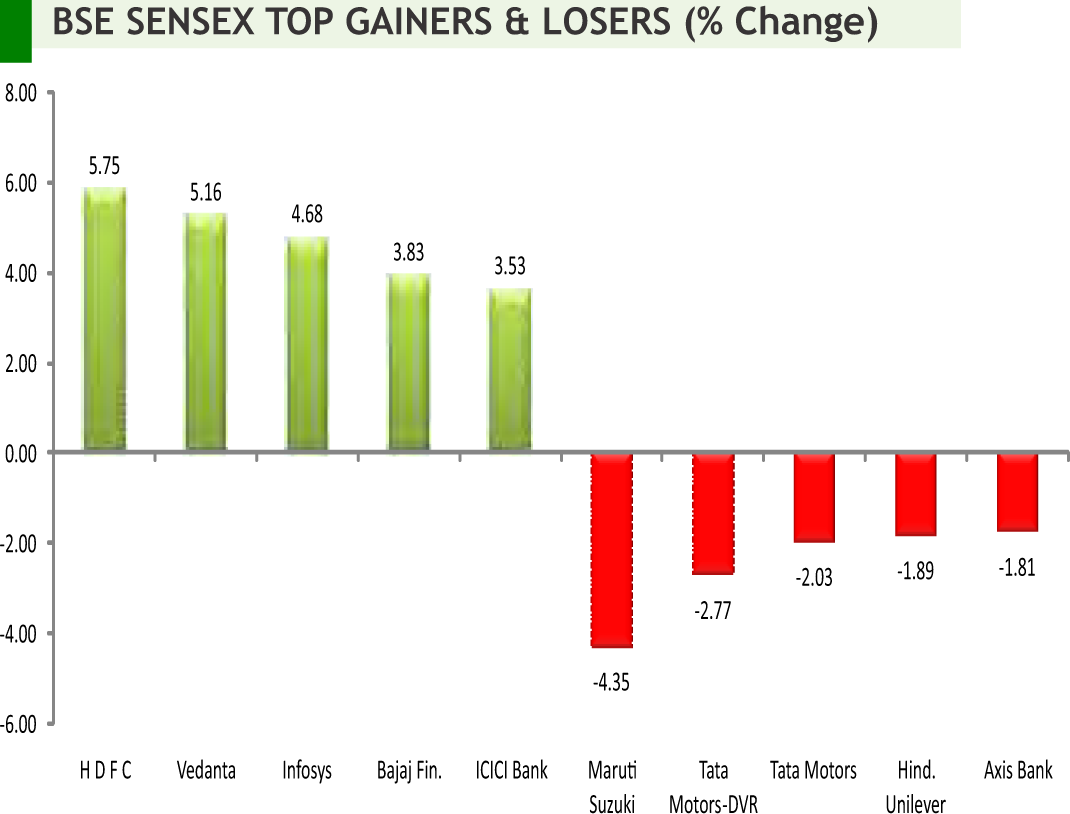

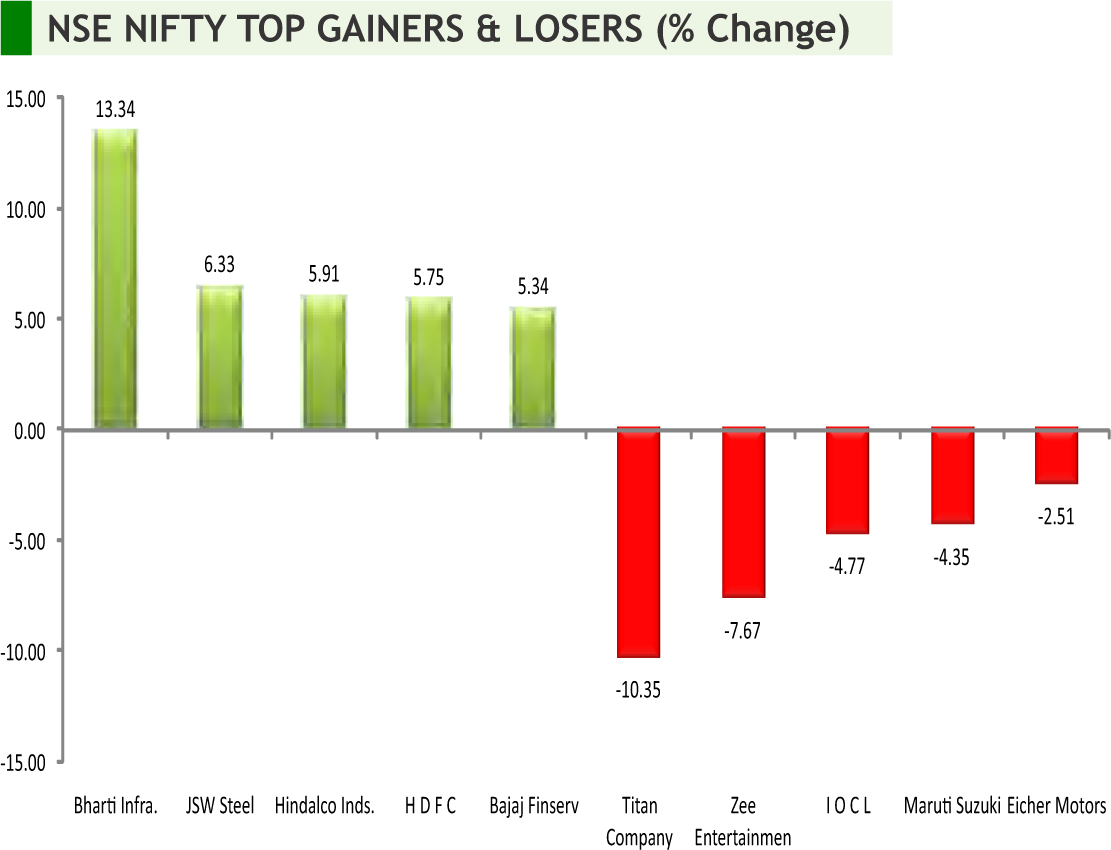

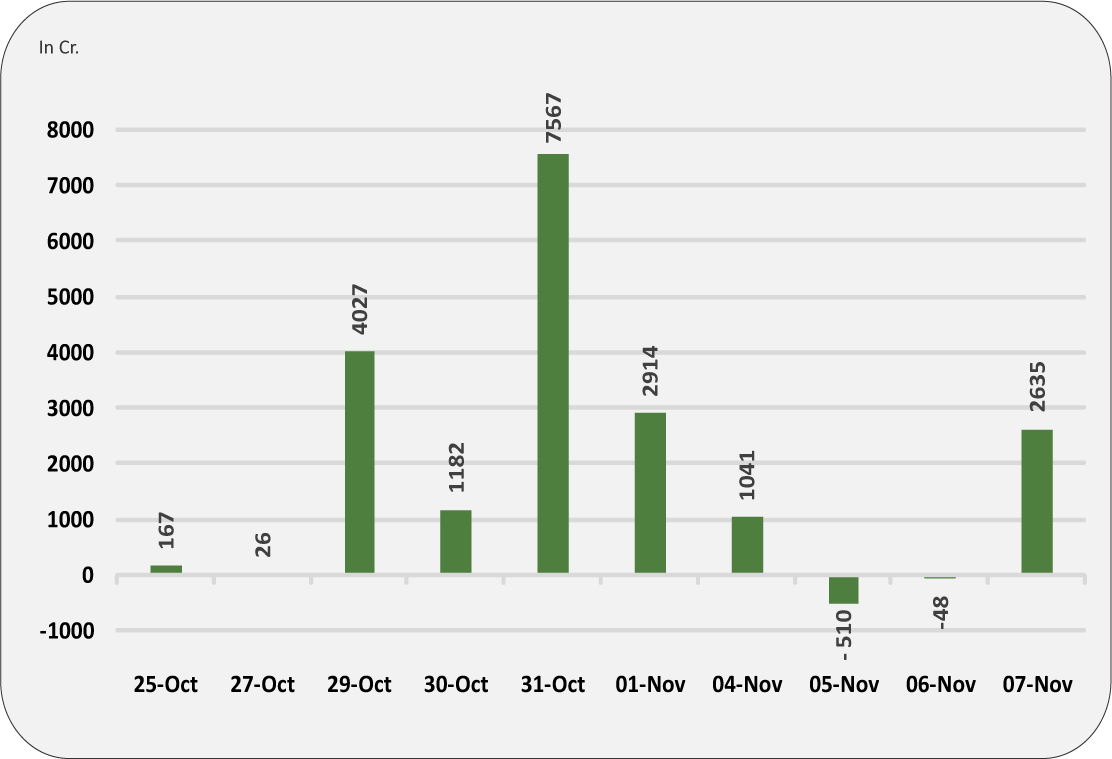

Back at home, domestic markets witnessed a northward journey amid improved earnings by index heavyweights, hopes of further policy actions and a good festive season along with strong global indices. Actually market looked more optimistic after Finance Minister Nirmala Sitharaman said the government will use its strong electoral mandate to usher in the next wave of reforms. Now, the focus of the market is on longterm reforms such as Tax cuts, DDT, LTCG and Disinvestment to name a few. The Rs 25,000 crore AIF announced by the government to help complete the stalled housing projects is expected to be a game changer not only for the housing sector but also will have a positive impact on other industries as well. Domestic production of crude oil and natural gas has fallen by 6% and 1.5%, respectively, in the first half of the current fiscal year, further increasing dependence on imports to meet rising demand. Meanwhile, India’s credit ratings outlook was cut to negative from stable by Moody’s Investors Service on concern the government won’t be able to help stunted economic growth. Going into a new week, global cues, flow of foreign funds, macroeconomic data such as IIP and inflation and movement of crude oil prices will have their sway on the market.

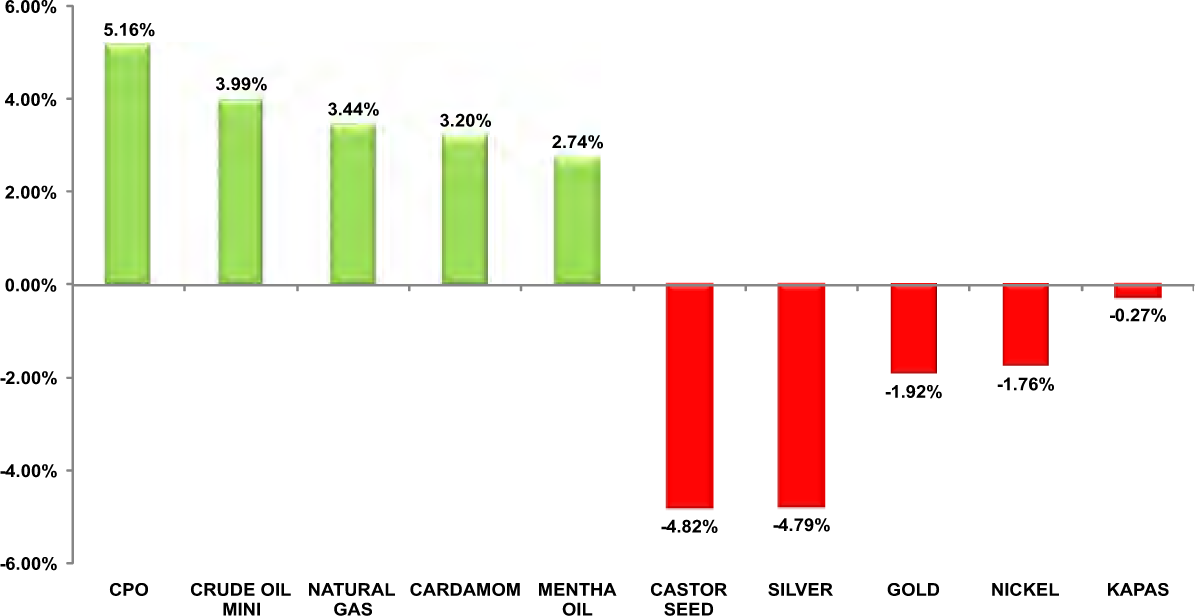

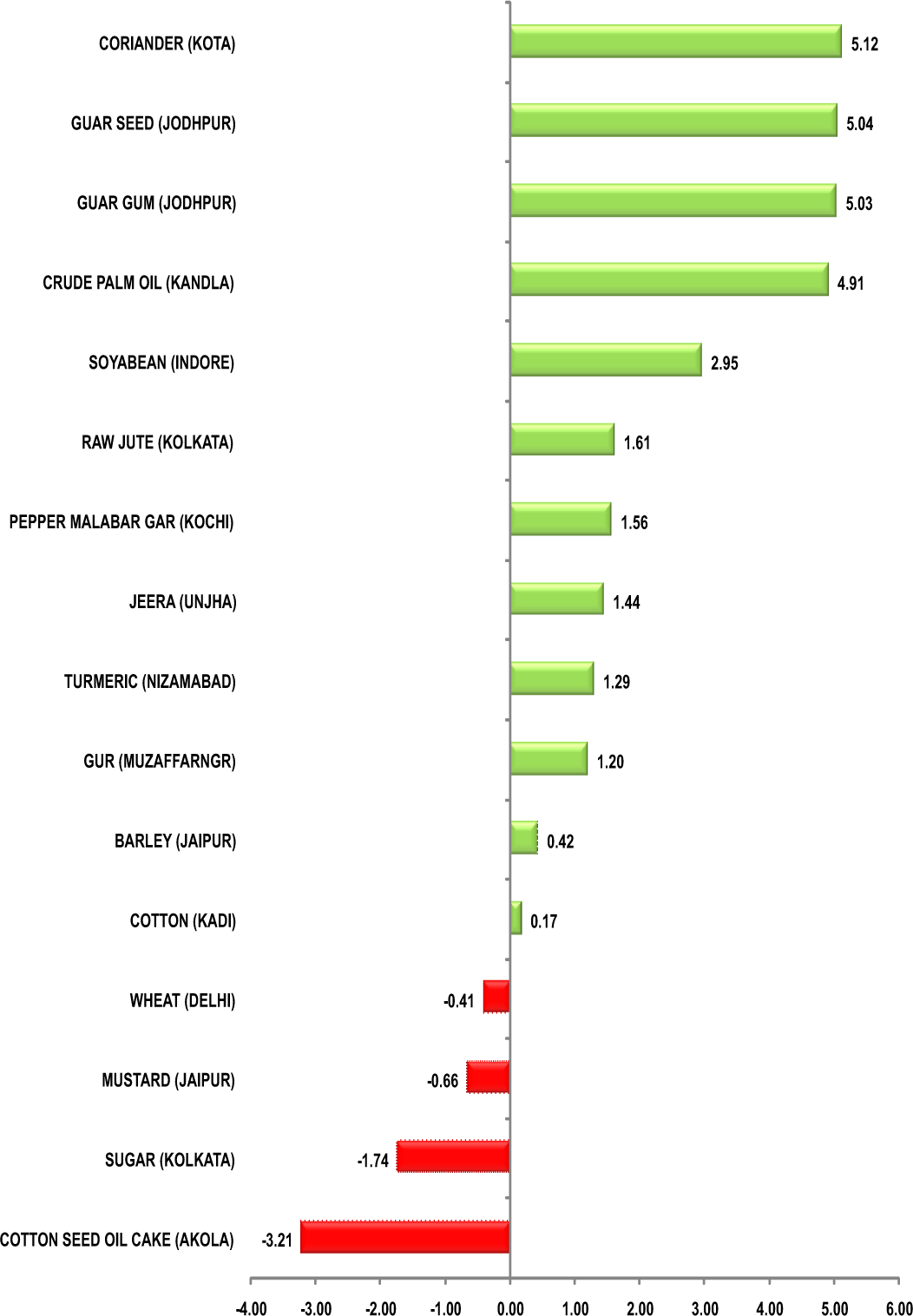

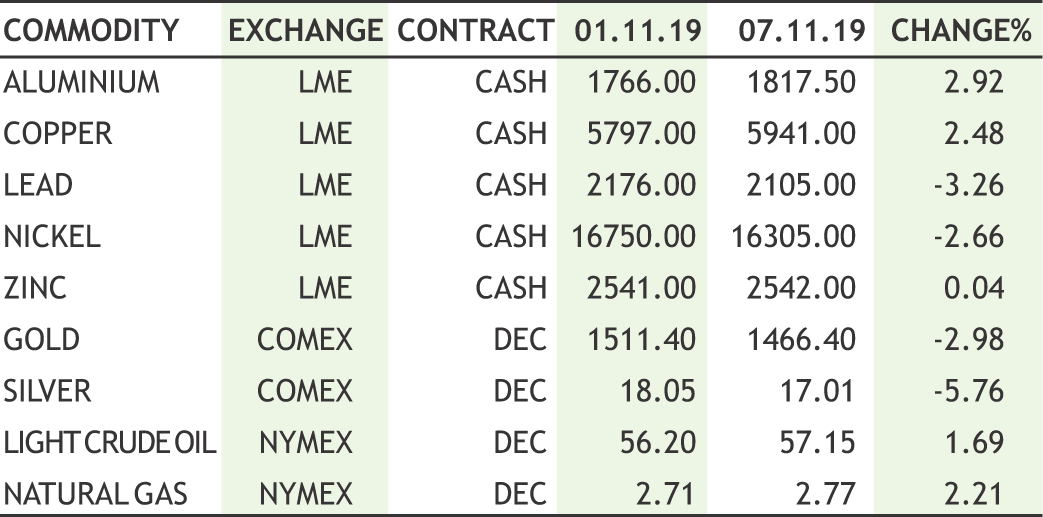

On the commodity market front, CRB traded higher in the week gone by but couldn’t sustain at higher levels. Some positive move in trade talk was the major trigger for the commodities. It seems that oil bulls are slowly returning and oil prices are creeping higher. The U.S. and China are expected to sign a partial trade deal later this month, and China is pressing the U.S. to remove more tariffs. The U.S. is already expected to delay the planned tariff hike in December, but markets are trading up on rising expectations that existing tariffs could be rolled back. GDP, Manufacturing Production, CPI of UK, German ZEW Economic Sentiment, RBNZ Interest Rate Decision, Core CPI, Fed Chair Powell Testifies, PPI and Retail Sales of US, GDP of Japan, Industrial Production of China, CPI of Euro Zone etc are few important triggers for commodities.

SMC Global Securities Ltd. (hereinafter referred to as “SMC”) is a registered Member of National Stock Exchange of India Limited, Bombay Stock Exchange Limited and its associate is member of MCX stock Exchange Limited. It is also registered as a Depository Participant with CDSL and NSDL. Its associates merchant banker and Portfolio Manager are registered with SEBI and NBFC registered with RBI. It also has registration with AMFI as a Mutual Fund Distributor.

SMC is a SEBI registered Research Analyst having registration number INH100001849. SMC or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities market.

SMC or its associates including its relatives/analyst do not hold any financial interest/beneficial ownership of more than 1% in the company covered by Analyst. SMC or its associates and relatives does not have any material conflict of interest. SMC or its associates/analyst has not received any compensation from the company covered by Analyst during the past twelve months. The subject company has not been a client of SMC during the past twelve months. SMC or its associates has not received any compensation or other benefits from the company covered by analyst or third party in connection with the research report. The Analyst has not served as an officer, director or employee of company covered by Analyst and SMC has not been engaged in market making activity of the company covered by Analyst.

The views expressed are based solely on information available publicly available/internal data/ other reliable sources believed to be true.

SMC does not represent/ provide any warranty express or implied to the accuracy, contents or views expressed herein and investors are advised to independently evaluate the market conditions/risks involved before making any investment decision.

DOMESTIC NEWS

Economy

• The Centre has announced a Rs 25,000 crore stimulus package for the ailing real estate sector. Finance Minister Nirmala Sitharaman announced that the government plans to give impetus to the housing market to revive over 1600 stalled housing projects covering 4.58 lakh units.

• Moody's Investor Service downgraded India's rating outlook and affirmed the sovereign ratings at 'Baa2'. The rating agency cut the rating outlook to 'negative' from 'stable' citing rising risks to economic growth and rising debt burden. A prolonged period of slower growth would dampen income growth and the pace of improvements in living standards.

Pharmaceuticals

• Aurobindo Pharma said the US Food and Drug Administration (US FDA) had issued Form 483 with 4 observations each for two of its manufacturing facilities — Unit 5 API facility at Pashamailaram and Unit 8 API facility at Gaddapotharam in Hyderabad.

• Zydus cadile has received a warning letter from the US health regulator for its Moraiya-based formulation facility. The company has already taken multiple steps after the inspection of the facility by the US Food and Drug Administration (USFDA) and would continue to take all necessary steps in future as well to ensure that the health regulator is fully satisfied with its remediation of the above facility.

• Biocon has received an establishment inspection report (EIR) from the US health regulator for its biologics drug product unit at Bengaluru. The US Food and Drug Administration has said the inspection is closed. The company had undergone good manufacturing norms compliance inspection of the unit from August 22-30.

Information Technology

• Infosys has set up a Digital Innovation Centre in Dusseldorf, Germany. The centre will help Infosys work more closely with its clients in the region in supporting their digital transformation journey, while focusing on next-generation business suites such as SAP HANA, as well as cloud based services, internet of things, 5G, artificial intelligence and machine learning.

Automobile

• Maruti Suzuki and Toyota Tsusho Group announced an equal joint venture, Maruti Suzuki Toyotsu India (MSTI), for vehicle dismantling and recycling. The venture will set up its vehicle dismantling and recycling unit in Noida in 2020-21 and will add more units. Maruti Suzuki Toyotsu will procure and dismantle end-of-life vehicles (ELVs).

Power

• Tata Power will create an arm, TP Renewable Microgrid, to set up 10,000 microgrids to provide power to five millions homes across the country. The TP Renewable Microgrid would be set up in collaboration with Rockefeller Foundation, which will provide technical support to the offshoot for achieving its objective.

INTERNATIONAL NEWS

• US initial jobless claims slid to 211,000, a decrease of 8,000 from the previous week's revised level of 219,000. Economists had expected jobless claims to dip to 215,000 from the 218,000 originally reported for the previous week.

• US labor productivity dipped by 0.3 percent in the third quarter after spiking by an upwardly revised 2.5 percent in the second quarter. The drop came as a surprise to economists, who had expected productivity to climb by 0.9 percent compared to the 2.3 percent jump originally reported for the previous month.

• US consumer credit rose by $9.5 billion in September after jumping by $17.9 billion in August. Economists had expected consumer credit to climb by $15.0 billion.

• The Bank of England maintained its key interest rate unchanged but two members sought a rate cut. Seven members of the Monetary Policy Committee voted to maintain the bank rate at 0.75 percent, while Jonathan Haskel and Michael Saunders preferred a quarter-point reduction.

• China's exports fell less than expected in October and imports declined for the sixth month in a row. In dollar terms, exports decreased 0.9 percent year-on-year in October, data from the General Administration of Customs reported.

• The average of household spending in Japan was up 9.5 percent on year in real terms in September, the Ministry of Internal Affairs and Communications said - coming in at 300,609 yen. That beat forecasts for an increase of 7.0 percent following the 1.0 percent gain in August.

| Stocks | *Closing Price | Trend | Date Trend Changed | Rate Trend Changed | SUPPORT | RESISTANCE | Closing S/l |

|---|---|---|---|---|---|---|---|

| S&P BSE SENSEX | 40654 | UP | 08.02.19 | 36546 | 36300 | 35300 | |

| NIFTY50 | 12012 | UP | 08.02.19 | 10944 | 10900 | 10600 | |

| NIFTY IT* | 15624 | UP | 21.07.17 | 10712 | 15200 | 14800 | |

| NIFTY BANK | 30633 | UP | 30.11.18 | 26863 | 27700 | 27000 | |

| ACC | 1527 | DOWN | 04.10.19 | 1488 | 1560 | 1590 | |

| BHARTIAIRTEL | 372 | UP | 15.03.19 | 338 | 360 | 345 | |

| BPCL | 513 | UP | 30.08.19 | 355 | 470 | 450 | |

| CIPLA | 472 | UP | 25.10.19 | 460 | 440 | 430 | |

| SBIN | 318 | UP | 01.11.19 | 314 | 285 | 275 | |

| HINDALCO | 205 | UP | 07.11.19 | 205 | 195 | 192 | |

| ICICI BANK | 479 | UP | 20.09.19 | 418 | 450 | 440 | INFOSYS | 720 | DOWN | 25.10.19 | 637 | 690 | 720 |

| ITC* | 266 | DOWN | 31.05.19 | 279 | - | 270 | |

| L&T | 1435 | UP | 20.09.19 | 1412 | 1430 | 1410 | |

| MARUTI | 7287 | UP | 13.09.19 | 6450 | 7100 | 6900 | |

| NTPC | 120 | DOWN | 16.08.19 | 118 | 126 | 130 | |

| ONGC | 142 | UP | 20.09.19 | 134 | 134 | 130 | |

| RELIANCE | 1459 | UP | 16.08.19 | 1278 | 1370 | 1340 | |

| TATASTEEL | 403 | UP | 01.11.19 | 396 | 375 | 365 | |

*ITC has breached the resistance of 260

Closing as on 07-11-2019

NOTES:

1) These levels should not be confused with the daily trend sheet, which is sent every morning by e-mail in the name of "Morning Mantra ".

2) Sometimes you will find the stop loss to be too far but if we change the stop loss once, we will find more strength coming into the stock. At the moment, the stop loss will be far as we are seeing the graphs on weekly basis and taking a long-term view and not a short-term view.

| Meeting Date | Company | Purpose |

|---|---|---|

| 13/11/2019 | Dabur India | 140% Interim Dividend |

| 14/11/2019 | Godrej Consumer | 200% Interim Dividend |

| 18/11/2019 | Exide Inds. | 160% Interim Dividend |

| 18/11/2019 | IndiabullsHous. | 350% Interim Dividend |

| 19/11/2019 | Manappuram Fin. | 27.5% Interim Dividend |

| Ex-Date | Company | Purpose |

|---|---|---|

| 11/11/2019 | Britannia Inds. | Quarterly Results |

| 11/11/2019 | Hindalco Inds. | Quarterly Results |

| 11/11/2019 | Coal India | Quarterly Results |

| 11/11/2019 | NMDC | Quarterly Results |

| 11/11/2019 | Mahanagar Gas | Quarterly Results |

| 11/11/2019 | Adani Ports | Quarterly Results |

| 12/11/2019 | Adani Enterp | Quarterly Results |

| 12/11/2019 | Aurobindo Pharma | Quarterly Results,Interim Dividend |

| 12/11/2019 | Sun TV Network | Quarterly Results,Interim Dividend |

| 13/11/2019 | Bata India | Quarterly Results |

| 13/11/2019 | Natl. Aluminium | Quarterly Results |

| 13/11/2019 | B H E L | Quarterly Results |

| 13/11/2019 | Adani Power | Quarterly Results |

| 13/11/2019 | Cadila Health. | Quarterly Results |

| 13/11/2019 | Muthoot Finance | Quarterly Results |

| 14/11/2019 | BalkrishnaInds | Quarterly Results,Interim Dividend |

| 14/11/2019 | CESC | Quarterly Results |

| 14/11/2019 | Grasim Inds | Quarterly Results |

| 14/11/2019 | Apollo Hospitals | Quarterly Results |

| 14/11/2019 | S A I L | Quarterly Results |

| 14/11/2019 | Union Bank (I) | Quarterly Results |

| 14/11/2019 | O N G C | Quarterly Results |

| 14/11/2019 | Power Fin.Corpn. | Quarterly Results |

| 14/11/2019 | NBCC | Quarterly Results |

| 14/11/2019 | Glenmark Pharma. | Quarterly Results |

4

5

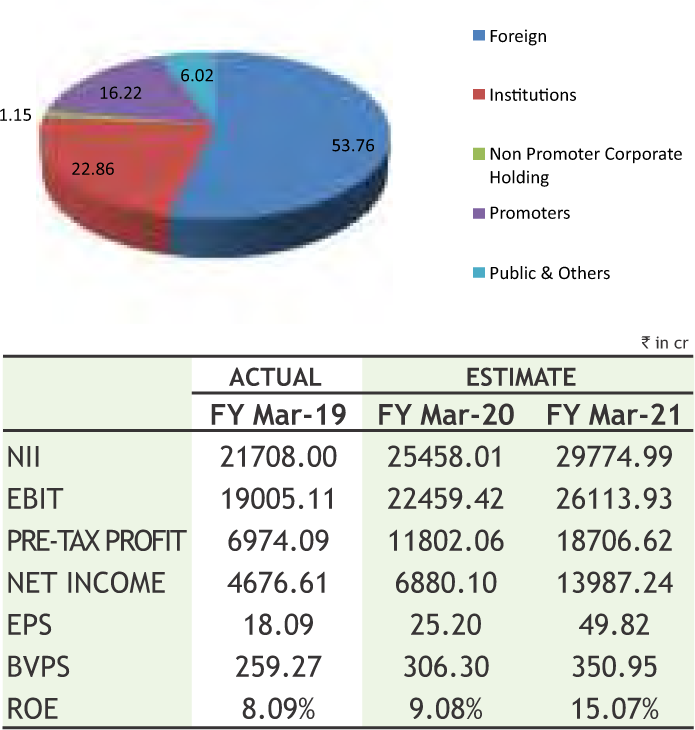

Axis Bank Limited

CMP: 734.65

Target Price: 856

Upside: 17%

| Face Value (Rs.) | 2.00 |

| 52 Week High/Low | 826.55/580.00 |

| M.Cap (Rs. in Cr.) | 207115.20 |

| EPS (Rs.) | 16.60 |

| P/E Ratio (times) | 44.27 |

| P/B Ratio (times) | 2.07 |

| Stock Exchange | BSE |

Investment Rationale

• The Bank’s Advances grew 14% YoY to Rs.5,21,594 crores as on 30th September 2019. Domestic loans grew 19% while the overseas book de-grew by 25%. Retail loans grew 23% YOY to Rs. 2,73,223 crores and accounted for 52% of the Net Advances of the Bank. The total deposits on Quarterly Average Basis (QAB) grew by 23%. CASA and Retail Term deposits on a QAB basis put together recorded a growth of 21% YOY. On a period end basis, the total deposits grew 22% YOY.

• Net Interest Margin for the quarter improved 11 bps QoQ and stood at 3.51%. Domestic NIM was 3.63%. NII grew 17% QoQ to Rs.6102 crores from Rs.5232 crores.

• In percentage terms, Gross Non Performing Asset (GNPA) fell to 5.03% as of September 2019 as compared to 5.25 % as of June 2019. In percentage terms, Net Non Performing Asset (NNPA) fell to 1.99% as of September 2019 as compared to 2.04% as of June 2019.

• The Bank’s Capital Adequacy Ratio (CAR) remains stable. Under Basel III, Total CAR & Tier I stood at 18.23% and 15.03% respectively.

• The Bank has fully recognized the necessary impairment and the resultant provisioning impact of the asset reclassification as per Reserve Bank of India (RBI) assessment,

• According to the management of the company, Bank's Execution strategy 2022 pivots on delivery of growth and profitability on a sustainable basis with the intention to get back to 18% ROE levels.

• The bank continues to expect its loan growth to be

5-7% faster than industry. Cost to Assets is expected to consolidate around current levels and aimed to reach 2% over the medium term. The bank now expects Net Interest Margin for FY20 to be higher than NIM in FY19 and bank reiterates medium term range of 3.5%-3.8% on NIM.

Risk

• Regulatory norms

• Unexpected slippages

Valuation

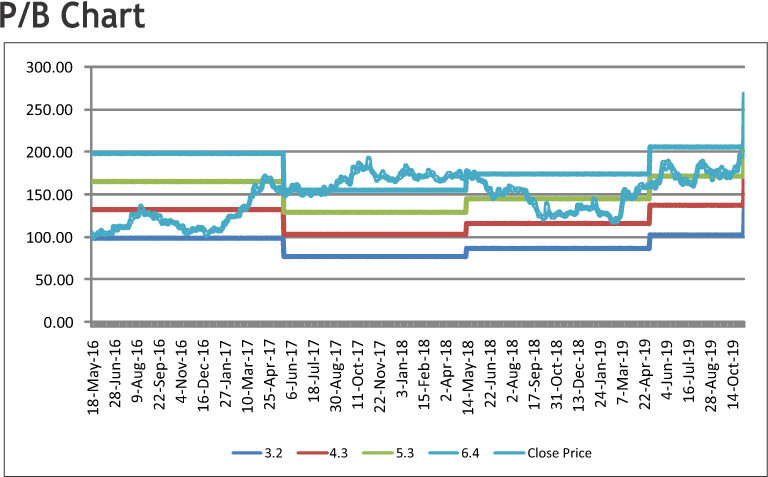

With the strong operating metrics, stressed asset resolution and robust return ratios, the stock is expected to move further. Retail Bank continues to be the bedrock of Bank's financial performance and strong execution, robust distribution and digital proliferation would help the Bank to gain strong market share and improve customer experience. Thus, it is expected that the stock may see a price target of Rs.856 in 8 To 10 months time frame on target P/BV of 2.44x and FY21 BVPS of Rs.350.95.

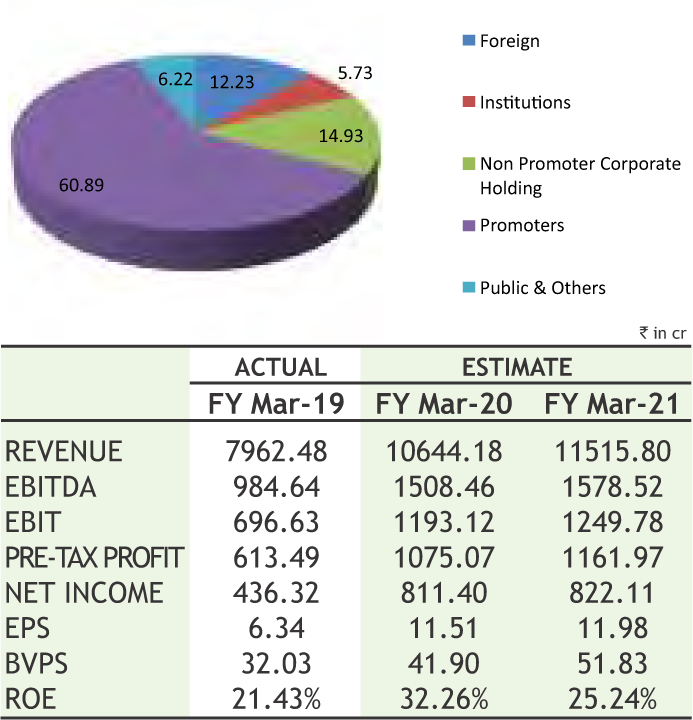

Gujarat Gas Limited

CMP: 194.10

Target Price: 223

Upside: 15%

| Face Value (Rs.) | 2.00 |

| 52 Week High/Low | 217.00/116.00 |

| M.Cap (Rs. in Cr.) | 13361.65 |

| EPS (Rs.) | 14.88 |

| P/E Ratio (times) | 13.05 |

| P/B Ratio (times) | 4.66 |

| Dividend Yield (%) | 0.52 |

| Stock Exchange | BSE |

Investment Rationale

• Gujarat Gas Limited (GGL), is the largest City Gas Distribution player with its presence spread across 23 Districts in the State of Gujarat, Union Territory of Dadra & Nagar Haveli and Thane Geographical Area (GA) (excluding already authorised areas), which includes Palghar District of Maharashtra. In 10th CGD bidding round announced by PNGRB, the company has won 6 GAs comprising of 17 cities in the state of Punjab, Haryana, Madhya Pradesh and Rajasthan, making GGL a pan India Company.

• The company has around 23,200 kms of gas pipeline network. It has around 344 CNG stations and distributes approximately 8.5 mmscmd of natural gas to about 13,55,000 households, approximately 2 lakh CNG vehicles (serving per day) and to over 3540 industrial customers.

• The management of the company is aiming at setting up more than 63 CNG stations in financial year 2020, for the target to increase volume of 9-9.5 mmscmd in FY20. The debt stands at Rs 1,800 crore and the management of the company is looking at EBITDA margin of around 13 Percent in FY20.

Government of Gujarat has also initiated a CNG Sahbhagi Scheme and also pushing for this market in other way and have eased land requirement from 1000 square meter to about 500-550 square meter and permission process has been fastened in Gujarat now

• So ecosystem around the company has been improved due to that effort and in last budget, Gujarat government allocated 1,000 crore for CNG buses. Therefore, all these will help it to improve its CNG volumes and that needs to push more CNG

stations in time to come.

Risk

• Fluctuation in commodity prices

• Regulatory changes

Valuation

The company has strong & steady revenue growth momentum and sustainable margins. It shall continue to focus on growing the penetration in the current operating areas by increasing the PNG connections and additional CNG stations while tapping the untapped potential by expeditious rollout of distribution network in the newly acquired geographic areas as well. With this focused endeavor, GGL shall continue its efforts in providing clean fuel solutions across all operational area to augment an energetic top-line and bottom-line in coming years. Thus it is expected that the stock will see a price target of Rs. 223 in 8-10 months time frame on an expected PBV multiple of 4.3 times and FY21E BVPS of Rs. 51.83. l

Source: Company Website Reuters Capitaline

Above calls are recommended with a time horizon of 8 to 10 months.

6

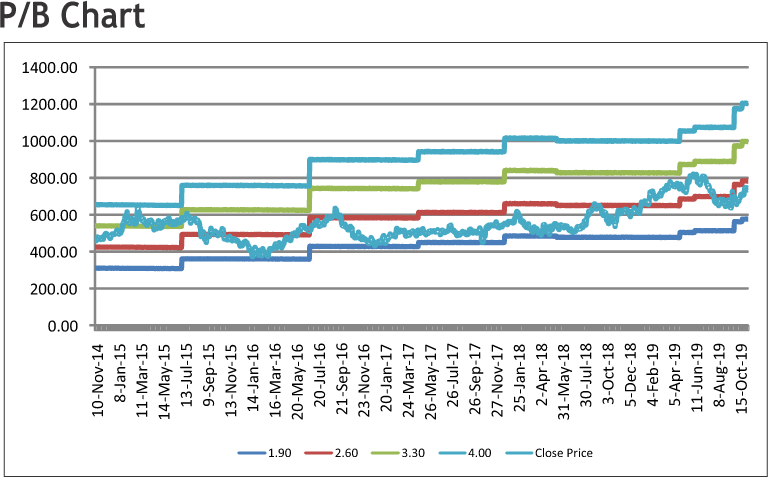

The stock closed at Rs 8832.90 on 07th November, 2019. It made a 52-week low of Rs 5516.59 on 12th November 2018 and a 52-week high of Rs. 8887.75 on 05th November 2019. The 200 days Exponential Moving Average (DEMA) of the stock on the daily chart is currently at Rs 7434.79

As we can see on chart that stock is trading in higher highs and higher lows on broader charts, which is bullish in nature. Apart from this, it was forming a “Cup and Handle” pattern on weekly charts and has given the breakout of same during last week and also has managed to close above the same. So buying momentum is expected to continue in coming days. Therefore, one can buy in the range of 8750-8760 levels for the upside target of 9500-9700 levels with SL below 8350.

The stock closed at Rs 212.50 on 07th November, 2019. It made a 52-week low at Rs 177.70 on 22nd August 2019 and a 52-week high of Rs. 271.85 on 09th November 2018. The 200 days Exponential Moving Average (DEMA) of the stock on the daily chart is currently at Rs 223.31

After giving sharp correction from levels, stock made yearly low of 178 in short span of time and started moving higher. Moreover, stock has formed “Double bottom” pattern around 178-180 levels and has started moving higher. On the technical indicators front, RSI and MACD are also suggesting buying for the stock so, we can expect more upside in coming days. Therefore, one can buy in the range of 206-208 levels for the upside target of 225-230 levels with SL below 195.

Disclaimer : The analyst and its affiliates companies make no representation or warranty in relation to the accuracy, completeness or reliability of the information contained in its research. The analysis contained in the analyst research is based on numerous assumptions. Different assumptions could result in materially different results.

The analyst not any of its affiliated companies not any of their, members, directors, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of the analysis research.

SOURCE: CAPITAL LINE

Charts by Spider Software India Ltd

Above calls are recommended with a time horizon of 1-2 months

7

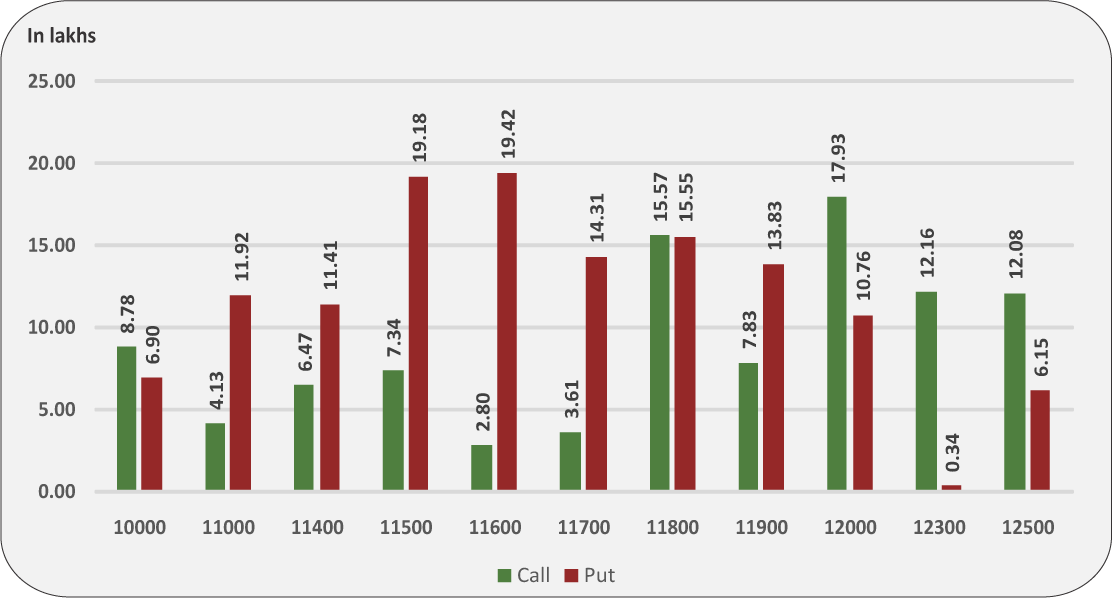

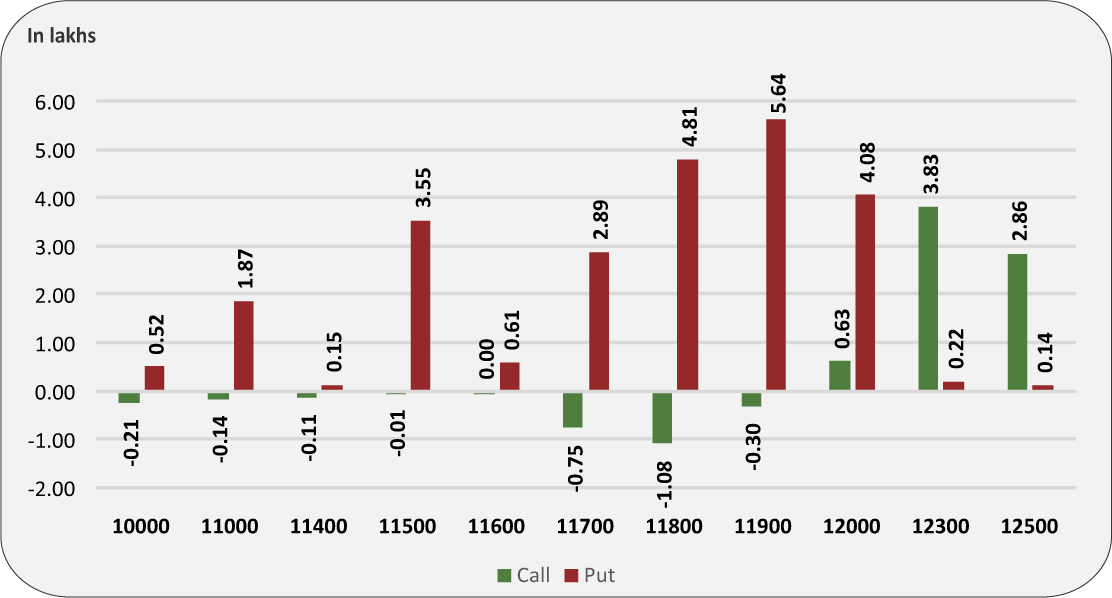

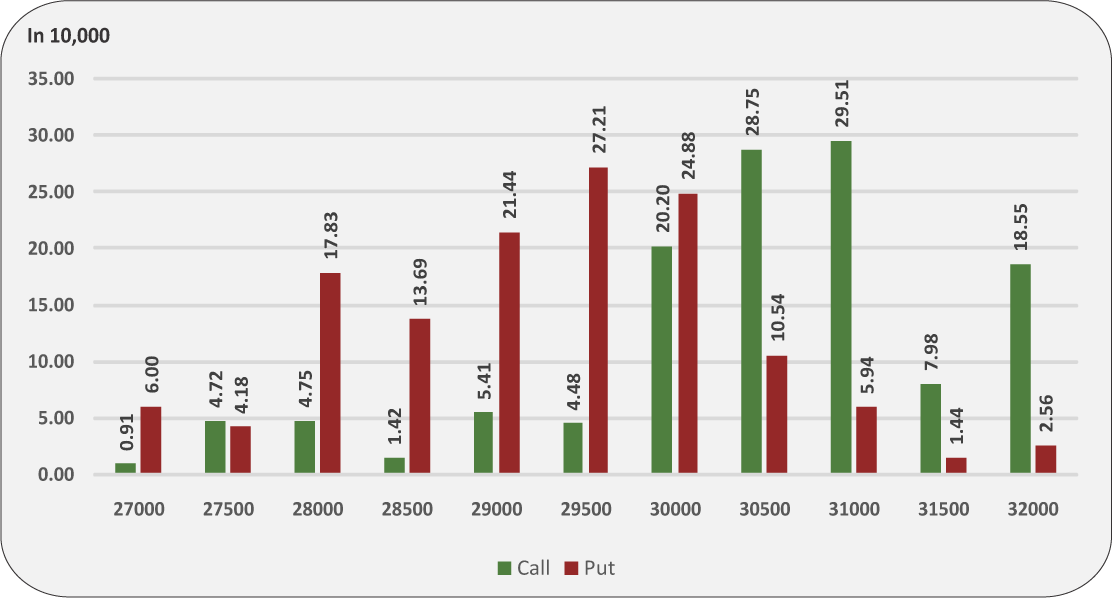

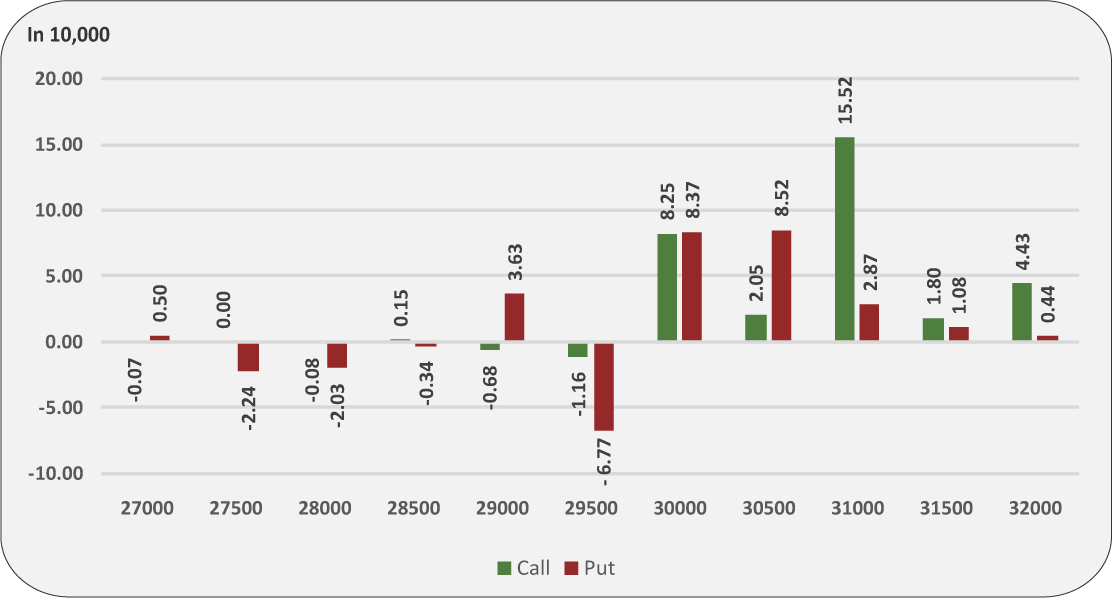

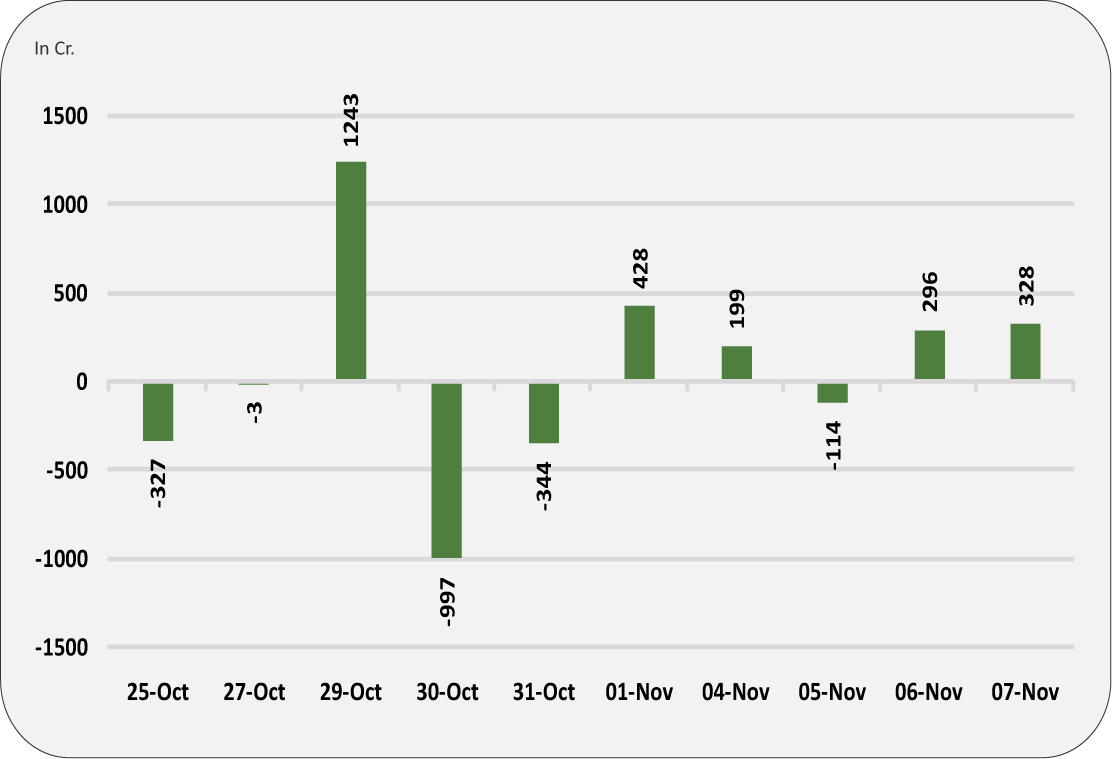

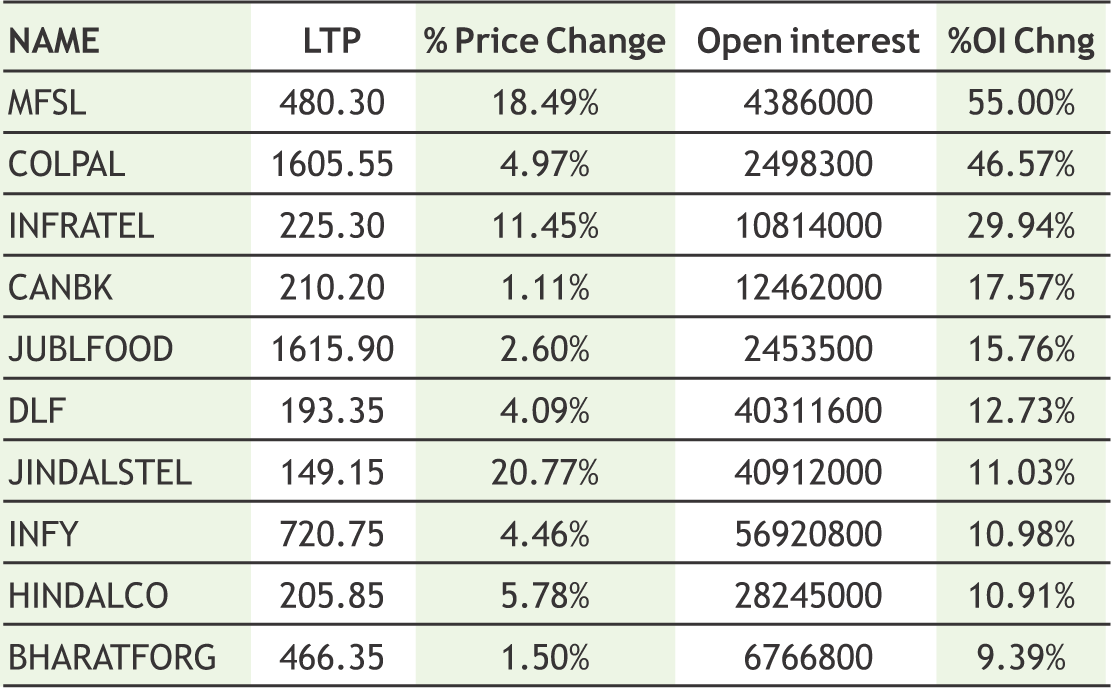

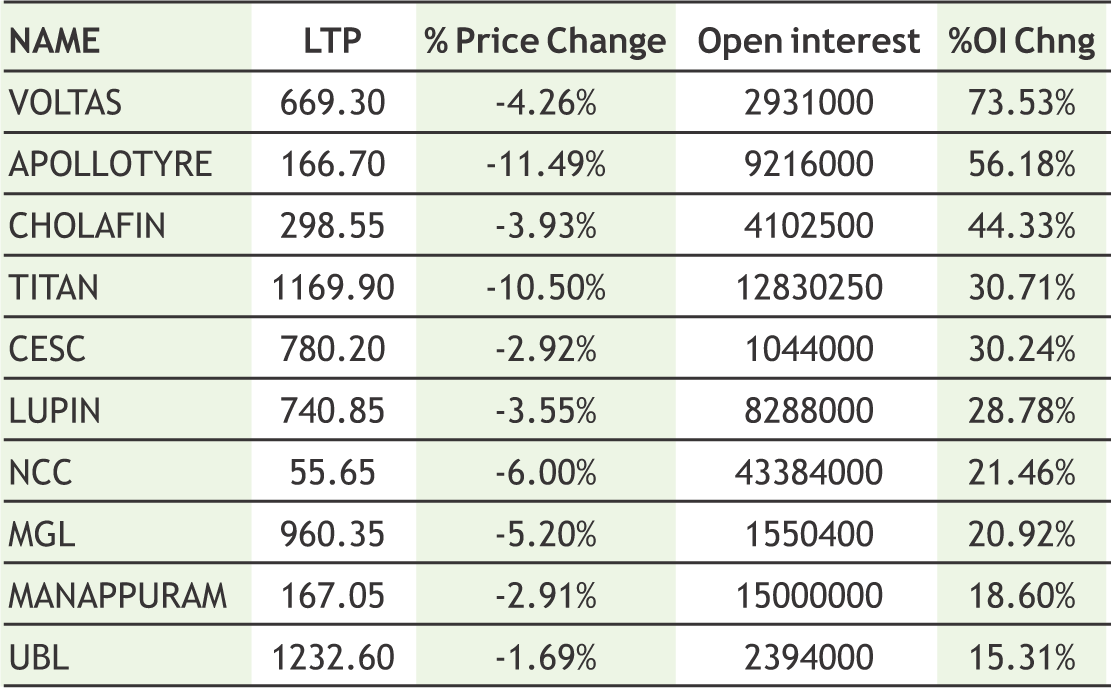

Indian markets remained volatile during the week gone by, with Nifty scaling above 12000 mark alongside BSE Sensex making its record high. The volatility remained high in the Indian markets on the back of Q2 earnings and other micro and macro economic factors. However, from the derivative data front, once again call writers at 11800 & 11900 strike were seen covering their short positions while put writers added hefty open interest at 11900 strike. On the higher side, still 12000 levels is holding up with the highest open interest, which should act as strong hurdle as of now for coming sessions. From the technical front, still we are trading into a positive territory as markets are continuously maintaining their uptrend with formation of higher high and higher low patterns on daily and weekly interval. The Implied Volatility (IV) of calls was up and closed at 13.09% while that for put options closed at 14.15%. The Nifty VIX for the week closed at 15.21% and is expected to remain volatile. PCR OI for the week closed at 1.24, which points towards put writing and is positive for markets. For next week, we believe that the bullish biasness is likely to continue in Indian markets with banknifty once again taking a lead to move towards 31500 levels.

8

|

|

|

|

**The highest call open interest acts as resistance and highest put open interest acts as support.

# Price rise with rise in open interest suggests long buildup | Price fall with rise in open interest suggests short buildup

# Price fall with fall in open interest suggests long unwinding | Price rise with fall in open interest suggests short covering

9

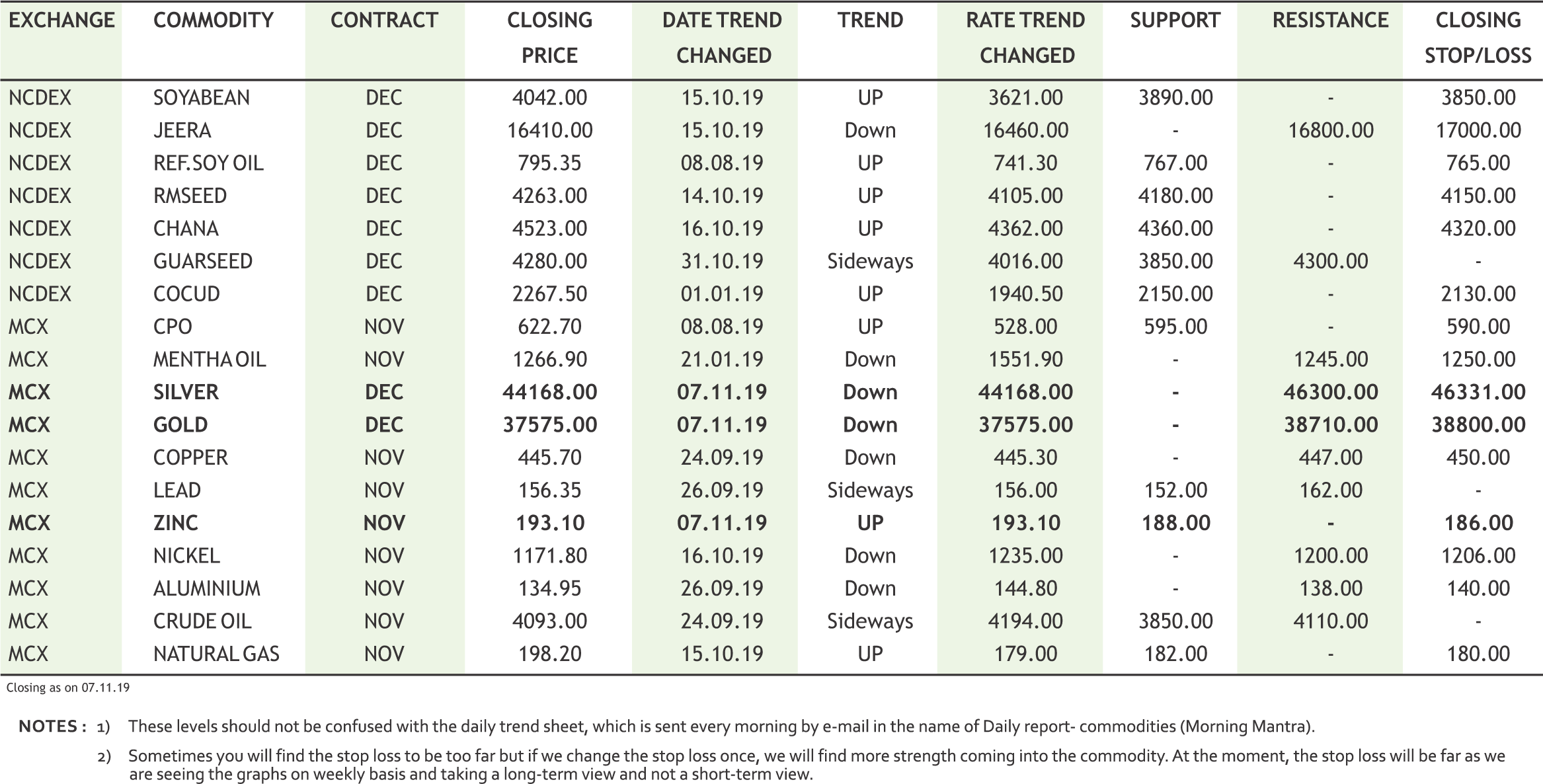

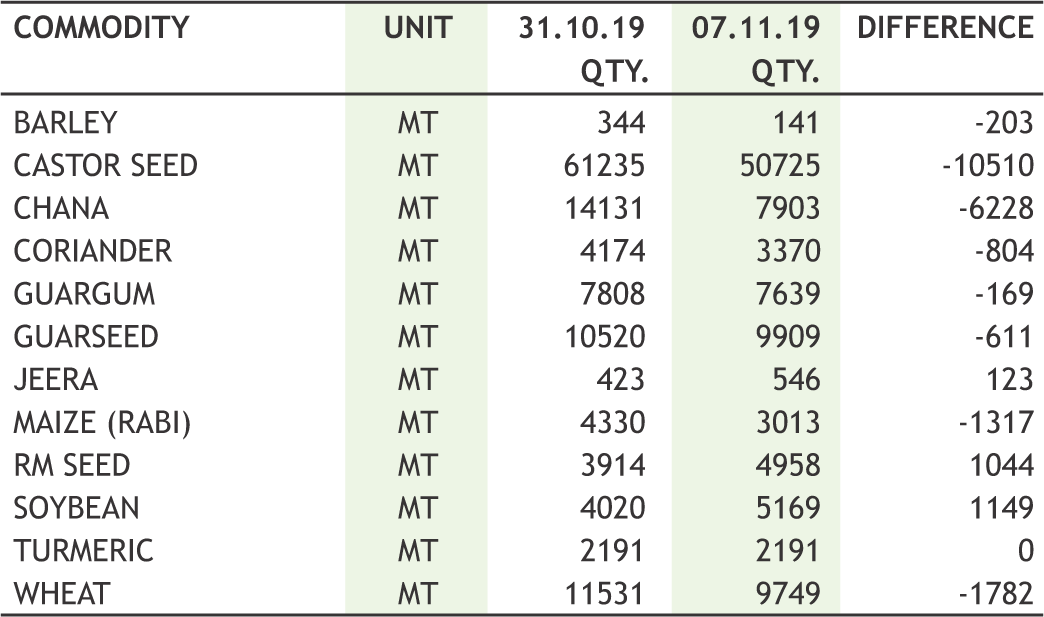

Turmeric futures (Dec) is likely to remain below 6500 & move in negative direction towards 6050-5950 levels. As per trade sources, demand remained lackluster in the market as quality of spice that is being supplied reported inferior. Finger turmeric was sold at Rs.5,700-7,269 a quintal, while the root variety was sold at Rs.5,389-6,559 at the Erode Turmeric Merchants Association Sales yard. Jeera futures (Dec) will possibly trade with a downside bias, may even break the near term support of 16200 & descend further to test 16000-15800 levels. As per traders, unfavorable weather conditions in Gujarat have led to delays in sowing for the new season by around 10-15 days but output is unlikely to be affected. Instead yield may remain higher this year. Dhaniya futures (Dec) is expected to hold on to the support near 6630 levels & trade with an upside bias till 7000-7100 levels. Unfavorable weather conditions in the major growing areas have led to delays in sowing for the new season by around 10-15 days. Cardamom futures (Dec) may fall further towards 2300-2200 due to lack of fresh cues of demand from the auctions. According to the traders, the major buyers catering to northern part of the country are not aggressively buying from the market. The different qualities of cardamom traded in the auctions are also giving a negative impact to the prices. The weak trend seemed have forced planters to release more stocks to garner comfortable revenue. It is reported that cardamom traded lower with an average price realization of Rs 2,707 per kg at the auctions held at Spices Park in Puttady.

Bullion counter may witness selling pressure on optimism of US China trade deal and stronger greenback but short covering at lower levels cannot be denied. Gold can further dip lower towards 37000 while taking resistance near 38400 while silver can test 43000 while taking resistance near 45400. China and the United States have agreed to cancel, in phases, the tariffs imposed during their months-long trade war, the Chinese commerce ministry stated, without specifying a timetable. In recent US economic data new orders for U.S.-made goods fell more than expected in September and business spending on equipment was slightly weaker than initially thought, suggesting that manufacturing remains soft amid the U.S.-China trade war. U.S. Federal Reserve cut interest rates for the third time this year to help sustain American growth, but signalled there would be no further reductions unless the economy took a turn for the worse. Minneapolis Federal Reserve Bank President Neel Kashkari stated that U.S. monetary policy is now “modestly accommodative,” a view that puts him on the same page as most of his colleagues at the U.S. central bank. According to the World Gold Council (WGC)”India's gold demand is expected to fall to its lowest level in three years in 2019”. Gold demand in 2019 could drop 8% from a year ago to around 700 tonnes, the lowest since 2016. India's gold consumption in the quarter ended September slumped nearly a third from a year ago to 123.9 tonnes. China just hit the pause button on its gold-buying spree. Meanwhile China kept holdings level 62.64 million ounces in October, unchanged from a month earlier.

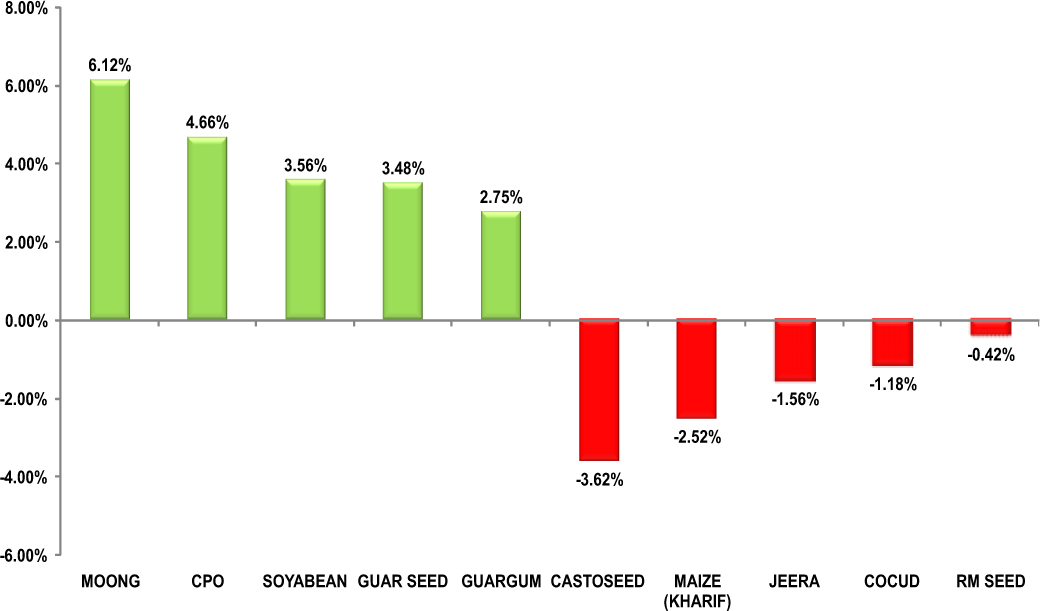

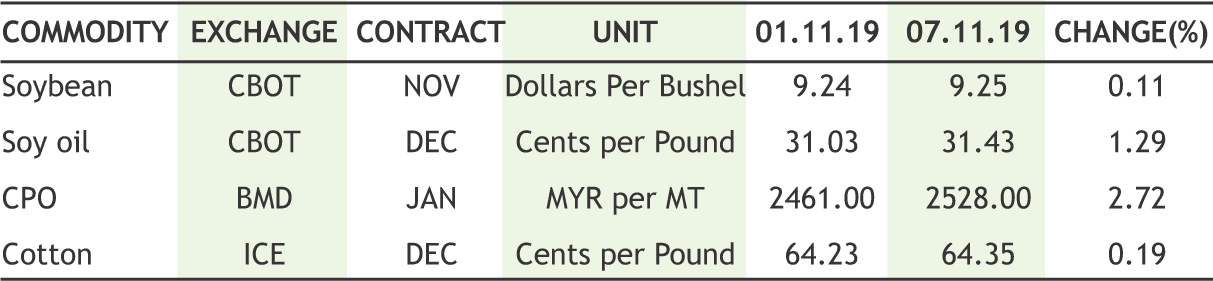

Soybean futures (Dec) is trading around its highest in around three and a half years on concerns about the crop in Maharashtra and Madhya Pradesh. This bullishness is likely to continue & day’s ahead it can test 4200 levels. Soybean prices are zooming up in spot markets on good demand from local crushing plants amid weak supply from producing regions. Sharp rise in soybean oil & soymeal is also jacking up prices. On the CBOT, U.S soybean futures (Dec) is expected to trade with a positive bias in the range of $9.10-9.40 a bushel. The market participants are optimistic about the resolution coming up in U.SChina trade war. The implementation of a trade deal in November appears set to change the nature of soybean exports over the next year. Mustard futures (Dec) is expected to trade with a downside bias towards 4200-4150, facing resistance near 4300 levels owing to declining pace of demand from crushers. Mustard seed crushing by mills in India declined 16.7% on year to 500,000 tons in October, according to Mustard Oil Producers Association of India data. Secondly, the inventories with processors, stockists, and state-run agencies were at 1.4 million tons, while farmers had 1.3 million tons in October. The trend of edible oils in the domestic market continues to remain bullish on the back of the news that the commerce ministry has asked the agriculture ministry to prepare a road map for told ‘zero edible oil import’ plan. In days to come, CPO futures (Nov) is expected to trade further to test 630, while soy oil futures (Dec) may give a break out above 800 to test 810-815 levels.

Crude oil prices may continue to witness volatile movement as positive news regarding US China trade war to lift the sentiment but surge in inventories likely to cap the upside. Crude oil may face resistance near 4200 while taking support near 3850 levels. Trade war between the world’s two biggest economies has slowed economic growth around the world and it has impacted global oil demand. U.S. crude oil stockpiles rose sharply recently as refineries cut output and exports dropped, while refined products extended a multiweek drawdown. Gasoline and distillate inventories dropped 2.8 million barrels and by 622,000 barrels respectively. Markets have been eyeing a possible extension, or even a deepening, early next year of OPEC’s current production curbs, which have been supporting oil prices. Russia lowered its oil output to 11.23 million barrels per day (bpd) last month from 11.25 million bpd in September, but again missed its obligations under a pact to curb production. Natural gas may witness further upside momentum and buy on dips should be the strategy as colder weather conditions in US will increase its demand. Natural gas can further move upside towards 215 while taking support near 185. The weather is also expected to be much colder than normal over the next 6-10 and then turn slightly milder over the 8-14 days forecast according to the latest estimates from the National Oceanic Atmospheric Administration. Large parts of US may experience record low temperatures as an Arctic blast sweeps across Midwest and Northeast through the middle of next week.

Cotton futures (Nov) may continue to take support near 19250, while on the contrary, it may face resistance near 19650 levels. Overall, it is expected to trade sideways as the market participants are watching multiple factors ranging from developments of U.S-China trade war, arrivals in the domestic market, U.S crop progress as well as export sales data & INR movement against Dollar. On the spot, cotton prices ruled steady in Gujarat, Maharashtra and Andhra Pradesh amid sluggish trading activities.While, prices are trading lower in Madhya Pradesh, Telangana and Karnataka due to higher arrivals and limited demand. This season the total new crop arrivals so far this season have reached 2,137,000 bales, down 43.09 percent from 3,755,000 bales arrived during the same period last year. In the international market, ICE cotton futures (Dec) may trade sideways in the range of 63-66 cents per pound. Positive vibes from the US-China trade front are likely to lend support to this soft commodity. China and the United States have agreed to cancel, in phases, the tariffs imposed during their protracted trade war, the Chinese commerce ministry said, without specifying a timetable. Chana futures (Dec) may witness correction towards 4450-4420, facing resistance near 4555 levels. This commodity is under pressure at major markets amid limited physical buying as per immediate requirement from crushing. Demand and sale counters in Chana dal and besan are also being reported thin. Moreover, sentiments are still under pressure as Nafed planning to sell procured stock around 10 lakh tonnes state wise in next three month. Plunging stocks at the MCX-accredited warehouses since past five consecutive weeks may act as catalyst to the upside momentum for menthe futures.

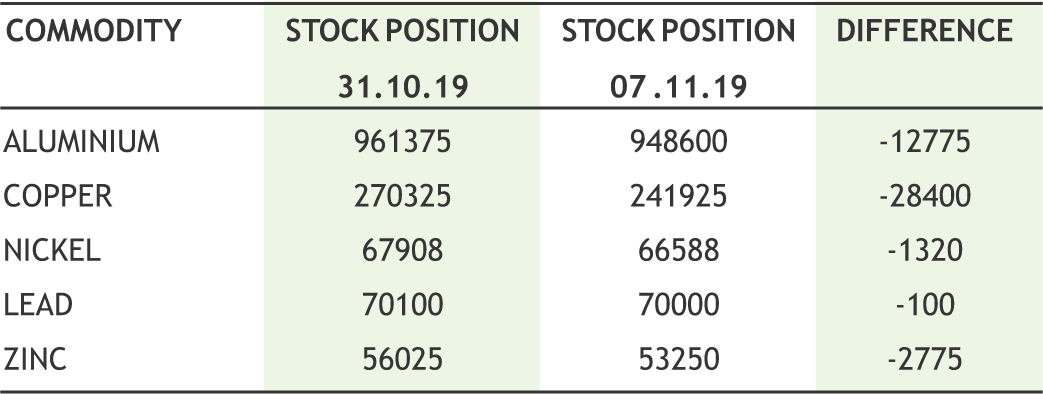

Base metal counter can witness positive movement on hope of partial trade deal between China and US. Meanwhile China’s exports and imports contracted less than expected in October, providing some relief for the export-reliant economy as Beijing tries to reach a partial trade deal with Washington. Copper may trade sideways to upside bias as it can test 453 levels by taking support near 435. Antofagasta doubled its forecast production cut from Chile to about 10,000 tonnes this year due to the protests. Still, that was a tiny percentage of the company’s total production of 725,300 tonnes of copper in 2018. Meanwhile, Lead may remain sideways as it can move range of 152-160 levels. Zinc may witness lower level buying as it can test 200 levels while taking support near 187 levels. LME cash zinc’s premium over the threemonth contract rose to $62 a ton, which is the highest since July 1, as high premium indicates near-term shortages of metal in the LME system. Nickel prices can move with sideways to positive bias as it can recover towards 1210 while taking support near 1150. Indonesia has allowed some nickel ore exporters to resume shipments following a temporary halt to investigate reports of violations. Indonesia, the world’s largest nickel ore exporter, temporarily stopped ore shipments on Oct. 28 following reports that monthly exports had surged nearly three-fold after the government announced it was bringing forward an export ban by two years to January 2020. Aluminum can recover towards 138 while taking support near 130 levels.

10

|

ALUMINIUM MCX (NOV) contract closed at Rs. 134.95 on 07th Nov’19. The contract made its high of Rs. 142.05 on 24th Sep’19 and a low of Rs. 130.50 on 25th Oct’19. . The 18-day Exponential Moving Average of the commodity is currently at Rs. 134.39. On the daily chart, the commodity has Relative Strength Index (14-day) value of 49.130.

One can buy between Rs. 131-132 for a target of Rs. 140 with the stop loss of Rs. 128.

ZINC MCX (NOV) contract closed at Rs. 193.10 on 07th Nov’19. The contract made its high of Rs. 193.55 on 07h Nov’19 and a low of Rs. 181.25 on 03rd Oct’19. The 18-day Exponential Moving Average of the commodity is currently at Rs. 189.80. On the daily chart, the commodity has Relative Strength Index (14-day) value of 62.918.

One can buy near Rs. 190 for a target of Rs. 202 with the stop loss of Rs. 184.

GUARSEED NCDEX (DEC)contract was closed at Rs. 4280.50 on 07th Nov’19. The contract made its high of Rs. 4319.00 on 07th Nov’19 and a low of Rs. 3841.00 on 03rd Oct’19. The 18- day Exponential Moving Average of the commodity is currently at Rs. 4143.40. On the daily chart, the commodity has Relative Strength Index (14-day) value of 66.998.

One can buy near Rs. 4220 for a target of Rs. 4500 with the stop loss of Rs 4080.

11

• The commerce ministry has asked the agriculture ministry to prepare a road map for India to attain selfsufficiency in edible oil production.

• The export of oilmeals during October 2019 is provisionally reported at 105,085 tons compared to 233,867 tons in October, 2018 i.e. down by 55%. - The Solvent Extractors’ Association of India

• China and the U.S. have agreed to proportionally roll back tariffs on each other’s goods in phases, a Ministry of Commerce spokesman said.

• Production of Malaysian palm oil products for October 1- 31 was up 1.02% compared to the same period a month ago. - Malaysia Palm Oil Association

• US net cotton sales were at 164,500 RB for the week ended October 31 in the marketing year 2019/2020, up 52% from the previous week and 2% from the prior 4- week average.

• In October, China’s imports shrank 6.4% from a year earlier for the sixth consecutive month.

• Moody’s have downgraded India’s credit ratings outlook to “negative”.

• India is planning to impose anti-subsidy duty for a period of five years on copper wire rods from Indonesia, Malaysia, Thailand and Vietnam.

• Euro zone economic growth is set to slow more than expected as the bloc's manufacturing crisis could spill over to the larger services sector under protracted global trade tensions.

• Growth in demand for fuel in India is on course to fall to its lowest in at least six years as the economy slows.

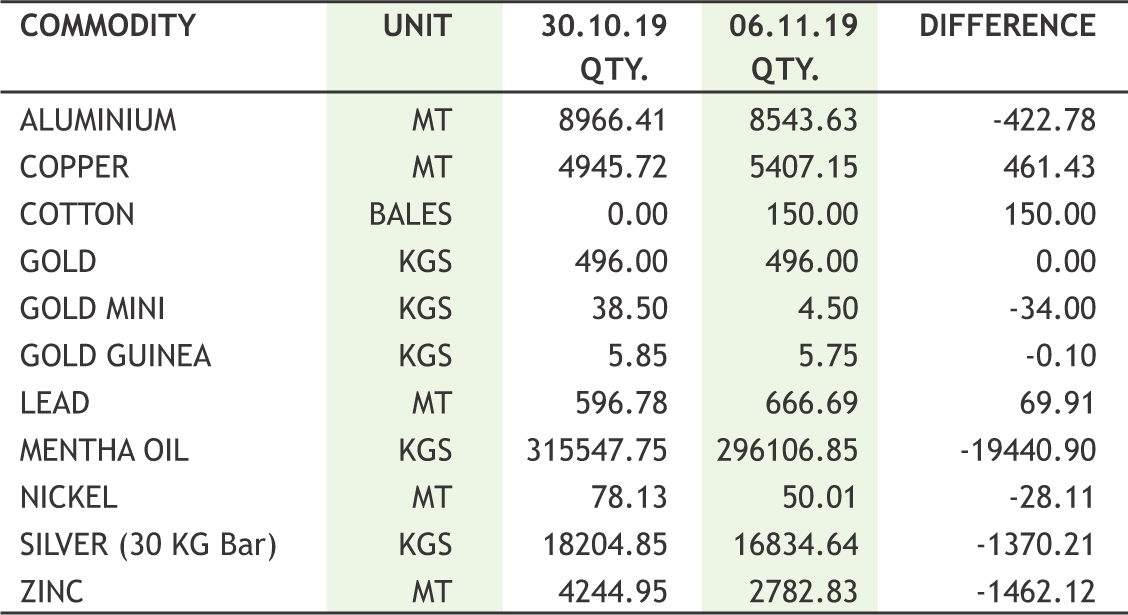

CRB traded higher in the week gone by but couldn’t sustain at higher levels. Some positive move in trade talk was the major trigger for the commodities. Oil prices moved higher at the start of the week as signs of a trade breakthrough between the U.S. and China continue to gain steam and OPEC hints at making deeper production cuts. While bearish sentiment continued in oil markets, with OPEC revising down its oil demand projections once again. OPEC said that demand for its oil will be lower than expected over the next five years, due to rising U.S. shale production. The group said that demand for its oil would average 32.8 mb/d by 2024; a sharp cut from the 35 mb/d in last year’s forecast. Natural gas prices moved up, though some of the gain erased on technical weakness amid profit booking from the higher side. Some base metals reacted positively; only nickel and lead moved down. The U.S. and China are expected to sign a partial trade deal later this month, and China is pressing the U.S. to remove more tariffs. The U.S. is already expected to delay the planned tariff hike in December, but markets are trading up on rising expectations that existing tariffs could be rolled back. It was negative news for bullion counter. Gold lost as much as $30 an ounce, Treasuries tumbled the most since summer and defensive equities sank. Gold hit three-month lows on Thursday and was headed for its biggest losing week since 2017. Silver followed the negative trend of gold too.

Edible oil and oil seeds counters performed well; except mustard which saw some healthy profit booking after a strong upside ride. The sentiments are strong due to rise in demand for the fresh crop from stockists and oil millers. A likely disruption in supply due to continuous rainfall in some parts of Madhya Pradesh also stimulated buying. In a new development’ the commerce ministry has asked the agriculture ministry to prepare a road map for India to attain self-sufficiency in edible oil production. The aim is to help farmers and local industry, apart from reducing the current account deficit. Cotton counter was weak as the damaged crop has higher moisture content and at present. Menthe prices strengthened owing to lower level buying from the pharma industries for medicinal purpose ahead of winter season & plunging stocks at the MCXaccredited warehouses since past four consecutive weeks. Jeera was marginally higher as the rains in the key growing regions of Gujarat and Rajasthan which is likely to delay sowing by around 10-15 days.

|

|

12

|

|

Most of the agricultural commodities traded on the domestic exchanges are under the “Compulsory Delivery” system wherein it is mandatory for sellers to deliver goods upon the expiry of the contract. The Regulator introduced a system of staggered delivery in Compulsory Delivery contracts in a move which gives the seller an option to tender delivery much before the expiry of the contract. So staggered delivery period is the period, beginning of few working days prior to expiry of any contract and ending with expiry, during which sellers/buyers having open position may submit an intention to give/take delivery. Currently all compulsory delivery commodity futures contracts (agriculture commodities as well as non-agriculture commodities) have a staggered delivery period. The minimum duration of staggered delivery period is at least five working days.

In the interest of trade and public, Exchanges have the flexibility to set higher duration of staggered delivery period for any commodity futures contract, as deemed fit, taking into account of various factors such as historical open interest, volume near expiry etc. In this regard, for the benefit of the market participants, all the exchanges jointly prepare and publish a detailed framework outlining various circumstances and factors which would generally require longer duration of staggered delivery period in any commodity.

Framework:

• Seller/buyer having open position has an option, of submitting an intention of giving/taking delivery, on any day during the staggered delivery period.

• On each day (except for the expiry day), Exchange shall allocate intentions received to give delivery during the day, to buyers having open long position as per random allocation methodology to ensure that all buyers have an equal opportunity of being selected to receive delivery irrespective of the size or value of the position. However, preference may be given to buyers who have marked an intention of taking delivery, which may be based on aspects such as location, quality etc.

• Pay-in and pay-out for the allocated deliveries shall happen within 2 working days after allocation.

• All open positions after expiry of the contract shall result in compulsory delivery and be settled at Final Settlement Price (FSP) of the respective contract and pay-in and pay-out shall happen latest by the 2nd working day after expiry.

• In staggered delivery like in Gold matching of delivery takes place in all the five days under delivery period. While in the case of Seller’s option, i.e., if the seller gives his intention to give delivery, buyers have no choice, but to accept delivery or face selling on account and/or penalty.

• However in both option contracts both buyer and seller have to match the intention and thus all outstanding short and long position are settled at the “Due Date Rate”.

Benefits of staggered delivery

• This has benefits of facilitating smooth closure of the contracts as deliveries would be spread over a period of two weeks and permitting the Seller to tender delivery and exit his position, thereby reducing his holding and margining costs.

• It also ensures that only buyers who intend to take delivery would remain in the expiry month contract during this period, thereby reducing speculative interest towards the expiry of the contract.

• It translates the increase in volume of business. It benefits monthly contracts more than long period contracts.

• Staggered delivery aims to bring in more participants and improve hedging potential on commodity exchanges.

13

|

| 5th NOV | India pulled out of the RCEP free trade deal. |

| 5th NOV | India’s Services PMI contracted for second consecutive month. |

| 7th NOV | EU commission trims growth forecast sees muted inflation. |

| 7th NOV | China says US agrees to tariff rollback in phases. |

| 7th NOV | BOE leaves bank rate unchanged at 0.75%. |

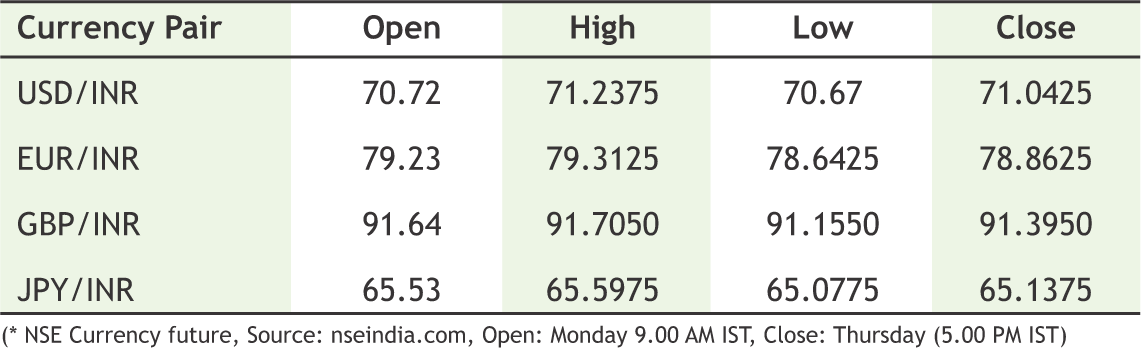

Indian Rupee continued to streamline between risk-on and risk-off led by US-China trade war news flows. “Financial Times” reported that The White House is considering whether to roll back levies on $112bn of Chinese imports including clothing, appliances, and flat-screen monitors that were introduced at a 15 per cent rate on September 1. Accordingly Chinese renminbi went up above 7/US Dollar mark. The renminbi had weakened to 7.18 in September amid escalated trade tensions between US and China. Admittedly Rupee was not gained to that extent as other Asian peers amid RBI’s strong intervention to hold-back any sudden rise in domestic unit. Later Chinese foreign ministry revealed that US-CHINA will roll-back existing tariffs in phases. On global front, economic data from euro-zone continues to drag euro/dollar exchange rate. October retail sales remain weak, although final PMI went onto upward revision but still unfolding a weaker GDP growth at the beginning of Q4. Sterling remains muted in absence of major news flows from Brexit front. UK Parliamentarians are muddling through next month general election campaign. Meanwhile Bank of England kept bank rate unchanged at 0.75% and cut its growth forecasts amid Brexit uncertainty. Next week headline monthly inflation releases from India and US are the key economic data to be monitored. Most likely domestic headline inflation has surpassed the RBI upper band of 4% amid ongoing spike in onion prices.

USDINR is likely to stay within the range of 70.80 and 71.50 in the next week.8

|

USD/INR (NOV) contract closed at 71.0425 on 7th Nov’19. The contract made its high of 71.2375 on 7th Nov’19 and a low of 70.67 on 4th Nov’19 (Weekly Basis). The 14-day Exponential Moving Average of the USD/INR is currently at 71.11.

On the daily chart, the USD/INR has Relative Strength Index (14-day) value of 43.04. One can buy at 70.95 for the target of 71.55 with the stop loss of 70.65.

EUR/INR (NOV) contract closed at 78.8625 on 7th Nov’19. The contract made its high of 79.3125 on 4th Nov’19 and a low of 78.6425 on 6th Nov’19 (Weekly Basis). The 14-day Exponential Moving Average of the EUR/INR is currently at 79.09.

On the daily chart, EUR/INR has Relative Strength Index (14-day) value of 43.72. One can sell at 79.30 for a target of 78.70 with the stop loss of 79.60.

GBP/INR (NOV) contract closed at 91.3950 on 7th Nov’19. The contract made its high of 91.7050 on 4th Nov’19 and a low of 91.1550 on 5th Nov’19 (Weekly Basis). The 14-day Exponential Moving Average of the GBP/INR is currently at 91.34.

On the daily chart, GBP/INR has Relative Strength Index (14-day) value of 56.31. One can sell at 91.70 for a target of 91.10 with the stop loss of 92.

JPY/INR (NOV) contract closed at 65.1375 on 7th Nov’19. The contract made its high of 65.5975 on 7th Nov’19 and a low of 65.0775 on 6th Nov’19 (Weekly Basis). The 14-day Exponential Moving Average of the JPY/INR is currently at 65.57.

On the daily chart, JPY/INR has Relative Strength Index (14-day) value of 34.89. One can sell at 65.40 for a target of 64.80 with the stop loss of 65.70.

14

Burger King's India unit looks to raise Rs 400 crore in IPO

The Indian arm of U.S.-based Burger King filed for a local initial public offering (IPO) to raise up to Rs 400 crore ($56.6 million) on November 4, as it looks to open more restaurants in a country where international fast-food brands are gaining in popularity. The Whopper Burger maker, which launched its first restaurant in India in 2014, competes directly with market leader McDonald's Corp and other restaurant chains such as Domino's Pizza. Burger King India Ltd plans to have 325 stores by December 31, 2020, up from 202 as of June. McDonald's had 470 at last count, according to data by consulting firm Technopak Advisors. The issue includes an offer for sale of up to 60 million equity shares by QSR Asia PTE, which owns 99 percent of the Indian entity. The company did not disclose pricing details. Private equity firm Everstone Capital, which operates Burger King India, is considering a private placement of shares worth Rs 1.5 billion ahead of the IPO, according to the draft red herring prospectus. The company will look to list with the Bombay Stock Exchange as well as the National Stock Exchange. Kotak Mahindra Capital, CLSA India, Edelweiss Financial Services and JM Financial are lead managers of the IPO.

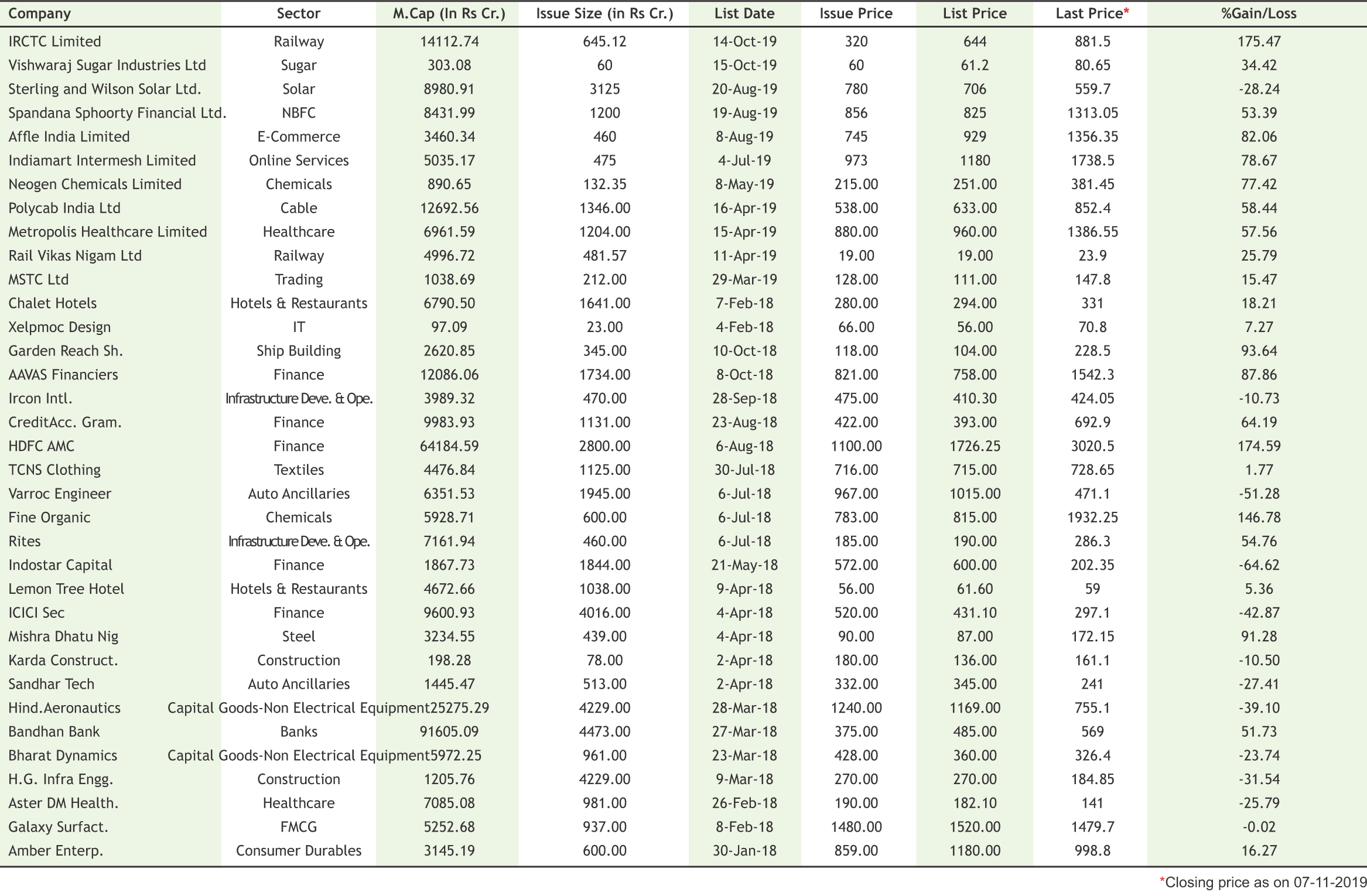

IPOs worth Rs.30,000 crore in the pipeline

A host of public issues from high-profile companies to the tune of Rs. 30,000 crore, especially from the financial services segment, may hit the market in the next few months. While some of them have already received regulator SEBI’s nod and are waiting for the right time, others have initiated the process to tap the primary market. Among them are SBI Cards and Payment Services, CSB Bank, IREDA, Bajaj Energy, Ujjivan SFB, Angel Broking, Annai Infra Developers and Shyam Steel Industries. These companies have to hit the market within one year of SEBI's approval, otherwise they have to reapply for an IPO.

Saudi Aramco IPO brings cheer to Indian Markets

The world's largest initial public offering (IPO), which Saudi Aramco is planning, brings cheer to the Indian market as the Saudi government owned firm targets $100 billion investments in the country. The oil behemoth has announced two voluminous transactions in India - the strategic investment in $44 billion petroleum refinery in Maharashtra and $15 billion worth stake acquisition in the refining and petrochemicals business of Reliance Industries (RIL). Besides, the country may see Aramco bidding for either Bharat Petroleum Corporation (BPCL) or Hindustan Petroleum Corporation (HPCL) or both, which are slated for privatisation.

|

15

|

* Interest Rate may be revised by company from time to time. Please confirm Interest rates before submitting the application.

* For Application of Rs.50 Lac & above, Contact to Head Office.

* Email us at fd@smcindiaonline.com

16

Keyman insurance can be defined as an insurance policy where the proposer as well as the premium payer is the employer, the life to be insured is that of the same employer's key employee (Keyman) and the benefit, in case of a claim, goes to the employer. The `Keyman' here can be any employee, having a special skill set or substantial responsibilities, who contributes significantly to the profits of that organization. It is not a special plan of insurance but just application of life insurance to fulfill a special need.

An Employee or Director in a Key position, Key Sales Person, Key project Managers whose services have significant effect on the profitability of the company due to his technical background, experience in the field, industry wide vision or market image or anybody with specialized skills, whose loss can cause a financial strain to the company, is eligible for Keyman Insurance.

How can keyman insurance be used & its Benefits?

Basically, it is a pure term plan that can be bought by a company to cover the life of an important employee. But, the policy has many uses. The amount that can be claimed with such a policy allows you to not only recruit and train key personnel, but also secure and settle loans, offer salary continuation arrangements to the spouse of the deceased and fund executive compensation plans.

• It protects against business risk in the event of unfortunate death of the key man person.

• The premium paid will be treated as business expenses and the company would save Significant TAX & surcharge on every rupee of premium paid for such a policy as per current tax law.

• Disruption of lines of business credit due to the death of Key Man can seriously affect the business. Here, the insurance money can help as a guarantee of loan repayment in case of death of the key person.

• The morale of the key employee is boosted. He/She feel important. The sense of belonging increases productivity and help in retention of the key employee.

• It protects the company's valuation. For example, in case of the company being put up for sale, prospective buyers are likely to put a higher value to the company if they know that it has a monetary backup (insurance) to meet the cost of replacement of the its key person.

Maximum Allowable Sum Assured

• 3 times of Average Gross Profit* of the company for last 3 years.

• 5 times of Average Net Profit of the company for last 3 years.

• 10 times of the annual compensation for the Key person including salary, bonus and all other perquisites.

Least of the amount as arrived under the above 3 methods will be the allowable Sum Assured.

Key Points to Remember

• The Money received (Death Benefit under Keyman Policy) will be treated as Business profit u/s 28 (vi) for that financial year. Company may also decide to give partially or entire policy money to the widow or other legal heirs of the demised employee.

• The CBDT, through circular No, 573 dated August 21, 1990, has clarified that a lump sum payment made gratuitously or by way of compensation or otherwise, to the widow or other legal heirs of an employee, who dies while still in active service, is not taxable as income under the Income-Tax Act, 1961.

Ashok Kumar Head – Sales & Development Life Insurance

|

|

|

|

|

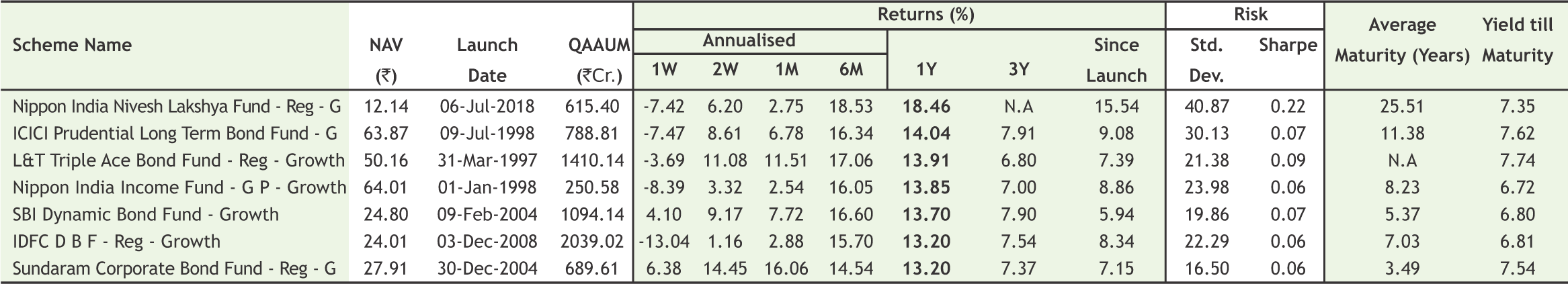

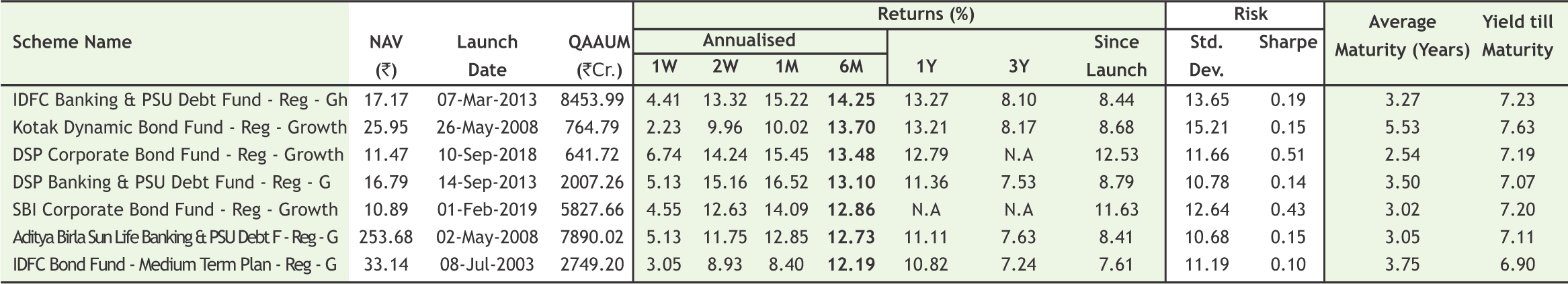

Note:Indicative corpus are including Growth & Dividend option . The above mentioned data is on the basis of 08/08/2019 Beta, Sharpe and Standard Deviation are calculated on the basis of period: 1 year, frequency: Weekly Friday, RF: 7%

*Mutual Fund investments are subject to market risks, read all scheme related documents carefully

18

Proud to share that Mr. Ajay Garg, Director & CEO, SMC Group has been conferred upon with ET’s Most Promising Business Leader of Asia - 2019 award at The Economic Times - Asian Business Leaders Conclave held on 8th November 2019 at Marina Bay Sands, Singapore.

Mr. S C Aggarwal (CMD, SMC Group), Mr. Mahesh C Gupta (Vice CMD, SMC Group) & other key directors celebrating the Sensex crossing again the mark of 40,000 by sounding the gong at the Head Office, New Delhi.

Mr. Anurag Bansal (Director, SMC Global Securities Ltd and Ex-VC Bombay Stock Exchange Brokers’ Forum) speaking at the Asia Securities Forum held in Istanbul, Turkey.

Ms. Kuntal Bhat (Deputy Vice President SMC Global Securities Ltd.) receiving award on behalf of SMC for Highest Number of Transactions in Mutual Funds (2018-19) through BSE Star (Regional Distributors).

REGISTERED OFFICES:

11 / 6B, Shanti Chamber, Pusa Road, New Delhi 110005. Tel: 91-11-30111000, Fax: 91-11-25754365

MUMBAI OFFICE:

Lotus Corporate Park, A Wing 401 / 402 , 4th Floor , Graham Firth Steel Compound, Off Western Express Highway, Jay Coach Signal, Goreagon (East) Mumbai - 400063

Tel: 91-22-67341600, Fax: 91-22-67341697

KOLKATA OFFICE:

18, Rabindra Sarani, Poddar Court, Gate No-4,5th Floor, Kolkata-700001 Tel.: 033 6612 7000/033 4058 7000, Fax: 033 6612 7004/033 4058 7004

AHMEDABAD OFFICE :

10/A, 4th Floor, Kalapurnam Building, Near Municipal Market, C G Road, Ahmedabad-380009, Gujarat

Tel : 91-79-26424801 - 05, 40049801 - 03

CHENNAI OFFICE:

Salzburg Square, Flat No.1, III rd Floor, Door No.107, Harrington Road, Chetpet, Chennai - 600031.

Tel: 044-39109100, Fax -044- 39109111

SECUNDERABAD OFFICE:

315, 4th Floor Above CMR Exclusive, BhuvanaTower, S D Road, Secunderabad, Telangana-500003

Tel : 040-30031007/8/9

DUBAI OFFICE:

2404, 1 Lake Plaza Tower, Cluster T, Jumeriah Lake Towers, PO Box 117210, Dubai, UAE

Tel: 97145139780 Fax : 97145139781

Email ID : pankaj@smccomex.com

smcdmcc@gmail.com

Printed and Published on behalf of

Mr. Saurabh Jain @ Publication Address

11/6B, Shanti Chamber, Pusa Road, New Delhi-110005

Website: www.smcindiaonline.com

Investor Grievance : igc@smcindiaonline.com

Printed at: S&S MARKETING

102, Mahavirji Complex LSC-3, Rishabh Vihar, New Delhi - 110092 (India) Ph.: +91-11- 43035012, 43035014, Email: ss@sandsmarketing.in