2020: Issue 728, Week: 23rd - 27th March

A Weekly Update from SMC (For private circulation only)

WISE M NEY

NEY

2020: Issue 728, Week: 23rd - 27th March

A Weekly Update from SMC (For private circulation only)

NEY

NEY

| Equity | 4-7 |

| Derivatives | 8-9 |

| Commodity | 10-13 |

| Currency | 14 |

| IPO | 15 |

| FD Monitor | 16 |

| Mutual Fund | 17-18 |

I

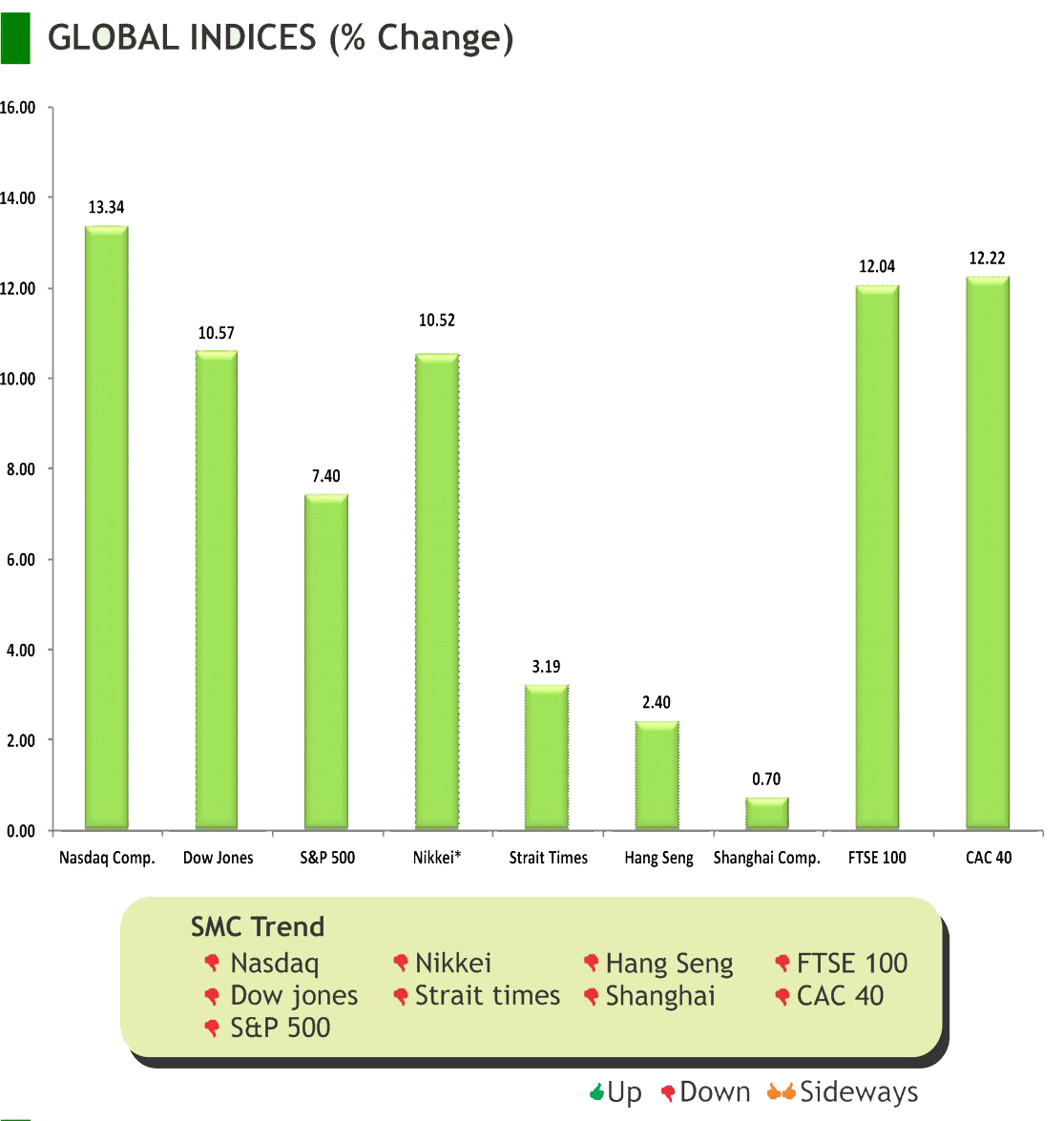

n the week gone by, some calmness returned to stock markets after central banks and governments around the world unleashed a torrent of stimulus measures Idesigned to cushion the shock from coronavirus. Meanwhile, the Bank of England cut its interest rates to a record low of 0.1 percent and added 200 billion pounds to its asset purchase program in its latest emergency action to mitigate the economic impact of the coronavirus pandemic. Oil prices remained volatile after a dramatic rebound from multi-year lows but stayed below $30 a barrel on fears the deadly coronavirus will push the world into recession with an oversupply.

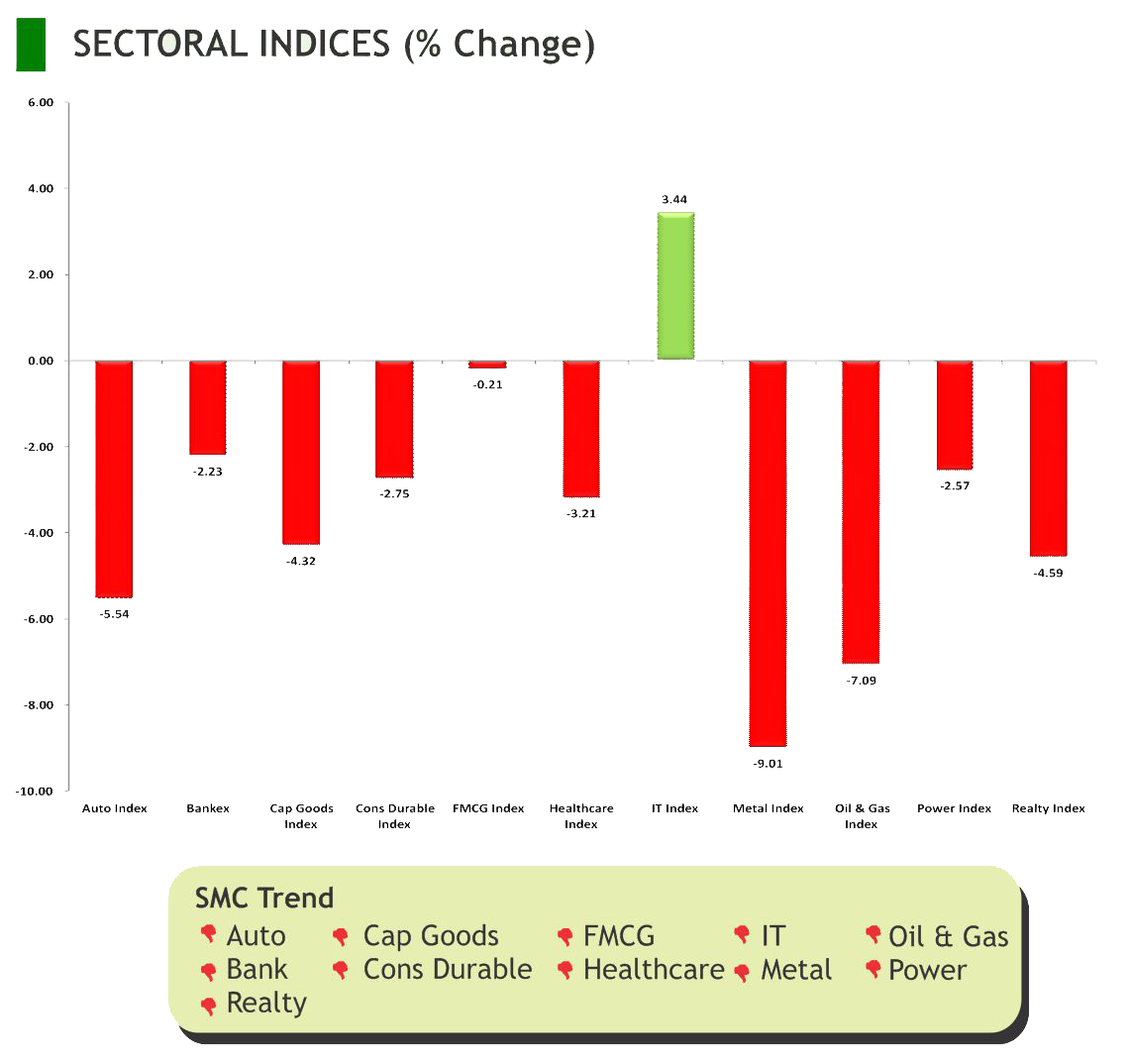

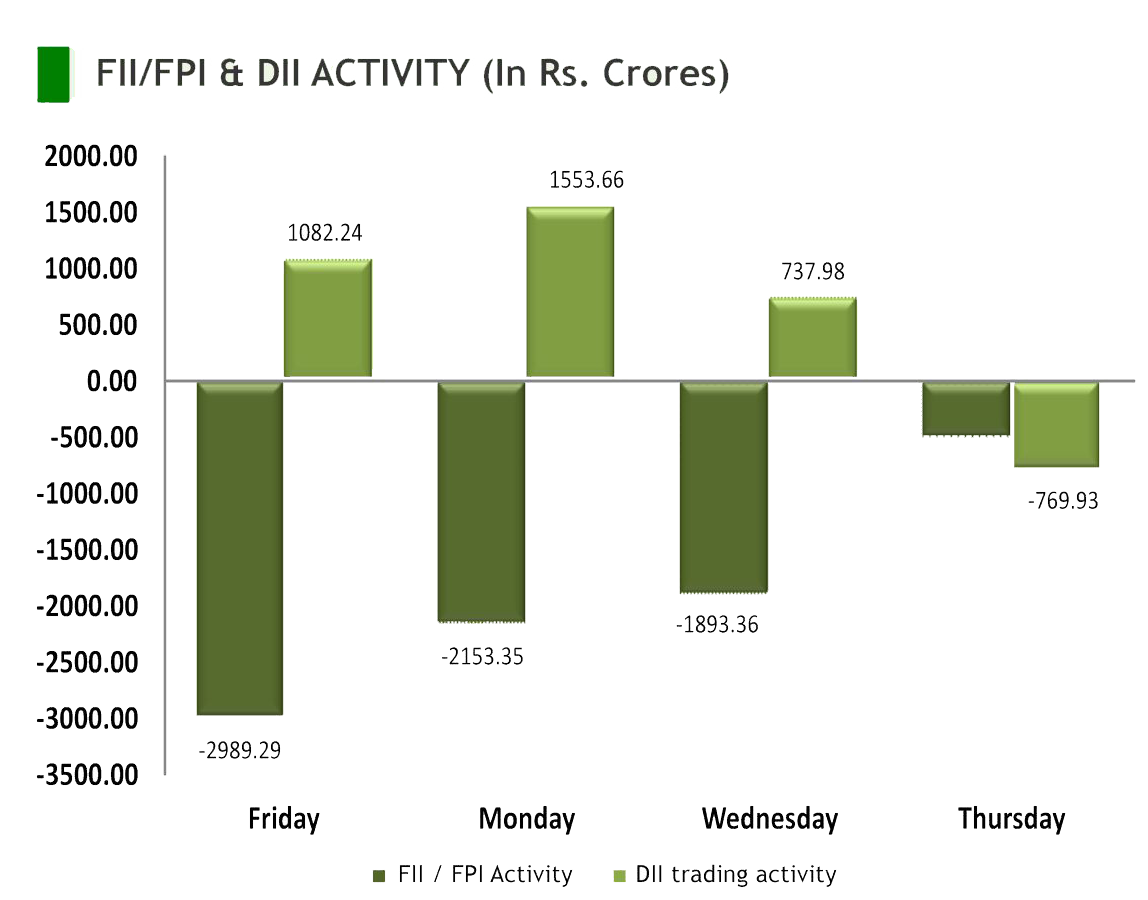

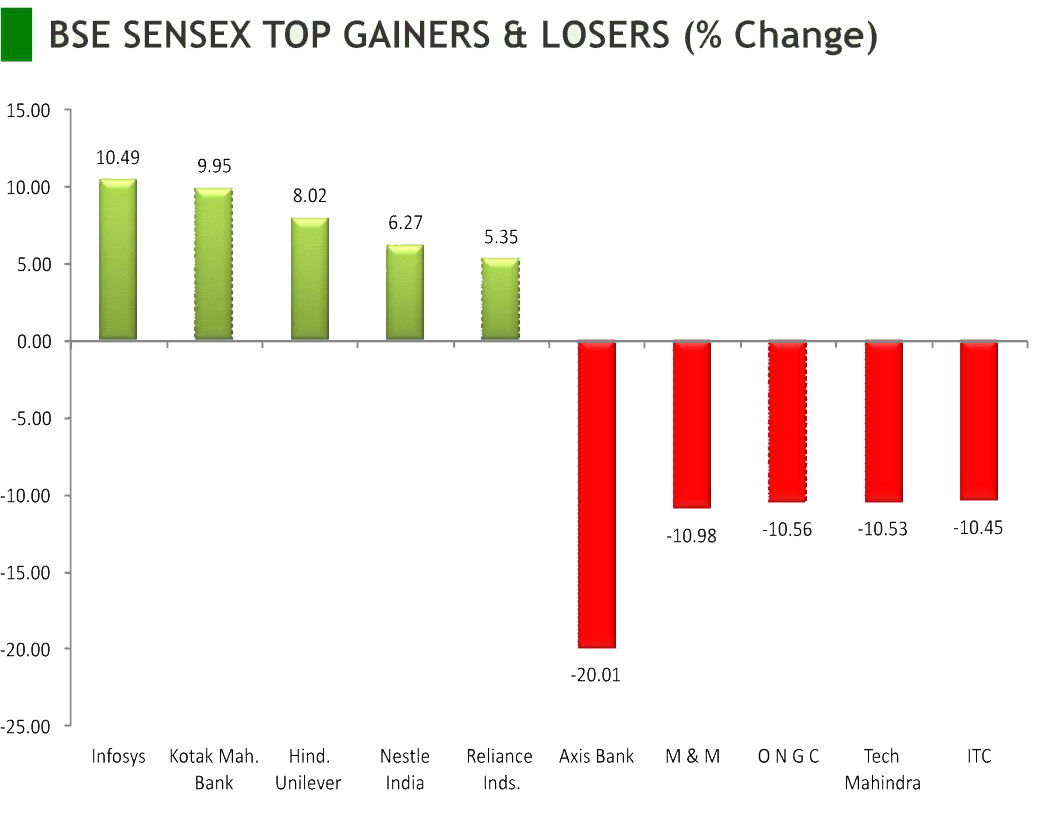

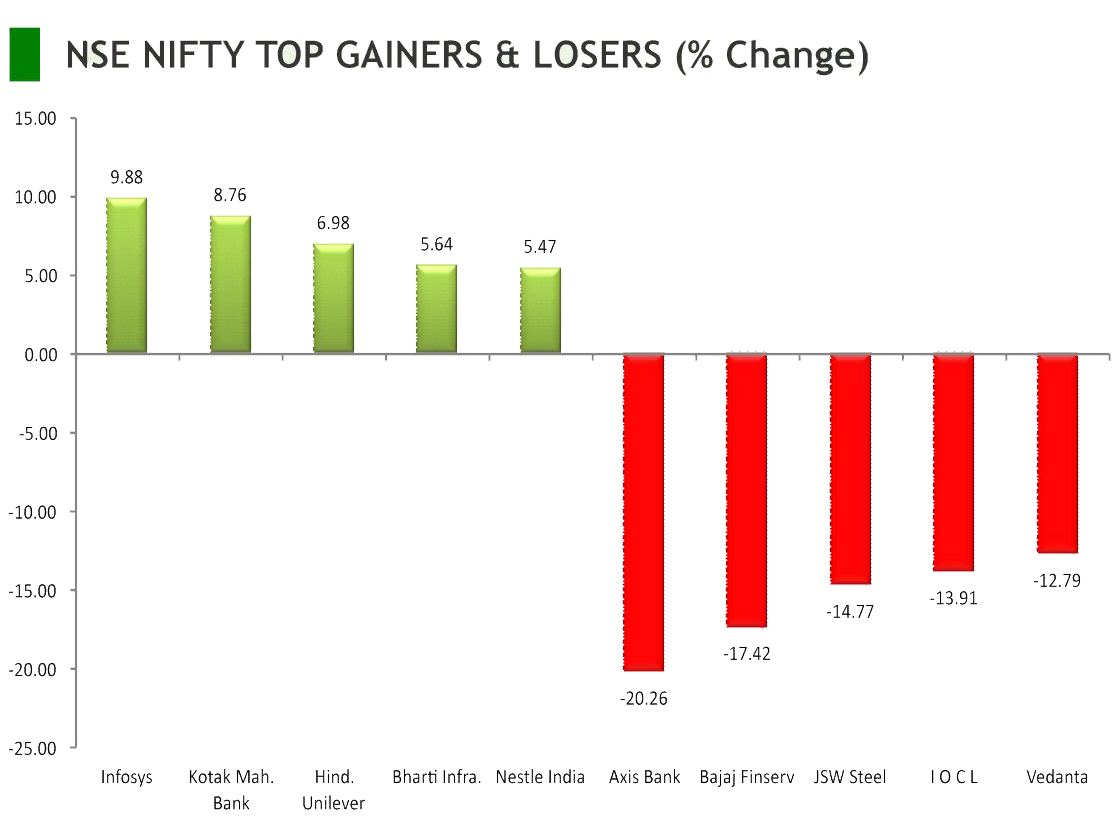

Back home, markets also have fallen drastically from their respective record highs and currency got tattered. However on Friday, market sentiments turned positive on hopes of a stimulus package as Prime Minister Narendra Modi announced a financial task force to combat the Covid-19 pandemic's economic fallout. Further market sentiments were optimistic after Maharashtra Health Minister's announced that banks & stock exchange would remain open even as Mumbai braces for a shut down in light of rising cases of coronavirus pandemic in the state. All the sectoral indices ended in the green with IT and FMCG index rose more than 8 percent, followed by the Energy, Infra, Metal, Auto, and Pharma. On the flip side, the rupee continued its downward spiral and plunged to a new record low of 75.10 against the dollar as investors braced for a coronavirus-led economic recession. Meanwhile, India's fuel demand has dropped by a steep 10-11 per cent in the first two weeks of March as the outbreak of coronavirus led to the cancellation of flights and reduction in industrial activity. As per CRISIL, the Covid-19 pandemic will leave the economy crippled next fiscal pulling down the growth to a low of 5.2 per cent. India's wholesale prices rose at a softer rate in February. The wholesale price index rose 2.26 percent year-on-year in February, slower than a 3.10 percent increase in January. Going ahead, the development in number of COVID-19 cases amid other factors such as rupee movement, crude oil prices, inflow and out flow of the foreign money will continue to dictate the trend of the market going forward.

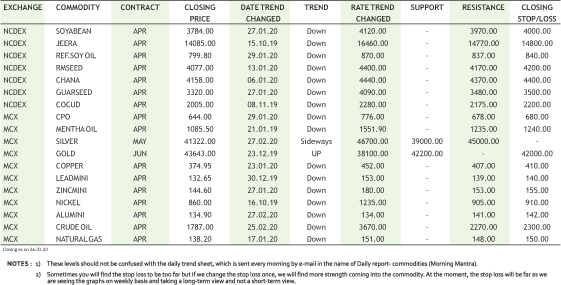

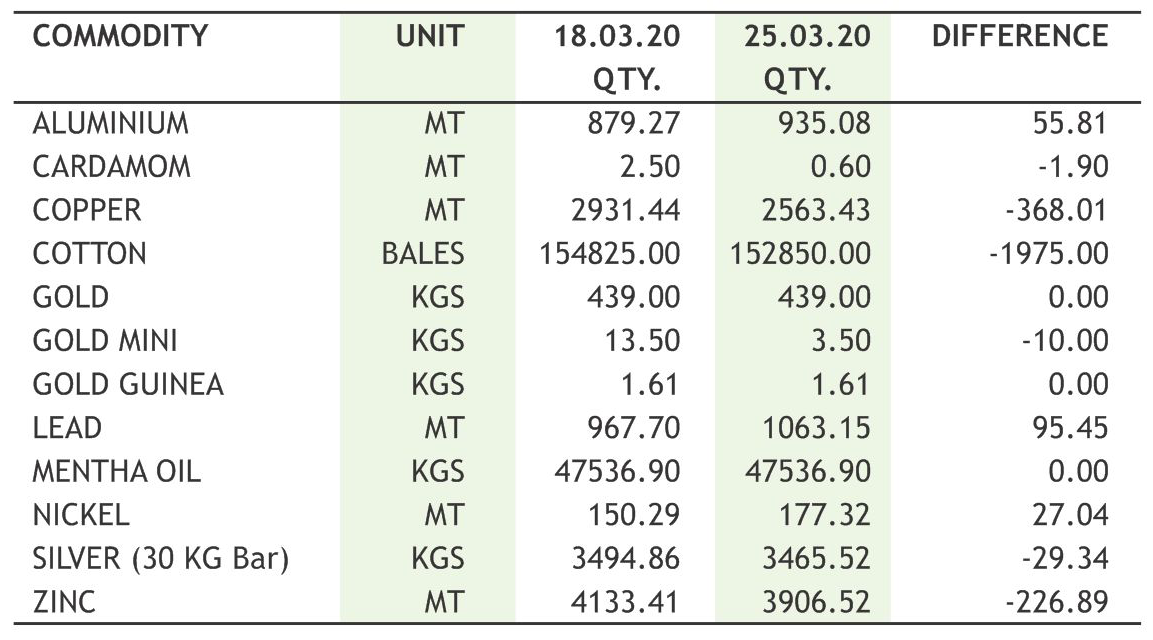

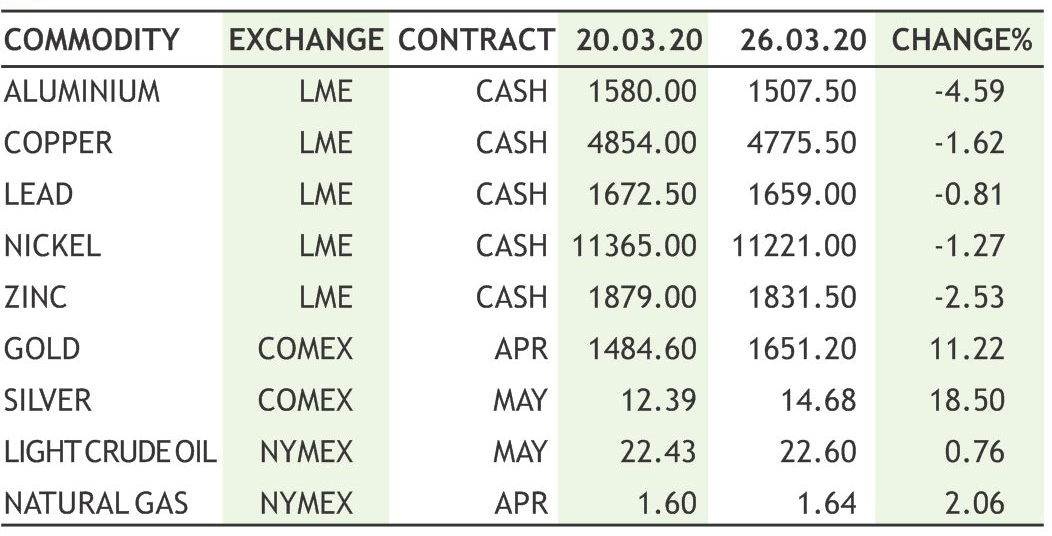

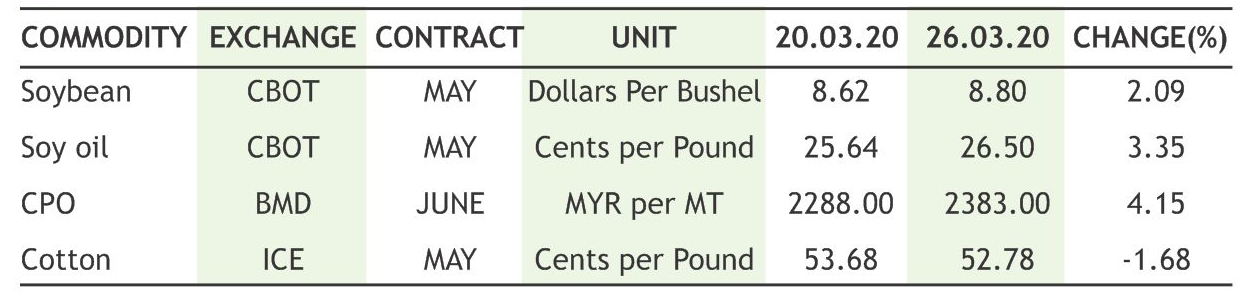

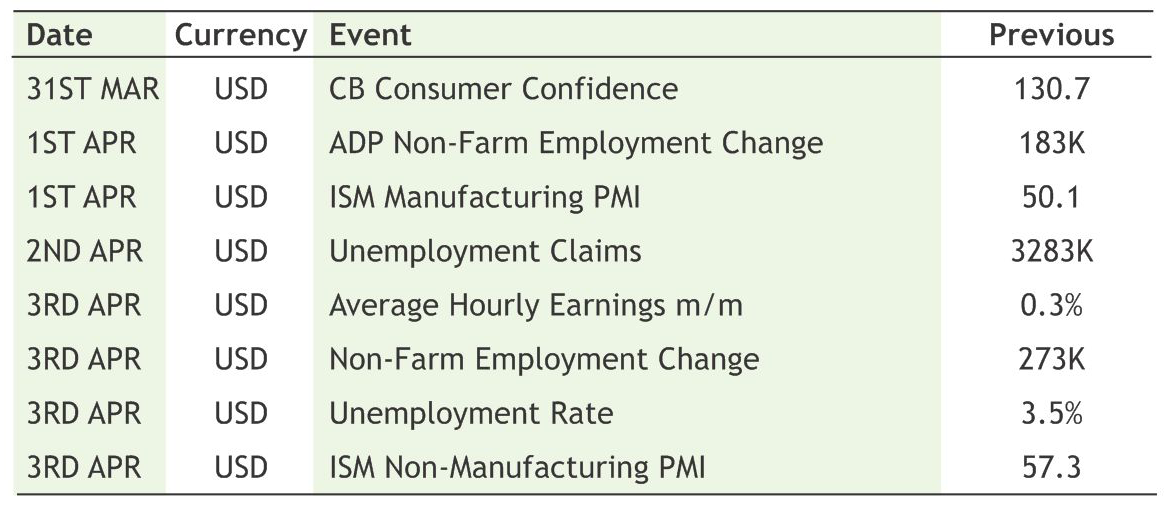

On the commodity market front, it was another week in which commodities saw high volatility. Among all commodities, crude oil caught the attention of all as it was moving on the tune of COVID-19 amid tensions among oil produces. Bullion counter may remain under selling pressure as investors are doing panic selling across all asset classes to hoard cash due to widespread coronavirus globally. Gold silver ratio tested lift time high of above 125 as silver fell at drastic pace than silver. Gold may move towards 38000 while taking resistance near 42000 and silver can test 32000 while facing resistance near 39500. Crude oil prices may continue to drop further as worries about global demand persist as the spread of coronavirus showing no sign of abating. Crude oil may further dip towards 1800 while taking resistance near 2500. Base metal counter may remain on under selling pressure. ECB's Lagarde Speaks at ECB and Its Watchers Conference, RBNZ Official Cash Rate, CPI of UK, Durable Goods Orders, Advance Goods Trade Balance, PCE Core and GDP of US, Bank of England Bank Rate, etc are only high importance data scheduled this week.

SMC Global Securities Ltd. (hereinafter referred to as “SMC”) is a registered Member of National Stock Exchange of India Limited, Bombay Stock Exchange Limited and its associate is member of MCX stock Exchange Limited. It is also registered as a Depository Participant with CDSL and NSDL. Its associates merchant banker and Portfolio Manager are registered with SEBI and NBFC registered with RBI. It also has registration with AMFI as a Mutual Fund Distributor.

SMC is a SEBI registered Research Analyst having registration number INH100001849. SMC or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities market.

SMC or its associates including its relatives/analyst do not hold any financial interest/beneficial ownership of more than 1% in the company covered by Analyst. SMC or its associates and relatives does not have any material conflict of interest. SMC or its associates/analyst has not received any compensation from the company covered by Analyst during the past twelve months. The subject company has not been a client of SMC during the past twelve months. SMC or its associates has not received any compensation or other benefits from the company covered by analyst or third party in connection with the research report. The Analyst has not served as an officer, director or employee of company covered by Analyst and SMC has not been engaged in market making activity of the company covered by Analyst.

The views expressed are based solely on information available publicly available/internal data/ other reliable sources believed to be true.

SMC does not represent/ provide any warranty express or implied to the accuracy, contents or views expressed herein and investors are advised to independently evaluate the market conditions/risks involved before making any investment decision.

DOMESTIC NEWS

Economy

• India's wholesale prices rose at a softer rate in February. The wholesale price index rose 2.26 percent year-on-year in February, slower than a 3.10 percentincreaseinJanuary.Economistshadexpecteda2.65percentrise.

Engineering

• Ashoka Buildcon announced that AshokaBanwaraBettadahalli Road (SPV) has executed a Concession Agreement with National Highways Authority of India (NHAI) on 19 March 2020, for the Project viz. Four Laning of Tumkur-Shivamogga section from Km 119+790 (Design Km 121+900) to Km 166+100 (Design Km170+415), Banwara to Bettadahalli section of NH-206 in the State of Karnataka, on Hybrid Annuity Mode under BharatmalaPriyojana (Package-III). The accepted Bid Project Cost is Rs.1,035.50 crore.

Realty

• Godrej Properties announced its entry into the Faridabad market with its first residential plotted development. Spread across 43.61 acres (17.65 hectares), this land parcel has been acquired from BPTP. This project will offer approximately 95,000 square meters (1 million sq. ft.) of plotted development potential offering attractive plot sizes along with good lifestyle amenities. The site is strategically located and offers a well-developed social infrastructure with multiple schools, hospitals, and retail spaces in vicinity. This micro-market also has excellent road connectivity to both Delhi and Noida.

Pharmaceuticals

• Dr. Reddy's Laboratories announced the launch of Naloxone Hydrochloride Injection USP, 2 mg/2 ml (1 mg/ml) Single-dose Prefilled Syringe, a therapeutic equivalent generic version of Narcan® (naloxone hydrochloride) Injection USP, approved by the U.S. Food and Drug Administration (USFDA).

Information Technology

• Wipro announced the launch of its Microsoft Business Unit. The unit will focus on the development and evangelization of solutions leveraging Microsoft's enterprise cloud services. This initiative is an outcome of Wipro's expanded global alliance with Microsoft to accelerate cloud adoption and digital transformation for its customers across sectors. Wipro's Microsoft Business Unit consists of a team of trained and certified Azure consultants and specialists.

Media

• Inox Leisure has opened two additional screens (with seating capacity of 73 seats) in the existing multiplex cinema theatre, taken on lease basis at Indore. Considering the Madhya Pradesh Government's recent order on temporary closure of cinemas as a precautionary measure to avoid spread of COVID-l9, the screens will be opened for movie screening as soon as the order is lifted.

Power

• Tata Power has expanded its rooftop solar service to 90 cities across the country.The big rollout from Tata Power comes at a time when consumers across all major categories including commercial, industrial, residential and public sector are adopting solar energy as a reliable and sustainable solution to meet their energy needs that also holds tremendous potential to save costs.

INTERNATIONAL NEWS

• US business inventories edged down by 0.1 percent in January after coming in unchanged in December. The slight drop in inventories matched economist estimates. The modest decrease in business inventories was partly due to a continued decline in wholesale inventories, which fell by 0.4 percent in January after slipping by 0.3 percent in December.

• US industrial production climbed by 0.6 percent in February after falling by a downwardly revised 0.5 percent in January. Economists had expected industrial production to increase by 0.4 percent compared to the 0.3 percent drop originally reported for the previous month.

• US retail sales fell by 0.5 percent in February after climbing by an upwardly revised 0.6 percent in January.The pullback came as a surprise to economists, who had expected retail sales to edge up by 0.2 percent compared to the 0.3 percent increase originally reported for the previous month.

• The Bank of England cutthe bank rate again,to a record low on Thursday, and expanded its bond buying scheme and the targeted funding measure for small and medium businesses, extending further support to the UK economy amid the spread ofthe coronavirus, or Covid-19.

• Eurozone construction output increased 3.6 percent month-on-month in January, after a 1.8 percent fall in December. In November, output rose 0.9 percent.

• China left its benchmark lending rates unchanged, defying expectations for a reduction as economic activity faces severe downturn after the outbreak of coronavirus, or covid-19. The one-year loan prime rate was retained at 4.05 percent and the five-year loan prime rate at 4.75 percent. The one-year LPR was last reduced in February, by 10 basis points.

| Stocks | *Closing Price | Trend | Date Trend Changed | Rate Trend Changed | SUPPORT | RESISTANCE | Closing S/l |

|---|---|---|---|---|---|---|---|

| S&P BSE SENSEX | 29916 | DOWN | 13.03.20 | 34103 | - | 37000 | 38300 |

| NIFTY50 | 8745 | DOWN | 13.03.20 | 9955 | - | 10800 | 11200 |

| NIFTY IT | 12306 | DOWN | 13.03.20 | 13665 | - | 14800 | 15400 |

| NIFTY BANK | 20275 | DOWN | 13.03.20 | 25347 | - | 28000 | 29000 |

| ACC | 1128 | DOWN | 14.02.20 | 1440 | - | 1260 | 1280 |

| BHARTIAIRTEL | 463 | DOWN | 13.03.20 | 492 | - | 510 | 520 |

| BPCL | 318 | DOWN | 28.02.20 | 426 | - | 420 | 430 |

| CIPLA | 393 | DOWN | 20.02.20 | 436 | - | 440 | 450 |

| SBIN | 210 | DOWN | 28.02.20 | 303 | - | 270 | 285 |

| HINDALCO | 106 | DOWN | 31.01.20 | 189 | - | 145 | 155 |

| ICICI BANK | 346 | DOWN | 28.02.20 | 497 | - | 470 | 485 | INFOSYS | 585 | DOWN | 13.03.20 | 642 | - | 690 | 720 |

| ITC | 176 | DOWN | 31.05.19 | 279 | - | 180 | |

| L&T | 865 | DOWN | 15.11.19 | 1378 | 1120 | 1160 | |

| MARUTI | 5079 | DOWN | 31.01.20 | 6913 | - | 6300 | 6450 |

| NTPC | 81 | DOWN | 16.08.19 | 118 | 105 | 108 | |

| ONGC | 72 | DOWN | 06.12.19 | 127 | 80 | 84 | |

| RELIANCE | 1018 | DOWN | 31.01.20 | 1412 | - | 1180 | 1210 |

| TATASTEEL | 298 | DOWN | 31.01.20 | 439 | - | 360 | 370 |

Closing as on 20-03-2020

NOTES:

1) These levels should not be confused with the daily trend sheet, which is sent every morning by e-mail in the name of "Morning Mantra ".

2) Sometimes you will find the stop loss to be too far but if we change the stop loss once, we will find more strength coming into the stock. At the moment, the stop loss will be far as we are seeing the graphs on weekly basis and taking a long-term view and not a short-term view.

| Meeting Date | Company name | Purpose |

|---|---|---|

| 23-Mar-20 | Allcargo Logistics | Interim Dividend - Rs 3 Per Share |

| 23-Mar-20 | RBL Bank | Interim Dividend - Rs 1.50 Per Share |

| 23-Mar-20 | Muthoot Finance | Interim Dividend - Rs 15 Per Share |

| 23-Mar-20 | Oil & Natural Gas Corp. | Interim Dividend - Rs 5 Per Share |

| 23-Mar-20 | Mastek | Interim Dividend |

| 23-Mar-20 | Indian Oil Corporation | Interim Dividend - Rs 4.25 Per Share |

| 23-Mar-20 | Cyient | Interim Dividend Rs - 9 Per Share |

| 23-Mar-20 | Graphite India | Interim Dividend - Rs 2 Per Share |

| 23-Mar-20 | Galaxy Surfactants | Interim Dividend - Rs 8 Per Share Spl. Div -Rs 6 Per Share |

| 23-Mar-20 | Adani Enterprises | Interim Dividend - Re 1 Per Share |

| 23-Mar-20 | Cadila Healthcare | Interim Dividend - Rs 3.50 Per Share |

| 23-Mar-20 | Bharat Petroleum Corp. | Interim Dividend - Rs 16.50 Per Share |

| 24-Mar-20 | DixonTechnologies(India) | Interim Dividend |

| 24-Mar-20 | Larsen & Toubro | Interim Dividend |

| 26-Mar-20 | Sun TV Network | Interim Dividend - Rs 12.50 Per Share |

| 26-Mar-20 | NTPC | Interim Dividend |

| 26-Mar-20 | City Union Bank | Interim Dividend |

| 26-Mar-20 | L&T Finance Holdings | Interim Dividend |

| 26-Mar-20 | HUDCO | Interim Dividend - Rs 0.75 Per Share |

| 27-Mar-20 | ACC | Dividend - Rs 14 Per Share |

| 30-Mar-20 | Varun Beverages | Annual General Meeting |

| 31-Mar-20 | CRISIL | Dividend Rs 13 Per Share |

| 23-Mar-20 | AshokaBuildcon | Fund Raising |

| 23-Mar-20 | ITI | Fund Raising |

| 24-Mar-20 | Kalpataru Power Transmission | Buyback/Other business matters |

| 24-Mar-20 | Sterlite Technologies | Buyback |

| 27-Mar-20 | Praj Industries | Buyback |

4

5

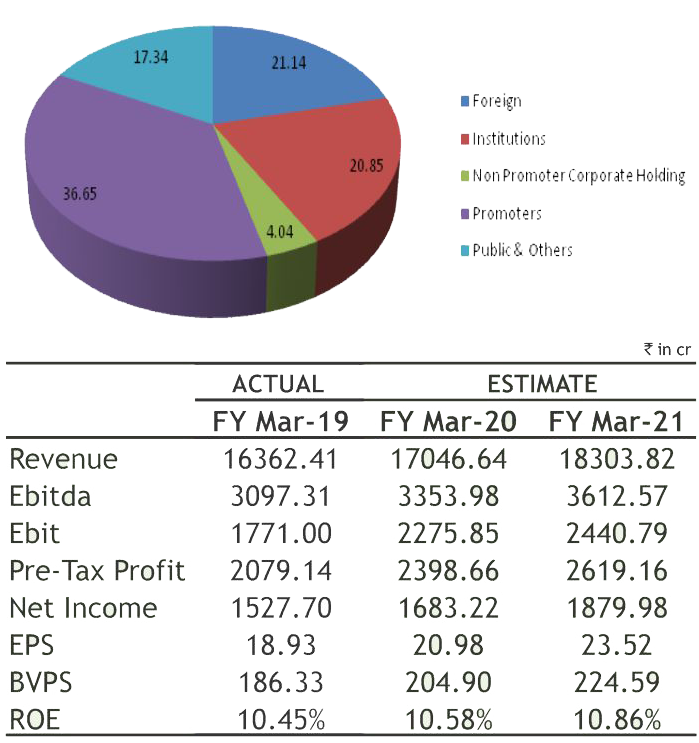

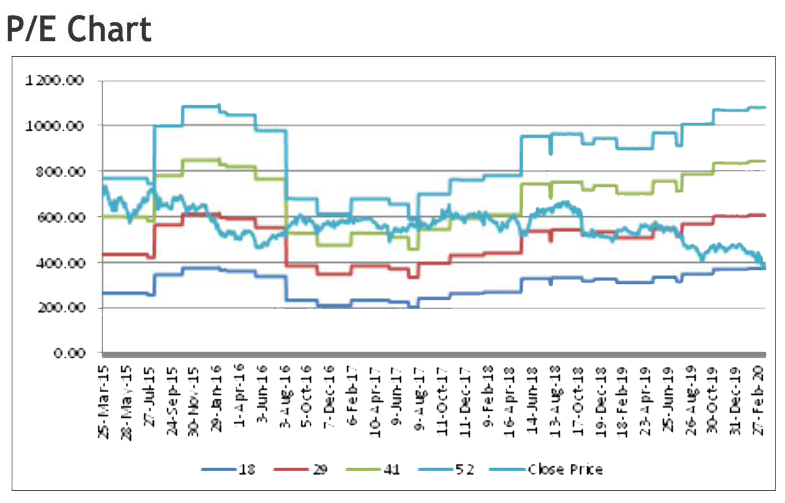

STATE BANK OF INDIA

CMP: 209.65

Target Price: 234

Upside: 12%

| Face Value (Rs.) | 1.00 |

| 52 Week High/Low | 373.70/184.25 |

| M.Cap (Rs. in Cr.) | 187104.48 |

| EPS (Rs.) | 13.64 |

| P/E Ratio (times) | 15.37 |

| P/B Ratio (times) | 0.84 |

| Dividend Yield (%) | 0.00 |

| Stock Exchange | BSE |

Investment Rationale

• Business of the bank rose at higher pace of 9% yoy to Rs 5412898 crore at end December 2019 Capital increased at higher pace of 10% at Rs 3111229 crore, Adequacy Ratio (CAR) has improved to 13.73% as on while advances growth eased 7% at Rs 2301669 crore Dec2019,anincreaseof96basispoints fromDec2018. at end December 2019. Domestic advances rose at Risk slower pace of 5% to Rs 1978799 crore, while yoy to Rs 322870 crore at endDecember 2019.

• It has posted 22% rise in NII at Rs 27778.79 crore for Valuation quarter ended December 2019. Interest earned Operating performance of the bank remains strong moved up 9% to Rs 67691.99 crore, while the and doing better than industry average during interest expended rose 1% to Rs 39913.20 crore. current quarter and management expects core NIM of the bank improved to 3.05% in Q3FY2020 operating performance continues to be strong. The from 2.90% in the previous quarter.

• The provisions and contingencies has increased such as asset quality, earnings, NPA management, NII, 21% to Rs 7252.90 crore in Q3FY2020 over NIM, operating income. According to the Q3FY2019, as the investment provisions jumped to management, bank is in right direction; long term Rs 3287.00 crore in Q3FY2020 from write-back of outlook is bright and aims to improve operating profit Rs 7994 crore in Q3FY2019. However, the NPA to Rs 1 lakh crore in next three years with 15% annual provisions declined 41% to Rs 8193 crore, while the growth. Thus, it is expected that the stock will see a bank has written back standard assets provisions of price target of Rs.234 in 8 to 10 months time frame on Rs 1752.00 crore and other provisions of Rs 2475 current P/Bvx of 0.84x and FY21 BVPS of Rs.278.50. crore in Q3FY2020. With the decline in NPA provisions, the PBT jumped 66% to Rs 10969.66 crore in the quarter ended December 2019.

• The bank's asset quality has improved. Gross nonperforming assets (NPAs) stood at Rs 1,59,661.19 crore as on 31 December 2019 as against Rs 1,61,635.05 crore as on 30 September 2019 and Rs 1,87,764.57 crore as on 31 December 2018. The ratio of gross NPAs to gross advances stood at 6.94% as on 31 December 2019 as against 7.19% as on 30 September 2019 and 8.71% as on 31 December 2018. The ratio of net NPAs to net advances stood at 2.65% as on 31 December 2019 as against 2.79% as on 30 September 2019 and 3.95% as on 31

December 2018.

• Provision Coverage Ratio as on 31 December 2019 Rs 5412898 crore at end December 2019. Deposits stood at 81.73%, up 710 basis points YoY. Capital increased at higher pace of 10% at Rs 3111229 crore, Adequacy Ratio (CAR) has improved to 13.73% as on while advances growth eased 7% at Rs 2301669 crore Dec2019,anincreaseof96basispoints fromDec2018.

Risk

• Slowdown in domestic and international demand international for end-markets

• Regulatory norms

Valuation

Operating performance of the bank remains strong asset quality, earnings, NPA management, NII, 21% to Rs 7252.90 crore in Q3FY2020 over NIM, operating income. According to the Q3FY2019, as the investment provisions jumped to management, bank is in right direction; long term Rs 3287.00 crore in Q3FY2020 from write-back of outlook is bright and aims to improve operating profit Rs 7994 crore in Q3FY2019. However, the NPA to Rs 1 lakh crore in next three years with 15% annual provisions declined 41% to Rs 8193 crore, while the growth. Thus, it is expected that the stock will see a bank has written back standard assets provisions of price target of Rs.234 in 8 to 10 months time frame on Rs 1752.00 crore and other provisions of Rs 2475 current P/Bvx of 0.84x and FY21 BVPS of Rs.278.50.

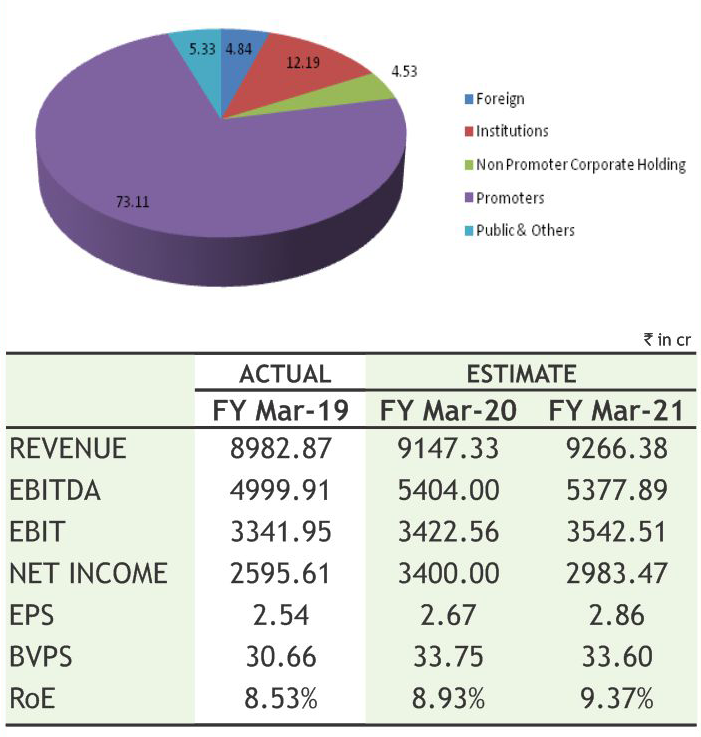

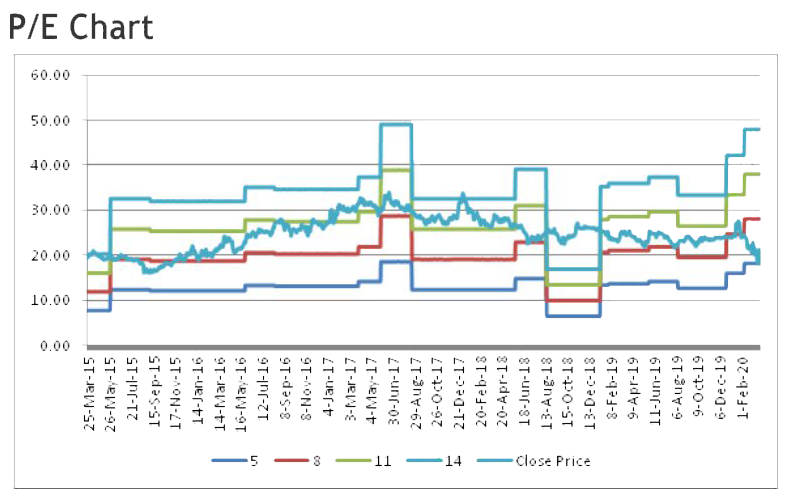

Deepak Nitrite Limited

CMP: 380.10

Target Price:428

Upside:13%

| Face Value (Rs.) | 2.00 |

| 52 Week High/Low | 543.40/252.25 |

| M.Cap (Rs. in Cr.) | 5184.30 |

| EPS (Rs.) | 38.87 |

| P/E Ratio (times) | 9.78 |

| P/B Ratio (times) | 3.93 |

| Dividend Yield (%) | 0.58 |

| Stock Exchange | BSE |

Investment Rationale

• Deepak Nitrite offers sodium nitrite, 2 ethyl hexyl guidance forfine and speciality chemicals at 10-15%. nitrate and optical brightening agent (OBA). The Risk firm's segments include bulk chemicals fuel additives The company has strong track record on quarterly as and sodium nitrite/nitrate

• During the December quarter, operating profit Furthermore, the schedules as well as focus on high-value high-margin company in filing said that uncertainties caused by products. Moreover, balanced growth across basic the coronavirus are exacerbating the concerns chemicals, fine & speciality chemicals and around China. This is a tailwind for the speciality performance products segment resulted in robust chemical industry and the company is well placed to topline performance which was supported by continue to build upon its success in recent years. encouraging demand scenario of company's products Thus, it is expected that the stock will see a price intheexportmarkets.

• Deepak Phenolics (DPL), a wholly-owned subsidiary expected P/BVx of 2.8x and FY21 BVPS of Rs.152.99. of Deepak Nitrite, operates a Global Scale Plant to manufacture Phenol & Acetone, with a capacity of 200,000 MTPAand 120,000 MTPArespectively. This is supported by capacity to manufacture 260,000 MTof Cumene for captive consumption.

• DPL registered revenue growth of 24% to Rs 550 crore in Q3 FY20, with operating profit of Rs 58 crore and has delivered its maiden profitable quarter with net profit of Rs 15 crore. Despite the challenges in the Phenol and Acetone market globally and slowing economic growth in the domestic market, the company has been able to increase sales volumes to sustain its leadership position in the domestic market. The capacity utilisation continued to remain high, at over 100%. • The management of the company expects capex of

Rs 400 crore in FY21 and has maintained its growth guidance forfine and speciality chemicals at 10-15%.

Risk

• Volatility in Raw Material Prices

• Currency Fluctuations

Valuation

The company has strong track record on quarterly as and sodium nitrite/nitrate. well as yearly basis. It has a positive outlook towards Moreover, balanced growth across basic the coronavirus are exacerbating the concerns chemicals, fine & speciality chemicals and around China. This is a tailwind for the speciality performance products segment resulted in robust chemical industry and the company is well placed to topline performance which was supported by continue to build upon its success in recent years. encouraging demand scenario of company's products Thus, it is expected that the stock will see a price intheexportmarkets. target of Rs.428 in 8 to 10 months time frame on an • Deepak Phenolics (DPL), a wholly-owned subsidiary expected P/BVx of 2.8x and FY21 BVPS of Rs.152.99.

Source: Company Website Reuters Capitaline

Above calls are recommended with a time horizon of 8 to 10 months.

6

The stock closed at Rs 285.80 on 20th March, 2020. It made a 52-week low at Rs 220 on 13th March 2020 and a 52-week high of Rs. 352.60 on 01st April, 2019. The 200 days Exponential Moving Average (DEMA) of the stock on the daily chart is currently at Rs 265.18

As we can see on chart that stock has consolidated in narrow range and has given the breakout of same along with high volumes. So, buying momentum may continue for coming days. Apart from this, technical indicators such as RSI and MACD are suggesting buying for the stock. Therefore, one can buy in the range of 277-280 levels for the upside target of 320-330 levels with SL below 255.

The stock closed at Rs 175.50 on 20th March 2020. It made a 52-week low of Rs 134.60 on 13th March 2020 and a 52-week high of Rs. 310 on 21st May, 2019. The 200 days Exponential Moving Average (DEMA) of the stock on the daily chart is currently at Rs 237.16

After melting sharply from 260 levels, stock made yearly low of 135 levels and recovered sharply due to huge buying force. Last week, stock witnessed follow up buying and formed a reversal candle on weekly charts, which shows reversal in stock so more upside is anticipated from current levels. Therefore, one can buy in the range of 170-172 levels for the upside target of 190-195 levels with SL below 158.

Disclaimer : The analyst and its affiliates companies make no representation or warranty in relation to the accuracy, completeness or reliability of the information contained in its research. The analysis contained in the analyst research is based on numerous assumptions. Different assumptions could result in materially different results.

The analyst not any of its affiliated companies not any of their, members, directors, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of the analysis research.

SOURCE: CAPITAL LINE

Charts by Spider Software India Ltd

Above calls are recommended with a time horizon of 1-2 months

7

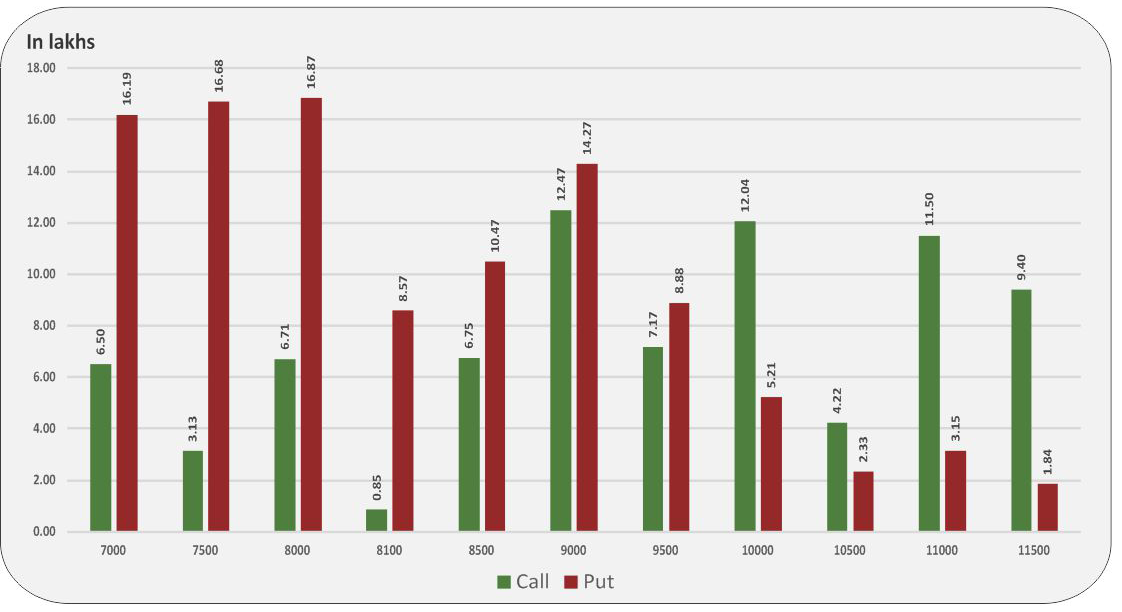

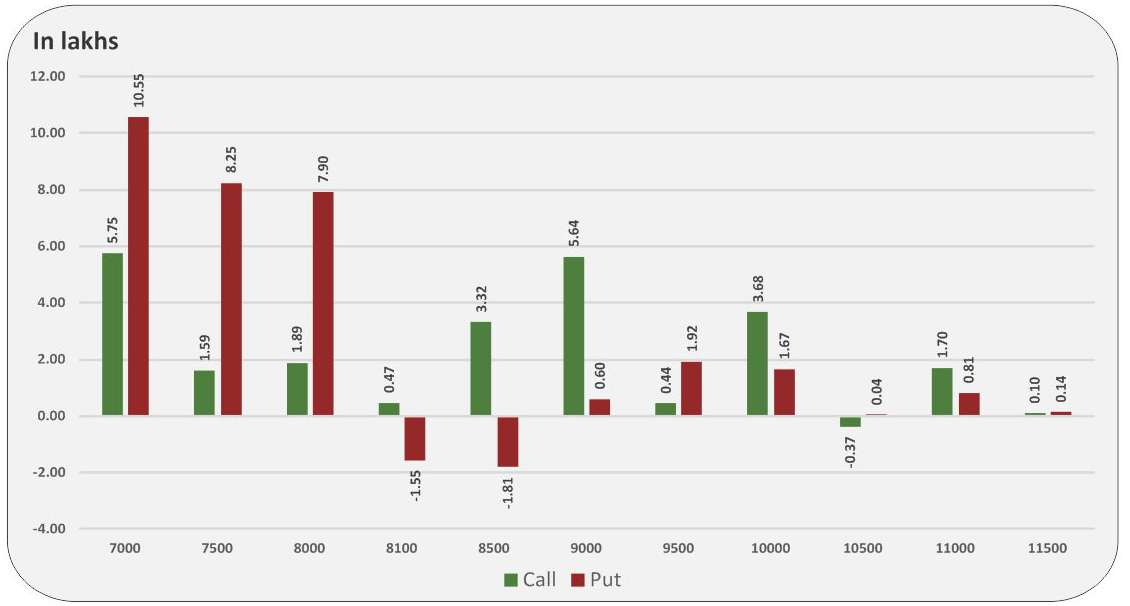

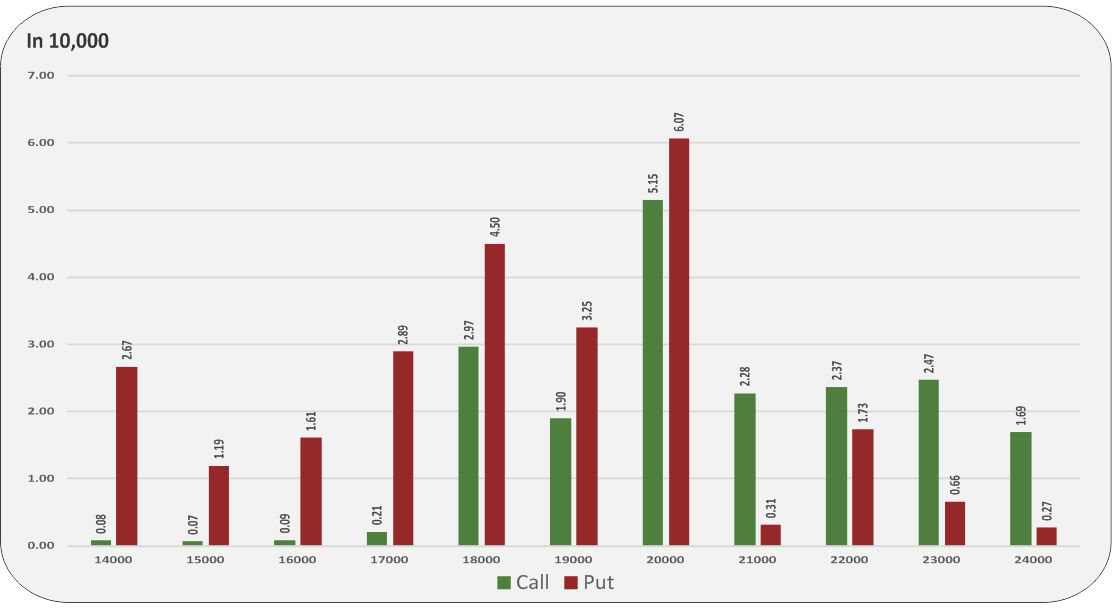

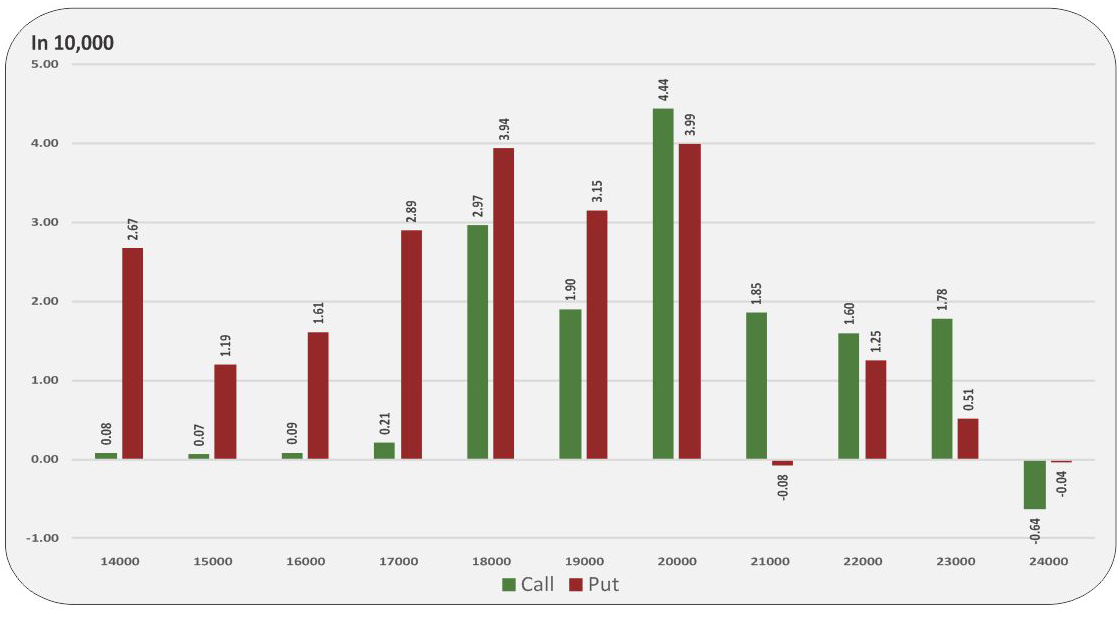

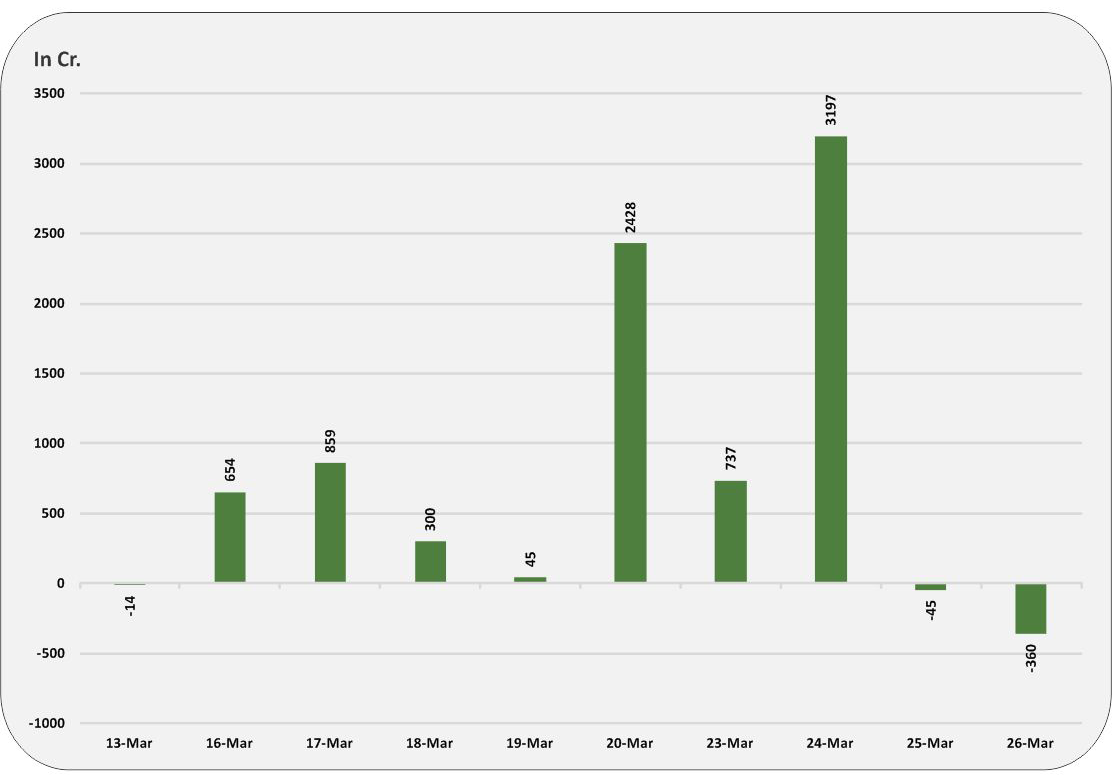

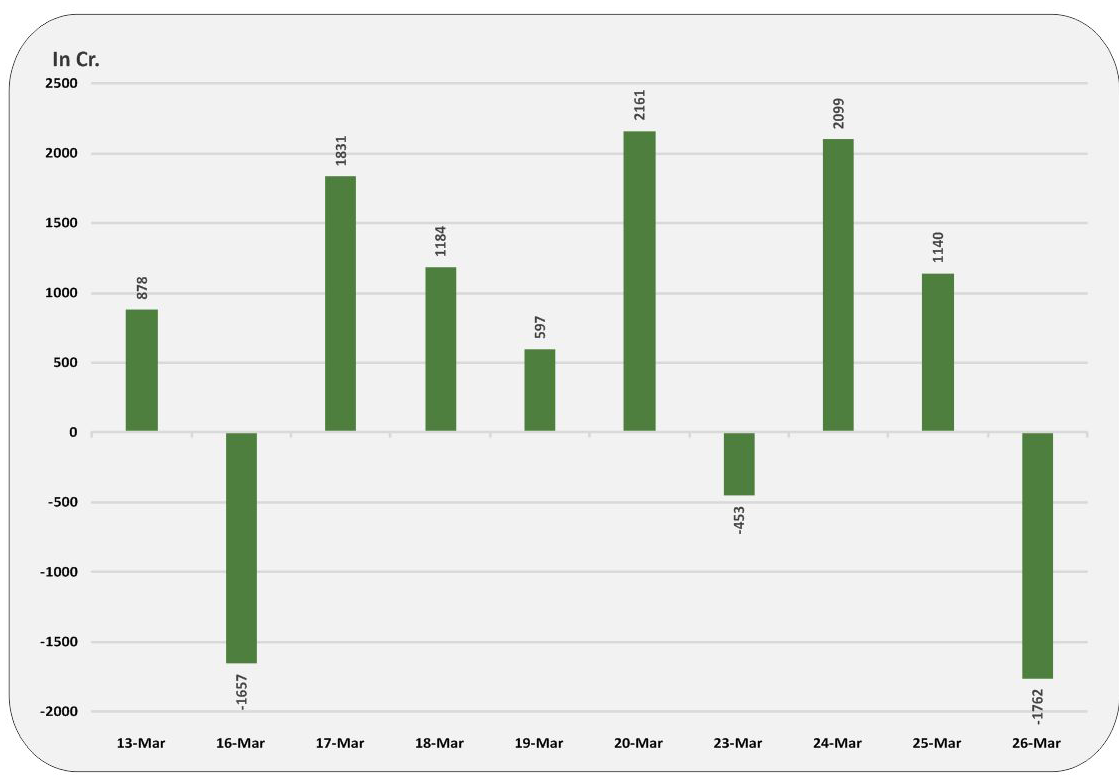

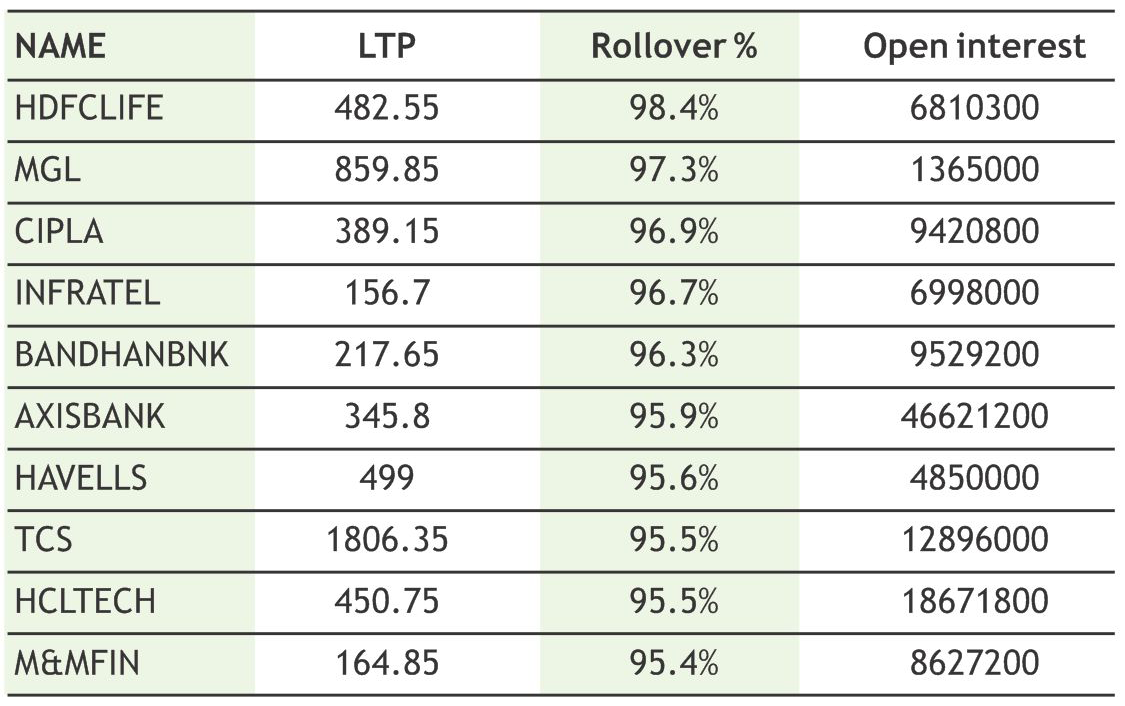

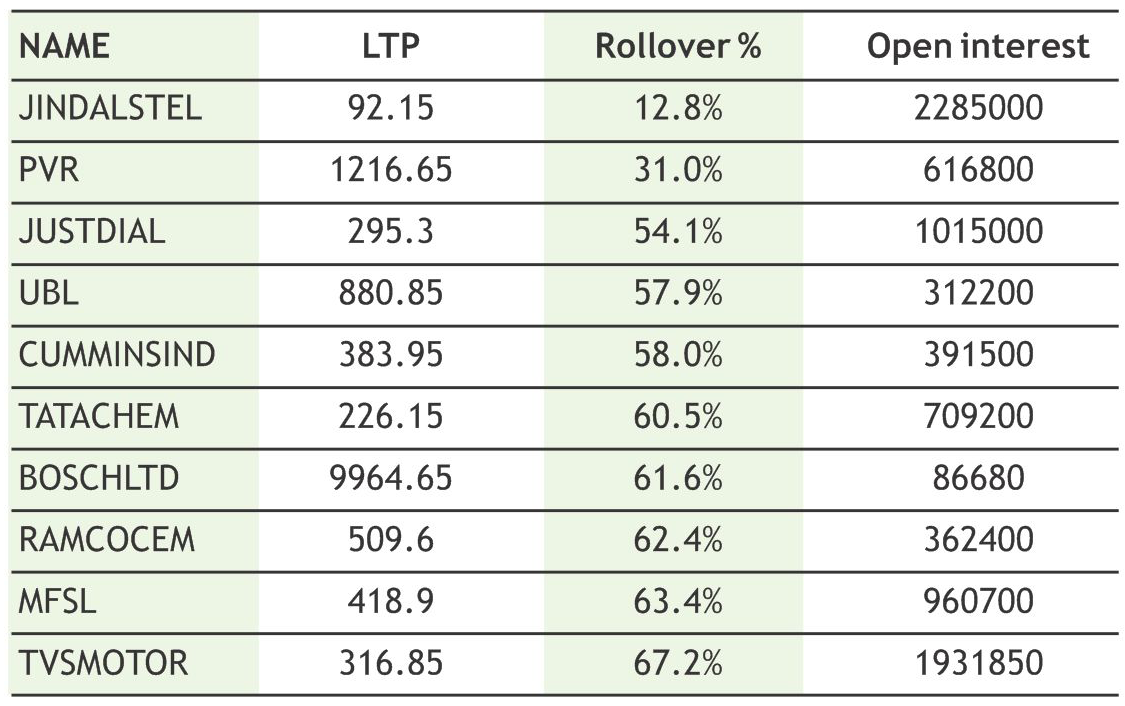

After a steep fall during the week, Indian markets bounced back sharply in Friday’s session and post best one day gain since 2009 along with worst weekly drop since 2008. However, Nifty once again reclaimed 8700 levels after dropping towards 3 year low of 7850 amid escalating fears of economic dislocation due to corona virus. On weekly basis, Nifty witnessed losses of nearly 12% despite Friday’s session recovery and Bank nifty also ended the week with losses of nearly 19% with closing just above 20300 marks. On technical front, both the indices are currently trading in a bearish zone, but also at highly oversold territory. From current level, one can expect some more recovery towards 8900 levels as short players try to book at lower levels ahead of monthly future and option expiry. On higher side, however, still 9100-9200 levels would act as crucial resistance for Nifty while 21000 to 21500 zone would cap any sharp upside in bank nifty. The Implied Volatility (IV) of calls closed at 68.80% while that for put options closed at 72.50%. The Nifty VIX for the week closed at 67.10% and is expected to remain volatile with bullish bias. PCR OI for the week closed at 0.70. In coming week, we expect that markets may once again witness some wild swings with bears likely to keep control over the markets on any further bounce

8

|

|

|

|

**The highest call open interest acts as resistance and highest put open interest acts as support.

# Price rise with rise in open interest suggests long buildup | Price fall with rise in open interest suggests short buildup

# Price fall with fall in open interest suggests long unwinding | Price rise with fall in open interest suggests short covering

9

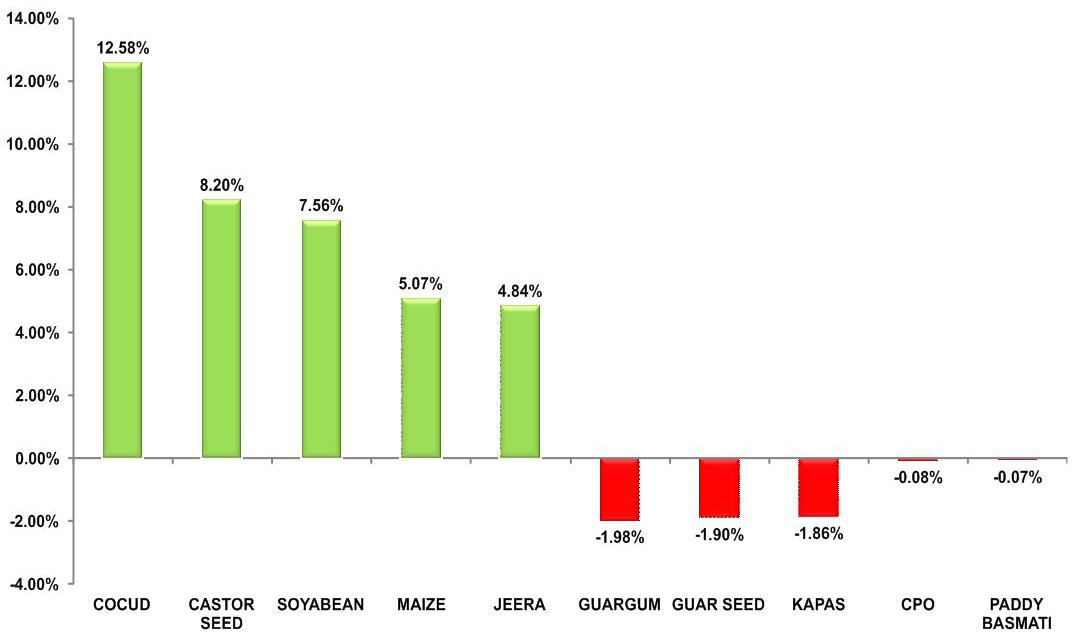

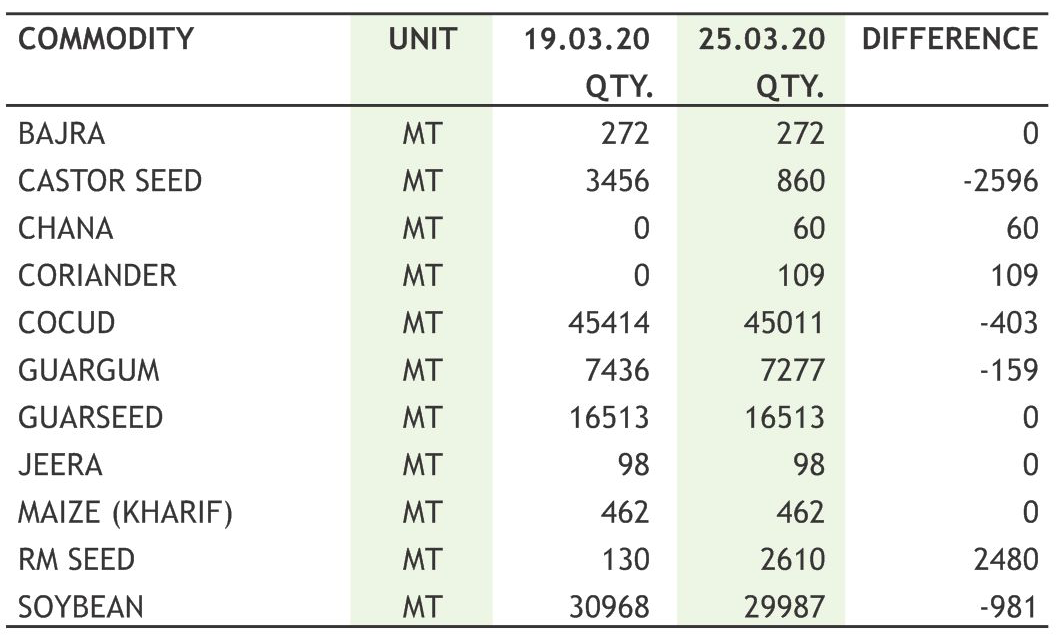

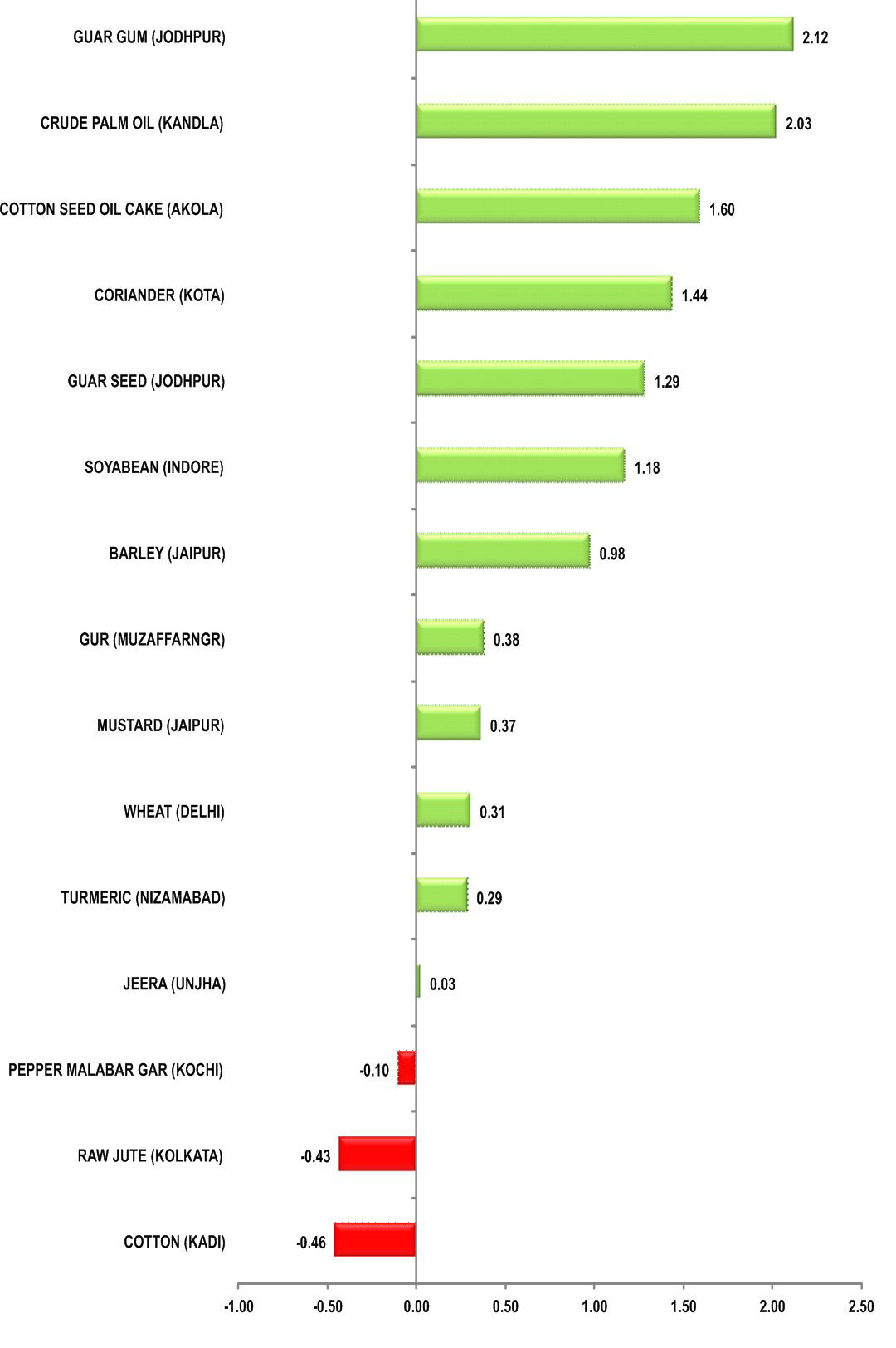

Turmeric futures (April) may take support near 5350 & witness gain towards 5800-5900 levels. Exporters across India are confirming an increased interest from corona-affected countries in consuming raw turmeric. The demand for raw turmeric has risen sharply in the UK and Germany. It is reported that the demand has shot up to 3 tonnes a day this month. However, market participants are advised to take long positions cautiously as the sale of turmeric in spot market of Erode would be closed till the month end. Jeera futures (April) is seen facing resistance near 13800 and taking support around 12900. There are two factors playing around this counter, firstly, there is increased supply of the fresh crop at spot markets and forecast of higher production. Secondly, it is being reported that shipments of jeera to China have begun. Exporters have started getting fresh orders, although at slower pace. Lower level buying can be seen in coriander futures (April) around 5400 & upside momentum can be seen till 6000-6100 levels. The sentiments are positive after the recent heavy rain and hailstorm over the key growing areas of Rajasthan have damaged the crop. Cardamom futures (April) may plunge further towards 2000-1930 levels. Cardamom traders are apprehensive over the restrictions imposed in the auction hall, saying that such limitations are hindering a smooth trading process. Moreover, subdued demand for cardamom across the upcountry markets due to virus scare has also led to a slow movement in the trade. The average price realization is lower at ? 2,380 per kg, especially with the offer of present bulk that too of medium quality.

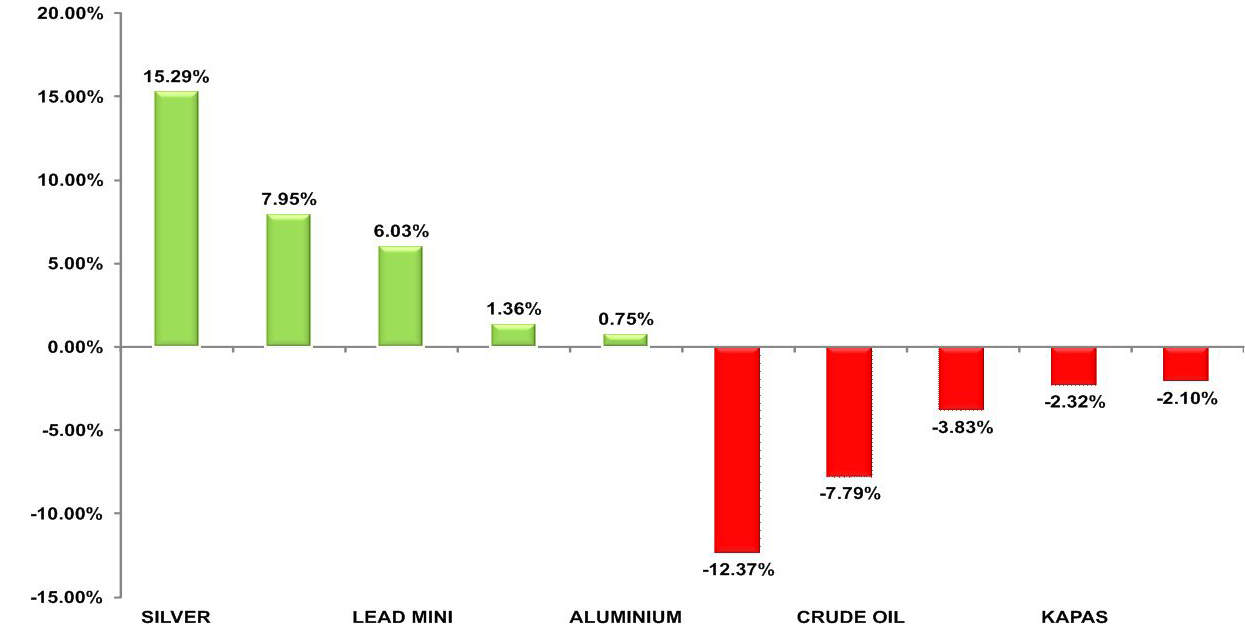

Bullion counter may remain under selling pressure as investors are doing panic selling across all asset classes to hoard cash due to widespread coronavirus globally. Many central banks giving various stimulus measure to lift the dampened sentiments. Meanwhile gold silver ratio tested lift time high of above 125 as silver fell at drastic pace than silver. Silver, on the other hand, tanked and traded below $12 per ounce on March 16, the lowest price since way back in 2009 during the last significant financial crisis. Gold may move towards 38000 while taking resistance near 42000 and silver can test 32000 while facing resistance near 39500. The Fed stated that it would reinstate a funding facility used during the 2008 financial crisis to get credit directly to businesses and households as fears over a liquidity crunch due to the virus have grown in recent days.US Fed decided to slash interest rates by 1 percent to 0 percent and promised to boost its bond holdings by at least $700 billion in Treasuries and MBS securities. The Trump administration pursued a $1 trillion stimulus package that could deliver $1,000 checks to Americans within two weeks to buttress an economy hit by the virus. The European Central Bank launched a 750 billion euro ($818 billion) emergency bond purchase programme to push down borrowing costs in a bloc struggling with the economic fallout of coronavirus. Britain launched a new lending scheme to provide short-term bridging finance forlarge businesses hurt by the spread of coronavirus, which will be run and funded by the Bank of England.

Soybean futures (April) is expected to witness consolidation in the range of 3400-3600 & trade with a positive bias. The sentiments are positive due to improved buying at lower price levels. Gains in U.S soybean on CBOT is also lending support to the domestic prices. Mustard futures (April) is likely to gain further & test 4050-4110 levels. This Rabi oilseed crop across many parts of North India has witnessed heavy damage due to the repeated spells of heavy rain accompanied by hailstorm and strong winds this month.Major producing states such as Punjab, Haryana, Uttar Pradesh and Rajasthan have seen maximum loss. Soy oil futures (April) will possibly continue to show upside momentum & move higher towards 780-800 levels. The demand in the domestic market is catching up as the end consumers are indulging in physical buying ahead of Navaratri. Also, U.S soy oil on CBOT is seen stabilizing near 25 cents per pound as demand from China has started coming into the international market. CPO futures (April) is expected to trade with an upside bias & test 660-680 levels. Lower level buying accompanied with rising gap between demand & supply may fuel the upside. The overall import of vegetable oils during November 2019 to February 2020 is reported at 4,563,791 tons compared to 4,862,849 tons i.e. down by 6.1%. Currently total stock at ports and in pipelines is reported at 1,530,000 tons, decreased by 205,000 tons from 1,735,000 tons as on 1st Feb., 2020. India’s monthly requirement is about 19.00 lakh tons and ordinarily operates at 30 days stock against which currently holding stock 15.30 lakh tons equalto 24 days requirements.

Crude oil prices may continue to drop further as worries about global demand persist as the spread of coronavirus showing no sign of abating. Countries on every continent have resorted to drastic lockdowns, steps to try to tame a virus that has now infected more than 200,000 people worldwide, killing more than 8,000, with a major global recession in prospect. Crude oil may further dip towards 1800 while taking resistance near 2500. Elsewhere, Iraq's oil minister pleaded for an emergency meeting between members of the Organization of the Petroleum Exporting Countries (OPEC) and non-OPEC producers to discuss immediate action to help balance the oil market. The impact on oil demand is starting to show in official statistics with Japan's trade bureau saying that crude imports into the world's third-biggest economy fell 9% from a year earlier in February. Saudi Arabia and Russia started a price war after failing to agree to extend their pact to cut output to support the markets. Saudi Aramco has stated that it would likely carry over its planned higher oil output for April into the following month, and that it was "very comfortable" with an oil price of $30 a barrel. Natural gas can remain on weaker path as travel bans sparked by the coronavirus slashed the global outlook for energy demand volatile path, Overall it can move towards 110-100 range by taking resistance near 150 levels. Warmer than normal weather is expected to cover most of the United States for the next 6-10 and 8-14 days according to the National Oceanic Atmospheric Administration.

The bearish trend in cotton futures (April) is likely to get extended towards 17000-16500 taking negative cues from the international market. Exporters have already been out of the market due to the outbreak of coronavirus in 168 countries of the world, including Vietnam. While liquidity problem has also started in the market due to the fall in the price and as the deals were done earlier at higher levels. U.S cotton is trading near its 3 year low of 53.64 cents per pound due to fears of dwindling demand for the natural fiber due to the coronavirus and its impact on supply chains. Data from the United States Department of Agriculture (USDA) is showing that net sales of this natural fibre are continuously descending amid lower demand from China. Traders noted that the shutdown of two terminals at Port Houston, Texas, added to concerns about cotton shipments. Disruptions at Port Houston could have serious implications on shipping of the natural fiber from Texas, the biggest cotton growing region in the United States. Further weighing on cotton prices, is the dollar soared to its highest since 2017, rising against a basket of currencies for a third day. Mentha oil futures (April) is expected to trade with a downside bias to retest its previous week low of 1070 & if it trades below it then we may see 1020 also in days to come. The fundamentals of low demand and expectation of a rise in acreage this season is giving a bearish indication to the counter. Castor seed futures (April) is expected to witness some short covering & move higher towards 3900-4000 levels. As situation is getting better in China, the exporters have started getting order.

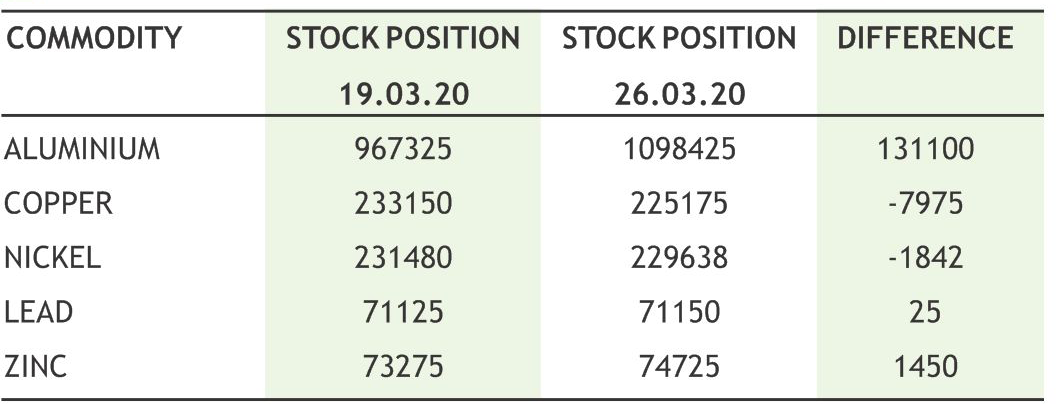

Base metal counter may remain on under selling pressure amid fast spreading coronavirus deepened worries about a global recession and spread turmoil across financial markets. Economic data released showed that growth in industrial production in China contracted by 13.5% in January and February compared to the same period last year. But short covering at lower levels cannot be denied. Copper may test 340 levels while facing resistance near 410.Inventories of copper climbed by 34,959 tonnes from the penultimate week to 380,065 tonnes and that’s the most since March 25, 2016. Chilean copper miner Codelco stated it would reduce its operations to comply with a state of catastrophe announced by the government in a bid to curb the spread of coronavirus. China's refined copper production rose 2.8% on the year in the first two months of 2020, but the daily rate fell more than 15% from December, as smelters reduced loads amid a coronavirus outbreak. China, churned out 1.527 million tonnes of the metal in January and February combined. Meanwhile, lead may remain in red as it can test 128 while taking resistance near 147 levels. Zinc may remain on weak bias as it can test 130 levels while facing resistance near 160. Nickel prices can slip lower towards 800 while taking resistance near 950. Aluminium prices can dip towards 128 while taking resistance near 138. Norsk Hydro one of the world's largest aluminium producers, warned last week about increasing risk for its operations due to the coronavirus outbreak.

10

|

CRUDE MCX (APR) contract closed at Rs. 1980.00 on 19th Mar’2020. The contract made its high of Rs. 4186.00 on 21st Jan’2020 and a low of Rs. 1717.00 on 18th Mar’2020. The 18-day Exponential Moving Average of the commodity is currently at Rs. 2659.00. On the daily chart, the commodity has Relative Strength Index (14-day) value of 30.984.

One can buy near Rs. 2050 for a target of Rs. 2500 with the stop loss of Rs. 1825.

REF. SYO NCDEX (APR) contract closed at Rs. 746.80 on 19th Mar’2020. The contract made its high of Rs. 938.40 on 02nd Jan’2020 and a low of Rs. 687.20 on 13th Mar’2020. The 18-day Exponential Moving Average of the commodity is currently at Rs. 754.77. On the daily chart, the commodity has Relative Strength Index (14-day) value of 49.118.

One can buy near Rs. 750 for a target of Rs. 850 with the stop loss of Rs. 700.

TURMERICNCDEX (APR) contract was closed at Rs. 5524.00 on 19th Mar’2020.The contract made its high of Rs. 6780.00 on 04th Nov’19 and a low of Rs. 5354.00 on 16th Mar’2020. The 18-day Exponential Moving Average of the commodity is currently at Rs. 5721.71. On the daily chart,the commodity has Relative Strength Index (14-day) value of 40.628.

One can buy near Rs. 5650 for a target of Rs. 6000 with the stop loss of Rs 5475.

11

US stated that it will take advantage of low oil prices to fill its Strategic Petroleum Reserve (SPR), and other countries and companies are planning similar measure to fill storage tanks.

Ÿ Saudi Arabia will continue to supply a record 12.3 million barrels per day (bpd) to the oil market in the coming months.

Ÿ China's retail salesof consumer goodsdeclined20.5percent year on yearin the firsttwo months ofthis year as the novel coronavirusoutbreaktookits tollontheeconomy

Ÿ China's industrial output contracted at the sharpest pace in 30 years in the first two months of the year.

Ÿ SEBI has proposed, ‘one commodity, one exchange’ plan even though currently multiple exchanges are allowed to launch contract on the same commodity to create competition and give choice to investors.

Ÿ The trading in bullion derivatives at Multi Commodity Exchange (MCX) recorded its highest daily turnover at Rs 35,112.35 crore on March 16, 2020.The turnover for gold options was at one and a half year high at Rs 3,917 crore (9.49 MT).

Ÿ MCX has modified the Trading Unit and Delivery Unit in Mentha Oil futures contracts effective from June 2020 expiry contract and onwards. Accordingly, MCXCCL has announced modifications in delivery unit of Mentha Oil from 2160 kg / 12 drums to 1080 kg / 06 drums with effect from June 2020 contract

Ÿ Exports of Malaysian palm oil products for March 1 - 20 fell 21.2 percent to 644,421 tonnes from 817,314 tonnes shipped during February 1 - 20, cargo surveyor Intertek Testing Services.

Ÿ China has approved the launch of liquefied petroleum gas (LPG)futuresandoptionsontheDalianCommodityExchange

It was another week in which commodities saw high volatility. Financial market saw turmoil and dollar index soared above 102 on safe haven buying. Among all commodities, crude caught the most attention as it was acting on the tune of COVID-19 amid tensions among oil producers. U.S. crude prices closed up 24% on Thursday, in a u-turn to the previous day’s losses, after the Trump administration said it will buy oil to top up the nation’s reserves and support American drillers hurt by the coronavirus crisis and ill-timed production hikes by Saudi rivals. Traders also responded positively to the announcement by leading U.S. shale oil producer Continental Resources that it will halve its capital expenditure and slash rigs in the Bakken and Oklahoma drilling fields where it operated. Open interest in the precious metal, a tally of outstanding futures contracts, has plunged to the lowest in more than seven months. Pressure to dump bullion to raise cash and cover losses in other markets has sent the metal tumbling this month. Industrial metals saw panic selling. LME copper declined, heading for a weekly drop of almost 13%. It is the biggest weekly slump since September 2011. Chile’s top producer Codelco will operate at reduced capacity for the next 15 days to help contain the virus. Aluminum fell for a fifth straight session, heading for a weekly drop of 3.2%. It touched an almost 4-year low of $1,579.50 yesterday. Rusal may have to close its Irish alumina refinery, which supports many European aluminium smelters with feed, due to the coronavirus. On Wednesday’s announcement of the European Central Bank’s €750 billion ($821.23 billion) Pandemic Emergency Purchase Programme to purchase securities to support European economies limited the fall of metals.

Agri commodities were not in exception but they noticed limited fall as compared to metals and energy. Chan, mentha spices except cardamom saw some lower level value buying. Soyabean, refined soya oil, mustard seed also some gain on fresh buying. The upside in mustard was capped as it is reported that NAFED was offloading old mustard stocks amid higher fresh supplies. The trend of cotton futures reversed to bearish owing to weakness in international cotton market. Export demand has also come to a standstill due to the rapid spread of coronavirus globally. The demand in chana dal and besan from wholesale/retailer counters was reported to be good. Good buying from besan flour millers was witnessed at lower rates.

|

|

12

|

|

Rabi crops-wheat, mustard, chickpeas, chana, masur and barley- are sown during the winter and harvested by farmers in summer. But recent unseasonal rain and hailstorms this month in several part of north-western and central India damaged these rabi crops and left farmers praying for a miracle to happen.

India registered an over 80 per cent increase in rainfall in the first two weeks of March — from an average of 9.3 mm to 16.9 mm. Major wheat and mustard producing states such as Punjab, Haryana, Uttar Pradesh and Rajasthan bore the maximum damage.

Uttar Pradesh, which is the largest wheat-producing state, recorded 23.8 mm rain in March. This is 667 per cent higher than the normal rainfall level of 3.1 mm during this period. Similarly, Punjab, Madhya Pradesh, Haryana, Rajasthan and Bihar have also recorded much higher rainfall than is normally recorded during this period — 311 per cent, 168 per cent, 702 per cent, 685 per cent and 604 per cent, respectively

The government has pegged the rabi food grain output in 2019-20 (Jul-Jun) at a record high of 149.6 mln tn, with wheat production seen at a new high of 106.2 mln tn and chana crop at 11.2 mln tn. Output estimates of both these crops are now under a cloud, as the recent rains are seen taking a toll on yield as well as quality

While Uttar Pradesh has been the worst hit, crops have also been hit in parts of Rajasthan, Punjab, Haryana and Bihar. The extent of the damage is not yet officially known, since governments are yet to collect data. Preliminary reports, however, officials in the state agriculture ministry said, that 70% mustard and 60% wheat have been damaged in north-west India.

According to Punjab Agriculture department, wheat on 2.02 lakh hectares has flattened. At least 20 per cent of wheat crop have been damaged in Punjab.

Heavy rain and hailstorm over the weekend in key parts of Rajasthan damaged rabi crops planted over 400,000 ha. Apreliminary report showed total 19 districts in the state had been affected and ready-to-harvest crops like mustard and wheat were the worst hit. Of the total 2.4 mln ha under mustard in the current 2019-20 (JulJun) season, standing crop on 188,000 ha has been affected due to untimely rains, and wheat over 164,000 ha has been damaged. Around 10% of the mustard yield is likely to be hit in key growing parts of Rajasthan, which is a leading producer of the oilseed. In Rajasthan, about 60% of the mustard crop is yet to be harvested. The ripened crop of mustard has been hit hard by inclement weather in Haryana and Uttar Pradesh also.

Among pulses, around 38,000 ha under chana has been damaged. Acreage under chana in the current season is estimated at 2.1 mln ha, and wheat at 3.3 mln ha.Total rabi sowing in Rajasthan was pegged at 9.97 mln ha in the ongoing season, according to the Rajasthan farm department data

In Bihar Masur and mustard crops were the worst-affected and is likely to fall by 25%-30% because of the rains. Pulses are cultivated in 5 lakh hectares across Bihar, with the masur crop covering 1.5 lakh hectares, according to the state government’s data.

This untimely shower and hailstorm may also delay harvest of rabi crops in the affected areas by about a fortnight and raising concern about a low food grain output, and a spike in food prices in the coming months.

13

|

| 16th March | US Fed Cuts Key Interest Rate to 0-0.25% amid Coronavirus Crisis. |

| 16th March | The India WPI index rose 2.26 percent year-on-year in February, slower than a 3.10 percent increase in January. |

| 19th March | The BOE cut interest rates to 0.1% and ratcheted up its bondbuying program Thursday, in an effort to offset the economic impact of the coronavirus outbreak. |

| 20th March | Rupee gained by 34 paise to 74.78 against dollar after stron intervention from RBI. |

| 20th March | GBP/USD rallies from 35-year low as BoE slashes rates. |

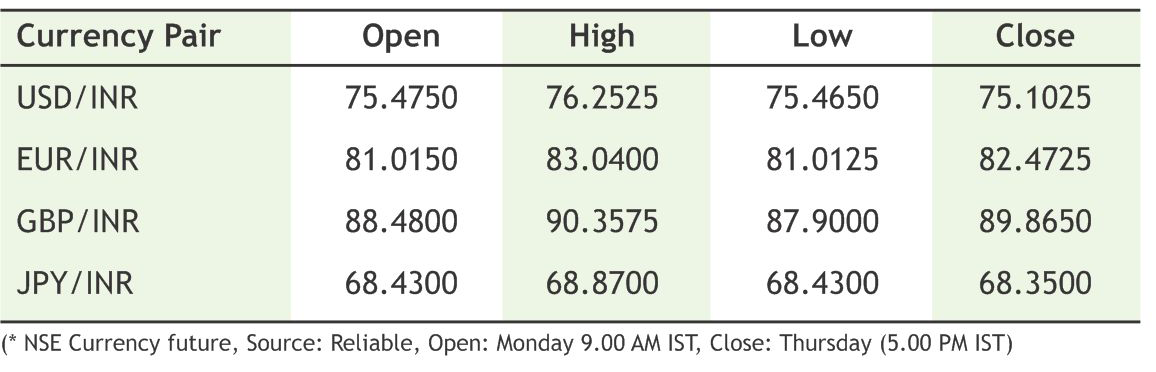

Indian rupee hit the lowest level in history amid the outbreak, weakened past 75.00 in this week as we rightly pointed earlier in the wake of pandemic call from WHO. The plunge in the rupee also led to a sharp rise in domestic bond yields as market participants’ feared heavy outflow from Indian dated securities by overseas investors. Moreover, market participants perceived the Reserve Bank of India's response so far as underwhelming, which has dented the view on interest rates as people were expecting an imminent rate cut by the central bank in the backdrop of the economic fallout of corona virus. The dollar index has blasted higher since the corona virus crisis in markets intensified, hitting a record high when compared with a trade-weighted basket of other currencies this week. Since the beginning of the month, equity markets have plummeted and vital debt markets, including those for US Treasuries and mortgages, have started to fray, along with short-term funding markets. Policymakers have taken steps to address these issues, but at times, equities and bonds have been dropping simultaneously - a classic sign of market distress. This prompts companies, for example, to bulk up on dollars to make up for lost revenues. Going forward next week rupee move will be briefly guided by Indian policymaker’s possible announcement of more fiscal stimulus program to combat the outbreak impact along with Euro-Zone and UK economic releases at a time of lockdown may scale up DXY.

|

USD/INR (MAR) contract closed at 75.2000 on 19-Mar-2020. The contract made its high of 75.4175 on 19-Mar-2020 and a low of 73.9500 on 16-Mar-2020 (Weekly Basis). The 21-day Exponential MovingAverage oftheUSD/INR is currently at 73.67

On the daily chart,the USD/INR has Relative Strength Index (14-day) value of 73.13. One can buy@74.70-74.80 forthe target of 75.50 with the stop loss of 74.30.

EUR/INR (MAR) contract closed 81.2225 on 19-Mar-2020. The contract made its high of 83.1600 on 17-Mar-2020 and a low of 81.6350 on 18-Mar-2020 (Weekly Basis). The 21-day Exponential MovingAverage ofthe EUR/INR is currently at 81.40

On the daily chart, EUR/INR has Relative Strength Index (14-day) value of 48.90. One can buy at 80.00 for a target of 82.00 with the stop loss of 79.50.

GBP/INR (MAR) contract closed at 87.2075 on 19-Mar-2020. The contract made its high of 92.2900 on 16-Mar-2020 and a low of 86.2000 on 19-Mar-2020 (Weekly Basis). The 21-day Exponential MovingAverage oftheGBP/INR is currently at 92.29

On the daily chart, GBP/INR has Relative Strength Index (14-day) value of 35.90. One can buy at 87.00 for a target of 90 with the stop loss of 86.25.

JPY/INR (MAR) contract closed at 68.6775 on 16-Mar-2020. The contract made its high of 70.3975 on 17-Mar-2020 and a low of 68.4000 on 19-Mar-2020 (Weekly Basis). The 21-day Exponential MovingAverage ofthe JPY/INR is currently at 68.43

On the daily chart, JPY/INR has Relative Strength Index (14-day) value of 51.49. One can buy at 68.00 for a target of 70 with the stop loss of 67.50.

14

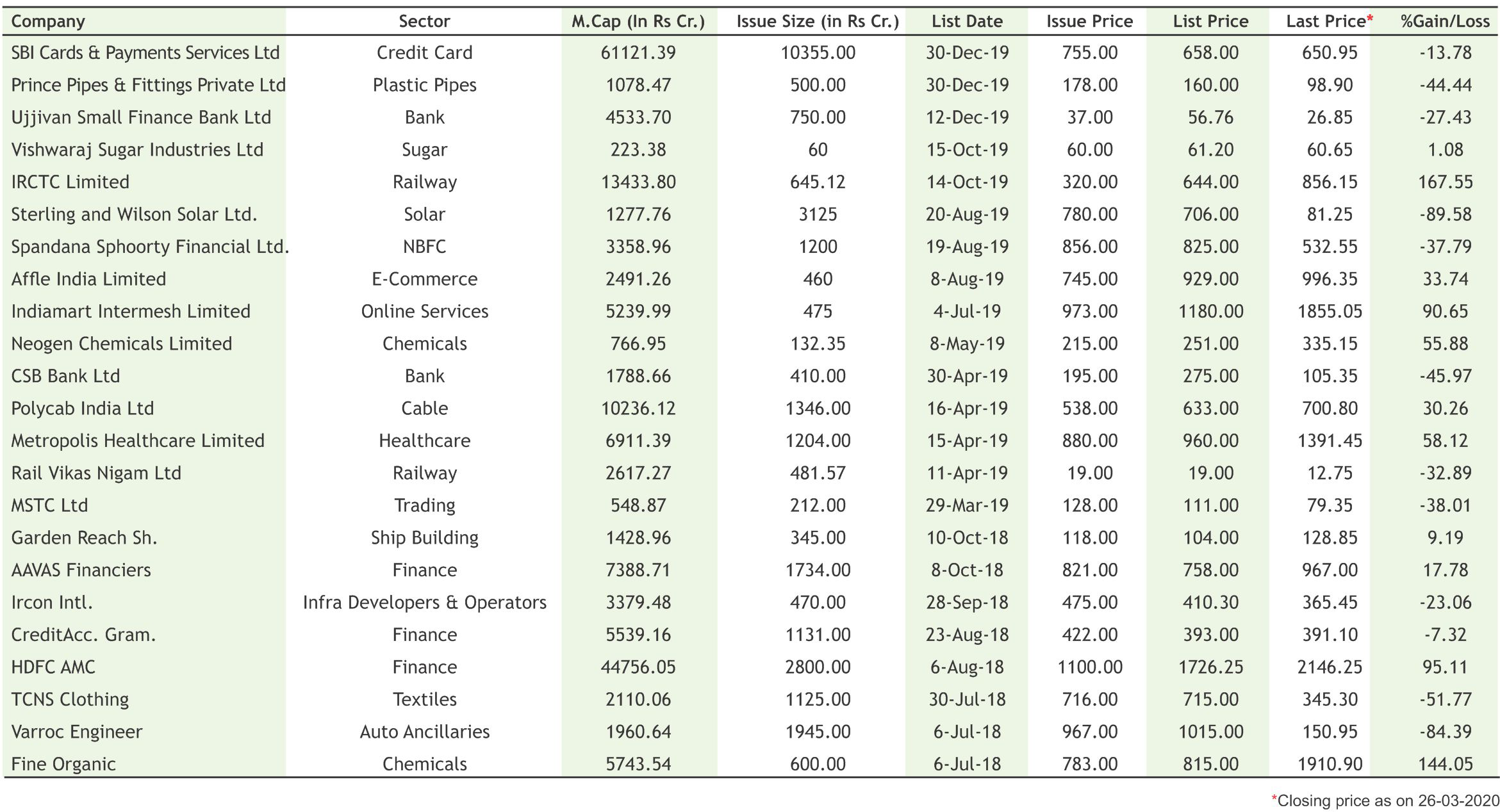

SBI Cards shares have a weak listing, end at 10% discount to issue price

SBI Cards made a weak debut on exchanges with shares ending 10% discount as compared to its issue price of Rs. 755, amid a selloff in broader markets. The Rs. 10,000 crore IPO of SBI Cards and Payment Services Ltd, India's largest IPO in over two years, was subscribed over 22 times and had closed on March 5. The QIB category was subscribed 57.18 times while retail over two times. SBI Cards is the second largest credit card issuer in the country, with 9.4 million outstanding cards as of September end.

Coronavirus hits IPO mart: Burger King shelves plan; Antony Waste withdraws issue

Burger King India joined a growing list of companies putting their initial public offerings (IPO) on hold, as the bears continued to batter the secondary market. Antony Waste Handling Cell had withdraw its IPO as the issue failed to receive requisite subscription even after an extension of its initial subscription period. It became the first mainboard IPO of the year to go unsubscribed.

|

15

|

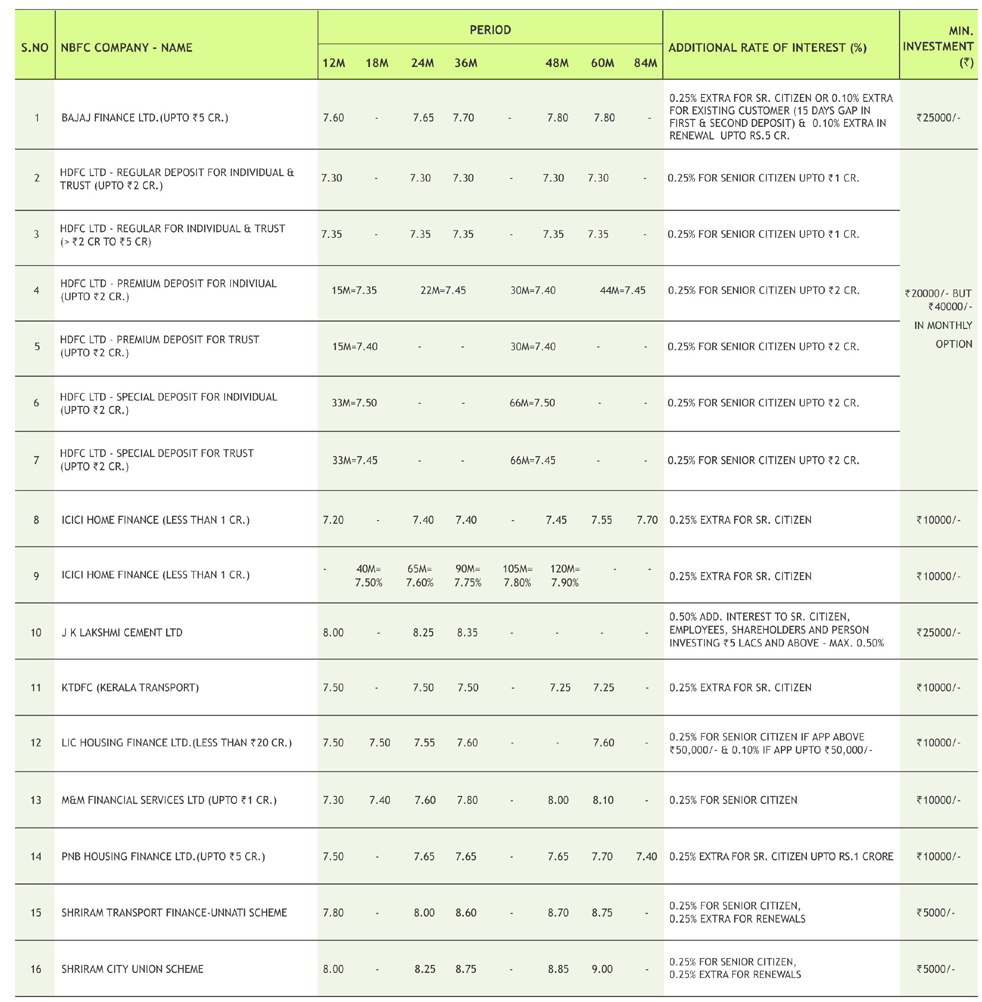

* Interest Rate may be revised by company from time to time. Please confirm Interest rates before submitting the application.

* For Application of Rs.50 Lac & above, Contact to Head Office.

* Email us at fd@smcindiaonline.com

16

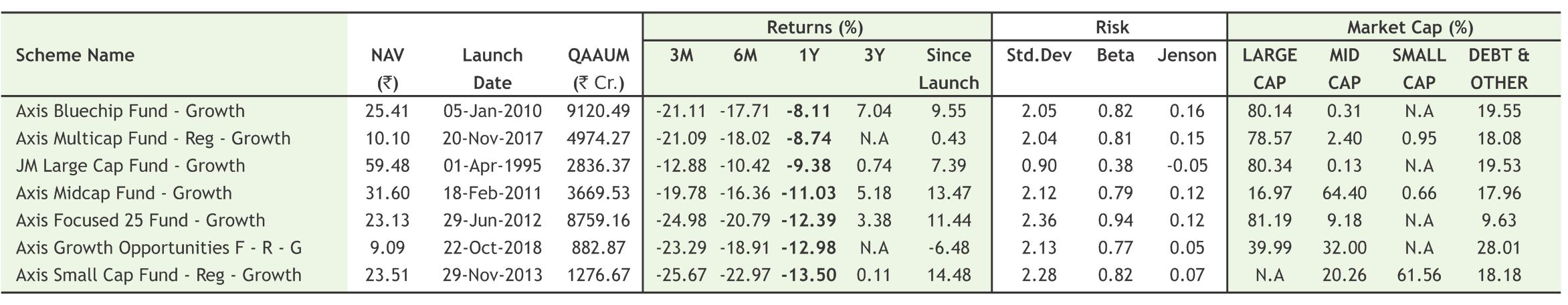

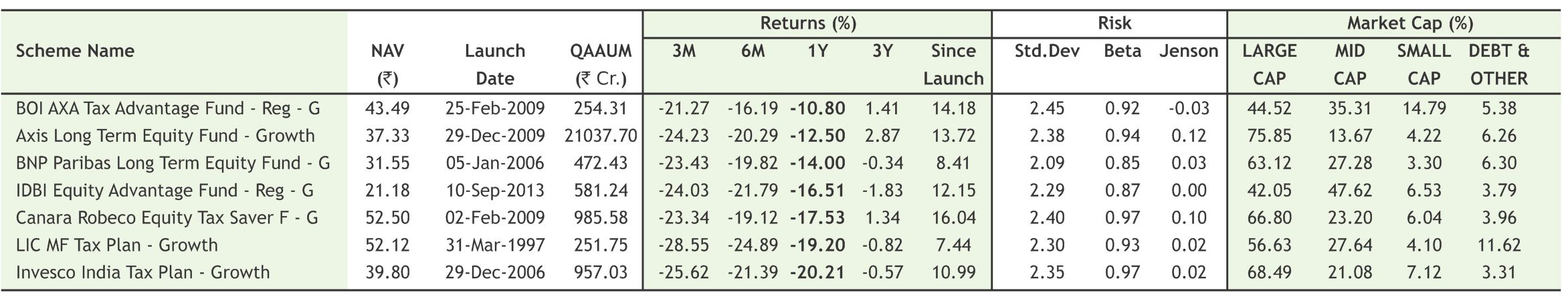

Open-ended equity MFs see Rs 10,796cr inflows in February

Open-ended equity-oriented mutual fund schemes saw the highest monthly inflows at Rs 10,796 crore in February this fiscal. At the aggregate level, the open-ended equity fund AUM declined 4.1 percent to settle at Rs 7.57 lakh crore weighed by mark-to-market losses, Crisil said, quoting Amfi data. According to Amfi data, SIP net inflows in February stood at Rs 8,513 crore, slightly lower than the record high seen in the previous month. But throughout the fiscal, SIP inflows have been stable, which, in turn, steadied the money flow into equity-oriented schemes even though net inflows remained lumpy and erratic at times, says the report. Within the open-ended schemes, multi-cap and large-cap funds saw net inflows of Rs 1,625 crore and Rs 1,607 crore, respectively. Investors even opted for mid-cap and small-caps due to attractive valuations. Total net inflows into these categories stood at Rs 2,949 crore in the month. Sectoral/thematic funds saw net inflow surge to Rs 1,928 crore -- the highest since April 2019, partly because of new schemes launched during the month. Gold exchange traded funds also saw a sharp spike in inflows at Rs 1,483 crore as investors took advantage of the massive rally in the yellow metal.

Mutual funds add 3 lakh investor accounts in February

The mutual fund industry has added over 3 lakh investor accounts in February, taking the total folio tally to 8.88 crore, which suggests investors' understanding about market risks associated with such schemes. However, the pace of growth in folio numbers dropped in February compared to the preceding two months. In January, the industry added 14 lakh folios and in December, the number was over 6 lakh. Mutual fund houses added just 2.6 lakh investor accounts in November. Folios are numbers designated to individual investor accounts. An investor can have multiple folios. According to data from Association of Mutual Funds in India, the number of folios with 44 fund houses rose to 8,88,36,162 at the end of February, from 8,85,33,153 in the end of January, registering a gain of 3.03 lakh folios. This comes at a time even as broader market witnessed heavy volatility amid concerns over the impact of coronavirus pandemic. Number of folios under the equity and equity-linked saving schemes rose by 6.85 lakh to 6.18 crore in Februaryend as compared to 6.13 crore at the end of the preceding month. Notably, investment in equity mutual funds rose to an 11-month high of Rs 10,730 crore in February. However, the number of folio count in debt oriented schemes dropped by 6 lakh to 61.88 lakh at February-end from 67.88 lakh at January-end.

Liquid, other debt mutual funds see Rs 28,000-crore outflow in February

Mutual funds focussed on investing in fixed-income securities saw an outflow of nearly Rs 28,000 crore in February, after registering an infusion of over Rs 1 lakh crore in the preceding month, mainly on account of a massive pullout from liquid funds. According to Association of Mutual Funds in India (Amfi), mutual funds that invest in fixed-income securities saw an outflow to the tune of Rs 27,940 crore last month, compared with an inflow of Rs 1.09 lakh crore in January. The outflow has pulled the asset base of debt mutual funds to Rs 12.22 lakh crore by February-end from Rs 12.42 lakh crore at the end of January. Atotal of Rs 43,825 crore was taken out from liquid funds, which invest in cash assets such as treasury bills, certificates of deposit and commercial paper for shorter horizon. The withdrawal from overnight schemes, which invest in securities with a maturity of one day, stood at Rs 1,474 crore and the same for credit risk funds that invest in riskier debt securities was at Rs 637 crore.

17

|

|

|

|

|

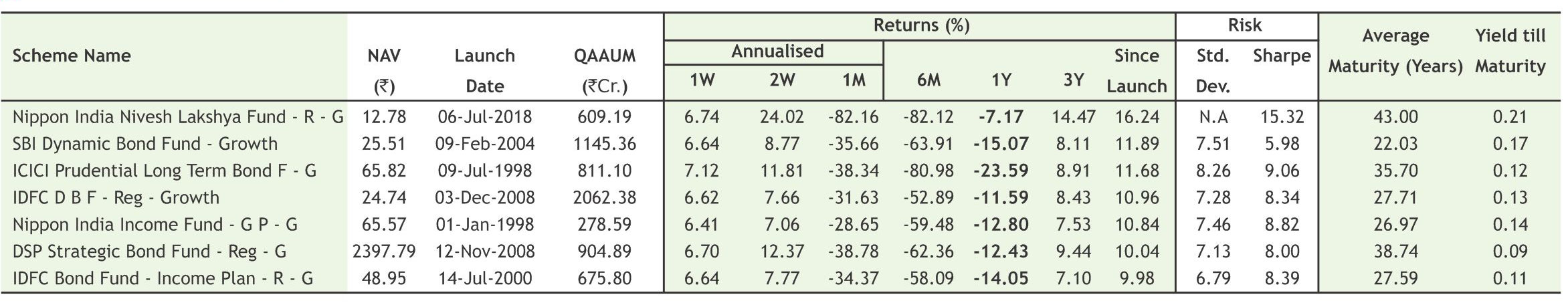

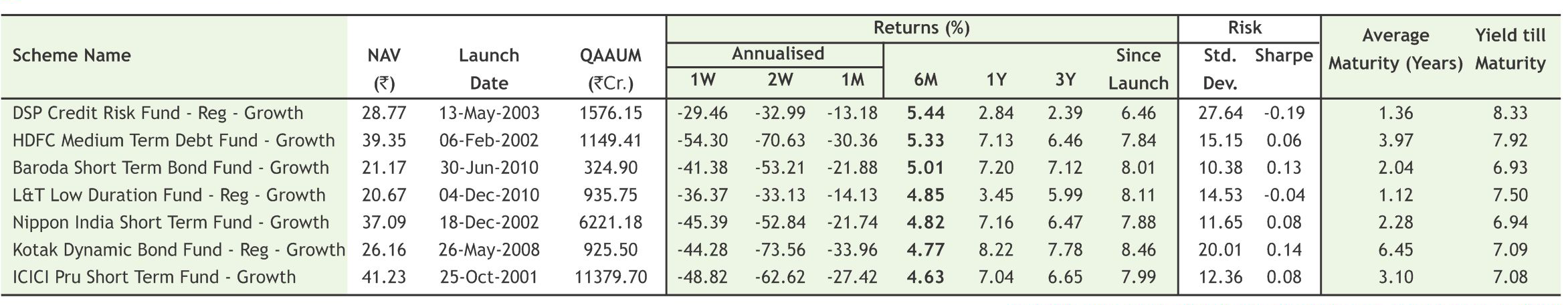

Note:Indicative corpus are including Growth & Dividend option . The above mentioned data is on the basis of 08/08/2019 Beta, Sharpe and Standard Deviation are calculated on the basis of period: 1 year, frequency: Weekly Friday, RF: 7%

*Mutual Fund investments are subject to market risks, read all scheme related documents carefully

18

Dr. D K Aggarwal (CMD, SMC Investments & President, PHDCCI) during the meeting with Shri Ajay Bhushan Pandey, Revenue Secretary, Government of India on 11th December, 2019 at New Delhi.

Mr. Pulin Behari Das (Vice President, SMC Global Securities Ltd.) and Mr. Smruti Ranjan Sahoo (Area Manager, SMC Global Securities Ltd.) during the inauguration of SMC's New Branch at Sambalpur, Odisha.

www.smcindiaonline.com

![]() Comprehensive Investment Solutions

Comprehensive Investment Solutions

![]() Goal Based Investment Advise

Goal Based Investment Advise

![]() Lower Risk by Diversifying Portfolio

Lower Risk by Diversifying Portfolio

![]() Long-term Focus

Long-term Focus

Call Toll-Free 180011 0909

Visit www.smcindiaonline.com

REGISTERED OFFICES:

11 / 6B, Shanti Chamber, Pusa Road, New Delhi 110005. Tel: 91-11-30111000, Fax: 91-11-25754365

MUMBAI OFFICE:

Lotus Corporate Park, A Wing 401 / 402 , 4th Floor , Graham Firth Steel Compound, Off Western Express Highway, Jay Coach Signal, Goreagon (East) Mumbai - 400063

Tel: 91-22-67341600, Fax: 91-22-67341697

KOLKATA OFFICE:

18, Rabindra Sarani, Poddar Court, Gate No-4,5th Floor, Kolkata-700001 Tel.: 033 6612 7000/033 4058 7000, Fax: 033 6612 7004/033 4058 7004

AHMEDABAD OFFICE :

10/A, 4th Floor, Kalapurnam Building, Near Municipal Market, C G Road, Ahmedabad-380009, Gujarat

Tel : 91-79-26424801 - 05, 40049801 - 03

CHENNAI OFFICE:

Salzburg Square, Flat No.1, III rd Floor, Door No.107, Harrington Road, Chetpet, Chennai - 600031.

Tel: 044-39109100, Fax -044- 39109111

SECUNDERABAD OFFICE:

315, 4th Floor Above CMR Exclusive, BhuvanaTower, S D Road, Secunderabad, Telangana-500003

Tel : 040-30031007/8/9

DUBAI OFFICE:

2404, 1 Lake Plaza Tower, Cluster T, Jumeriah Lake Towers, PO Box 117210, Dubai, UAE

Tel: 97145139780 Fax : 97145139781

Email ID : pankaj@smccomex.com

smcdmcc@gmail.com

Printed and Published on behalf of

Mr. Saurabh Jain @ Publication Address

11/6B, Shanti Chamber, Pusa Road, New Delhi-110005

Website: www.smcindiaonline.com

Investor Grievance : igc@smcindiaonline.com

Printed at: S&S MARKETING

102, Mahavirji Complex LSC-3, Rishabh Vihar, New Delhi - 110092 (India) Ph.: +91-11- 43035012, 43035014, Email: ss@sandsmarketing.in