Interim Budget 2019-20

Presenting the Union Budget on February 1, government has cheered for

farmers and middle class both and also aims to build next-gen infrastructure -

physical as well as social - for a $10 trillion economy and to provide Ease of

Living. India is poised to become a $5 trillion economy in the next five years and

aspire to become a $10 trillion economy in the next eight years. Expenditure

target for FY20 is set at Rs 27.84 lakh crore.

Highlights of Budget 2019-20

To cheer the farmers, finance minister announced a relief package of Rs 75,000

crore under a new scheme PM Kisaan Samman Nidhi for distressed farmers who

have seen their incomes stagnate because of plunging prices, barely enough to

pay for loans and input costs. It will enable farmers to earn a respectable living.

• The government has already increased MSP to fulfill its aim of doubling farm

income. All 22 crops have been put under Minimum Support Price. Assured

income support to small and marginal farmers PM Kisan Samman Nidhi launched.

• The government will provide Rs 6,000 per annum to farmers holding land of up to

2 hectares.

The amount will be transferred in three installments of Rs 2,000 directly to the

farmers. Around 12 crore farmers will directly benefit from this scheme:

• The Finance Minister proposed higher allocation for MNREGA by 9 percent to Rs

60,000 crore for the financial year 2019-20, as a part of the NDA government's

larger plan to focus specifically on the country's rural sector, amid concerns over

rising agrarian crisis.

• Defense budget enhanced beyond Rs 3 lakh crore.

• Indian Railways have experienced the safest year. All unmanned level crossings

eliminated. Capital support for railways proposed at Rs 64,500 crore.

Railways operating ratio pegged at 95% in Budget Estimate 2019-20.

• Govt. to introduce container cargo movement to North east.

• Vande Bharat Express will provide speed, service and safety to citizens and will

give a boost to Make in India.

• Govt. will set up 1 lakh digital villages in the next 5 years

• GST is the undoubtedly the biggest taxation reform implemented since

Independence; through tax consolidation, India became one common market;

inter-state movements became faster through e-way bills, improving Ease of

Doing Business.

• GST increased in higher collection (of taxes). Interstate movement of goods has

become hassle free, faster. GST has been continuously reduced, resulting in

relief of Rs 80,000 crore to consumers.

• Items of daily use for poor and middle class are between 0-5 per cent Goods and

Services Tax. Burden should be less on home buyers, so recommendations will be

acted upon by GST Council.

• The Government also aims to expand rural industrialization using modern

industrial technologies, based on Make in India approach.

• Pushing rural infrastructure in the new financial year, union budget of 2019-20

allocated Rs 19,000 crore for development of roads in rural and backward

area under Pradhan Mantri Gram Sadak Yojana (PMGSY).

• FM announces tax exemption for income up to Rs 5 lakh per year

• Individuals with gross income up to Rs 6.5 lakh will not need to pay any tax if

they make investments in provident funds and prescribed equities.

• Standard deduction has been increased to Rs 50,000 from Rs 40,000.

• TDS threshold on rental income raised from Rs 1,80,000 to Rs 2,40,000.

• Income tax relief on Notional Rent from unsold houses extende d to 2 years.

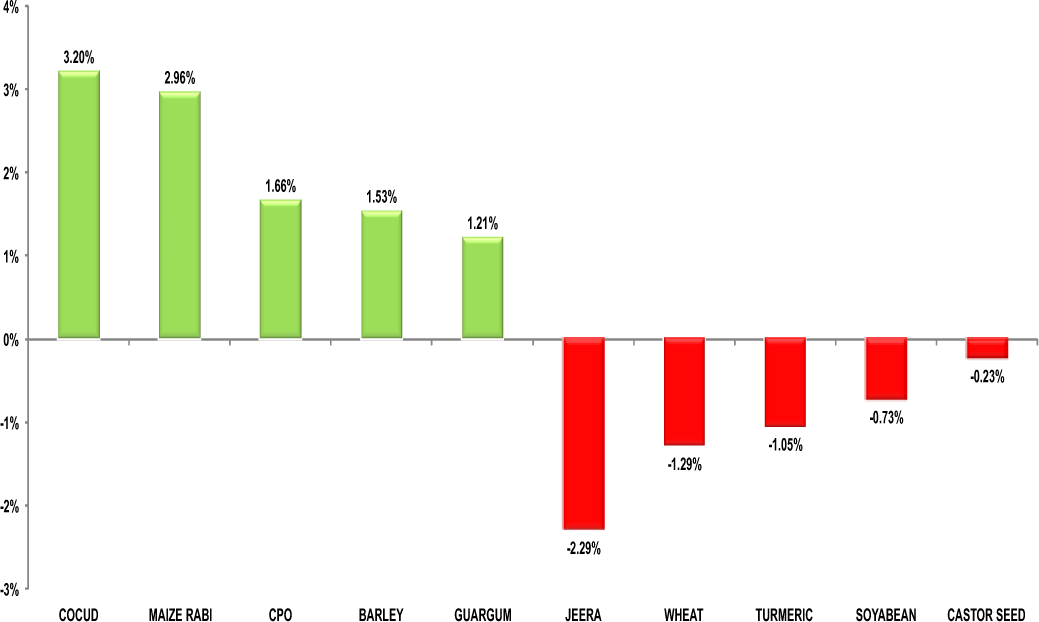

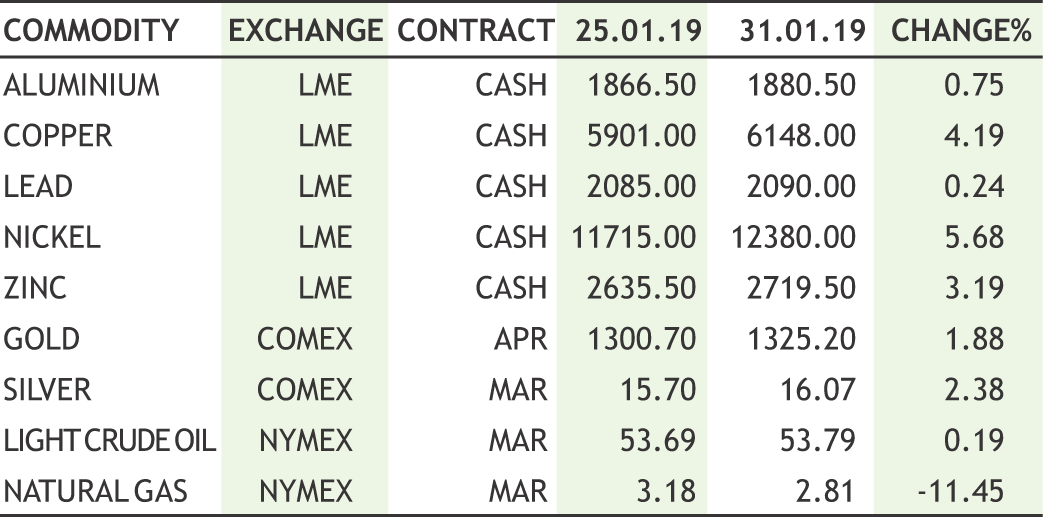

INTERNATIONAL COMMODITY PRICES

NEY

NEY