2019: Issue 713, Week: 09th - 13th December

A Weekly Update from SMC (For private circulation only)

WISE M NEY

NEY

2019: Issue 713, Week: 09th - 13th December

A Weekly Update from SMC (For private circulation only)

NEY

NEY

| Equity | 4-7 |

| Derivatives | 8-9 |

| Commodity | 10-13 |

| Currency | 14 |

| IPO | 15 |

| FD Monitor | 16 |

| Mutual Fund | 17-18 |

I

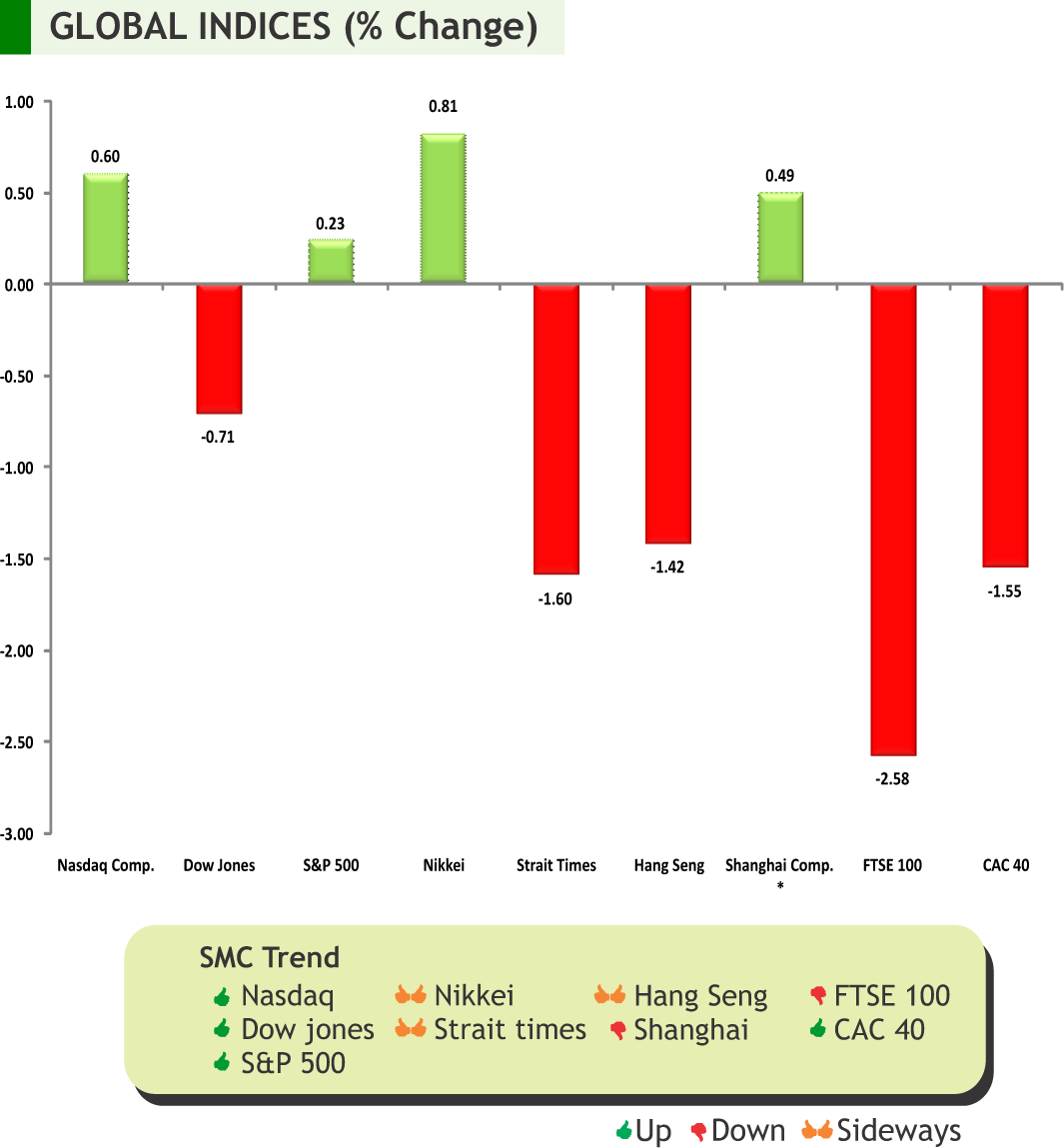

n the week gone by, global markets looked cautious about the likelihood of a I “phase one” trade deal before a new round of U.S. tariffs on Chinese imports begins in 10 days. However, Trump has indicated that trade discussions are going very well. Meanwhile, US saw a fall in weekly jobless claims and a decline in the U.S. trade deficit. U.S. economic reports showed manufacturing activity contracted for a fourth straight month in November, a slowdown in growth in the services sector and a drop in construction spending in October. Japan unveiled a $120 billion (93.53 billion pounds) fiscal package on Thursday to support stalling growth in the world’s thirdlargest economy.

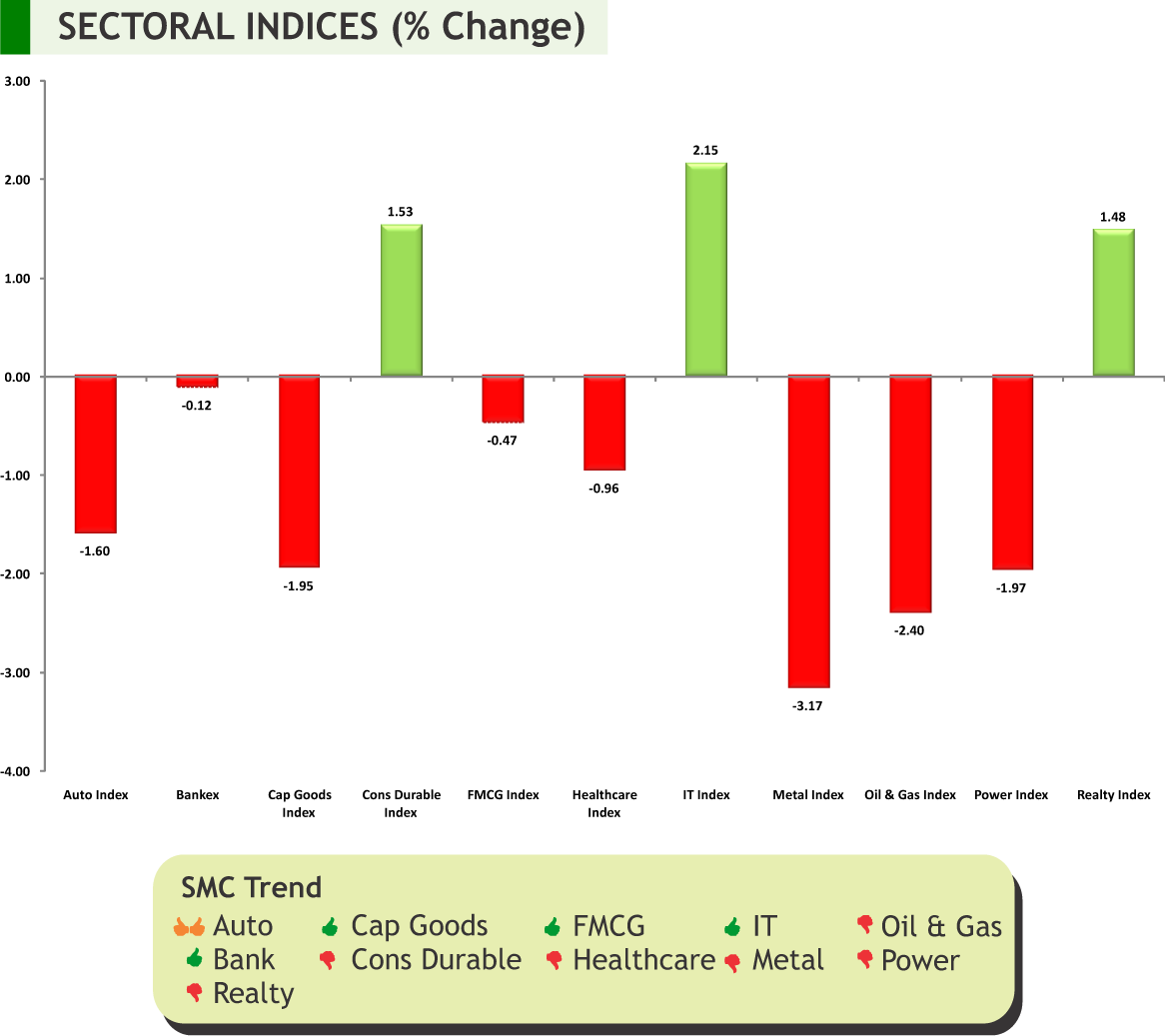

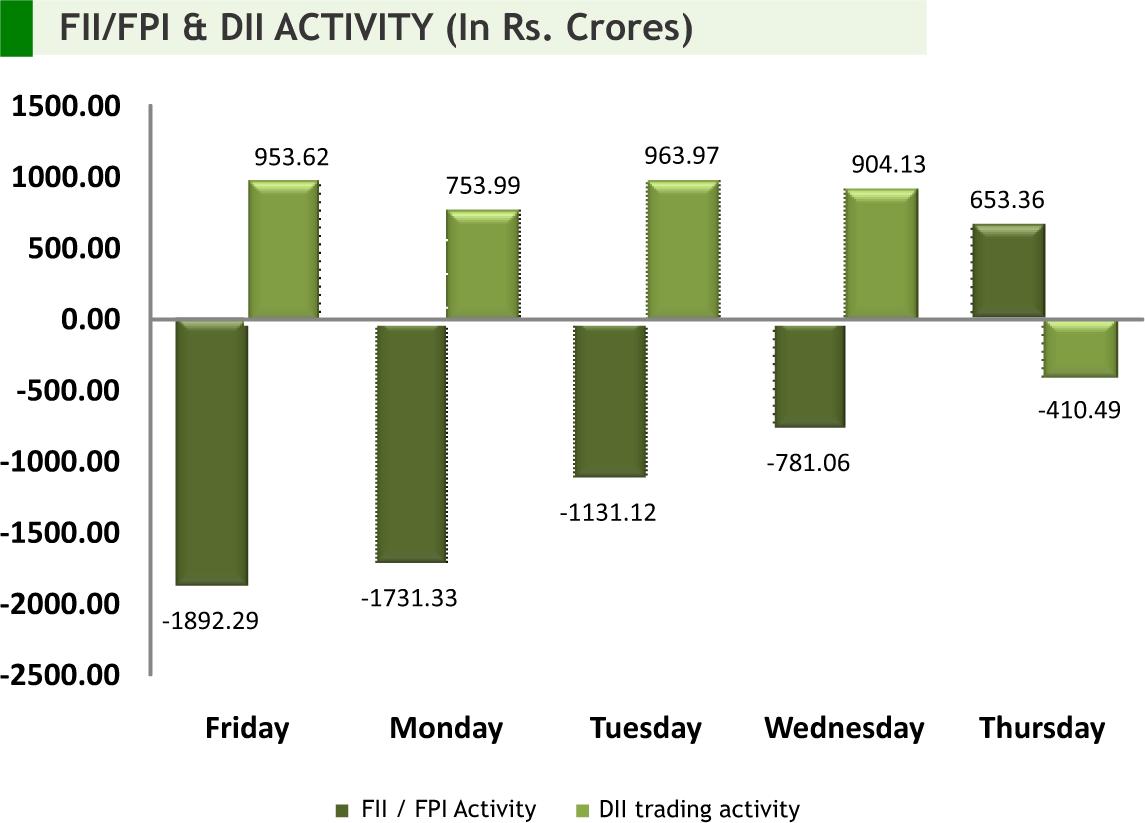

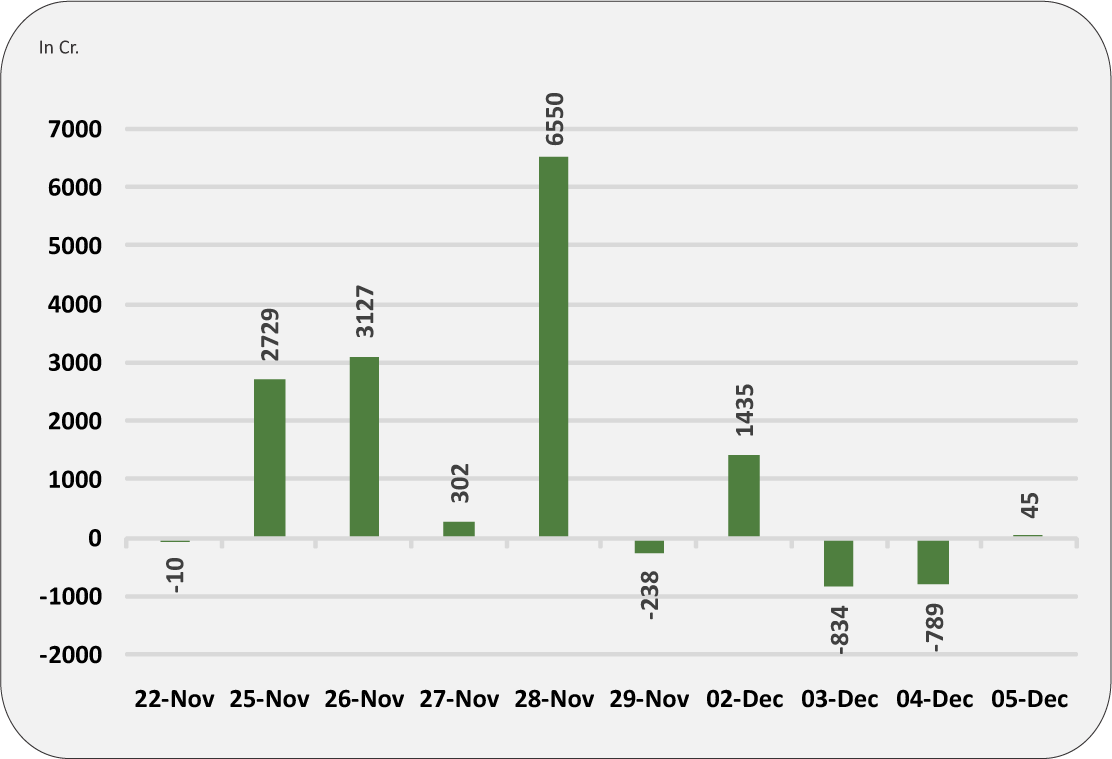

Back at home, the Indian market looked cautious as RBI stunned the market by keeping status-quo on interest rates against market expectations of 25 bps point cut. Central bank also slashed growth forecast from 6.1% to 5% for 2019-2020 as growth turned out significantly lower in the first half than projections. Meanwhile, India's service sector returned to growth in November, expanding at the fastest pace in four months. To note, the IHS Markit India Services Index rose to 52.7 in November from 49.2 in the previous month. Going forward, investors expect both the government and the RBI to follow up with more measures to spur the economy. There is a report that government is considering easing lending rules for NBFCs, a move that would give the cash-starved financiers access to funds. According to the Organization for Economic Cooperation and Development (OECD), India is set for a modest recovery after a loss of momentum as reforms to simplify taxation, lighten business regulations and upgrade infrastructure start to bear fruit. Going into a new week, global cues, flow of foreign funds, outcome of Upcoming Fed Meeting, macroeconomic data such as IIP and inflation and movement of crude oil prices will have their sway on the market.

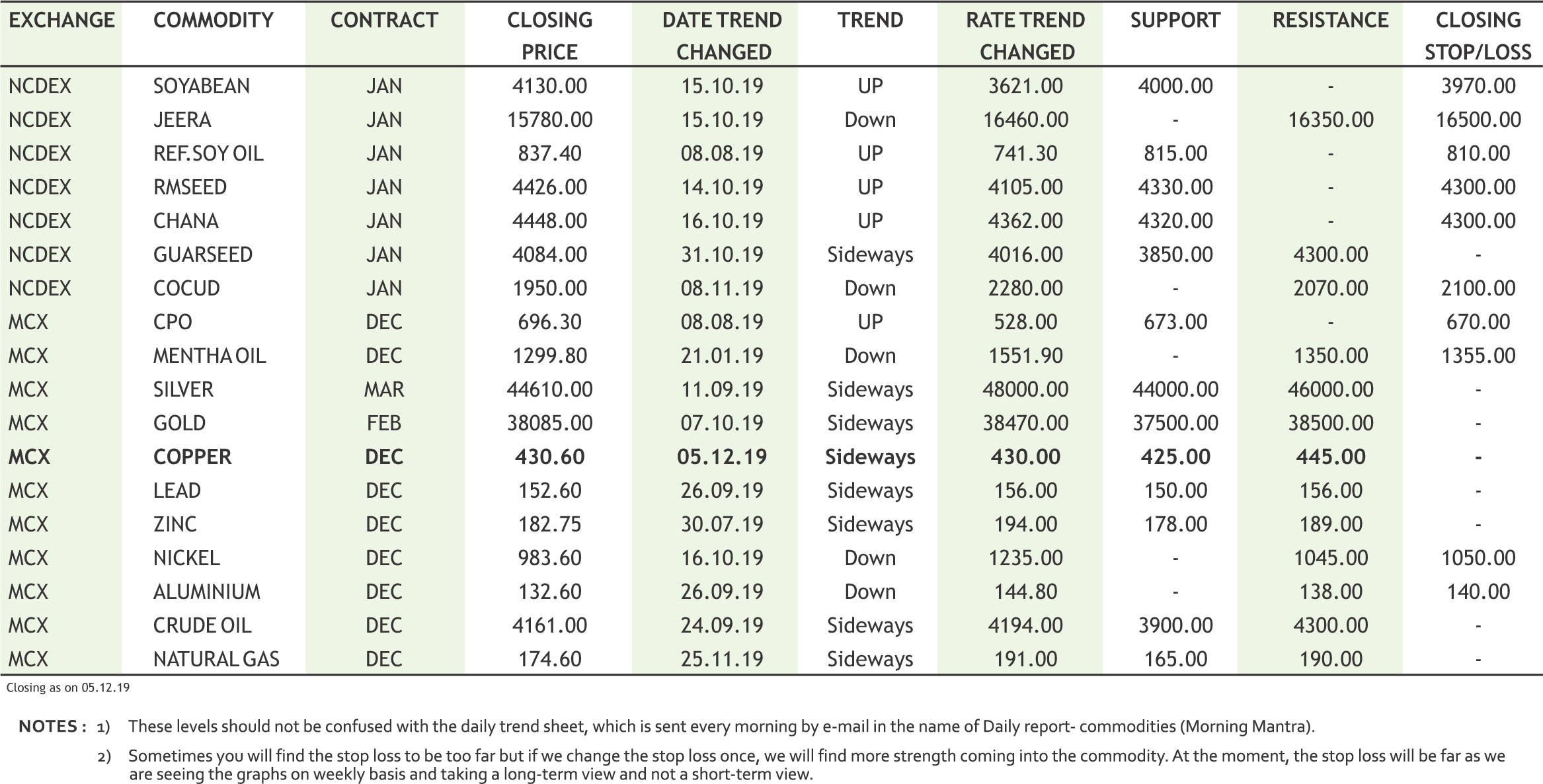

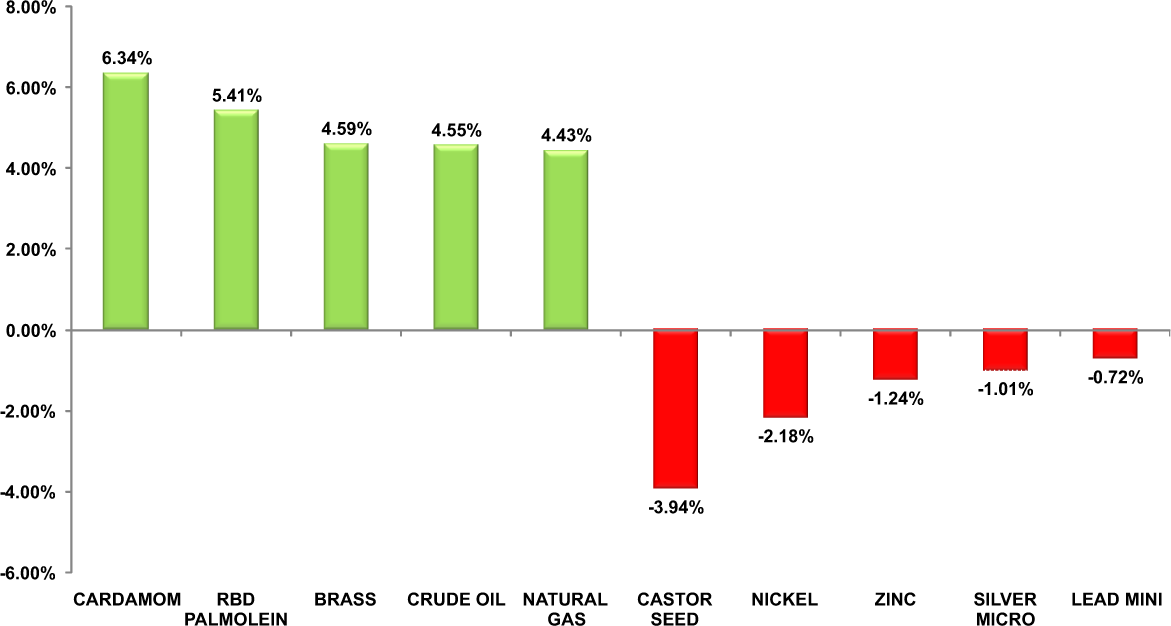

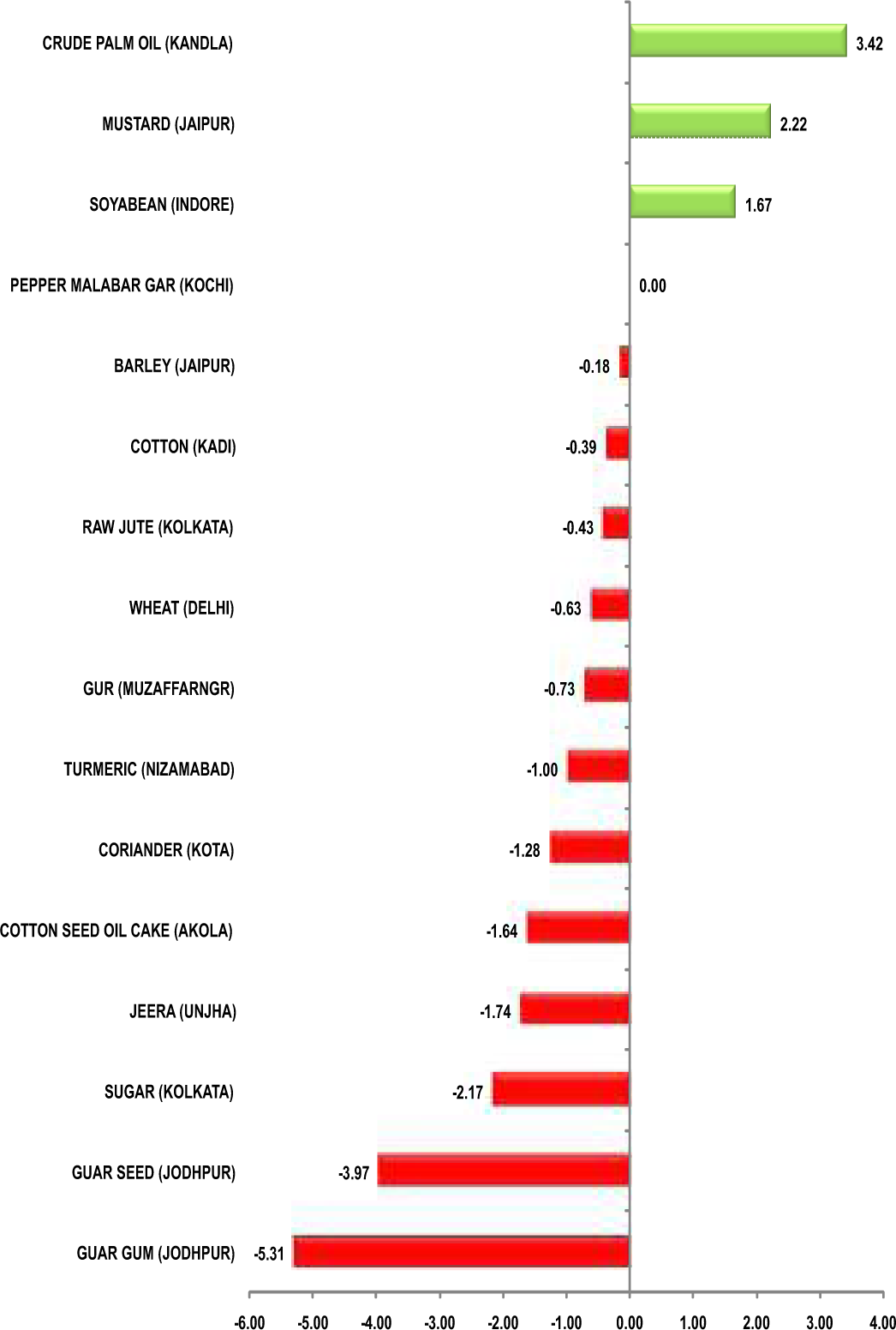

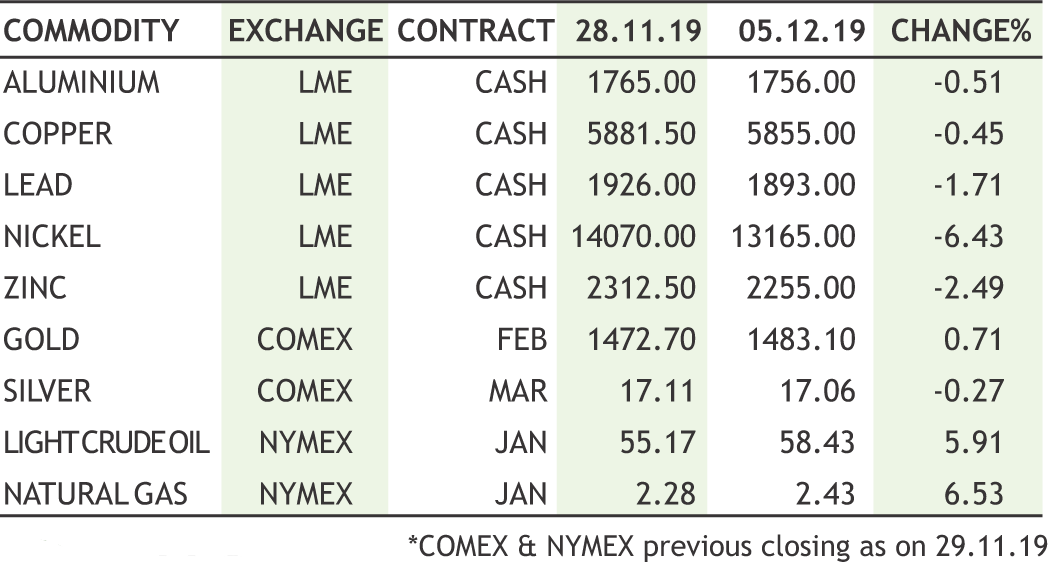

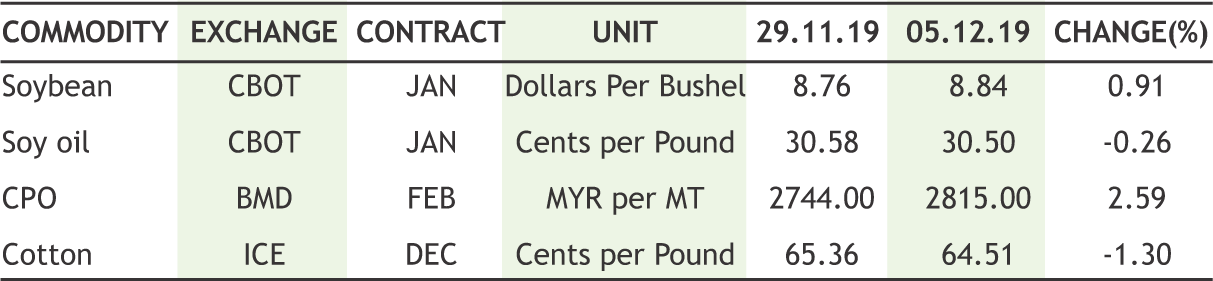

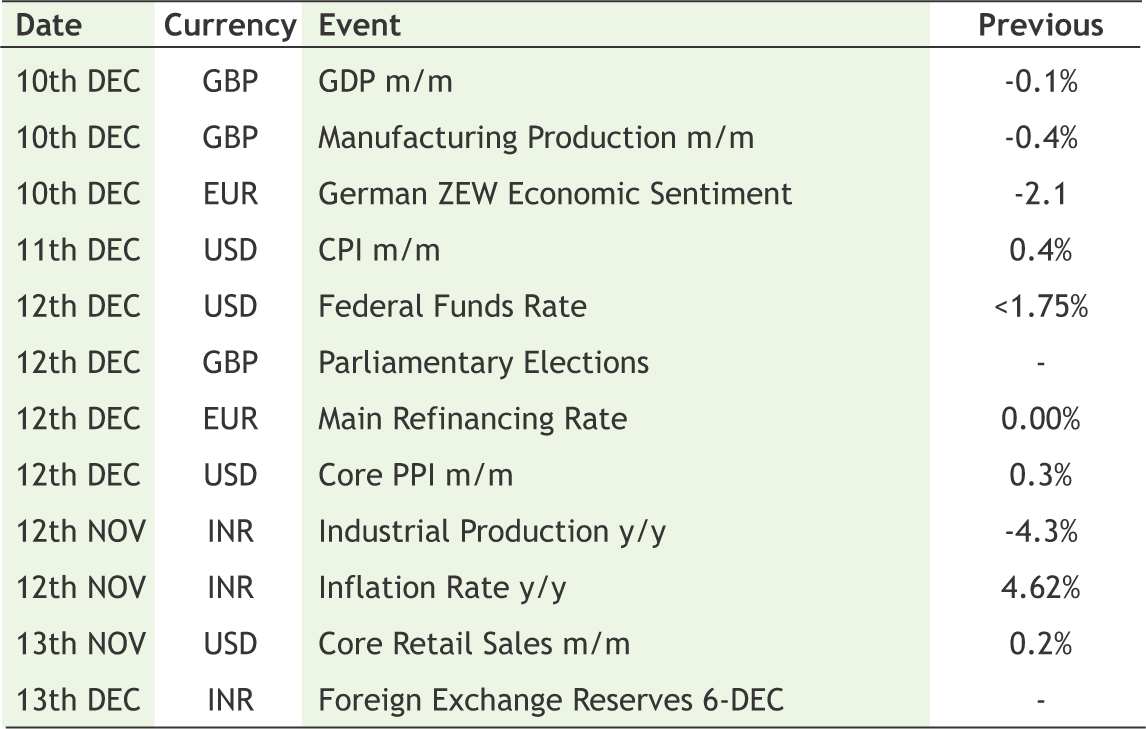

On the commodity market front, it was an average week for commodities where CRB tried to hold it marginally higher levels, near 190 levels. Dollar index were significantly down though it couldn’t give expected strength to the commodities prices. Bullion counter may trade with mixed bias as lack of clarity regarding initial trade deal between US and China is keeping investors on the edge. Gold may remain in narrow range of 37800-38600 whereas on the other hand silver may recover towards 46000 levels while taking support near 43500 levels. Crude oil prices may remain on upside path as OPEC and Russia agreed to make further small cuts in oil production to firm up crude prices. Base metal counter may trade with sideways path with some short covering can be seen at lower levels. GDP of Japan, GDP and Manufacturing Production of UK, German Zew Survey Sentiment, CPI, FOMC Economic Projections, FOMC Statement, FOMC Rate Decision, PPI, Retail Sales and Core Retail Sales Data of US, UK General Election, ECB Interest Rate Decision and Press Conference, Interest Rate Decision of Russia etc are many important triggers for commodities.

SMC Global Securities Ltd. (hereinafter referred to as “SMC”) is a registered Member of National Stock Exchange of India Limited, Bombay Stock Exchange Limited and its associate is member of MCX stock Exchange Limited. It is also registered as a Depository Participant with CDSL and NSDL. Its associates merchant banker and Portfolio Manager are registered with SEBI and NBFC registered with RBI. It also has registration with AMFI as a Mutual Fund Distributor.

SMC is a SEBI registered Research Analyst having registration number INH100001849. SMC or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities market.

SMC or its associates including its relatives/analyst do not hold any financial interest/beneficial ownership of more than 1% in the company covered by Analyst. SMC or its associates and relatives does not have any material conflict of interest. SMC or its associates/analyst has not received any compensation from the company covered by Analyst during the past twelve months. The subject company has not been a client of SMC during the past twelve months. SMC or its associates has not received any compensation or other benefits from the company covered by analyst or third party in connection with the research report. The Analyst has not served as an officer, director or employee of company covered by Analyst and SMC has not been engaged in market making activity of the company covered by Analyst.

The views expressed are based solely on information available publicly available/internal data/ other reliable sources believed to be true.

SMC does not represent/ provide any warranty express or implied to the accuracy, contents or views expressed herein and investors are advised to independently evaluate the market conditions/risks involved before making any investment decision.

DOMESTIC NEWS

Economy

• The Reserve Bank of India (RBI) has decided to keep the policy repo rate under the liquidity adjustment facility (LAF) unchanged at 5.15%. Consequently, the reverse repo rate under the LAF remains unchanged at 4.90%, and the marginal standing facility (MSF)rate and the bank rate at 5.40%. Real GDP growth for 2019-20 is revised downwards from 6.1% in the October policy to 5% to 4.9-5.5% in H2 and 5.9-6.3% for H1:2020-21. The CPI inflation projection is revised upwards to 5.1-4.7% for H2:2019- 20 and 4-3.8% forH1:2020-21, with risks broadly balanced.

Pharmaceuticals

• Zydus Cadila has filed the NDA of Saroglitazar Mg in Non-alcoholic Steatohepatitis (NASH) with theDrug ControllerGeneral ofIndia (DCGI).

Dr Reddys Laboratories has launched Bortezomib for Injection 3.5 mg/vial, approved by the U.S. Food and Drug Administration (USFDA) via a 505(b)(2) new drug application (NOA) pathway for intravenous use only.

• Strides Pharma Science announced that its step down wholly owned subsidiary, Strides Pharma Global, Singapore, has received tentative approval for Diclofenac Potassium Softgel Capsules, 25 mg from the United States Food & Drug Administration (USFDA). The product is a generic version of Zipsor Capsules, 25 mg, ofAssertioTherapeutics,Inc.

Information Technology

• Wipro announced the launch of its NextGen Cyber Defence Centre (CDC) in Melbourne, Australia. With the launch of this centre, Wipro aims to make substantial investments to upskill its employees, hire more local resources and generate more than 100 jobs in Melbourne for cyber security specialists. Wipro also plans to launch similar CDCs in other cities in Australia and offer cyber resilience and provide digital protection to large government organizations.

• Tata Consultancy Services has announced that it has successfully completed the finance transformation for Ayala Land Inc. (ALI), by migrating its operations to SAP S/4HANA, in the first such implementation in the Philippines.

• Wipro announced the launch of advanced cloud Security Operations Centre (SOC) services using Microsoft Azure Sentinel. As part of this integration, Wipro will offer managed cloud SOC services with built in Artificial Intelligence (Al) and Orchestration capabilities for rapid threat detection and response forits clients across hybrid cloud environments.

Breweries

• United Breweries (UB) has forayed into the niche and fast growing craft beer segment with the launch of Kingfisher Ultra Witbier. It is the first non-lager beer from Heineken-controlled UB.

Realty

• Nirlon signed a long-term leave and license agreement with J.P. Morgan, the global banking and financial services provider, for premium office space at Nirlon Knowledge Park (NKP) in Mumbai.

INTERNATIONAL NEWS

• US factory orders rose by 0.3 percent in October after falling by a revised 0.8 percent in September. Economists had expected orders to rise by 0.3 percent compared to the 0.6 percent drop originally reported for the previous month.

• US trade deficit narrowed to $47.2 billion in October from a revised $51.1 billion in September. Economists had expected the trade deficit to narrow to $48.7 billion from the $52.5 billion originally reported for the previous month.

• US initialjobless claims slipped to 203,000, a decrease of 10,000 from the previous week's unrevised level of 213,000. The drop came as a surprise to economists, who had expected jobless claims to inch up to 215,000.

• US construction spending fell by 0.8 percent to an annual rate of $1.291 trillion in October after slipping by 0.3 percent to a revised $1.302 trillion in September. Economists had expected construction spending to climb by 0.4 percent compared to the 0.5 percent increase originally reported for the previous month.

• US home sales index plunged by 1.7 percent to 106.7 in October after surging up by 1.4 percent to a revised 108.6 in September. Economists had expected pending home sales to climb by 0.8 percent compared to the 1.5 percent jump originally reported for the previous month.

• Eurozone Retail sales decreased 0.6 percent month-on-month in October, bigger than the 0.2 percent fall in September and the expected drop of 0.5 percent. This was the second consecutive decrease in sales.

| Stocks | *Closing Price | Trend | Date Trend Changed | Rate Trend Changed | SUPPORT | RESISTANCE | Closing S/l |

|---|---|---|---|---|---|---|---|

| S&P BSE SENSEX | 40445 | UP | 08.02.19 | 36546 | 36300 | 35300 | |

| NIFTY50 | 11922 | UP | 08.02.19 | 10944 | 10900 | 10600 | |

| NIFTY IT* | 15290 | UP | 21.07.17 | 10712 | 15200 | 14800 | |

| NIFTY BANK | 31342 | UP | 30.11.18 | 26863 | 27700 | 27000 | |

| ACC | 1483 | DOWN | 04.10.19 | 1488 | 1540 | 1565 | |

| BHARTIAIRTEL | 445 | UP | 15.03.19 | 338 | 410 | 390 | |

| BPCL | 489 | UP | 30.08.19 | 355 | 470 | 450 | |

| CIPLA | 455 | UP | 25.10.19 | 460 | 440 | 430 | |

| SBIN | 320 | UP | 01.11.19 | 314 | 315 | 305 | |

| HINDALCO | 198 | DOWN | 15.11.19 | 188 | 198 | 203 | |

| ICICI BANK | 525 | UP | 20.09.19 | 418 | 490 | 480 | INFOSYS | 715 | DOWN | 25.10.19 | 637 | 690 | 720 |

| ITC | 243 | DOWN | 31.05.19 | 279 | 260 | 270 | |

| L&T | 1291 | DOWN | 15.11.19 | 1378 | 1370 | 1390 | |

| MARUTI | 6887 | DOWN | 06.12.19 | 6887 | 7250 | 7350 | |

| NTPC | 113 | DOWN | 16.08.19 | 118 | 120 | 124 | |

| ONGC | 127 | DOWN | 06.12.19 | 127 | 136 | 141 | |

| RELIANCE | 1555 | UP | 16.08.19 | 1278 | 1460 | 1440 | |

| TATASTEEL | 403 | UP | 01.11.19 | 396 | 390 | 375 | |

Closing as on 06-12-2019

NOTES:

1) These levels should not be confused with the daily trend sheet, which is sent every morning by e-mail in the name of "Morning Mantra ".

2) Sometimes you will find the stop loss to be too far but if we change the stop loss once, we will find more strength coming into the stock. At the moment, the stop loss will be far as we are seeing the graphs on weekly basis and taking a long-term view and not a short-term view.

| Meeting Date | Company | Purpose |

|---|---|---|

| 10/12/2019 | Nestle India | 550% Third Interim Dividend |

| 13/12/2019 | Trident Limited | FV Split - From Rs 10/- To Rs 1/- Per Share |

| 26/12/2019 | BalmerLawries | 1:2 Bonus Issue of Equity Shares |

| Meeting Date | Company name | Purpose |

|---|---|---|

| 9/12/2019 | JagranPrakashan | Buy Back |

| 9/12/2019 | Quess Corp | Scheme of Arrangement |

| 12/12/2019 | Centrum Capital | Quarterly Results |

| 13/12/2019 | Sastasundar Ventures | Financial Results |

| 14/12/2019 | R Systems International | Dividend |

| 27/12/2019 | RBL Bank | Preferential Issue |

| 02/01/2020 | Dr Reddy’s Labs | Scheme of Amalgamation, Scheme of Arrangement |

4

5

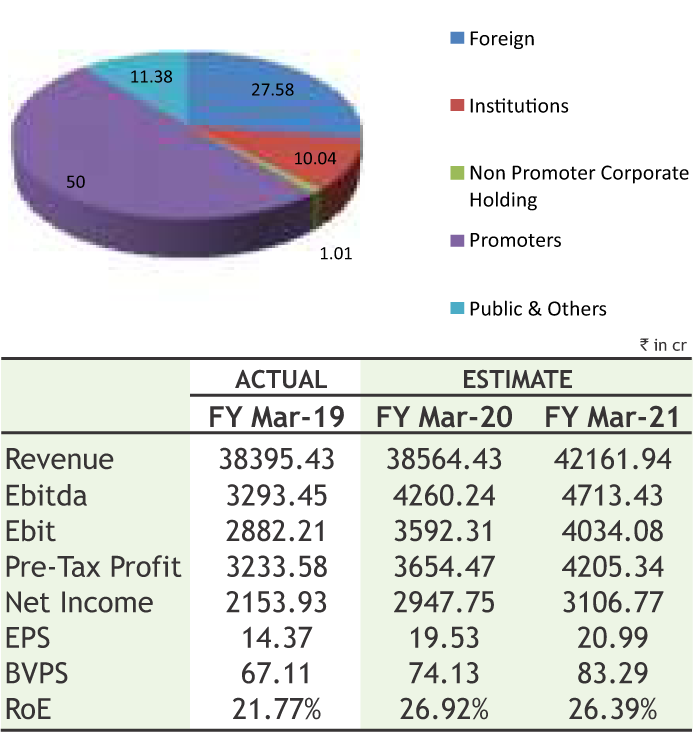

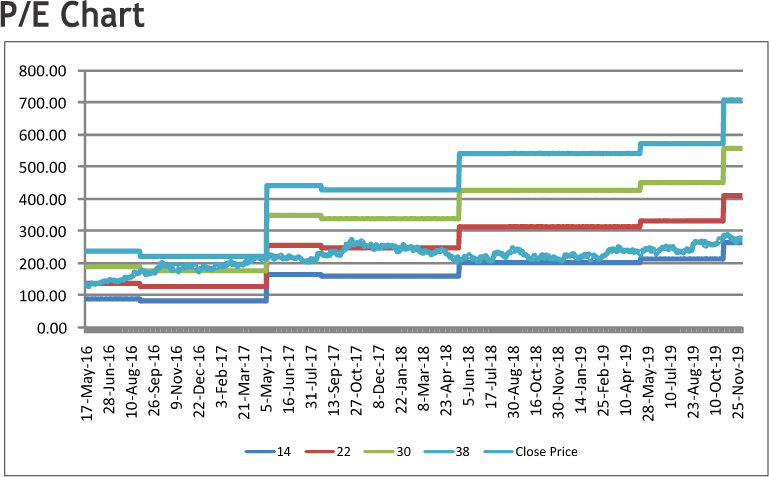

Petronet LNG LIMITED

CMP: 268.25

Target Price: 306

Upside: 14%

| Face Value (Rs.) | 10.00 |

| 52 Week High/Low | 302.00/203.40 |

| M.Cap (Rs. in Cr.) | 40237.50 |

| EPS (Rs.) | 18.39 |

| P/E Ratio (times) | 14.59 |

| P/B Ratio (times) | 3.64 |

| Dividend Yield (%) | 3.73 |

| Stock Exchange | BSE |

Investment Rationale

• Petronet LNG is promoting and developing LNG as motor vehicle fuels and for other small scale consumption. It has set up the country's first LNG receiving and regasification terminal at Dahej, Gujarat, and anotherterminal at Kochi, Kerala.

• The company has guided for a capex of Rs. 450 crore for FY2020E and plans to build two storage tanks, which would require a capex of ~Rs. 1,300 crore in the next 2-3 years. The company also plans to build a jetty which would cost ~$130 million.

• During the quarter ended 30th September, 2019 (current quarter), Dahej terminal operated at around 108% of its expanded name plate capacity (17.50 MMTPA) and processed 240 Trillion British Thermal Units (TBTU) of LNG as against 217 TBTU processed during the previous quarter and 211 TBTU processed during the corresponding quarter. The overall LNG volume processed by the Company in the current quarter was 250 TBTU, as against the LNG volume processed in the previous and corresponding quarter, which stood at 226 TBTU and 217 TBTU respectively.

• It has signed MoU for doing pre feed studies along with Japanese consortium and Sri Lanka Gas Terminal Company Limited for setting up a Floating Storage & Regasification Terminal at Colombo Sri Lanka.

• The company has shown interest for the construction of land-based LNG re-gasification terminal at Matarbari, Bangladesh but has not received any instruction to submit the bid yet.

• It has reported nearly doubling of net profit in

September quarter on back of improved margins. Net profit in July-September at Rs 1,089 crore was 90 per cent higher than Rs 572.89 crore net profits in the same period. The higher financial results in Q2, 2019-20, is due to higher volumes processed at the Dahej Terminal on account of better efficiency in operations and higher utilization of the expanded nameplate capacity of 17.50 MMTPA.

Risk

• Industrial Slowdown

• Fluctuation in Natural Gas prices

Valuation

The company is well-placed to benefit from rising gas demand, supported by its recent capacity expansion to 17.5 mmt at the Dahej terminal and plans to further expand capacity to 19.5 mmt in the next 2-3 years by setting up two storage tanks and a jetty. Thus it is expected that the stock will see a price target of Rs. 306 in 8-10 months time frame on an current PE multiple of 14.59 times and FY21E EPS of Rs. 20.99.

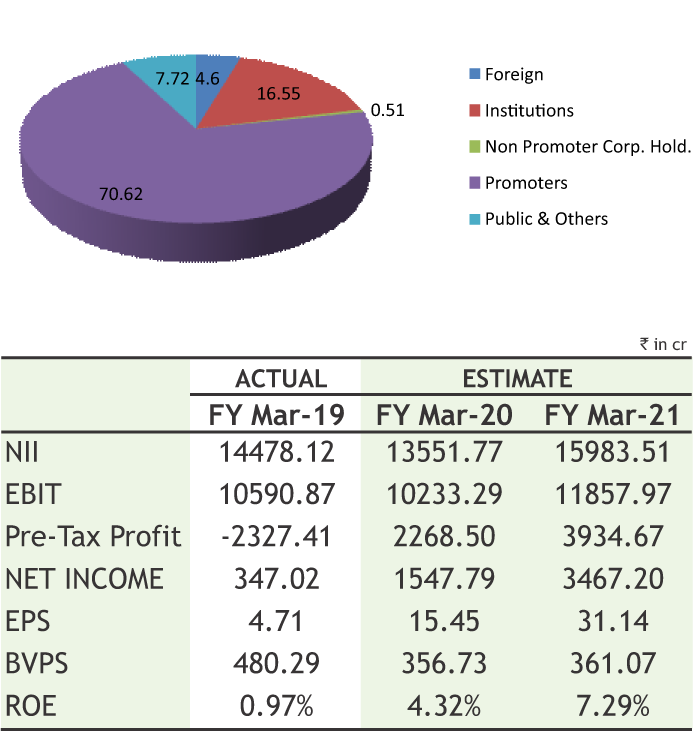

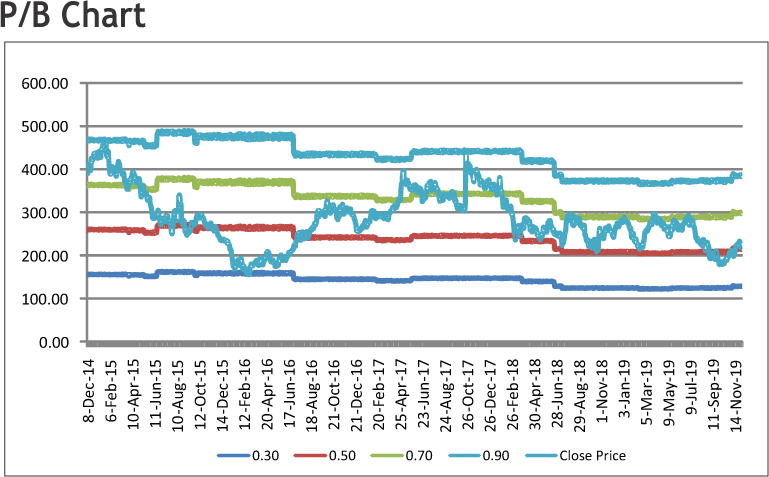

Canara Bank

CMP: 208.20

Target Price: 253

Upside: 21%

| Face Value (Rs.) | 10.00 |

| 52 Week High/Low | 302.00/170.55 |

| M.Cap (Rs. in Cr.) | 15682.56 |

| EPS (Rs.) | 9.55 |

| P/E Ratio (times) | 21.80 |

| P/B Ratio (times) | 0.49 |

| Dividend Yield (%) | 0.00 |

| Stock Exchange | BSE |

Investment Rationale

• The business of the bank has risen at improved pace of 8% yoy to Rs 1055653 crore at end September 2019. Deposits increased 10% at Rs 609436 crore, Advances have grown at a rate of 5% YoY. The growth was majorly driven by the retail segment while the corporate and SME segment has decreased by 4% & 2% respectively.

• The Bank has posted 13.5% growth in the interest earned at Rs 12500.37 crore and credit cost of the bank has declined to 2.06% in Q2FY2020 from 2.14% in Q1FY2020 and 2.28% in Q2FY2019. The provisions for NPAs declined 4% to Rs 2295.61 crore in Q2FY2020.

• Domestic NIM stood at 2.45% and the management of the bank expects NIM to increase to 2.65% going forward. Overseas spreads have been impacted the overall NIM.

• The Gross Non Performing Asset (NPA) % of the bank stood at 8.77% as at September 2019 in comparison to 8.83% during the quarter ended September 2019 and the net NPA % stood at 5.37% as against 5.35% for the same period. According to the management, GNPA is expected to reach below 8% & NNPAbelow 4% for FY20.

• The recoveries of NPAs was healthy at Rs 1297 crore and upgradations at Rs 707 crore, while the write-off loans stood at Rs 1286 crore in Q2FY2020. The bank has 262 accounts with the exposure of Rs 35693 crore under NCLT with provisions coverage ratio of 78.4%. The bank has improved provision coverage ratio improved to 70.1% end September 2019 from 68.6% end June 2019.

• On asset quality front, the bank has exhibited improvement in asset quality with the decline in

fresh slippages of loans and higher NPA reductions. The fresh slippages of loans declined to Rs 2602 crore in Q2FY2020 from Rs 3676 crore in Q1FY2020 and Rs 3697 crore in Q2FY2019.

• The management of the bank has provided a timeline for the merger process and expects the due diligence is expected to get completed by 3rd week of December and likely date for amalgamation is 1st April 2020.

Risk

• Strict Regulatory guidelines

• Liquidity risk

Valuation

The bank has been consisting delivering on improving asset quality, cost efficiency, other income and productivity in the pastfew quarters.The management is confident for improvement in incremental disbursement with better credit monitoring. Thus, it is expected thatthe stock will see a price target of Rs.253 in 8 to 10 months time frame on a target P/Bv of 0.70x and FY21 BVPS of Rs.361.07.

Source: Company Website Reuters Capitaline

Above calls are recommended with a time horizon of 8 to 10 months.

6

The stock closed at Rs 488.10 on 06th December 2019. It made a 52-week low of Rs 352 on 15th October 2019 and a 52-week high of Rs. 1063 on 04th June 2019. The 200 days Exponential Moving Average (DEMA) of the stock on the daily chart is currently at Rs 411.56

Short term, medium term and long term bias are looking positive for the stock as it is trading in higher high and higher lows on daily charts which are bullish in nature. Apart from this, the stock has formed a “Cup and Handle” pattern on weekly charts and has given the breakout of same so follow up buying may continue for coming days. Therefore, one can buy in the range of 480-483 levels for the upside target of 520-530 levels with SL below 455.

The stock closed at Rs 849.95 on 06th December, 2019. It made a 52-week low at Rs 592.25 on 14th August 2019 and a 52-week high of Rs. 1052.95 on 05th December 2018. The 200 days Exponential Moving Average (DEMA) of the stock on the daily chart is currently at Rs 810.42

As we can see on charts that stock recovered sharply from lower levels and tested its earlier resistance of 830 levels with positive bias. Moreover, it has formed an “Inverted Head and Shoulder “pattern on weekly charts, which is considered to be bullish. Last week, stock gained around 5% and has given the neckline breakout of pattern and also has managed to close above the same. Therefore, one can buy in the range of 835-842 levels for the upside target of 900-920 levels with SL below 800.

Disclaimer : The analyst and its affiliates companies make no representation or warranty in relation to the accuracy, completeness or reliability of the information contained in its research. The analysis contained in the analyst research is based on numerous assumptions. Different assumptions could result in materially different results.

The analyst not any of its affiliated companies not any of their, members, directors, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of the analysis research.

SOURCE: CAPITAL LINE

Charts by Spider Software India Ltd

Above calls are recommended with a time horizon of 1-2 months

7

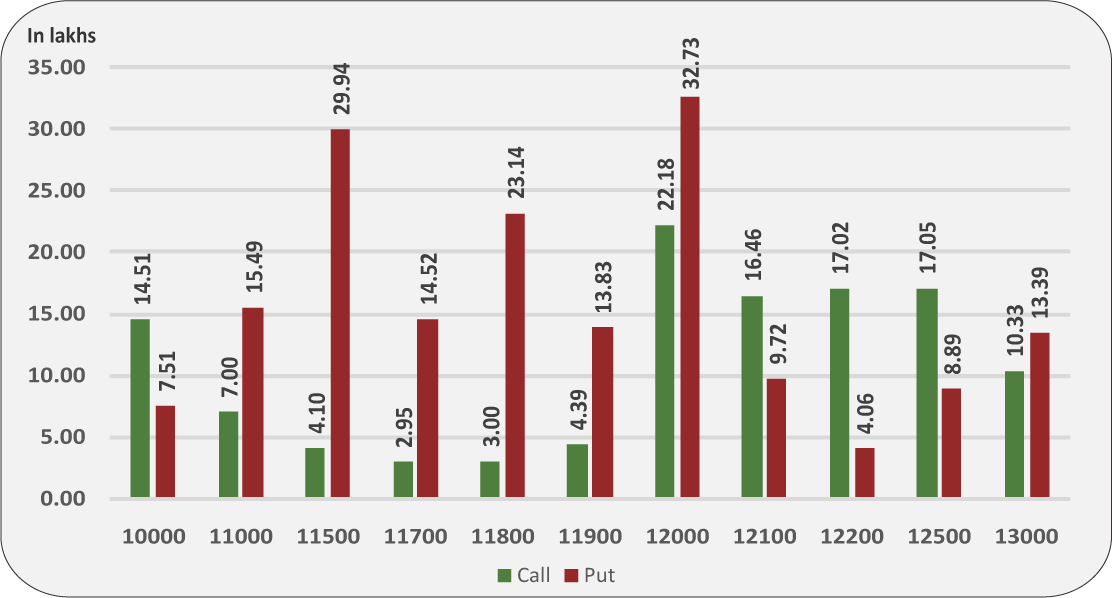

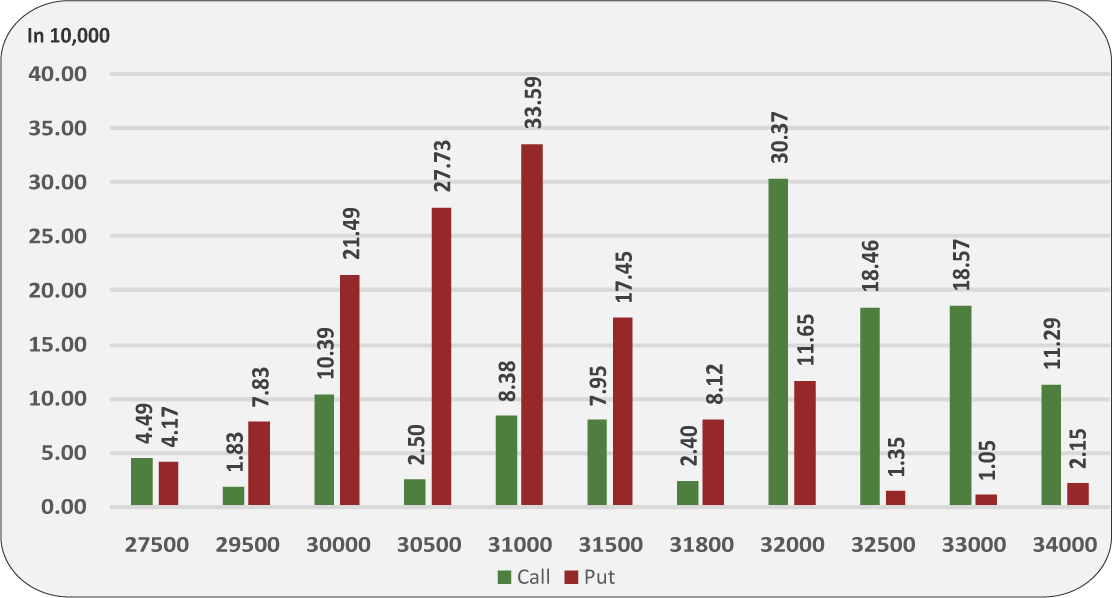

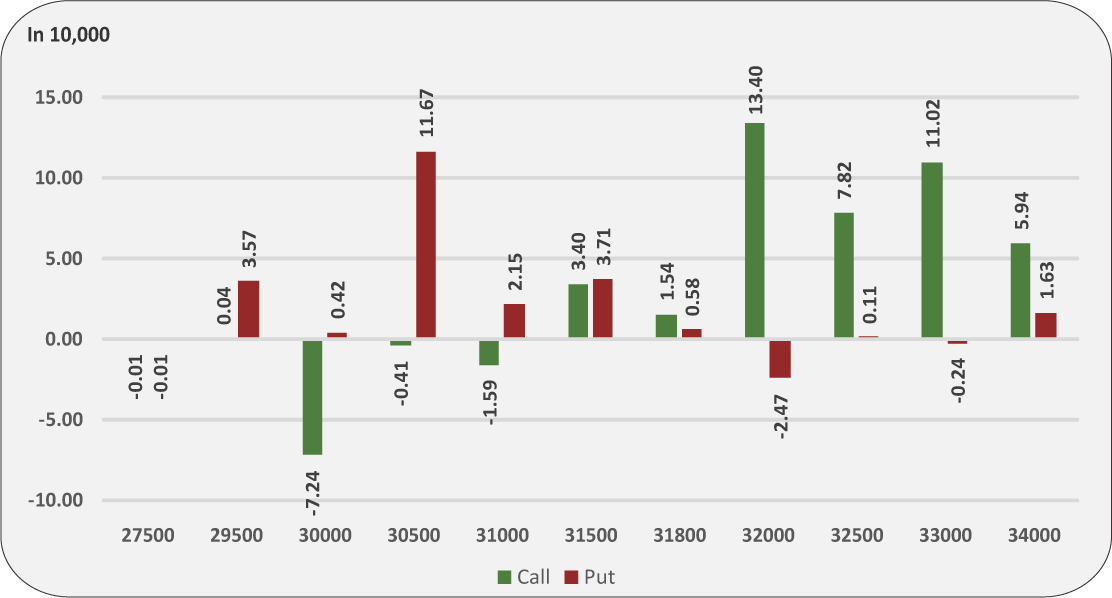

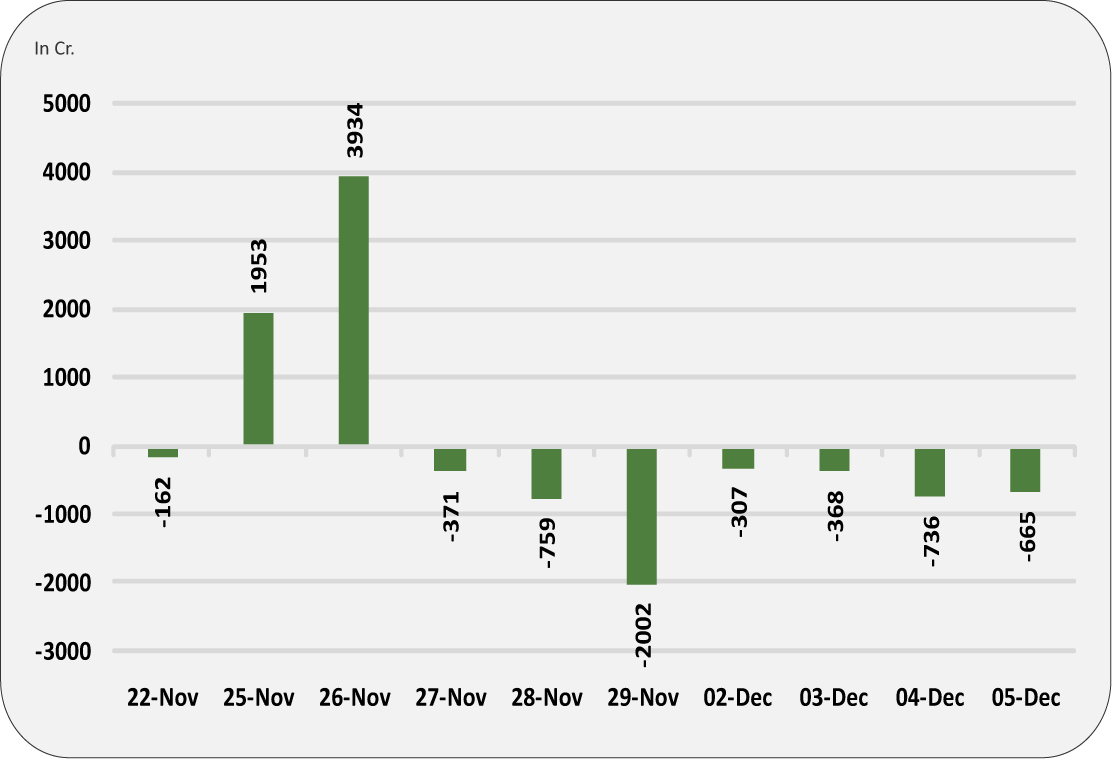

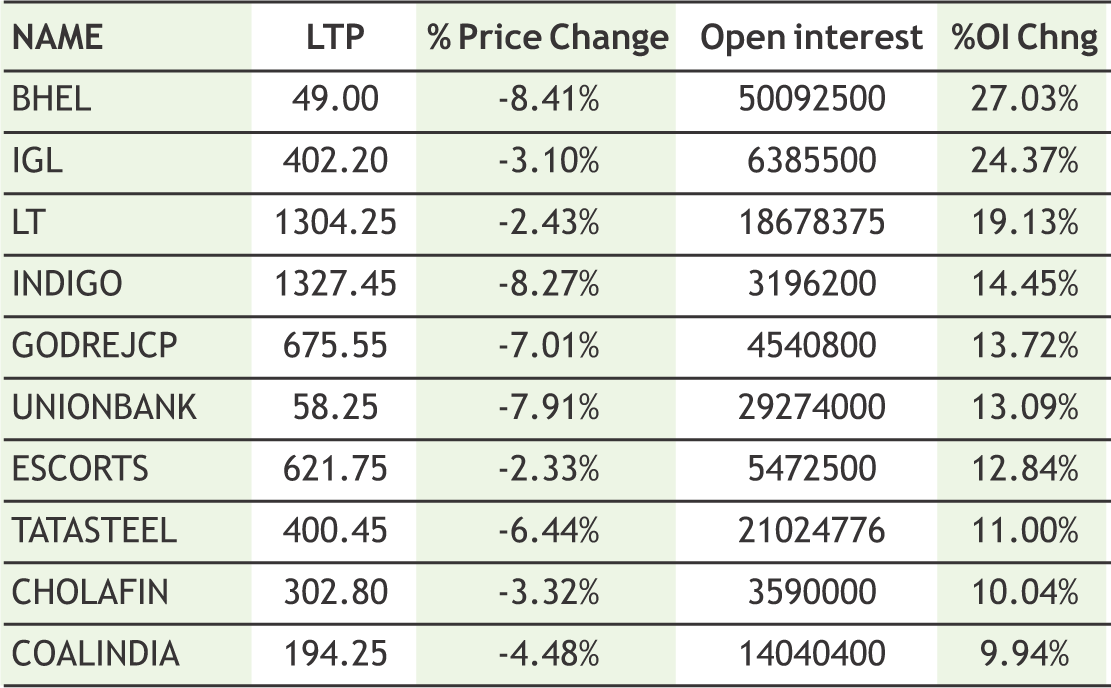

Indian markets remained under pressure in the week gone by as traders took profits at higher levels on back of weak growth concerns. Sell off was seen in later part of the week in heavyweights like HDFC twins, SBI, ICICIBANK along with Tata Motors and Maruti. Nifty indices ended the week well below 11950 mark while Bank Nifty also witnessed loss of more than 1.5% (week on week basis). From derivative front put writers at 12000 strike seen unwinding their positions while call writers added hefty open interest at 12000 strike. Now 12100 call strike holds with the maximum open interest of more than 26 lakh shares followed by 12000 strike. It clearly indicates that selling pressure on every bounce will likely to remain intact in coming sessions as well. However, as far Bank Nifty is concern now 31600-31700 (SPOT) levels should act as crucial hurdle and on downside 31100-31000 will act as immediate support. The Implied Volatility (IV) of calls closed at 11.79% while that for put options closed at 12.10%. The Nifty VIX for the week closed at 14.31% and is expected to remain volatile. PCR OI for the week closed at 1.25. On the technical basis, now both the indices have entered into short term bearish channel, which indicates towards limited upside.

8

|

|

|

|

**The highest call open interest acts as resistance and highest put open interest acts as support.

# Price rise with rise in open interest suggests long buildup | Price fall with rise in open interest suggests short buildup

# Price fall with fall in open interest suggests long unwinding | Price rise with fall in open interest suggests short covering

9

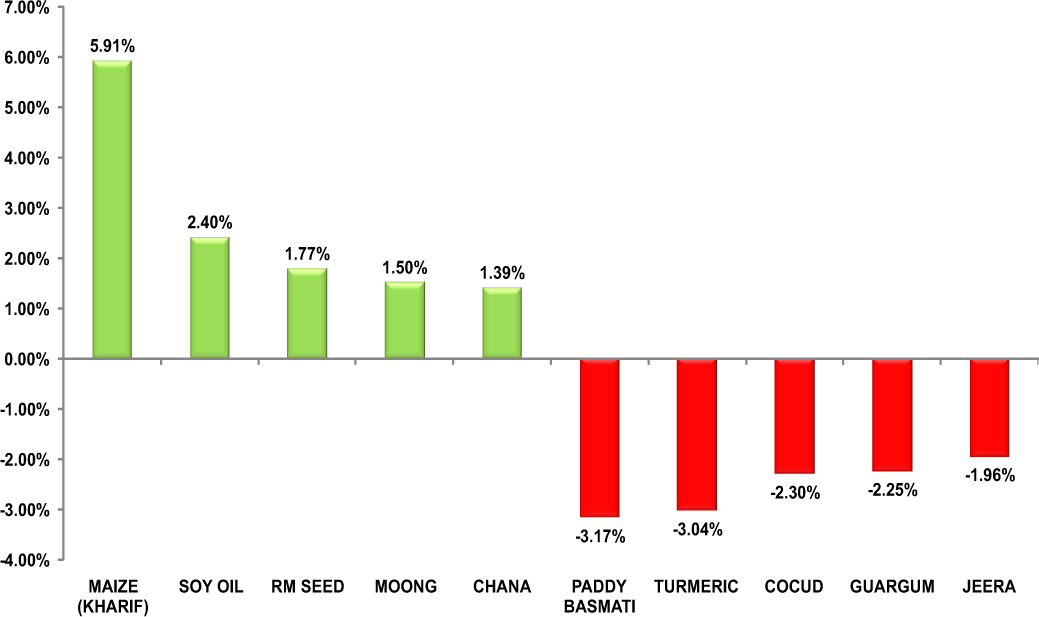

Turmeric futures (Mar) is expected to witness sell on every rise & hence trade with a downside bias in the range of 5700-6000 levels. This season, there is a dearth of demand as the stockists are not showing interest in buying due to arrival of low quality stocks. The spot prices have dropped near Rs.5900 per quintal in Nizamabad, lowest in two and half years. From cutting to processing the yellow spice, per acre, it would cost roughly Rs.1.50 lakh. According to farmers, an acre can produce around 20 to 25 quintals. Hence, the cost of production per quintal of turmeric is Rs.6000. The downtrend in jeera futures (Jan) is likely to see a pause by taking support near 15500 levels, while the short covering accompanied with lower level buying may lift the counter towards 16230-16475 levels. This season the sowing is delayed & the acreage is also down as compared to previous year. The latest statistics shows that as on December 2, 2019, Rabi sowing for jeera was undertaken on 1,31,561 hectares in Gujarat, nearly 70,000 hectares down from 1,99,455 hectares reported around the same time last year. The three-year average jeera acreage in the State is 3.36 lakh hectares. The trend of cardamom futures (Jan) has again turned bullish & in days to come it is seen to move higher to test 3200 levels. Export enquiry from Gulf markets has boosted sentiments in the cardamom auctions market at Spices Park at Puttady. According to traders, buying enquiries are flowing in both from exporters and their intermediaries for the purchase of quality cardamom. Buyers including from North India were also active, witnessing an aggressive buying

Bullion counter may trade with mixed bias as lack of clarity regarding initial trade deal between US and China is keeping investors on the edge. Multiple comments from various sources have increased the volatility in safe haven assets as well as riskier assets recently. US President Trump mentioned that the trade talks are moving right along and on other hand China remained fixed on their stance reiterating that roll back of tariffs should be a part of ‘phase one’ deal. Earlier last week, though, Trump rattled global markets when he said a deal might have to wait until after the 2020 election. Completion of a phase one deal between the world’s two biggest economies had been initially expected in November, ahead of a new round of U.S. tariffs set to kick in on Dec. 15, covering about $156 billion of Chinese imports. Gold may remain in narrow range of 37800-38600 whereas on the other had silver may recover towards 46000 while taking support near 43500. Meanwhile trade delegations on both sides remained locked in discussions over “core issues of concern,” with rising bilateral tensions over non-trade issues such as the protests in Hong Kong and Beijing’s treatment of its Uighur Muslim minority clouding prospects for a near-term deal to end a trade war. Central bank gold demand officially hit a new multi-decade record and although purchases have slowed recently. India's gold imports in November jumped 78% from a month earlier to 71 tonnes the highest level in five months as jewellers restocked after a fall in prices.

The outlook of soybean futures (Jan) is bullish & it is expected to test 4250- 4300 on the higher side. Skymet estimates the soybean production in the upcoming Kharif season to be around 12.15 million tons, 12 per cent lower than the last year's production estimates of 13.78 million tons due to excess rains in Madhya Pradesh and Maharashtra towards the fag end of monsoon rains. The sentiments of mustard futures (Jan) are buoyant amid higher demand from crushers and this may take the counter higher towards 4500 levels. However, the market participants should be cautious as the sowing is in progress. A poll by Cogencis has highlighted that India's mustard acreage is likely to rise 2.9% on year to 7.1 mln ha in 2019-20 (Jul-Jun). The likely higher area under mustard in Madhya Pradesh, Uttar Pradesh and Gujarat may offset the fall in acreage in Rajasthan. Mustard yield could rise to 1.42-1.45 tn per ha this season, up from 1.40 tn per ha last year, due to ample moisture content in the soil and better farm practices. Soy oil futures is making a new life time high every week & this trend is likely to persist in days to come. The January contract is expected to soar towards 855-870 levels. With sowing being slow in the current Rabi season it has triggered an upward trend in edible oil prices in the domestic market. On similar lines, the stellar rally in CPO futures (Dec) will possibly continue as it is seen to be headed for 720-725 levels. On the international market, high demand from the bio-diesel sector has been boosting prices this year

Crude oil prices may remain on upside path as Organization of the Petroleum Exporting Countries and Russia agreed to make further small cuts in oil production to firm up crude prices. Russian Energy Minister Alexander Novak stated that a panel of key energy ministers including Saudi Arabia and Russia had recommended the OPEC+ group deepens existing supply curbs of 1.2 million barrels per day by another 500,000 bpd. The cut of 1.7 million bpd would amount to 1.7% of global supply. Recently fall in inventories also supported the prices. EIA showed a drawdown of 4.9 Mbpd compared to expectations for a 1.9 Mbpd decline. On other hand, gasoline and distillate stocks surged by a similar amount as crude’s decline, with refinery runs increasing ahead of winter stockpiling. Crude oil may move upwards towards 4300-4350 levels while taking support near 4100 levels. Saudi Arabia suggested that it would flood market if the other members don’t abide by any production rate quotas. It is expected that production cut would last through the first quarter of 2020, a much shorter timeframe than suggested by some OPEC ministers, who have called for extending cuts until June or December 2020. Weather related developments to keep natural gas on volatile path as prices can take support near 165-160 range and recover towards 180-185 in near term. Meanwhile Natgasweather stated that GFS model is coming in “quite cold” for the December 11 to 17 time frame. Inventories remain near the 5-year average for this time of year according to the Energy Information Administration.

Cotton futures (Dec) may continue to consolidate in the range of 18800-19300 levels. The spot prices are trading range bound at major markets in Central and South India due to selective demand. According to traders, prices are unlikely to fall further as the quality of arrivals in the mandis has improved to a large extent. However, the upside may remain capped as the arrivals are getting stronger in the mandis, and also the demand from mills is only according to their needs. In the international market, ICE cotton futures (Mar) is likely to remain trapped in the range of 64-67 cents per pound. The sentiments are continuously getting hurt by lack of clarity in trade talks between the United States and China. The market participants are now awaiting USDA’s monthly World Agriculture Supply and Demand Estimates (WASDE) report due on Dec. 10. Chana futures (Jan) is expected to trade sideways to up in the broader range of 4350-4550 levels. In the current scenario, there are various news affecting the prices of pulses. Among pulses, chana acreage is lagging behind at 61.59 lakh hectares as compared to 68.40 lakh hectare achieved in the same period last year. Secondly, there are talks that the government is likely to impose stock-holing limit on urad to check soaring prices. Guar seed futures (Jan) is expected to take support near 4000 levels, while guar gum futures (Jan) may manage to remain above 7200 levels. Factors of lower crop and demand side improving on account of lower level buying would possibly keep these counter is the positive territory

Base metal counter may trade with sideways path with some short covering can be seen at lower levels. Copper may take support near 425 levels and recover towards 440 levels. Copper is getting support from lows as stocks in LME-registered warehouses as they fell to their lowest in nearly seven months, shedding 1,100 tonnes to 114,000 tonnes. However, spreads were unaffected by LME supply tightness, with the discount between LME cash copper and 3M deepened to $25 a tonne from $7.50 nearly a month ago. Meanwhile, lead may remain sideways as it can move in the range of 150-160 levels. Primary lead output in China increased more than expected in November as smelters including Henan Yuguang, Henan Jinli, Xing’an Silver & Lead, and Haicheng Chengxin recovered from maintenance and phase-two production lines at Hunan Shuikoushan Zhihui smelter commissioned. Zinc may recover towards 190 levels while taking support near 180 levels. Nickel prices can move with weaker path and may dip lower towards 950 levels while taking resistance near 1040 levels. Nickel prices continue to slide on concerns of dented demand for the key ingredient in stainless steel and EV batteries. China's steel rebar futures dropped and were on course for their biggest weekly loss in nearly four months, as both supplies and inventories picked up. Aluminium prices can trade on mixed path in range of 130-138 levels. Brazilian mining giant Vale stated that it would hike nickel production by about 70% in coming years to 360,000 tonnes a year, mainly by expanding in Indonesia.

10

|

CRUDE OILMCX (DEC) contract closed at Rs. 4161.00 on 04th Dec’19. The contract made its high of Rs. 4222.00 on 22nd Nov.’19 and a low of Rs. 3696.00 on 03rd Oct’19. . The 18- day Exponential Moving Average of the commodity is currently at Rs. 4104.35. On the daily chart, the commodity has Relative Strength Index (14-day) value of 55.967.

One can buy above Rs. 4225 for a target of Rs. 4450 with the stop loss of Rs. 4115.

COPPER MCX (DEC) contract closed at Rs. 430.60 on 5th Nov’19. The contract made its high of Rs. 452.30 on 14th Oct’19 and a low of Rs. 427.70 on 4th Dec’19. The 18-day Exponential Moving Average of the commodity is currently at Rs. 435.90. On the daily chart, the commodity has Relative Strength Index (14-day) value of 40.048.

One can buy above Rs. 436 for a target of Rs. 456 with the stop loss of Rs. 426.

TURMERIC NCDEX (MAR) contract was closed at Rs. 5878.00 on 5th Dec’19. The contract made its high of Rs. 7600.00 on 03rd Sep’19 and a low of Rs. 5842.00 on 5th Dec’19. The 18-day Exponential Moving Average of the commodity is currently at Rs. 6077.87. On the daily chart, the commodity has Relative Strength Index (14-day) value of 34.288.

One can buy above Rs. 5950 for a target of Rs. 6350 with the stop loss of Rs 5750.

11

• Saudi Aramco announces it priced its IPO at 32 riyals per share, valuing the company at $1.7 trillion, short of $2 trillion targeted.

• The U.S. trade deficit dropped to its lowest level in nearly 1-1/2 years in October, suggesting trade could contribute to economic growth in the fourth quarter.

• The Trump administration blacklisted six oil tankers involved in the shipment of Venezuelan oil to Cuba.

• Japan is preparing an economic stimulus package worth $120 billion to support fragile growth.

• Total area sown under rapeseed & mustard in Rajasthan was at 21.15 lakh hectares as on December 4 in the current 2019-20 rabi season, as per the state agriculture ministry's data.

• State-run Cotton Corporation of India (CCI) has procured around 7.5 lakh bales (of 170 kg each) of cotton so far this year, i.e. 2019-20 at the minimum support price (MSP) from key growing states.

• As per Skymet, India may get lower Soybean crop of this season and expect total 12.15 million tonnes lower by 12% against last year record on account of heavy rains during post monsoon season.

• Mustard seed crushing by mills in India jumped 22.2% on year to 550,000 tn in November, according to Mustard Oil Producers Association of India data.

• MCX has been granted recognition by the European Securities and MarketsAuthority (ESMA) as a third-country CCP under Chapter 4 of Title III of the European Market Infrastructure Regulation. Based on the ESMArecognition, European participants shall be able to apply lower risk weightage towards their exposures to MCX CCL.

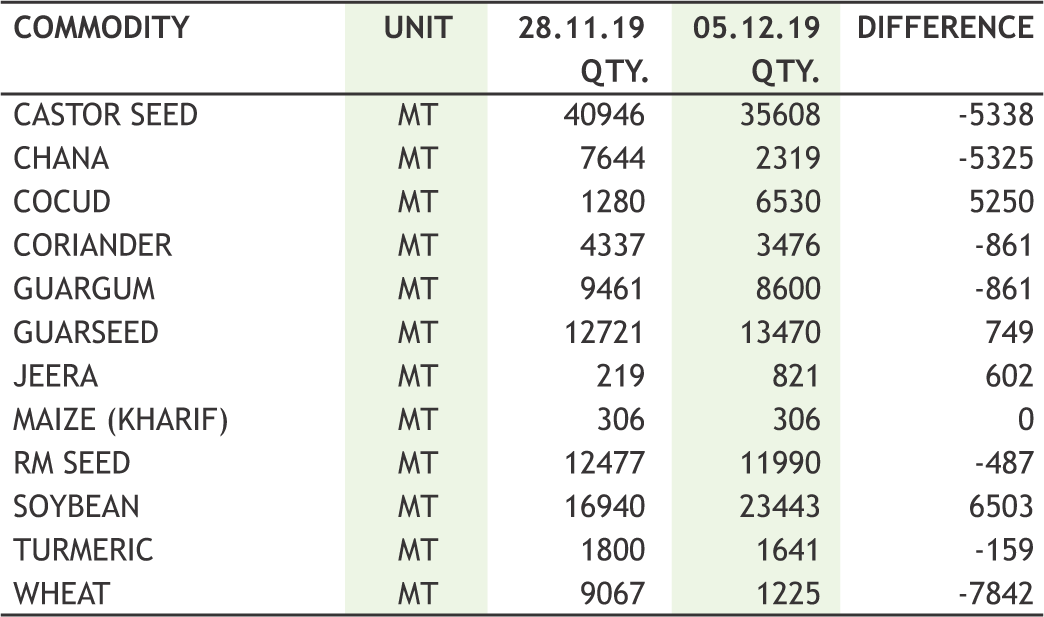

It was an average week for commodities where CRB tried to hold it marginally higher levels; near 190 levels. Dollar index were significantly down though it couldn’t give expected strength to the commodities prices. Bullion counter tried to trade in higher zone though it gave up some of its weekly gains on some improvement in economic data. OPEC meet was most awaited events for the week, kept energy traders on toes. Crude saw good revival from lower sides on expected cut by OPEC together with steep fall in inventories. The Energy Information Administration reported a crude oil inventory draw of 4.9 million barrels for the week to November 29, after a 1.6- million-barrel increase reported for the previous week. Natural gas which saw steep fall in the previous week saw some rebound in the prices. Base metals mostly reacted negatively as trade talk once again turned sour. Copper was four week down, the best performer of 2019 in base metals, Nickel prices dropped for straight 6th week on poor demand.

Pulses futures rose on strong spot market where demand has improved on the news of crop losses. Chana traded above 4430 levels. It is reported that the government is likely to impose stock-holing limit on urad to check soaring prices. The fresh crop will hit spot markets in a month. A portion of the crop in Madhya Pradesh, Gujarat, and Maharashtra was damaged due to heavy rainfall. Cotton counter remained weak on bearish international market. ICE cotton futures settled lower, hurt by uninspiring export sales data from the U.S. Department of Agriculture (USDA), while lack of clarity in trade talks between the United States and China kept investors on edge. CCI's procurement and demand from the mills limited the downside though. Guar was weak on arrival pressure. The arrivals are expected to catch pace from the nonirrigated belts of Barmer, Jaisalmer, etc. In spices, cardamom and coriander prices moved up whereas turmeric and jeera were bearish. Both cardamom arrivals and prices are now on a higher side in the recent period and this has affected the purchasing capacity of traders. The current price realisation in the range of above Rs 2,800 per kg is the highest in the history of cardamom auctions when compared to Rs 1000 per kg registered in 2010-11. Oil seeds and edible oil counter continued its multi week rally on firm international market. CPO futures were up for nonstop 9 weeks on MCX and 10 weeks on BMD. More blending in Bio fuel in Malaysia supported the prices on higher side. Refined soya saw and CPO made new historic high in Indian market.

|

|

12

|

|

Recently the crude oil, nickname black gold, prices traded with bullish sentiment since last few weeks on account on bullish sentiment on easing of US-China trade war tensions and the surprise draw in US inventories and hope that the Opec and its allies would extend their production cuts in an effort to stabilise prices. But Oil prices are being held back by the skepticism over the chances for a near-term preliminary trade deal between Washington and Beijing due to disagreements over the removal of tariffs and recent development of US legislation for support of Honkong protestor and for against Beijing’s treatment of its Uighur Muslim minority that irked China.

Brent & WTI crude oil are hovering around $61 & $55 per barrel respectively. Prices have fluctuated throughout the year, reaching nearly $75 & $70 per barrel respectively in April after U.S. sanctions on Iran and Venezuela limited world supply, but lingering trade tensions between the U.S. and China dampened economic expectations, pushing prices back down.

In the meeting at Vienna, OPEC and non OPEC group led by Russia agreed on December 5 to cut output by an extra 500,000 barrels a day in the first quarter of 2020 but stopped short of pledging action beyond March. OPEC and non OPEC group led by Russia are already cutting 1.2 million barrels per day of output through March to bolster prices.

Global Supply & Demand of crude oil

• OPEC has downwardly revised its forecast for global oil demand growth over both the medium-term and long-term, citing tough market conditions and “signs of stress” in the world economy.

• IEA forecasts global demand growth for 2020 at 1.2 million bpd, and OPEC puts it at 1.4 million bpd. Based on the global macroeconomic challenges, and in the absence of a speedy resolution of the U.S.-China trade spat, both projections appear optimistic.

• If, as the IEA predicts, non-OPEC oil production growth will come in at around 2.3 million bpd, that alone could be three times over demand growth levels for 2020.

• The International Energy Agency (IEA) which has continually reminded the market about a possible flood of non-OPEC barrels, not just from the U.S., but Brazil, Canada, Guyana and Norway as well.

• India and China are two of big three global crude importers. China has been witnessing challenges due to trade war with US. Now even the Indian economy is showing signs of strain due to multiple reasons

OPEC has lowered its outlook numbers for global oil demand growth, to 104.8 million barrels per day (b/d) by 2024, and 110.6 million b/d by 2040. India is thought to be the country with the fastest oil demand growth and the largest additional demand over the next two decades.

• In the November, EIA forecasts U.S. crude oil production will increase to 12.3 MMBPD in 2019 from 11.0 MMbpd in 2018.

• Notably, Goldman Sachs has lowered its demand for crude in 2019 and 2020. The forecast for 2019 was lowered to 950,000 barrels per day, down from an earlier forecast of 1.25 million. The forecast for 2020 has been lowered to 1.25 million, down from 1.45 million. The direction of global demand will depend on U.S.-China trade spat, showing no signs of an immediate settlement, uncertainty over how Brexit will unfold, and a slowdown in German economic activity.

13

|

| 2nd DEC | US ISM Manufacturing contracts further, tempers economic growth hopes. |

| 3rd DEC | Trump says China-US trade deal could wait until after 2020 election. |

| 5th DEC | US trade gap lowest in 17 months. |

| 5th DEC | Sterling hits 7-month highs amid prospects of Conservatives win in UK elections. |

| 5th DEC | RBI kept repo rate unchanged and slashes growth forecast. |

Indian Rupee almost gained over three-quarter percent this week amid improvement in bilateral trade talks between US & China. In NATO summit, Trump reiterated that trade deal may extend beyond US election 2020 and on the very next day, Bloomberg reported that US & China trade deal is moving closer despite heated rhetoric. Meanwhile RBI policy decision to kept rate unchanged after five successive cut with an accommodative stance gave additional boost in domestic currency along with dollar flows, although bond yield jumped the most in two months by 15 bps to 6.61%. Policy makers halted the cut after headline inflation exceeding the inflation target upper bound band and revised the band to 4.7-5.1% from 3.5-3.7% for the second half of the current fiscal. From Majors, the pound has risen to its highest level since May against both the dollar and euro, notching up a second day of strong gains as traders bank on a Conservative victory in the UK general election. A You Gov poll released on Tuesday showed both the Tories and Labour down one point at 42 per cent and 33 per cent respectively. An earlier Kantar poll had the Conservatives increasing their lead by 1 percentage point to 12 points. Next week, 12th December is a pivotal date in forex space as UK election will underway and FOMC will be delivered the last monetary policy in 2019.

USDINR is likely to stay within the range of 71.10 and 71.70 in the next week.

|

USD/INR (DEC) contract closed at 71.4475 on 5th Dec’19. The contract made its high of 71.9950 on 2nd Dec’19 and a low of 71.4025 on 5th Dec’19 (Weekly Basis). The 14-day Exponential Moving Average of the USD/INR is currently at 71.75.

On the daily chart, the USD/INR has Relative Strength Index (14-day) value of 41.55. One can buy at 71.40 for the target of 72 with the stop loss of 71.10.

EUR/INR (DEC) contract closed at 79.2925 on 5th Dec’19. The contract made its high of 79.7875 on 4th Dec’19 and a low of 79.16 on 2nd Dec’19 (Weekly Basis). The 14-day Exponential Moving Average of the EUR/INR is currently at 79.39.

On the daily chart, EUR/INR has Relative Strength Index (14-day) value of 46.75. One can sell at 79.55 for a target of 78.95 with the stop loss of 79.85.

GBP/INR (DEC) contract closed at 93.8575 on 5th Dec’19. The contract made its high of 94.1775 on 5th Dec’19 and a low of 92.62 on 2nd Dec’19 (Weekly Basis). The 14-day Exponential Moving Average of the GBP/INR is currently at 92.95.

On the daily chart, GBP/INR has Relative Strength Index (14-day) value of 66.38. One can sell below 93.50 for a target of 92.50 with the stop loss of 94.00.

JPY/INR (DEC) contract closed at 65.6925 on 5th Dec’19. The contract made its high of 66.42 on 4th Dec’19 and a low of 65.5850 on 2nd Dec’19 (Weekly Basis). The 14-day Exponential Moving Average of the JPY/INR is currently at 65.96.

On the daily chart, JPY/INR has Relative Strength Index (14-day) value of 41.86. One can buy above 66 for a target of 66.60 with the stop loss of 65.70.

14

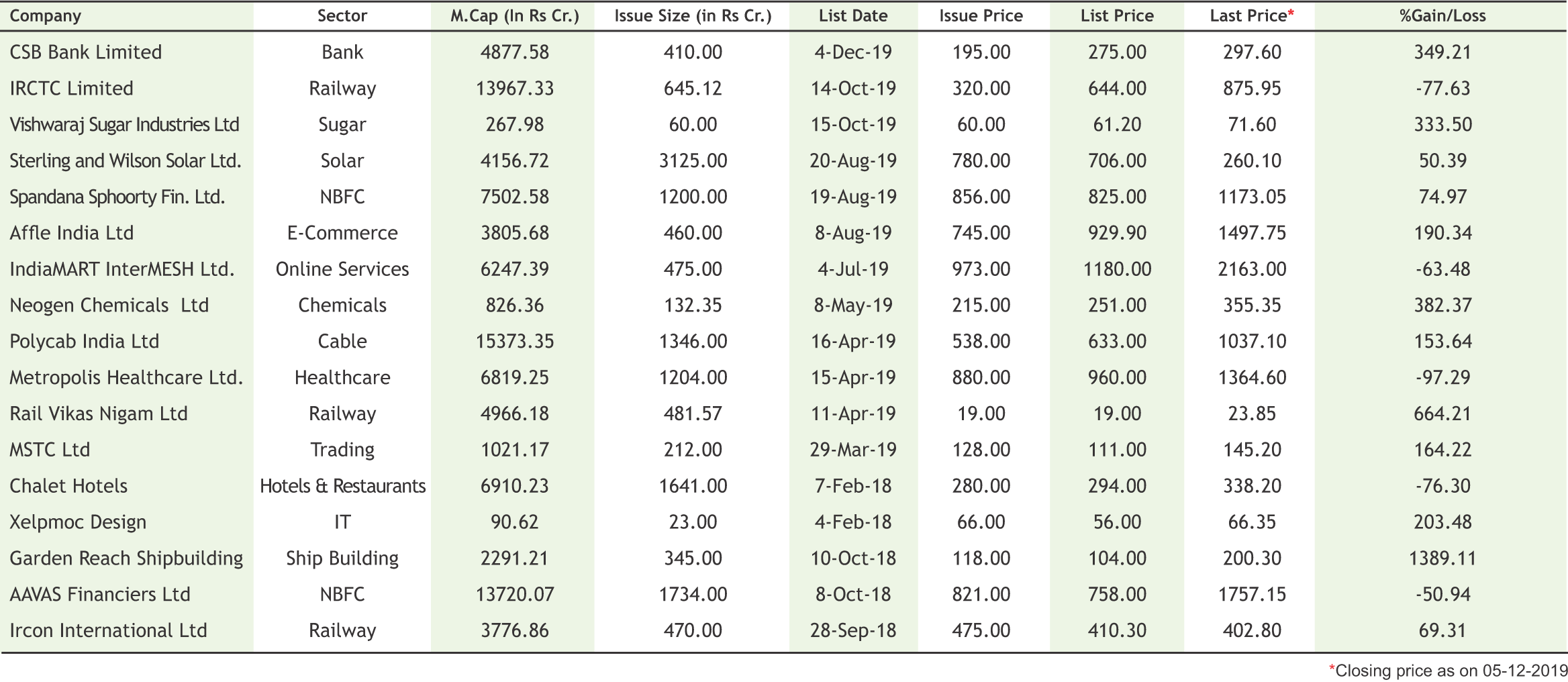

CSB Bank makes strong debut, lists at 41% premium against issue price

Shares of CSB Bank made a strong debut by listing at Rs 275, a 41 per cent premium against its issue price of Rs 195 per share. Fairfax-backed CSB Bank’s Rs 410-crore initial public offering (IPO) was subscribed a whopping 86.89 times last month. The category reserved for qualified institutional buyers (QIBs) was subscribed 62.18 times, non institutional investors (NIIs) 164.68 times and retail individual investors quota was subscribed 44.25 times, the exchange data shows. Formerly known as Catholic Syrian Bank, the Kerala-based lender has presence in Maharashtra, Tamil Nadu, and Karnataka. With a customer base of nearly 1.3 million people (as on March 31, 2019). Its credit portfolio includes sectors like agriculture, MSMEs, education, and housing. Given the bank’s consistent improvement in asset quality and turnaround performance in this financial year, analysts recommended subscribing to the issue, albeit with riders.

Ujjivan Small Finance Bank IPO subscribed 166 times on final day, receives Rs 76,000 cr worth of bids

The Rs 750-crore IPO of Ujjivan Small Finance Bank, the subsidiary of listed microfinance lender Ujjivan Financial Services, has subscribed 165.68 times on the final day of bidding December 4. The strong response from all categories of investors continued as the issue received bids for 2,053.8 crore shares against the offer size of 12.39 crore shares, the exchange data showed. The issue has seen highest subscription since January 2018 and received bids for around Rs 76,000 crore worth of shares.

SAMHI Hotels receives SEBI approval for Rs 1,800-2,000 crore IPO

SAMHI Hotels has received markets regulator SEBI's go ahead to raise an estimated Rs 1,800-2,000 crore through its initial public offering. The company, which had filed IPO papers with the regulator in September, obtained "observations" from the markets watchdog on November 29, according to information available with the SEBI. The regulator's observations are necessary for any company to launch public issue like initial public offer, follow-on public offer and rights issue. Going by the draft papers, SAMHI Hotels' IPO comprises a fresh issue of Rs 1,100 crore and an offer for sale (OFS) of 1,91,45,624 equity shares. Net proceeds of the fresh issue will be utilised towards repayment or prepayment of certain indebtedness by the company and its subsidiaries. Besides,the money will be utilised for general corporate purposes. Kotak Mahindra Capital Company, CLSAIndia, DSP Merrill Lynch and Goldman Sachs will manage the offer.As on June 30, 2019,the current portfolio of SAMHI consists of 27 operating hotels across 12 cities.

SBI Cards files IPO papers with Sebi

SBI Cards, the credit card arm of State Bank of India filed Draft Red Herring Prospectus (DRHP) for its initial public offer (IPO) with Sebi. The company will offer up to 130,526,798 equity shares via offer for sale route. This will include up to 37,293,371 share sale by SBI and up to 93,233,427 shares on offer by Carlyle Group (CA Rover). In addition, the company will also issue fresh equity shares of Rs 500 crore. Up to 1,864,669 shares have been reserved for employees of the company whereas 13,052,680 have been reserved for SBI shareholders. SBI holds 76 per cent in SBI Cards and rest of the stake is held by Carlyle Group. SBI Cards is the second-largest credit card issuer in India with an 18 per cent market share. For the half year ended September 30, the company’s net income was Rs 725.88 crore. Its revenue was at Rs 4,677.20 crore. Kotak Mahindra Capital, Axis Capital, DSP Merryl Lynch, Nomura Financial Advisory, HSBC Securities and SBI Capital Markets will are the book-running lead managers of the issue.

Home First Finance plans to raise Rs 1,500 crore, files IPO papers with SEBI

Home First Finance Company (HFFC) has filed a DRHP with the Securities and Exchange Board of India (SEBI) for its proposed IPO. The housing finance company is expected to raise Rs 1,500 crore through the public issue. The IPO comprises a fresh issue of Rs 400 crore and Rs 1,100-crore offer for sale by promoters and investors. The offer for sale consists of Rs 498.4 crore worth of shares by True North Fund V LLP, Rs 332.2 crore worth of shares by Aether (Mauritius) (both are promoter selling shareholders), and Rs 176.4 crore shares by Bessemer India Capital Holdings II, Rs 56 crore shares by PS Jayakumar, Rs 35.9 crore shares by Manoj Viswanathan and Rs 1.1 crore shares by Bhaskar Chaudhry. The prospectus also says that the company may consider a pre-IPO placement of up to Rs 160 crore in consultation with merchant bankers. If the pre-IPO placement is undertaken, the amount will be reduced from the fresh issue.The company intends to utilise the net proceeds from the fresh issue for augmenting its capital base to meet requirements arising out of the growth of business and assets.

|

15

|

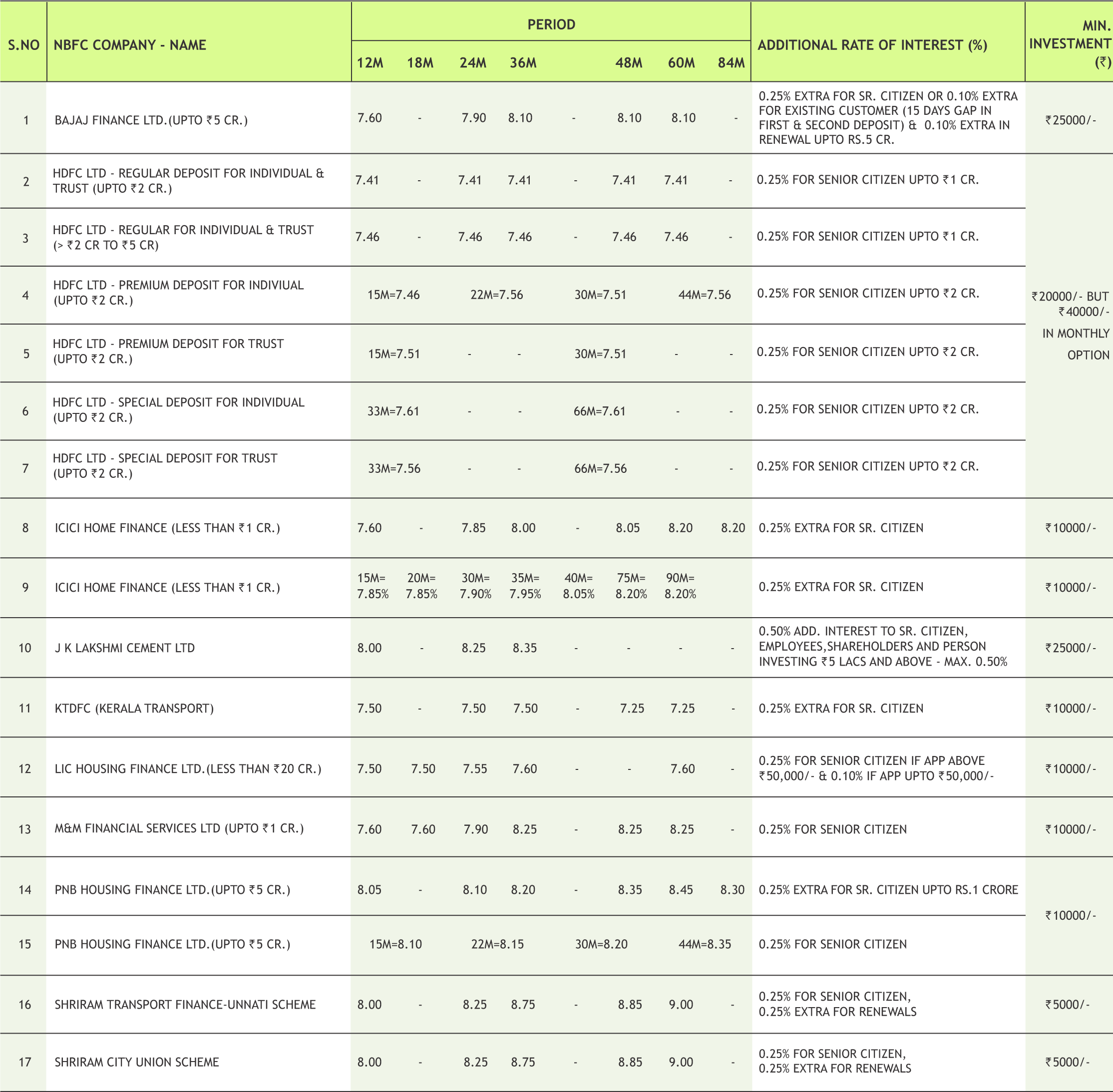

* Interest Rate may be revised by company from time to time. Please confirm Interest rates before submitting the application.

* For Application of Rs.50 Lac & above, Contact to Head Office.

* Email us at fd@smcindiaonline.com

16

Aditya Birla Sun Life Mutual Fund announced the launch of Aditya Birla Sun Life PSU Equity Fund

Aditya Birla Sun Life Mutual Fund announced the launch of Aditya Birla Sun Life PSU Equity Fund, an open-ended equity scheme following PSU theme. The New Fund Offer (NFO) will open for subscription on Dec 9, 2019 and close on Dec 23, 2019.

IDBI Mutual Fund announces change in directorship

IDBI Mutual Fund announced that Dilip Kumar Mandal has ceased to be Managing Director, Chief Executive Officer and key personnel of IDBI Asset Management Limited effective closure of business hours of Nov 30, 2019.

Nippon India Mutual Fund announced the Introduction of Dividend skip withdrawal Facility

Nippon India Mutual Fund announced the introduction of “Dividend skip withdrawal” facility in Nippon India Equity Hybrid Fund, Nippon India Equity Savings Fund, Nippon India Large Cap Fund and Nippon India Balanced Advantage Fund effective Dec 3, 2019.

UTI Mutual Fund announce change in key personnel of UTI AMC

UTI Mutual Fund announced that Debashish Mohanty, President , Head of Retail business and Investor Service Management, Vivek Kumar, Head – Legal, and Mani Kant Chaudhary, Head – Internal Audit have been identified as key personnel of UTI AMC Ltd.

17

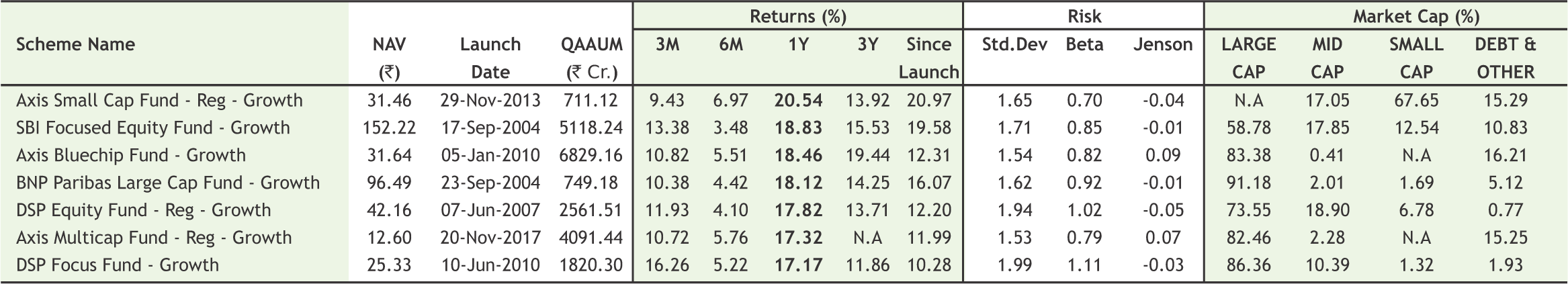

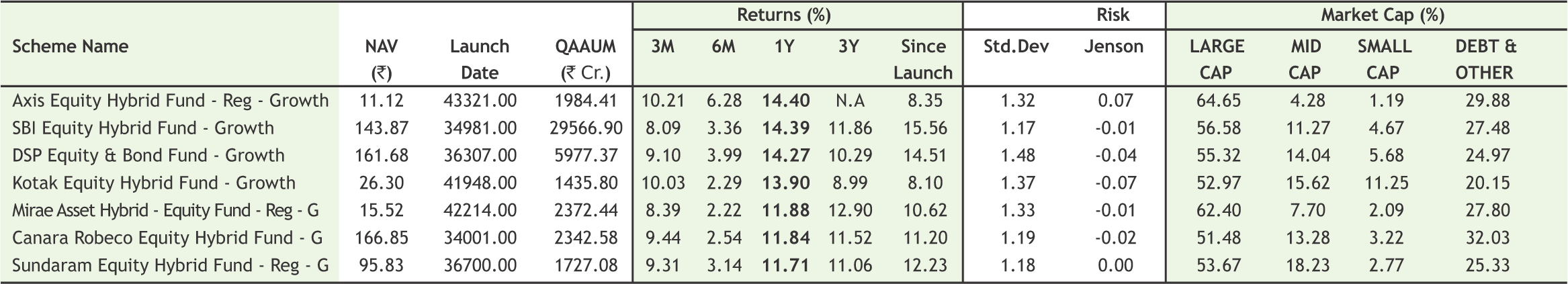

|

|

|

|

|

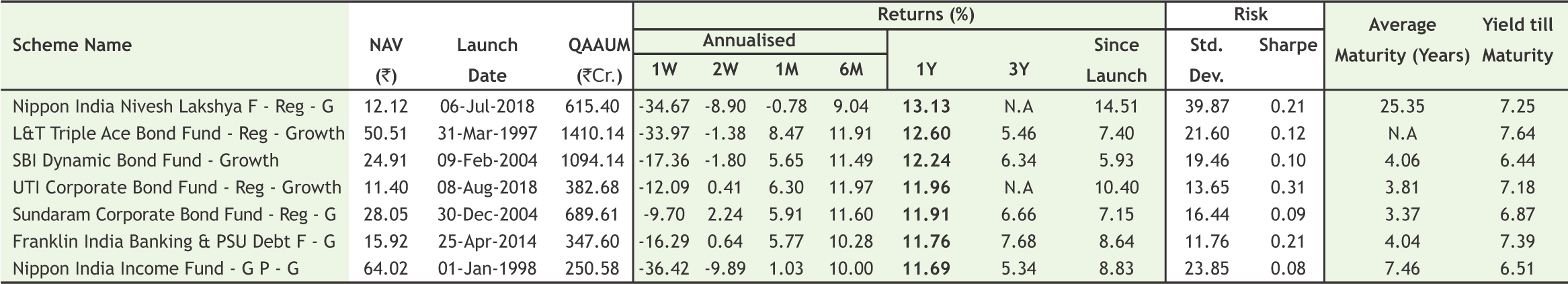

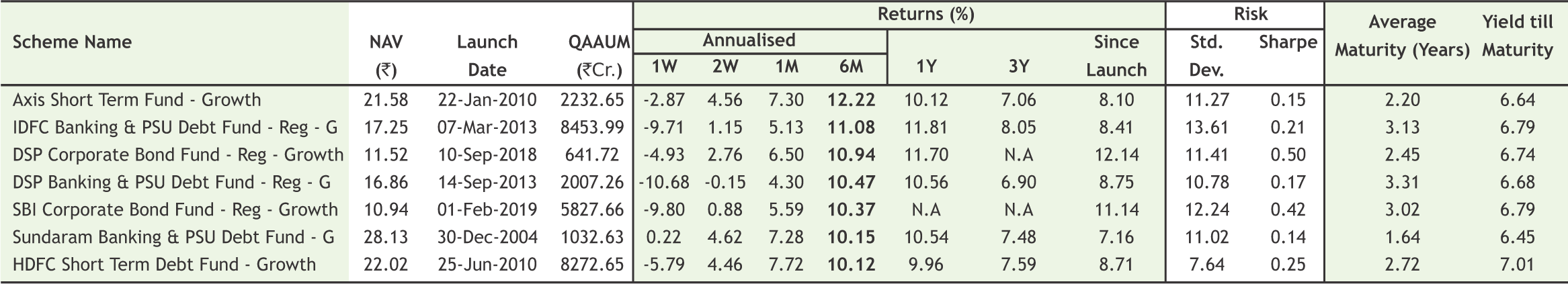

Note:Indicative corpus are including Growth & Dividend option . The above mentioned data is on the basis of 08/08/2019 Beta, Sharpe and Standard Deviation are calculated on the basis of period: 1 year, frequency: Weekly Friday, RF: 7%

*Mutual Fund investments are subject to market risks, read all scheme related documents carefully

18

Mr. S C Aggarwal (CMD, SMC Group) addressing the audience during 17th Commodity Derivatives Market Summit organized by Assocham on 29th November, 2019 at Hotel Taj Mahal, Mansingh Road, New Delhi.

Dr. D K Aggarwal (CMD, SMC Investments & President, PHDCCI) along with Shri Manish Sisodia Ji (Deputy Chief Minister of Delhi) on 20th November, 2019 at PHD House, New Delhi.

Mr. Rajesh Sharma (AVP, Sub-Broker Marketing, SMC Global) addressing the audience during an Investor Awareness Program organized by SMC in association with Multi Commodity Exchange (MCX) on 28th November, 2019 at Hotel Dream Palace, Udaipur.

![]() Customized Plans

Customized Plans

![]() Comprehensive Investment Solutions

Comprehensive Investment Solutions

![]() Long-term Focus

Long-term Focus

![]() Independent & Objective Advise

Independent & Objective Advise

![]() Financial Planning

Financial Planning

Call Toll-Free 180011 0909

Visit www.smcindiaonline.com

REGISTERED OFFICES:

11 / 6B, Shanti Chamber, Pusa Road, New Delhi 110005. Tel: 91-11-30111000, Fax: 91-11-25754365

MUMBAI OFFICE:

Lotus Corporate Park, A Wing 401 / 402 , 4th Floor , Graham Firth Steel Compound, Off Western Express Highway, Jay Coach Signal, Goreagon (East) Mumbai - 400063

Tel: 91-22-67341600, Fax: 91-22-67341697

KOLKATA OFFICE:

18, Rabindra Sarani, Poddar Court, Gate No-4,5th Floor, Kolkata-700001 Tel.: 033 6612 7000/033 4058 7000, Fax: 033 6612 7004/033 4058 7004

AHMEDABAD OFFICE :

10/A, 4th Floor, Kalapurnam Building, Near Municipal Market, C G Road, Ahmedabad-380009, Gujarat

Tel : 91-79-26424801 - 05, 40049801 - 03

CHENNAI OFFICE:

Salzburg Square, Flat No.1, III rd Floor, Door No.107, Harrington Road, Chetpet, Chennai - 600031.

Tel: 044-39109100, Fax -044- 39109111

SECUNDERABAD OFFICE:

315, 4th Floor Above CMR Exclusive, BhuvanaTower, S D Road, Secunderabad, Telangana-500003

Tel : 040-30031007/8/9

DUBAI OFFICE:

2404, 1 Lake Plaza Tower, Cluster T, Jumeriah Lake Towers, PO Box 117210, Dubai, UAE

Tel: 97145139780 Fax : 97145139781

Email ID : pankaj@smccomex.com

smcdmcc@gmail.com

Printed and Published on behalf of

Mr. Saurabh Jain @ Publication Address

11/6B, Shanti Chamber, Pusa Road, New Delhi-110005

Website: www.smcindiaonline.com

Investor Grievance : igc@smcindiaonline.com

Printed at: S&S MARKETING

102, Mahavirji Complex LSC-3, Rishabh Vihar, New Delhi - 110092 (India) Ph.: +91-11- 43035012, 43035014, Email: ss@sandsmarketing.in