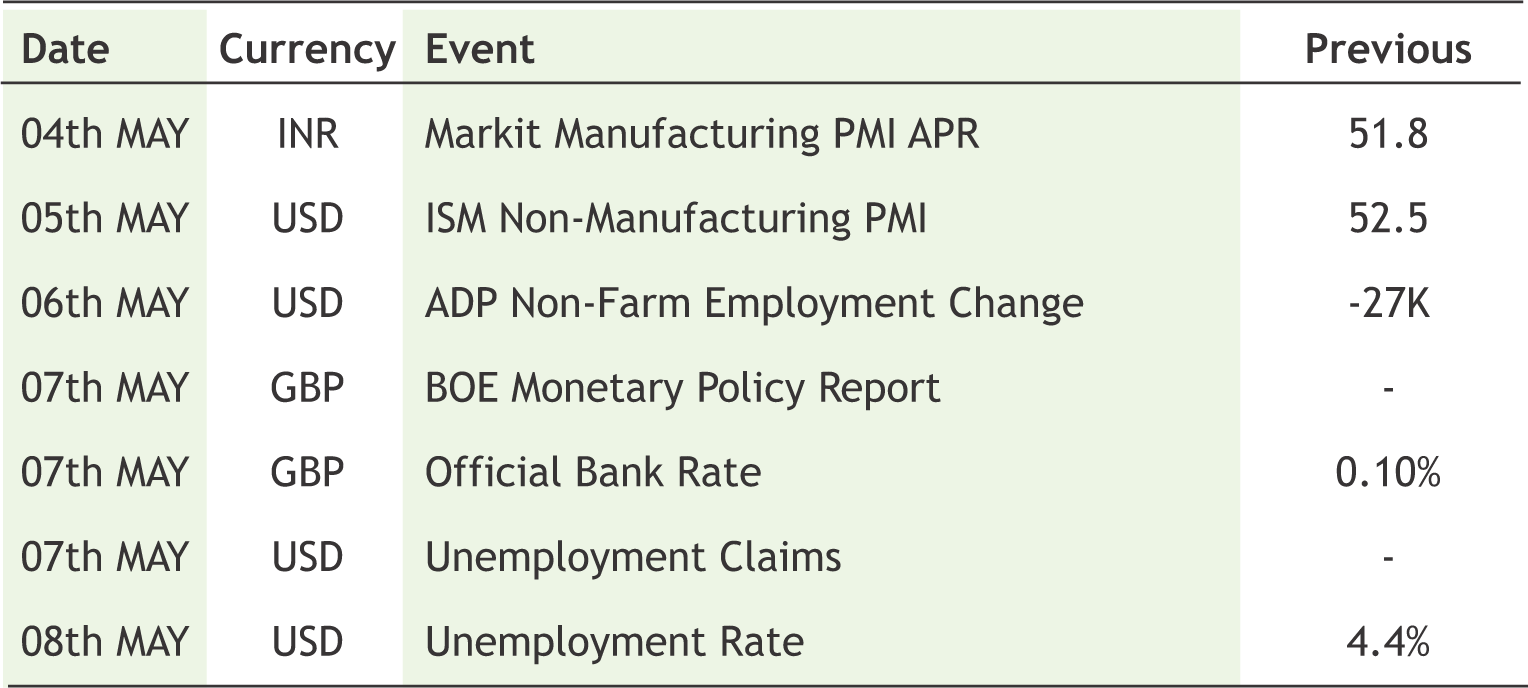

2020: Issue 734, Week: 4th - 8th May

A Weekly Update from SMC (For private circulation only)

2020: Issue 734, Week: 4th - 8th May

A Weekly Update from SMC (For private circulation only)

NEY

NEY

| Equity | 4-7 |

| Derivatives | 8-9 |

| Commodity | 10-13 |

| Currency | 14 |

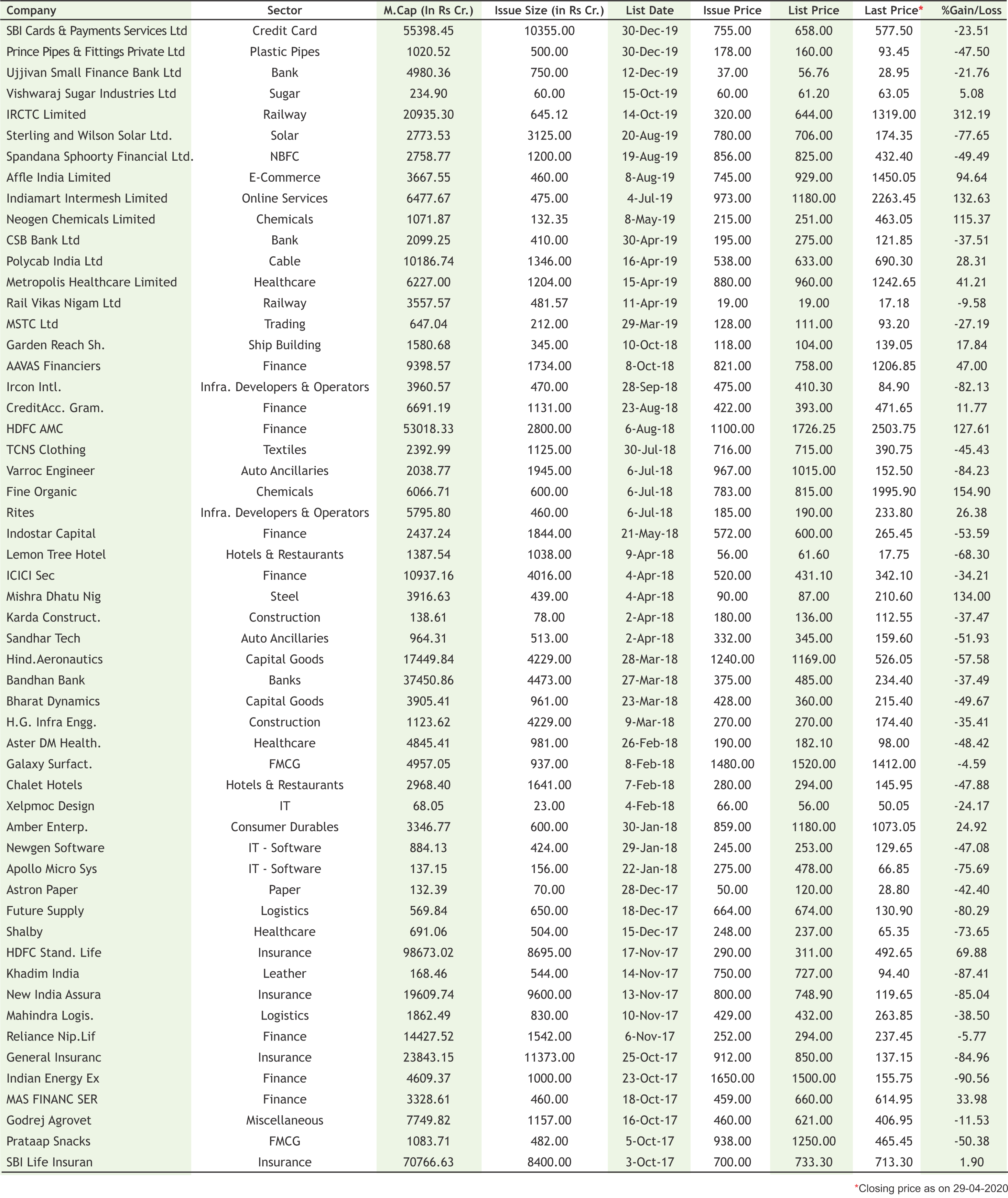

| IPO | 15 |

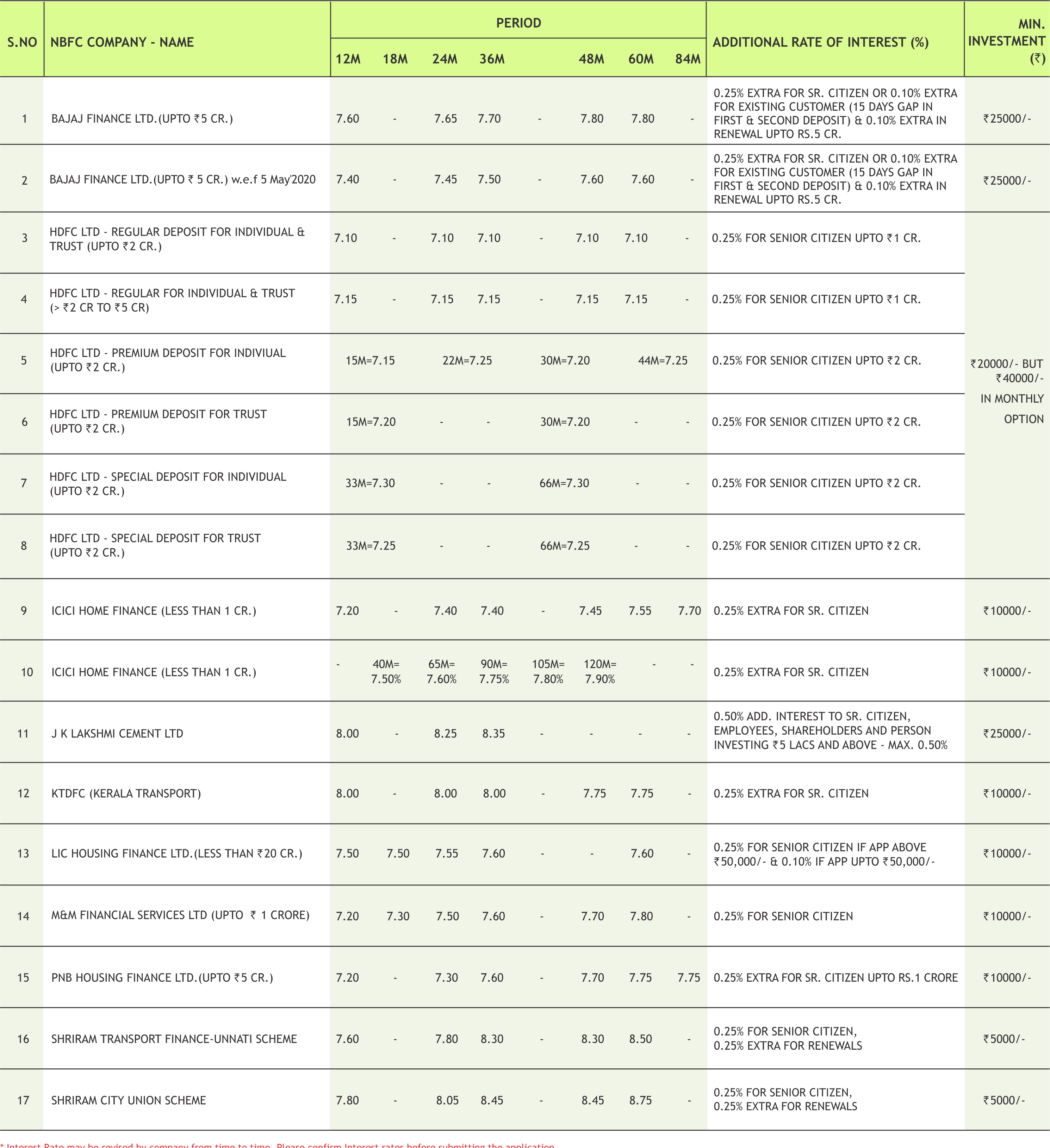

| FD Monitor | 16 |

| Mutual Fund | 17-18 |

I

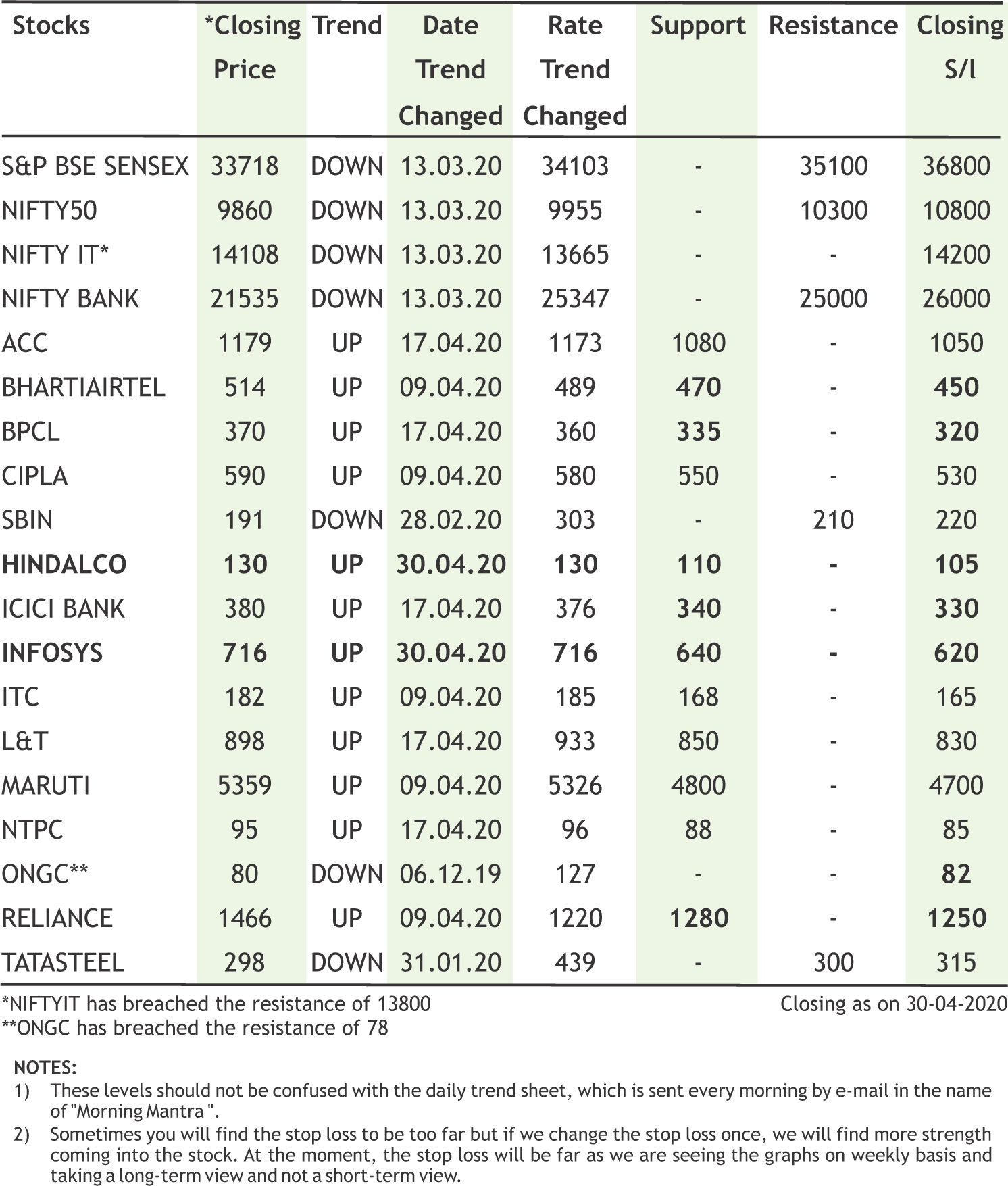

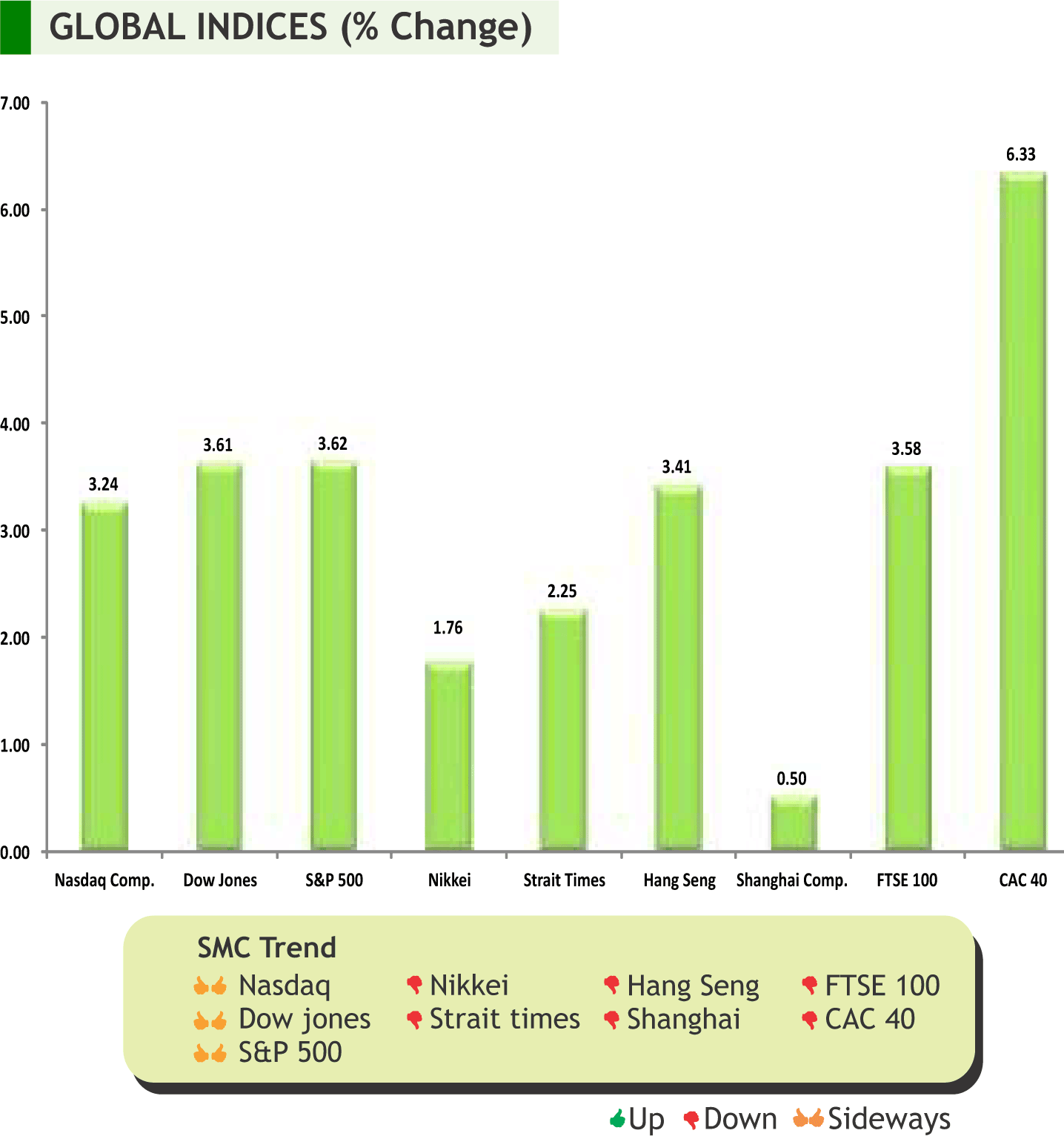

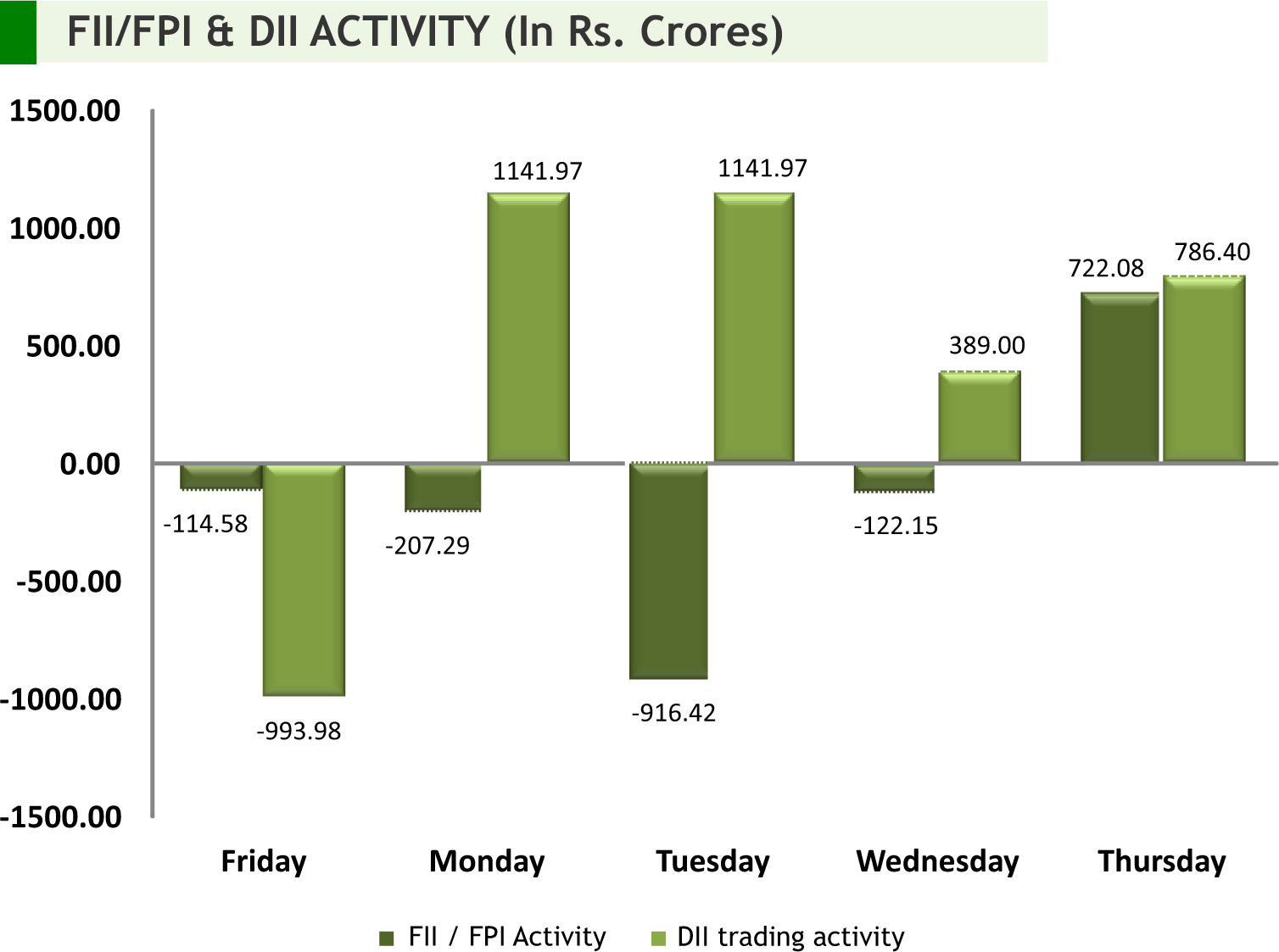

n the week gone by, global market soared after investors shrugged off a deep I slump in the US economy and pinned their hopes on a possible breakthrough in treatment for Covid-19. In the recent meeting Fed left interest rates near zero and repeated a vow to do what it takes to shore up the economy. US economy shrank at 4.8% rate last quarter as coronavirus struck. The optimism about a viable coronavirus treatment and a supportive central bank offset the first U.S. GDP growth decline since 2014. The Bank of Japan expanded monetary stimulus and pledged to buy unlimited amount of bonds to keep borrowing costs low as the government tries to spend its way out of the deepening economic pain from the coronavirus pandemic. On the economic front, Japan’s March factory output fell at the fastest pace in five months, while retail sales also dropped as businesses struggled with the coronavirus pandemic’s sharp hit to overseas and domestic demand. Factory activity in China expanded for a second straight month in April, as more businesses resumed work after the coronavirus-led shutdowns.

Back at home, domestic markets moved higher tracking global markets after positive trial results of an experimental COVID-19 treatment, US Federal Reserve pledge to shore up the economy and jump in oil prices. The rupee also surged against the US dollar on Wednesday, bolstered by gains in domestic equities and a weak greenback in global markets. In another development, the government has begun consultations with stakeholders on ways to step up foreign investment into the country, with commerce and industry minister launching discussions with investment bankers, consulting agencies and law firms. India is forecast to get an overall ‘normal’ monsoon rainfall this year, but an initial month-wise prediction suggests ‘below normal’rainfall during June, long dry spells in July and the rains then making up with ‘excess rainfall’ during August and September — almost similar to last year’s pattern. Going forward, it is expected that a host of domestic earnings, threat of Covid -19 and other global factors will continue to dictate the trend of the domestic stock market.

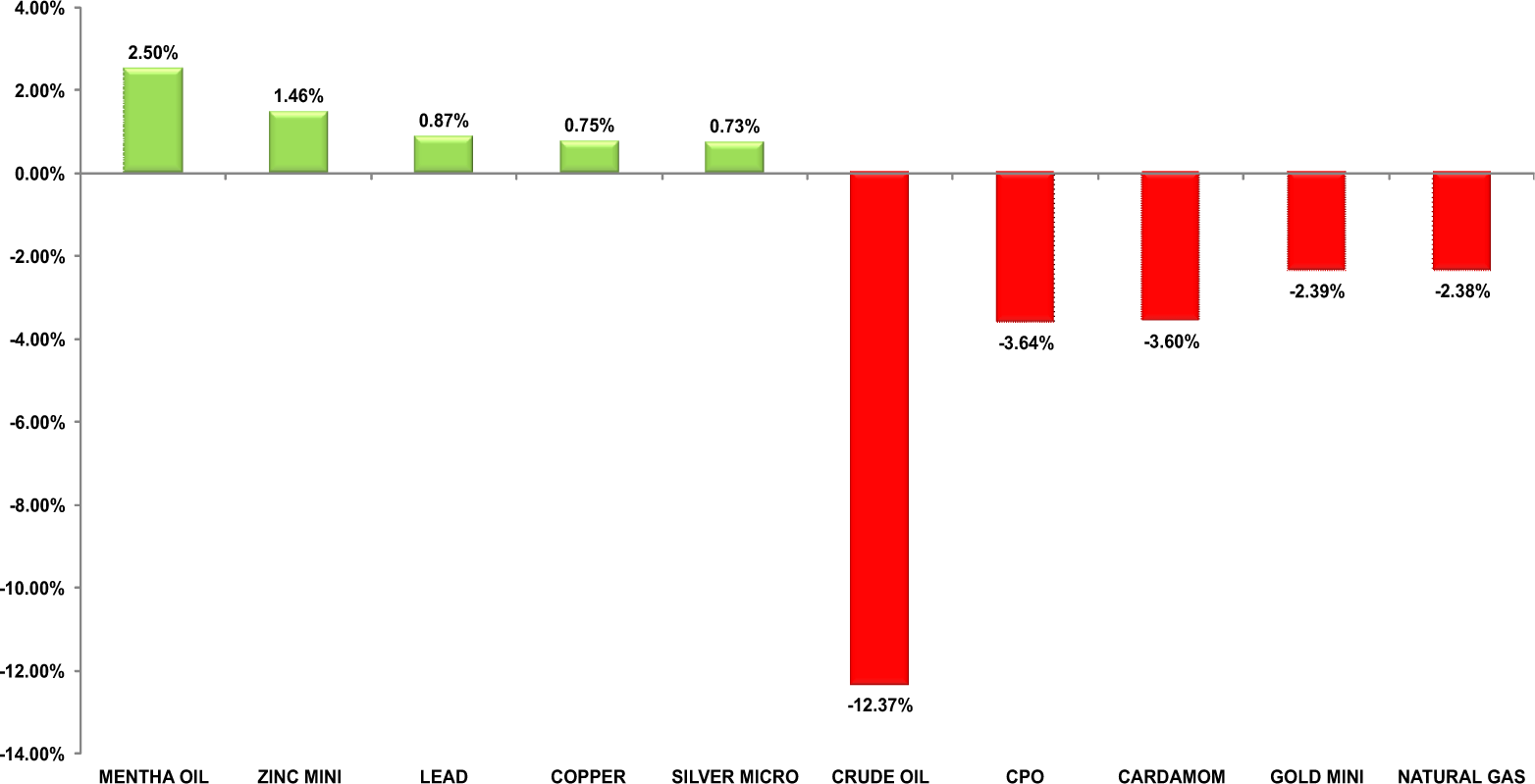

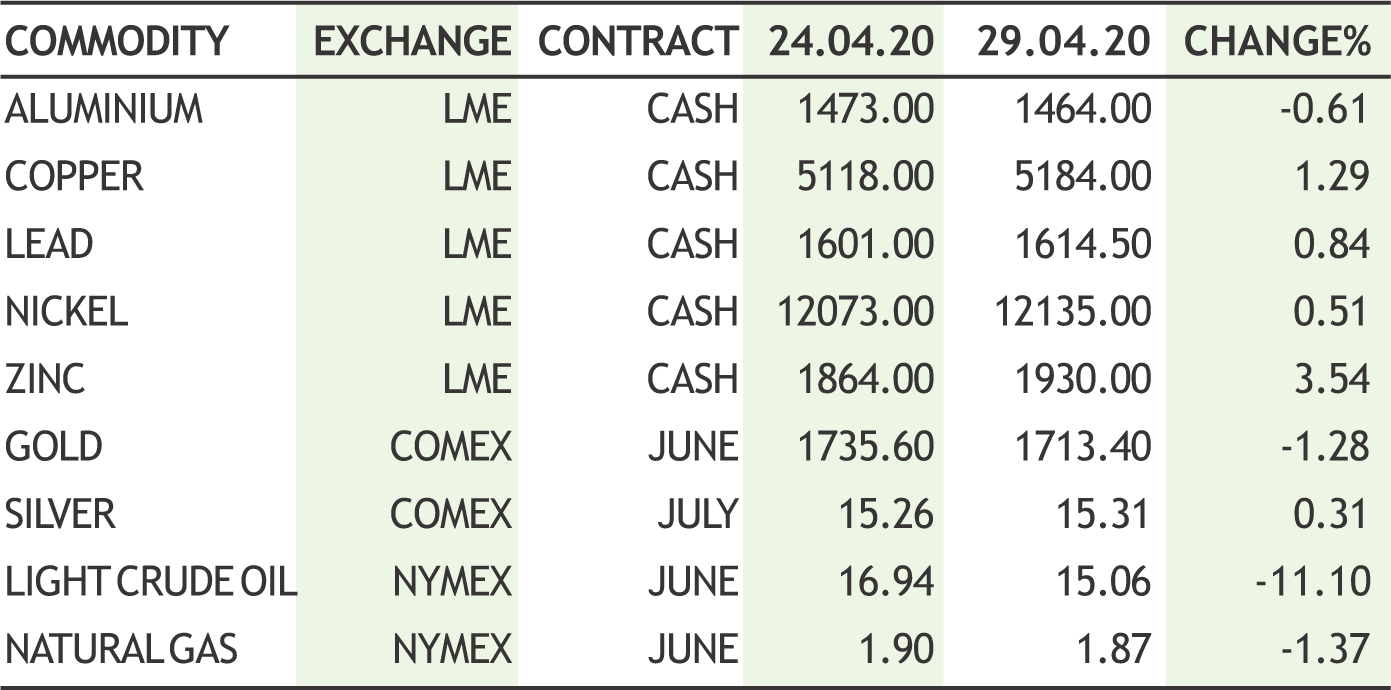

On the commodity market front, the week gone by was all about the big moves in the crude futures, mostly it traded in lower circuits, however in the second half it tried to recover its previous losses and kept itself above the mark of $17 in NYMEX and Rs1200 in MCX. MCX increased the margin multifold for proper risk management. Crude may see some rise though the stability at higher side is questionable as world is sitting on massive inventories. Base metals are trying to make a base on lower side and moving up with baby steps. With fresh stimulus along with strong recovery in equity market is making this riskier asset class attractive. Copper is likely to touch 420 levels in near term. Edible oil futures are trading in sharp backwardation as new crop is about to arrive. Bullion counter may see further rise but the upside should be limited as equity market is recovering and now people are more interested into riskier assets.

SMC Global Securities Ltd. (hereinafter referred to as “SMC”) is a registered Member of National Stock Exchange of India Limited, Bombay Stock Exchange Limited and its associate is member of MCX stock Exchange Limited. It is also registered as a Depository Participant with CDSL and NSDL. Its associates merchant banker and Portfolio Manager are registered with SEBI and NBFC registered with RBI. It also has registration with AMFI as a Mutual Fund Distributor.

SMC is a SEBI registered Research Analyst having registration number INH100001849. SMC or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities market.

SMC or its associates including its relatives/analyst do not hold any financial interest/beneficial ownership of more than 1% in the company covered by Analyst. SMC or its associates and relatives does not have any material conflict of interest. SMC or its associates/analyst has not received any compensation from the company covered by Analyst during the past twelve months. The subject company has not been a client of SMC during the past twelve months. SMC or its associates has not received any compensation or other benefits from the company covered by analyst or third party in connection with the research report. The Analyst has not served as an officer, director or employee of company covered by Analyst and SMC has not been engaged in market making activity of the company covered by Analyst.

The views expressed are based solely on information available publicly available/internal data/ other reliable sources believed to be true.

SMC does not represent/ provide any warranty express or implied to the accuracy, contents or views expressed herein and investors are advised to independently evaluate the market conditions/risks involved before making any investment decision.

DOMESTIC NEWS

Telecom

• Lupin announced it has received tentative approval for its Arformoterol Tartrate Inhalation Solution 15 mcg (base)/2 mL, Unit-dose Vials, from the United States Food and Drug Administration (U.S. FDA) to market a generic version of Brovana® Inhalation Solution, 15 mcg/2 mL of Sunovion Pharmaceuticals Inc. (Sunovion).

• Glenmark Pharmaceuticals announced that it has received approval from the DCGI (Drug Controller General of India), the regulator in India to conduct clinical trials on Favipiravir Antiviral tablets on COVID-19 patients. The product is a generic version of Avigan® of Fujifilm Toyama Chemical Co., Japan, a subsidiary of Fujifilm Corporation.

• Dr Reddys Laboratories announced the launch of Fenofibrate Tablets USP, a therapeutic equivalent generic version of Tricor® (fenofibrate) Tablets, approved by theU.S. Food andDrugAdministration (USFDA).TheTricor® brand and generic had U.S. sales of approximately $90 million MAT for the most recenttwelve months ending in January 2020 according to IQVIAHealth.

• Granules India announced that the USFDA has approved the Abbreviated New Drug Application (ANDA) filed by Granules Pharmaceuticals, Inc. (GPI), a wholly owned foreign subsidiary of Granules India for Vigabatrin for Oral Solution USP, 500 mg. It is bioequivalent to the reference listed drug product (RLD), Sabril® (vigabatrin) for Oral Solution, 500 mg, of Lundbeck Pharmaceuticals LLC.

• J B Chemicals & Pharmaceuticals has received USFDA approval for the company's Abbreviated New Drug Application (ANDA) for Carbamazepine Extended Release Tablets USP 100 mg, 200 mg and 400 mg. (for treatment of Epilepsy and Trigeminal Neuralgia). The product is a generic version of Tegretol XR tablet in the same strength of Novartis Pharmaceuticals Corp. According to IQVIA, US sales were approximately USD 128 million.

• Natco Pharma has received final approval of its 1st supplemental abbreviated new drug application (sANDA) product from the U.S. Food and Drug Administration (USFDA) filed from its new drug formulations facility in JNPC SEZ, Ramky Pharma City, Visakhapatnam (Vizag),Andhra Pradesh,India.

Bank

• Axis Bank entered into a definitive agreement with Max Financial Services Ltd to become a joint venture partner in Max Life Insurance Company Ltd, a pure play insurance player. The move will make Axis Bank, the third-largest private sector bank, a significant stakeholder in a life insurance venture and will allow it to participate in its long term capital appreciation.

Plastic Products

• Finolex Industries has partially resumed operations at its Ratnagiri (Maharashtra) and Masar (Gujarat) plants based on the permission received from the respective authorities. The manufacturing at these plants shall be started in a phased manner.

Auto Ancillary

• Endurance Technologies has been granted permission by the State and local District Administration concerned to resume operations for its plants located at Pantnagar(Uttarakhand) and WalujinAurangabad (Maharashtra).

INTERNATIONAL NEWS

• The U.S. Federal Reserve held its interest rate target between 0 percent and 0.25 percent. The Fed said it would continue with its aggressive policy stance until it is comfortable that the economy is back on its feet.

• US consumer confidence index plunged to 86.9 in April after tumbling to a downwardly revised 118.8 in March. Economists had expected the index to plummet to 90.0 from the 120.0 originally reported for the previous month.

• US pending home sales index plunged by 20.8 percent to 88.2 in March after jumping by 2.3 percent to 111.4 in February. Economists had expected the index to tumbled by 10.0.

• Eurozone monetary aggregate M3 expanded at a pace of 7.5 percent annually in March, following a 5.5 percent rise in February. The rate was forecast to remain unchanged at 5.5 percent.

• Eurozone economic confidence index fell to 67.0 in April from 94.2 in March. This was the strongest monthly decline since 1985. The industrial sentiment index plunged to -30.4 from -11.2 a month ago.

• China's manufacturing sector conditions weakened slightly in April as the impact of the coronavirus globally led to a substantial fall in export sales, survey results from IHS Markit. The Caixin manufacturing Purchasing Managers' Index fell unexpectedly to 49.4 in April from 50.1 in March. A score below 50 indicates contraction in the sector.The score was expected to rise to 50.3.

|

|

4

5

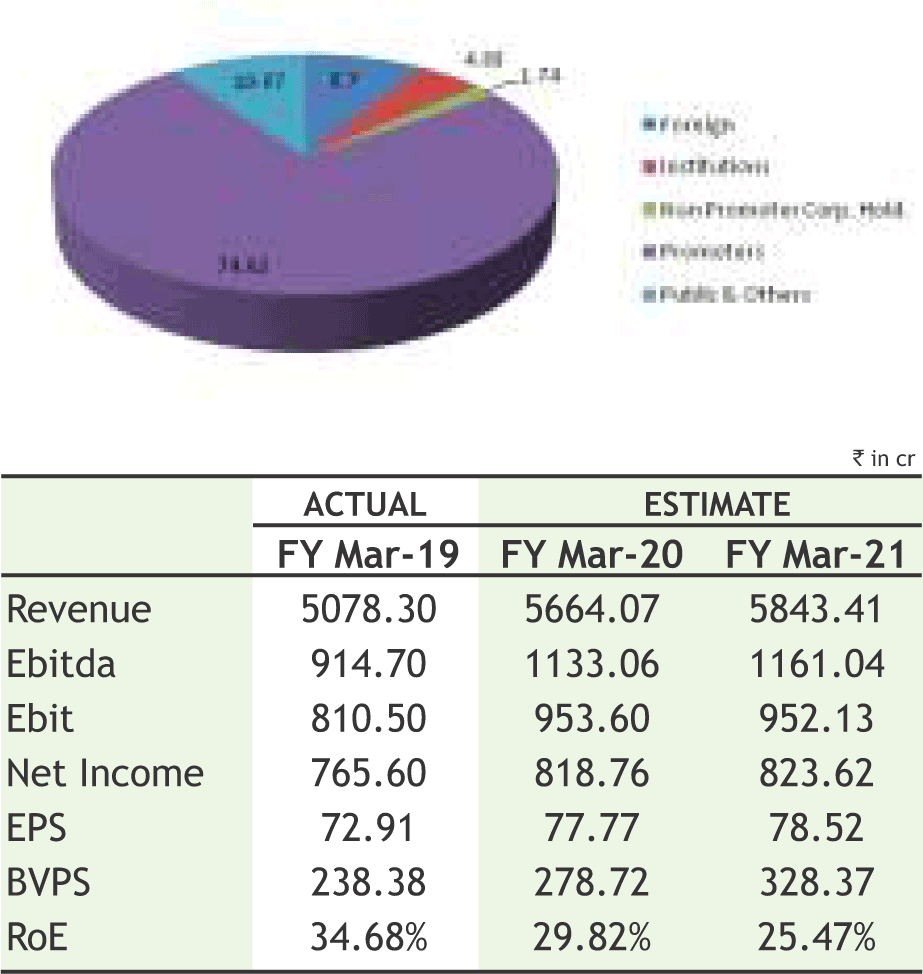

L&TTECHNOLOGY SERVICES LIMITED

CMP: 1252.00

Target Price: 1492

Upside: 19%

| Face Value (Rs.) | 2.00 |

| 52 Week High/Low | 1817.75/995 |

| M.Cap (Rs. in Cr.) | 13084.85 |

| EPS (Rs.) | 77.05 |

| P/E Ratio (times) | 16.25 |

| P/B Ratio (times) | 4.97 |

| Dividend Yield (%) | 1.91 |

| Stock Exchange | BSE |

Investment Rationale

• L&T Technology Services Limited (LTTS) is a subsidiary of Larsen & Toubro Limited focused on Engineering and R&D (ER&D) services and offer consultancy, design, development and testing services across the product and process developmentlife cycle.

• During the quarter, it has won 9 multi-million dollar deals across all major industry segments which include 2 deals having TCV of USD30mn+ each. On a YoY basis, LTTS has increased its USD20mn+ clients by 2 and its USD10mn+ clients by 4.

• Total headcount stood at 16,787 at the end of the December 2019 quarter. Attrition on last 12-month basis stood at 13.9%.

• Atthe end ofthe third quarter,the patents portfolio ofthe company stood at 472, out of which 352 are co-authored withitscustomersandtherestarefiledbyLTTS.

• The management of the company expects a new set of opportunities as customers seek disruptive technologies like AI, sensor fusion and industrial robotics to strengthen its market competitiveness. To support this, the company continues to invest in building competencies and design centers that will take closer to the customer.

• On the development front, recently, it has opened its 9th design center outside of India - an Aerospace & Defense Engineering Design Center in Rockford, Illinois (USA) that will cater to the development of high-performance engineering solutions for the global aerospace and defense industry. In Europe, LTTS won an engineering services deal from a multinational steel manufacturer to manage the Engineering, Procurement and Construction Management (EPCM) services for an upcoming plant.

• During Q3FY20, It has reported strong performance in three segments - Transportation, Plant Engineering, and Medical Devices that are each growing in excess of 20% on YoY basis. Digital & leading-edge technologies - the growth driver for ER&D, contributed to 41% of Q3 revenuesandgrewby29%YoY.

Risk

• Currency Fluctuation

• Highly Competitive

Valuation

The management of the company expects a healthy deal pipeline and good traction in focus areas such as Edge computing, Smart Manufacturing, IoT, Electric & Autonomous vehicles. Moreover, the company will continue to benefit from the strong managerial and operational support from its parent and the overall strength of the L&T brand. Thus, it is expected that the stock will see a price target of Rs.1492 in 8 to 10 months time frame on an expected P/E of 19x and FY21 (E) earnings of Rs.78.52.

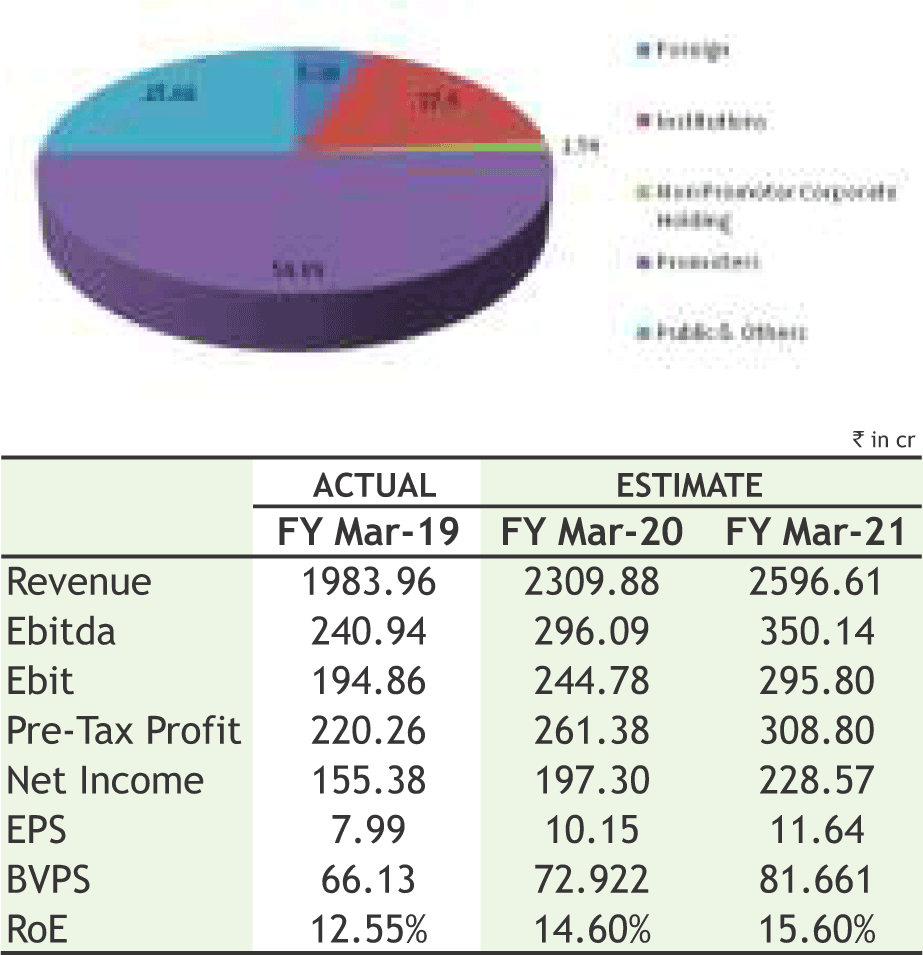

RALLIS INDIA LIMITED

CMP: 213.70

Target Price: 251

Upside: 18%

| Face Value (Rs.) | 1.00 |

| 52 Week High/Low | 255.60/127.10 |

| M.Cap (Rs. in Cr.) | 4164.55 |

| EPS (Rs.) | 9.92 |

| P/E Ratio (times) | 21.59 |

| P/B Ratio (times) | 3.03 |

| Dividend Yield (%) | 1.17 |

| Stock Exchange | BSE |

Investment Rationale

• Rallis India Limited is engaged in the business of manufacture and marketing of Agri Inputs. The Company has its manufacturing facilities in India and sells both in Indiaandacrosstheglobe.

• Strong brand and steady engagement with farmers facilitated regular launch of new products. The company undertakes farmer relationship programmes such as Rallis Kisan Kutumba, through which it provides them information on new and improved practices in agriculture.

• The management has announced growth capex of Rs 800 crore in the next 5-6 years and is keen to expand the export segment rapidly. The company is also working on backward integration of key intermediates and raw materials which would help stabilise the input cost in future.

• During the quarter ended December 2020, the company’s domestic business grew by 35 per cent and international sales by 24 per cent over the previous year quarter. It introduced two new formulations Sarthak and Impeder.

• In addition, Rallis is undertaking backward integration for Metribuzin, reducing its dependence on imported raw material from China which will improve EBDITA/kg in the long run.

• Rallis India has resumed operations at its plants from April 27 after completing critical maintenance jobs. These plants are located in Lote (Maharashtra), Ankleshwar and Dahej in Gujarat. According to the company, the production levels will be gradually increased. The company’s operations come under the approved list of essential activities as per Ministry of Home Affairs.

• Rallis India reported impressive growth for the December quarter, driven by both domestic and international business. Revenue came out strongly at Rs. 533.6 crore against Rs. 417 crore in the same period last year, rising 28% YoY aided by extended kharif season and its spillover effect on better than last year rabi season.

Risk

• Changes inguidelinesorpolicies invariousgeographies

• Dependent on monsoons

Valuation

The company will continues to get support by steady demand prospects for its products in the domestic market, and improving focus on exports. Large scale capex over the medium term is expected to result in better market share and mitigate impact on profitability caused by increasing raw material prices. Thus, it is expected that the stock will see a price target of Rs.251 in 8 to 10 months time frame on a one year average P/E of 21.59x and FY21 (E) earnings of Rs.11.64.

Source: Company Website Reuters Capitaline

Above calls are recommended with a time horizon of 8 to 10 months.

6

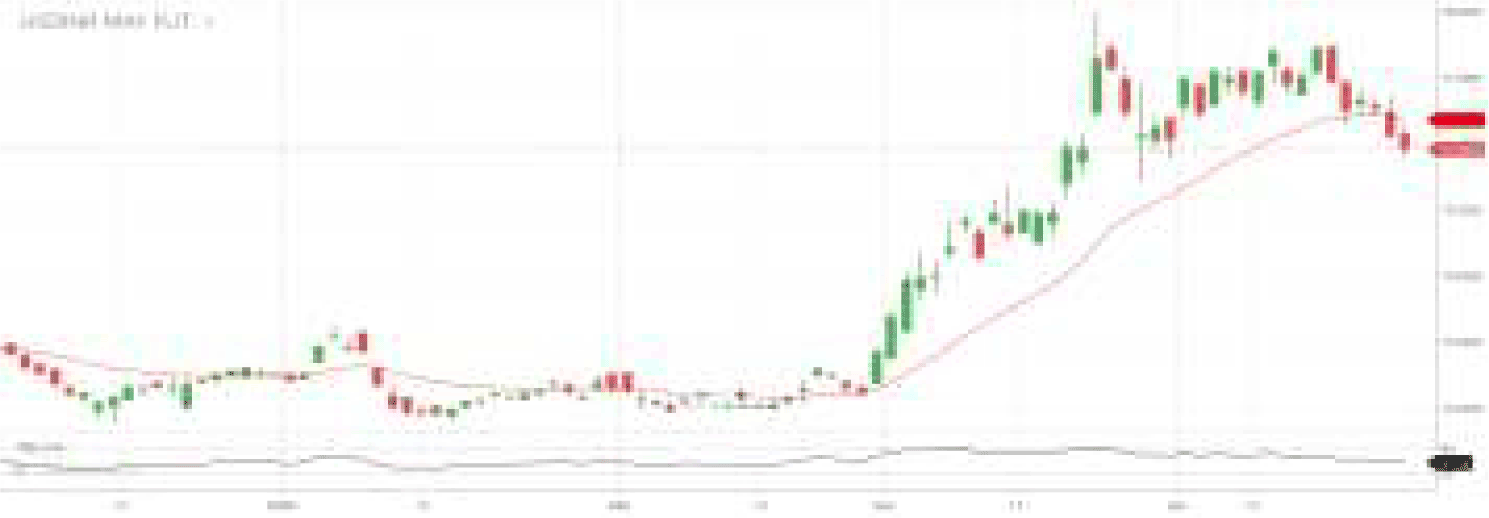

The stock closed at Rs 563.50 on 30th April 2020. It made a 52-week low at Rs 458.05 on 31st March 2020 and a 52-week high of Rs. 806.85 on 28th June, 2019. The 200 days Exponential Moving Average (DEMA) of the stock on the daily chart is currently at Rs 623.80

After registering yearly low, stock has recovered sharply and consolidated in range of 480 to 560 levels with positive bias and formed a “Triangle” pattern on daily charts, which is bullish in nature. Last week, stock ended over 7% gains and has closed on verge of breakout of pattern along with high volumes so further upside is expected from the stock. Therefore, one can buy in the range of 553- 557 levels for the upside target of 610-620 levels with SL below 520.

The stock closed at Rs 95.55 on 30th April 2020. It made a 52-week low of Rs 78.75 on 26th March 2020 and a 52-week high of Rs. 169.55 on 05th July, 2019. The 200 days Exponential Moving Average (DEMA) of the stock on the daily chart is currently at Rs 123.85

As we can see on chart that stock witnessed massive selling from 155 levels and made yearly low of 79 in single down swing. Then after, stock traded in consolidation and formed a “Bearish Pennant” pattern on weekly charts. Moreover, stock has negated the pattern and likely to give the breakout of downward sloping resistance line along with volumes so buying momentum can continue for coming days. Therefore, one can buy in the range of 93-94 levels for the upside target of 112-115 levels with SL below 85.

Disclaimer : The analyst and its affiliates companies make no representation or warranty in relation to the accuracy, completeness or reliability of the information contained in its research. The analysis contained in the analyst research is based on numerous assumptions. Different assumptions could result in materially different results.

The analyst not any of its affiliated companies not any of their, members, directors, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of the analysis research.

SOURCE: CAPITAL LINE

Charts by Spider Software India Ltd

Above calls are recommended with a time horizon of 1-2 months

7

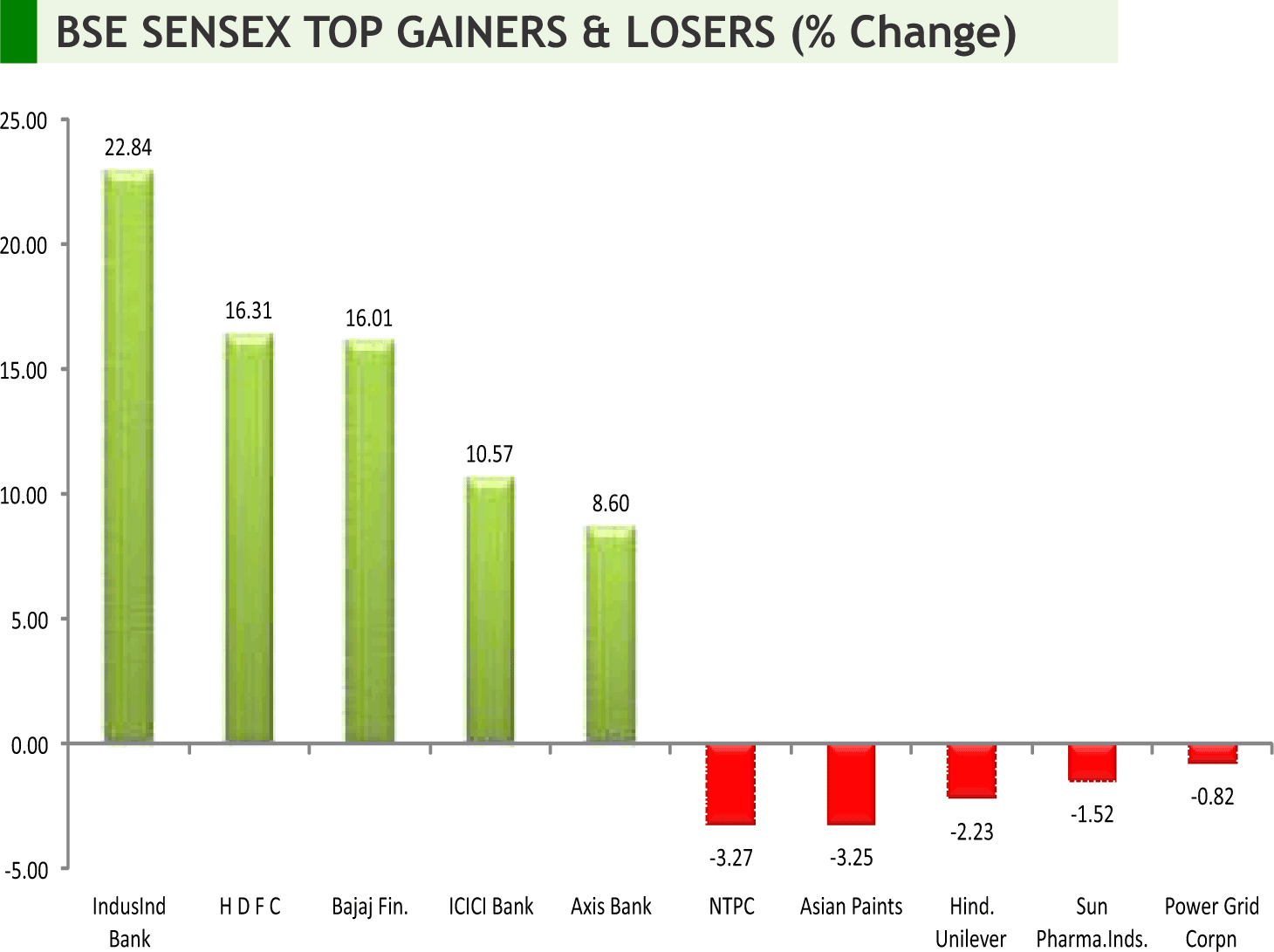

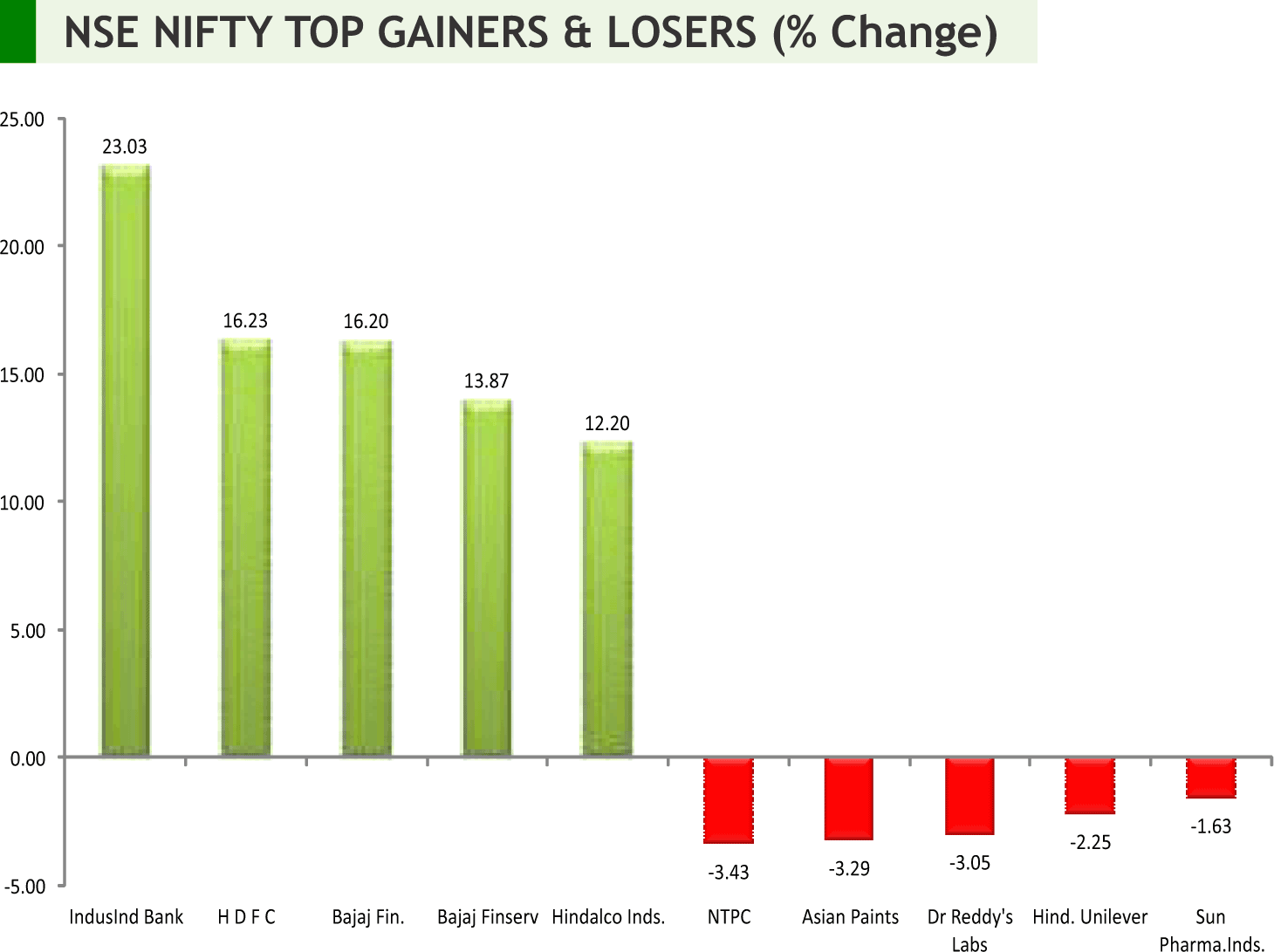

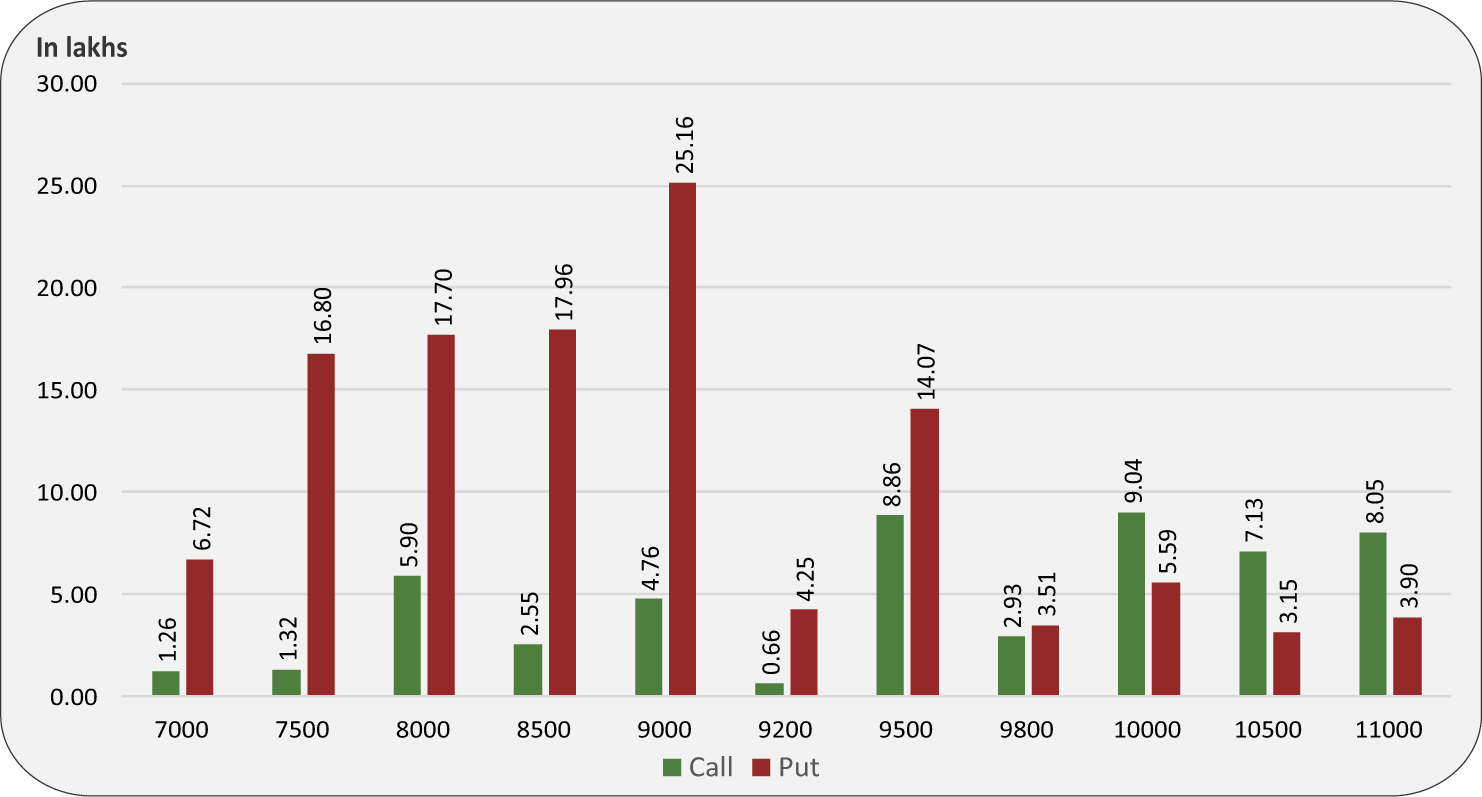

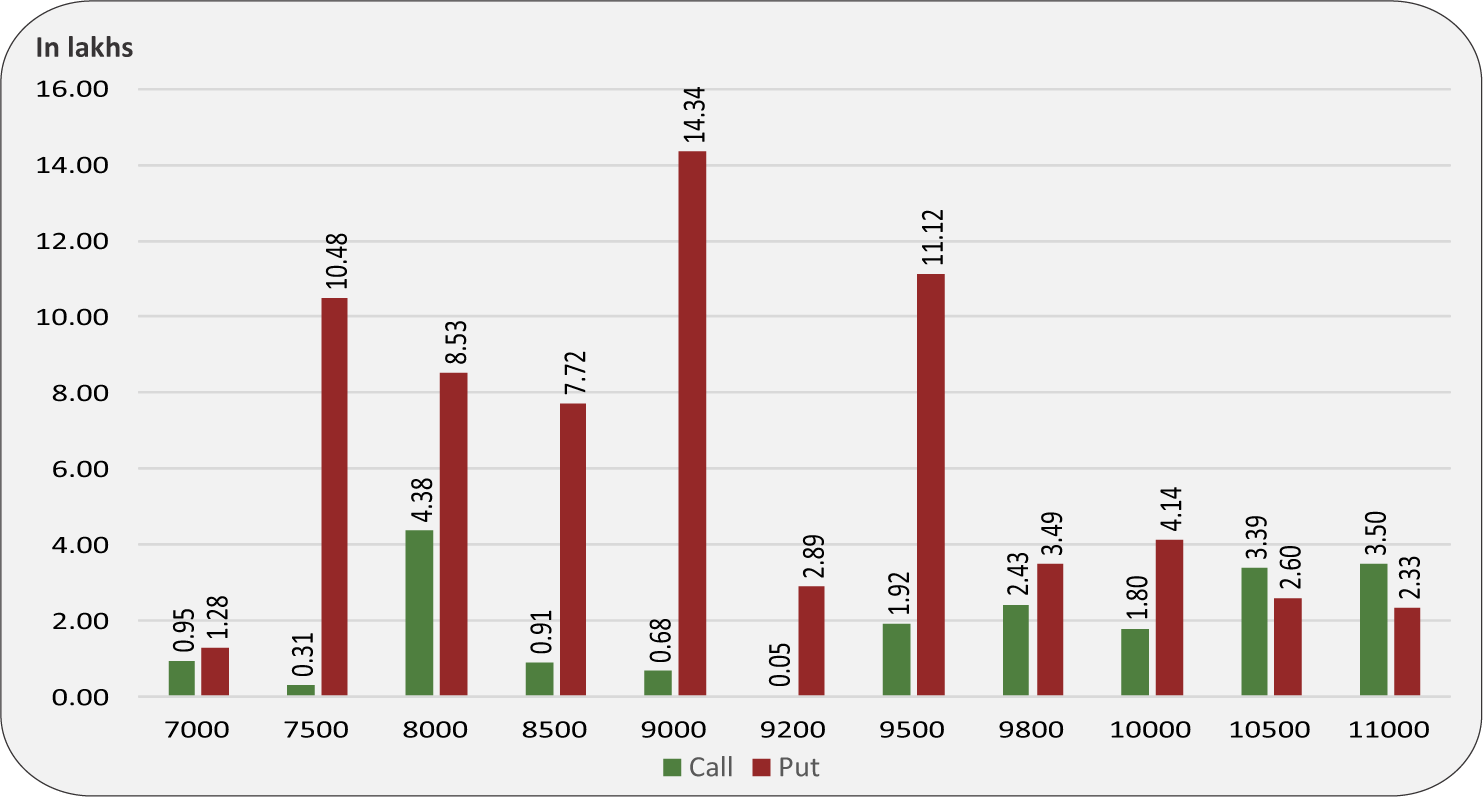

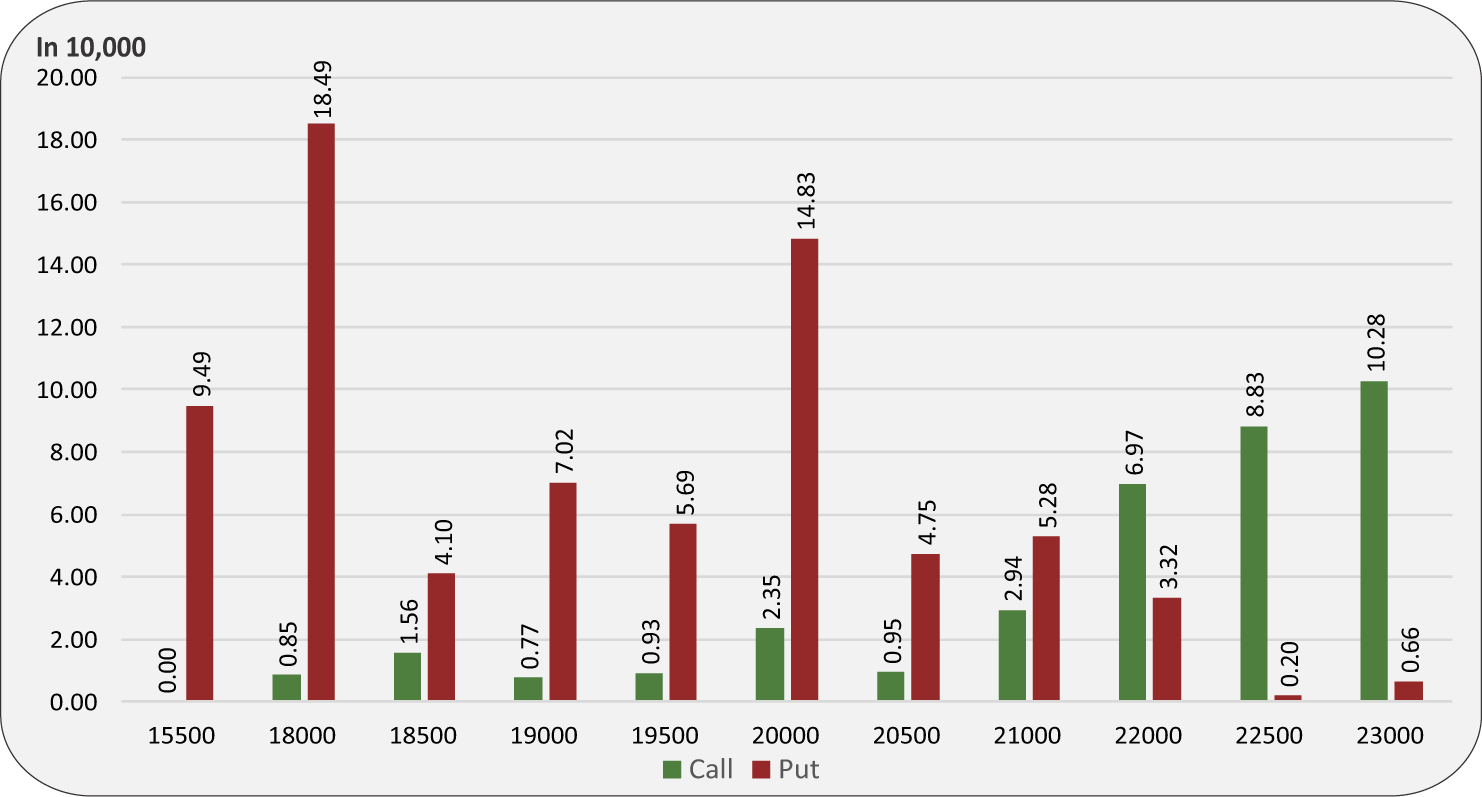

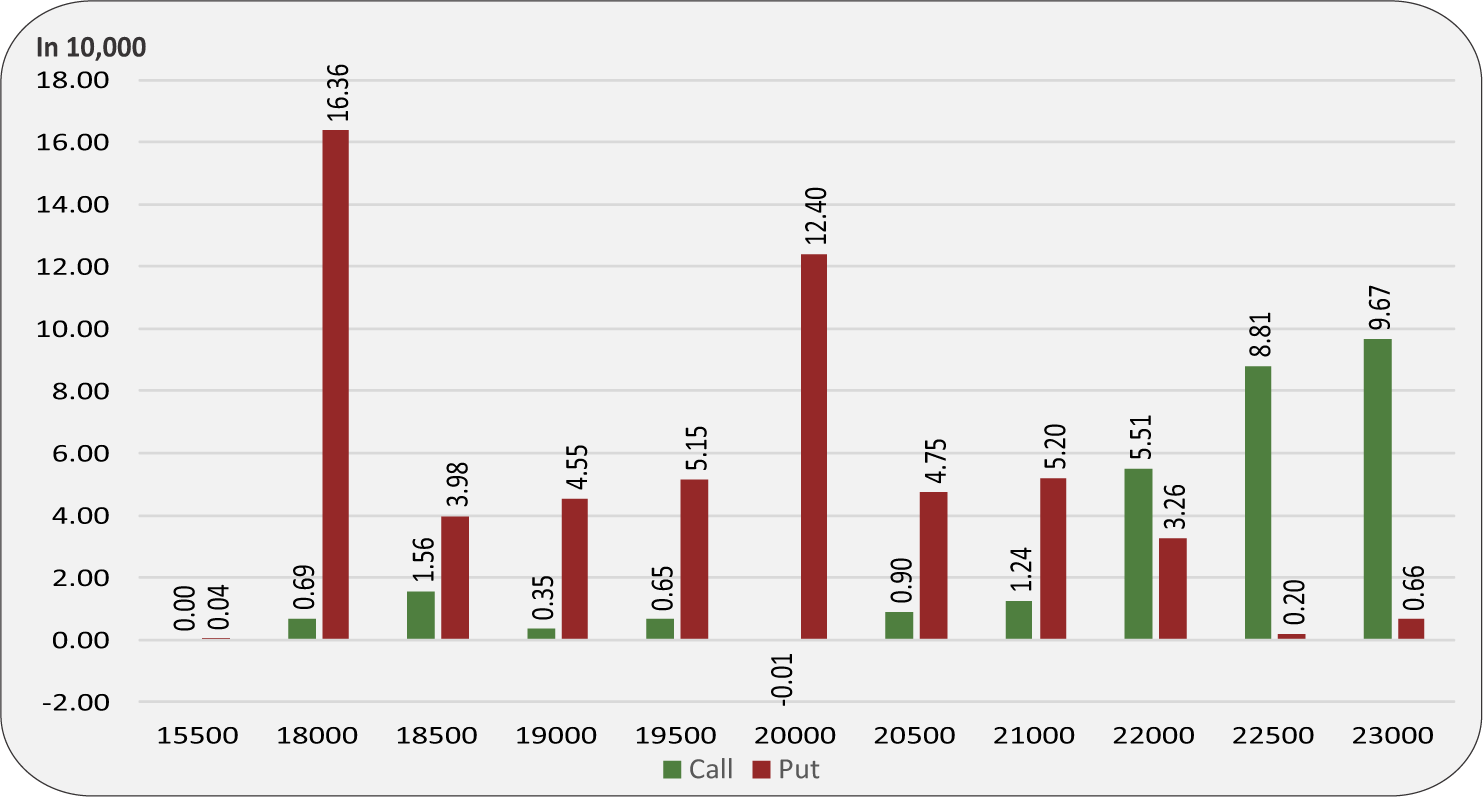

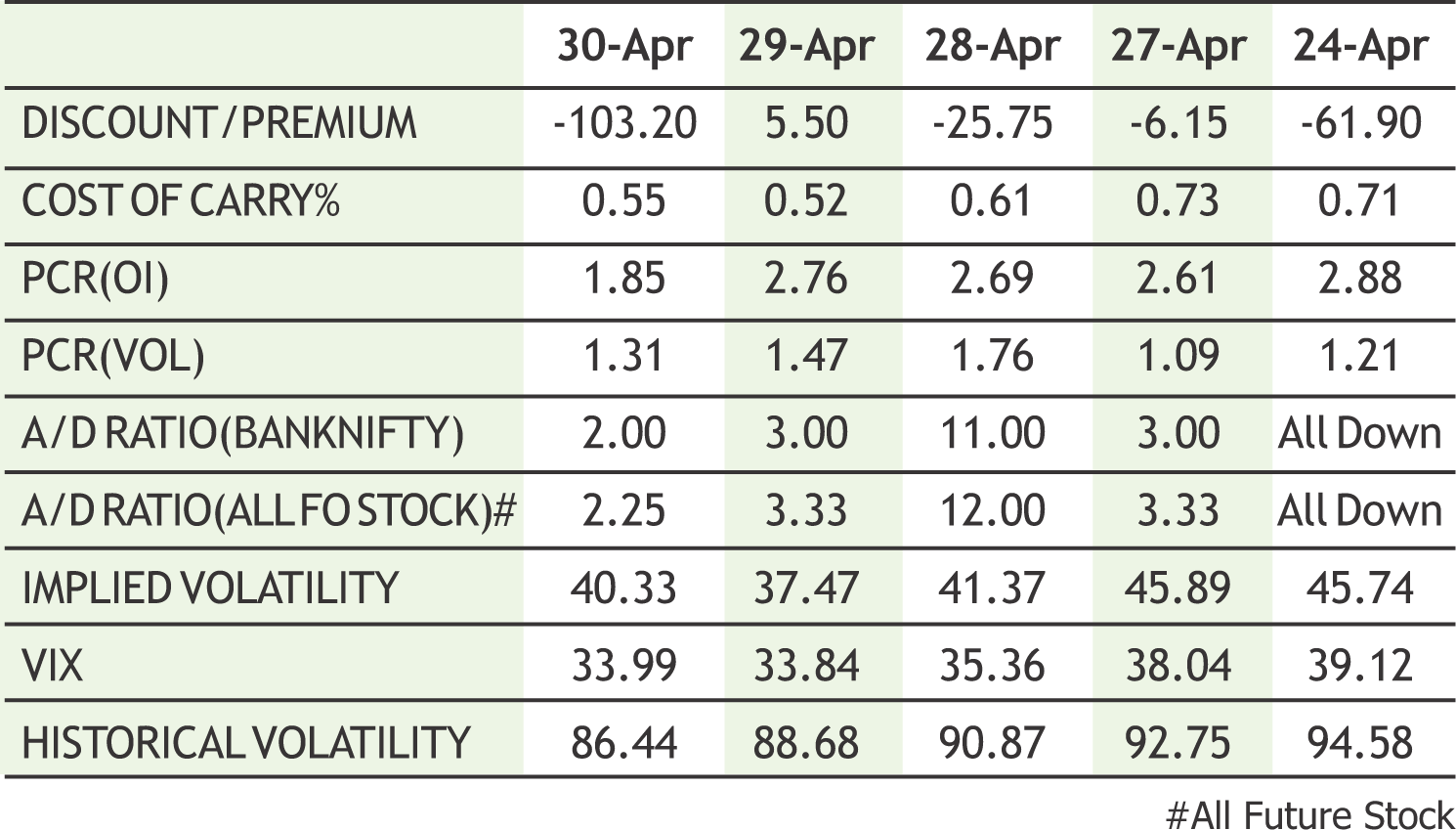

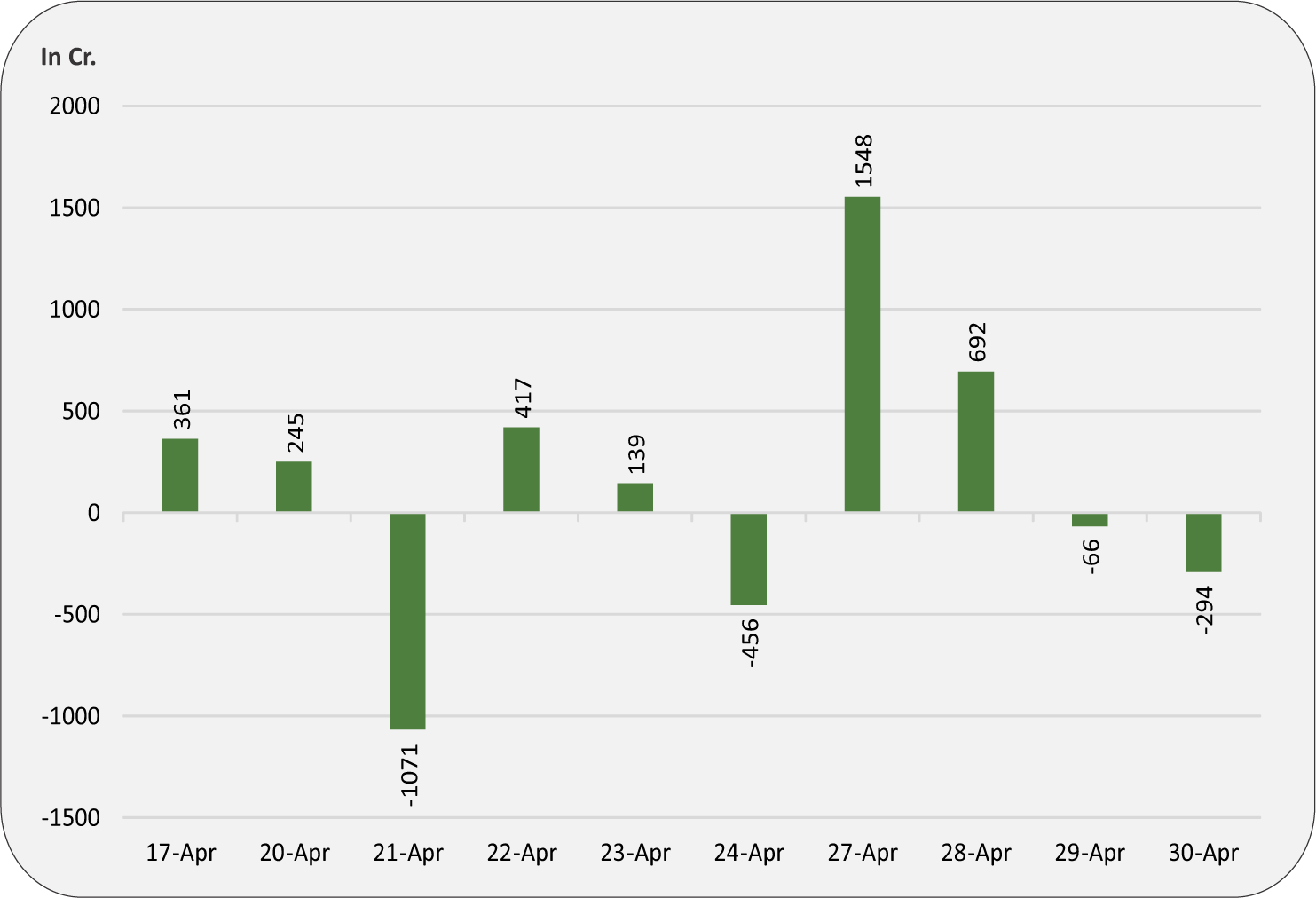

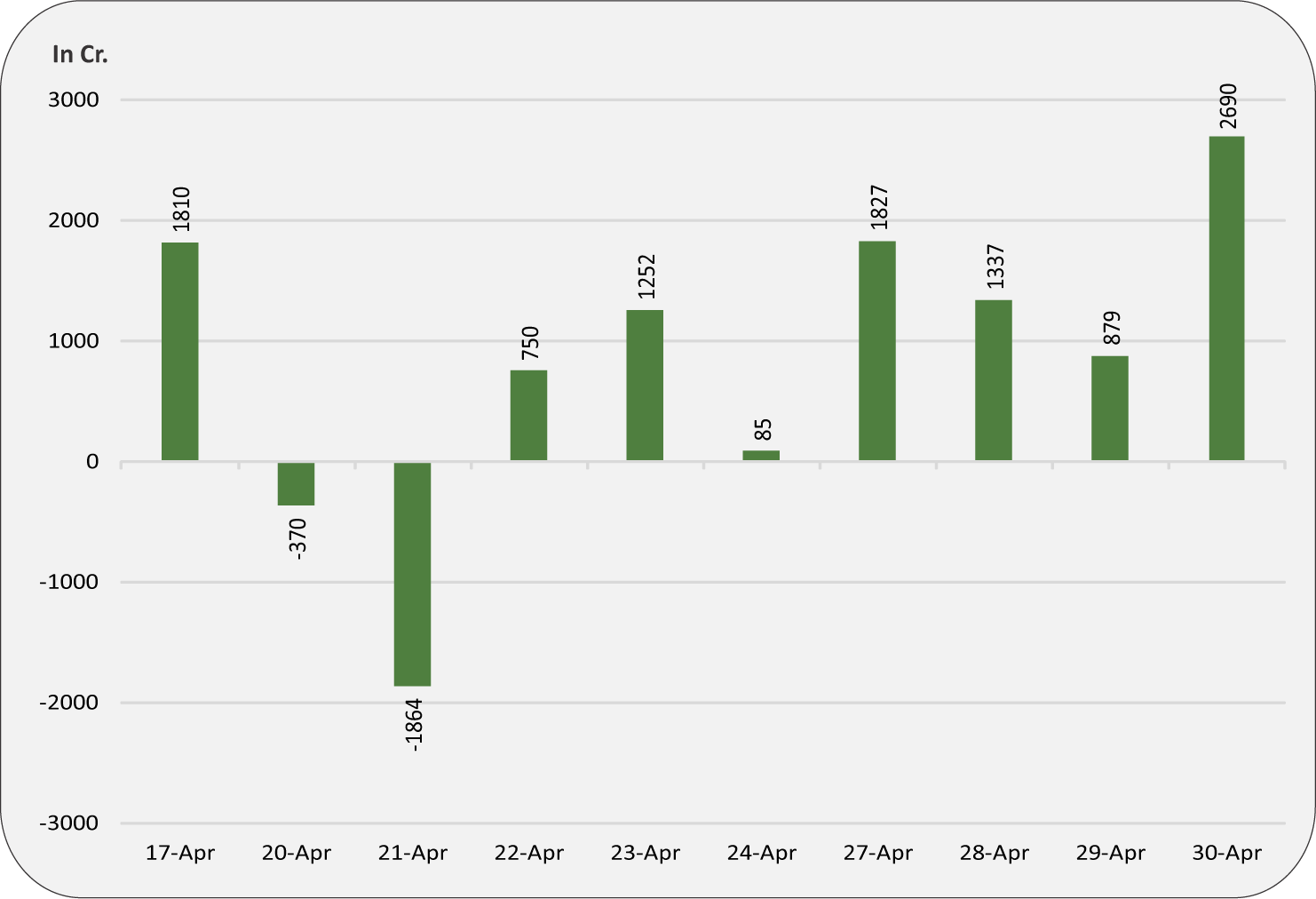

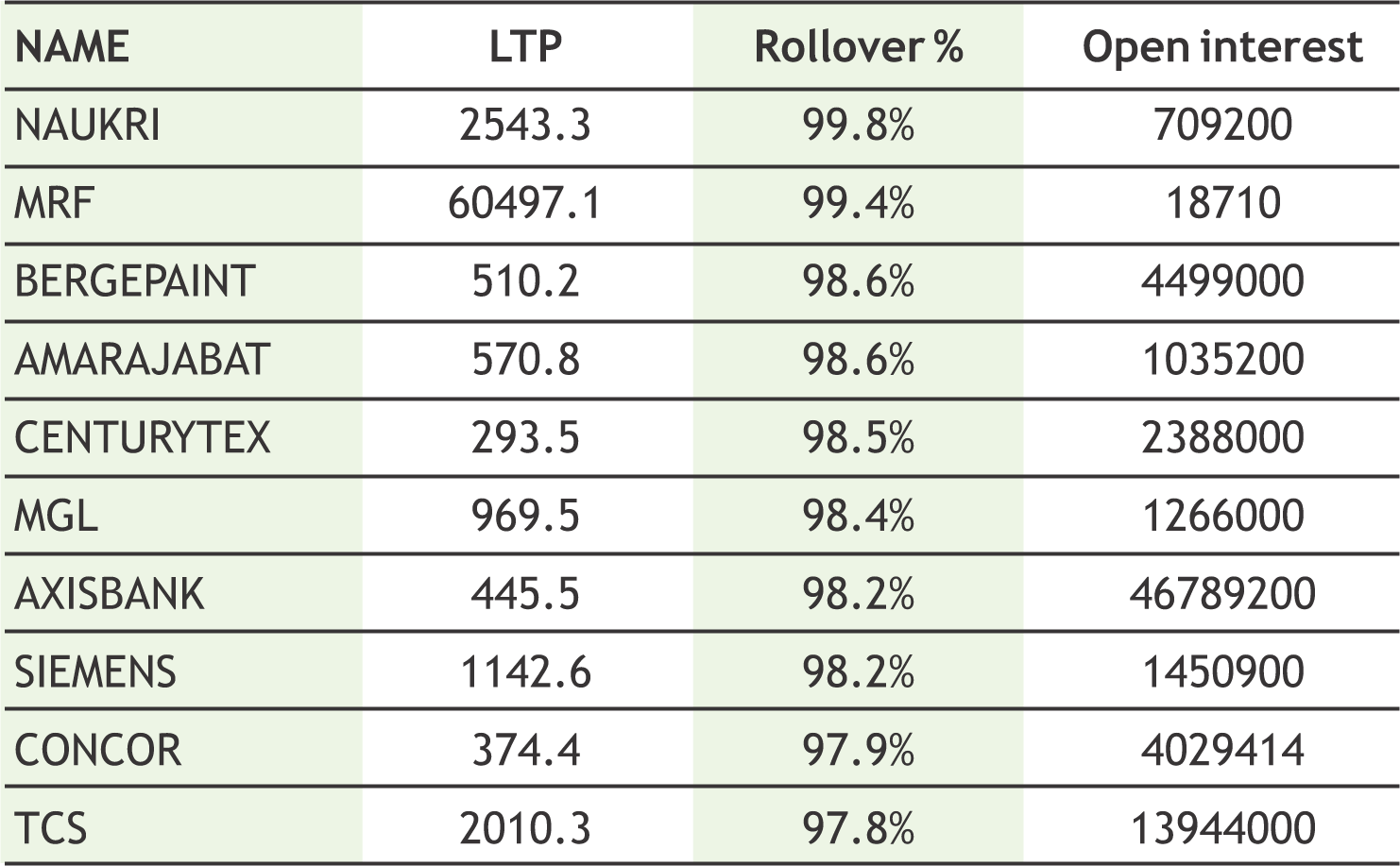

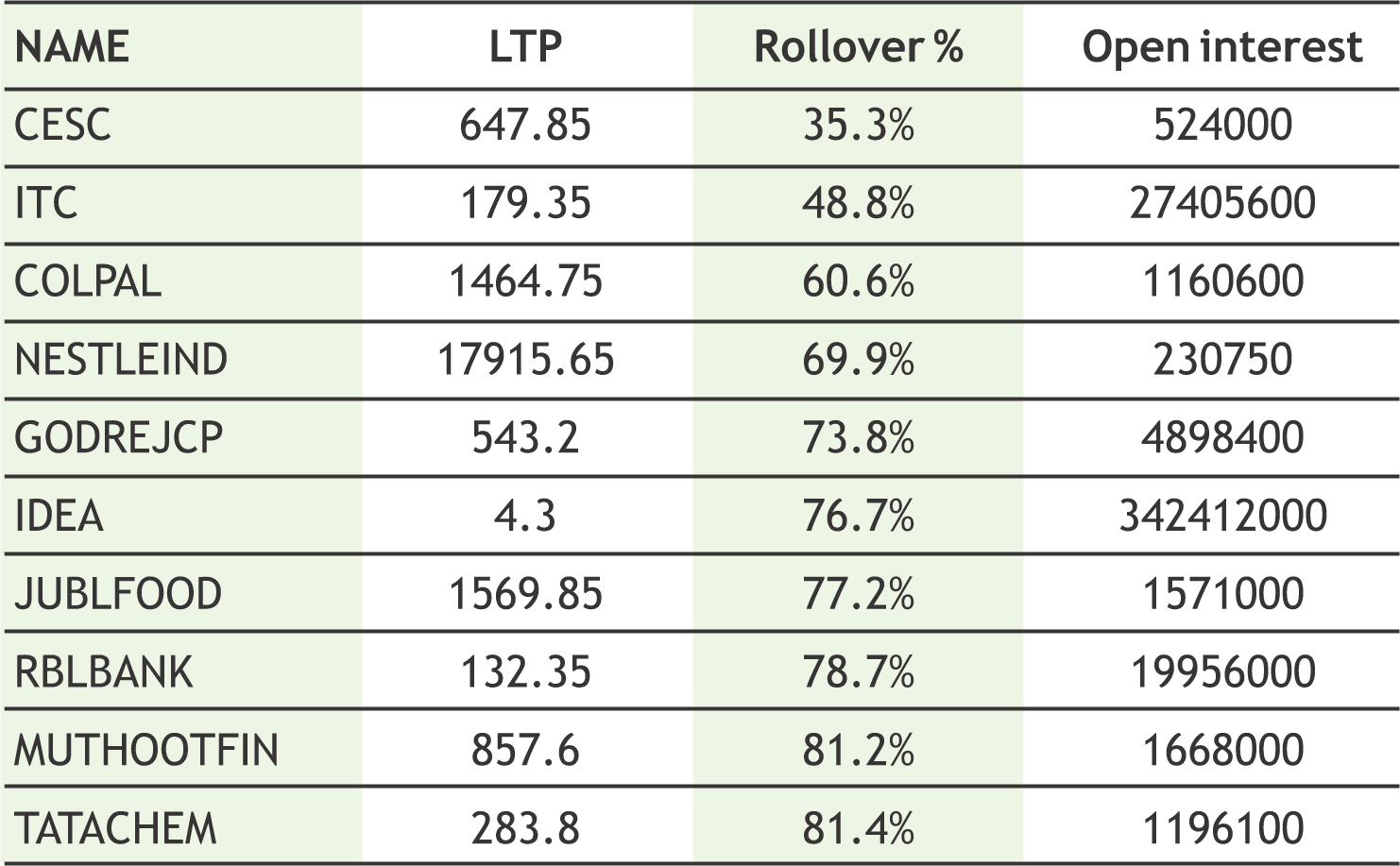

Once again bulls made a comeback in Indian markets and Nifty and Bank nifty both the indices soared high in the week gone by majorly taking cues from firm global markets as positive results for experimental Remdesivir drug towards Covid-19 treatment lifted the sentiment. Banking index, however, outperformed the other sectors as hefty short covering was seen from lower levels with HDFC and HDFC Bank remained among top performers in the financial sector. From the derivative front, the call writers at 9500 strike trigger sharp short covering which leads the nifty to move towards 9900 levels. The Implied Volatility (IV) of calls closed at 29.68% while put options closed at 31.43%. The Nifty VIX for the week closed at 33.99% and is expected to remain volatile. PCR OI for the week closed at 2.09 up as compared to last week at 1.59 which indicates put writing. For coming week, however now 9500-9400 zone would act as a key support for the markets while 10000 would act as psychological level for nifty on higher side. From the technical front, the secondary oscillators suggest further upside into the prices in coming sessions and traders should use any dip as an buying opportunity.

8

|

|

|

|

**The highest call open interest acts as resistance and highest put open interest acts as support.

# Price rise with rise in open interest suggests long buildup | Price fall with rise in open interest suggests short buildup

# Price fall with fall in open interest suggests long unwinding | Price rise with fall in open interest suggests short covering

9

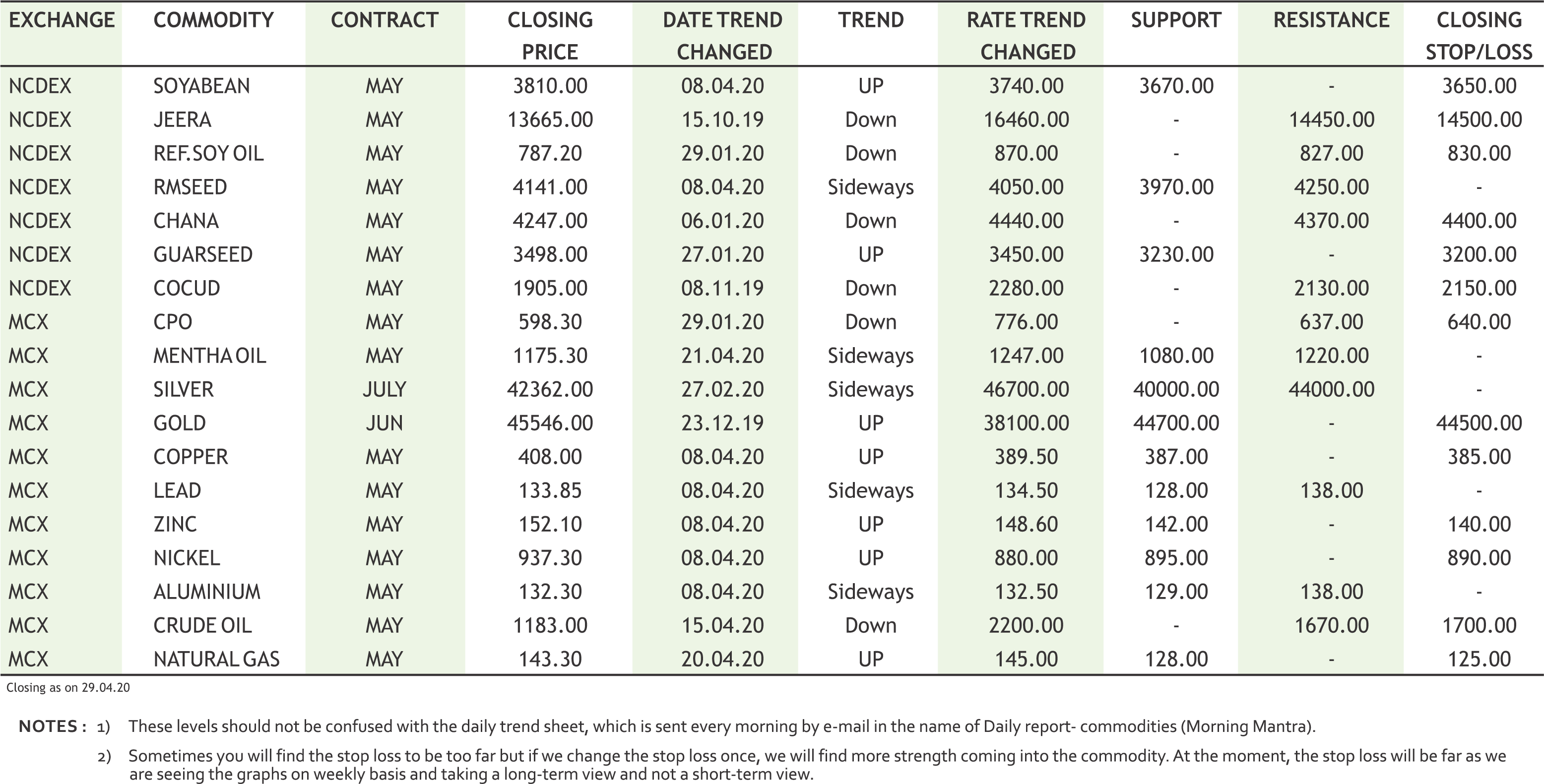

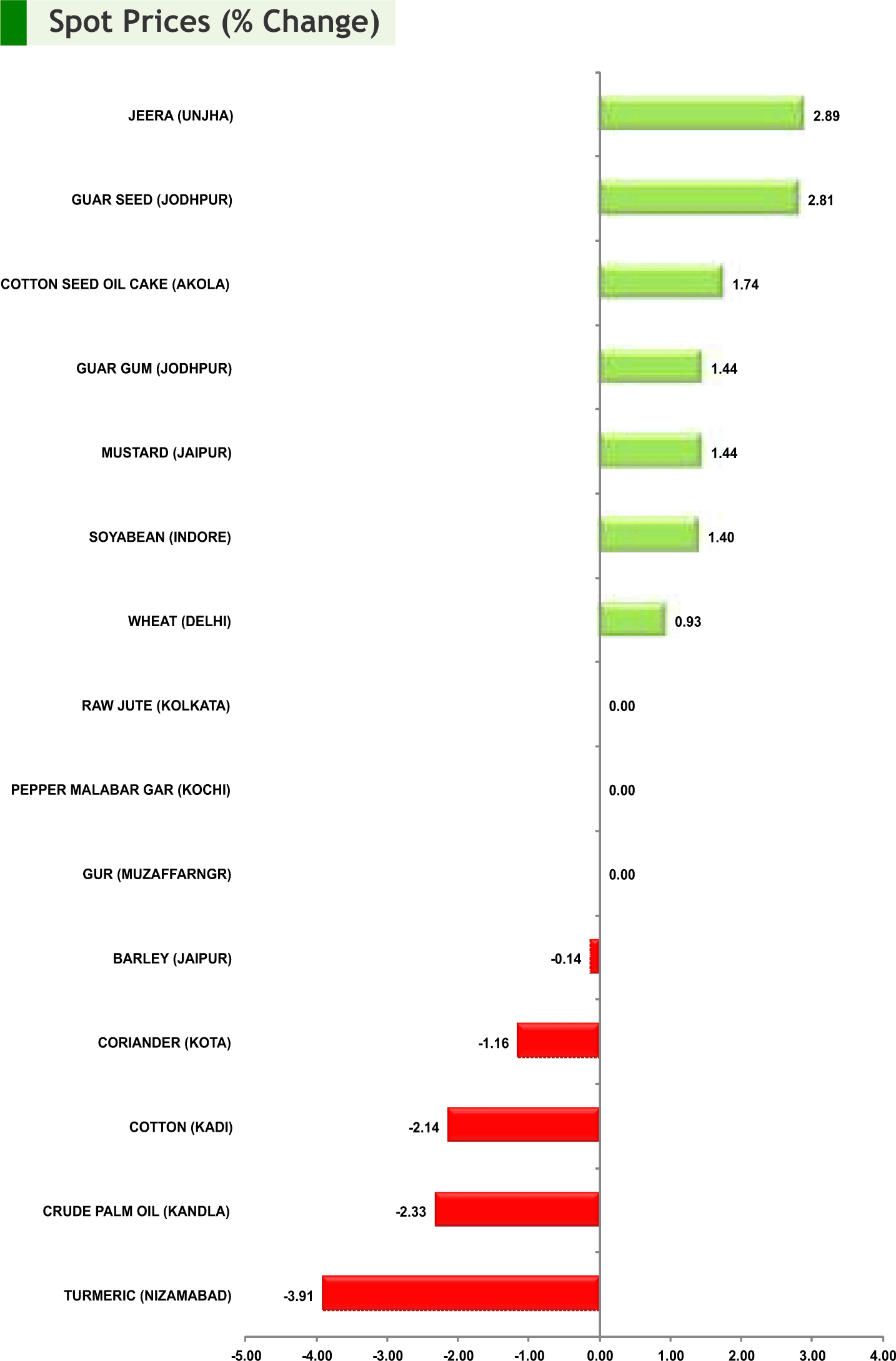

Turmeric futures (May) is unlikely to recover as it is facing resistance near 5550-5600 levels taking negative cues from the spot markets. The sales of the yellow spice is falling in Erode as the traders are mainly buying turmeric in Erode and not placing any bulk order as the exports have slowed down. It is also being observed that many buyers are expecting the arrival of more quantity only in the first week of May and also waiting for best quality arrival. Saying this, it is expected that if the counter breaks the previous support near 5500, then it may plunge towards 5200-5100 levels. The Covid-19 pandemic seems to have a taken a toll on cardamom, the reason being it is making fresh yearly lows on the national bourse. This year the exports also did not commence during the peak season of demand particularly from Gulf countries at the time of holy Ramadan month, which begins on April 21 and runs up to May 20. Most of the stocks are lying with farmers and traders. Only if the stocks are cleared, planters can invest in new crop, for which the first picking season begins by the end of May or early June. Analyzing the bearish fundamental factors, the price outlook of cardamom futures is bleak and in days to come it may go down further to test 1650-1600 levels. Jeera futures (May) is on the verge of revisiting its previous quarterly low of 12750 in the wake of slump in demand. On the spot, the physical trading is not happening since auctions are still suspended as farmers are not allowed to bring their produce to the market.

Bullion counter may continue to remain on firm path as concerns over global economic growth and a wave of stimulus measures from central banks and governments continue to support the bullish sentiments. The U.S. economy contracted in the first quarter at its sharpest pace since the Great Recession as stringent measures to slow the spread of the virus almost shut down the country, while economists expect an even sharper contraction in GDP in the second quarter. In its first-quarter Global Demand Trends report, the WGC said that total gold demand increased to 1,083.8 tons between January and March, up 1% compared to gold demand in the first quarter of 2019. Gold-backed ETFs saw inflows of more than 298 tons in the first three months of the year, which pushed global holdings in these products to a record high of 3,185 tons. Gold can move towards 46800 levels while taking support near 45000 levels while silver may move higher towards 43500 levels while taking support near 40500 levels. Retail demand for physical gold suffered in top Asian hubs as jewellery shops remained shut due to coronavirus restrictions, but some regions saw steady buying from investors hunting for a safe haven. China’s net gold imports via Hong Kong in March as the country began gradually easing coronavirus restrictions, but imports were still down 63% from last year as the pandemic choked demand, data showed. The Fed kept interest rates near zero and repeated a vow to use its “full range of tools” to shore up the economy that could feel the weight of consumer fear and social distancing for a year or more.

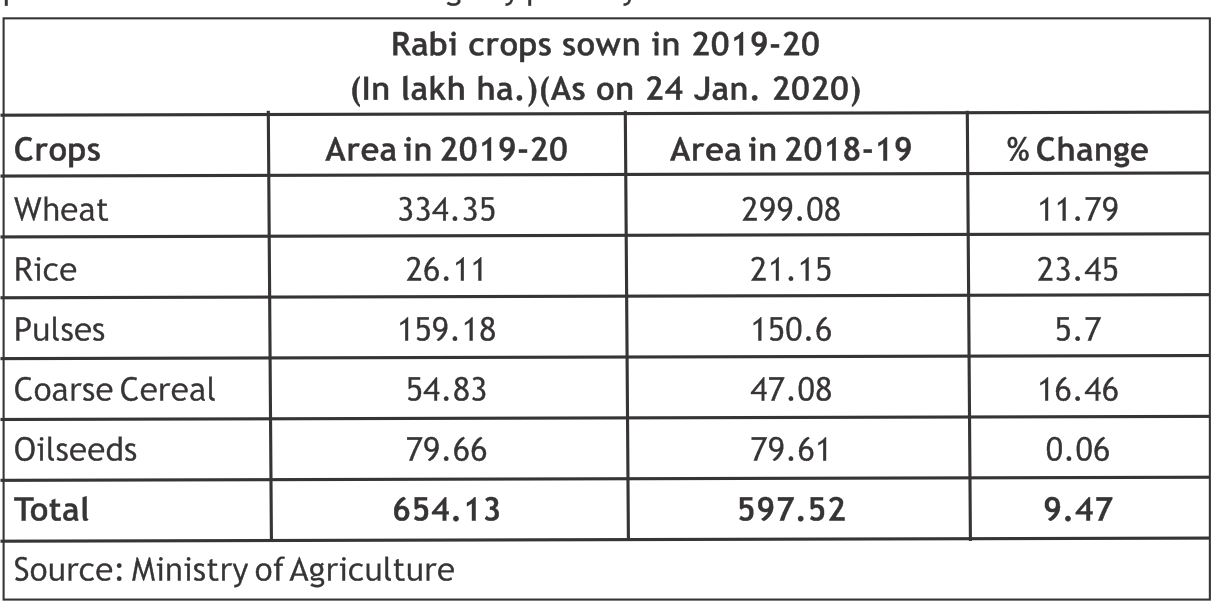

The upside momentum shall continue to remain intact in soybean futures (May) and it may rally forward to test 3900-3950 taking support near 3780- 3720 levels. This phenomenon will be possibly due to a rise in demand from crushing plants amid subdued arrivals due to the lockdown. In the international market, U.S soybean may take support near $8.20 a bushel on hopes that demand may rise as there are plans being chalked out by countries to ease lockdown measures. But on the contrary, the market participants are also keeping a close watch on the export sales data, the past record of which is showing low US soybean sales to China keeping the upside capped. Mustard futures (May) is expected to rally further towards 4200-4250 levels supported by rising demand from the millers. This is the peak crushing season in Rajasthan and it is reported that many plants in Alwar are operating at full capacity. These mustard oil manufacturing plants are mostly located in green zones have they have got clearance from the state authorities before starting operations. Also maintaining standard operating procedure laid out by the government at factories. Despite strength in oilseeds complex owing to recovery in oil, the gains of edible oils may remain capped as the rupee may move higher against dollar, making imports cheaper. Moreover, the demand side is facing challenges due to the lockdown. Malaysian palm oil is also is entering the phase of seasonal higher months of production. Recently, many of jetties were also opened after the movement control order was lifted. Back at home, soy oil futures (May) is expected to trade sideways to down in the range of 775-800, while CPO futures (May) may slide further towards 585-575 levels.

Crude oil may witness lower levels buying on hope of coordinated production cuts by OPEC and OPEC+ from this week. But there are concerns that production cuts will not be fast enough to catch up with the collapse in demand from the coronavirus pandemic. Kuwait and Azerbaijan are coordinating cuts, while Russia is set to reduce its western seaborne exports by half in May. The Organization of the Petroleum Exporting Countries and its allies including Russia, a group known as OPEC+, pledged earlier this month to cut output by an unprecedented 9.7 million barrels per day in May and June. Crude oil (May) can recover 1800 by taking support near 1000. Rig counts in the United States are down to the lowest since July 2016, while the total number of oil and gas rigs in Canada has fallen to the lowest since at least 2000, according to Baker Hughes data. Strategists stated that part of the WTI decline is due to retail investment vehicles like exchange-traded funds selling out of the front-month June contract and buying into months later in the year to avert massive losses recently, when WTI plummeted below zero. Natural gas can witness some recovery as it may test 165 while taking support near 130. The weather is expected to remain colder than normal on the east coast of the US for the next two weeks while becoming warmer than normal throughout most of the west coast. The COVID-19 pandemic has caused significant changes in energy fuel supply and demand patterns.

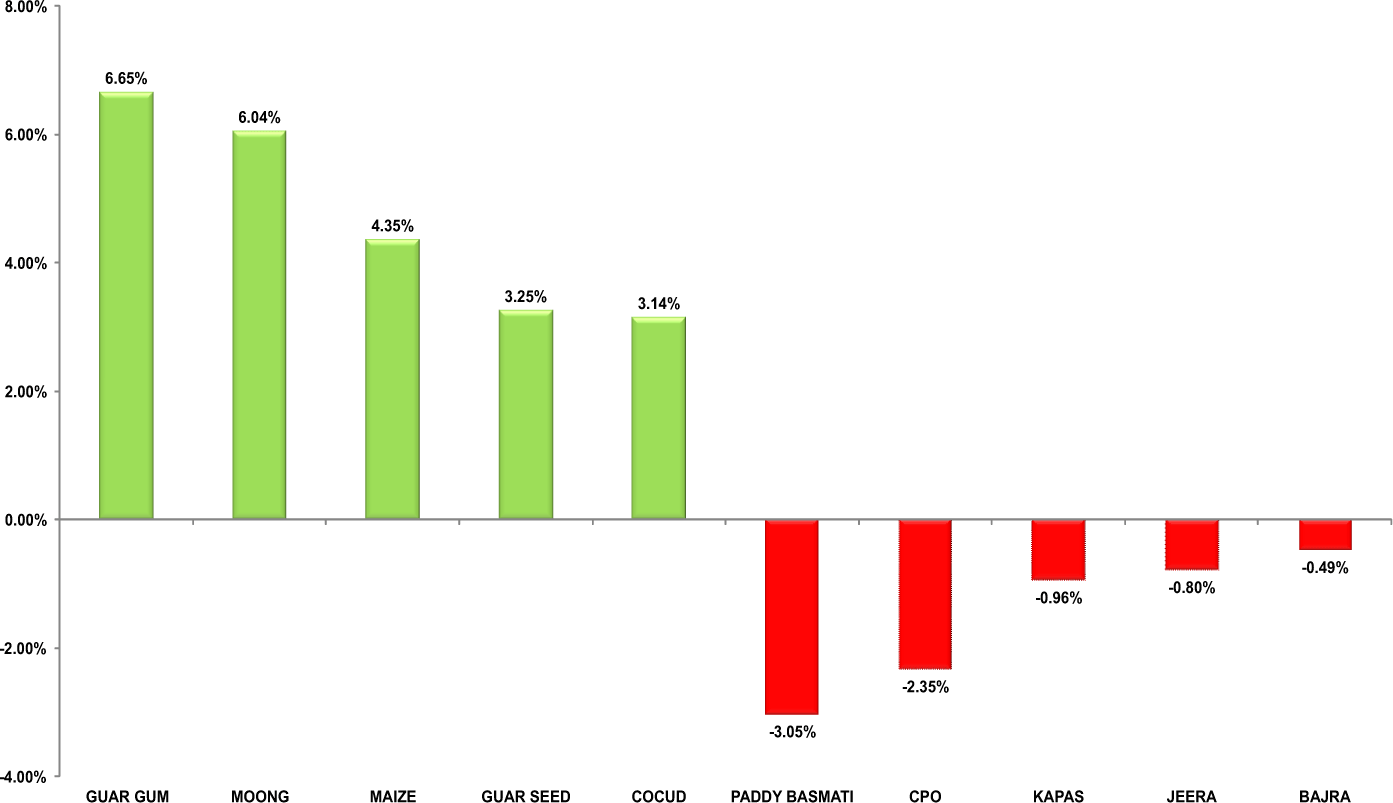

Cotton futures (May) facing resistance near 16500-16700 levels is likely to witness sell on rise and descend towards 15500-15000 levels. It is estimated that cotton consumption may fall by about 25-30 lakh bales in the current year. Since the outbreak of the pandemic, the demand for cotton has reduced with the closure of textiles mills due to the lockdown. Usually, traders procure cotton from farmers and send it to spinning mills but, currently the produce is either stocked at home by farmers or at godowns by traders, as the clothing supply chain that have been disillusioned into crisis by the Covid-19 across the globe. The supply is much heavier because the farmers have no option, but to sell the produce for any rate that the traders offer, as they need money to meet their everyday expenses. The price outlook of chana futures (May) seems to be bullish and hence buying on dips would be suggested near 4130, eyeing a target of 4250-4300 levels in days to come. The demand is on rise and with the major mandis in Madhya Pradesh remaining closed, millers of Indore are procuring pulse seeds either directly from the farmers or from dedicated godowns in the State. Last week, it was correctly suggested that guar gum futures (May) would show a bullish momentum owing to recovery in international oil prices. Fundamentally, the data suggests the U.S. may not run out of space to store its glut of crude as quickly as previously feared. Moreover the demand is also expected to catch pace on the hopes that economies will re-open sooner-than-expected. Going ahead, we maintain the same view as the counter has a potential to test 5500-5700 taking support near 4800 levels.

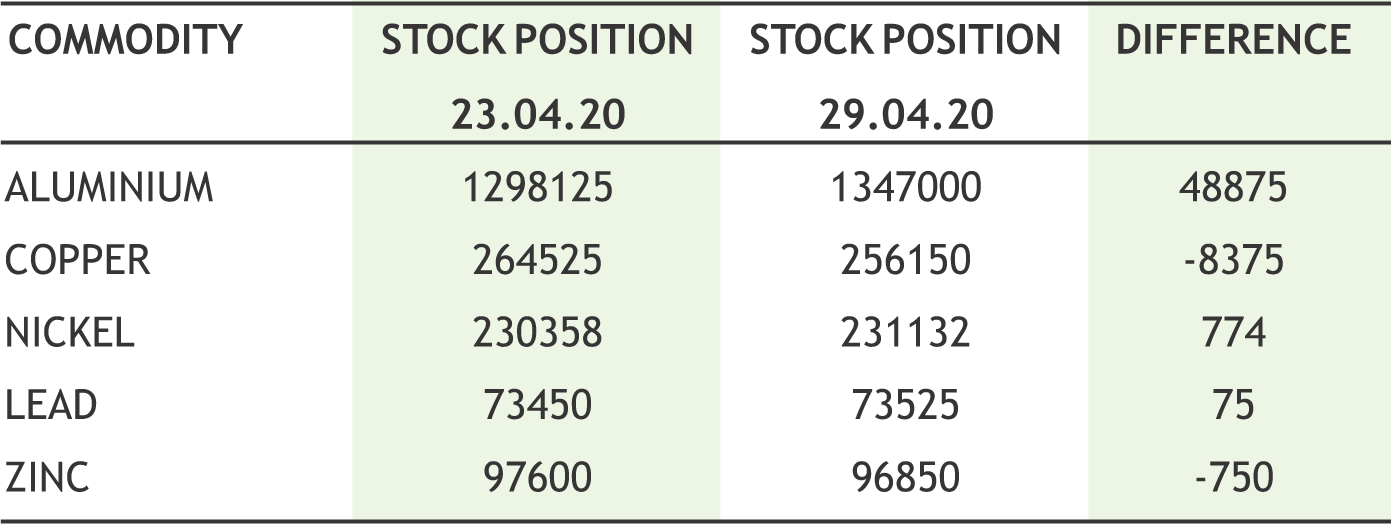

Base metals may witness steady upside movement on supply concerns. Copper may test 420 levels while taking support near 380 levels. Total imports of copper concentrate into China in March edged up 1.03% to 1.78 million tonnes year-on-year, as the country boosted imports from alternative sources amid a slump in shipments from top suppliers Peru and Chile. Australia-based MMG saw copper production decline 20% in the first three months of the year, compared to the same period in 2019, after declaring force majeure at its Las Bambas mine in Peru amid coronavirus-related restrictions. Copper treatment charges in China are in freefall, pointing to a tighter market, and Yangshan import premiums are at a seven-month high of $84 a tonne. Zinc may recover towards 160 levels by taking support near 145 levels. Lead may face resistance near 140 levels while taking support near 130 levels. China’s net imports of refined lead collapsed to just 900 tonnes in the first three months of the year from 48,000 tonnes in the quarter of 2019. Nickel may witness recovery towards 960 levels while taking support near 900 levels. The global nickel market surplus narrowed to 13,400 tonnes in February from a revised surplus of 13,900 tonnes in the previous month. LME on-warrant nickel inventories - those not earmarked for delivery - rose to 176,556 tonnes, the highest since September 2018 and up about 40 per cent so far this year. Aluminum is also expected to remain in narrow range of 130-138 levels. An alumina plant in Ukraine’s Mykolaiv, part of Russian aluminium group Rusal, stated that it may have to temporarily suspend production after Ukrainian customs authorities blocked access to supplies of bauxite.

10

|

ALUMINIUM MCX (MAY)contract closed at Rs. 132.30 on 29th Apr’2020. The contract made its high of Rs. 145.40 on 20th Jan’2020 and a low of Rs.128.30 on 20th Mar’2020. The 18-day Exponential Moving Average of the commodity is currently at Rs. 132.57 On the daily chart, the commodity has Relative Strength Index (14-day) value of 39.77.

One can sell around Rs. 136 for a target of Rs.123 with the stop loss of Rs.140.

RMSEED NCDEX (MAY)contract closed at Rs. 4141 on 29th Apr’2020. The contract made its high of Rs. 4630 on 12th Dec’2019 and a low of Rs. 3775 on 13th Mar’2020. The 18-day Exponential Moving Average of the commodity is currently at Rs. 4076 on the daily chart, the commodity has Relative Strength Index (14-day) value of 60.02.

One can buy around Rs.4100 for a target of Rs. 4270 with the stop loss of Rs. 4020.

GUARGUM NCDEX (MAY) contract was closed at Rs. 5150 on 23rd Apr’2020. The contract made its high of Rs. 6550 on 05th Mar’2020 and a low of Rs. 4664 on 28th Apr’2020. The 18-day Exponential Moving Average of the commodity is currently at Rs. 5197.15 on the daily chart, the commodity has Relative Strength Index (14-day) value of 46.51.

One can buy at Rs. 5100 for a target of Rs.5450 with the stop loss of Rs 4970.

11

Ÿ Ministry of Agriculture & Farmers Welfare had launched “Kisan Rath” App on 17.04.2020 to facilitate Farmers and Traders in identifying right mode of transportation for movement of farm produce.

Ÿ The Procurement Status of Pulses & Oilseeds at MSP from farmers under the Price Support Scheme (PSS) scheme in Rabi 2020-21 season during lockdown period is as below: 72,415.82 MT Gram (Chana), 1,20,023.29 MT Toor Dal and 1,83,400.87 MT Mustard. - Ministry of Agriculture & Farmers Welfare

Ÿ An initial margin of 100% shall be levied for all existing and yet to be launched Crude Oil contracts of MCX. Minimum Initial margin of Rs. 95,000/- per lot shall be levied. An additional margin of Rs.1,00,000/- per lot shall be levied on near month Crude Oil Futures contract and on short side of near month Crude Oil Options contract. Further, an additional margin of Rs.50,000/- per lot shall also be levied on all other Crude Oil Futures contracts and on short side of Crude Oil Options contracts (including yet to be launched Crude Oil contracts).

Ÿ BSE, has inserted a provision for negative pricing in its commodity derivative trading segment. The feature will be enabled in the simulation environment and made available to BSE members to test from Monday.

Ÿ The IEA is forecasting a 6% drop in energy demand for the year. In absolute terms this is the largest on record. Percentage wise, it’s the steepest decline in 70 years.

Ÿ China's manufacturing PMI dropped back to 50.8 in April, from 52.0, presumably due to softer import demand from the rest of the world.

The week gone by was all about the big moves in the crude futures, mostly it traded in lower circuits however in the second half it tried to recover its previous losses and kept itself above the mark of $10 in NYMEX and Rs1100 in MCX. MCX increased the margin multifold for proper risk management. Oil climbed after losing more than a quarter of its value over the two days with volatility is likely to continue on concern; prices may drop below zero again as investors and a major fund exit the June contract. Futures added 14% in New York after dropping Tuesday as S&P Global Inc. told clients to immediately sell their stakes in West Texas Intermediate for June delivery into July crude. Lesser than expected decline in inventories and hope of reopening of many economies gave some strength to the crude prices and it recovered some of its weekly losses.Sharp decline in crude prices kept CRB in lower range. The U.S. Dollar Index fell for a fourth straight day.Yellow metal gold saw a pause in rally on confident upside move in equity which moved up from past few weeks. The yellow metal normally moves inversely to equity market. However the downside was capped the spread is on increase in major economies. Gold will benefit from further widespread stimulus measures as it acts as a hedge against inflation and currency debasement.Silver was on the path of correction. Base metal prices were supported on stimulus hopes in China, where local governments may issue as much as 4 trillion yuan ($565 billion) in special bonds funding infrastructure projects this year, almost the double from 2019.Copper and zinc traded up. Stocks in LME sheds fell for a fifth straight day to 256,150 tons, with metal earmarked for delivery gaining to 23.6% of the total, up almost 10 percentage points since the middle of the month. In China, stainless scrap demand is weak with the market in standstill, it gave negative impact on nickel prices.

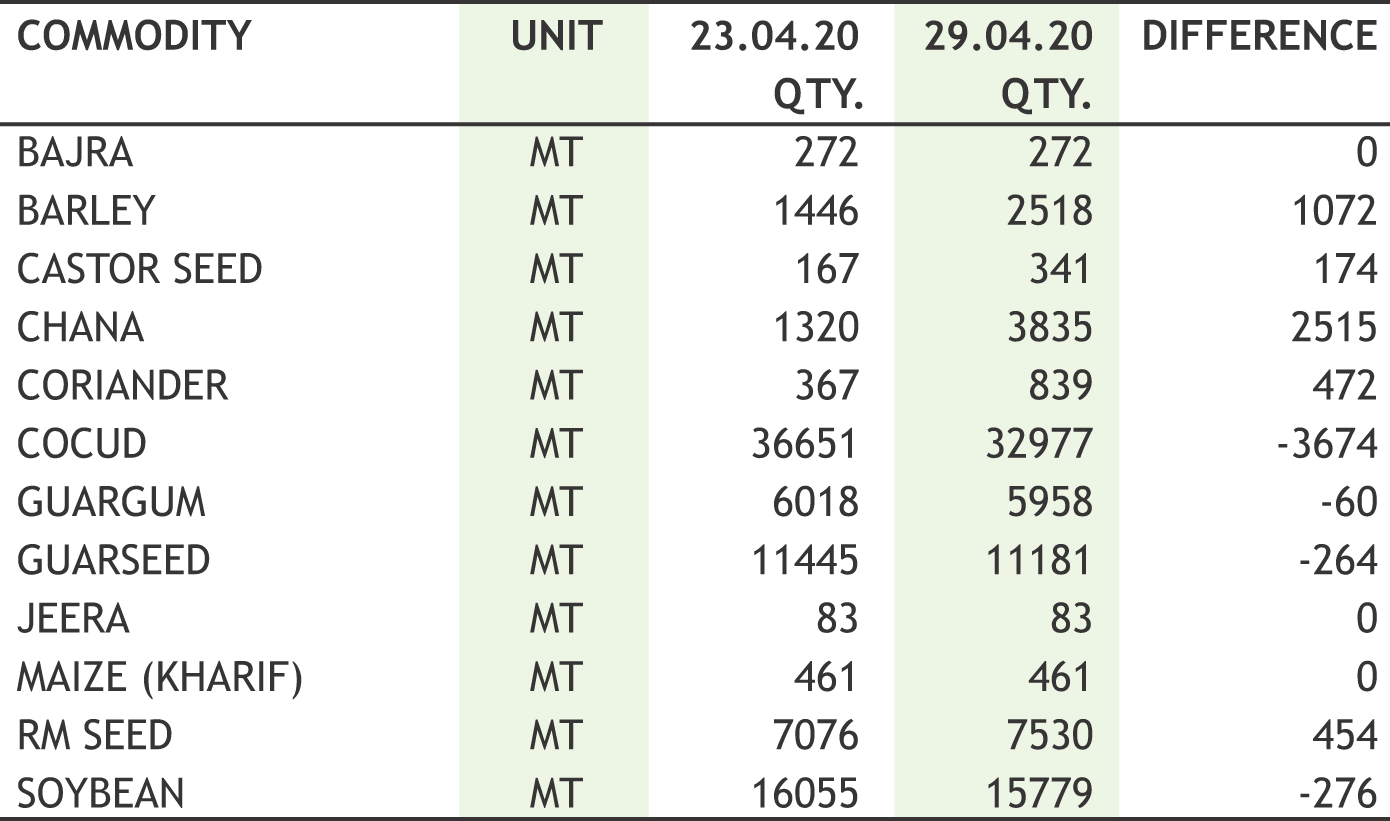

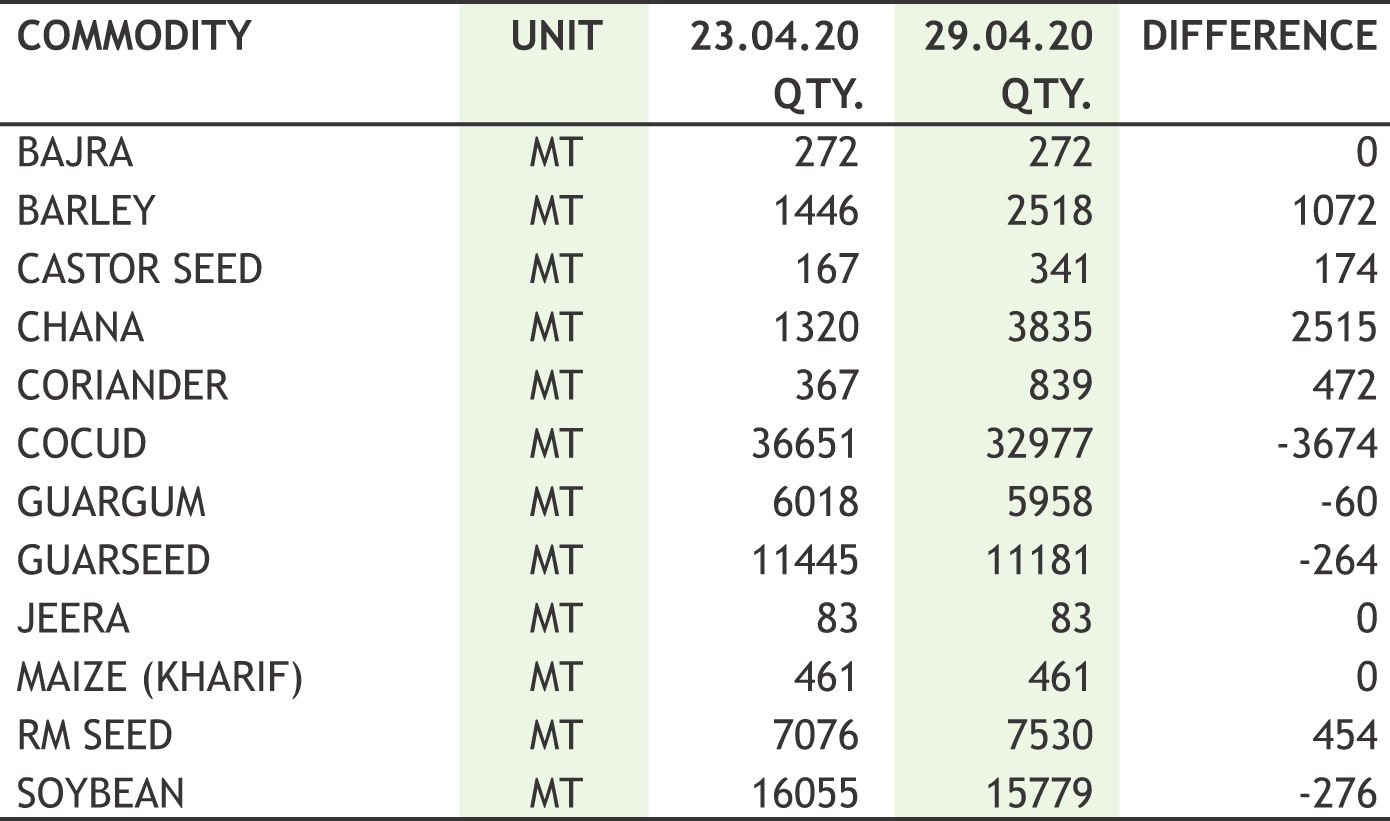

In agri commodities, guar counter revived on some upside in crude prices. In spices coriander and cumin moved down whereas turmeric tried to remain in range. Chana price got boost up on the news of procurement by state government. Edible oil futures are trading in sharp backwardation as new crop is about to arrive. CPO is trading below 2000 ringgit in Malaysia, which triggered selling in CPO in MCX. Refined Soya and soya counter saw some gain, nevertheless appreciation in rupee capped the upside. Cotton futures saw no respite and further moved down.

|

|

12

|

|

• Recently WTI crude-oil futures dropped below zero for the first time ever due to dwindling capacity for storing crude and oil demand tumbling because economies around the world are locked down to slow the spread of the coronavirus.

• Crude is already flooding into storage at land and sea worldwide as storage levels are rising even before a wave of supply hits the market from Saudi Arabia, Russia and other producers who are gearing up to fight a price war for market share.

• The world typically consumes about 100m barrels of oil and finished products a day and produces roughly the same amount. Worldwide lockdown, demand has plummeted by as much as 30m b/d, creating a huge supply glut. If supply continues to outstrip demand, more oil will head for storage.

• Therefore oil traders are also struggling to find enough ships, railcars, caverns and pipelines to store fuel as more conventional storage facilities fill up.

• On the Baltic Exchange, which measures the cost of moving commodities, very large crude carriers (VLCC) earnings for U.S. Gulf to China cargoes were quoted on April 21 at $111,570 a day, up $5,000 from April 17’ s level. Cargoes from the Middle East to China were up $4,000 from April 17’s level to $174,570.

• Global crude oil storage capacity is believed to be up to 6.7 billion barrels, including commercial and strategic storage. However, for technical reasons only about 80 percent of this nameplate capacity is actually usable.

• The IEA now estimates the United States held 635 million barrels of crude in its SPR as of April 10, along with 504 million barrels in commercial and other stocks.The Energy Information Administration pegged total U.S. working storage capacity is at 653.4 million barrels. Net stocks held at refineries and tank farms were at about 323.5 million barrels as of the week ended April 10, taking up 57% of storage capacity.

• China’s inventories are especially difficult to estimate because there are multiple categories: strategic petroleum reserves, commercial inventories, and national oil company and refining company stocks. Citibank estimates that China has 1.5 billion barrels of storage capacity.

• According to Cornerstone Macro, most of the available large-scale storage capacity for crude oil is located in just five places: the United States, China, Europe, Japan, and South Korea.

• India’s storage tanks to be full in third week of May. The country’s storage caverns, in Visakhapatnam, Mangaluru and Padur (Karnataka), which together can hold 5.33 million tonnes (mt) of crude.

• Royal Vopak, world’s biggest oil storage firm, has run out of space for crude and refined products as a result of the fast-expanding glut.

• Thecompany traditionallybenefits fromcontangoinoilmarketswherethespotpriceis depressed, meaning fuels can be stored for sale later at a higher price. The company saidthattheimpactofcontangowillcertainlybeseeninthesecondquarter

• Maritime data provider Kpler showed that total floating oil storage has hit an all-time high of 160 million barrels this week. If more of the tanker fleet is converted from shippingtofloatingstorageinthecomingmonths,this figurecouldpotentiallydouble.

|

13

|

| 27th APR | U.S. economy faces historic shock, with 16% joblessness possible, Trump adviser says |

| 27th APR | Bank of Japan expanded stimulus as pandemic pain worsens |

| 27th APR | RBI chief says 'very challenging' to meet FY21 fiscal deficit target |

| 27th APR | Brexittalkscanstillbedonewithinagreedtimescale,UKminister says |

| 27th APR | UK offers 100% state-backed COVID loans to smallest firms |

| 28th APR | Japan's March jobless rate rises to one-year high as coronavirus hits economy |

| 29th APR | Singapore's first quarter jobless rate highest in a decade, foreign employment drops |

| 29th APR | German economy to shrink by 10% in second quarter - DIW |

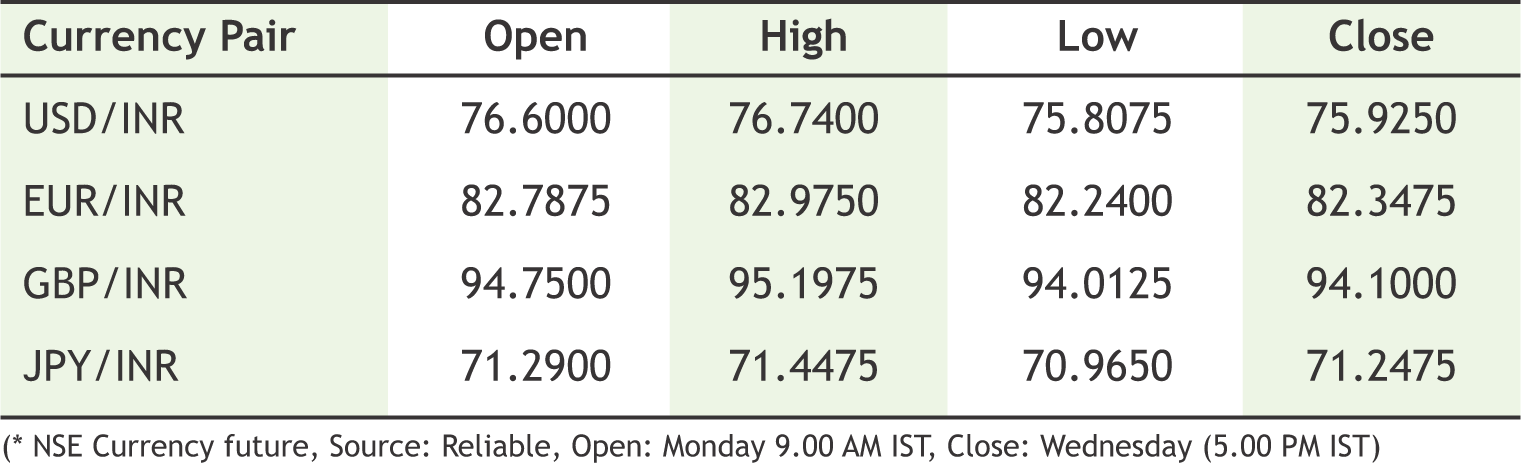

Green week in Indian rupee amid risk-on mode prompted after renewed hope of major economies are partially lifting the lock-down. However the rally in rupee can be attributed more of a flows from foreign investors and partly claimed by over $5bn Facebook & Jio deal. Long liquidation of dollar around 75.80 was the major driver of rupee to rise sharply. Apparently global markets are finding some greenshoots whenever news swung from remdesivir - possible drug to minimise the impact of COVID-19. Accordingly Gilead Sciences, the California-based biotech company, said that its potential corona virus drug remdesivir had produced positive results in a US study. Admittedly the risk-on sentiment cannot be broadly defined by such development when the same drug was unsuccessful in trial in China. We are closely monitoring such development and latest green-shoots may create price volatility further. In major pairs, euro is holding ground against dollar after widely muted outcome from FOMC policy; Fed had already gone all-in on its monetary policy stimulus. Over the next few months the Fed will continue to expand its balance sheet toward $10trn, albeit with more of a focus on establishing and expanding its credit facilities for the private sector and less of a focus on Treasury securities which can be major driver for riskier assets to hold ground. Next week when India may ease lockdown after 3rd of May and announcement of possible fiscal stimulus may guide the rupee pair.

|

USD/INR (MAY) contract closed at 75.9250 on 29-Apr-2020. The contract made its high of 76.7400 on 28-Apr-2020 and a low of 75.8075 on 29-Apr-2020 (Weekly Basis). The 21-day Exponential MovingAverage oftheUSD/INR is currently at 76.27

On the daily chart, the USD/INR has Relative Strength Index (14-day) value of 40.96. One can buy @ 75.1-75.2 for the target of 76 with the stop loss of 74.59.

EUR/INR (MAY) contract closed 82.3475 on 29-Apr-2020. The contract made its high of 82.9750 on 27-Apr-2020 and a low of 82.2400 on 29-Apr-2020 (Weekly Basis). The 21-day Exponential MovingAverage ofthe EUR/INR is currently at 82.83

On the daily chart, EUR/INR has Relative Strength Index (14-day) value of 40.40. One can sell at 82.00-81.90 for a target of 81.00 with the stop loss of 82.50.

GBP/INR (MAY) contract closed at 94.7500 on 29-Apr-2020. The contract made its high of 95.1975 on 29-Apr-2020 and a low of 94.0125 on 29-Apr-2020 (Weekly Basis). The 21-day Exponential MovingAverage oftheGBP/INR is currently at 94.40

On the daily chart, GBP/INR has Relative Strength Index (14-day) value of 46.6. One can sell at 94.00 for a target of 92.5 with the stop loss of 94.51.

JPY/INR (MAY) contract closed at 71.2475 on 29-Apr-2020. The contract made its high of 71.4475 on 29-Apr-2020 and a low of 70.9650 on 27-Apr-2020 (Weekly Basis). The 21-day Exponential MovingAverage ofthe JPY/INR is currently at 70.77

On the daily chart, JPY/INR has Relative Strength Index (14-day) value of 51.10. One can buy at 70.50-70.40 for a target of 72.00 with the stop loss of 69.90.

14

|

15

|

* Interest Rate may be revised by company from time to time. Please confirm Interest rates before submitting the application.

* For Application of Rs.50 Lac & above, Contact to Head Office.

* Email us at fd@smcindiaonline.com

16

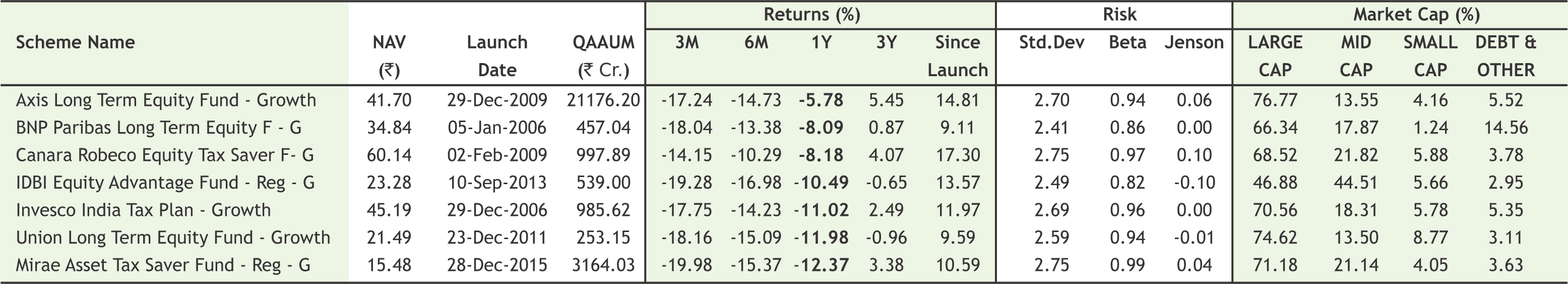

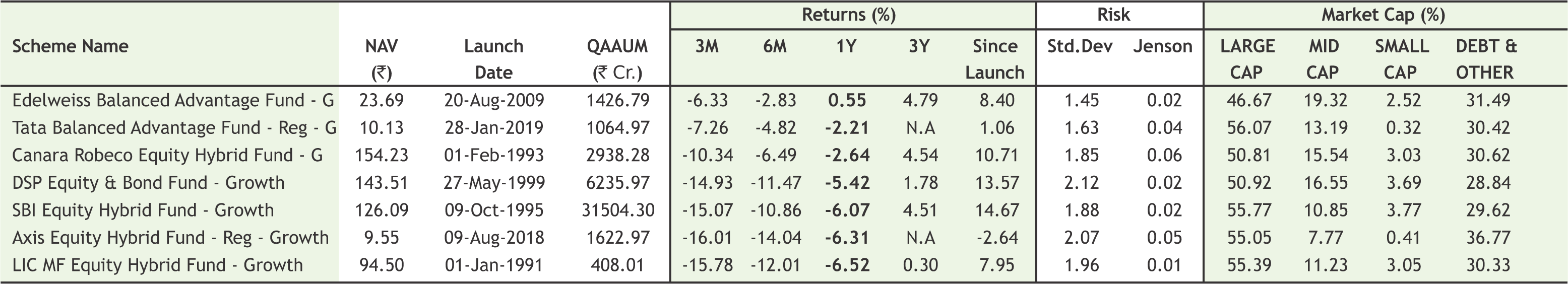

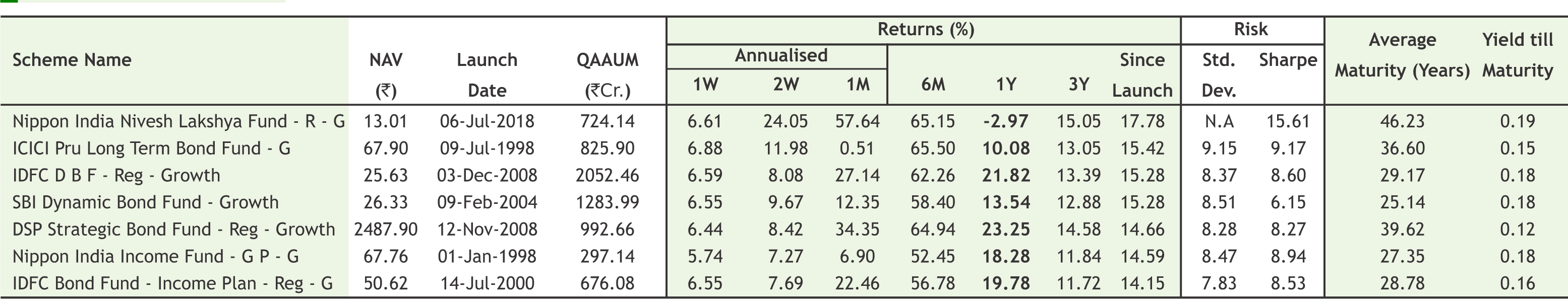

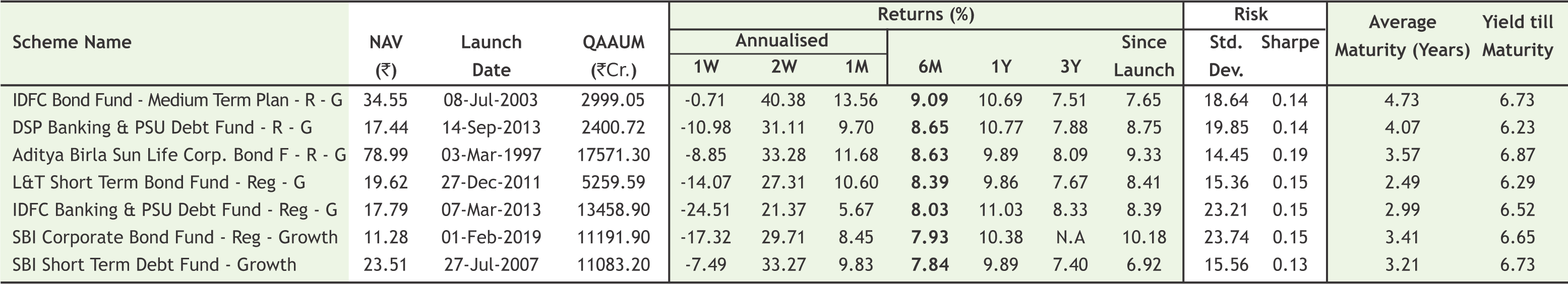

Mutual funds add over 72 lakh folios in 2019-20

Mutual fund industry has added more than 72 lakh folios in 2019-20 taking the total tally to near 9 crore mark. However, the pace of growth in folio numbers dropped in the just concluded financial year 2019-20 as compared to preceding two fiscal, which suggests investors' understanding about market risks associated with such schemes. Industry experts attributed the trend to decline in investors account in debt oriented schemes as they were spooked by credit events in fixed income market. In comparison, the industry had added 1.13 crore investors account in 2018-19 and 1.6 crore accounts in 2017-18, according to data from Association of Mutual Funds in India. The mutual fund space saw an addition of over 67 lakh folios in 2016- 17 and 59 lakh in 2015-16.

After Franklin Templeton crisis, MFs record Rs 22,054 crore drop in AUM in 3 days

The aftermath of Franklin Templeton Mutual Fund's decision to wind down six managed credit funds is being felt on the entire industry. Franklin Templeton announced their decision late April 23 evening and as early as April 24 morning, investors big and small started redemptions across the spectrum. According to daily assets under management (AUM) data uploaded on the Association of Mutual Funds in India (AMFI) website, mass redemptions in excess of Rs 22,054 crore have been seen in just the three working days since the FT announcement.

AMFI assures money in debt schemes safe

In the light of the latest announcement of winding up of six credit risk fixed income schemes by one of the asset management companies (AMC), the Association of Mutual Funds in India (AMFI) assured investors that majority of fixed income mutual funds AUM is invested in superior credit quality securities and schemes have appropriate liquidity to ensure normal operations. According to the press release, AMFI strongly recommends that investors continue to focus on their investment goals, consult their financial advisor and not get side-tracked by an isolated event in a few schemes of one fund company.

SEBI has relaxed the KYC norms for mutual funds, PMS and AIF

SEBI has relaxed the KYC norms for mutual funds, PMS and AIF, in order to make boarding process easier during nationwide lockdown. Accordingly, investors’ KYC can be completed through online / App based KYC, in-person verification through video, online submission of Officially Valid Document (OVD) / other documents under eSign. SEBI has allowed all registered intermediaries like fund houses, PMS players, AIF players and RIAs to offer appbased video KYC facility to onboard new clients digitally. These intermediaries will have to ensure that they are ready with necessary infrastructure to verify KYC documents online and facilitate video in person verification.

Reserve Bank of India has opened special liquidity window of Rs.50,000 crore for mutual funds

Reserve Bank of India has opened special liquidity window of Rs.50,000 crore for mutual funds. In the wake of recent coronavirus pandemic, mutual fund houses have been facing redemption pressure in debt schemes following closure of six schemes by Franklin Templeton mutual fund. Fund houses can avail this facility till May 11, 2020. Under the SLF-MF, the RBI shall conduct repo operations of 90 days tenor at the fixed repo rate.

Nippon India Mutual Fund has revised the exit load of Nippon India Gold Savings Fund

Nippon India Mutual Fund has revised the exit load of Nippon India Gold Savings Fund w.e.f. Apr 27. Accordingly, an exit load of 1% of the applicable NAV will be charged if units redeemed or switched out on or before completion of 15 days from the date of allotment of units.

17

|

|

|

|

|

Note:Indicative corpus are including Growth & Dividend option . The above mentioned data is on the basis of 08/08/2019 Beta, Sharpe and Standard Deviation are calculated on the basis of period: 1 year, frequency: Weekly Friday, RF: 7%

*Mutual Fund investments are subject to market risks, read all scheme related documents carefully

18

![]() Comprehensive Investment Solutions

Comprehensive Investment Solutions

![]() Goal Based Investment Advise

Goal Based Investment Advise

![]() Lower Risk by Diversifying Portfolio

Lower Risk by Diversifying Portfolio

![]() Long-term Focus

Long-term Focus

Call Toll-Free 180011 0909

Visit www.smcindiaonline.com

REGISTERED OFFICES:

11 / 6B, Shanti Chamber, Pusa Road, New Delhi 110005. Tel: 91-11-30111000, Fax: 91-11-25754365

MUMBAI OFFICE:

Lotus Corporate Park, A Wing 401 / 402 , 4th Floor , Graham Firth Steel Compound, Off Western Express Highway, Jay Coach Signal, Goreagon (East) Mumbai - 400063

Tel: 91-22-67341600, Fax: 91-22-67341697

KOLKATA OFFICE:

18, Rabindra Sarani, Poddar Court, Gate No-4,5th Floor, Kolkata-700001 Tel.: 033 6612 7000/033 4058 7000, Fax: 033 6612 7004/033 4058 7004

AHMEDABAD OFFICE :

10/A, 4th Floor, Kalapurnam Building, Near Municipal Market, C G Road, Ahmedabad-380009, Gujarat

Tel : 91-79-26424801 - 05, 40049801 - 03

CHENNAI OFFICE:

Salzburg Square, Flat No.1, III rd Floor, Door No.107, Harrington Road, Chetpet, Chennai - 600031.

Tel: 044-39109100, Fax -044- 39109111

SECUNDERABAD OFFICE:

315, 4th Floor Above CMR Exclusive, BhuvanaTower, S D Road, Secunderabad, Telangana-500003

Tel : 040-30031007/8/9

DUBAI OFFICE:

2404, 1 Lake Plaza Tower, Cluster T, Jumeriah Lake Towers, PO Box 117210, Dubai, UAE

Tel: 97145139780 Fax : 97145139781

Email ID : pankaj@smccomex.com

smcdmcc@gmail.com

Printed and Published on behalf of

Mr. Saurabh Jain @ Publication Address

11/6B, Shanti Chamber, Pusa Road, New Delhi-110005

Website: www.smcindiaonline.com

Investor Grievance : igc@smcindiaonline.com

Printed at: S&S MARKETING

102, Mahavirji Complex LSC-3, Rishabh Vihar, New Delhi - 110092 (India) Ph.: +91-11- 43035012, 43035014, Email: ss@sandsmarketing.in