Initiatives to promote farming and allied sectors during lockdown

The Department of Agriculture, Cooperation and Farmers Welfare, Government of

India is taking several measures to facilitate the farmers and farming activities at

field level during the lockdown period. Following exemptions were given by

Government of India for agricultural operations keeping in view the harvesting and

sowing season:

• Agencies engaged in procurement of agriculture products, including MSP

operations;

Ÿ Farming operations by farmers and farm workers in the field;

Ÿ ‘Mandis’ operated by the Agriculture Produce Market Committee or as notified

by the State Government;

Ÿ ‘Mandis’ include direct marketing, facilitated by the State Government/UT

Administration, directly from the farmers/groups of farmers. FPOs,

Cooperatives, etc;

Ÿ Shops for Seeds, Fertilisers and Pesticides;

Ÿ Manufacturing and packaging units of Seeds, Fertilisers and Pesticides;

Ÿ Custom Hiring Centres (CHC) related to farm machinery;

Ÿ Intra and inter-state movement of harvesting and sowing related machines like

combined harvester and other agriculture/ horticulture implements;

Ÿ Cold storage and warehousing services;

Ÿ Manufacturing units of packaging material for food items;

Ÿ Transportation for essential goods;

Ÿ Shops of agriculture machinery, its spare parts (including its supply chain) and

repairs.

Ÿ Tea industry, including plantation with maximum of 50% workers.

Ÿ The Agriculture Minister along with Ministers of State (Agriculture) formally

launched the All India Agri Transport Call Centre on 15th April 2020. This Call

Centre has been set up for coordination between States forinter-state movement

of perishables like vegetables & fruits, agri inputs like seeds, pesticides and

fertilizer etc.The Call Centre numbers are 18001804200 and 14488.

Ÿ Truck drivers, traders, retailers, transporters or any other stakeholders who are

facing problems in inter-state movement of above commodities, may seek help

by calling at the Call Centre.

Ÿ Railways introduced 67 routes for running 236 Parcel Specials (out of which 171

are time table parceltrains)to supply essential commodities including perishable

horticultural produce, agricultural inputs viz. seed, fertilizer and pesticides, milk

and dairy products at fast speed which will facilitate farmers/FPOs/traders and

companies for continuity of supply chain across the country.

Ÿ Under the Pradhan Mantri Kisan Samman Nidhi (PM-KISAN) Scheme during the

lockdown period from 24.3.2020, about 8.46 crore farmer have been

benefitted and an amount of Rs. 16,927 crore has been released so far.

Ÿ Decision has been taken (on 30.03.2020) for providing 2% Interest Subvention

(IS) to Banks and 3% Prompt Repayment Incentive (PRI) to farmers for the

extended period of repayment of loans upto 31.05.2020 or date of actual

repayment date whichever is earlier, for short terms crop loan upto Rs.3 lakh

per farmers given by Banks @ 7% p.a., which have become due or shall become

due between 1st March, 2020 and 31st May, 2020.

Ÿ Module of Uberisation of logistics aggregator has been recently launched on eNAM Platform. More than 7.76 lakh trucks and 1.92 lakh transporters are

already linked to this module.

Ÿ Exports of all major products i.e rice, groundnut, processed food, meat,

poultry, dairy and organic products has started.NAFED has exported 50,000 MT

wheattoAfghanistan and 40,000 MTwheatto Lebanon underG2Garrangement.

Ÿ The validation of pack houses, rice mills, processing units, treatment facilities,

fumigation agencies, PEQ facilities etc. which have expired in the lockdown

period due to COVID-19 situation have been extended.

Ÿ During this lockdown period, 2.70 Lakh quintals seed of cereals, millets, pulses

etc was moved and 42.50 Lakh cotton seed packets was also moved in Northern

India especially for Haryana and Punjab.

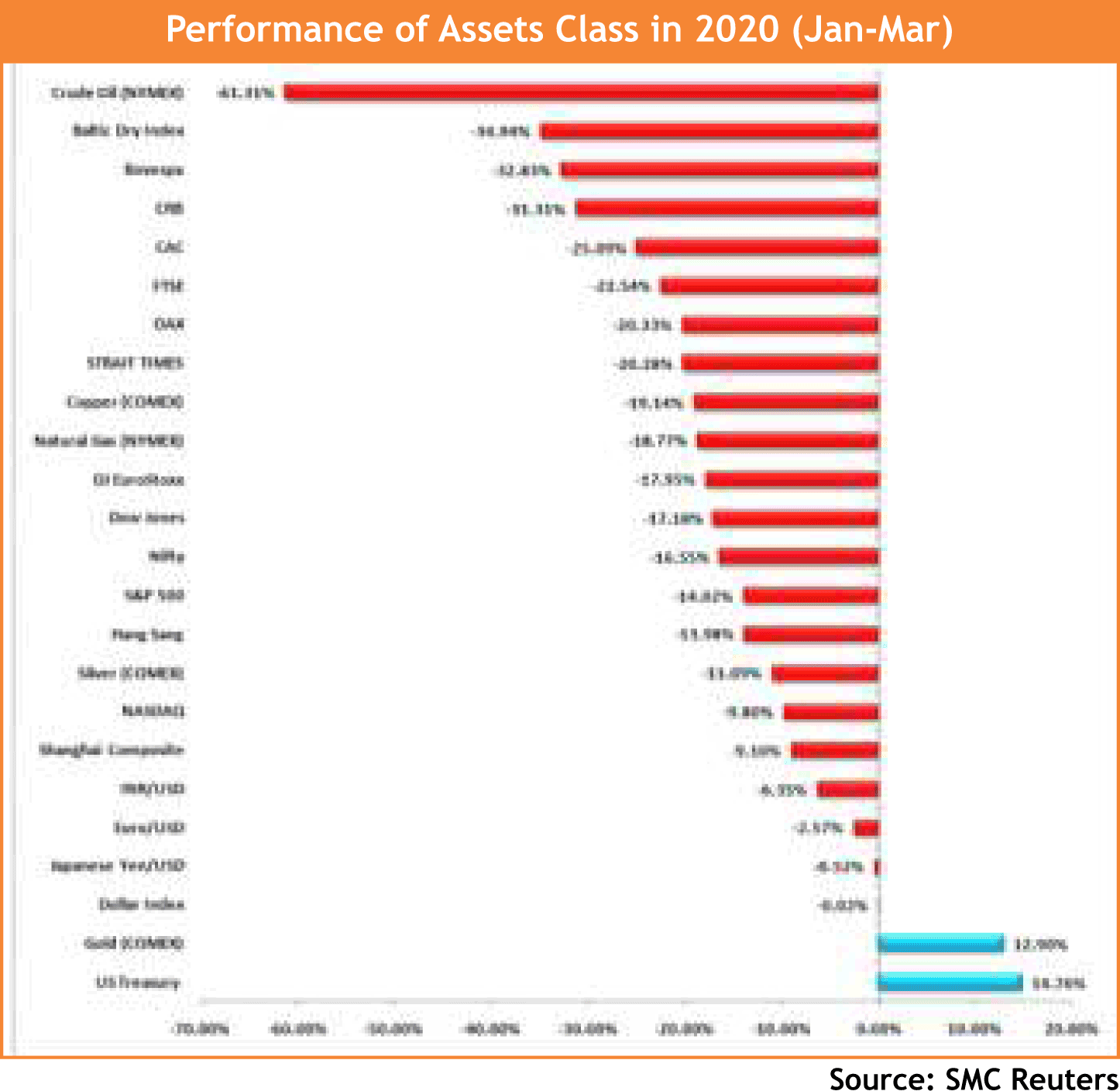

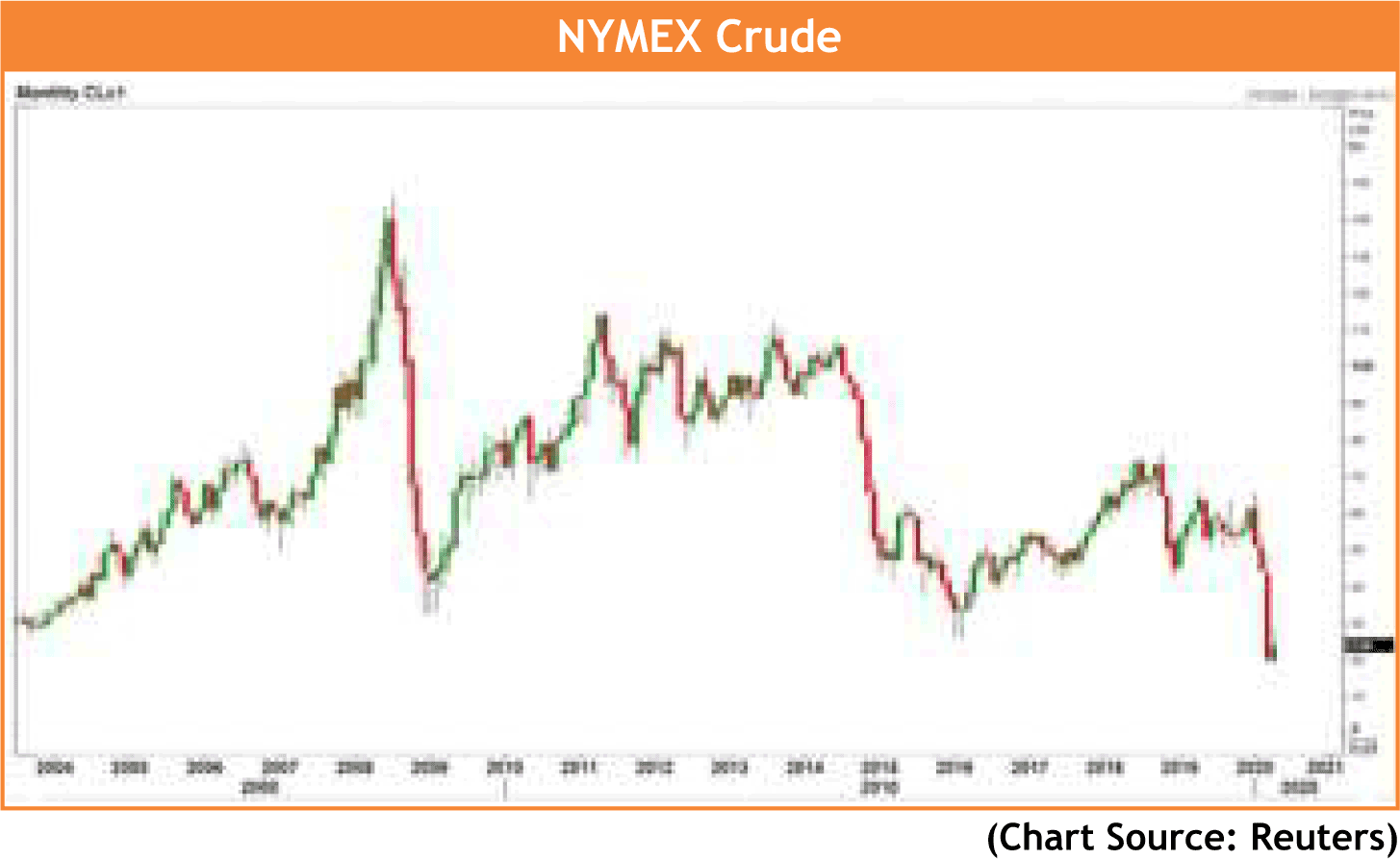

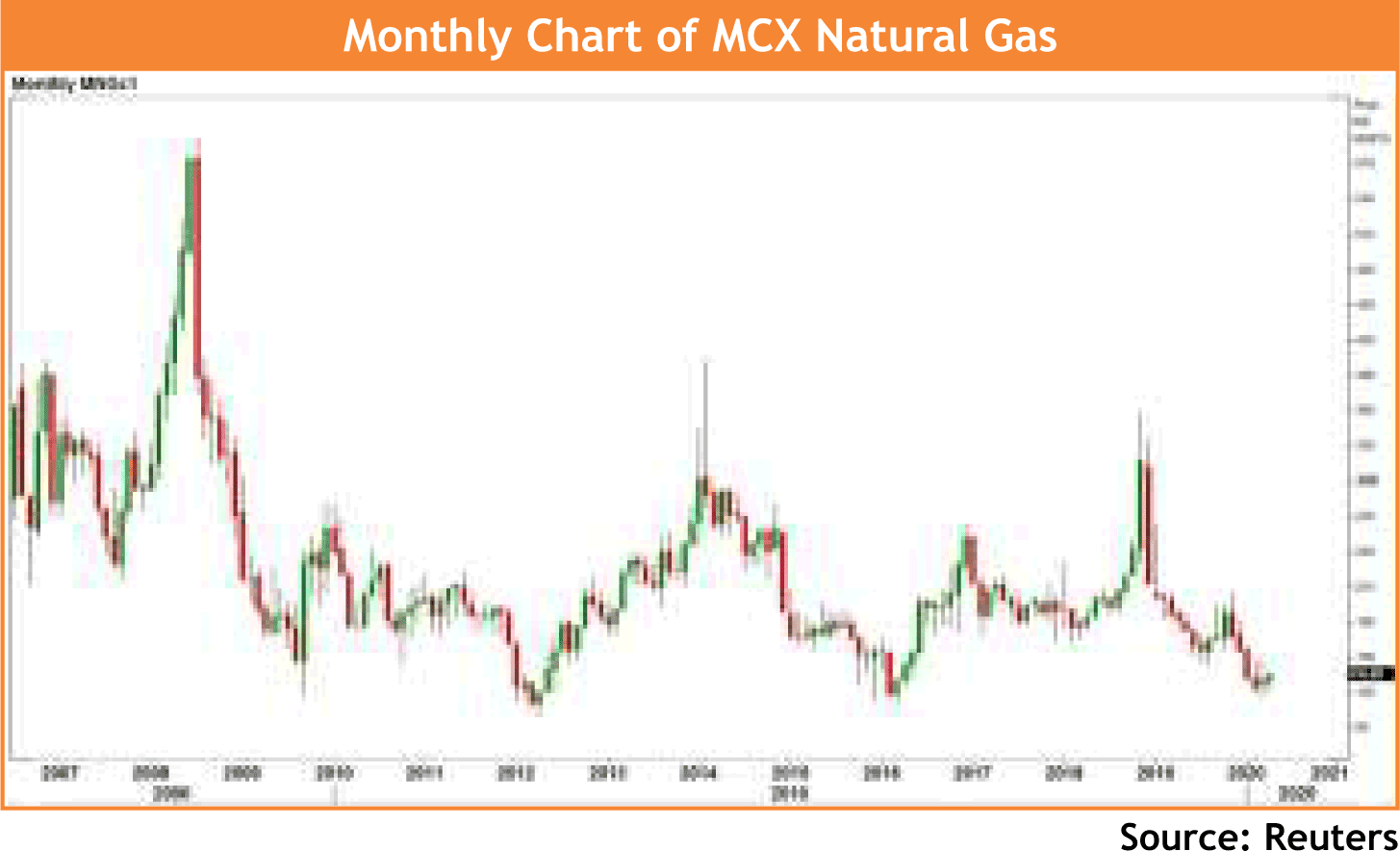

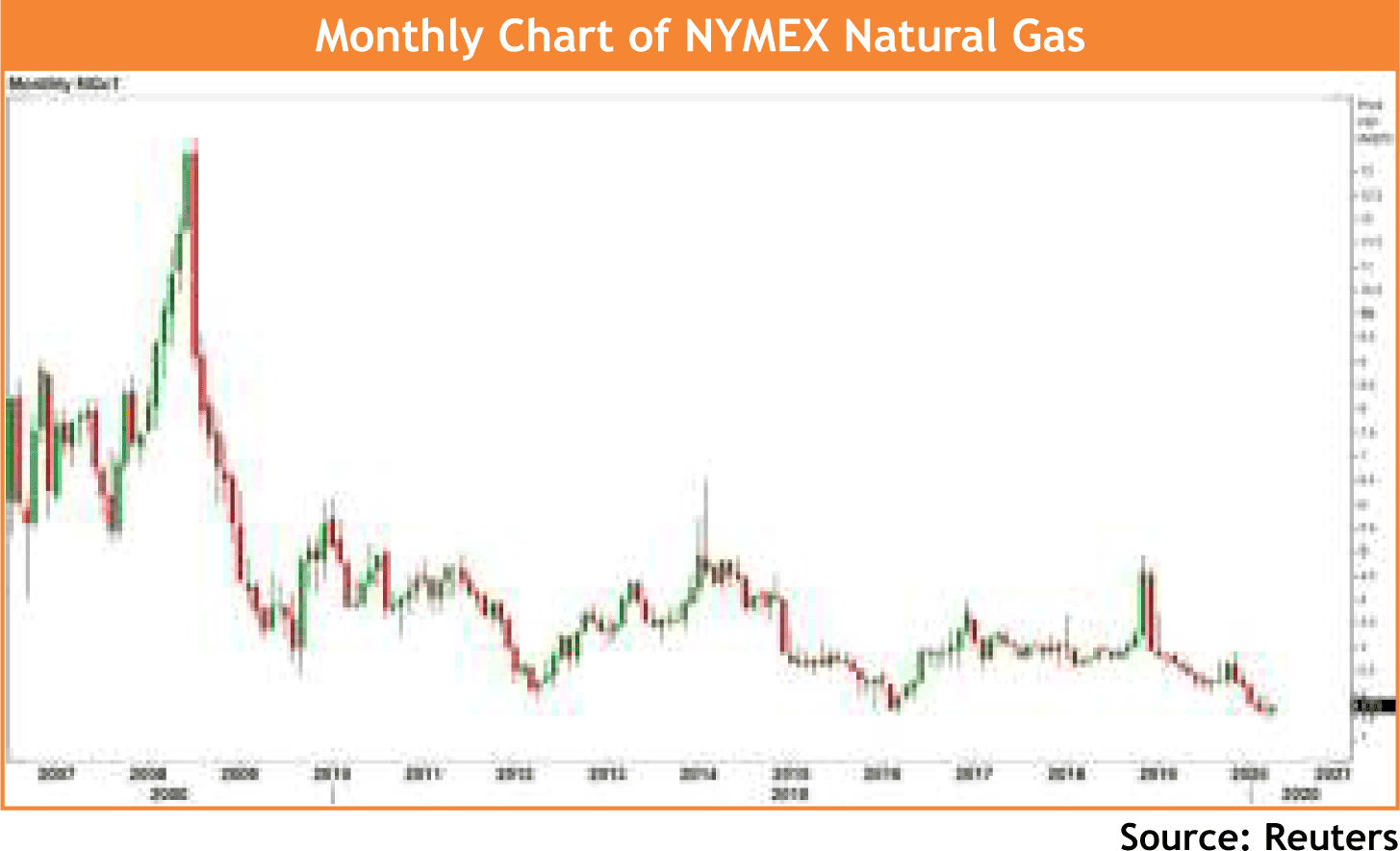

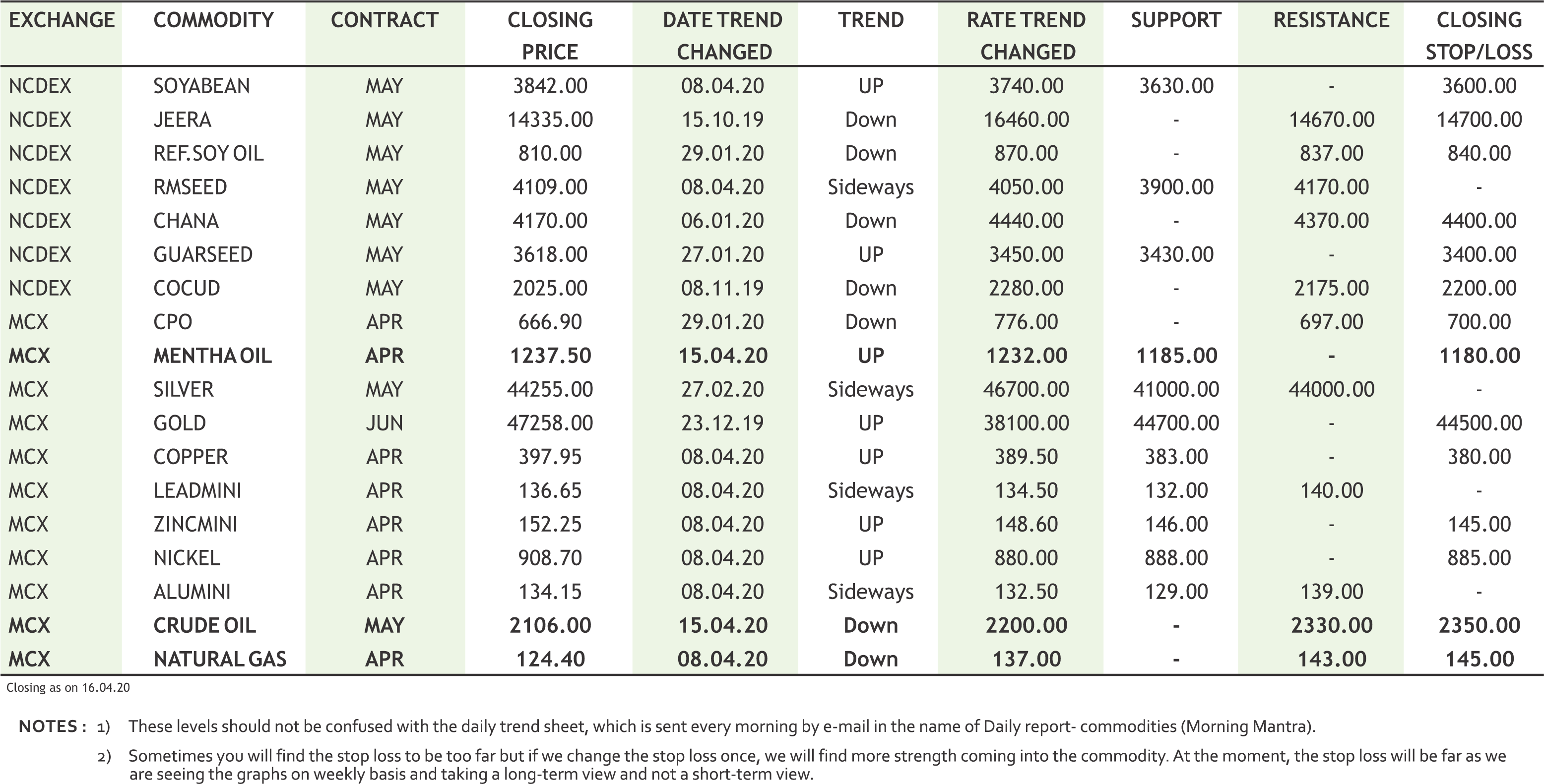

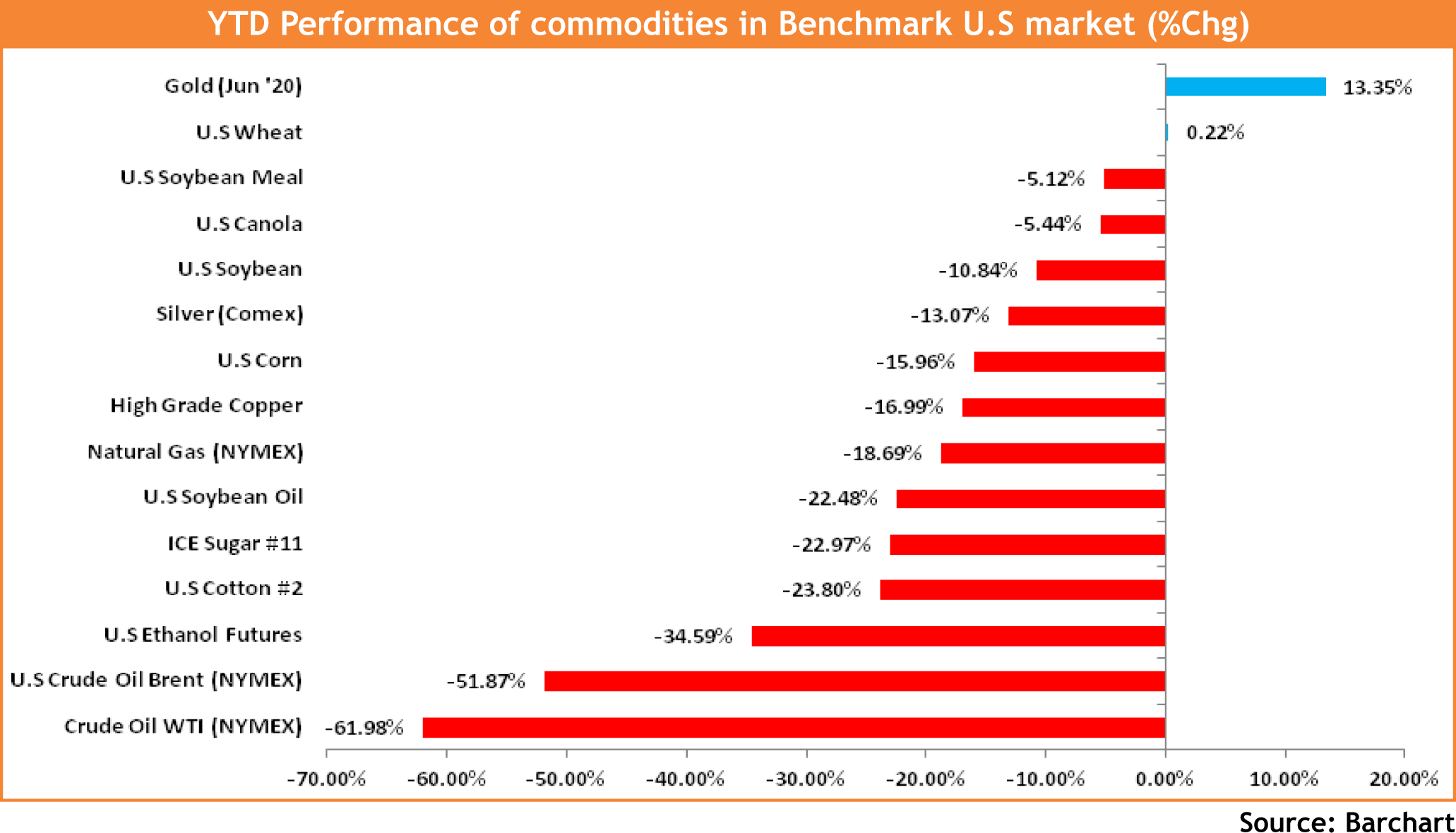

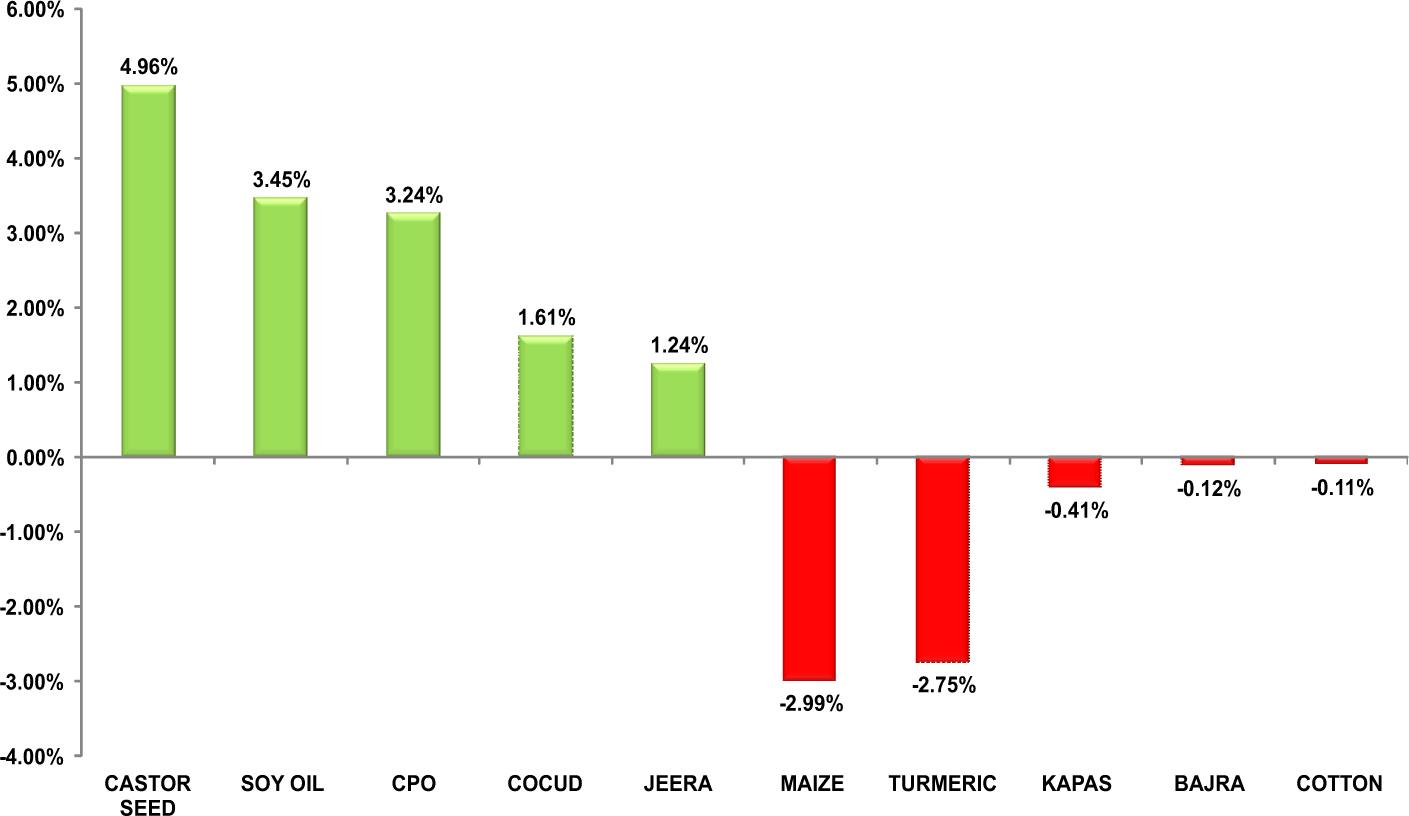

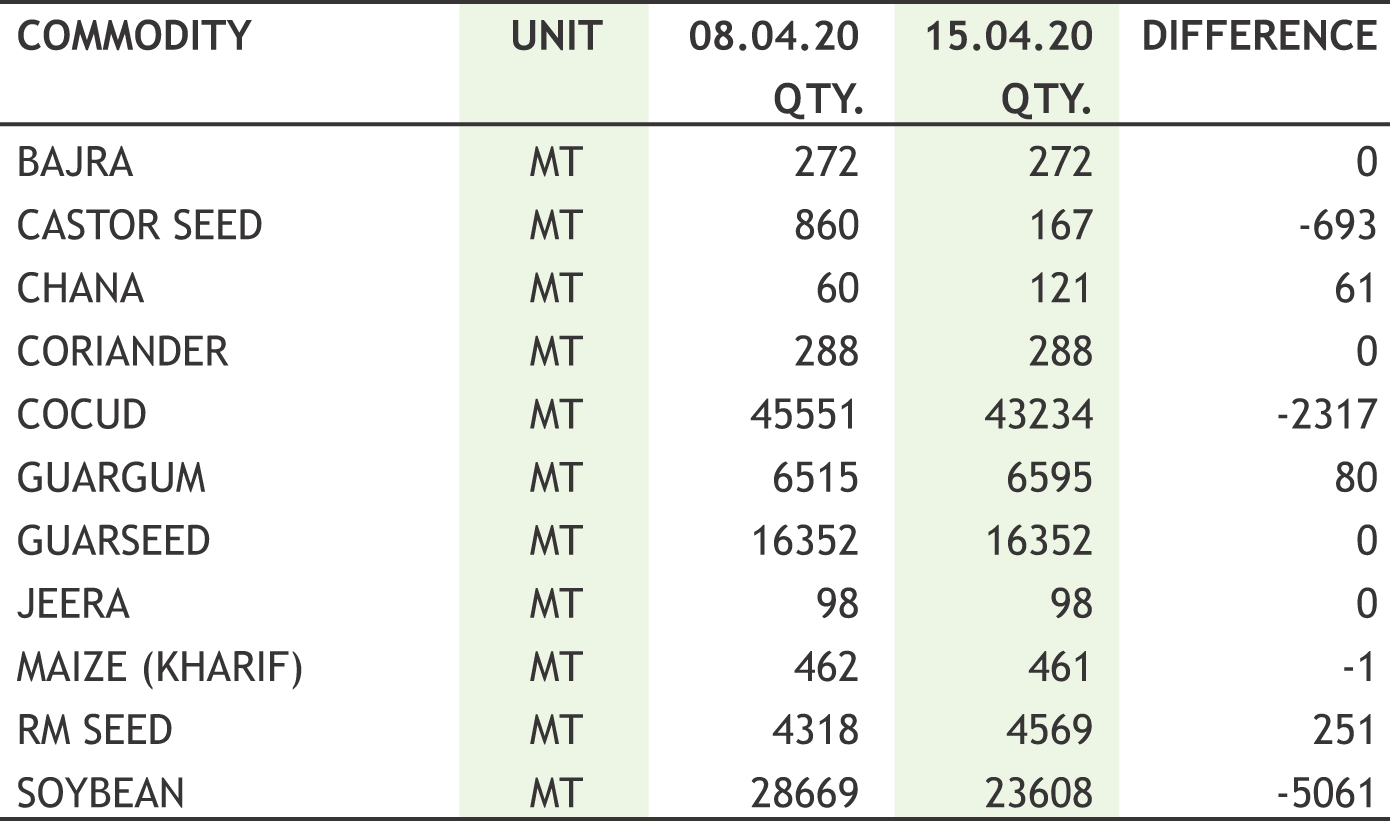

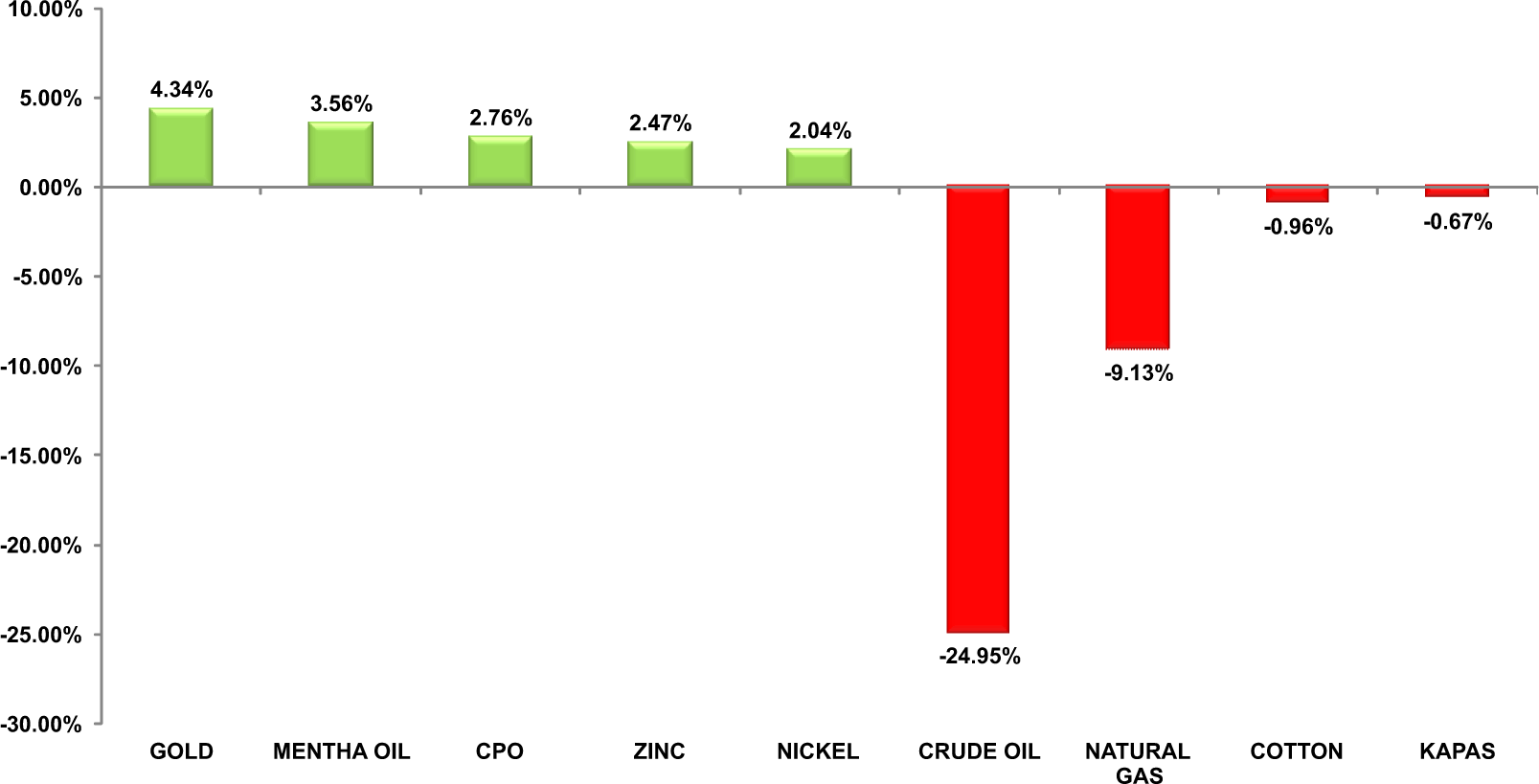

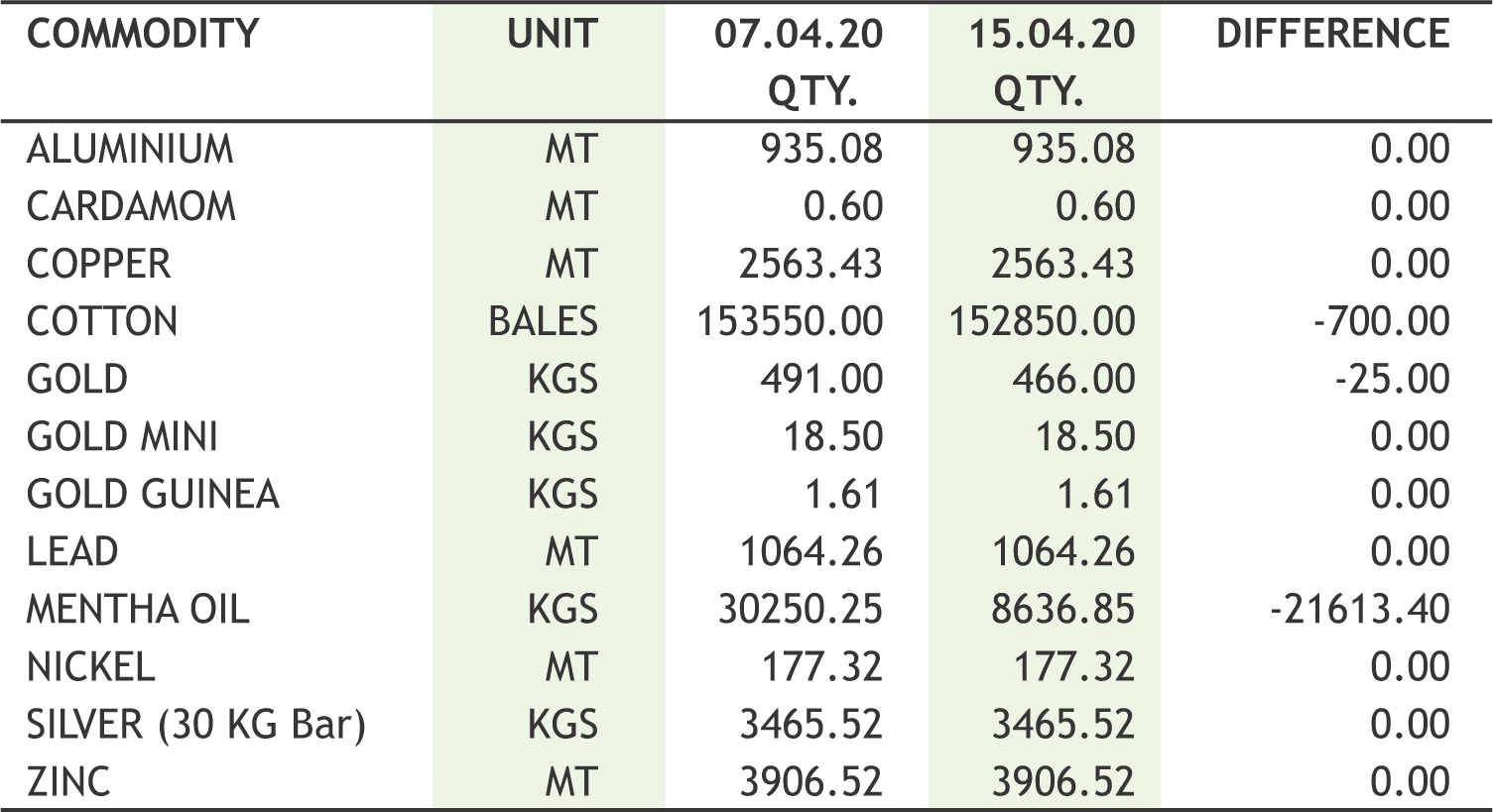

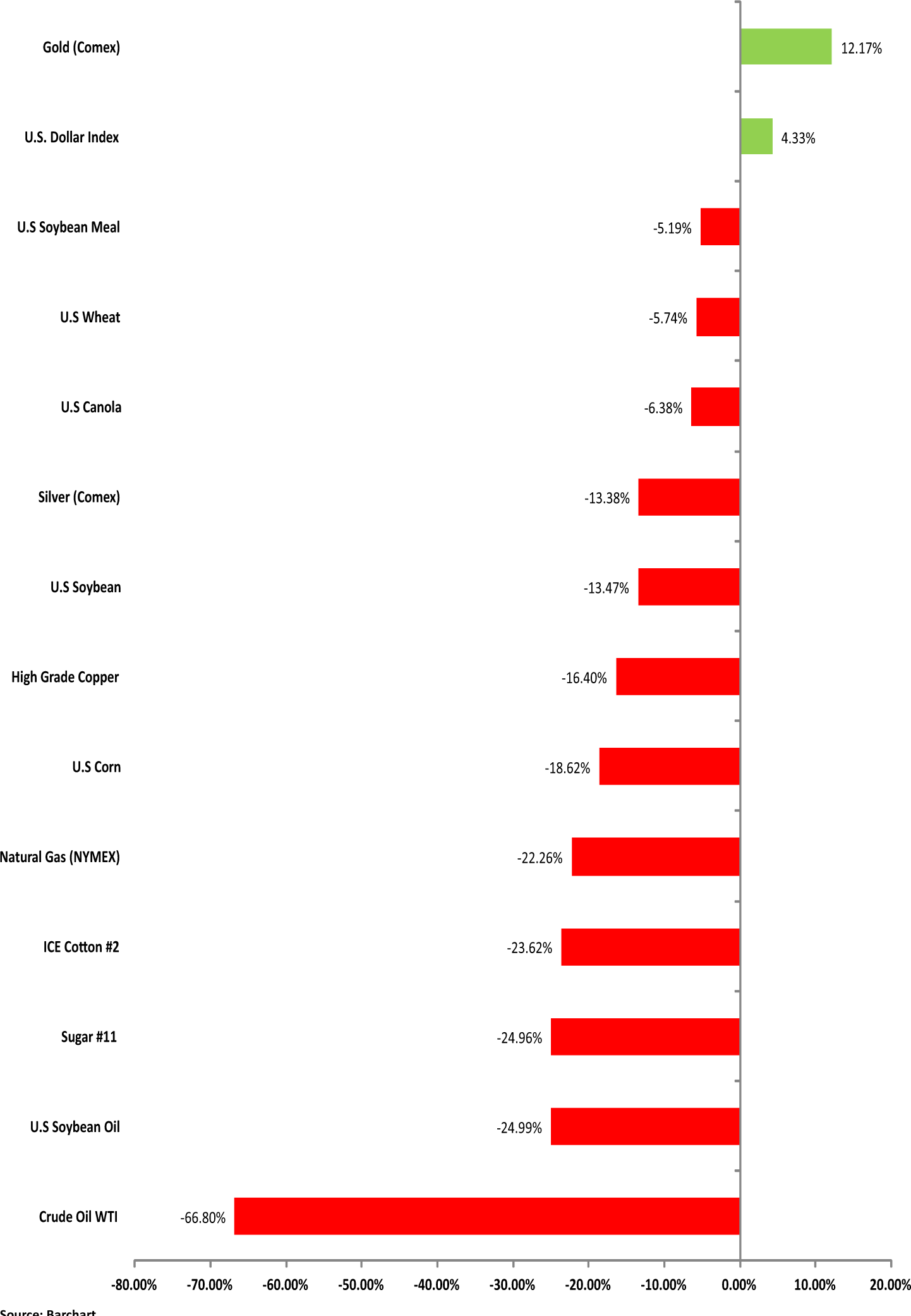

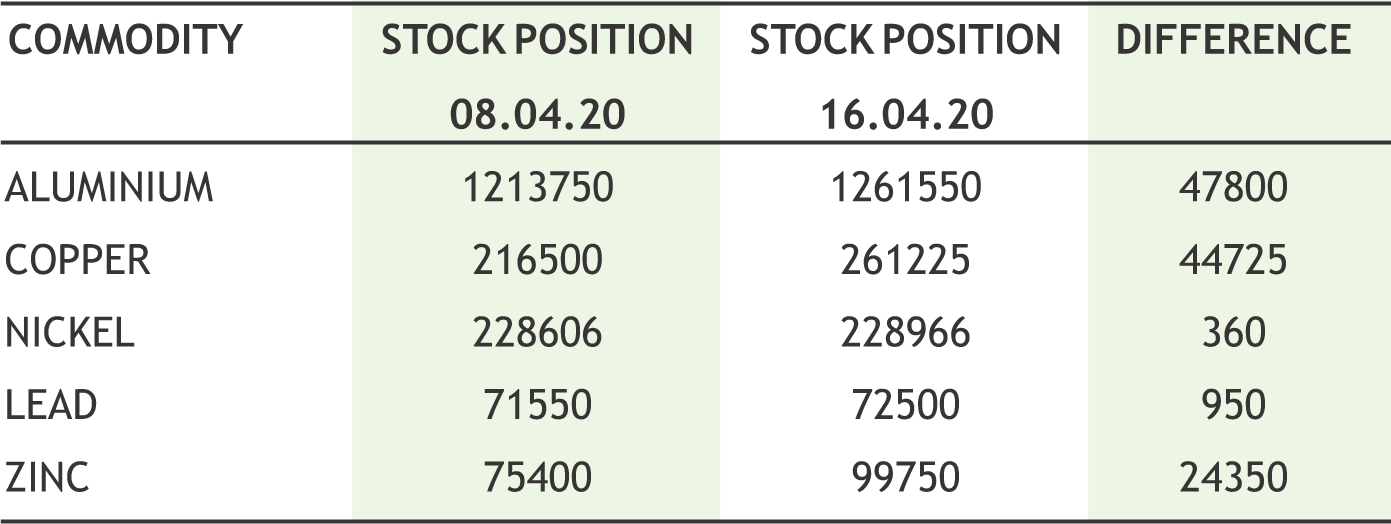

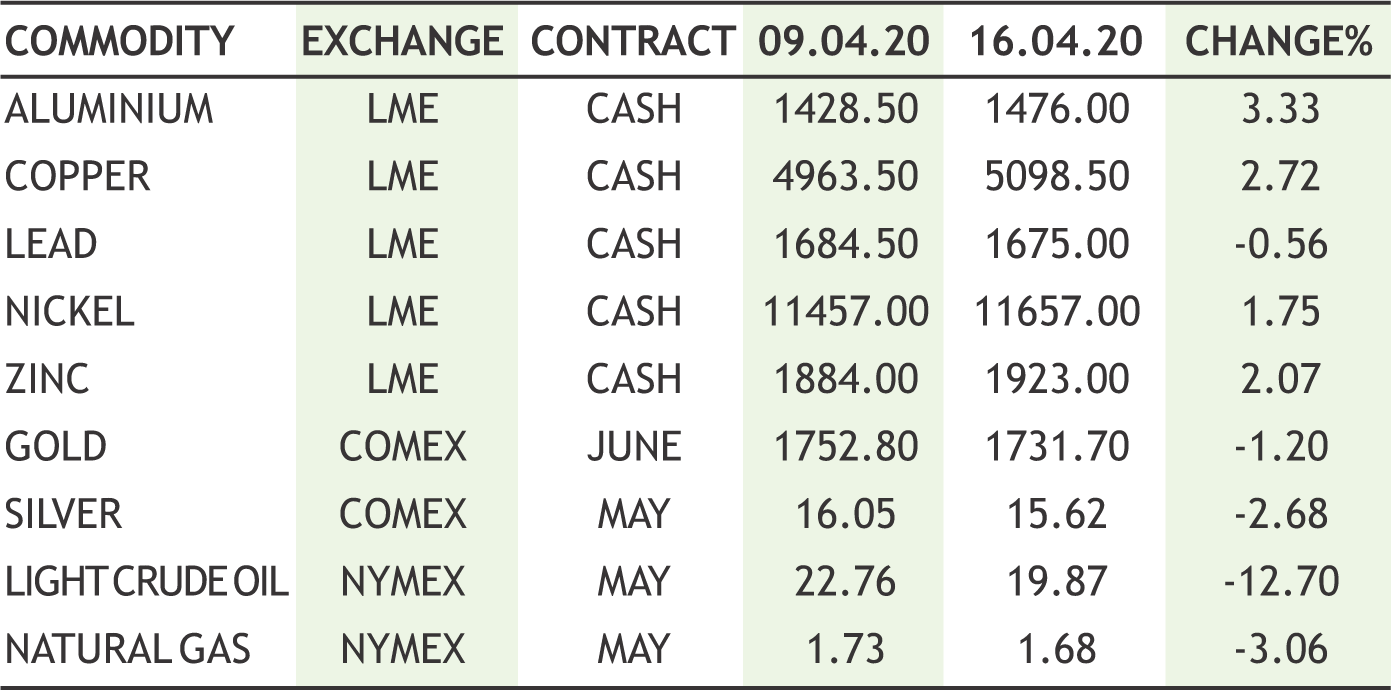

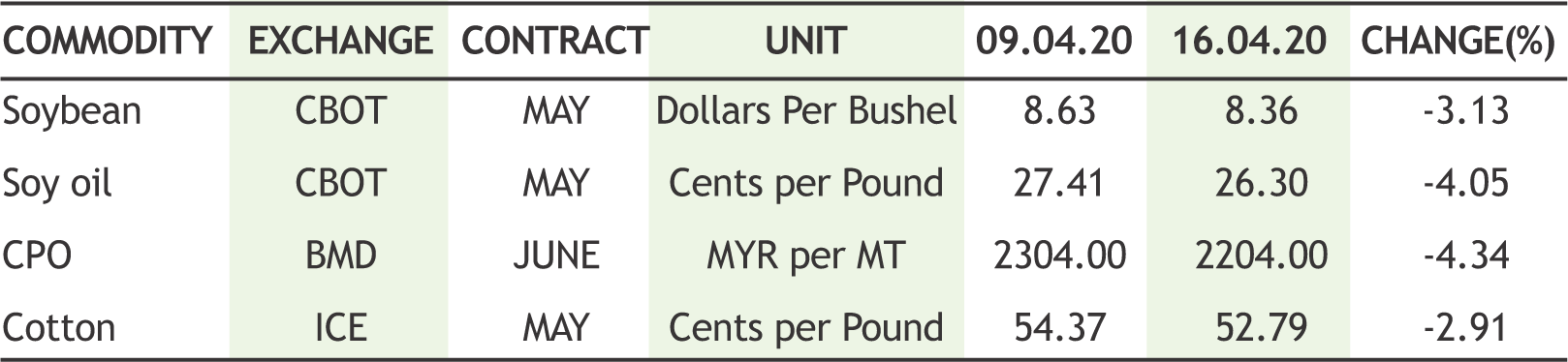

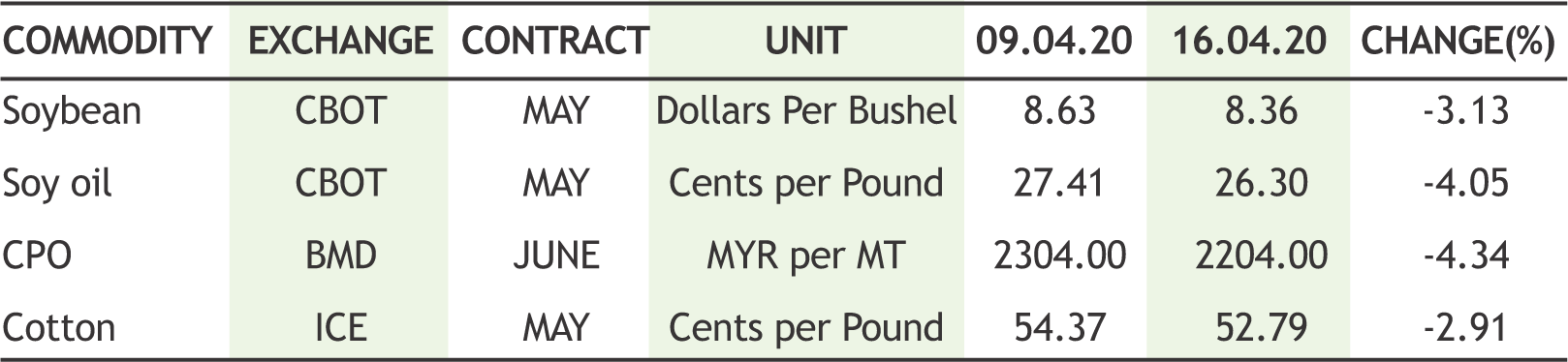

INTERNATIONAL COMMODITY PRICES

NEY

NEY