2020 : Issue 721, Week : 3rd - 7th February

A Weekly Update from SMC (For private circulation only)

WISE M NEY

NEY

2020 : Issue 721, Week : 3rd - 7th February

A Weekly Update from SMC (For private circulation only)

NEY

NEY

![]() Customized Plans

Customized Plans

![]() Comprehensive Investment Solutions

Comprehensive Investment Solutions

![]() Long-term Focus

Long-term Focus

![]() Independent & Objective Advise

Independent & Objective Advise

![]() Financial Planning

Financial Planning

Call Toll-Free 180011 0909

Visit www.smcindiaonline.com

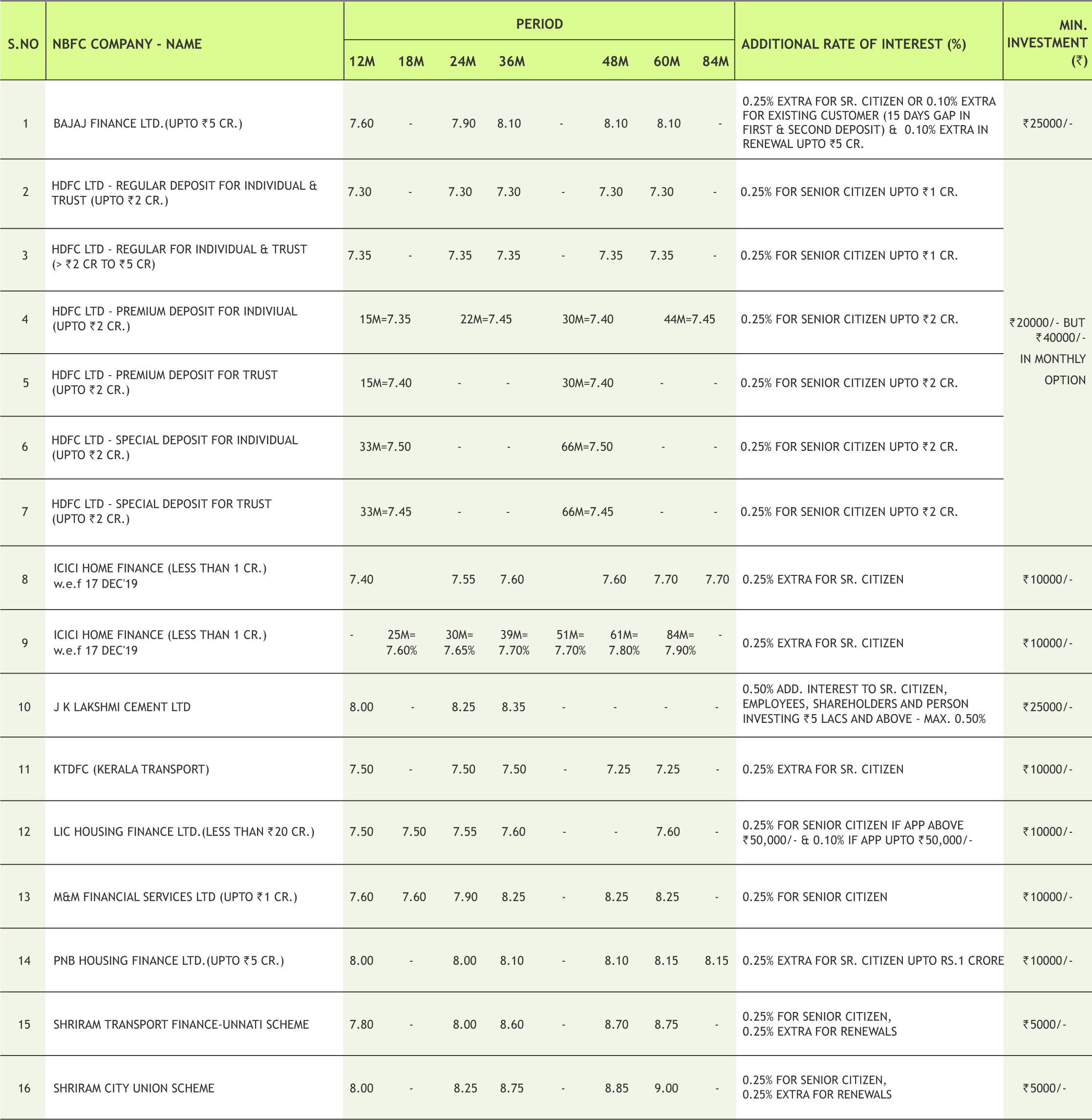

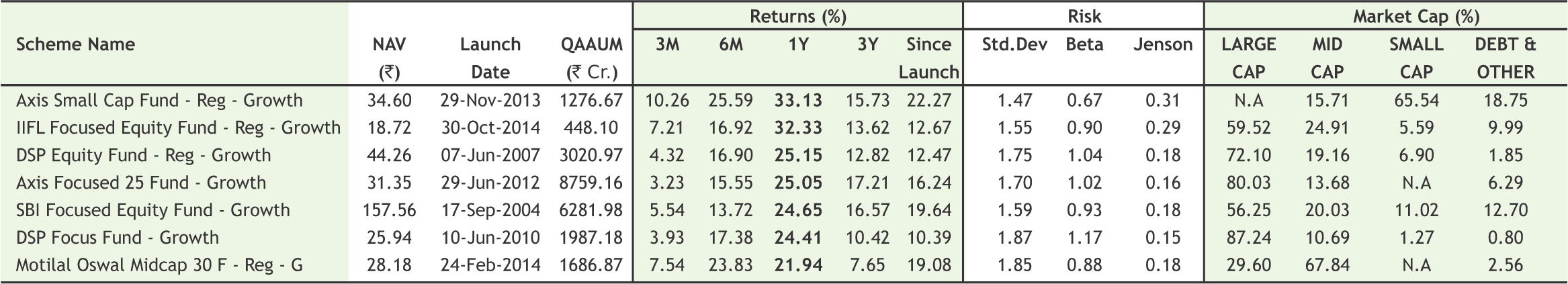

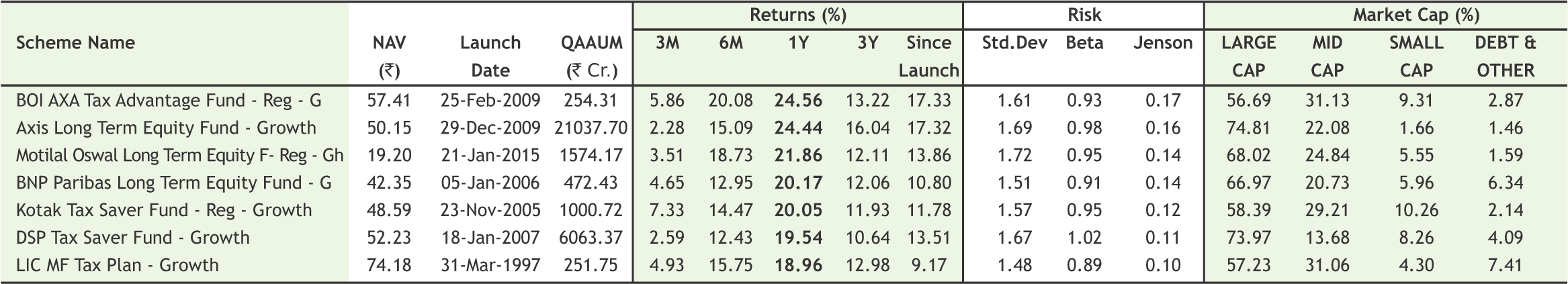

| Equity | 4-7 |

| Derivatives | 8-9 |

| Commodity | 10-13 |

| Currency | 14 |

| IPO | 15 |

| FD Monitor | 16 |

| Mutual Fund | 17-18 |

G

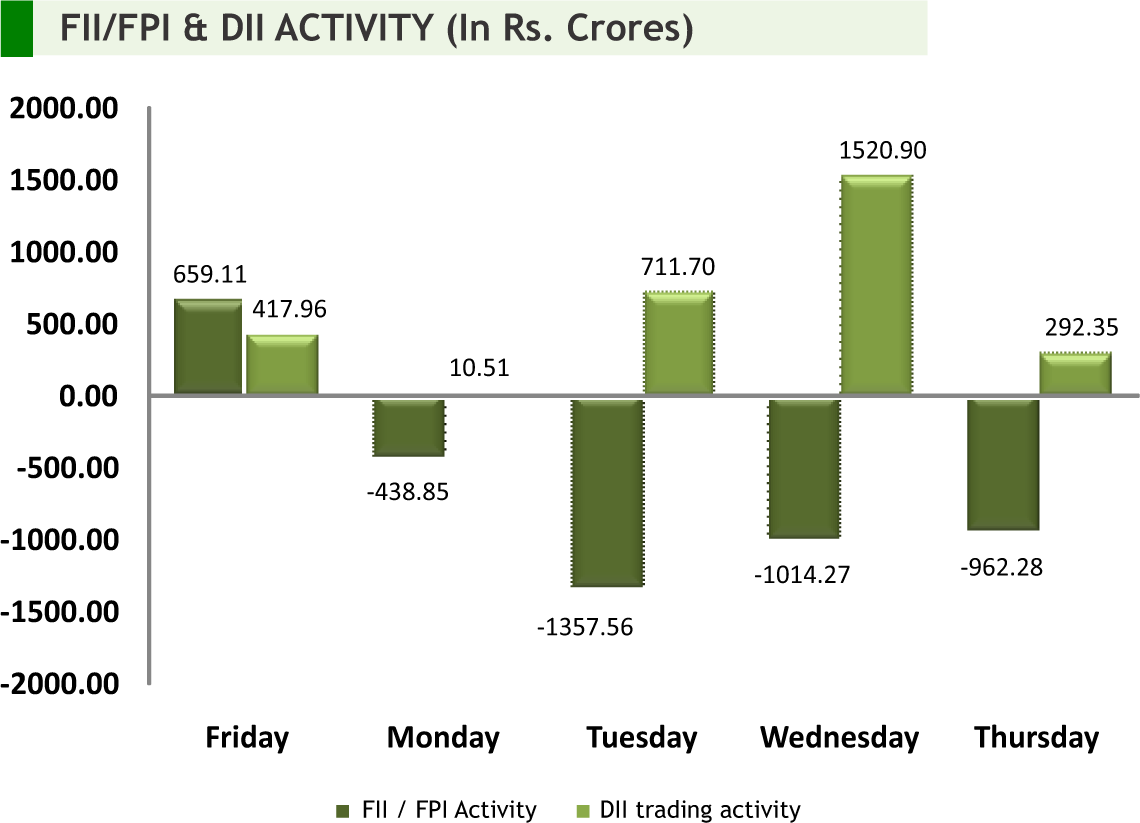

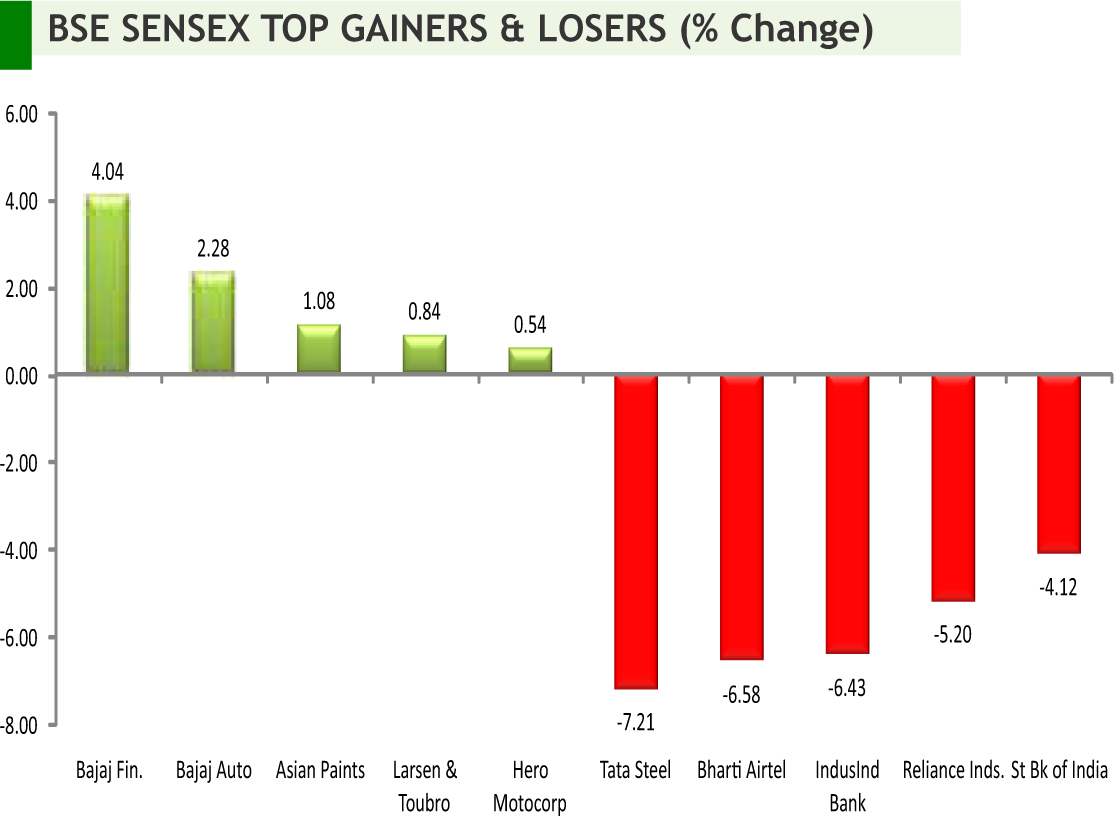

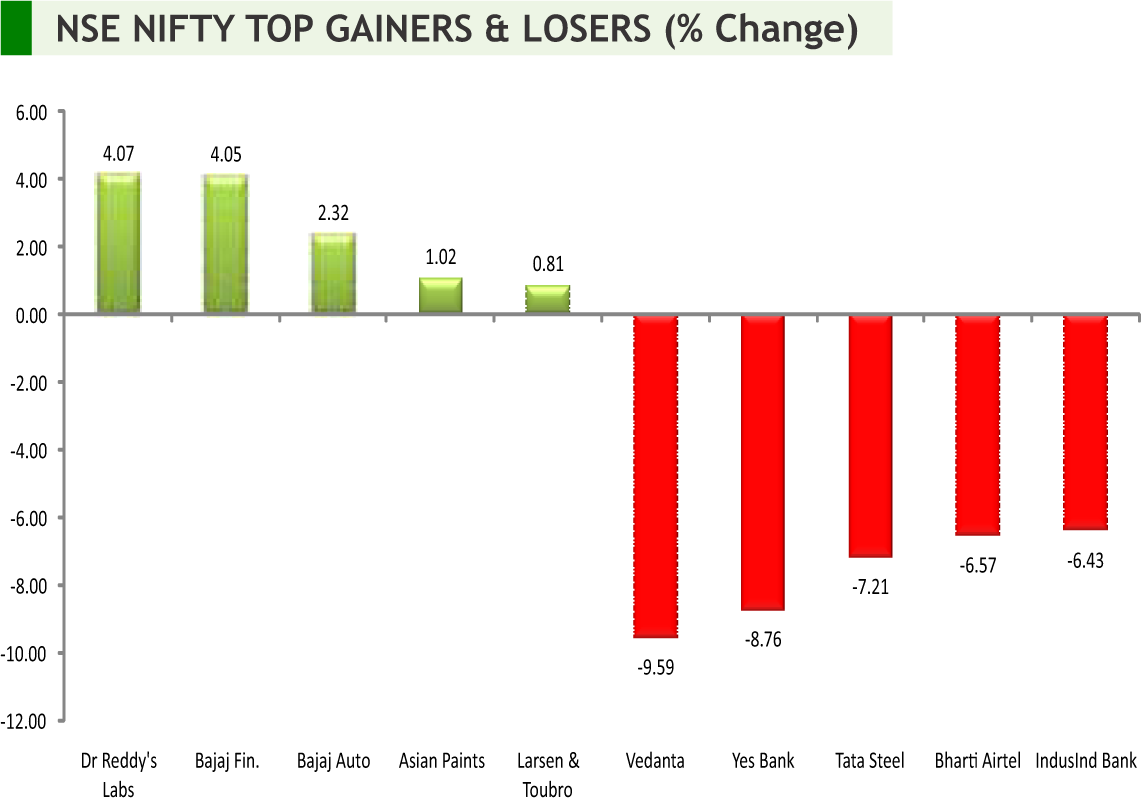

lobal markets, in the week gone by, have had a turbulent week as investors fretted about the economic impact from the coronavirus outbreak in China, which has so far killed 213, prompting the World Health Organization on Thursday to declare a global health emergency. Such a designation could signal that the worst is yet to come, for China and global businesses. Undoubtedly, China’s deadly coronavirus has hit global stock markets hard. In another development, after threeand-a-half years, three prime ministers and seemingly endless votes in Parliament since the 2016 Brexit referendum, Britain finally becomes the first ever country to leave the European Union . Meanwhile, the US Fed left a key interest rate unchanged in its recent meeting and signalled that policy is appropriate to support sustained expansion of economic activity. Fed also said that it is closely monitoring the severity of the deadly coronavirus and potential disruption to the global economy.

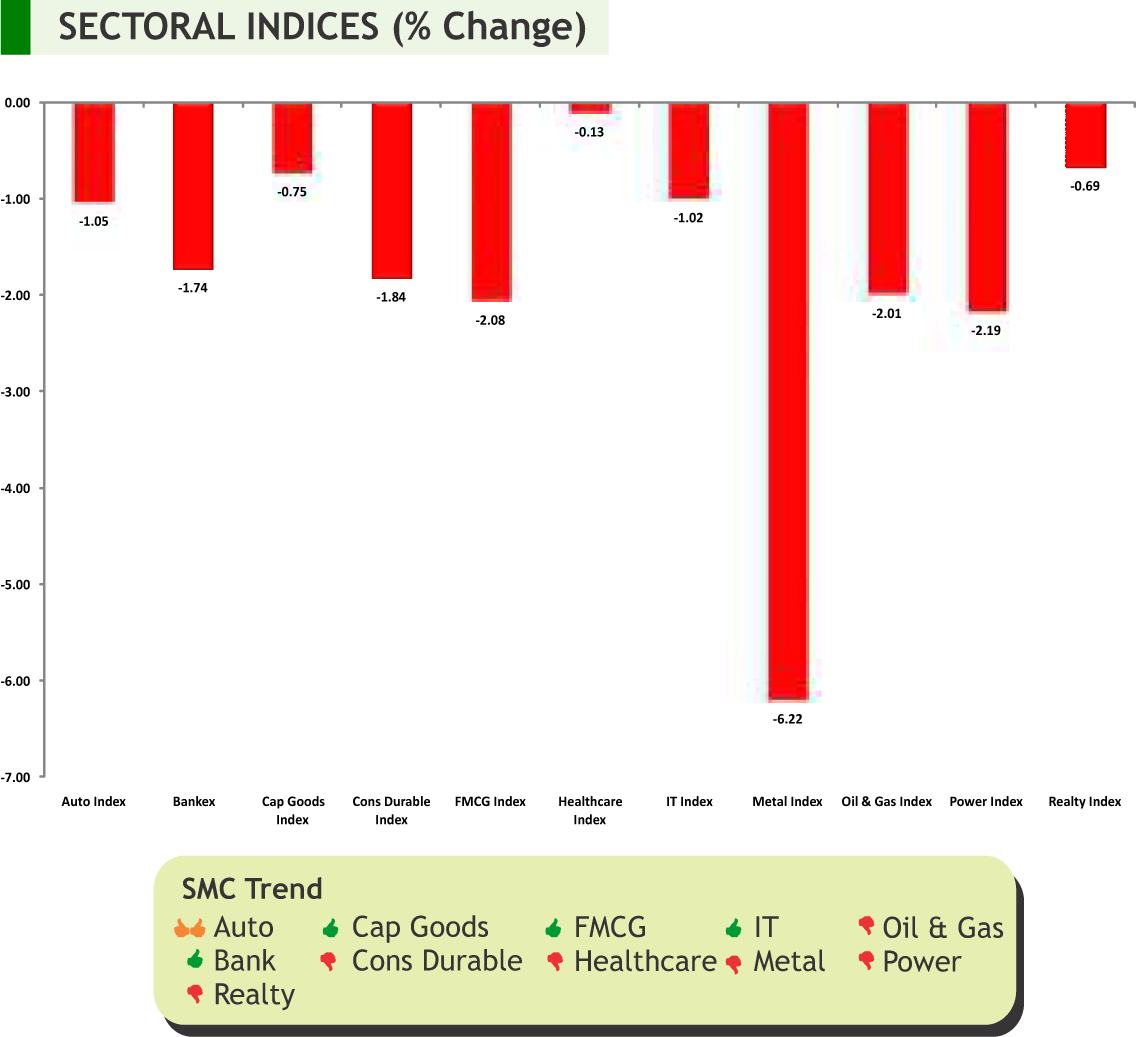

On the domestic front, market continued to trade in a volatile mood as investors remained cautious ahead of the Union Budget later this week and January F&O expiry. Besides other sectors, metal sector looked pressured amid fears of falling demand for commodities due to the coronavirus outbreak in the world's top metals consumer China. In the upcoming budget, it is expected that government would announce some measures to give strong support to the economy and boost demand. Finance minister is expected to rise spending on infrastructure and cut some personal tax. There is large expectation among investors that government may abolish DDT and tweak long term Tax, which will help in increasing money flow through equities. Going forward, market would take direction from the budget announcement which is scheduled on 1st February, 2020 and at the same time will keep close eye on Corona Virus updates.

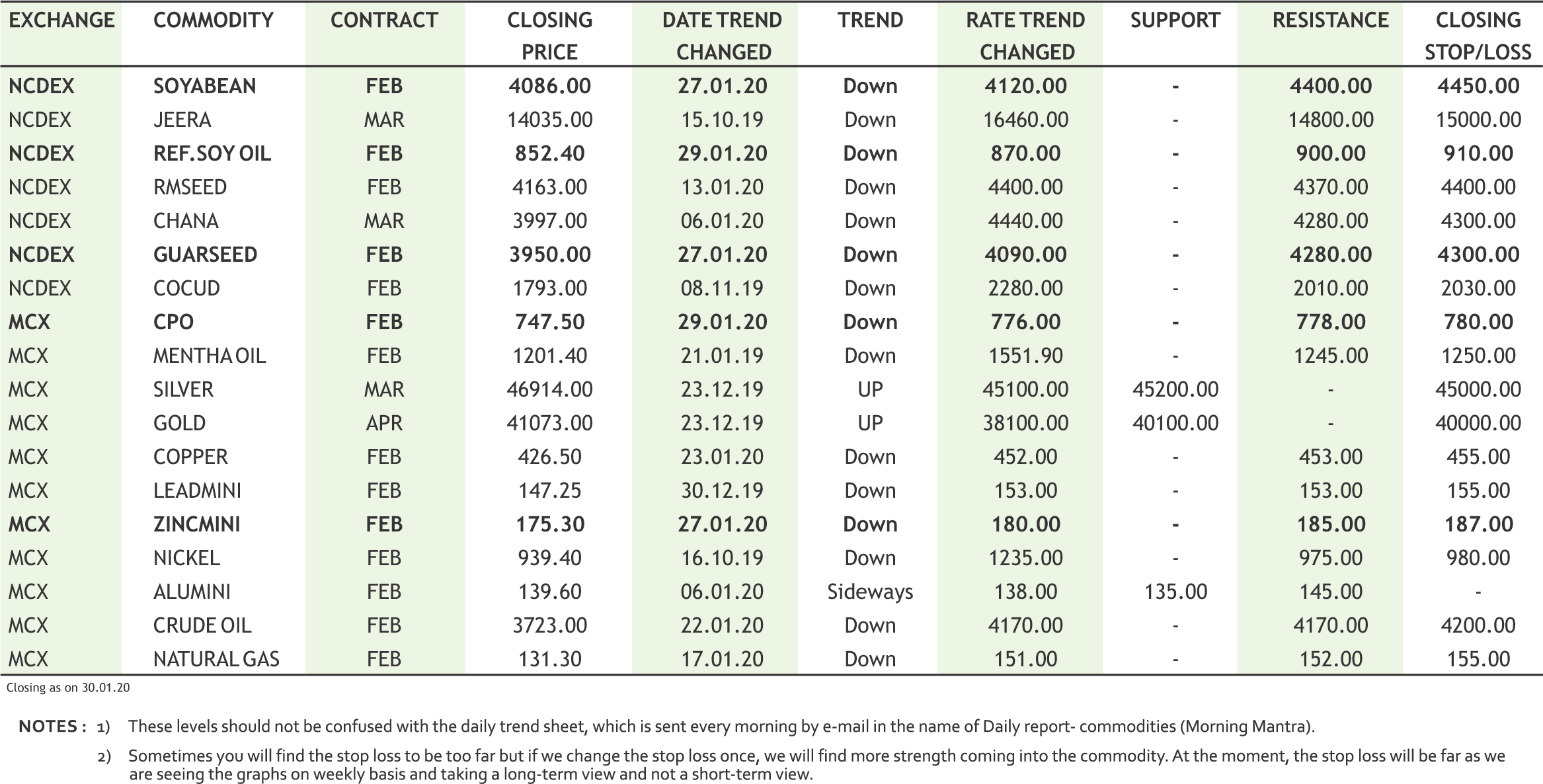

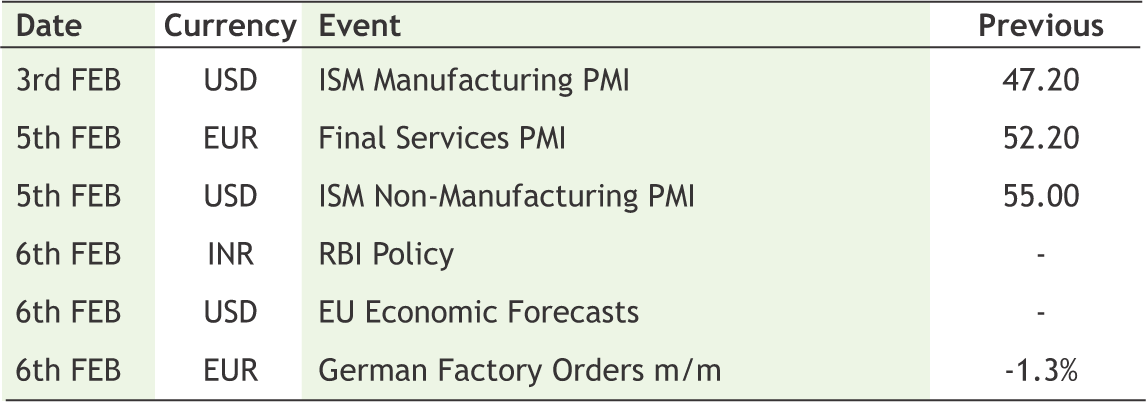

On the commodity market front, the world and financial market are eyeing on the update of outbreak of corona virus in China and other countries. It has raised the fear factor in markets. Bullion counter can extend its upside momentum as concern of a slowdown in global growth due to a virus outbreak and rise in US treasury yields will keep the prices well supported. Gold may move upside towards 41500 levels while taking support near 40500 levels whereas silver may move towards 47500 levels while taking support near 45500 levels. Crude oil prices may remain on weaker path as spread of coronavirus is keeping the sentiments down. Crude oil may dip lower towards 3600 levels while facing resistance near 4200 levels. RBC Canadian Manufacturing PMI, ISM Employment, ISM Manufacturing, ISM NonManufacturing/Services Composite, Change in Non-farm Payrolls and Unemployment Rate of US, Unemployment Rate of Newzeland and Canada etc are strong triggers for commodities market this week.

SMC Global Securities Ltd. (hereinafter referred to as “SMC”) is a registered Member of National Stock Exchange of India Limited, Bombay Stock Exchange Limited and its associate is member of MCX stock Exchange Limited. It is also registered as a Depository Participant with CDSL and NSDL. Its associates merchant banker and Portfolio Manager are registered with SEBI and NBFC registered with RBI. It also has registration with AMFI as a Mutual Fund Distributor.

SMC is a SEBI registered Research Analyst having registration number INH100001849. SMC or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities market.

SMC or its associates including its relatives/analyst do not hold any financial interest/beneficial ownership of more than 1% in the company covered by Analyst. SMC or its associates and relatives does not have any material conflict of interest. SMC or its associates/analyst has not received any compensation from the company covered by Analyst during the past twelve months. The subject company has not been a client of SMC during the past twelve months. SMC or its associates has not received any compensation or other benefits from the company covered by analyst or third party in connection with the research report. The Analyst has not served as an officer, director or employee of company covered by Analyst and SMC has not been engaged in market making activity of the company covered by Analyst.

The views expressed are based solely on information available publicly available/internal data/ other reliable sources believed to be true.

SMC does not represent/ provide any warranty express or implied to the accuracy, contents or views expressed herein and investors are advised to independently evaluate the market conditions/risks involved before making any investment decision.

DOMESTIC NEWS

Oil & Gas

• Hindustan Petroleum Corporation Limited (HPCL) almost exhausted its entire planned capital expenditure for this financial year in the first nine months, much faster than the average 67% for all state-run oil companies during April-December 2019.

Engineering

• Larsen & Toubro (L&T) said its construction arm has bagged a "large" order from Narmada Valley Development Authority for executing a micro-irrigation project. The company, however, did not provide the exact value of the contract, but according to its project classification, "large" orders are those valued between Rs 2,500 crore and Rs 5,000 crore.

Pharmaceuticals

• Biocon said the US health regulator conducted a pre-approval inspection and good manufacturing practice (GMP) examination of the API manufacturing facility and has issued a Form 483, with five observations.

• Alembic Pharmaceuticals said its joint venture firm Aleor Dermaceuticals has received approval from the US health regulator to market a generic product, which is used to treat various skin conditions, in the American market.

• Alembic Pharmaceuticals has received a final nod from the US health regulator for Azithromycin tablets, used for the treatment of infections. Azithromycin tablet is a macrolide antibacterial drug indicated for mild to moderate infections.

Automobile

• Hero MotoCorp has commenced despatching of its first BS-VI compliant scooter model -- Pleasure+ 110 FI. The scooter in BS-VI avatar is priced at Rs 54,800 for self-start sheet wheel and Rs 56,800 for self-start alloy wheel trim.

• Force Motors has lined up Rs 600 crore in fresh investment to develop two new models over the next two years. The proposed new models in the shared mobility space will come out from its soon-to-be-launched premium platform, code-named T1N, an export-focused premium van developed with an investment of Rs 1,000 crore and is getting ready for commercial production by the end of the year.

Miscellaneous

• Reliance Industries, India's largest petchem player, is launching a project to use plastics in road construction, amid growing concerns over pollution in the country of 1.3 billion whose major cities are often plagued with smog and litter.

INTERNATIONAL NEWS

• US real gross domestic product climbed by 2.1 percent in the fourth quarter, unchanged from the third quarter and in line with economist estimates.

• US initial jobless claims fell to 216,000, a decrease of 7,000 from the previous week's revised level of 223,000. Economists had expected jobless claims to inch up to 215,000 from the 211,000 originally reported for the previous week.

• US pending home sales index plunged by 4.9 percent in December after jumping by 1.2 percent in November. Economists had expected pending home sales to rise by 0.5 percent.

• Eurozone Inflation rose to 1.4 percent from 1.3 percent in December. The rate came in line with expectations.

• Eurozone Gross domestic product edged up 0.1 percent sequentially, slower than the 0.3 percent expansion seen in the third quarter and the forecast of 0.2 percent.

• Japan's Housing starts decreased 7.9 percent year-on-year in December, following a 12.7 percent drop in November. This was the sixth consecutive decrease in housing starts. Economists had forecast an annual 11.1 percent fall.

| Stocks | *Closing Price | Trend | Date Trend Changed | Rate Trend Changed | SUPPORT | RESISTANCE | Closing S/l |

|---|---|---|---|---|---|---|---|

| S&P BSE SENSEX | 40723 | UP | 08.02.19 | 36546 | 36300 | 35300 | |

| NIFTY50 | 11962 | UP | 08.02.19 | 10944 | 10900 | 10600 | |

| NIFTY IT | 16144 | UP | 21.07.17 | 10712 | 15200 | 14800 | |

| NIFTY BANK | 30834 | UP | 30.11.18 | 26863 | 27700 | 27000 | |

| ACC | 1505 | UP | 23.01.2020 1 | 1548 | 1500 | 1470 | |

| BHARTIAIRTEL | 496 | UP | 15.03.19 | 338 | 480 | 460 | |

| BPCL | 457 | UP | 30.08.19 | 355 | - | 450 | |

| CIPLA | 447 | UP | 25.10.19 | 460 | - | 440 | |

| SBIN | 318 | UP | 01.11.19 | 314 | 315 | 305 | |

| HINDALCO | 189 | DOWN | 31.01.20 | 189 | 200 | 205 | |

| ICICI BANK | 526 | UP | 20.09.19 | 418 | 510 | 500 | INFOSYS | 776 | UP | 20.12.19 | 732 | 750 | 730 |

| ITC | 235 | DOWN | 31.05.19 | 279 | 250 | 255 | |

| L&T | 1369 | DOWN | 15.11.19 | 1378 | - | 1380 | |

| MARUTI | 6913 | DOWN | 31.01.20 | 6913 | 7300 | 7400 | |

| NTPC | 113 | DOWN | 16.08.19 | 118 | 120 | 124 | |

| ONGC | 109 | DOWN | 06.12.19 | 127 | 122 | 127 | |

| RELIANCE | 1412 | DOWN | 31.01.20 | 1412 | 1500 | 1530 | |

| TATASTEEL | 439 | DOWN | 31.01.20 | 439 | 470 | 485 | |

Closing as on 31-01-2020

NOTES:

1) These levels should not be confused with the daily trend sheet, which is sent every morning by e-mail in the name of "Morning Mantra ".

2) Sometimes you will find the stop loss to be too far but if we change the stop loss once, we will find more strength coming into the stock. At the moment, the stop loss will be far as we are seeing the graphs on weekly basis and taking a long-term view and not a short-term view.

| Meeting Date | Company name | Purpose |

|---|---|---|

| 3-Feb-20 | Tata Chemicals | Financial Results |

| 3-Feb-20 | SRF | Financial Results/Dividend |

| 4-Feb-20 | Bharti Airtel | Financial Results |

| 4-Feb-20 | Tata Global Beverages | Financial Results |

| 4-Feb-20 | TVS Motor Company | Financial Results |

| 4-Feb-20 | Titan Company | Financial Results |

| 4-Feb-20 | Punjab National Bank | Financial Results |

| 4-Feb-20 | Exide Industries | Financial Results |

| 4-Feb-20 | Adani Ports and SEZ | Financial Results |

| 5-Feb-20 | HPCL | Financial Results |

| 5-Feb-20 | IndiabullsHousingFinan. | Financial Results/Dividend |

| 5-Feb-20 | DLF | Financial Results/Dividend |

| 5-Feb-20 | Divi's Laboratories | Financial Results |

| 5-Feb-20 | Adani Enterprises | Financial Results |

| 5-Feb-20 | Apollo Tyres | Financial Results |

| 6-Feb-20 | Aurobindo Pharma | Financial Results/Dividend |

| 6-Feb-20 | Sun Pharmaceutical Ind. | Financial Results |

| 6-Feb-20 | United Breweries | Financial Results |

| 6-Feb-20 | Lupin | Financial Results/Other business matters |

| 6-Feb-20 | Hero MotoCorp | Financial Results |

| 7-Feb-20 | Britannia Industries | Financial Results/Fund Raising |

| 7-Feb-20 | Voltas | Financial Results |

| 7-Feb-20 | Tata Steel | Financial Results |

| 7-Feb-20 | UPL | Financial Results |

| 7-Feb-20 | NCC | Financial Results |

| 7-Feb-20 | Container Corp. of India | Financial Results/Other business matters |

| 8-Feb-20 | Mahindra & Mahindra | Financial Results |

| 10-Feb-20 | MRF | Financial Results/Dividend |

| 10-Feb-20 | GAIL (India) | Financial Results |

4

5

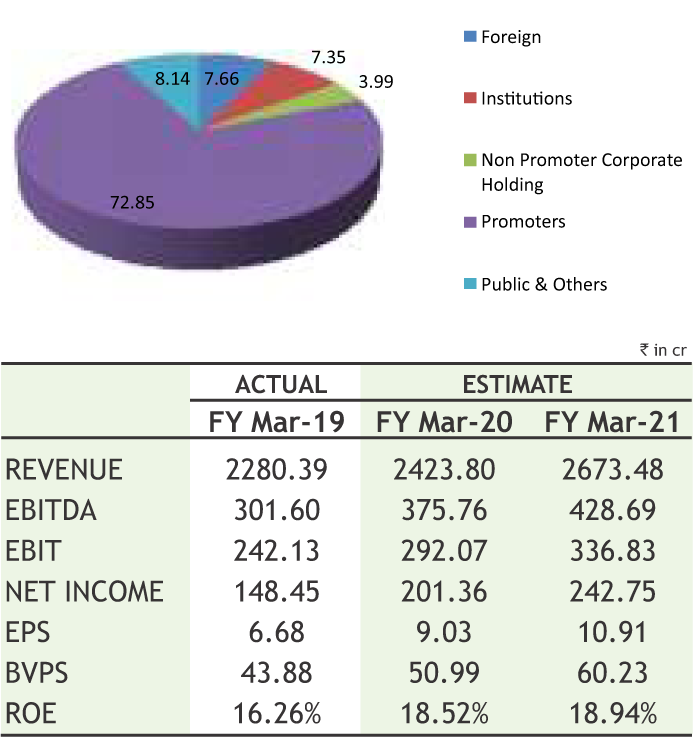

Century Plyboards (India) Limited

CMP: 170.00

Target Price: 237

Upside: 40%

| Face Value(Rs.) | 1.00 |

| 52 Week High/Low | 222.35/112.30 |

| M.Cap (Rs. in Cr.) | 3776.94 |

| EPS (Rs.) | 7.82 |

| P/E Ratio (times) | 21.74 |

| P/B Ratio (times) | 3.65 |

| Dividend Yield (%) | 0.59 |

| Stock Exchange | BSE |

Investment Rationale

• The management has highlighted segment-wise guidance for FY2020. The plywood division is expected to grow at 2-3% y-o-y with operating margin of 14%. The laminate division is expected to grow at 15%+ with operating margin of 12%. MDF is expected to grow by clock a more than 20% revenue growth with operating margin of more than 20% while the particle board division is expected to grow at 10% with a 25% operating margin. Overall, the management of the company has guided for double digit revenue growth, 15% operating margin and 11% PBT margin for FY2020.

• On the development front and on the basis of optimum capacity utilization of its MDF and particle board plant, the company is planning a greenfield expansion for MDF and particle board in UP. The company is working on the project and is yet to announce the final details of the plant. With the licence already in place, the company is working on finding suitable land.

• On the development front, the company is setting up five lines with installed capacity of 2,000 cubic metre per month for timber and 1,500 cubic metre for Veneer at Gabon. The management expects production at Gabon to start in Q4FY2020 (February-March 2020). The Gabon unit will be producing Acumae Veneer (30% cheaper than Garjan) which will be used by the company for its cheaper products.

• During the Q2FY20, the company has reported 37 per cent rise in net profit to over Rs.52 crore as compared to Rs. 38 crore, Q2 FY19. Net revenue from operations during the quarter stood at ₹589.35 crore; an increase of over 4 per cent compared with the corresponding quarter

(₹564.44 crore). Favorable market conditions, lower commodity prices and better sales volume have led to significant margin improvement.

Risk

• Subdued demand due to liquidity crunch.

• Fluctuations in raw material prices.

Valuation

The company has strong track record on quarterly as well as yearly basis. According to the management, Capacity addition across segments would boost revenue and profitability going ahead. The Central Government took number ofinitiatives to strengthen prospects ofthe country’s residential real estate sector; this is expected to drive prospects of the interior infrastructure industry. Government push for the affordable housing is another big trigger for the company. Century Ply has strong financials with robustreturn ratios and it has under gone significant capex since last few years and able to maintain its operating cash positive. Thus, itis expected that the stock will see a price target of Rs.237 in 8 to 10 months time frame on a current P/Ex of 21.74x and FY21 EPSofRs.10.91.

Granules India Limited

CMP: 146.10

Target Price: 178

Upside: 22%

| Face Value (Rs.) | 1.00 |

| 52 Week High/Low | 161.00/83.70 |

| M.Cap (Rs. in Cr.) | 3714.56 |

| EPS (Rs.) | 12.88 |

| P/E Ratio (times) | 11.34 |

| P/B Ratio (times) | 2.18 |

| Dividend Yield (%) | 0.68 |

| Stock Exchange | BSE,NSE,MSEI |

Investment Rationale

• Granules India Limited is a pharmaceutical company with presence across the pharmaceutical manufacturing value chain, including active pharmaceutical ingredients (APIs), pharmaceutical formulation intermediaries (PFIs) and finished dosages (FDs).

• The company’s major focus would be on the bottom line which is expected to be driven by better product mix, new launches from the company, and contribution from the new facility in Vizag and Metformin facility andnewOncology facility (yettobe commercialized). The Vizag facility has been commissioned and is expected to break-even in FY21 andcontributesmeaningfullyfromFY22.

• During Q3FY20, it has reported a profit of Rs 64.03 crore up by 6.16%yoy,impacted by an impairmentloss of Rs 32 crore in Granules-Biocause Pharmaceutical, whichisnowbeing soldby thecompany.Revenuefrom operations in Q3 grew 11.4 percent YoY to Rs 704 crore. For the next three years, the management of thecompanyexpectsa25%PATCAGR.

• The company has received 3 ANDA approvals and has filed 2ANDAs this quarter.As onDecember 2019,there are19ANDAsawaitingapprovals.

• Recently, the company has approved a proposal to Buy-back up to 1.25 crore equity shares of the Company for an aggregate amount not exceeding Rs. 250 crores, being 4.92% of the total paid-up equity share capital, at Rs.200/- per equity share. The management said that the buyback is being done to reward shareholders as well as to reduce the promoter’spledge.

• From the concall of Q3 FY20, Capex during 9M FY20 was Rs. 129 crore and the company guided to FY20

capex of Rs 150 crore.The nextround of huge capacity addition would be after 3-4 years and the company aims tomaintainadebt-EBITDAratioof1x.

• The gross debt as on December 2019 stood at Rs 902 crore as compared to Rs 1,040 crore at the end of Q3FY19.

Risk

• Promoter Pledging

• Increase in R&D spend

Valuation

The company has a healthy balance sheet with strong cash balance; it has continued same performance and reported good bottom line due to growing profitability from its joint venture companies. Moreover, the management has committed towards adhering to regulations and standards benchmarked globally and produce quality drugs forits marquee clients which are giving good strength to the company. Thus, it is expected thatthe stock will see a price target of Rs.178 in 8 to 10 months time frame on a one year average P/Ex of 11.34x and FY21 EPS of Rs.15.69.

Source: Company Website Reuters Capitaline

Above calls are recommended with a time horizon of 8 to 10 months.

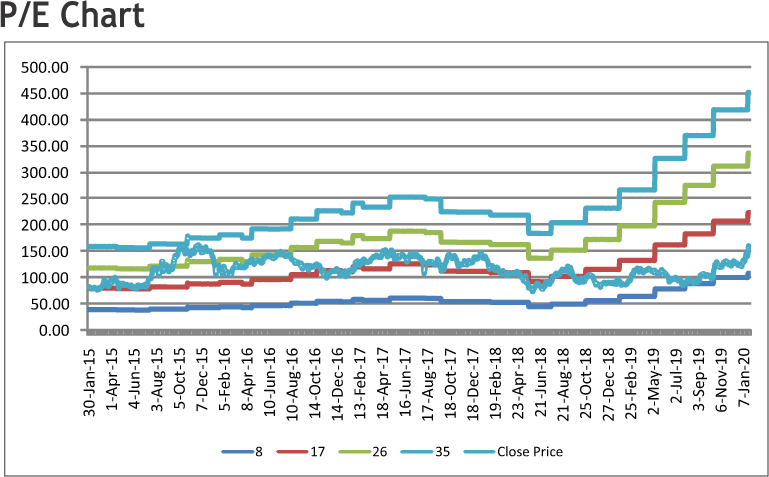

6

The stock closed at Rs 796.60 on 31st January 2020. It made a 52-week low of Rs 607.15 on 31st July 2019 and a 52-week high of Rs. 846.50 on 02nd May 2019. The 200 days Exponential Moving Average (DEMA) of the stock on the daily chart is currently at Rs 742.93

As we can see on chart that stock is trading in higher highs and higher lows on weekly charts which is bullish in nature. Apart from this, it has formed an

“Inverted Head and Shoulder” pattern on daily charts and has given the breakout of same. So buying momentum may continue in coming days. Therefore, one can buy in the range of 784-790 levels for the upside target of 860-880 levels with SL below 755.

The stock closed at Rs 385.70 on 31st January, 2020. It made a 52-week low at Rs 252.00 on 14th February 2019 and a 52-week high of Rs. 387.50 on 31st January 2020. The 200 days Exponential Moving Average (DEMA) of the stock on the daily chart is currently at Rs 315.98

Short term, medium term and long term bias are positive for the stock as it is trading in uptrend. Stock has formed a “Continuation Triangle” on weekly charts, which is bullish in nature. Last week, stock has given the breakout of same and also has managed to close above the breakout of pattern. So follow up buying may continue for coming days. Therefore, one can buy in the range of 376-380 levels for the upside target of 415-430 levels with SL below 355.

Disclaimer : The analyst and its affiliates companies make no representation or warranty in relation to the accuracy, completeness or reliability of the information contained in its research. The analysis contained in the analyst research is based on numerous assumptions. Different assumptions could result in materially different results.

The analyst not any of its affiliated companies not any of their, members, directors, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of the analysis research.

SOURCE: CAPITAL LINE

Charts by Spider Software India Ltd

Above calls are recommended with a time horizon of 1-2 months

7

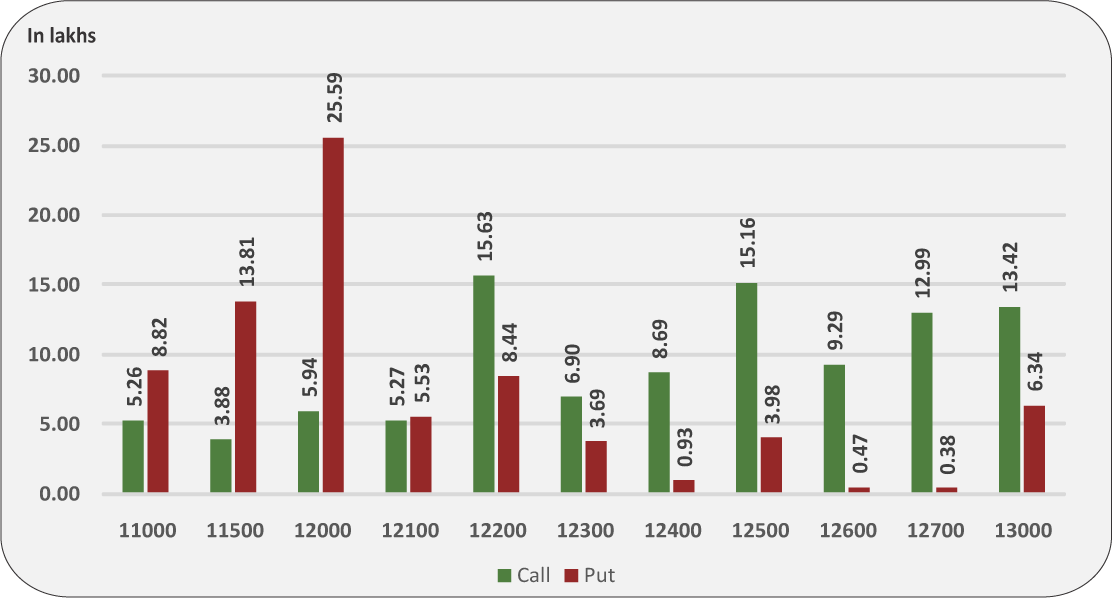

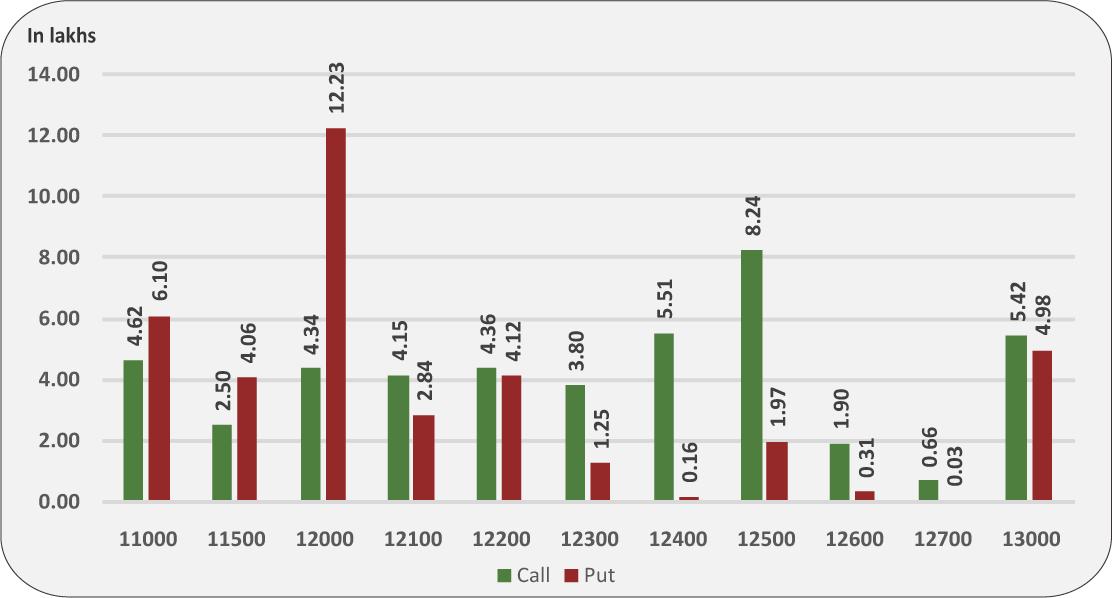

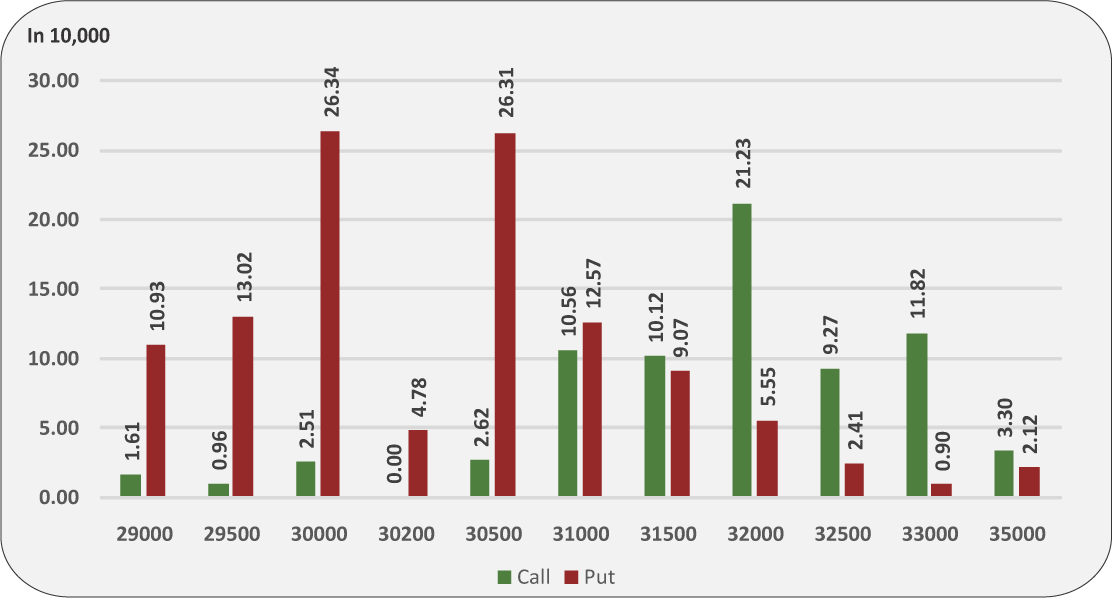

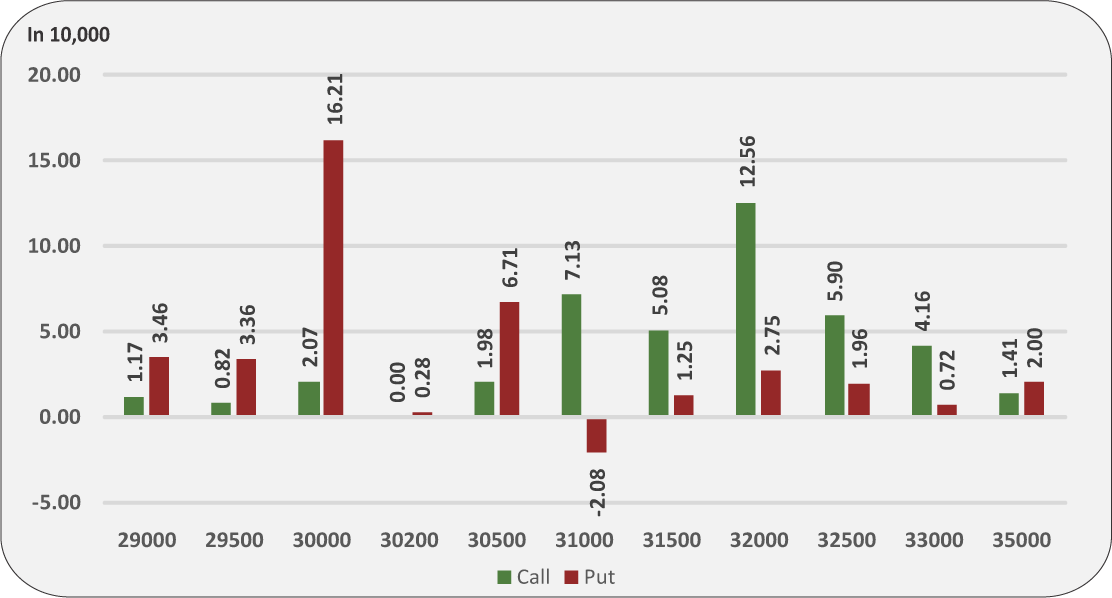

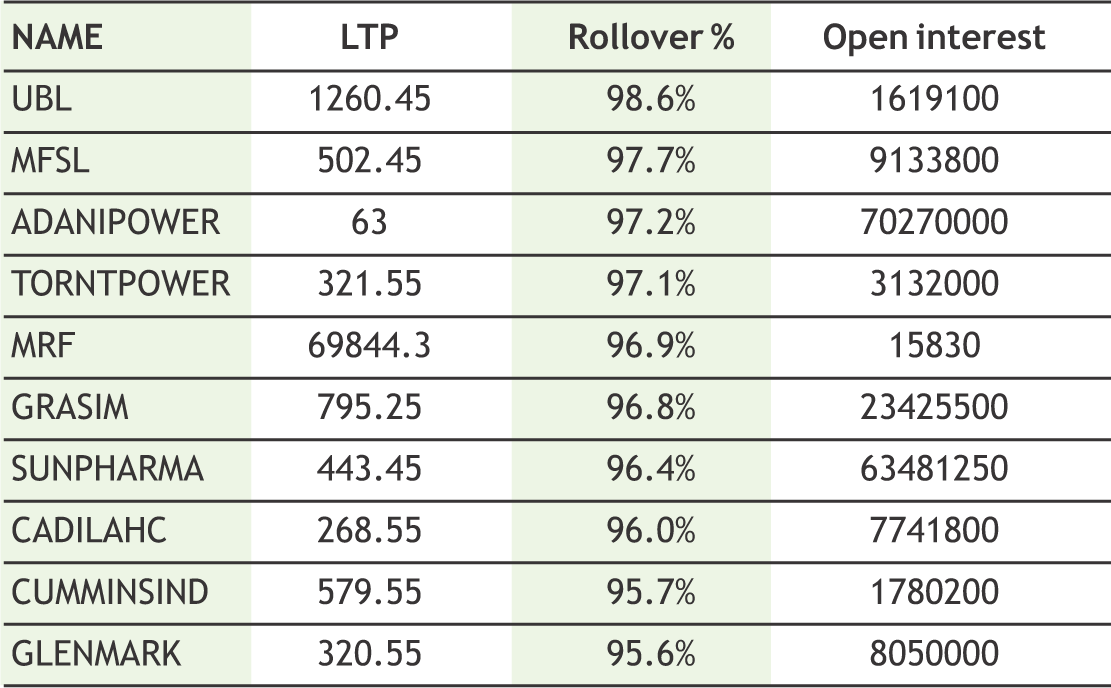

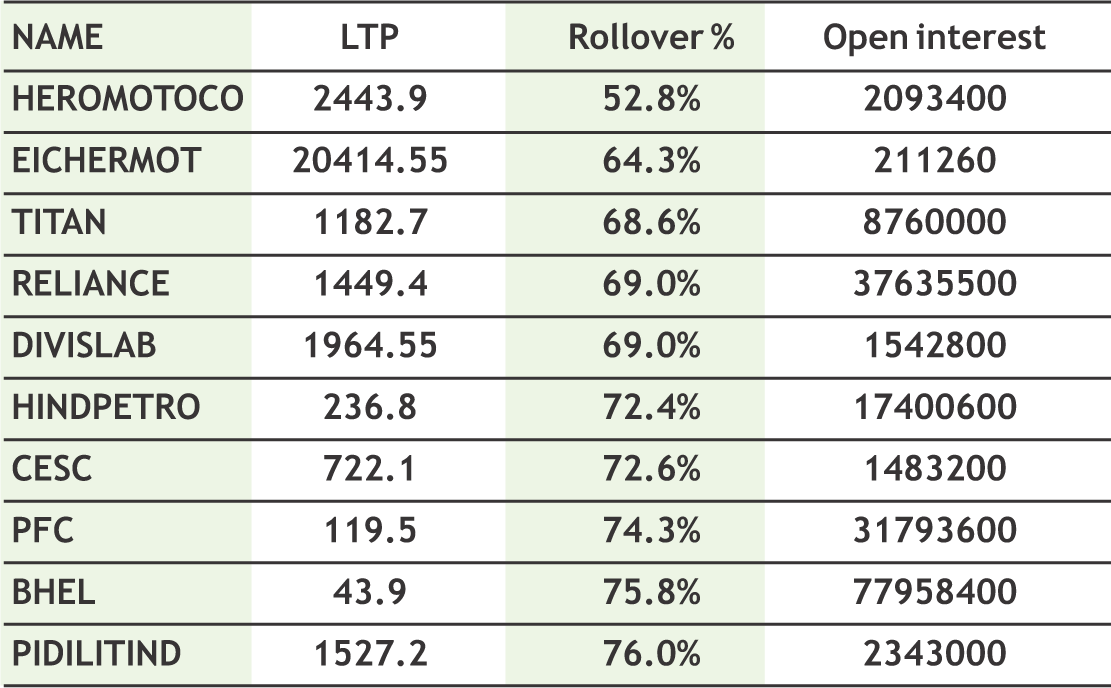

Overall derivative data indicates short rollover to Feb series, and most of the Nifty Feb futures positions have been rolled over in the range of 12050 - 12075. Derivative data indicates bearish scenario to continue. Nifty has multiple resistances at higher levels. Various resistance are 12200, 12300 spot levels. Short buildup and long unwinding are seen on every rise. In the Feb option contracts, maximum options open interest building up was seen in 11800 puts and 12200 calls. In option data, shifting of range towards lower band is seen. Market Undertone is likely to remain bearish. The Implied Volatility (IV) of calls was up and closed at 16.27% while that for put options closed at 16.80%. The Nifty VIX for the week closed at 16.80% and is expected to remain volatile. PCR OI for the week closed at 1.04, which indicates OTM call writing. On the technical front, 11800-11750 spot levels is support zone. Budget should be the next trigger for markets; however data formation before budget is tilted towards weakness.

8

|

|

|

|

**The highest call open interest acts as resistance and highest put open interest acts as support.

# Price rise with rise in open interest suggests long buildup | Price fall with rise in open interest suggests short buildup

# Price fall with fall in open interest suggests long unwinding | Price rise with fall in open interest suggests short covering

9

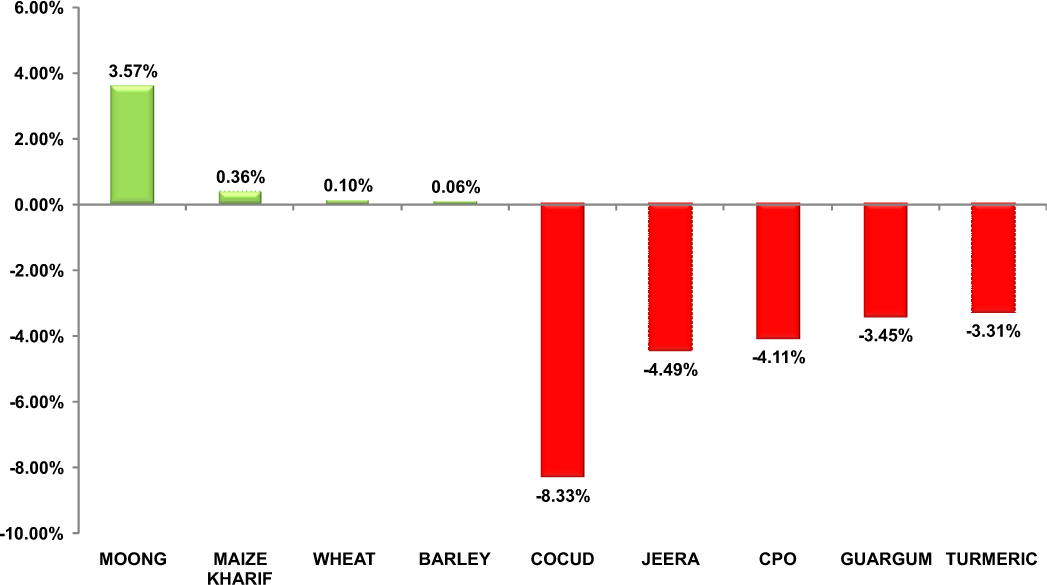

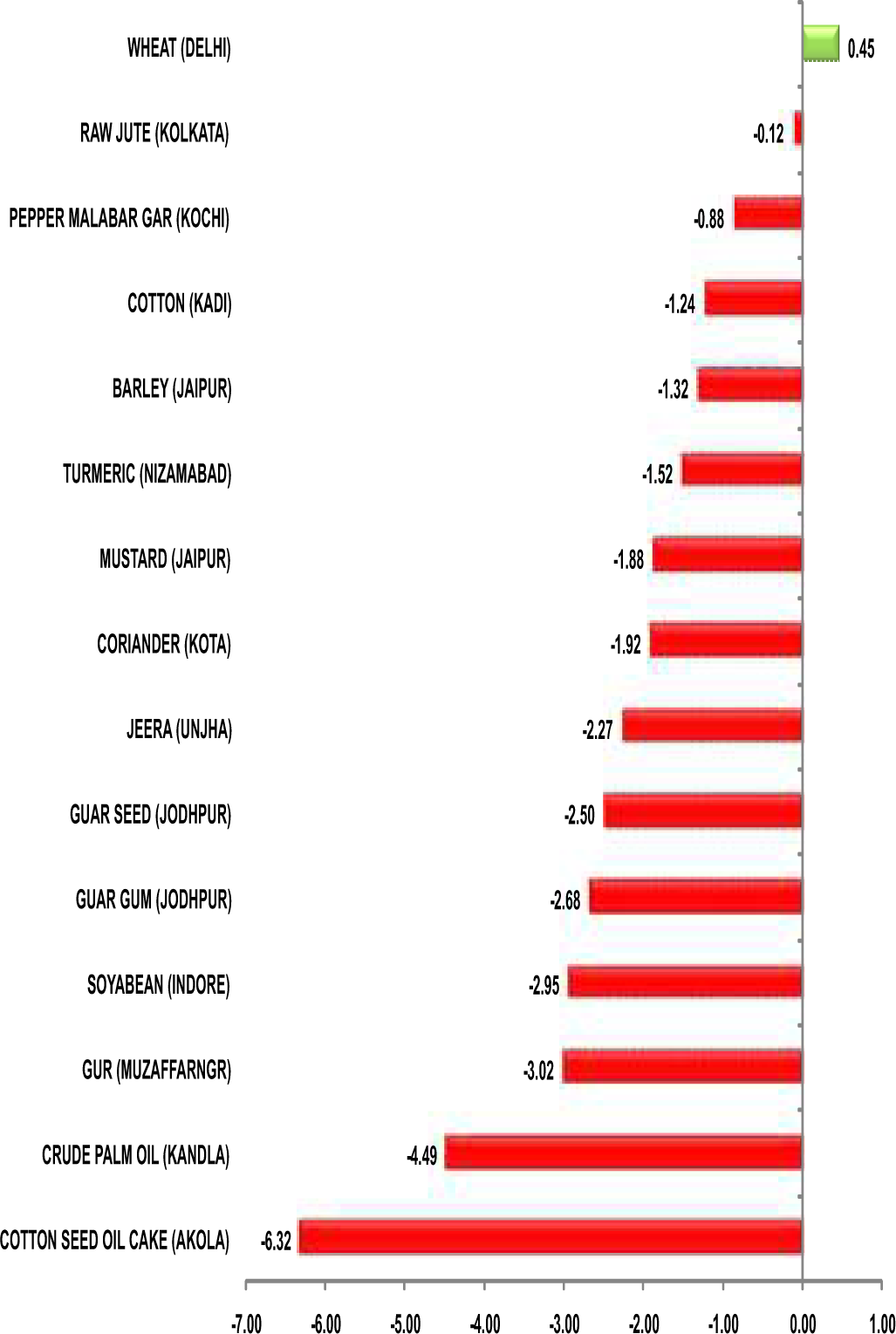

Turmeric futures (Mar) may witness correction for the second consecutive week towards 5825, facing resistance near 6190 levels. According to traders, apart from Nizamabad and Erode, there is sporadic arrival of new crops in Maharashtra as well. Currently, the new Mysore-8 turmeric is arriving for sale& traders are waiting for upcountry demand to pick up as at present, there is only a little local demand. At the Erode Turmeric Merchants Association Salesyard, finger turmeric was sold at Rs.6,169-7,189 a quintal and root variety at Rs.5,644-6,307. At the Erode Cooperative Marketing Society, finger turmeric was sold at Rs.5,888-7,039 and root variety at Rs.5,513-6,589. Last month, jeera futures have descended by more than 15% on the back of estimates a bigger crop this year. The overall sentiment is weak as sharp increase in acreage has been seen in Gujarat and Rajasthan and favourable weather conditions across the growing regions. The growers in Rajasthan and Gujarat are expecting about 25-30% higher yield over last year. As the sowing was delayed, the harvest will also get extended to March instead of the usual February. This is keeping the big traders on the sidelines. Dhaniya futures (Apr) may continue to face resistance near 7000-7100 & the upside may remain capped. Demand is weak and market participants are waiting for fresh arrivals, which are expected in the middle of February. According to traders, the sowing has been good in in the major growing regions, which has boosted the new crop estimates. Sharp increase in acreage in Gujarat and Rajasthan and favourable weather conditions may lead to a rise in yield.

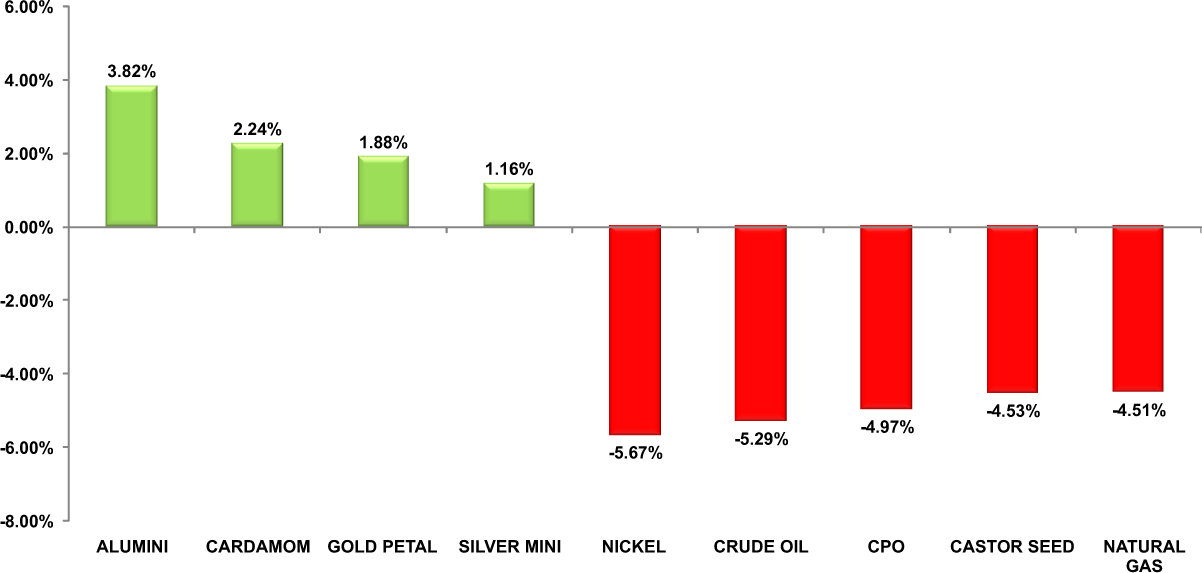

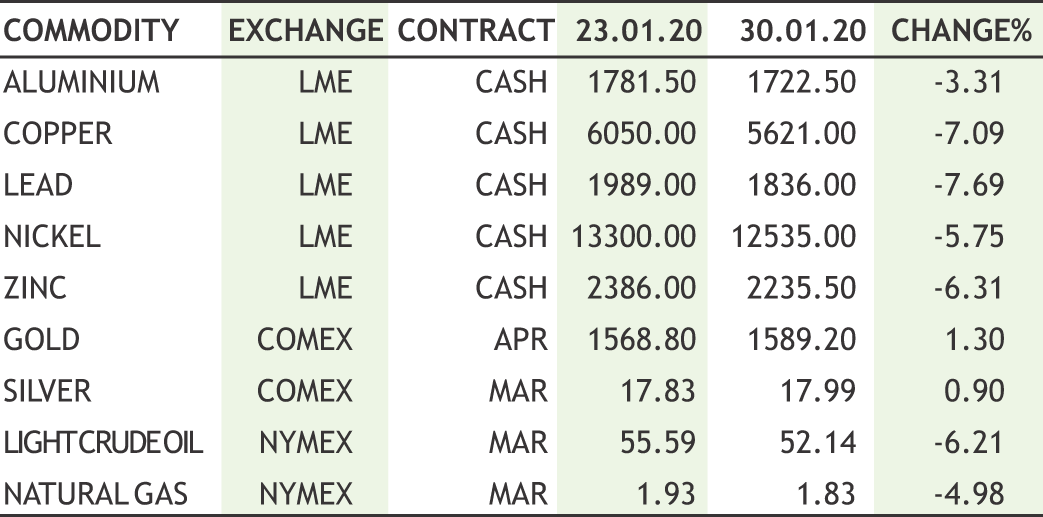

Bullion counter can extend its upside momentum as concern of a slowdown in global growth due to a virus outbreak , fall in global equities markets and rise in US treasury yields will keep the prices well supported. Federal Reserve Chair Jerome Powell also noted the risks of a short-term slowdown in China, including to the U.S economy, after the central bank’s widely expected decision to keep interest rates unchanged. The United States Federal Reserve held interest rates steady at 1.5 -1.75% at its first policy meeting of the year, with officials pointing to continued moderate US economic growth and a "strong" job market. The World Health Organization declared that the coronavirus epidemic in China now constitutes a public health emergency of international concern. The new coronavirus has claimed 213 lives so far in China and has spread to at least 22 countries, while paralyzing many provinces in the world’s second-largest economy with lockdowns, travel restrictions and closed businesses. The declaration of a global emergency triggers recommendations to all countries aimed at preventing or reducing cross-border spread of disease, while avoiding unnecessary interference with trade and travel. Gold may move upside towards 41500 levels while taking support near 40500 levels whereas silver may move towards 47500 levels while taking support near 45500. Meanwhile global demand for gold fell in the last three months of last year as sales of gold jewellery, bars and coins declined alongside purchases by central banks and financial investors.

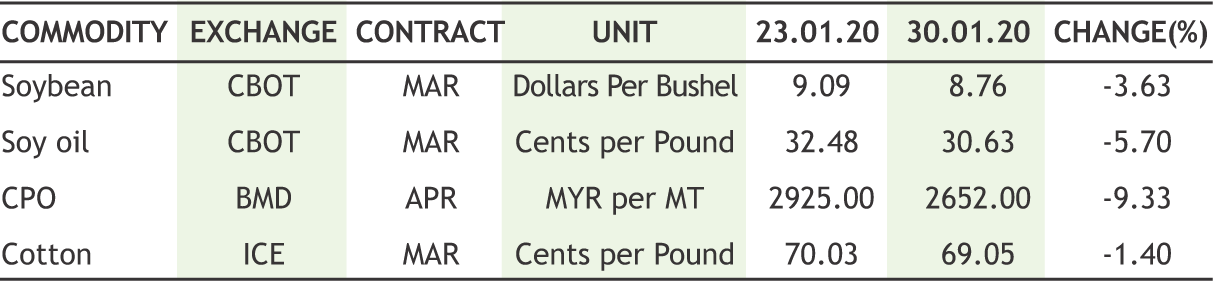

The one & only factor which has dented the sentiments of the oilseeds complex globally is the outbreak of coronavirus in China, due to which the demand has slowed down from the highest consuming nation of edible oils & soybean. In days to come, this virus may induce more fear in the commodities market. Analyzing these negative factors, it is expected that we may see more of a selling pressure in the oilseeds. In the domestic market, soybean futures (Feb) may trade sideways to down in the range of 3910-4130 levels taking negative cues from the international market. In days to come, more correction can be seen in mustard futures (Feb) as it can trade lower towards 4040-4000 levels. This season, production can be at a record high of 9.7 million tons in 2019-20 (Jul-Jun), up from 9.3 million tons. The yield could rise over 1.4 tons per hectare due to ample moisture content in the soil. The current status of the crop is that pod formation has started in early sown crop while the late sown crop is at flowering stage. CPO futures (Feb) may continue to slide down to 720-710; while soy oil futures (Feb) may retest its previous week low near 820. The increasing death tolls & people getting affected have raised a doubt over the trade in global oilseed market and Chinese purchases in the months ahead. As of now, it is unclear how soon the epidemic will be contained. Recently, the World Health Organization declared the outbreak a global emergency after cases were discovered in more than a dozen countries.

Crude oil prices may remain on weaker path as spread of coronavirus is keeping the sentiments down. Until this, fear does not vanish the sharp downtrend in oil is also unlikely to be reversed. The curbs for China outbound tourism and international carrier halt flights will reduce demand of crude by 5,00,000bpd. Crude oil may dip lower towards 3600 while facing resistance near 4200. Meanwhile some short covering cannot be denied as Saudi Arabia has opened discussion about moving upcoming output policy meeting to early February from March following the recent slide in oil prices. No final decision over the new date of the meeting has been made, and not all OPEC members are on board yet, with Iran a possible contender to oppose the move, OPEC wants to extend current oil output cuts until at least June from March, with the possibility of deeper reductions on the table if oil demand in China is significantly impacted by the spread of the coronavirus. Energy Information Administration reported that U.S. crude supplies rose by 3.5 million barrels for the week ended Jan 24. The EIA’s data showed a weekly climb was the largest since the 7.9 million-barrel rise reported for the week ended Nov. 1. Natural gas can remain on weaker bias as weather is expected to remain warmer than normal as it can further slip lower towards 120 by taking resistance near 150. The fact that winter has been relatively mild in the United States and 17 % excess gas production last year have resulted in huge glut of natural gas.

The trend as well as sentiments attached to cotton in international as well as in the domestic market is bearish owing to outbreak of coronavirus in China. This epidemic has dented the export demand from U.S & India to China. The virus has spread to more than 8,100 people globally, surpassing the 2002-2003 SARS epidemic's total fueling fears. Any signs of disruption in cotton shipments to China could pressure prices that had been recovering from three-year lows. Saying this, ICE cotton futures may break the support near 68 & can crash to 67-65 cents per pound. Following it footsteps, cotton futures (Feb) is likely to trade lower towards 19050-18800 levels. Chana futures (Mar) is expected to trade with a downside bias & test 3850-3800 levels. The sentiments are reeling under pressure due to improvement in Rabi Chana sowing and Government agencies holding major stocks. As per market view, millers will most likely purchase new Chana from Karnataka & Maharashtra as it trades below Rs.4,000/100Kg, instead of purchasing old Nafed procured Chana. Availability of new Chana at lower price will drag chana prices further down. Mentha oil futures (Jan) may breach its previously low near 1190 levels & witness further correction towards 1175-1150 levels. Firstly, this season the area under mentha cultivation is expected to be higher. Secondly, this year the farmers of Sambhal, Badaun and Chandausi in discussion with agricultural scientists in Badaun have decided to work on using the right technology to reduce the cost of the farmer and increase production. Also, emphasis will be laid on the use of drip method to reduce the cost of crop irrigation.

Base metal counter may remain on weaker path. Copper may dip further lower towards 420 levels while taking resistance near 440 levels. Copper tanked to a 5 month low correcting by over 12% in last 15 days as funds sold on expectations of slowing demand in China, where a coronavirus outbreak has raised the prospect of an economic slowdown. Copper prices are expected to be sustained by low stocks in LME warehouses, which at 182,550 tonnes are down more than 45% since the end of August 2019. Meanwhile, lead may remain in red as it can test 144 levels while taking resistance near 151 levels. Lead stocks on the LME fell to 50,025 tonnes, the lowest since July 26 last year. The premium for cash LME lead over the 3M contract rose to $12 a tonne, the highest since Oct. 31, indicating tighter supplies. Zinc may tumble lower towards 170 levels while facing resistance near 183. Global crude steel production rose to 1.87 billion tonnes last year, up 3.4% from 2018, as per World Steel Association. Nickel prices can further decline towards 900 while facing resistance near 985. Aluminium prices can move in range of 143-149 levels. Aluminium stocks held at three major Japanese ports at the end of December were down 2.2% at 314,000 tonnes from the previous month. U.S. President Donald Trump signed a proclamation increasing tariffs on derivative steel products by an additional 25 percent and boosting duties on derivative aluminum products by an additional 10 percent.

10

|

MENTHAMCX (FEB) contract closed at Rs. 1201.40 on 30th Jan’2020. The contract made its high of Rs. 1336.90 on 08th Jan’2020 and a low of Rs. 1196.00 on 31st Jan’2020. The 18-day Exponential Moving Average of the commodity is currently at Rs. 1245.32. On the daily chart, the commodity has Relative Strength Index (14-day) value of 22.534.

One can sell below Rs. 1190 for a target of Rs. 1120 with the stop loss of Rs. 1225.

NICKEL MCX (FEB) contract closed at Rs. 936.90 on 31st Jan’2020. The contract made its high of Rs. 1025.80 on 20th Jan’2020 and a low of Rs. 930.00 on 28th Jan’2020. The 18- day Exponential Moving Average of the commodity is currently at Rs. 976.92. On the daily chart, the commodity has Relative Strength Index (14-day) value of 32.471.

One can sell near Rs. 975 for a target of Rs. 880 with the stop loss of Rs. 1020.

JEERA NCDEX (MAR) contract was closed at Rs. 14035.00 on 30th Jan’2020. The contract made its high of Rs. 16235.00 on 11th Nov’19 and a low of Rs. 13780.00 on 31st Jan’2020. The 18-day Exponential Moving Average of the commodity is currently at Rs. 14761.15. On the daily chart,the commodity has Relative Strength Index (14-day) value of 17.742.

One can buy above Rs. 14200 for a target of Rs. 15500 with the stop loss of Rs 13550.

11

• The new coronavirus has been declared a global emergency by WHO, as the outbreak continues to spread outside China.

• Central banks added 650.3 tonnes (t) of Gold to global official gold reserves in 2019, 1% lower y-o-y but still the second largest in last 50 years. - World Gold Council

Indonesia will impose an export tax of $18 per tonne of crude palm oil from February for the first time in nearly three years.

• Area coverage under chickpeas in Australia in 2019-20 is expected to decline by 15% to 1.7 lakh ha.

• The government has cut sharply the reserve price of rice and wheat to help FCI offload bulk of its stock. Rice will now be sold at Rs.2,250/quintal, while wheat at Rs.2,135/quintal.

• China's crude oil imports from top supplier Saudi Arabia rose nearly 47% in 2019.

China official services PMI rose to 54.1, from 53.5 in December.

• Russia's oil and condensate production rose to 11.28 million barrels per day on Jan. 1-29 from 11.26 million barrels per day on average in December.

The world and financial markets eyed on the update of outbreak of coronavirus in China and other countries. It has raised fear and concern in markets across the globe. Safe haven buying returned in gold and it hit the mark of $1590 in comex but couldn’t sustain at higher side as after declaring emergency; THAT also showed its faith in China that it will control the virus in best possible way. In India, gold closed in green territory as depreciation in currency from past few weeks added premium in the prices. Silver saw some wild movements in both directions, finally settled down due to fall in base metal prices. Dollar index moved up owing to coronavirus issues together with unchanged interest rate. The central bank’s Federal Open Market Committee kept the rates between 1.5% and 1.75%. It was the second straight meeting the Fed made no changes to rates following three rate cuts in 2019. The greenback is the best performing currency among G10 currencies in January, with the dollar index rising 1.6% so far this month. It was a bad week for base metals, excluding aluminum which saw some surprise upside move. Copper touched an almost 5-month low of $5,565 last week. The metal is set for a monthly drop of 8.9%, the worst performance since May last year. Downstream zinc users in China have postponed resumption of operations until after Feb. 9, while most upstream producers are operating as normal. Oil prices fell more than 2% on Thursday to the lowest in three months on concerns over the potential economic impact of the coronavirus that continues to spread worldwide, while the market also considered the possibility of an early OPEC meeting. There was no respite for natural prices and it dipped further.

In spices, jeera fell the most in recent days and saw massive fall for continuous 5th week, now trading near the level of 14000. Jeera growers in Rajasthan and Gujarat are expecting about 25- 30 percent higher yield over last year. Turmeric was weak as well as arrivals of the fresh crop have started in key spot markets of Nizamabad and are likely to gain momentum in the coming weeks. The sentiments of the oilseeds and edible oil complex were bearish as they are under pressure from expectations for a massive harvest in rival supplier Brazil & also from China’ coronavirus. Even cotton counter was not immune and it saw further bearishness as the coronavirus scare looms large over the commodity trade with China, the largest buyer of the natural fibre and its yarn.

|

|

12

|

|

OPEC is planning to extend current oil production cuts until June and could discuss deeper cuts if needed, as worries spread about the impact of the corona virus outbreak on China demand. At the OPEC+ meeting in December, OPEC and its Russia-led partners decided to deepen the oil production cuts by 500,000 bpd in the first quarter of 2020, when demand is expected at its weakest for 2020. This brings total production reductions at 1.7 million bpd—that is if rogue members fall in line with their quotas. OPEC’s compliance was exceptionally high throughout most of 2019. That’s largely due to deeper-than-required cuts by Saudi Arabia,which also suffered an attack on its oil infrastructure in September.

13

|

| 27th JAN | The week started-off with risk-off note amid outbreak of Coronavirus. |

| 28th JAN | Indian Rupee dipped further amid concern of fiscal deficit’s projection in upcoming Budget 2020 on 1st February. |

| 30th JAN | Euro zone jobless rate slided to 12-year low as sentiment improved |

| 30th JAN | Bank of England kept rates unchanged but still fears Brexit. |

| 30th JAN | W.H.O. Declares Global Emergency as Wuhan Coronavirus Spreads |

Indian Rupee started-off with a weaker note after a severe outbreak of coronavirus which claimed life of over 170 as per the latest survey spooked the global financial markets. Although rupee got some support amid dollar flows coming-in mainly from subscription in Central Public Enterprise ETF and another flows of over Rs 25,000 crs may have emerged from Canadian based Brookfield Infrastructure’s investment into units issued by Reliance Jio Towers Infrastructure Trust. Importers are aggressively hedging at every rise in rupee in fear of further deterioration of coronavirus’s aftermath. Further the key attention will be India’s Union Budget on 1st of February. General consensus already priced-in 20-30 bps expansion in fiscal deficit projection but the question whether government will borrow from private savings or taps the offshore bond market. If it does tie-up with offshore avenues, we may see positive reaction in rupee in anticipation of dollar flows, although gyrations in dollar denominated debt may lead to more vulnerabilities which is again negative for rupee in long term. Another area where market will monitor is the possible stimulus announcement. If the quantum is beyond expectations, it will be highly negative for bond and rupee as well as it will elevate the core inflation in the next few quarters which further prompt RBI to change the current accommodative stance in upcoming MPC meetings.

USDINR is likely to stay above 71.30 and move higher towards 72.10 in the next week.

|

USD/INR (FEB) contract closed at 71.6750 on 30th Jan 2020. The contract made its high 71.8075 on 30th Jan 2020 and a low of 71.3700 on 29th Jan 2020 (Weekly Basis). The 14-day Exponential MovingAverage oftheUSD/INR is currently at 71.54.

On the daily chart, the USD/INR has Relative Strength Index (14-day) value of 52.28. One can buy at 71.40 for the target of 72.10 with the stop loss of 71.10

EUR/INR (FEB) contract closed 79.1225 on 30th Jan 2020. The contract made its high of 79.2450 on 28th Jan 2020 and a low 78.7050on 29th Jan 2020 (Weekly Basis). The 14-day Exponential MovingAverage ofthe EUR/INR is currently at 79.29.

On the daily chart, EUR/INR has Relative Strength Index (14-day) value of 41.71. One can buy at 79.00 for a target of 79.60 with the stop loss of 78.70.

GBP/INR (FEB) contract closed at 93.3575 on 30th Jan 2020. The contract made its high of 93.9750 on 27th Jan 2020 and a low of 92.9525 on 29th Jan 2020 (Weekly Basis).The 14-day Exponential MovingAverage oftheGBP/INR is currently at 93.17.

On the daily chart, GBP/INR has Relative Strength Index (14-day) value of 53.31. One can buy at 93.50 for a target of 94.40 with the stop loss of 93.10.

JPY/INR (FEB) contract closed at 65.9025 on 30th Jan 2020. The contract made its high of 65.0600 on 30th Jan 2020 and a low of 65.4625 on 29th Jan 2020 (Weekly Basis).The 14-day Exponential MovingAverage ofthe JPY/INR is currently at 65.55.

On the daily chart, JPY/INR has Relative Strength Index (14-day) value of 52.38. One can buy at 65.70 for a target of 66.30 with the stop loss of 65.35

14

Everstone-run Burger King India gets SEBI nod for IPO

Burger King India Ltd, the national master franchisee of the American burger brand in India, has received a green signal from the Securities and Exchange Board of India to float its initial public offering (IPO). SEBI issued its final observations on Burger King India’s IPO proposal on January 24, according to the capital markets regulator’s website. The proposed IPO will involve private equity firm Everstone selling a quarter of its shares and the burger chain issuing fresh shares worth Rs 400 crore. The total IPO size is estimated at Rs 1,000 crore ($141 million), two people aware of the matter had told VCCircle earlier. The company will use Rs 290 crore out of the fresh net proceeds to roll out new company-owned restaurants and part of the money for general corporate purposes. The burger chain had filed its documents for the proposed IPO last November. At the time, it had 216 restaurants and eight sub-franchised restarants across India. Burger King is the second-largest burger brand globally as measured by the total number of restaurants; it had a global network of over 18,000 restaurants in more than 100 countries and US territories at the end of June 30, 2019.

ITI FPO subscription remains unchanged at 49% on 4th day

State-owned telecommunications technology company ITI's follow-on public offer was subscribed 49 percent on January 29, the fourth day of bidding. The Rs 1,400-crore further public offer (FPO) has received bids for 8.86 crore equity shares against offer size of 18.18 crore shares, as per data available on the NSE. The reserved category for retail investors has seen a 94 percent subscription, while that of qualified institutional buyers is 49 percent and non-institutional investors at 16 percent. Due to a muted response, the company on January 28 revised the offer price band to Rs 71-77 per share in consultation with the merchant bankers. It also extended the closing date for FPO by three days to January 31, 2020. The company intends to use issue proceeds to fund its working capital requirements as well as repay existing debt. After the issue, government shareholding in the company will reduce to 74.96 percent from 90 percent. ITI has 5 manufacturing units located at Mankapur, Bengaluru, Palakkad, Naini and Raebareli and an R&D center in Bengaluru.

Ontario Teachers’, Capital International eye 5% stake in NSE: Report

Big-ticker Canadian institutional investors -- the Ontario Teachers’ Pension Plan Board and Capital International Group -- are in separate talks to acquire stake in the National Stock Exchange (NSE) once it is listed. The NSE is planning an initial public offering (IPO) in Q3 FY20, subject to approval from the Securities and Exchange Board of India (SEBI), MD Vikram Limaye informed the Finance Ministry and SEBI at the end of 2019. For precedent, BSE raised close to Rs 1,243 crore via the IPO route in February 2017.

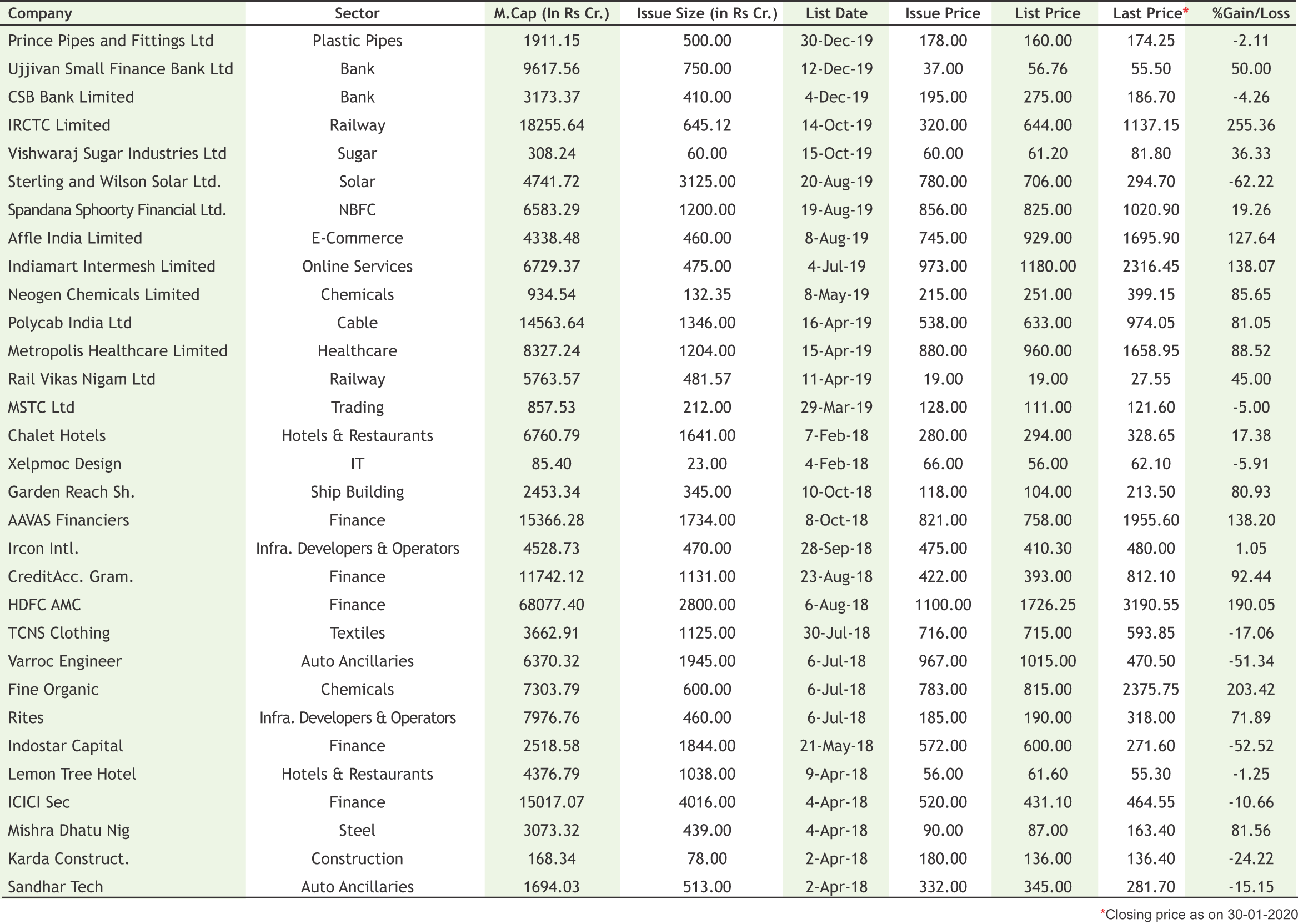

|

15

|

* Interest Rate may be revised by company from time to time. Please confirm Interest rates before submitting the application.

* For Application of Rs.50 Lac & above, Contact to Head Office.

* Email us at fd@smcindiaonline.com

16

Kotak Mutual Fund announced the creation of segregated portfolio

Kotak Mutual Fund announced the creation of segregated portfolio in line with the provisions of SEBI circular and modifies the Scheme Information Document (SID) of Kotak Liquid Fund, Kotak Money Market Fund, Kotak Dynamic Bond Fund, Kotak Low Duration Fund, Kotak Bond Short Term Fund, Kotak Savings Fund, Kotak Banking and PSU Fund and Kotak Corporate Bond Fund. This would come into effect from Feb 26, 2020. Segregated portfolio refers to those debt or money market instruments, which have been impacted by a credit event, i.e. experienced a credit downgrade to below investment grade. This portion of the portfolio is excluded from the main portfolio.

DSP Mutual Fund announced the change in exit load of DSP Bond Fund

DSP Mutual Fund announced the change in exitload ofDSPBond Fund.As perthe revised structure, no exitload will be applicable effective Feb 1, 2020.

BOI AXAannounced the change in fund management of BOI AXAShort Term Income Fund

BOI AXAannounced the change in fund management of BOI AXAShort Term Income Fund to Alok Singh and Amit Modani, BOI AXAEquity Debt Rebalancer Fund to Amit Modani and Ajay Khandelwal and BOI AXAUltra Short Duration Fund to Amit Modani with effect from Jan 23, 2020.

L&T Mutual Fund announced change in scheme name

L&T Mutual Fund announced the name in name of L&T Cash Fund to L&TOvernight Fund with effect from Feb 1, 2020

Motilal Oswal Mutual Fund announced the change in benchmark of Motilal Oswal Dynamic Fund

Motilal Oswal Mutual Fund announced the change in benchmark of Motilal Oswal Dynamic Fund from CRISIL Hybrid 35+65 - Aggressive TRI to CRISIL Hybrid 50+50 - Moderate Index TRI effective Jan 28, 2020.

Invesco Mutual Fund announced change in total expense ratio (TER) of Invesco India Ultra Short Term Fund

Invesco Mutual Fund announced the change in total expense ratio (TER) of Invesco India Ultra Short Term Fund from 0.40% to 0.25% with effect from Jan 30, 2020.

17

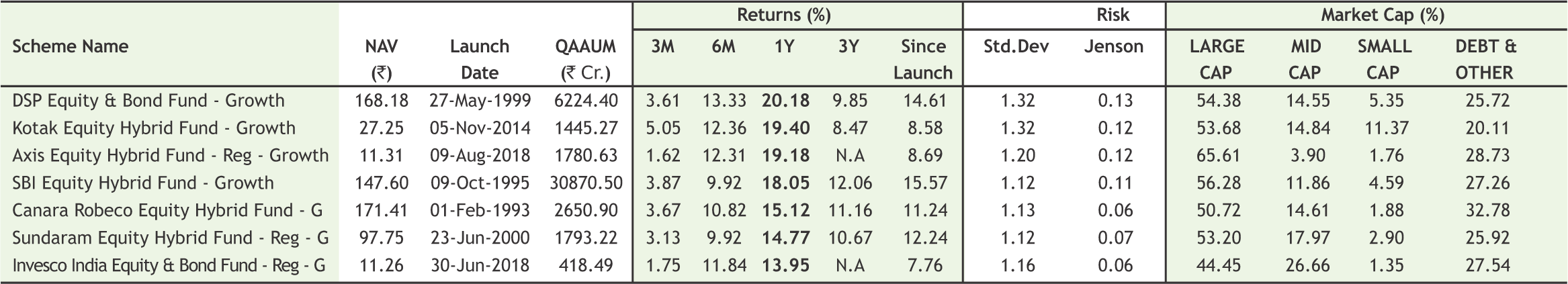

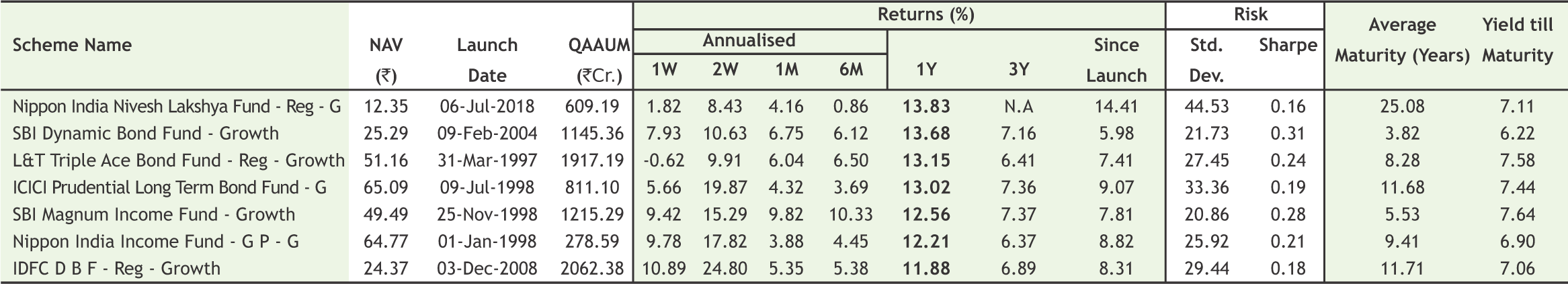

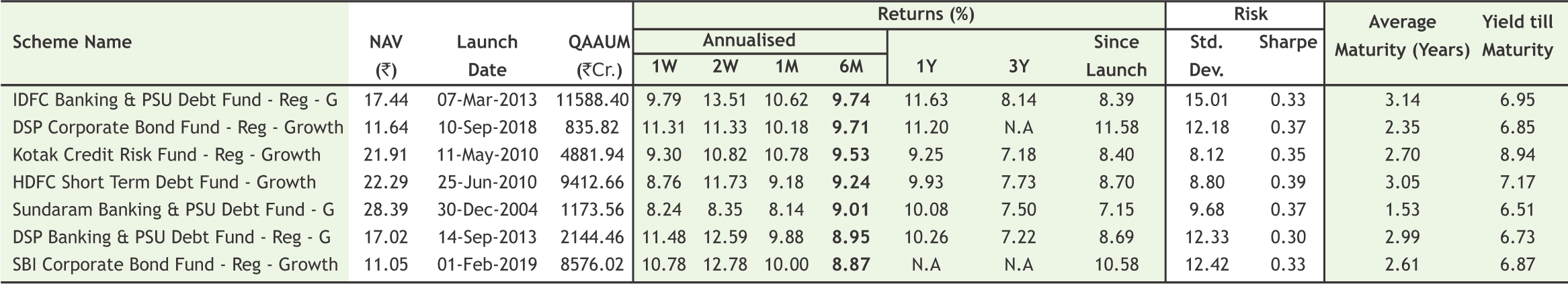

|

|

|

|

|

Note:Indicative corpus are including Growth & Dividend option . The above mentioned data is on the basis of 08/08/2019 Beta, Sharpe and Standard Deviation are calculated on the basis of period: 1 year, frequency: Weekly Friday, RF: 7%

*Mutual Fund investments are subject to market risks, read all scheme related documents carefully

18

Glimpses of Republic Day Celebration held on Friday, 24th January, 2020 at SMC Head Office, New Delhi.

REGISTERED OFFICES:

11 / 6B, Shanti Chamber, Pusa Road, New Delhi 110005. Tel: 91-11-30111000, Fax: 91-11-25754365

MUMBAI OFFICE:

Lotus Corporate Park, A Wing 401 / 402 , 4th Floor , Graham Firth Steel Compound, Off Western Express Highway, Jay Coach Signal, Goreagon (East) Mumbai - 400063

Tel: 91-22-67341600, Fax: 91-22-67341697

KOLKATA OFFICE:

18, Rabindra Sarani, Poddar Court, Gate No-4,5th Floor, Kolkata-700001 Tel.: 033 6612 7000/033 4058 7000, Fax: 033 6612 7004/033 4058 7004

AHMEDABAD OFFICE :

10/A, 4th Floor, Kalapurnam Building, Near Municipal Market, C G Road, Ahmedabad-380009, Gujarat

Tel : 91-79-26424801 - 05, 40049801 - 03

CHENNAI OFFICE:

Salzburg Square, Flat No.1, III rd Floor, Door No.107, Harrington Road, Chetpet, Chennai - 600031.

Tel: 044-39109100, Fax -044- 39109111

SECUNDERABAD OFFICE:

315, 4th Floor Above CMR Exclusive, BhuvanaTower, S D Road, Secunderabad, Telangana-500003

Tel : 040-30031007/8/9

DUBAI OFFICE:

2404, 1 Lake Plaza Tower, Cluster T, Jumeriah Lake Towers, PO Box 117210, Dubai, UAE

Tel: 97145139780 Fax : 97145139781

Email ID : pankaj@smccomex.com

smcdmcc@gmail.com

Printed and Published on behalf of

Mr. Saurabh Jain @ Publication Address

11/6B, Shanti Chamber, Pusa Road, New Delhi-110005

Website: www.smcindiaonline.com

Investor Grievance : igc@smcindiaonline.com

Printed at: S&S MARKETING

102, Mahavirji Complex LSC-3, Rishabh Vihar, New Delhi - 110092 (India) Ph.: +91-11- 43035012, 43035014, Email: ss@sandsmarketing.in